Recyclable mono-material PE Market Growth, Demand and Production Forecast

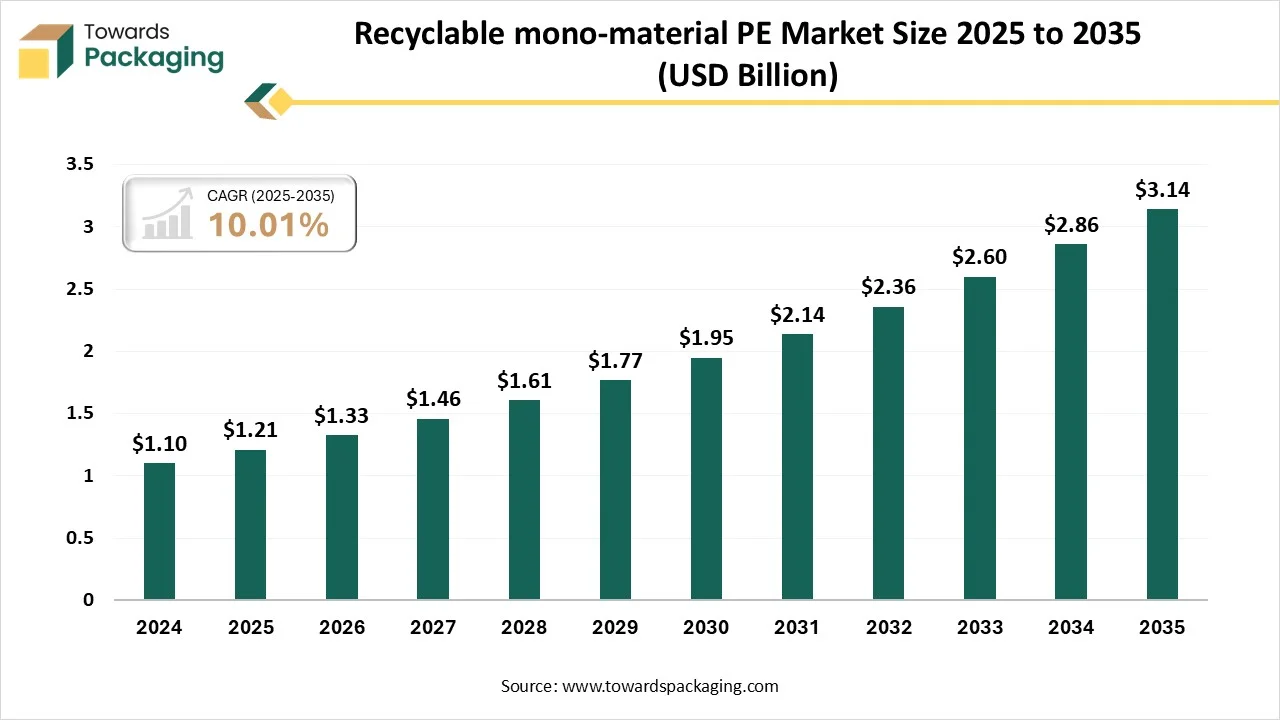

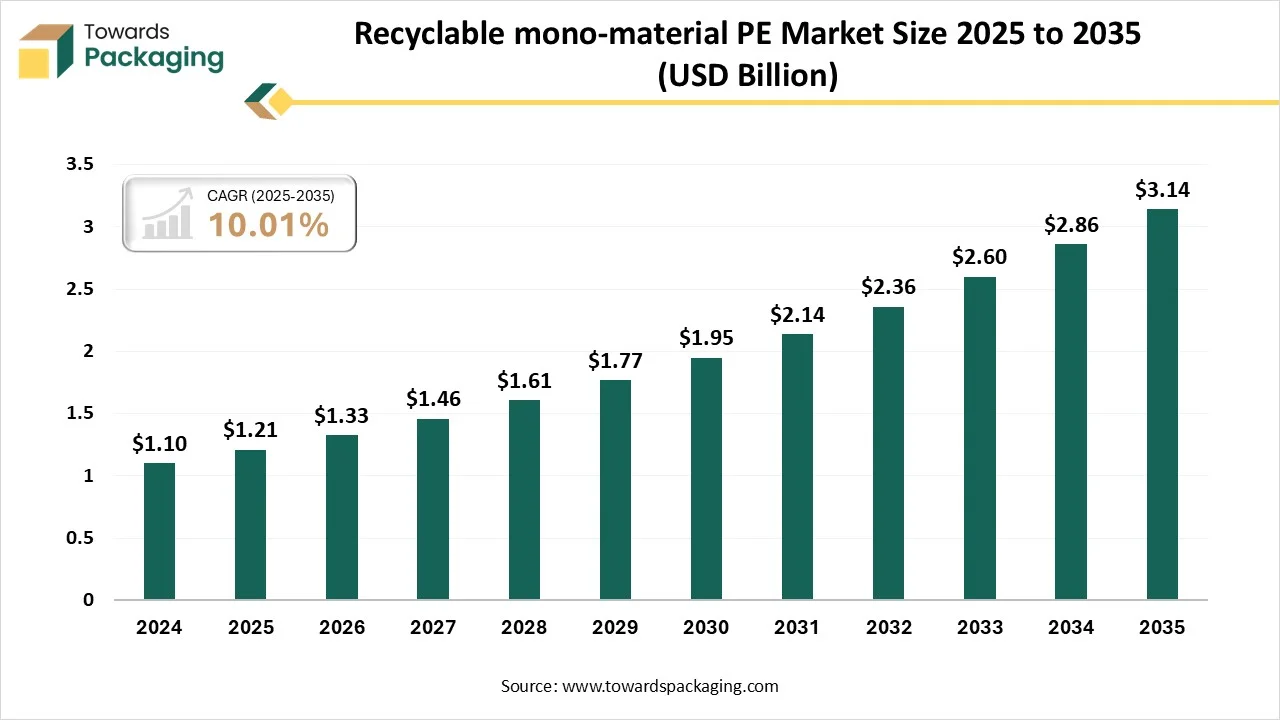

The recyclable mono-material PE market is forecast to grow from USD 1.33 billion in 2026 to USD 3.14 billion by 2035, driven by a CAGR of 10.01% from 2026 to 2035. This market is growing due to rising demand for fully recyclable packaging solutions that meet sustainability regulations while maintaining cost efficiency and performance.

Key Takeaways

- By region, Asia Pacific has dominated the market, having the biggest share of approximately 38% in 2025.

- By region, Europe is expected to rise at the fastest CAGR between 2026 and 2035.

- By material type, the HDPR segment contributed the largest share of approximately 43% in 2025.

- By material type, the LLDPE segment will grow at the fastest CAGR between 2026 and 2035.

- By foam/product format, the films & sheets segment has contributed to the largest market with approximate share of 45% in 2025.

- By foam/product format, the spouted pouches and tubes segment will grow at the fastest CAGR between 2026 and 2035.

- By application/end use, the flexible packaging segment contributed to the largest share of approximately 50% in 2025.

- By application/end use, the healthcare and pharmaceutical packaging segment will grow at the fastest CAGR between 2026 and 2035.

- By end-use industry, the food & beverages industry segment has contributed to the largest market share of approximately 42% in 2025.

- By end-use industry, the e-commerce and logistics segment will grow at the fastest CAGR between 2026 and 2035.

Market Overview

The recyclable mono-material PE market is gaining strong momentum as companies move away from multi-layer packaging to comply with the circular economy and increase recyclability. Food, FMCG, and pharmaceutical industries are adopting sustainable packaging more quickly due to growing consumer demand and regulatory pressure to reduce plastic waste.

Market Trends

- Industry Growth Overview: The recyclable mono-material PE market is witnessing steady growth driven by increasing adoption of flexible packaging solutions that are lightweight, cost-effective, and compatible with existing recycling streams. Expansion of the food, personal care, and household products industries is further supporting market demand.

- Sustainability Trends: Brands are increasingly replacing complex multi-material structures with mono-material PE to enhance recyclability and meet extended producer responsibility (EPR) targets. The use of post-consumer recycled (PCR) PE and downgauging techniques is also rising to reduce carbon footprint and plastic usage.

- Startup Ecosystem: Startups are actively innovating areas such as recyclable barrier coatings, advanced PE film formulations, and PCR integration technologies. Many new entrants are partnering with FMCG brands and recyclers to develop scalable, circular packaging solutions.

Technological Shifts

- Adoption of machine-direction oriented (MDO) PE films to improve strength, clarity, and barrier performance

- Development of high-barrier recyclable PE structures to replace multi-material laminates

- Increased use of post-consumer recycled (PCR) PE without compromising package quality

- Advances in sealant and coating technologies compatible with mono-material PE recycling streams

- Lightweighting and downgauging innovations to reduce material usage and carbon footprint

Trade Analysis

- According to Global Import data, between June 2024 and May 2025 (TTM), the world imported 3,960 shipments of Recycled Plastic. These were handled by 533 exporters to 537 buyers, reflecting growth rate of 29% comparing from the previous 12 months.

- World imports most recycled plastic from Vietnam, the United States, and China.

- Globally, the top three importers are the United States, China, and India, with United States leading at 4543 shipments, followed by China with 3598, and the India with 2131 shipments.

Value Chain Analysis

Raw Materials Sourcing

PE sourcing is shifting toward recyclable and PCR-based resins to ensure regulatory compliance and supply stability. Partnerships with recyclers are increasing.

- Key Players: Dow, LyondellBasell, SABIC, ExxonMobil

Supply to Government and Airlines

Government bodies and airlines are adopting mono-material PE packaging to meet sustainability and waste-reduction mandates. Lightweight and recyclable formats are preferred.

- Key Players: Amcor, Berry Global, Sealed Air, Huhtamaki

Aftermarket Services and Upgrades

Companies are offering packaging optimization, recyclability support, and performance upgrades for mono-material PE solutions.

- Key Players: Mondi, Constantia Flexibles, Coveris, UFlex

Segmental Insights

Material Type Insights

Why Did HDPE Segment Dominate The Recyclable Mono-Material PE Market?

HDPR segment dominates the recyclable mono-material PE market with around 43% share in 2025, motivated by its superior barrier qualities, stiffness, and strength. When durability and recyclability are crucial, HDPE is frequently used in rigid and semi-rigid packaging applications like bottles, containers, and heavy-duty films. Large-scale adoption in the food industry and household packaging applications is further supported by its excellent compatibility with the current recycling infrastructure.

LLDPE segment expects the fastest growth in the market during the forecast period, backed by the growing need for high-performance lightweight and flexible packaging. LLDPE is perfect for stretch packaging and recyclable mono-material films because of its exceptional flexibility and puncture resistance. Its market expansion is being accelerated by its increasing use in consumer goods for e-commerce and downgauged packaging solutions.

Why Did Films & Sheets Segment Dominate The Recyclable Mono-material PE Market?

Films & sheets segment dominated the recyclable mono-material PE market with around 45% share in 2025. Manufacturers choose them because of their cost-effectiveness, ease of processing, and compatibility with mono-material recycling streams. Their dominant position is further reinforced by the high demand from industrial applications and food packaging.

Spouted pouches and tubes segment expects the fastest growth in the market during the forecast period, fueled by demand for convenience-driven, resealable, and lightweight packaging. These formats support mono-material structures while offering improved shelf appeal and reduced material usage. Increased adoption in personal care, liquid food, and pharmaceutical packaging is driving rapid growth.

Application/ End Use Insights

Why Did Flexible Packaging Segment Dominate The Recyclable Mono-Material PE Market?

Flexible packaging segment dominates the market with nearly 50% share in 2025. To achieve sustainability objectives, brands are increasingly using recyclable mono-material PE structures. Flexible packaging allows for more design flexibility, efficient transportation, and reduced material consumption. Its extensive use in household personal care and food products solidifies its leading position in the market.

Healthcare and pharmaceutical packaging segment expects the fastest growth in the market during the forecast period, driven by rising healthcare demand and strict packaging regulations. Mono-material PE solutions offer chemical resistance, hygiene safety, and recyclability, making them suitable for medical pouches, protective films, and pharmaceutical packaging. Increased focus on sustainable medical packaging is further accelerating adoption.

End Use Industry Insights

Why Did Food & Beverages Segment Dominate The Recyclable Mono-Material PE Market?

The food & beverages industry segment dominated the recyclable mono-material PE market with approximately 42% share in 2025, backed by the strong demand for packaging that is recyclable, lightweight, and safe. Compared to multi-layer structures, single-material PE packaging facilitates easier recycling while preserving product freshness. Dominance is still driven by consumer preference for sustainable food packaging and regulatory pressure.

E-commerce and logistics segment expects the fastest growth in the market during the forecast period, due to rapid growth in online retail and last-mile delivery. Recyclable mono-material PE films and mailers provide durability, flexibility, and reduced packaging weight. The push for sustainable shipping materials is significantly boosting adoption in this segment.

Regional Insights

Why Did Asia Pacific Dominate The Recyclable Mono-Material PE Market?

Asia Pacific dominated the recyclable mono-material PE market with around 38% share in 2025, driven by increased recycling efforts, robust consumer goods demand, and large-scale packaging production. Mono-material packaging is being rapidly adopted in nations like China, India, and Japan because of cost-effective manufacturing and regulatory support. Regional dominance is further reinforced by the existence of significant PE producers.

India is the fastest-growing market for recyclable mono-material PE, driven by e-commerce, increased consumption of packaged foods and beverages, and rapid urbanization. Mono-material packaging structures are becoming more popular due to government initiatives that support recyclability and the management of plastic waste. Growing investments in recyclable PE films by domestic packaging producers are contributing to the market's expansion.

Europe is the fastest-growing regional market backed by robust circular economy initiatives and stringent packaging waste regulations. To meet sustainability goals, governments and brand owners are actively moving toward recyclable packaging made of a single material. Growth in the area is being accelerated by high consumer awareness and innovative recyclable PE packaging solutions.

Germany Recyclable Mono-material PE Market Trends

Germany is a notable market for recyclable mono material PE, motivated by its robust circular economy policies, stringent packaging waste regulations, and sophisticated recycling infrastructure. Brands are encouraged to use easily recyclable mono material structures by the nation's extended producer responsibility framework. Continuous innovation in recyclable PE packaging is supported by strong cooperation between recyclers and packaging manufacturers.

North America is a significant market for recyclable mono material PE, driven by expanding demand for flexible packaging and growing sustainability pledges from international brands. PE recyclability rates are rising thanks o investments in mechanical and sophisticated recyclability rates are rising thanks to investments in mechanical and sophisticated recycling technologies. Mono-material PE solutions are actively being used by retailers and consumer goods companies in place of complex laminates.

U.S. Recyclable Mono-material PE Market Trends

The United States is a dominant market for recyclable mono-material PE driven by large-scale demand from food, healthcare, and e-commerce packaging applications. Packaging manufacturers are accelerating the development of recyclable PE films to meet industry guidelines. Increasing consumer awareness and corporate sustainability targets continue to support market growth.

MEA region is an emerging market for recyclable mono material PE, driven by growing retail infrastructure and an increase in the consumption of packaged foods. Initiatives for recycling and waste reduction are being progressively introduced by governments throughout the region. The need for flexible and recyclable packaging is rising due to the expansion of logistics and distribution operations.

UAE Recyclable Mono-material PE Market Trends

The UAE is a fastest growing market for recyclable mono-material PE, driven by the robust retail and logistics industry as well as national sustainability strategies. The use of recyclable packaging materials is encouraged by government-led circular economy initiatives. The market is expanding more quickly due to rising demand for food, personal care, and e-commerce packaging.

South America is a growing market for recyclable mono-material PE driven by growing urbanization and the consumption of packaged food and drinks to achieve sustainability objectives. Brand owners are increasingly using recyclable packaging. Stable market growth is supported by advancements in recycling infrastructure in important nations.

Brazil Recyclable Mono-material PE Market Trends

Brazil is a dominant market in South America for the recyclable mono-material PE market, driven by its sizable consumer goods sector and robust need for flexible packaging. Wider adoption is facilitated by government policies that support sustainable packaging solutions. Packaging manufacturers investment in recyclable PE film technologie sare bolstering the market's expansion.

Recent Developments

- In October 2025, Dow, Macchi, and ITP announced a recyclable mono-material PE pouch containing over 50% chemically recycled content, aimed at food packaging applications. The solution is designed to support circular economy goals while maintaining barrier and sealing performance.

- In October 2025, Amcor expanded its use of post-consumer recycled plastics, reaching 10% PCR content across parts of its global packaging portfolio. This move strengthens the company’s transition toward recyclable mono-material packaging formats.

- In November 2024, Amcor’s AmPrima Plus mono-material PE coffee packaging won an innovation award for improving recyclability and lowering carbon emissions compared to traditional laminates. The solution also offers high aroma protection for premium coffee brands.

- In July 2024, Mondi introduced its FlexiBag Reinforced mono-PE packaging range with enhanced strength and puncture resistance. The solution targets heavy-duty applications such as pet food while remaining fully recyclable.

- In December 2025, Masterpress joined an EU-backed initiative to test high-barrier mono-material PE pouches under real recycling conditions. The project aims to improve recyclability standards across flexible packaging in Europe.

Top Companies

- Amcor plc: A dominant global leader providing high-performance mono-PE films like the "AmPrima" range for food and healthcare applications.

- Berry Global Inc.: A major manufacturer of mono-material collation shrink films and flexible PE packaging, now operating as part of Amcor since April 2025.

- Mondi Group: Specializes in high-barrier mono-PE pouches and the "BarrierPack Recyclable" series designed for superior product protection.

- Sealed Air Corporation: Focuses on "CRYOVAC" brand recyclable mono-PE solutions for food integrity and protective shipping packaging.

Other Players

- Constantia Flexibles Group GmbH

- Huhtamaki Oyj

- ProAmpac LLC

- SABIC

Recyclable mono-material PE Market Segments Covered in the Report

By Material Type

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Ultra-High-Molecular-Weight PE (UHMWPE)

By Form / Product Format

- Films & Sheets

- PE Stretch Films

- PE Shrink Films

- Flat PE Films

- Bags & Sacks

- Containers & Bottles (mono-PE)

- Caps & Closures (PE)

- Tubes & Spouted Pouches (mono-PE)

- Rigid PE Packaging

By Application / End-Use

- Flexible Packaging

- Pouches

- Wraps & Overwraps

- Mailer Bags

- Rigid Packaging

- Bottles & Jars

- Containers

- Consumer Goods Packaging

- Food & Beverage Packaging

- Healthcare & Pharmaceutical Packaging

- Industrial & Chemical Packaging

- E-Commerce & Retail Packaging

By End-Use Industry

- Food & Beverages

- Personal Care & Cosmetics

- Household Goods

- Healthcare / Medical

- Industrial & Chemicals

- E-Commerce Logistics

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

-

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA