The hazardous goods packaging market is forecasted to expand from USD 13.62 billion in 2026 to USD 22.63 billion by 2035, growing at a CAGR of 5.80% from 2026 to 2035. The report provides a detailed segmentation by product type (drums, IBCs, pails, bottles, cartons & boxes, flexi tanks, others), material (plastics, metals, corrugated paper), and end use (chemicals & petrochemicals, oil & gas, pharmaceuticals, agriculture, and automotive). It includes regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, presenting statistical data on production, consumption, import–export trends, and investment flows.

The market for packaging hazardous materials is essential to guaranteeing the secure handling, storage, and transit of hazardous materials. It includes a broad range of packaging options made to abide by global laws and safeguard the environment and public health. This market provides services to businesses that handle and transport hazardous materials, such as manufacturing, chemicals, medicines, and oil and gas. In other words, the term "hazardous goods packaging" describes the specific materials and containers used for storing and moving hazardous materials. These products might contain hazardous, flammable, corrosive, or explosive materials that could explode or leak during transit, posing serious dangers.

The packing group of the item affects the appropriate packaging of hazardous materials as well. The United States Federal Aviation Administration defines a packing group as a collection of items arranged according to the level of risk they provide. The materials in the packing group are divided into three categories: items posing high hazard (packing group I), materials providing medium danger (packing group I), and moderate danger (packing group Ill).

Packing hazardous items for shipment is an essential step in the hazmat transportation process and is governed by regulations. The US Department of Transportation (DOT) or one of its agencies, such as the Federal Aviation Administration (FAA), the Pipeline and Hazardous Materials Safety Administration (PHMSA), or the Federal Motor Carrier Safety Administration (FMCSA), is in charge of supervising, enforcing, and monitoring these regulations. State and local laws pertaining to the transportation of hazardous chemicals may also apply, which the shipper is required to know about and abide with. According to law, it is the shipper's duty to properly classify and package the goods. To make sure that goods carrying hazardous items have the proper labeling and shipping documentation, there are a few measures that must be taken.

Even if there are, in reality, a lot of steps and procedures involved in preparing a hazardous substance for transportation, skilled professionals who are knowledgeable about the material's risks and the relevant packing rules should handle this operation. It's crucial to remember that hazardous materials laws have evolved considerably in recent years and are still being updated and modified when it comes to the latter. In particular, there have been numerous improvements in the field of international shipping, mostly to promote international trade. With these adjustments, US hazardous material laws and international norms should be more consistent.

Emerging markets for hazardous goods packaging is expected to drive the growth of the global hazardous goods packaging market over the forecast period.

Increasing Launch of Chemical and Petrochemical Industries

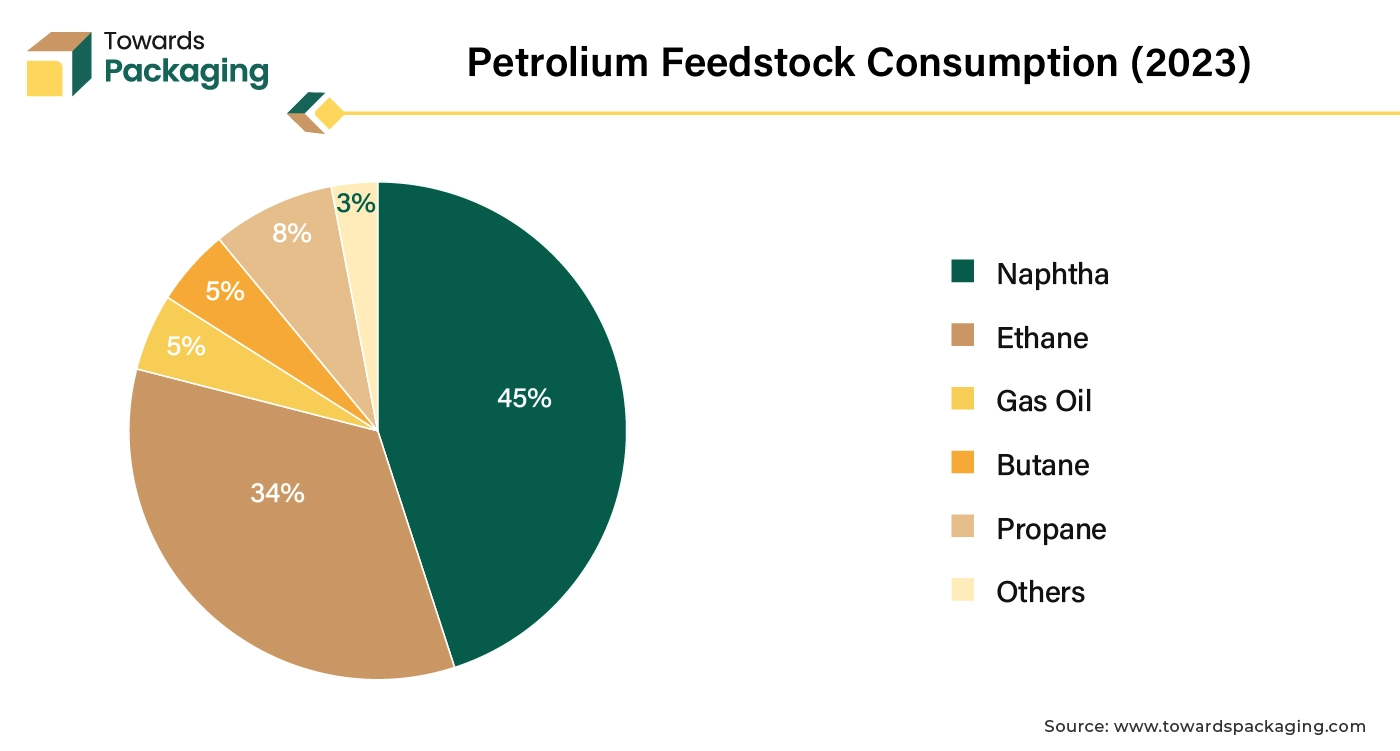

Petrochemicals are essential to raising living standards in developing nations and promoting sustainability in developed ones; they are found in most of the things use on a daily basis. Petrochemicals are used in electric cars, solar panels, wind turbines, batteries, insulation, and even can be made from recycled and renewable feedstock. Technological improvements, increased understanding of the products' applications, and population growth all have a significant impact on the growing demand for petrochemical products in developing nations like India. Moreover, increasing launch of the new chemical and petrochemical industries has risen the demand for the hazardous goods packaging and is estimated to drive the growth of the hazardous goods packaging market over the forecast period.

For instance,

Stringent Government Laws, Regulation and Compliance Cost

The key players operating in the are facing opposition from the government laws and strict regulation from regulatory bodies and high compliance cost, which is hampering the growth of the hazardous goods packaging market. Although laws are the primary force behind the hazardous packaging market, there can be difficulties because of the intricacy and rigor of these laws. Hazardous material makers and end users may find their total cost of hazmat packaging to rise as a result of the numerous, constantly-evolving rules that demand them to comply with. As a result, the strict laws and associated expenses may, in part, be a significant barrier to market expansion.

Technology Advancements

Advancements in packaging technology Advances in production, design, and packaging materials could bring about a significant transformation in hazardous material packaging. Opportunities arise from the development of high-performance materials with improved resistance to thermal, chemical, and physical hazards. Technological developments such as smart packaging technologies can provide real-time monitoring of hazardous substances, hence enhancing efficiency and safety during shipping. Therefore, it is expected that advancements in packaging technology will offer a strong chance for market expansion during the course of the estimated period.

The drums segment held the dominating share of the global hazardous goods packaging market in 2024. Drums are frequently used for both non-hazardous and hazardous material storage and transportation. In addition, there is an increasing need for drums for the transportation of hazardous materials due to the growth of numerous end-user sectors like chemicals, pharmaceuticals, and others.

Drums, which may hold around 200 liters, are used to store practically every kind of chemical, including medicinal liquids. For the past few years, manufacturers and logistics businesses have also reused the drums after taking significant safety measures as returnable shipment packaging. All of these factors are anticipated to increase demand for the hazardous goods packaging and estimated to drive the growth of the market over the forecast period.

The drums are strong and resistant to damage for transportation of hazardous material. Polyethylene and steel are the most common materials utilized for manufacturing drums for carrying hazardous goods. Even steel drums have several advantages as they are fairly resistant to collisions, fireproof, easy to reuse and strong in nature. Polythene drums or plastic drums are light-in-weight and also cost less for shipping. The key players operating in the market are focused on launching new drums for hazardous packaging which is estimated to drive the growth of the segment over the forecast period.

For instance,

The plastic segment held the largest share of the hazardous goods packaging market in 2024. The plastic material is highly resistant to acids as well as other chemicals. Due to this reason, hazardous chemicals and goods are able to be stored in plastic containers. The plastic material does not react with content inside container and maintain the optimum shelf life of the product. Manufacturers are, however, moving toward the use of recycled plastic in tiny amounts to reduce the usage of virgin plastic production as a result of the growing concern from various governmental organizations on the problems associated with the development in plastic waste pollution. Therefore, if environmentally friendly alternatives are adopted and the majority of plastic waste is recycled during the forecast period, the plastic hazmat packaging industry is anticipated to grow.

For instance,

The chemical & petrochemicals segment witnessed the significant growth in 2024. Enclosing chemical materials for storage, distribution, sale, and use is known as chemical packing. Packaging protects, preserves, and labels the chemical that is being carried and kept. The primary growth driver of the hazmat packaging industry is the increase in demand from the petroleum and chemical sectors. To maintain the fierce competition, major firms are implementing a variety of tactics, including new launches and acquisitions. Specialized tools and containers are needed by the petrochemical industry to guarantee product safety during packing.

An illustration of this is the industry's propensity to use thicker containers to stop leaks. While the packaging and shipping arrangements for different chemical goods will vary, all items must be distributed in safe, robust packaging. Enough robust boxes and packing are essential for safe and effective shipping, especially when it comes to caustic chemicals.

The expanding chemical sector, which produces petrochemicals, specialty chemicals, agrochemicals, and industrial chemicals, is fueling the segment's expansion. For instance, in 2023, the International Energy Agency projected that petrochemicals would surpass trucks, airplanes, and shipping to account for over half of the increase in oil demand through 2050 and more than a third through 2030. The spike in demand for petrochemical goods is the cause of this. The additional 56 billion cubic meters of natural gas required by petrochemicals by 2030 is roughly equivalent to Canada's current gas consumption.

Moreover, the key players operating in the market are focused on adopting inorganic growth strategies like collaboration and partnership to develop sustainable packing solutions for chemicals and petroleum. For instance, in June 2024, AeroFlexx, a company that is involved in developing sustainable packaging industry signed a strategic collaboration with Chemipack, a privately held chemical company to provide eco-friendly liquid chemical packaging containers.

Asia Pacific dominated the hazardous goods packaging market with the largest share in 2024. Rapid urbanization and industrial growth in Asia Pacific region has driven the growth of the hazardous goods packaging market in the Asia Pacific region. Mainly because of the extensive manufacturing in nations like China, India, and Vietnam. Furthermore, a major factor in the growth of the chemical, pharmaceutical and automotive industries in the region is the population's fast urbanization. Furthermore, the Asia-Pacific hazmat packaging market is growing at a substantial rate because to the region's vast population base, increasing urbanization, and robust economic expansion.

Due to the growing end-user industries brought about by increased industrialization and urbanization, which in turn have led to severe penalties for violating shipping regulations pertaining to hazardous materials, end-users prefer hazmat packaging that conforms with the regulations. Additionally, the region's growing population and rising family income are anticipated to fuel demand from a variety of end-user sectors, including chemical, petrochemical, pharmaceutical, etc. In addition, the region's growing population and rising standard of living are anticipated to fuel demand from a variety of end-user industries, including the chemical, pharmaceutical, and oil and gas sectors, offering the hazardous goods packaging market significant expansion prospects.

Increasing launch of the petrochemical industries in Asia Pacific has risen the demand for the hazardous goods packaging, which is estimated to drive the growth of the hazardous goods packaging market in the Asia Pacific region.

For instance,

Moreover, in India due to increase in launch of new pesticides the demand for the hazardous goods packaging has risen eventually which is estimated to drive the growth of the hazardous goods packaging market over the forecast period.

For instance,

North America is expected to witness the fastest growth over the forecast period due to rapid industrialization as well as increasing launch of the new petrochemical and chemical industries is rising the demand for the hazardous goods packaging which is estimated to drive the growth of the hazardous goods packaging market during the forecast period. Increasing launch of the hazardous goods packaging and expansion of service offering which is estimated to drive the growth of hazardous goods packaging market over the forecast period.

For instance,

The UN-certified containers launched by the American Labelmark Company Inc. company are developed to securely store, fill and transport a wide range of hazardous powders and solids. The newly launched curtec’s products are intent to ship a solid or powder in a regulated industry, such as speciality chemicals, pharmaceuticals, food products and agriculture.

Europe is estimated to be the second fastest growing region over the forecast period owing to increasing launch of the new hazardous goods packaging material and box which is expected to drive the growth of the hazardous goods packaging market in Europe over the forecast period.

For instance,

Product Type

Material Type

End-Use

Region

January 2026

January 2026

January 2026

January 2026