Industrial Packaging Recycling Services Market Disruptive Trends & Leading Industry Players

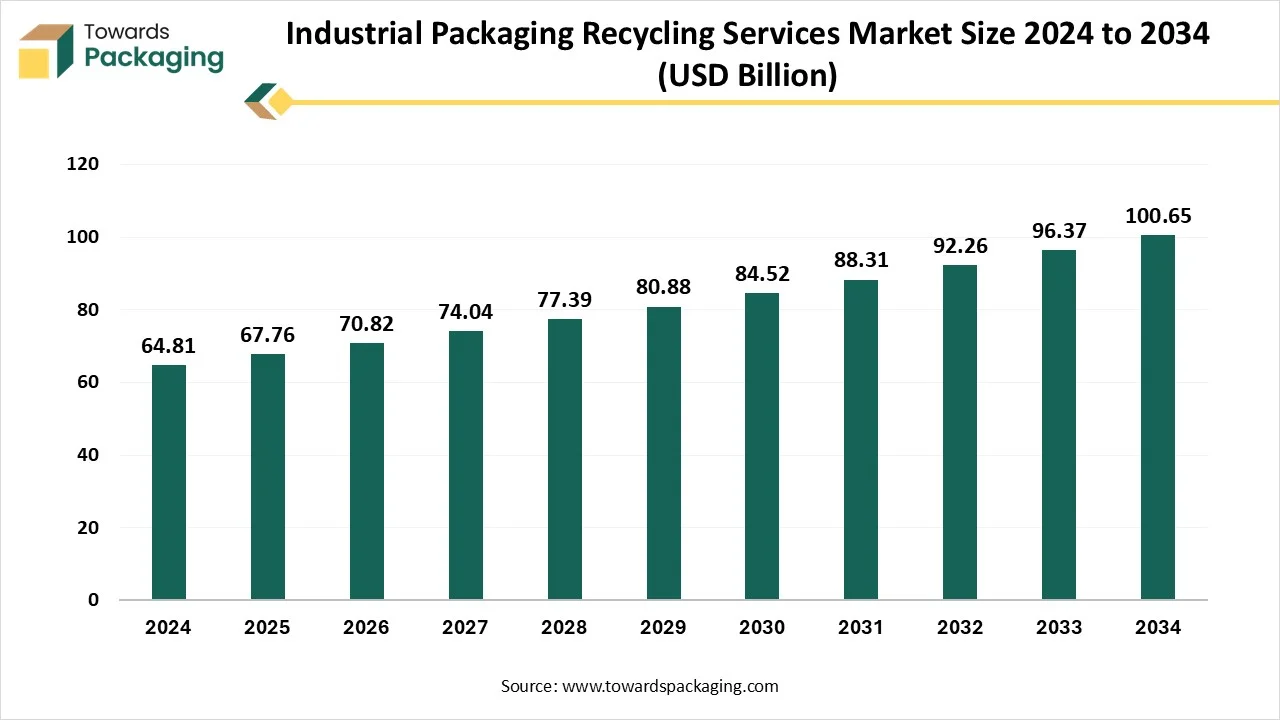

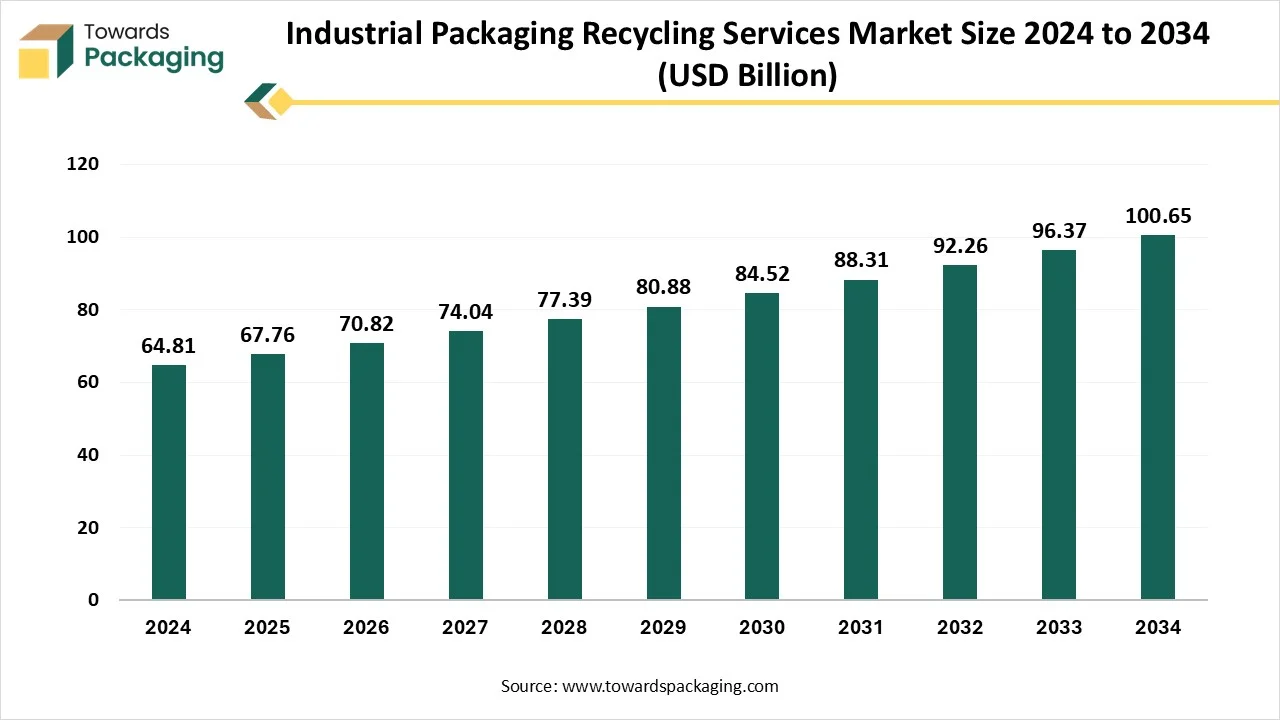

The industrial packaging recycling services market is forecasted to expand from USD 70.81 billion in 2026 to USD 105.51 billion by 2035, growing at a CAGR of 4.53% from 2026 to 2035. The global industrial packaging recycling services market growth, driven by supportive government policies & regulations, rapid expansion of the e-commerce sector, increasing consumer preference for environmentally friendly products, and rapid advancements in recycling technology.

The key players operating in the market are focused on adopting growth strategies like acquisitions and mergers to develop advanced technology for industrial packaging recycling services are expected to drive the global industrial packaging recycling services market over the forecast period.

Key Takeaways

- In terms of revenue, the market is valued at USD 67.76 billion in 2025.

- The market is projected to reach USD 105.51 billion by 2035.

- Rapid growth at a CAGR of 4.53% will be observed in the period between 2025 and 2035.

- North America dominated the industrial packaging recycling services market in 2024.

- Europe is expected to grow at a significant CAGR during the forecast period.

- By type, the recycling and reuse segment dominated the market with the largest revenue share.

- By type, the biodegradable segment is expected to grow at a notable CAGR over the studied period.

- By application, the food industry segment dominated the market in 2024.

- By application, the chemical industry segment will grow at a significant CAGR between 2025 and 2034.

Market Overview

Industrial packaging includes various materials such as plastics, aluminium, cardboard, and metals. Industrial packaging recycling services focus on collecting, sorting, processing, and recycling various materials used in industrial packaging. These services are adopted by companies to comply with governmental regulations, reduce wastage, promote environmental sustainability by recycling packaging materials, and avoid landfills. The market is expanding exponentially in various developing and developed regions, particularly North America, fuelled by the rising focus on sustainability and surging demand from multiple industries.

How is Artificial Intelligence Integration Impacting the Growth of the Industrial Packaging Recycling Services Market?

As technology continues to advance, the integration of artificial intelligence is poised to offer great potential to positively impact the market’s growth by automating sorting and improving industrial packaging recycling services to meet sustainability goals and reduce environmental impact. AI-driven recycling services assist in reducing material waste, lower the risk of human error, reduce maintenance costs, improve equipment uptime, and optimize the use of recycled materials. AI-powered services ensure significant transparency and traceability throughout the recycling chain. Therefore, industrial packaging recycling services facilities are increasingly benefiting from advanced technologies such as AI, machine learning, and computer vision, which results in reduced labor expenses while enhancing operational efficiency.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 67.75 Billion |

| Projected Market Size in 2035 |

USD 105.51 Billion |

| CAGR (2025 - 2035) |

4.53% |

| Leading Region |

North America |

| Market Segmentation |

By Type, By Application and By Region |

| Top Key Players |

Covanta, Bay Polymers, Newman & Company, Badger Plug, Goodwill Columbus, Portco Packaging, DS Smith, Southern Container |

What are the Key Trends Driving the Growth of the Industrial Packaging Recycling Services Market?

- The rising focus on recycling services to reduce waste disposal costs is anticipated to drive the market’s growth during the forecast period.

- The increasing environmental awareness, along with the rising focus on achieving a circular economy, is expected to accelerate the revenue of the industrial packaging recycling services in the coming years.

- The increasing investment of key market players in recycled and eco-friendly material innovation is expected to support the growth of the industrial packaging recycling services market during the forecast period.

- The rapid urbanization and industrialization have significantly increased the demand for recycling services and heightened corporate focus on environmentally responsible practices, contributing to the overall growth of the market.

How is Artificial Intelligence Integration Impacting the Growth of the Industrial Packaging Recycling services market?

As AI technology continues to evolve, the integration of artificial intelligence is significantly reshaping the entire packaging landscape and holds great potential to positively impact the market’s growth. AI integration into industrial packaging recycling services, production, and design provides unprecedented levels of speed, precision, and innovation. AI-driven production monitoring assists in reducing material waste and optimizing manufacturing processes. Several prominent manufacturers are leveraging advanced technologies such as AI, machine learning, and computer vision to optimize production cycles, reduce maintenance costs, improve equipment uptime, predictive maintenance, and lower the risk of human error.

Market Dynamics

Driver

Rising Consumer Demand for Recycled and Eco-friendly Packaging Solutions

The growing consumer preference for recycled and eco-friendly packaging solutions is expected to boost the growth of the industrial packaging recycling services market during the forecast period. This consumer shift is majorly influenced by stringent government mandates, increasing awareness of the environmental impact of non-recyclable packaging materials. Consumers are actively seeking sustainable alternatives and are willing to pay more for eco-friendly packaging options. The industrial packaging recycling services assist in reducing pollution levels, marine debris, and landfill overflow, which pose threats to both human health and ecosystems. Moreover, companies are recognizing the significance of sustainable packaging solutions that can improve brand image and loyalty among environmentally conscious consumers.

- According to the article published by Bain & Company in November 2023, Consumers are now more interested in environmentally friendly products and are willing to pay a premium price for sustainable products, 12% on average. For instance, in the U.S., consumers are willing to pay an average premium of 11 percent for products that have reduced environmental impact. However, to market the products as sustainable in the US, this premium increases to an average of 28%. In fast-growing markets such as Indonesia, India, China, and Brazil, consumers are willing to pay an even greater premium, ranging from 15% to 20%, due to a rise in environmental concern among consumers. (Source: ESG Today)

Restraint

Low-quality Recyclables

The low quality of recyclables is anticipated to hinder the market's growth. The improper disposal practices reduce the value of recycled materials. In addition, mixing of various kinds of materials can hinder recycling efforts may hinder the growth of the global industrial packaging recycling services market during the forecast period.

Opportunity

Increasing Focus on Sustainability

The growing emphasis on sustainability and the increasing regulatory pressures are projected to create immense growth opportunities for the industrial packaging recycling services market in the coming years. Sustainable packaging plays a crucial role in reducing the carbon footprint without compromising the performance of recycled packaging materials. The recycled packaging materials do not pollute the environment; instead, they assist in promoting a sustainable ecosystem. The industrial packaging recycling services bring optimum value to consumers through high functionality and recyclability. Several industries are increasingly adopting advanced sorting and processing technologies to make recycling facilities more efficient.

Several governments have implemented favorable regulations on the usage of recycled packaging materials and provide tax credits and incentives for companies and businesses that adopt sustainable and recycled packaging practices. These incentives can take various forms, like tax breaks, grants, and subsidies are specifically designed to encourage businesses to reduce their carbon footprint and promote a healthy environment.

Segmental Insights

Why Did the Recycling and Reuse Segment Dominate the Industrial Packaging Recycling Services Market in 2024?

The recycling and reuse segment held a dominant position in the industrial packaging recycling services market in 2024, owing to the increasing need for recycling and reuse of packaging materials across various industries. Several prominent market players are increasingly focusing on mechanical recycling and reusing packaging materials with an aim to reduce their carbon footprint and boost sustainability. The importance of recycling services has substantially increased with the surge in waste generation and increasing awareness of environmental degradation. On the other hand, the biodegradable segment is expected to grow at a significant rate. The segment is mainly driven by the rising utilization of biodegradable materials that decompose into organic matter. The biodegradable packaging material plays a crucial role in aligning with regulatory requirements and meeting consumer expectations for sustainability.

- In January 2025, UConn Researchers partnered with a bioplastics company to examine biodegradable plastics. A recent study published in the Journal of Polymers and the Environment found that Mater-Bi, a starch-based polymer produced by Italian company Novamont, degraded by as much as nearly 50% over nine months in a marine environment, significantly more than traditional plastics, and showing promise for reducing marine pollution. (Source: UConn Today)

Why Did the Food Industry Dominate the Industrial Packaging Recycling Services Market in 2024?

The food industry segment accounted for a significant share of the industrial packaging recycling services market in 2024, owing to the more sustainable packaging solutions in the food industry. The food industry generates significant packaging waste, including a wide range of materials such as plastics, aluminium, cardboard, and metals, each requires specific recycling processes. These services focus on managing and processing the large volumes of packaging waste with an aim to reduce landfill waste. The adoption of recyclable packaging materials is a crucial step toward reducing the environmental impact and promoting a circular economy for packaging.

- In November 2024, Greif, a global leader in industrial packaging, announced the launch of EnviroRAP, an innovative 100% recycled paperboard designed for the food industry. EnviroRAP offers exceptional resistance to oil and grease, making it suitable for packaging both aqueous and fatty foods. Its water-based, recyclable, and repulpable coating ensures it can be easily recycled, further reducing its environmental impact and supporting sustainability efforts. (Source: Packaging Strategies)

On the other hand, the chemical sector segment is expected to witness remarkable growth during the forecast period, owing to the increasing need for effectively managing waste and boosting sustainability. Chemical recycling efficiently tackles the increasing problem of waste plastic pollution by offering an innovative way to reuse and recycle plastic waste. It not only helps to reduce greenhouse gas emissions but also relieves pressure on landfill capacity.

Chemical recycling processes have the potential to improve recycling rates and divert plastic waste from landfills or incineration. Chemical recycling is a novel process to convert polymeric waste by changing its chemical structure and turning it back into substances, which can be widely used as a feedstock for manufacturing plastics and other plastic products. Chemical recycling efficiently tackles the increasing problem of waste plastic pollution by offering an innovative way to reuse and recycle plastic waste. It not only helps to reduce greenhouse gas emissions but also relieves pressure on landfill capacity.

Regional Insights

North America

North America held the dominant share of the industrial packaging recycling services market in 2024. The region’s rapid growth is driven by the strong presence of industrial packaging recycling infrastructure, increasing demand for recycling packaging materials from multiple industries, increasing awareness of environmental sustainability, rising expansion of the e-commerce industry, rapid advancements in recycling technologies, and rising popularity of biodegradable packaging. The rising focus on eco-friendly material innovation, along with an increasing government initiative to reduce carbon footprints, significantly contributes to the overall growth of the regional market. Moreover, the high consumer spending on sustainable packaging solutions as environmentally responsible practices, driving the expansion of the market in the region. Furthermore, several leading manufacturers are heavily investing in industrial packaging recycling services to advance sorting and recycling technologies for making them more efficient.

Europe’s growth is mainly attributed to the growing emphasis on improving recyclability, increasing consumer demand for recycled materials, and stringent government regulations on waste management. In the EU, Extended Producer Responsibility (EPR) schemes and plastic taxes have made non-recyclable packaging less viable. These policies create both opportunity and pressure to innovate packaging materials. Several key players are widely adopting innovative recycling technologies with sustainable solutions to lower their carbon footprint and promote the circular economy in the region. These factors are expected to propel the growth of the industrial packaging recycling services market in the region during the forecast period.

- According to the European Parliament report in March 2024, globally, researchers estimate that the production and incineration of plastic pumped more than 850 million tonnes of greenhouse gases into the atmosphere in 2019. By 2050, those emissions could rise to 2.8 billion tonnes, a part of which could be avoided through better recycling. (Source: Renewable Carbon)

Industrial Packaging Recycling Services Market Key Players

Latest Announcement by the Industry Leader

- In May 2025, Chemco partnered with Kandoi to launch an INR 450-crore JV for the rPET project, creating a circular economy project, which is expected to transform PET waste into industrial packaging. Commercial production will begin by the end of 2025, and it will generate over 2,500 jobs and formalise India's waste value chain. (Source: WhatPackaging)

Recent Developments

- In July 2024, SIG, a global leader in food and beverage packaging solutions, unveiled a recycle-ready bag for water, developed and manufactured in Australia. The current structure, which contains aluminum, will be replaced by SIG Terra RecShield, a uniquely formulated material structure with a polymer composition. This means that all components of the bag-in-box packaging are now recycle-ready. (Source: SIG)

- In February 2025, Tetra Pak claimed to be the first company in India’s food and beverage packaging industry to offer its packaging materials with ISCC PLUS-certified recycled polymers, aligning with incoming national legislation around plastic waste management. (Source: Packaging Europe)

Industrial Packaging Recycling Services Market Segmentations

By Type

- Recycle and Re-use

- Biodegradable

- Energy Recycling

- Landfill Disposal

By Application

- Electronic Industry

- Chemical Industry

- Medicine Industry

- Food Industry

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait