The metallized film market is projected to grow from USD 3.15 billion in 2026 to USD 6.04 billion by 2035, registering a CAGR of 7.53% during the forecast period from 2026 to 2035. The report provides detailed insights including market size, segment data, regional performance, competitive analysis, company profiles, value chain analysis, trade data, and manufacturers and suppliers information.

Growth is driven by increasing demand from electronics, food, and pharmaceutical industries, along with rising e-commerce activities and the need for packaging solutions that extend product shelf life. Technological advancements such as advanced coatings and nanotechnology are also shaping market innovation.

- In terms of revenue, the market is valued at USD 3.15 billion in 2026.

- The market is projected to reach USD 6.04 billion by 2035.

- Rapid growth at a CAGR of 7.53% will be observed in the period between 2026 and 2035.

- By region, Asia Pacific dominated the global market by holding highest market share in 2025.

- By region, Europe is expected to grow at a notable CAGR from 2025 to 2034.

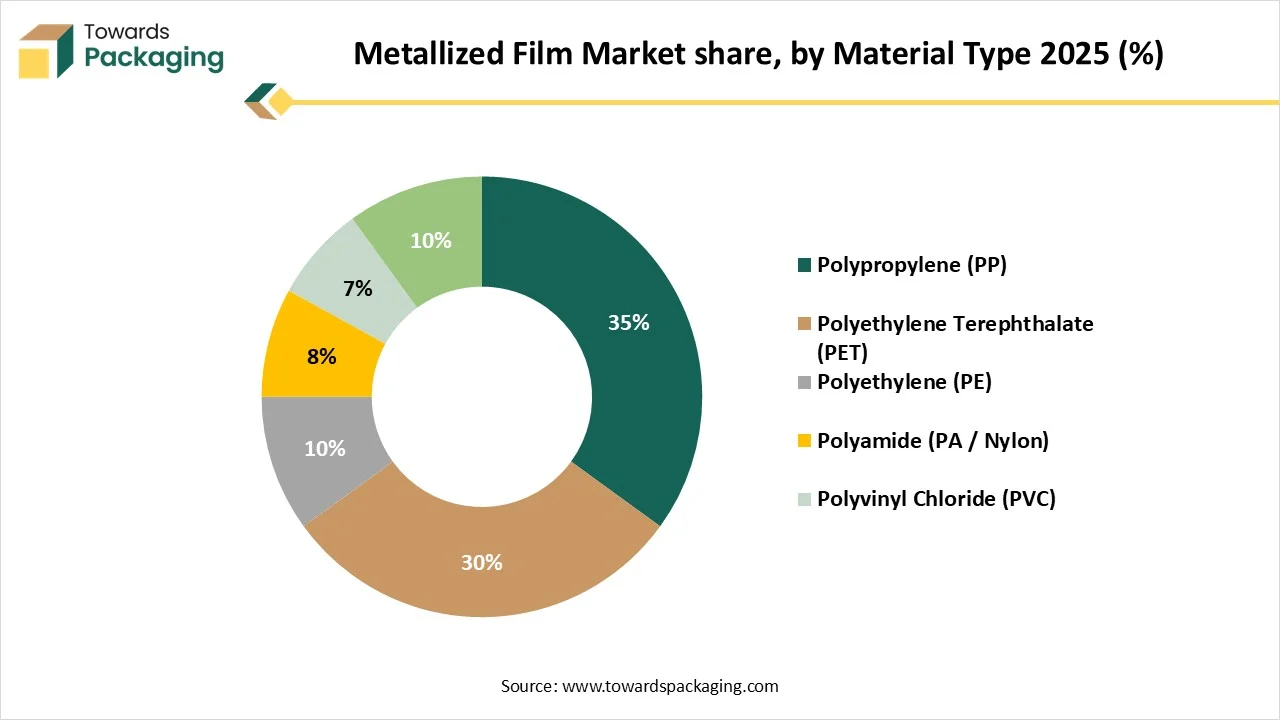

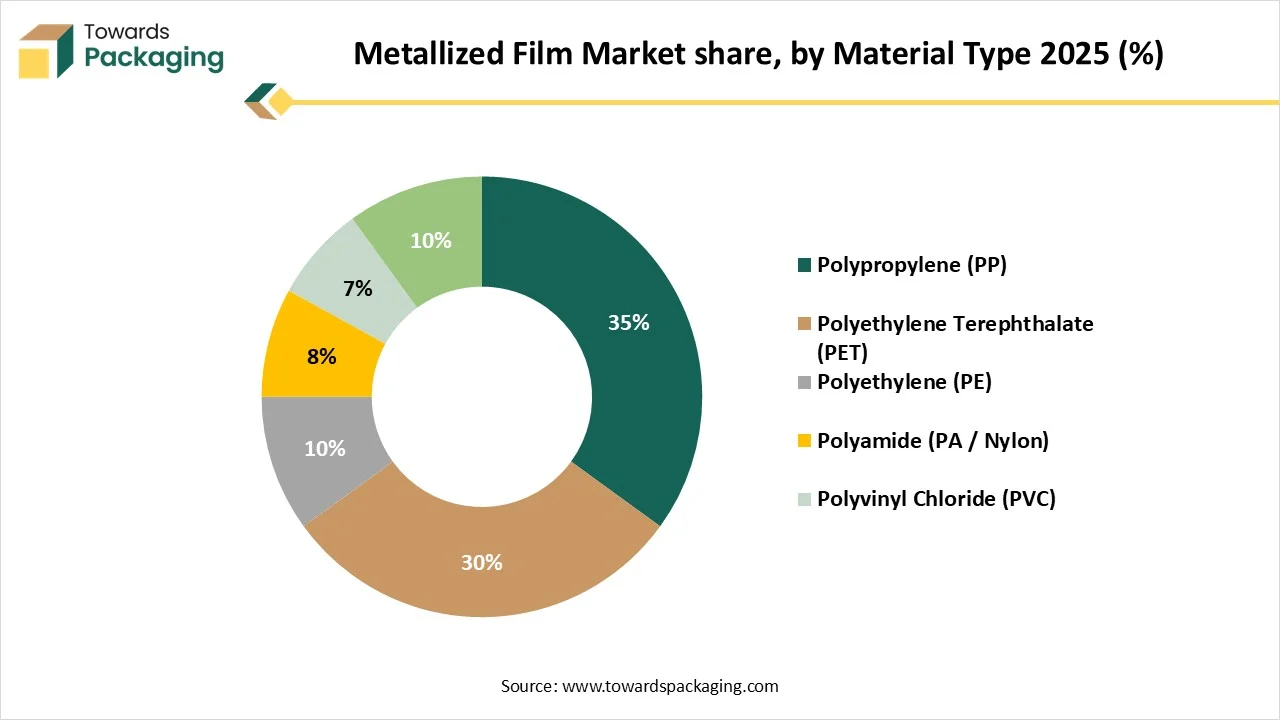

- By material type, the polypropylene (PP) segment contributed the biggest market share in 2025.

- By material type, the polyethylene terephthalate (PET) segment will be expanding at a significant CAGR in between 2026 and 2035.

- By metal type, the aluminum segment contributed the biggest market share in 2025.

- By metal type, the copper segment will be expanding at a significant CAGR in between 2026 and 2035.

- By product type, the single-sided segment contributed the biggest market share in 2025.

- By product type, the double-sided segment will be expanding at a significant CAGR in between 2026 and 2035.

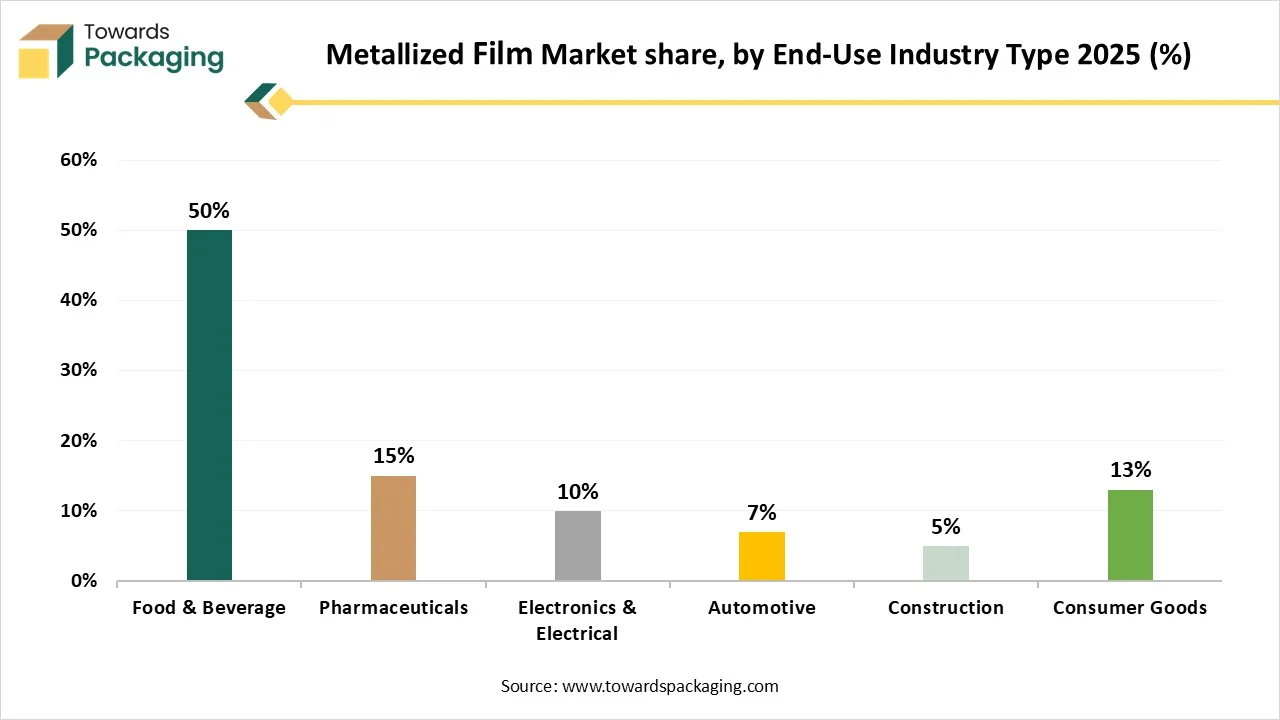

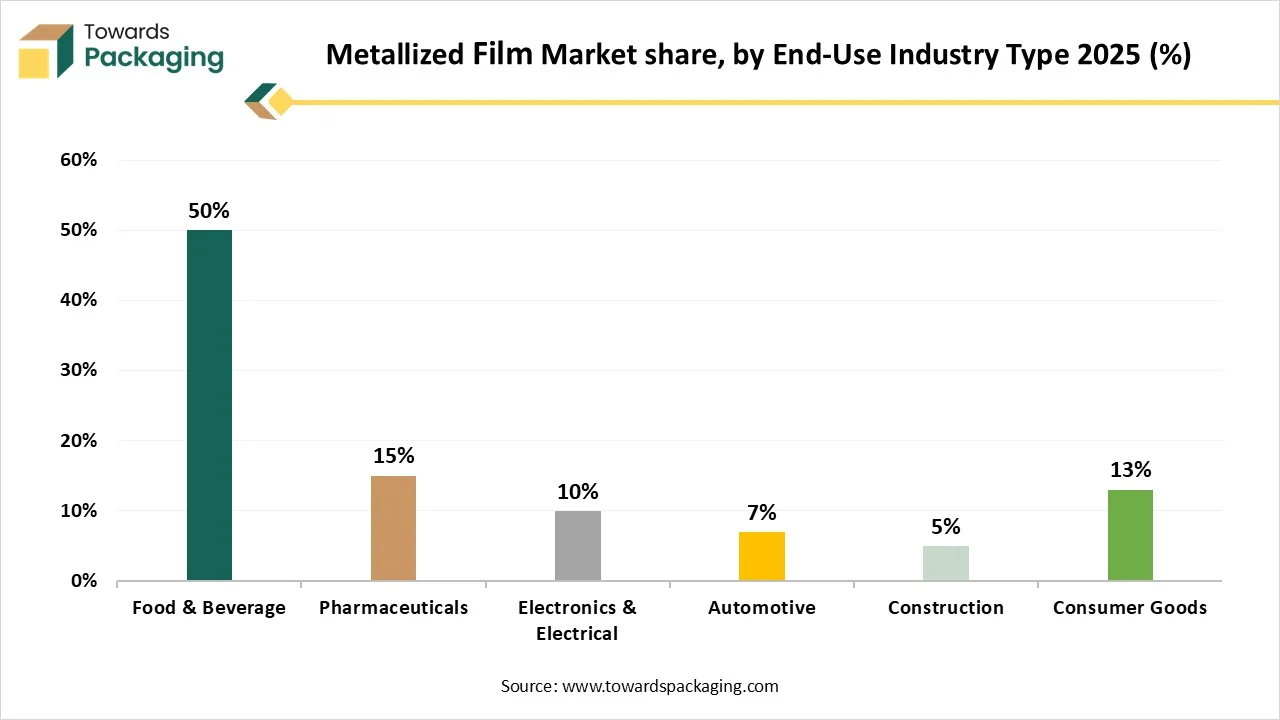

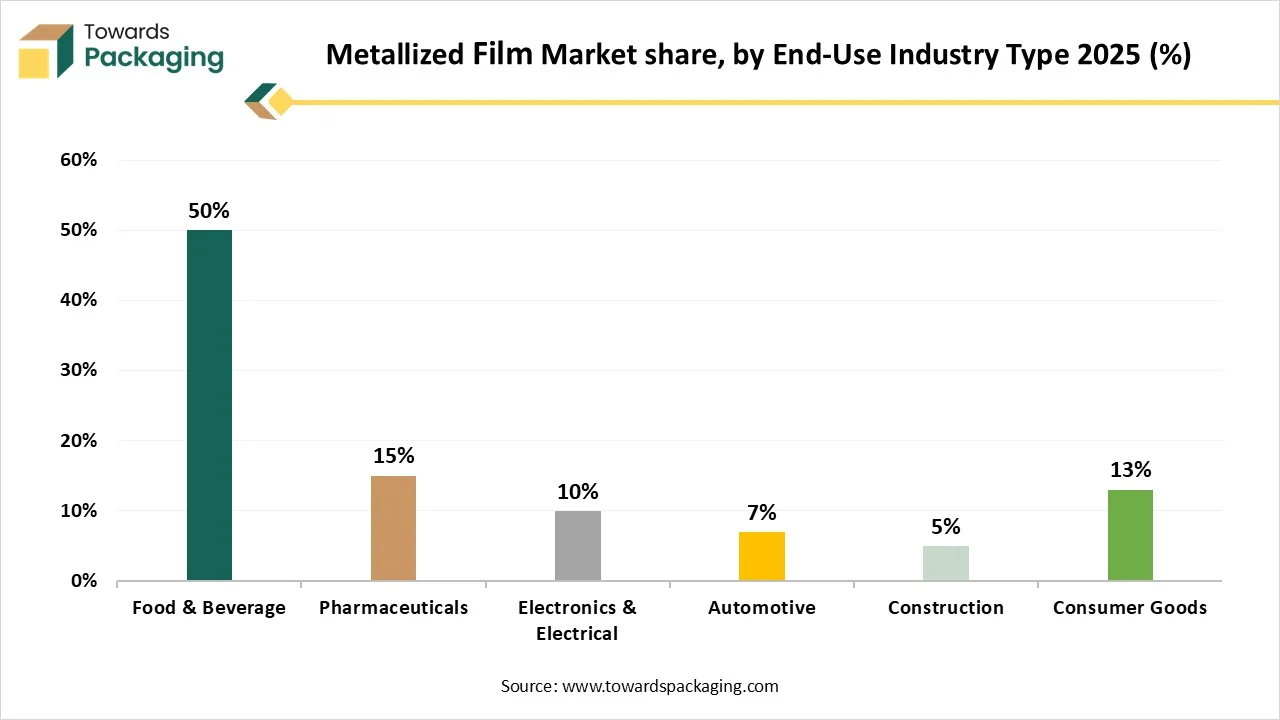

- By end-user, the food & beverage segment contributed the biggest market share in 2025.

- By end-user, the electronics & electrical segment will be expanding at a significant CAGR in between 2026 and 2035.

Metallized films include thin polymer films coated with a metallic layer (typically aluminum) through vacuum deposition or other metallization processes. These films are widely used for barrier protection, decorative finishes, electrical insulation, thermal reflection, and conductivity in packaging, electronics, automotive, construction, and energy applications.

Market growth is driven by increasing demand for flexible packaging, rising use in food & beverage and pharmaceutical packaging, expanding electronics and capacitor markets, lightweight material demand in automotive, and sustainability-driven shift toward recyclable and high-barrier packaging materials.

- Market Growth Overview: The market is expanding due to growing demand for aesthetic packaging, performance, sustainable resources, enhanced shelf life, and technological advancement.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, Middle East & Africa are witnessing rising demand for sustainable packaging, increasing end-user industries, technological advancements, strategic investment, and booming e-commerce sector.

- Major Market Players: The market includes Jindal Poly Films Limited, Uflex Ltd., Dunmore Corporation, Cosmo Films Ltd., Toray Industries, Inc., and many other.

- Startup Ecosystem: The startup industries play an important role in developing smart packaging, biodegradable films, high-performance barrier coatings, AI & automation production, and specialized usage.

Technological transformation in the metallized film market plays a significant role in its expansion. Adoption of AI and automation in the manufacturing process and integration of smart technologies has influenced the growth of the market. Corporations are discovering renewable resources such as sugarcane or corn to generate biodegradable metallized films, decreasing reliability on fossil fuels. Advanced films are manufactured to decay with time or break down completely under composting circumstances, supporting to decrease plastic waste. Developments in thinner preparations and barrier skills are creating metallized films highly recyclable in comparison to traditional plastic seals.

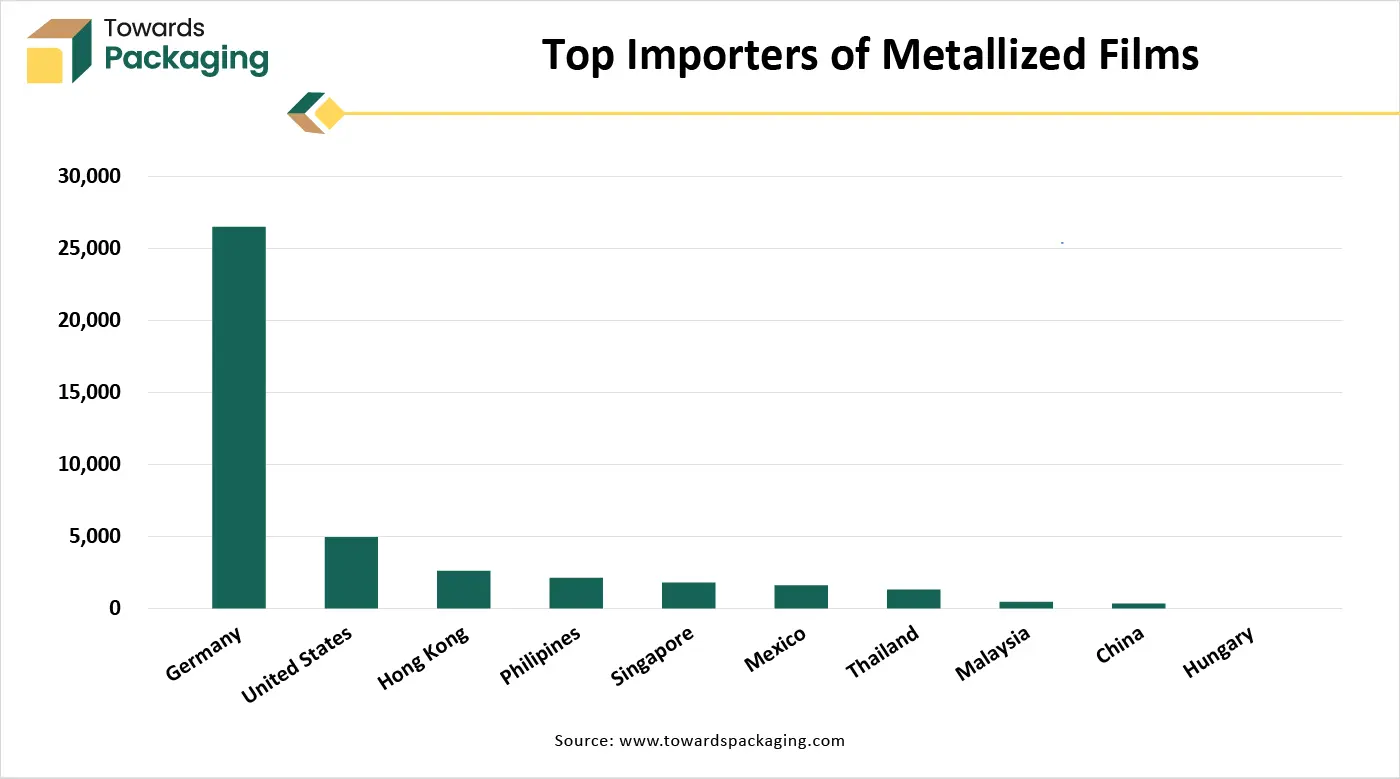

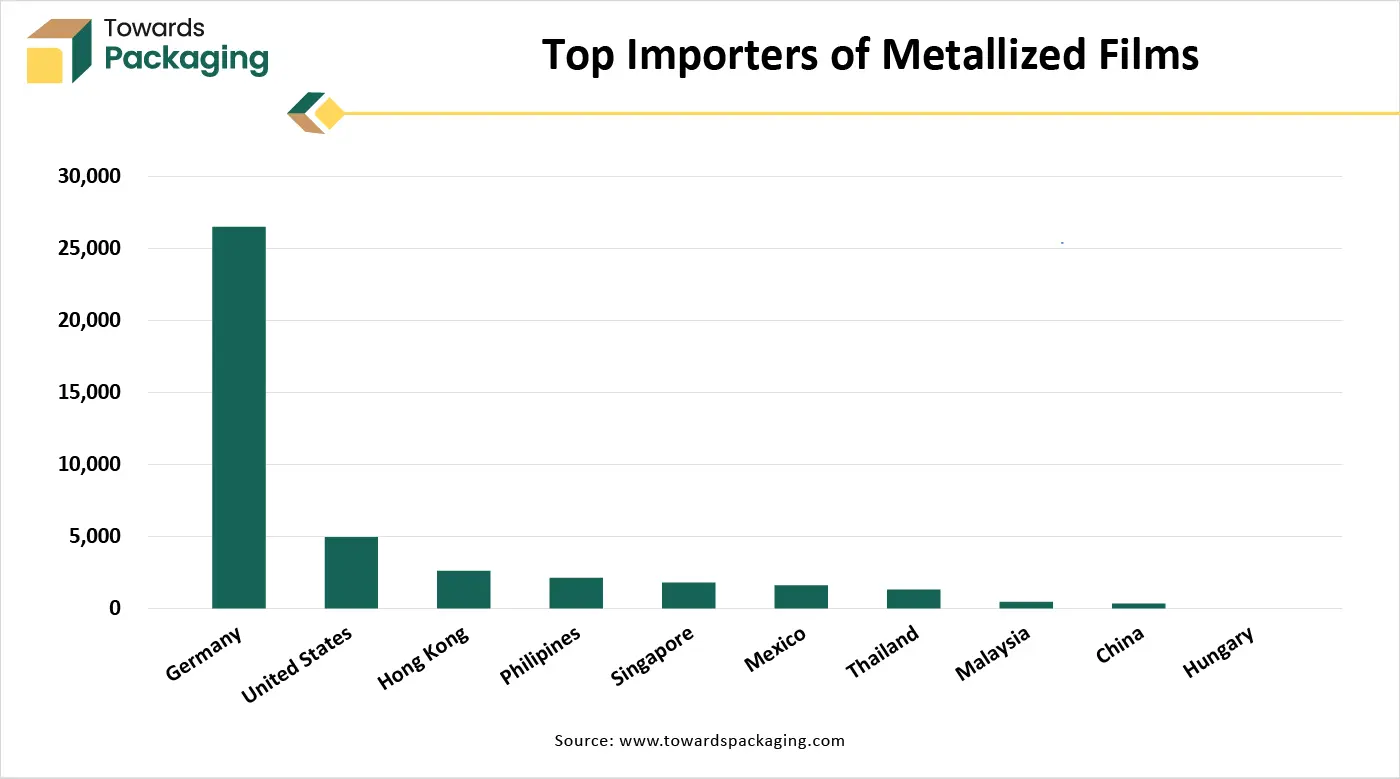

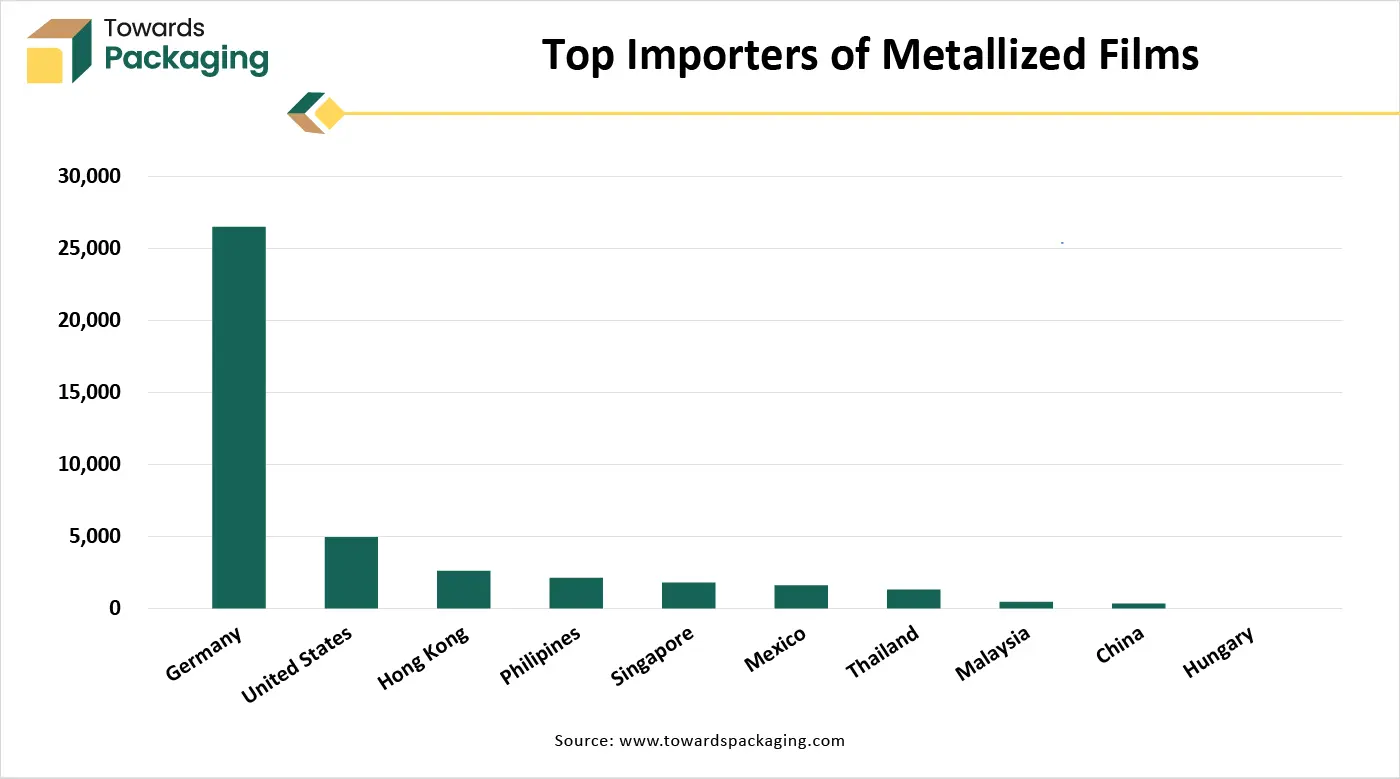

- China: It is considered as the top exporter of Metalized films in the world with 10,230 shipments.

- India: It stands in the second position as an exporter of the Metalized films worldwide with 7,874 shipments.

- Thailand: It stands in third position as an exporter of the Metalized films globally with 4,594 shipments.

Raw Material Sourcing

The major raw materials utilized in this market are base film, metallization metal, BOPP or PET.

- Key Players: UFLEX LIMITED, Cosmo Films Ltd.

Component Manufacturing

The component manufacturing in this market comprises base film, vacuum chamber set up, metal evaporation, polypropylene (PP).

- Key Players: Jindal Poly Films, Vacmet India Ltd.

Logistics and Distribution

This segment is growing focus on preserving quality, enhancing transportation charges, and fulfilling precise end-user necessities.

- Key Players: Ester Industries Ltd., Cosmo Films

Material Type Insights

The polypropylene (PP) segment dominated the market with highest share in 2025 due to its strength and cost-effectiveness. These provide exceptional barriers from moisture and odors as it supports in extension of the shelf life of goods such as confectionery, snacks, and coffee. It can be utilized in an extensive variety of applications, comprising food packaging & labeling, and several other industrial usages, like in components and electronics for insulation. The flexibility of the films also makes it appropriate for the increasing demand for convenient as well as lightweight packaging.

The polyethylene terephthalate (PET) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its flexibility, excellent barrier properties, and high strength. The rising demand for protective and durable packaging is a significant factor for this segment. It offers a robust barrier against gas and moisture as it is critical for protecting the quality of food and various other delicate products.

The polyethylene (PE) is the fastest-growing in the market, as it comprises moisture resistance, flexibility, and strength. These benefits make it an extremely cost-operative and extensively utilized resource for several applications. It is a cost-efficient and rich resource, which is making it a suitable option for a wide-scale production. It has low melting point permits for energy-effectual process, which supports in keeping total conversion charges competitive.

| Metal Type Segments |

Market Share 2025(%) |

| Aluminum |

60% |

| Copper |

15% |

| Silver |

10% |

| Zinc |

5% |

| Others |

10% |

The aluminum segment dominated the market with highest share in 2025 due to its lightweight nature and superior barrier properties. This segment offers excellent defence against light, moisture, and oxygen, as it has enlarged goods shelf life and is extensively utilized in food & beverage packing, as well as in labeling and electronics. It offers a superior barrier from light, moisture, and gases, that is essential for protecting product integrity and extending shelf life. This segment is considered as an affordable choice compared to various other metals, offering to its extensive usage in mass-market goods.

The copper segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to energy storage capacity and electronics industries. It is important for printed circuit boards (PCBs), high-frequency circuitry, and flexible circuits. The diminishment of electronic equipment such as medical equipment, smartphones, and wearables is a major factor for the request for thin and lightweight copper films. It is a huge development in this market with specialized high-value usages within the energy and electronics sectors.

The silver is the fastest-growing in the market, as it comprises antimicrobial properties. It is widely utilized for decorative purpose due to its reflective and shiny appearance. Its superior electrical conductivity properties which make it appropriate for using in the electric industry. It is highly reflectivity, antimicrobial, or conductivity effects. This packaging is also highly utilized in the pharmaceutical sector.

Product Type Insights

| Product Type Segments |

Market Share 2025 (%) |

| Single-Sided Metallized Films |

55% |

| Double-Sided Metallized Films |

45% |

The single-sided segment dominated the market with highest share in 2025 due to rising sustainable packaging, high-barrier, lightweight, and cost-effective. It offers exceptional barrier properties from UV light, moisture, and oxygen, on the covered side, encompassing the shelf life of packed products. The uncoated side permits for easy sealing or lamination to various other resources, providing flexibility in packing pattern. It covers wide range of packaging sector which influence the demand for this segment.

The double-sided segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its space-saving and lightweight properties. The market is influenced by the change from mechanical fastenings to pasting tapes, mainly in the electronics and automotive sectors. The growing utilization of electric vehicles also boosts demand for high-presentation adhesives. These are widely accepted due to their superior transparency and durability, preparing them appropriate for both visibly and structurally usage.

End-Use Industry Insights

The food & beverage segment dominated the market with highest share in 2025 due to enhanced brand appeal, intact freshness, and increase shelf life. It prevents sensitive food products from moisture and oxygen, that supports in preserving odors and stop spoilage, decreasing the necessity for preservatives. It offers a sturdy barrier against moisture, light, oxygen, and odors, that is important for preserving the quality of goods such as dairy, chips, cookies, and coffee. These are eco-friendly packaging options that help brands to establish their identity.

The electronics & electrical segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its usage in high-performance components. These are important because of its lightweight, electrical conductivity, insulating capacity, and flexible properties. The development of the electric vehicle sector is a noteworthy driver, as these films are utilized in manufacturing electric vehicle components such as capacitors, batteries, and thermal management process, for power electronics.

The pharmaceutical is the fastest-growing in the metallized film market, as it comprises tamper evident safety and enhance shelf life of the packaged products. It plays an important role in maintaining the efficacy and stability of pharmaceutical goods. These are important for generating tamper-evident closures, which improves product safety and patient protection. It offers a finest, visually attractive finish that enhances branding as well as customer engagement.

Regional Insights

Asia Pacific held the largest share in the market in 2025, due to the presence of huge manufacturing base. Rapid expansion of food & beverages sector has also fuelled this industry to grow significantly. Constant support of government towards using eco-friendly packaging materials raised awareness among consumers. Major market players are introducing advancement in manufacturing process which boost the growth of the market by covering a huge market. There is an upsurge in the demand for biodegradable and recyclable material for packaging purpose.

Why Metallized Film Market is Dominating in China?

Rising e-commerce and packaging industries has enhanced the demand for metallized film in China. It has large-scale production companies for manufacturing an extensive variety of flexible packaging resources, comprising metallized films. These are important for enhancing the shelf life of pharmaceuticals and food products by shielding them from factors such as light, oxygen, and moisture, which bring into line with customer demand for suitable and well-maintained products. These are progressively utilized in various other sectors such as personal care, electrical and electronics, and for decorative drives, further growing market demand.

Europe expects the fastest growth in the market during the forecast period. Presence of strict regulatory guidelines has enhanced the demand for the market. It boosts the demand for recyclable packaging with less wastage of resources. There is a huge consumption of packaged food products has influenced the growth of the market. Advancement in the packaging technology has raised the adoption of this market significantly. The excellent protective properties have raised the demand for such packaging in various sectors.

How Metallized Film Market is Expanding in Germany?

Growing electronics sector with enhanced safety demand has boosted the development of the market in Germany. This is influencing the innovation in sectors such as bio-based films, de-lamination technologies, and mono-material constructions. A rapid shift towards luxury packaging, and lightweight packaging with increasing transportation demand has raised the demand for this market significantly. This pharmaceutical industry also needs safe and sterile packing. Rising concern among consumers towards ecological impact of product packaging has boosted the adoption of this industry.

The major factors influencing the growth of metallized film market are demand for sustainable and lightweight packaging, extension of shelf life of products, aesthetic appeal and branding, technological advancement, and several others. Their barricade possessions are important for encompassing the shelf life of pharmaceuticals and food, resulting many chief food constructers to accept them. The area's importance on sustainability also supports metallized films as an environment-friendly substitute to traditional packaging resources. Brands are capitalizing in bio-based and recyclable options to fulfil customer and supervisory demands.

Why Canada is Utilizing Metallized Film Market Significantly?

The rising demand for aesthetically appealing packaging, high-performance, and sustainable packaging has fuelled the development of the metallized film market. Presence of major electronics, pharmaceuticals, food & beverages industries has enhanced the demand for these packaging. Canada holds strong food dispensation and pharmaceutical sector that steadily need effective and consistent packaging resources. The glossy and reflective nature of metallized films also offer noteworthy aesthetic appeal, and it is important for branding in the personal care and cosmetics sectors. It offers high barrier nature while being cost-effective and lightweight than other traditional foils.

The metallized film market in the Middle East and Africa is growing steadily, driven by rising demand for flexible packaging, food preservation, and enhanced product shelf life. Industries such as food and beverages, pharmaceuticals, and consumer goods are increasingly adopting metallized films for their barrier properties, durability, and cost efficiency. Expanding retail sectors, urbanization, and shifting consumer preferences toward packaged products further support market growth. Additionally, developments in local manufacturing and increased investment in packaging technologies are boosting regional production capacity. Sustainability trends are also encouraging the use of lightweight, recyclable metallized films across various applications in the region.

How Are the Food, Beverage, and Pharmaceutical Sectors Driving the Adoption of Metallized Films in the UAE?

In the UAE, the metallized-film segment is expanding steadily, supported by rising demand in food & beverage, personal care, pharmaceuticals, and flexible packaging industries. Metallized films valued for their excellent barrier properties, light reflectance and moisture/oxygen protection are widely used in snack, confectionery, ready-to-eat food packaging, as well as in cosmetic pouches and pharma wraps.

In South America, the metallized film market is steadily expanding. The growth is largely driven by the booming food and beverage industry, rising urbanization, and escalating demand for flexible, high-barrier packaging in countries like Brazil, Argentina, and Colombia. Rising e-commerce, expansion of retail sectors, and brand owners’ push for recyclable mono-material packaging are further propelling adoption of metallized films (especially BOPP) in snack, confectionery, and consumer goods.'

What Are the Major Factors Contributing to the Rising Demand for Metallized Films in Brazil?

In Brazil, metallized especially metallized BOPP (biaxially oriented polypropylene) films are becoming increasingly popular for food, snack, confectionery, and other packaged goods due to their strong barrier against moisture, oxygen and light, plus lighter weight and cost-effectiveness compared with older packaging materials.

Recent Developments

- In October 2025, Tradsark New Materials (Weifang) Co., Ltd., announces about its expansion of its product portfolio, comprising agricultural films, agricultural reflective films, PE metallized film, PET metallized film, CPP metallized film, and BOPP metallized film.

- In January 2025, Jindal Films announced about the completion of installation of new metallizer at Brindisi plant. It has enhanced production capacity of recyclable barrier BOPP.

Jindal Poly Films Ltd

Corporate Information

- Name: Jindal Poly Films Ltd (JPFL)

- Group: Part of B.C. Jindal Group.

- Incorporation & Registration: Originally incorporated on 9 September 1974 (as Hindustan Pipe Udyog Ltd) in Bulandshahr, Uttar Pradesh.

- Headquarters / Registered Office: Bulandshahr, U.P. (registered office address per filings)

History and Background

- 2005: Name changed to Jindal Poly Films Ltd (on 8 March 2005).

- 2005–06: Issued followon public offering; concurrently added a new BOPP film line (Line3, capacity 45,000 tpa) which began commercial production in September 2006.

- 2008–09: Added two more BOPP lines (combined capacity 90,000 tpa), raising total BOPP capacity to ~180,000 tpa.

Key Developments and Strategic Initiatives

- Diversification from yarn/steel business into polyester and polypropylene films, reflecting strategic pivot.

- Progressive capacity expansion multiple BOPP lines (2006, 2008–09, 2011–12) to meet rising demand.

- Expansion of metallizing & coating capabilities: e.g., in 2005–06 increasing metallizing capacity by 14,000 TPA (to 26,000 TPA) at Nashik plant.

Mergers & Acquisitions

- 2005–06 IPO / Follow-on Offering: JPFL raised capital via public equity (83,33,325 shares issued at premium).

- 2013 (effective from Oct 2013): Company acquired the global BOPP films business of ExxonMobil (USA), which included five manufacturing facilities (2 in USA, 3 in Europe) broadening its international manufacturing footprint and access to advanced filmtechnologies.

Partnerships & Collaborations

- As noted above, acquisition of ExxonMobil’s global BOPP films business (2013) effectively a major inorganic expansion / partnership by takeover.

- The 2023 acquisition of the Netherlands-based group of film-making entities (via JPF Netherlands Investment BV) backing specialty and metallized film/laminate operations across Europe.

Product Launches / Innovations

- JPFL produces a broad range of films: BOPET, BOPP, CPP, metallized, coated (including PVDC, Acrylic, LTS coated), thermal lamination, nonwoven fabrics.

- Their BOPET films cover thicknesses up to ~350 microns suitable for packaging, printing, lamination, electrical insulation, solarcontrol window films, and even photovoltaic / solar cell applications.

R&D Organisation & Investment

- JPFL has historically invested in modernizing its polymer & film production e.g. modernizing polyyarn plants (1990s), setting up polycondensation for polyester chips (1992), expanding film lines in successive years.

- The diversification into coated, metallized, specialty films and the acquisition of global filmmanufacturing operations (e.g. ExxonMobil’s business; European subsidiaries) indicates a strategic focus on advanced film technologies which likely involves R&D, process standardization, quality control.

SWOT Analysis

Strengths

- Largest flexiblepackaging film manufacturer in India; wellestablished domestic leadership.

- Broad product portfolio: BOPET, BOPP, CPP, metallized, coated, thermal, nonwoven serving multiple industries (food, packaging, insulation, lamination, industrial).

- Large integrated manufacturing facility (Nashik) economies of scale, capacity to meet large orders.

Weaknesses / Risks

- Diversification history while advantage in some ways may have led to complex business structure (especially after splitting packaging business to subsidiary).

- Dependence on raw materials (polymers, resins) whose cost volatility could impact margins. (Common for film/packaging industry; implicit in business model.)

- Limited publicly disclosed R&D spend possible risk if global competition moves faster to newer packaging solutions (biodegradable films, advanced barrier materials).

Opportunities

- Growing global demand for flexible packaging films (food, personal care, pharma, etc.), especially in emerging markets strong growth potential.

- Expansion into coated / specialty / metallized films for high-barrier applications (pharma, electronics, luxury packaging) higher value add.

- Leveraging global subsidiaries and acquisitions for advanced technology transfer, global clients, and wider market access.

Threats

- Intense competition (global & domestic) in packaging films and emerging alternative materials (bioplastics, compostables, other highperformance films).

- Regulatory/environmental pressure on plastic usage (particularly films) globally may increase cost of raw materials, compliance burden, or reduce demand.

- Operational hazards: as illustrated by recent fire incident (see below) safety, compliance, continuity risk.

Recent News & Strategic Updates

- In May 2025, JPFL (through its subsidiary JPFL Films) announced a major expansion at its Nashik facility: investment of ₹700 crore to install new production lines for BOPP, PET and CPP films. This expansion is expected to raise BOPP capacity by ~42,000 tonnes, PET by ~55,000 tonnes, and CPP by ~18,000 tonnes per annum.

- This plan complements the earlier BOPP Line9 project (announced Aug 2025), reflecting the firm’s push to strengthen its flexiblepackaging business despite industry-wide pressures.

Other Top Companies

- Cosmo Films Ltd.: It is widely known for its high-barrier, lightweight metallized films for packaging and branding.

- Uflex Limited: It offers sustainable, ultra-thin metallized films and expands its product line in this area.

- Toray Industries, Inc.: It produces high-performance metallized films for pharmaceutical and security applications.

- Polyplex: It is a global supplier of PET and BOPP films, which are used in metallized applications.

- Others: Dunmore Corporations, Innovia Films Ltd., Avery Dennison Corp., Sierra Coating Technologies LLC, and Taghleef Industries Group.

By Material Type

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polyamide (PA / Nylon)

- Polyvinyl Chloride (PVC)

- Others

By Metal Type

- Aluminum

- Copper

- Silver

- Zinc

- Others

By Product Type

- Single-Sided Metallized Films

- Double-Sided Metallized Films

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Electronics & Electrical

- Automotive

- Construction

- Consumer Goods

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA