OPP Pouches Market Trends, Investment Opportunities & Competitive Benchmarking

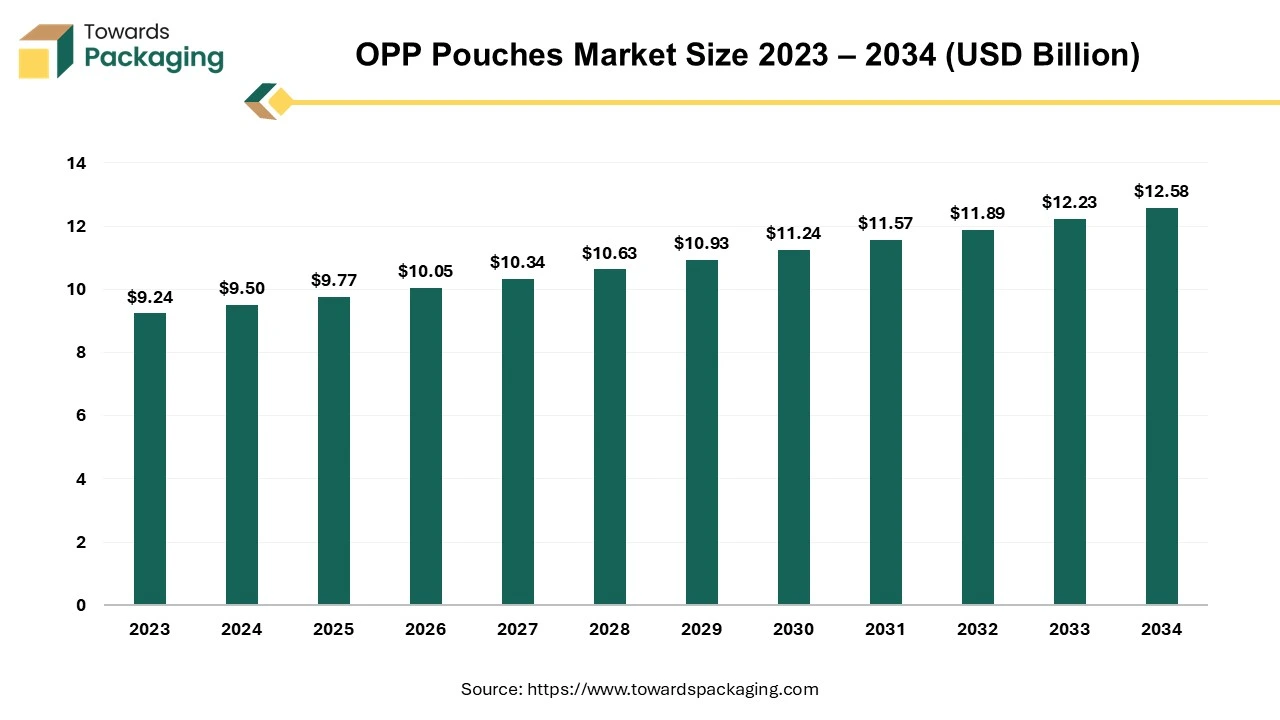

The OPP pouches market is set to grow from USD 10.05 billion in 2026 to USD 12.94 billion by 2035, expanding at a CAGR of 2.85%. We cover complete segmentation by material type, application, and pouch format, along with regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Our research includes company profiles, competitive analysis, value chain mapping, trade statistics, and detailed data on global manufacturers and suppliers.

Key Takeaways

- Asia Pacific led the OPP pouches market with a significant share in 2024.

- By product type, the stand-up pouches segment dominated the market in 2024.

- By capacity, the 201 to 500 gms segment held a significant share of the OPP pouches market in 2024.

- By end user, the food segment dominated the market with the largest share in 2024.

Market Overview

The OPP pouches market has grown rapidly due to the products’ convenience and is wide applications in multiple industries. The rising demand for customization in packaging sector is observed to promote the market’s expansion. In daily life, often see OPP plastic pouches outside. OPP bags are more transparent than PE plastic bags. OPP pouches are bags made of oriented polypropylene. OPP pouches are one of the most popular and widely used types of plastic bags on the market.

Most of the translucent or completely transparent "pouches " come across are made of OPP material. OPP is suitable for dry snacks, cookies, cigarettes, seeds, spices, dried fruits, and other foods due to its transparency and water resistance. Some companies are also packaging products such as clothing accessories in transparent OPP packaging, which is also driving the growth of the OPP pouches market.

Recent Trends in Opp Pouches Market

- In December 2024, Mondi offered integrated solutions for a variety of applications including fresh fruit (and home cooking), ready meals, and coffee capsules. In addition, all of Mondi’s kraft solutions are certified compostable, providing sustainable packaging for a wide range of needs, which is driving growth in the OPP pouches market.

- In March 2022, Amcor, a global packaging company developing new technologies for the packaging industry and a long-standing AIPIA member, announced a $5 million investment in PragmatIC Semiconductor, an AIPIA member and leading manufacturer and exporter of flexible polyethylene (PE) bags, driving growth in the OPP pouches market.

- In November 2022, the EPA announced the “National Strategy to Prevent Plastic Pollution”, which aims to eliminate plastic pollution in the environment, which is driving growth in the OPP pouches market.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 9.77 Billion |

| Projected Market Size in 2034 |

USD 12.58 Billion |

| CAGR (2025 - 2034) |

2.85% |

| Leading Region |

North America |

| Market Segmentation |

By Pouch Type, By Capacity, By End Use and By Region Covered |

| Top Key Players |

Amcor Plc, Carepac, Ouma Industrial Limited, United Bags, Jarrett Industries, Kleer Pak, Inteplast Group |

Integration of Artificial Intelligence in Pouch Packaging

Artificial intelligence and automation technologies are impacting flexible packaging manufacturing processes, increasing efficiency and innovation. AI enables predictive maintenance, process optimization, and real-time monitoring. By integrating AI-driven analytics, manufacturers can optimize pouch design, improve supply chain management, and enhance overall production efficiency. AI is being used in consumer behavior analysis, enabling manufacturers to tailor their packaging solutions to meet the specific needs of different regions and demographics.

The integration of artificial intelligence (AI) and automation into the OPP pouch packaging sector is significantly transforming. AI technologies are enhancing the efficiency and accuracy of packaging processes, enabling real-time quality control, predictive maintenance, and optimized production schedules. Automation streamlines operations by reducing manual intervention, thus minimizing errors and operational costs. As these technologies advance, they are expected to further boost market growth by increasing production capabilities and meeting the evolving demands of consumers and industries, this causes growth of the OPP pouches market.

Key Factors Influencing Future Market Trends

- The future of polypropylene packaging is electrifying and inventive. Companies concentrate on making BOPP, OPP, and PP Bags more eco-friendly. The latest technology is improving their recyclability and reducing waste. Biodegradable options are also at the forefront.

- Businesses are accepting more innovative designs, like bags that are perfect for selling and offer reasonable options. Also, high-level printing options assist brands in making eye-catching and colorful designs. As the urge for sustainable and tailored packaging rises, these trends are set to rechange the industry. These bags will become more evergreen and meet consumer demand.

Market Dynamics

Driver: Rising Transparency, Safety, and Consumer Appeal of OPP Pouches

The OPP pouches market is experiencing significant growth driven by its key benefits, particularly in the food packaging industry. OPP pouches offer exceptional high transparency, enhanced by anti-fog properties, which allow consumers to view the color, shape, and texture of products, especially for brightly colored or fresh food items like fruits and vegetables. This visual appeal boosts consumer confidence as they can assess product quality without relying on labels or reviews. In addition, since OPP pouches are made of food-grade, non-toxic materials, they do not compromise safety by coming into direct contact with products such as nuts and dried fruits.

Unlike traditional packaging that can hide or obscure the visibility of the content, OPP pouches maintain clarity, improve product presentation, and help customers understand the order's high purchasing power. OPP's environmental friendliness and lack of harmful chemical emissions are other important drivers of market growth, especially as consumers and businesses increasingly focus on food safety and sustainable solutions. These features come together to drive the demand for the OPP pouches market in the packaging sector, especially in the fresh food market.

Restraint: Environmental Concerns

The growth of the OPP pouches market faces significant restraints due to the broader issue of plastic pollution and its far-reaching environmental, social, and economic impacts. Plastic pollution can disrupt ecosystems, harm biodiversity, and reduce natural processes that support climate adaptation, thus posing a threat to global food production, livelihoods, and social well-being. The environmental risks associated with plastic waste combined with other stressors like ecosystem degradation and climate change highlight the urgency for more sustainable alternatives.

As governments and organizations increasingly focus on reducing plastic pollution, regulations and public scrutiny may limit the use of plastics, including OPP pouches. These societal concerns, along with the growing demand for more sustainable packaging solutions, could hinder market growth unless the industry adapts to meet evolving environmental standards and consumer expectations for eco-friendly packaging.

Opportunity: Rising Recycling and Sustainability of OPP Pouches

The OPP pouches market carries significant growth opportunities due to the importance of recycling and sustainability. OPP plastic films, including those used in tapes, labels, and packaging, are made from polypropylene (PP), a fully recyclable material. However, despite being a commonly used single-use plastic globally, OPP films are often under-recycled due to misconceptions about their disposal. With increasing consumer demand for eco-friendly packaging solutions, there is a growing market opportunity for companies to capitalize on recycling initiatives.

When properly processed by collecting, sorting, shredding, and separating by color OPP plastic can be repurposed into a variety of products, including fibers for clothing, industrial materials, and kitchenware. The ability to recycle OPP pouches, combined with the rising push for sustainable packaging solutions, presents manufacturers with a chance to not only reduce waste but also innovate and meet environmental standards, creating a competitive edge in the growing eco-conscious market. This trend towards recycling could drive the demand for OPP pouches and other polypropylene products, making sustainability a key driver in the future development of the industry.

Segmental Insights

Operative Packaging Solutions: Stand-up Pouches Led the Market in 2024

By pouch type, stand-up pouches segment dominated the OPP pouches market as these pouches help to maintain food fresher for a longer time period and provide important obstacle control to protect against the elements. Puncture-resistant films can be used to safeguard goods throughout transportation, and various specialty films can provide more protection against UV rays, moisture, and contaminants.

Stand-up OPP pouches are mostly used for packaging coffee, as well as for different products, containing food, and non-food products, and customizable wrapping. This pouch provides operative packaging resolutions.

Excellent Barrier Properties: 201-500 gms Capacity Pouches to Remain Bestsellers

OPP pouches offer excellent protection against moisture, oxygen, and light, which helps preserve the freshness and shelf life of products. The 201 to 500 grams segment benefits from these properties, particularly for items that need longer shelf lives. In emerging markets such as India, China, and Southeast Asia, the expanding middle class has led to a demand for convenient and affordable packaging sizes in the 201 to 500 grams segment. This weight range caters to urban families and working individuals looking for affordable yet adequate portions of products.

Expansion of Bakery Sector: Food to Sustain as a Dominant Segment

By package type, the food segment dominated the OPP pouches market as OPP pouches are widely used for food packaging this is safe and ecologically approachable. Therefore, mostly used in the food packaging industry. It is also used for packaging confectionery or finished products, but it is also most suitable for spices, vegetables, and bakery foodstuffs.

The pharmaceuticals segment is the fastest growing in the OPP pouches market due to these pouches are used to protect wholesale pharmaceutical medicines, drugs, and medical powders from humidity and moisture. OPP (Oriented Polypropylene) pouches are widely used for packaging a variety of medical items due to their flexibility, strength, and transparency.

Regional Segmentation

Sustainability and Innovation in OPP Packaging North America

North America is projected to dominate the global OPP pouches market throughout the forecast period, primarily due to the push for sustainability that is fostering innovation in packaging materials and designs. Companies that effectively create and promote eco-friendly packaging solutions are likely to gain a competitive advantage. Recent packaging technologies are advancing to address a variety of challenges to needs, focusing not only on aesthetics but also on functionality, ecological influence, and efficacy.

The future of packaging technology majorly focuses on key areas the implementation of supportable practices, the combination of advanced technologies, and the adoption of simple designs. Consumer demand for packaging that is easy to open, resealable, and visually appealing is influencing the design and functionality of OPP pouches, resulting in advancements in closure systems, graphic design, and shelf appeal. OPP pouches are extensively utilized in packaging for food and beverages, personal care and cosmetics, pharmaceuticals, and industrial products.

Canada

The Canadian OPP pouches market is experiencing steady growth, and the growth in the country is driven by the increasing consumer demand for convenient, lightweight, and sustainable packaging solutions. The OPP pouches are widely used in the food industry, especially for packaging dry snacks, frozen foods, and pet food, due to their excellent moisture resistance and clarity, which increases the demand for the market. The rise of e-commerce and on-the-go consumption habits further increases the demand for the product as these pouches are durable and easy to transport.

The shift towards bioplastic and recyclable materials, which reflects Canada's commitment to environmental sustainability, results in an increase in the growth of the market. Major and key companies like Amcor PLC, Mondi PLC are investing in innovative pouch design and materials to meet the demand of the consumers and meet regulatory standards. Overall, the technological advancement and sustainability practices in the country drive the growth of the market.

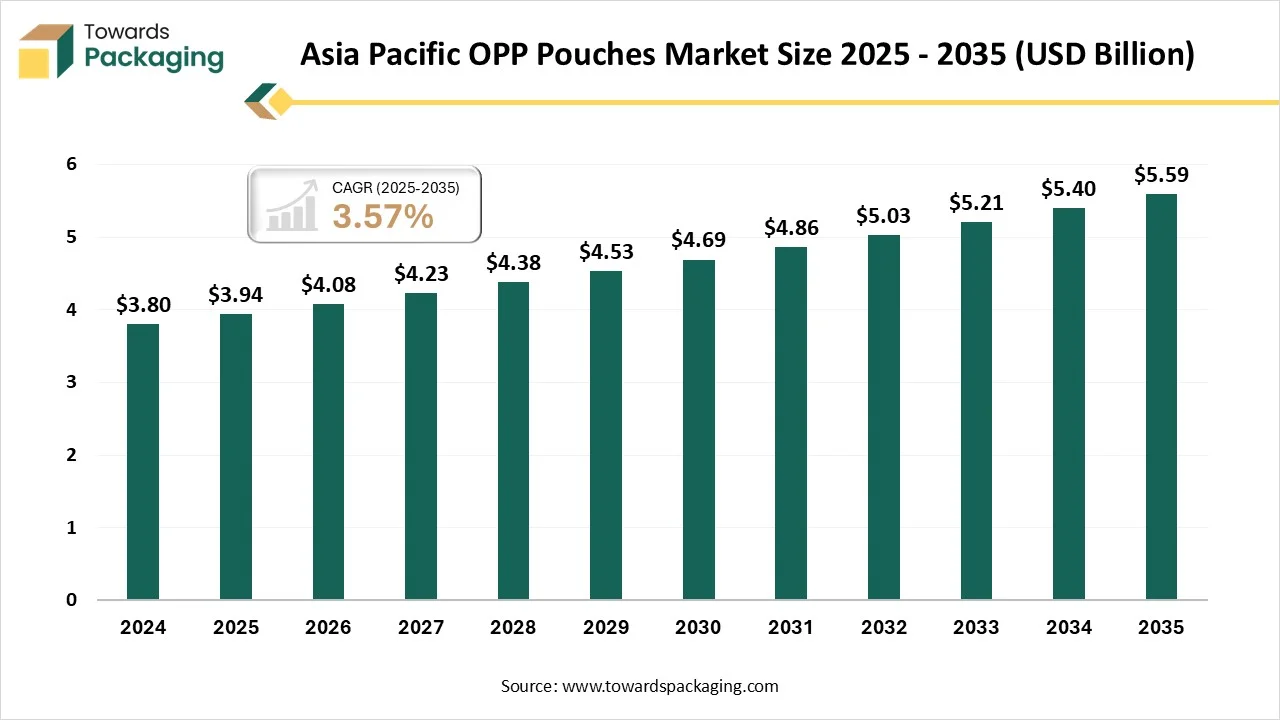

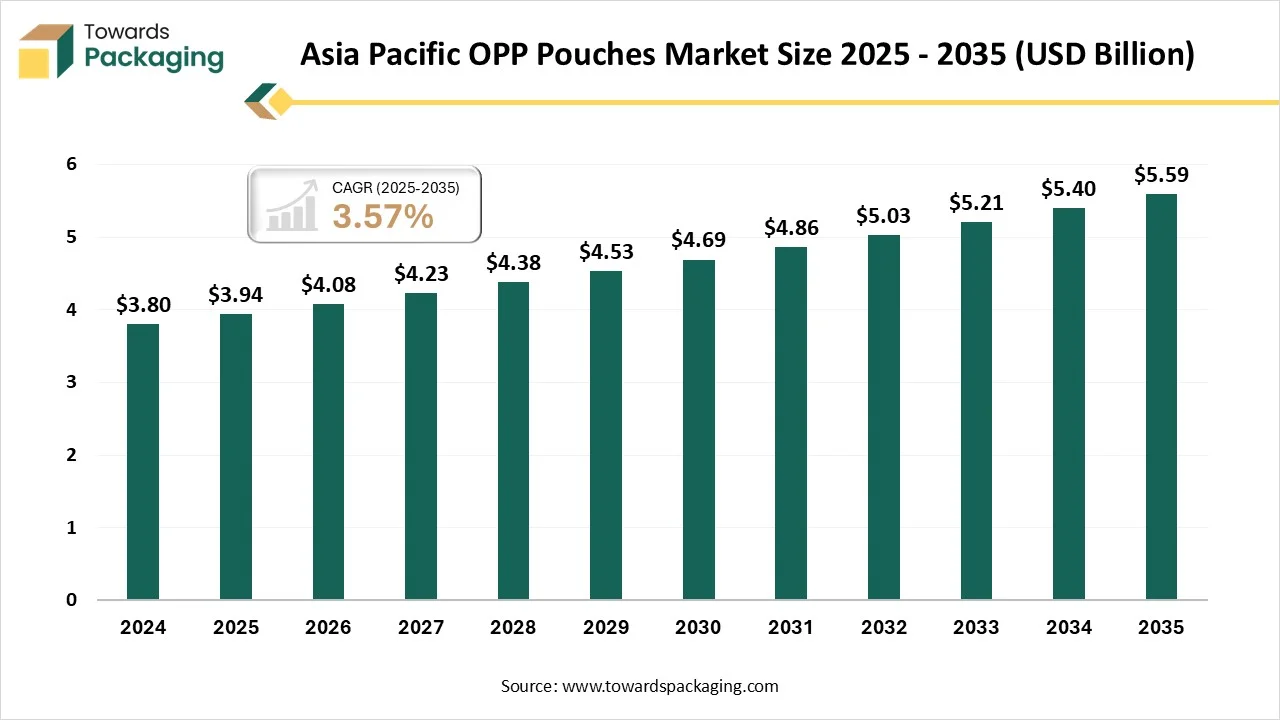

Cost-effective Production & Market Players’ Presence: Asian Countries to Sustain Dominance

The Asia Pacific region is projected to witness the fastest growth in the OPP sacks request, primarily due to its strength and the product of clear plastic film. OPP is constantly employed in the creation of small plastic bags, transparent markers, and flip lines throughout the Asia Pacific. OPP pouches are extensively used in food packaging and hot drinks, personal care and cosmetics, pharmaceuticals, and industrial products in Asia Pacific.

OPP plastic is tasteless and inoffensive with high impact strength. The OPP packaging has different parcels due to the different processing styles in the Asia Pacific region. Aware polypropylene, or OPP, is a cost-effective, flexible packaging film option with good strength, high clarity, and superior machinability, this caused the growth of the OPP pouches market in Asia Pacific.

India

India's OPP pouches market is experiencing robust growth, and due to the expansion of the food processing sector in the country, the rising demand for convenient packaging, and government supportive policies, drives the growth. The country's evolving food ecosystem, which is characterised by increasing investment and favourable economic policies, has significantly contributed to the growth of the market.

These pouches are particularly used in the food industry for their affordability, transparency, and adaptability, which makes them ideal for packaging consumables. The market is seeing growth due to its shelf life and cost effectiveness, which dominate the market and cater to both large-scale and small-scale manufacturers. Additionally, the surge in retail and e-commerce has amplified the need for sustainable and attractive packaging solutions, further driving the demand for OPP pouches. The growing shift towards sustainable alternatives, with rising concerns for the environment and consumer preference for eco-friendly solutions, drives the growth of the market.

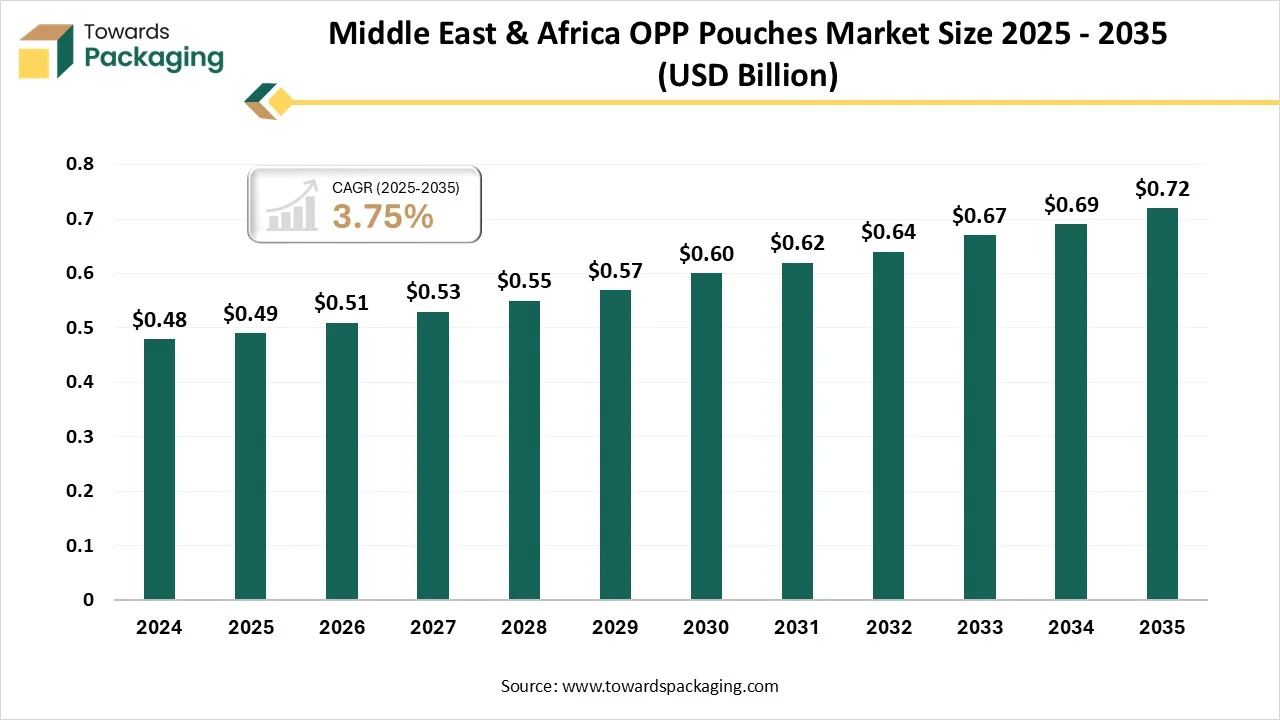

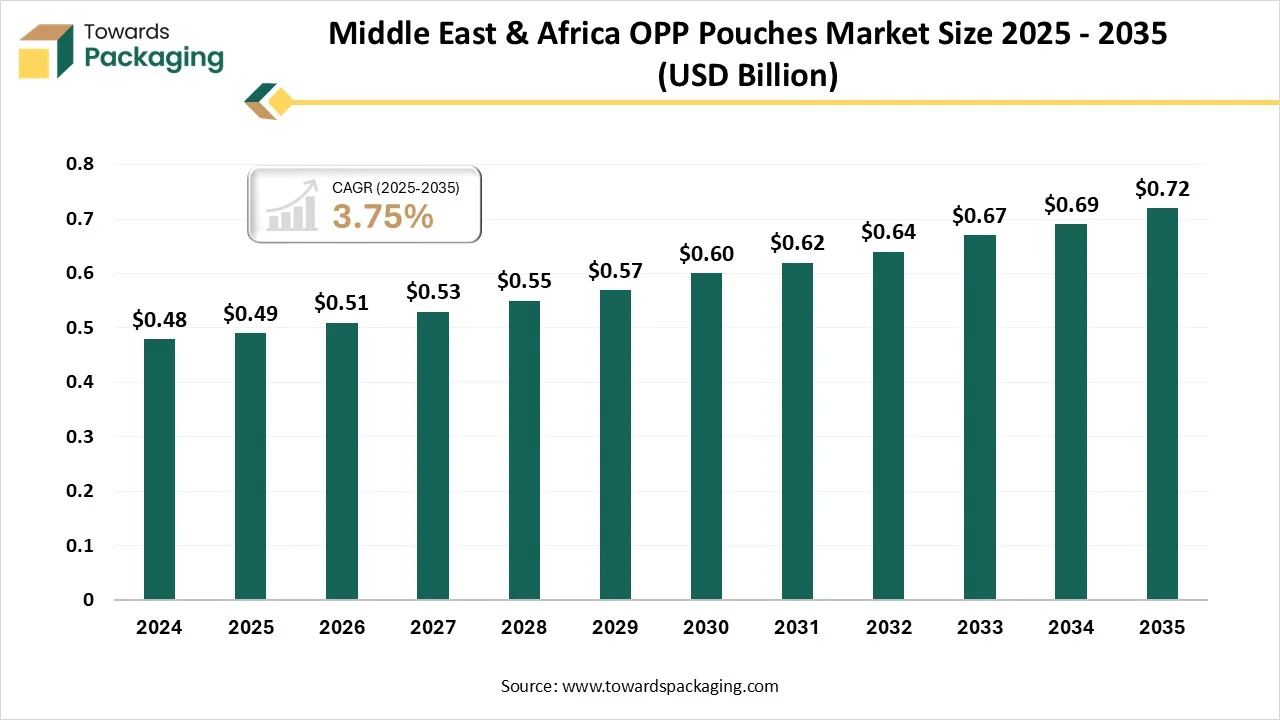

Middle East & Africa OPP Pouches Market Size 2025 - 2035 (USD Billion)

OPP Pouches Market Top Companies List

Latest Announcements by Market Leaders

- In December 2024, Amcor, a global leader in responsible packaging solutions, has contracted a strategic collaboration agreement with Kolon Industries Inc., a leading South Korean chemical materials manufacturer, to co-develop and commercialize more sustainable polyester materials for selected applications in Amcor's flexible packaging business. This collaboration signifies a phase forward in evolving packaging sustainability, merging Amcor's expertise in ground-breaking packaging with Kolon’s high-polymer industrial technology.

Recent Developments

- In July 2023, CCL Industries closed the acquisition of Pouch Partners, plus 2 more deals. The $44 million (Canadian) acquisition of Pouch Partners from the company owned by Capri-Sun Group is seen as a way to grow into novel markets. Other deals focused on in-mold labeling and badging.

- In February 2022, Texen acquired PRP Creation’s flexible packaging activity (pouches and Doypacks), with plans for its global development. This logical corporate combination provides excessive openings for the Luxury and Beauty packaging market. Whereas PRP Creation desires to concentrate on its core business, Texen will benefit from this acquisition to improve its maintainable portfolio and its novelty capacity at the provision of customers.

- In April 2024, American Packaging Corporation (APC), announced the profitable launch of another RE™Design for Recycle flexible packaging expertise designated for pet food products fluctuating from small pouches for pet treats to large poches for pet kibble. This novel technology seams a portfolio of packaging technologies in APC's RE maintainable packaging selection, it also contains Design for Compost, Circular Content, and Renewable Content, as well as several additional Design for Recycle film and paper options.

OPP Pouches Market Segments

By Pouch Type

- Stand up Pouches

- Flat Pouches

- Gusset Pouches

- Spout Pouches

By Capacity

- Less than 200 grams

- 201 to 500 grams

- 501 to 1000 grams,

- Above 1000 grams

By End Use

- Food

- Beverages

- Personal care & Cosmetics

- Pharmaceuticals

- Others

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait