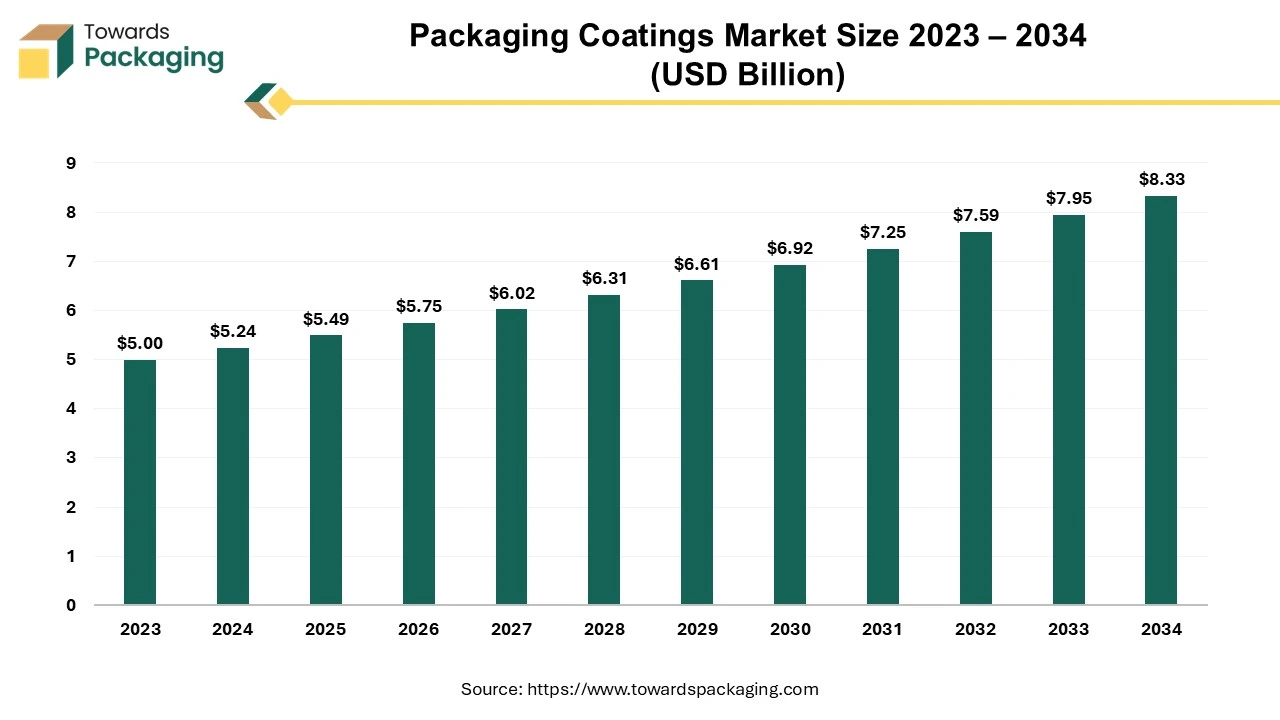

The packaging coatings market is forecasted to expand from USD 5.75 billion in 2026 to USD 8.73 billion by 2035, growing at a CAGR of 4.75% from 2026 to 2035.

The packaging coatings market is seen to sustain its growth with the integration of advanced technologies in the market. Additionally, the rising expansion of end users is seen to support the market’s growth.

The market for packaging coatings revolves around the production of packaging that offers protection against moisture, abrasion, and fading. Along with this, reducing waste generation and ensuring product availability are the leading objectives of the market. The product safety feature also includes adequate machinability, which provides efficient packaging and also increases the profit margin of companies due to increased capacity.

The ability to provide a glossy and matte finish and thereby enhance the appearance of the product contributes to the market growth. The vibrant colors or high-resolution images ensure a velvety texture, reduce glare, and add a premium feel to the packaging. Apart from this, the demand for packaging coating spans various sectors such as luxury packaging, high-end consumer goods, and automotive packaging.

The primary function of the packaging coatings is to ensure the design of intricate packaging by using robotics, precise labeling, soft algorithms, and minimizing human errors. The implementation of packaging coating plays a crucial role in enhancing production efficiency by designing packaging that will be more durable and long-lasting. This coating barrier shields the product from scratches, scuffs, and environmental factors such as moisture and UV light. By utilizing different types of coating in the packaging sector, businesses can achieve a high level of precision in their operations, which in turn leads to more accurate order fulfillment and optimized shipping costs.

The packaging coatings market comes in various types, such as varnish coating and lamination, that are often used for product boxes, labels, and retail packaging. Furthermore, aqueous and metallic coating provides an aesthetic appearance to the products and is used in cosmetic packaging, gift boxes, and high-end retail packaging. It also ensures the integrity of the product since heat-seal coatings provide secure and tamper-evident seals.

Technological advancements are moving from traditional synthetic polymers to sustainable breakthrough materials, which will provide innovation in paper-based packaging and barrier packaging. The integration of artificial intelligence, especially for nanotechnology purposes will help in extending the shelf life with the help of nanocomposite films, which will include nanoscale particles like clay, graphene, and metal oxides into polymer matrices, and these advancements will protect products from gases, UV lights, and moisture. They will also ensure durability and flexibility, which will enhance handling designs and provide smooth transportation.

Antimicrobial solutions have also used AI to improve their basic features, like cleanliness and durability, which prevent biological degradation and reduce the growth of contaminants like mold and mildew. Adoption of AI technology by coating manufacturers will increase the use of automation processes and as a result, will increase visual inspection or chemical inspection with the help of sensors. They will also be able to check for defects with greater accuracy compared to conventional QC processes.

| Emerging Technology | Description | Impact on Packaging Coatings Market |

| Water-Based Coatings | Use water as a solvent instead of chemicals | Reduces VOC emissions and supports sustainability regulations |

| Bio-Based & Plant-Derived Coatings | Made from renewable raw materials | Drives the adoption of eco-friendly and recyclable packaging |

| Active & Functional Coatings | Incorporate antimicrobial, moisture-control, or oxygen-scavenging properties | Extends shelf life and improves product safety |

| Nano-Coatings | Utilize nanotechnology for thin yet durable layers | Enhances barrier strength, scratch resistance, and durability |

| UV-Cured Coatings | Rapid curing using ultraviolet light | Improves production speed and energy efficiency |

| Smart & Interactive Coatings | Enable tracking, freshness indication, or tamper evidence | Adds value through consumer engagement and supply chain visibility |

The major driving factor is the increasing demand for packed food as it is convenient for the consumer, given the reason the food products have extended shelf life due to strong barrier protection. The coating also ensures that the food will be protected from contamination and spoilage.

The leading challenges that hinder the growth of the packaging coatings market are higher production costs and government regulations. The high-barrier lamination processes and specialized materials required for barrier production are highly expensive. The government regulations with their time-consuming nature hinder the growth of the market. Apart from this, changes in regulations due to external factors and economic factors increase the challenge for market stability.

The packaging coatings market offers opportunities in manufacturing of coating made from bio-degradable materials and also manufacturing barrier materials which will be easily recyclable. The demand for sustainable packaging solutions which will produce less garbage holds key player’s attention increasing opportunities for eco-friendly packaging solutions.

Consumers are becoming more environmentally conscious and are actively seeking products that have minimal environmental impact. This shift in consumer behavior is driving manufacturers to adopt sustainable packaging solutions. Packaging coatings play a crucial role in ensuring the quality, functionality, and visual appeal of eco-friendly packaging.

By Resins

The acrylics segment is growing rapidly in the packaging coatings market, driven by its superior clarity, robust adhesion, and chemical and UV resistance. Because of these characteristics, acrylic coatings are perfect for safeguarding packaging surfaces while improving aesthetic appeal. Acrylic resins are becoming more widely used in food, beverage, and consumer goods packaging due to the growing need for water-based and low-VOC coatings.

By Packaging Type

The rigid packaging segment is experiencing rapid growth in the packaging coatings market due to the growing need for protective and long-lasting packaging options. For containers used in food, drinks, and medication, coatings are crucial because they enhance barrier qualities of scratch resistance and shelf life. The growth of coated rigid packaging formats is further supported by trends in premium packaging and urbanization.

By End User

The consumer electronics segment is growing rapidly in the packaging coatings market, driven by the demand for high-performing protective coatings that guard against electrostatic damage, moisture, and abrasion. Manufacturers are paying more attention to packaging aesthetics and surface protection as electronic devices get smaller and more expensive. The demand for sophisticated packaging coatings in this market is also increasing due to the growth of global electronics production and e-commerce distribution.

Asia-Pacific is the dominating region in the packaging coatings market. India and China being the largest populated countries dominate the market due to their market share which is driven by rapidly growing middle class and the increasing urbanized population. The ready-to-go food segment, which uses most of the packaging coating is convenient for the busy population as it reduces time consumption. Asia is home to several major packaging trade shows and industry events, such as PackEx India, Sino-Pack, and Japan Pack, where manufacturers and suppliers in the packaging coatings market showcase their innovations and collaborate. This fosters rapid growth and development within the industry.

According to the Ministry of Consumer Affairs of India, the increasing number of working classes, lack of time for food preparation, increasing number of senior citizens, and lastly, the changing food habits have led to the increase of packed food consumption, in result, boosting the packaging coatings market which will provide a robust and secured packaging to the food products.

Asian countries have stringent regulations for food safety, which influences the packaging industry. Coatings must meet strict standards for compliance, which has led to significant investment in research and development for specialized coatings that can meet regulatory requirements in different countries.

China Market Trends

China packaging coatings market is driven by massive manufacturing base in the country. China has the world’s largest population and rising urbanization, which drives huge demand for packaged food, beverages, and personal care products. China is the global hub for packaging production, including cans, plastics, cartons, and flexible packaging. E-commerce in China is growing faster than anywhere else. More online shopping has risen demand for more packaged goods which has increased more coatings needed to preserve and brand packaging.

China’s government supports local chemical and manufacturing industries with subsidies, tax breaks, and infrastructure investment. China is investing in smart packaging and sustainable materials, requiring advanced coating technologies. Increasing launch of the new packaging coatings machine by the key players operating in the China has driven the growth of the packaging coatings market in the country.

For instance, At China Print 2025, which will be held from May 15–19 at Beijing's China International Exhibition Center (Shunyi Hall), Heidelberg will introduce a new machine. A virtual factory tour, interactive equipment demonstrations, product demos, live streaming from the show floor, and in-depth lectures on cutting-edge print solutions for the packaging, commercial, and other industries will all be available at the Heidelberg stand.

North America is the fastest-growing region in the market. North America is the fastest-growing market, given the reason it has steady growth due to its consumer preferences which are driven by sustainability and convenience. North America, particularly the United States and Canada, has a large and established consumer base with high levels of disposable income. This drives demand for packaged goods, including food and beverages, pharmaceuticals, cosmetics, and consumer electronics. The packaging industry in North America, particularly in the food and beverage sector, is a critical area where high-quality coatings are required for product protection, shelf life extension, and aesthetic appeal.

According to USDA ERS, American consumers spend an average of 11.2% of their disposable income on food sector which gives rise to packaging market. In contrast, low-income households depend on ultra-processed foods due less time-consumption and extended shelf life of packed food. The American population consumes packed food on daily basis and the US food system is dominated by packed food to preserve and ensure food safety, American companies are developing innovative packaging coating solutions.

U.S. Market Trends

U.S. packaging coatings market is growing owing to huge investment in technology advancement. Innovations in coating technologies, such as the development of oxygen barrier coatings, are enhancing the functionality of packaging materials. These advancements improve shelf life and product protection, catering to the evolving needs of the food and beverage industry. The U.S. food and beverage sector’s growth is fueling the need for high-quality packaging coatings that ensure product safety and extend shelf life. Consumers preference for packaged and processed foods necessitates coatings that maintain product integrity.

Companies like PPG industries are investing significantly in U.S. manufacturing facilities to meet the increasing demand for packaging coatings. For instance, PPG company’s US$ 300 million investments in a new Tennessee facility aims to enhance production capacity and supply chain efficiency. U.S. regulations, such as those enforced by the Environmental Protection Agency (EPA), are driving the adoption of eco-friendly packaging coatings.

Europe region is seen to grow at a notable rate in the foreseeable future. Europe is growing rapidly in the packaging coatings market, not necessarily by volume (China leads there), but in terms of technological advancement, sustainability, and regulatory-driven innovation. Europe has some of the world’s toughest regulations on chemicals, emissions, and packaging waste (e.g., REACH, Green Deal, Single-Use Plastics Directive). This pushes companies to adopt eco-friendly coatings (like water-based, low-VOC, BPA-NI, and compostable solutions).

European companies are leading in bio-based and waterborne coatings, replacing traditional solvent-based options. Focus areas include: Barrier coatings for paper & board (to replace plastics), Recyclable metal coatings for cans and BPA-free epoxy alternatives for food contact. Europe has a large premium food, cosmetics, and pharmaceutical market, which demands: High-performance barrier coatings, aesthetically appealing and brand-safe packaging. These sectors require advanced coating formulations that comply with health & safety regulations while delivering high shelf appeal. European consumers are highly aware of environmental issues and demand sustainable packaging. Retailers (like Carrefour, Tesco, Lidl) are pressuring suppliers to eliminate plastic and non-recyclable coatings, boosting demand for green coating solutions. Europe is home to major global coating companies (e.g., AkzoNobel, BASF, Wacker, Siegwerk) that are actively developing advanced packaging coatings. These companies are investing heavily in research, pilot projects, and collaboration with food and pharma brands.

Demand for packaging coatings in Latin America is steadily rising, driven by increasing consumer demand for packaged goods, the growth of e-commerce, and stricter environmental regulations. The market is further supported by a strong push toward sustainable packaging solutions, leading to a shift toward high-performance, eco-friendly coatings. Latin American converters are updating packaging to mono-material formats, for example, replacing multi-polymer laminates with mono-PE structures that utilize barrier coatings for protection. For ultra-high barrier applications, advanced technologies like atomic layer deposition and plasma coating are gaining acceptance for applying nano-scale coatings on paper and film.

The Middle East and Africa are emerging markets fueled by rapid urbanization, growth in fast-moving consumer goods, and rising disposable incomes. The UAE, in particular, is seeing increased adoption of packaged food and beverages, driving demand for advanced packaging coatings. However, factors such as economic instability, infrastructure challenges, and inconsistent regulatory enforcement in some areas may pose risks to market growth.

Resins

Packaging Type

Regional

February 2026

February 2026

January 2026

January 2026