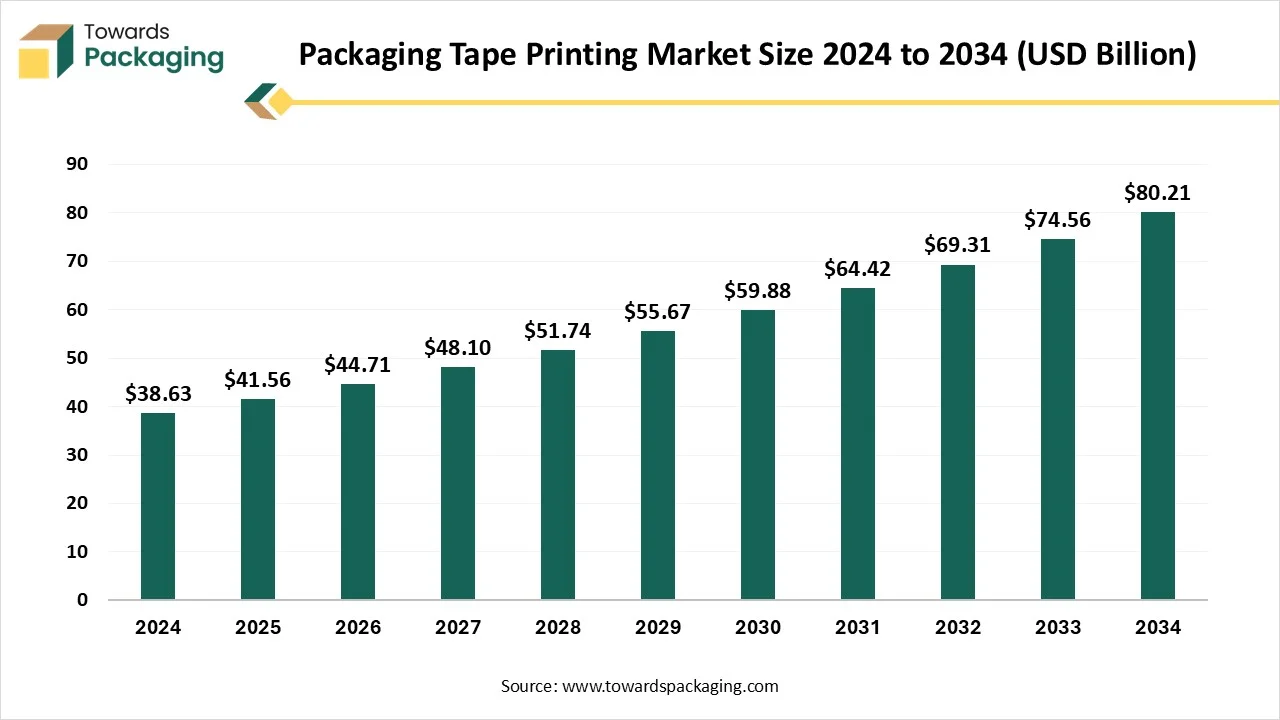

The report covers complete market is forecasted to expand from USD 44.71 billion in 2026 to USD 86.29 billion by 2035, growing at a CAGR of 7.58% from 2026 to 2035. It includes regional insights where North America leads with 35% share, Asia Pacific grows fastest, and detailed assessments of Europe, Latin America, and MEA. The study also maps top companies including 3M, Avery Dennison, IPG, Tesa, Nitto Denko, and Berry Global, along with full competitive analysis, trade data, value chain structure, sourcing strategies, and supplier–manufacturer linkages.

The packaging tape printing market refers to the industry that produces custom-printed adhesive tapes used for branding, security, product identification, and aesthetic purposes in packaging applications. These tapes often feature logos, warning messages, barcodes, or handling instructions, and are widely used in e-commerce, logistics, retail, FMCG, and industrial sectors. The market is growing due to increased emphasis on brand visibility, tamper-evident packaging, and cost-effective marketing solutions. Technological advancements in flexographic, digital, and inkjet printing on various adhesive substrates are further driving innovation in this space.

The incorporation of AI in the packaging tape printing market plays an important role by improving the customization process, enhancing supply chain efficacy, and optimization of production process. It analyses the demand of the market and limits the production process, which leads to less wastage of products. It is used for intrinsic design customization, which improves the reliability of the consumers. With the incorporation of advanced technologies support in the prediction of equipment failure becomes easy, which prevents production delay.

Rising Demand for Printed Packaging Tapes

The increasing demand for printed packaging tapes has driven the demand for the packaging tape printing market. This sector is becoming more famous in a number of usages such as bundling, carton sticking, branding, and several others. Printed packaging tapes are lightweight packing options that are used for sealing, logo branding, solidification, and have a choice of overprinted cartons for advertisement of brands, and fall under major marketing strategies. Moreover, the total cost efficacy of branding endorsement through printed tapes, contrasted with enormous printed cartons, is pushing the market.

Raw Material Charges Fluctuation

Regular fluctuations in the charges of the raw materials have hindered the growth of the packaging tape printing market. This results in losses to the business and disturbs consumer reliability in this market, which restricts the expansion of the industry.

Rising Personalized Packaging

Rising demand for personalized packaging has enhanced the opportunities in the packaging tape printing market. Customers look for authenticity and linking with brands, personalized packaging becomes a powerful instrument for businesses to attract and delight their consumers. From customized graphics and messages to custom-made patterns that reflect individual preferences, tailored packaging permits brands to generate a more intimate and expressive connection with their consumers, nurturing loyalty and support. Personalized packing goes beyond meagre aesthetics to offer practical advantages as well. By integrating adjustable data printing practices, such as personalized URLs, QR codes, or unique sequential numbers, brands can provide interactive involvements that improve product engagement and influence consumer interactions.

The polypropylene (BOPP) tapes segment contributed a considerable share of the packaging tape printing market in 2024 due to versatility, cost-effectiveness, and durability. This is majorly utilized for carton sealing and several other packaging. These tapes can be quickly printed with logos, brand title, and several other designs. The growing trend for the usage of eco-friendly packaging has influenced the growth of this segment.

The Kraft paper tapes segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to its ability to custom-design and printing. It is adopted by various sectors such as transportation & logistics, food & beverages, and consumer durables. These packages make the branding strategy attractive and increase consumer adoption.

The flexographic printing segment is expected to have a considerable share of the packaging tape printing market in 2024 due to its capacity to handle a wider variety of resources, cost-effectiveness, and versatility. Digital printing is highly accepted by several sectors due to its customization capacity with unique designs. The high-speed printing has helped to fulfil market demand and encouraged the adoption of this segment. It can generate high-quality prints and fulfil the rising demand for sustainable packaging.

The digital printing segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Growing demand for high-quality printing, sustainability, and customization choices has influenced the growth of this segment. The rising e-commerce expansion has increased the demand for digital printing for the production of a huge number of packages.

The branding & advertising segment is expected to have a considerable share of the packaging tape printing market in 2024 due to the huge customization options available in this sector. It improves the brand visibility and enhances the unboxing experience. The rising e-commerce industry has influenced the demand for unique designs for branding and advertising of companies. Aesthetic packaging is one of the major factors driving this segment rapidly.

The security & tamper evidence segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing significant growth due to the rising demand for brand authentication, regulatory compliance, and product safety. The increasing pharmaceutical industry has raised the demand for such printed tape packaging that can maintain the temperature of the products while stored and provide required data regarding medicine.

The e-commerce & logistics segment is expected to have a considerable share of the packaging tape printing market in 2024 due to significant development and shaping trends. This is majorly growing because of increasing online shopping and the requirement for secure handling of branded products. This segment has influenced the growth of this market by using such a packaging process to enhance the authenticity and reliability of the consumers. Printed tapes are considered as top solution for branding messages, which helps the market to expand.

The electronics & industrial goods segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing growth due to the rising demand for specialized printed tapes, which signifies specific functionalities such as providing protection to sensitive products, insulation, and heat dissipation. It is also essential for the safe handling of several electrical appliances such as machinery, and various others.

The hot melt adhesive tapes segment is expected to have a considerable share of the packaging tape printing market in 2024 due to its quick adhesive quality. These adhesive tapes facilitate fast cooling service and excellent bonding with several substrates such as cardboard, plastic, and foam. The rising e-commerce industry boosts demand for effective and fast-setting packaging solutions. Constant innovation in this field has led to the adoption of this segment, which has raised its production process.

The acrylic adhesive tapes segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing robust growth due to its strong and durable bonding capacity. These tapes are resistance to adverse ecological conditions such as moisture, UV light, and several others. This segment is actively utilized in various sectors such as the automotive sector, pharmaceuticals, food & beverages, and electronics.

The North America region held the largest share of the packaging tape printing market in 2024, due to the rising demand for packaging applications. The continuous innovation in this sector has evolved this market significantly. The region is focusing on sustainability, and brand differentiation additionally boosts the acceptance of tailored packaging tapes, influencing market development.

The Asia Pacific region is estimated to grow at the fastest rate in the packaging tape printing market during the forecast period. This is due to booming e-commerce, low-cost manufacturing, and growing brand-conscious SMEs in India, China, and Southeast Asia. This region is witnessing exponential development in the online retail and logistics segment, and the demand for personalized packaging solutions is intensifying, boosting market development.

Technological invention is updating how organizations enter into the Latin American packaging tape printing industry, particularly in the midst of the transforming supply chain scenario. With the assistance of World Bank data, which highlights over 68% of Latin America’s population in terms of e-commerce and urban zones entry growing post-pandemic, the demand for fast, trackable, brand-oriented packaging has grown. This has developed the huge spread acceptance of smart solutions like variable data printing, inline print inspection systems, and RFID-enabled tape. Market entry strategies are moving from volume-based differentiation to functionality-led offerings.

The demand for packaging tape printing industry in the Middle East and Africa is seen to slow and steady development, driven by factors such as economic development, a rising e-commerce sector, and growing disposable incomes. Main factors influencing this development include the rising demand for branded packaging for marketing, the importance of product safety through tamper-evident packaging, and the growing acceptance of sustainable and eco-friendly solutions within the packaging sector.

By Tape Type

By Printing Technology

By Application

By End User Industry

By Adhesive Type

By Region

February 2026

February 2026

February 2026

February 2026