Paper Cores Market Size and Regional Production Analysis

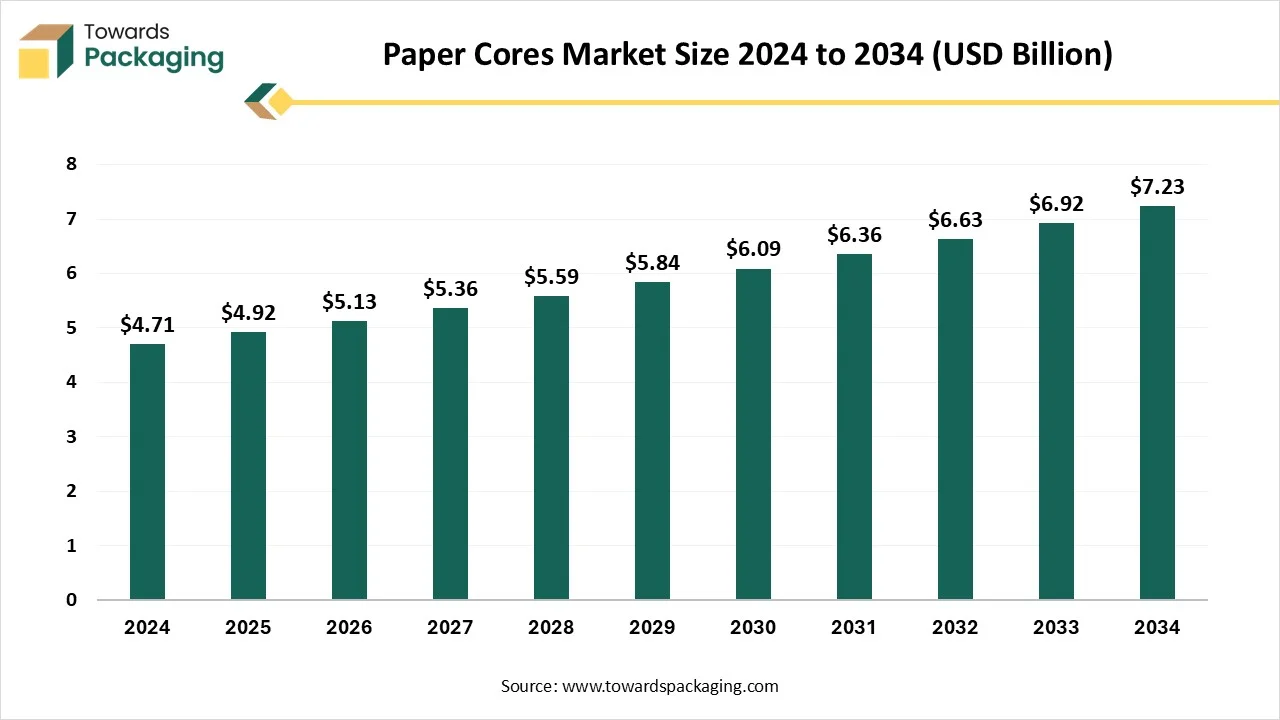

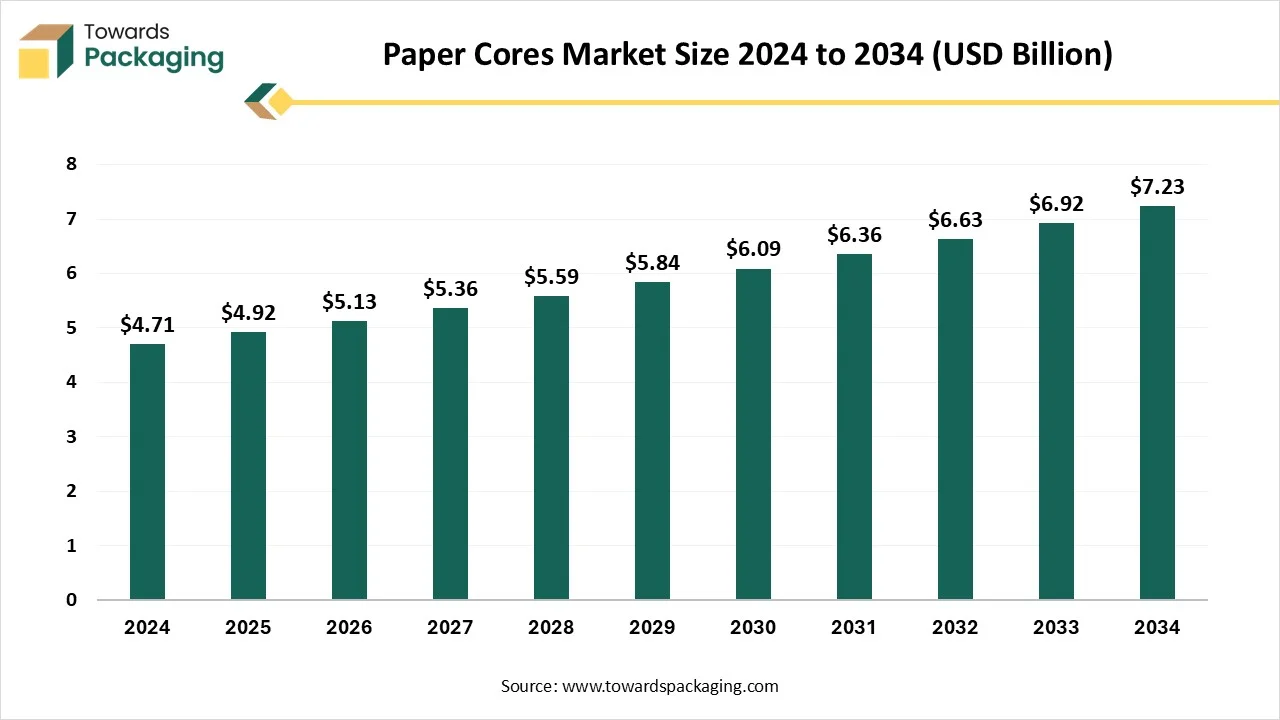

The global paper cores market is projected to increase from USD 5.13 billion in 2026 to USD 7.55 billion by 2035, expanding at a CAGR of 4.37%, and this report covers complete market size evaluation, product-type segmentation, end-use industries, and regional distribution across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. We explain the rising demand from flexible packaging, labels, and nonwoven applications, compare paper cores vs. paper tubes, and map trade flows, import–export data, and pricing trends. The study also includes profiles of leading players, M&A activities, competitive benchmarking, and a detailed value chain analysis covering raw materials, converters, distributors, and key suppliers.

Key Insights

- In terms of revenue, the market is valued at USD 5.13 billion in 2026.

- The market is projected to reach USD 7.55 billion by 2035.

- Rapid growth at a CAGR of 4.37% will be observed in the period between 2025 and 2034.

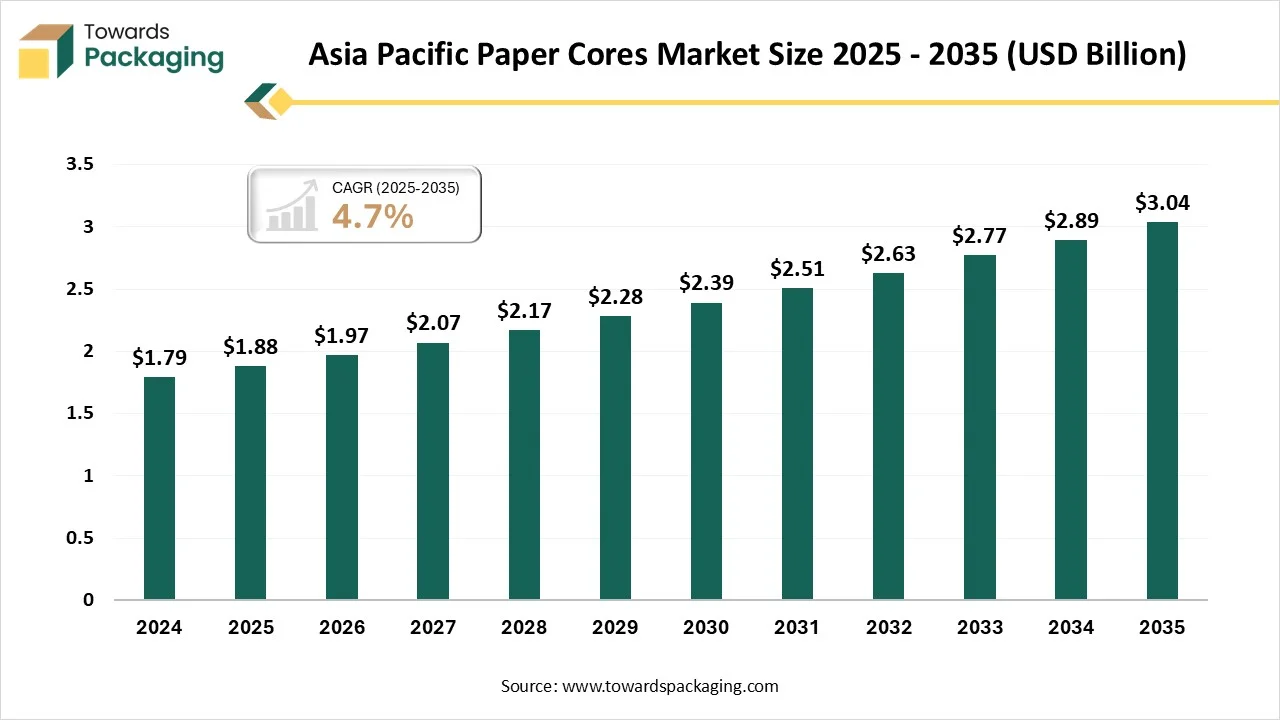

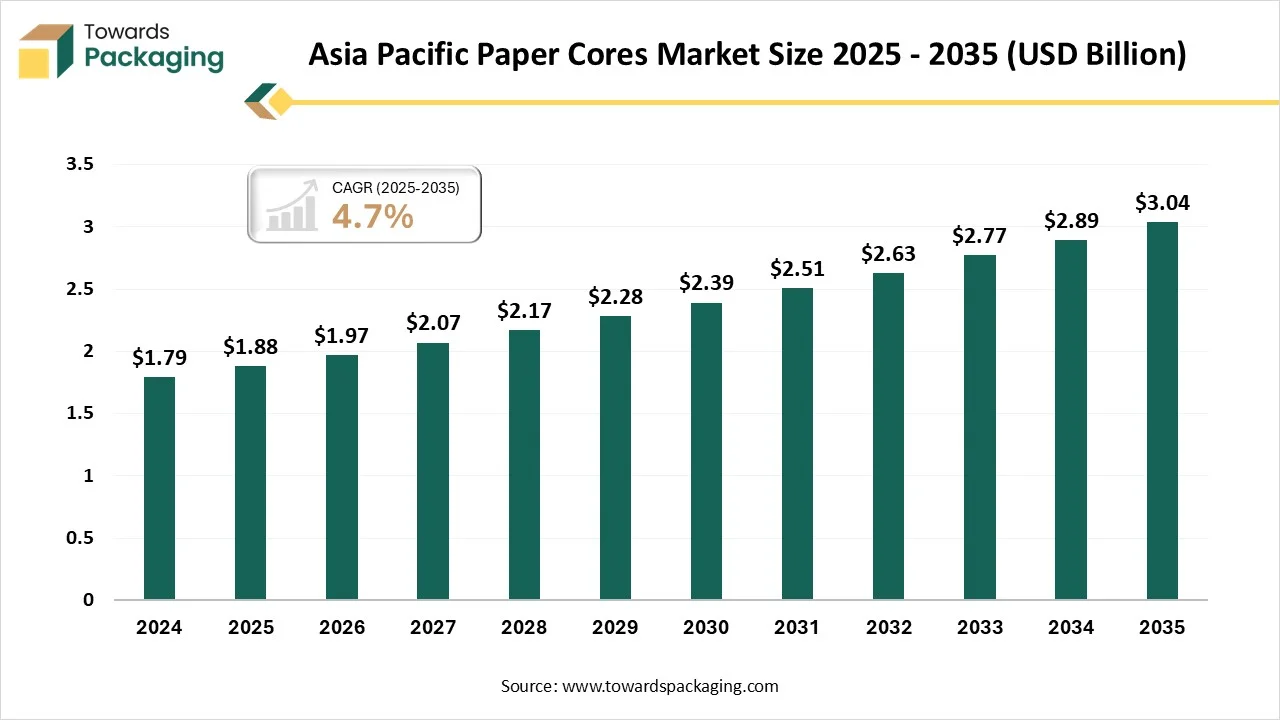

- Asia Pacific dominated the global paper cores market in 2024.

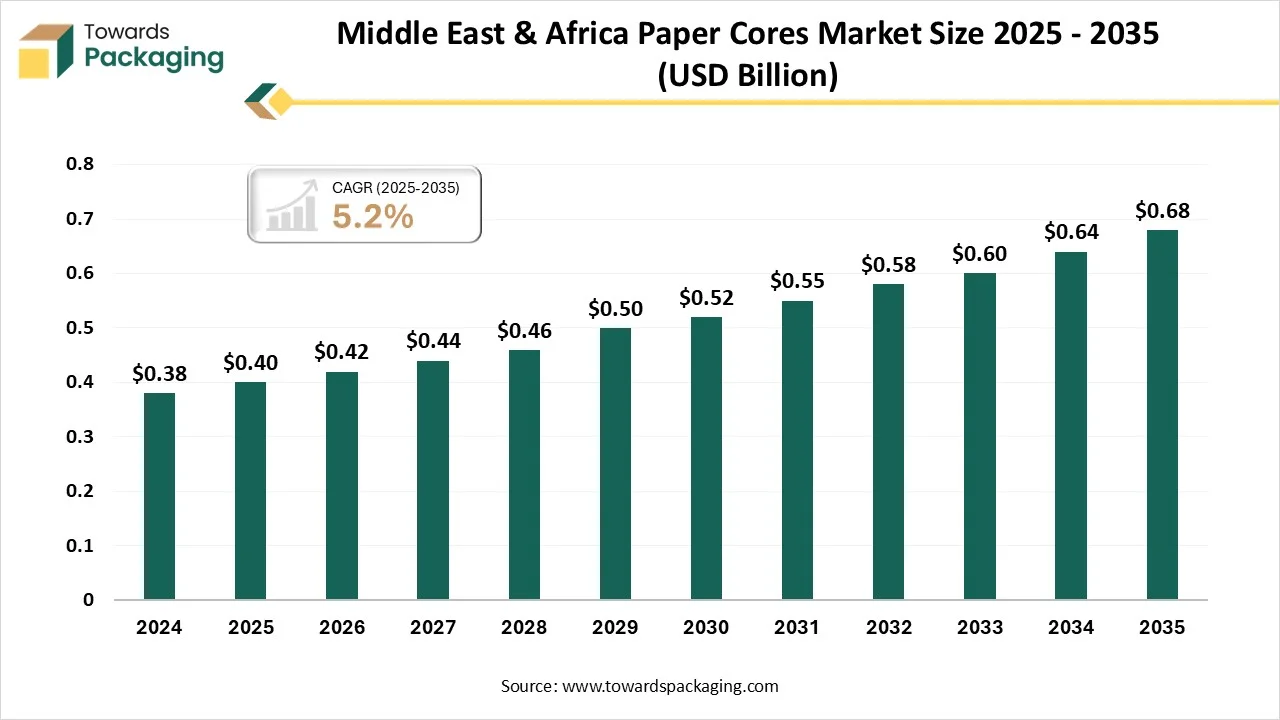

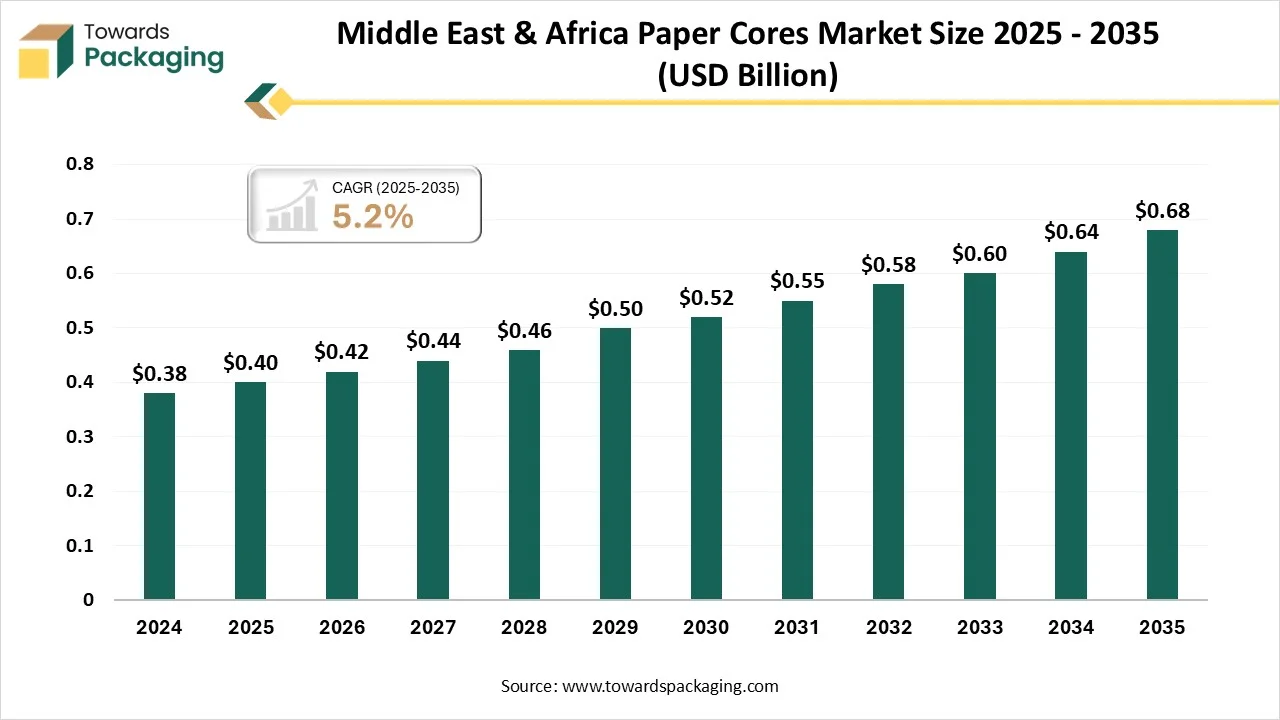

- Middle East & Africa is expected to grow at a significant CAGR in the market during the forecast period.

- The North American market is expected to grow at a notable CAGR in the foreseeable future.

- By type, the spiral-wound paper cores segment dominated the market with the largest share in 2024.

- By type, the parallel-wound paper cores segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By material origin, the recycled paper segment dominated the market in 2024.

- By material origin, the virgin paper segment is expected to grow at the fastest CAGR in the forecast period.

- By paper type, the Kraft paper segment dominated the market with the largest share in 2024.

- By paper type, the chipboard segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By end-use, the paper & printing segment dominated the market in 2024.

- By end-use, the flexible packaging segment is expected to grow at the fastest CAGR in the forecast period.

- By distribution channel, the direct sales segment dominated the market with the largest share in 2024.

- By distribution channel, the online channels segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

Paper Cores Market Overview

Paper cores are cylindrical structures made from layers of paper or cardboard that are wound together with adhesive to form a strong, rigid tube. The paper cores market refers to the manufacturing and distribution of rigid cylindrical tubes made from layers of kraft paper, chipboard, or recycled paperboard. These cores are widely used in various industries for winding, storing, and transporting materials such as plastic films, textiles, paper rolls, fabric, tapes, and foils. They come in different diameters, lengths, and wall thicknesses depending on the application requirements.

Paper cores are lightweight, cost-effective, recyclable, and offer excellent strength and dimensional stability. They are typically manufactured using recycled paperboard, which makes them an eco-friendly packaging and storage solution. In the printing and packaging industry, paper cores are essential for maintaining the shape and quality of wound products during storage and shipment. Additionally, they are used in construction, carpet manufacturing, and the label industries. With increasing demand for sustainable materials, paper cores are gaining popularity as a reliable and environmentally responsible alternative to plastic or metal cores.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 4.92 Billion |

| Projected Market Size in 2034 |

USD 7.23 Billion |

| CAGR (2025 - 2034) |

4.37% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Type, By Material Origin, By Paper Type, By Core Diameter, By End-Use Industry, By Distribution Channel and By Region |

| Top Key Players |

Sonoco Products Company, Corex Group, Papertech Inc., Yazoo Mills Inc., Cellmark AB, Primapack SAE |

What Are the Latest Trends in the Paper Cores Market?

Sustainability and Eco-Friendly Manufacturing

- The shift toward sustainable and environmentally responsible packaging is significantly influencing the paper core industry. Manufacturers are using recycled paperboard and adopting eco-friendly adhesives to reduce environmental impact. Emphasis is being placed on biodegradable, recyclable, and reusable core products. The drive toward a circular economy is prompting businesses to improve waste management practices and adopt greener production methods, appealing to both regulatory bodies and eco-conscious customers.

Increased Demand for Customization

- There is a growing need for custom-designed paper cores tailored to specific industry needs. Customers are demanding variations in core diameter, wall thickness, strength, coatings (e.g., water or oil resistance), and branding elements. This trend is especially prominent in sectors like textiles, flexible packaging, labeling, paper mills, and film industries, where precise winding requirements are crucial.

Material Innovation

- Manufacturers are exploring the use of composite materials and advanced coatings to enhance the durability, strength, and moisture resistance of paper cores. These innovations allow cores to perform well in harsh or high-humidity environments and extend their usability across a wider range of industrial applications. Some companies are also adopting certified recycled materials to improve product traceability and meet green certification standards.

How Can AI Improve the Paper Cores Industry?

AI integration can significantly improve the paper cores market by enhancing efficiency, quality control, and sustainability across the manufacturing process. Through predictive analytics, AI can anticipate equipment failures and schedule timely maintenance, reducing downtime and operational disruptions. Machine learning algorithms help optimize production parameters such as pressure, adhesive application, and winding speed to maintain uniformity and minimize material waste. AI-powered vision inspection systems can detect micro-defects or inconsistencies in real-time, ensuring higher product quality and reducing manual errors.

In supply chain management, AI enables accurate demand forecasting, inventory optimization, and streamlined logistics, which reduces lead times and enhances customer satisfaction. Additionally, AI supports eco-friendly initiatives by analyzing energy consumption and suggesting sustainable practices or material usage patterns. By incorporating AI into customization workflows, manufacturers can efficiently respond to specific client needs with faster design iterations and reduced costs. Overall, AI helps the paper core industry become more responsive, data-driven, and resource-efficient.

Market Dynamics

Driver

Rising Demand from the Packaging Industry

As the packaging and e-commerce industries expand, the demand for paper cores used for winding packaging films, stretch wraps, and paper rolls is increasing. These industries require lightweight yet durable cores that ensure protection and structure during storage and transportation. The trend is especially strong in urban and industrial hubs where logistics and supply chain operations are rapidly evolving.

The increasing need for flexible and durable packaging solutions, especially for products like films, foils, paper, and textiles, is a major driver. Paper cores are essential for winding and transporting these materials safely and efficiently. These cores are primarily used for winding and transporting materials such as films, textiles, paper, labels, foils, and tapes.

Restraint

Availability of Cheaper Alternatives & Lack of Standardization in Emerging Markets

The key players operating in the market are facing issues due to a lack of standardization and availability of cheaper alternatives. Paper cores are primarily made from paperboard and adhesives, which are sensitive to fluctuations in raw material costs. Price instability, especially in recycled paper, can affect production costs and profitability, particularly for small- and medium-sized manufacturers.

In certain applications, plastic or metal cores may be preferred due to their durability, moisture resistance, or cost advantages in bulk production. This competition limits paper core adoption in industries that demand high-performance materials. Standard paper cores may degrade or deform under humid or wet conditions. This makes them unsuitable for some industrial and outdoor uses, unless specially coated, raising production costs.

What Are the Opportunities for the Growth of the Paper Cores Market?

Customization and Niche Product Development

The ability to offer customized paper cores with different diameters, wall thicknesses, coatings (e.g., moisture-resistant), and printed branding opens opportunities in niche markets. Industries such as luxury packaging, electronics, and specialty films require highly specific core types, encouraging manufacturers to invest in R&D and value-added services.

Technological Advancements in Manufacturing

Automation, smart sensors, and AI-based systems in production lines enable greater precision, reduced waste, and faster turnaround times. Companies that adopt digital transformation in their manufacturing processes can serve complex orders efficiently and tap into larger industrial contracts, improving scalability and global competitiveness.

Increased Application in Non-Traditional Industries

Beyond packaging and textiles, paper cores are gaining adoption in construction (e.g., for forming columns), carpet manufacturing, paper mills, and electronics. Expanding into these non-traditional sectors with innovative and performance-enhanced core designs can open up new revenue streams.

Government Incentives for Green Manufacturing

Incentives and subsidies for sustainable manufacturing and recycling infrastructure development provide an encouraging environment for paper core producers to innovate, expand capacity, and attract environmentally conscious clients.

Segmental Insights

Why does the Spiral Wound Paper Core Segment Dominate the Paper Cores Market?

The spiral wound paper core segment is the dominant segment in the market due to its high strength, durability, and excellent crush resistance, making it ideal for heavy-duty industrial applications. These cores are extensively used in industries such as paper, textiles, plastic films, and metal foils for winding and transporting materials without deformation. Their customizable dimensions and thicknesses allow manufacturers to tailor cores for specific needs, enhancing operational efficiency. Additionally, spiral wound cores are environmentally friendly and recyclable, aligning with increasing sustainability goals. Their cost-effectiveness, versatility, and performance reliability contribute to their widespread adoption and market leadership.

Parallel Wound Paper Core Segment to Grow at the Fastest Rate

The parallel wound paper core segment is the fastest-growing segment in the paper cores market due to its smooth surface finish, dimensional accuracy, and excellent concentricity, which are essential for high-speed converting and precision applications. These cores are increasingly preferred in industries such as flexible packaging, films, foils, and specialty papers, where uniformity and surface quality are critical. The growing demand for high-performance cores in premium packaging and printing operations further drives their adoption. Additionally, advancements in manufacturing technology have enabled cost-effective production with minimal waste. Their adaptability, enhanced product protection, and compatibility with modern converting equipment fuel rapid market growth.

Which Material Origin Dominated the Paper Cores Market in 2024?

The recycled paper segment is the dominant material origin segment in the market due to increasing environmental awareness and the global shift toward sustainable and circular economy practices. Manufacturers and end-users prefer recycled paper cores as they help reduce waste, conserve natural resources, and lower the overall carbon footprint. These cores offer comparable strength and functionality to those made from virgin materials, making them suitable for a wide range of applications in packaging, textiles, and construction. Additionally, government regulations promoting eco-friendly materials and the growing consumer demand for sustainable products further support the widespread adoption of recycled paper cores.

Virgin Paper Segment to Grow at the Fastest Rate

The virgin paper segment is the fastest-growing material-origin segment in the paper cores market, thanks to several key advantages. Virgin paper is derived from fresh wood pulp, offering higher purity, strength, and dimensional stability compared with recycled alternatives, qualities essential for high-performance and hygiene-sensitive applications such as food-contact packaging and premium products. Its consistent quality and superior printability make it preferred for branded packaging and delicate materials, where appearance and integrity are vital. With global regulatory bans on single‑use plastics and a growing focus on eco‑friendly yet reliable alternatives, virgin paper gains traction in sectors requiring safety and compliance. Finally, e‑commerce and digital retail growth demand robust, visually appealing packaging, boosting virgin paper use for outer layers and high‑end cores in transit packaging.

Which Paper Type Dominated the Paper Cores Market in 2024?

The Kraft paper segment is the dominant paper type in the market due to its exceptional strength, durability, and resistance to tear and burst, making it ideal for heavy-duty core applications. Its high tensile strength supports the structural integrity of cores used in demanding industries such as textiles, paper, plastic films, and construction materials. Kraft paper is also preferred for its eco-friendly properties, being biodegradable, recyclable, and often sourced from sustainable forestry. Its cost-effectiveness, ease of processing, and compatibility with various adhesives further enhance its utility in core manufacturing. These combined attributes solidify its leading position in the market.

Chipboard Segment to Grow at the Fastest Rate

The chipboard segment is the fastest-growing paper type in the market due to its cost-effectiveness, versatility, and increasing adoption in lightweight and non-load-bearing applications. Made from recycled paper, chipboard offers an eco-friendly and economical option for manufacturing paper cores used in packaging, crafts, and consumer goods. Its adequate strength for light-duty applications, combined with ease of cutting, shaping, and laminating, makes it ideal for short-term or disposable uses. As industries seek more affordable and sustainable alternatives to traditional materials, chipboard stands out for balancing performance and price, especially in rapidly growing markets like e-commerce and retail packaging.

Why does the Paper & Printing Segment Dominate the Paper Cores Market?

The dominance of the paper & printing segment in the market stems from its critical dependence on cores for winding and supporting paper rolls during production, storage, transport, and converting operations. Paper mills and printing operations rely heavily on high‑quality cores to maintain roll integrity and alignment throughout processes. The sheer volume of paper output in publishing, commercial printing, and paper manufacturing ensures consistently high demand. Moreover, printing and paper operations often require cores customized for smooth unwinding and tension control, delivering performance and efficiency unmatched by other sectors.

Flexible Packaging Segment to Grow at the Fastest Rate

The flexible packaging segment is the fastest-growing end-use sector for paper cores due to several interlinked dynamics. The rapid rise of flexible paper packaging in industries like food, pharmaceuticals, cosmetics, and consumer goods is driving demand for cores that support roll stock and converting lines. Growing consumer and regulatory emphasis on sustainability has brands shifting from plastic to recyclable, lightweight paper packaging, boosting core usage for high-speed pouch, wrap, and sachet production. Additionally, e‑commerce growth requires efficient, durable packaging that protects products while minimizing shipping weight. Flexible packaging systems increasingly rely on precision-engineered cores to ensure consistent winding, smooth unwinding, and accurate tension control, which are vital for high-speed converting and branding operations.

Which Distribution Channel Dominated the Paper Cores Market in 2024?

The direct sales channel has emerged as the dominant distribution channel segment in the market for several reasons. Manufacturers selling directly cultivate deeper relationships with industrial buyers, such as paper mills and packaging firms, enabling them to deliver tailored products and offer superior technical support. This direct connection grants greater control over pricing, branding, and quality consistency, appealing to users with precision and service expectations. Without intermediaries, companies benefit from higher margins and streamlined logistics, optimizing delivery schedules and reducing costs. Additionally, direct sales allow producers to rapidly respond to customer feedback, support customization needs, and strengthen trust, making this approach especially effective in B2B markets demanding reliability and bespoke solutions.

Online Channels Segment to Grow at the Fastest Rate

The online channels segment is the fastest-growing distribution channel in the paper cores market for several key reasons. Rapidly expanding e‑commerce has boosted demand for protective, lightweight, and sustainable packaging, requiring more cores to support rolled materials used in flexible packaging and shipping operations. Online platforms offer wide product selection, price transparency, and fast delivery, making them attractive for buyers sourcing paper cores. Additionally, digital tools and automated ordering simplify purchasing for B2B and B2C customers alike, enabling efficient procurement and bulk ordering. As brands and converter firms increasingly use online to access eco-friendly packaging solutions, online retail becomes the go-to channel.

Regional Insights

Which Region Dominated the Paper Cores Market in 2024?

Asia Pacific is dominant in the paper cores market due to its rapidly expanding industrial base, particularly in countries like China, India, Japan, and Indonesia. The strong presence of packaging, textile, paper, and construction industries in the region fuels consistent demand for paper cores across various applications. Additionally, increasing urbanization, rising consumption of packaged goods, and growth in e-commerce have significantly boosted the need for flexible and durable packaging solutions. The availability of low-cost raw materials and labor, along with favourable government initiatives supporting sustainable and domestic manufacturing, further enhances the region’s position as a global leader in paper core production.

China Market Trends

China leads the Asia-Pacific market due to its vast manufacturing base, strong infrastructure, and high demand from the textile, packaging, and printing industries. The country's large-scale industrial production and exports require continuous use of cores for rolling films, fabrics, and paper. In addition, government support for eco-friendly materials is encouraging a shift from plastic to paper cores.

India Market Trends

India is experiencing rapid growth in the packaging, textile, and e-commerce sectors, all of which are major consumers of paper cores. The availability of affordable raw materials, labor, and the push for sustainable packaging alternatives further support market expansion. Additionally, the government’s initiatives like “Make in India” and rising investments in infrastructure boost demand for construction-related core products.

Japan Market Trends

Japan’s dominance comes from its technological advancements and quality-focused industries. The country’s well-established paper, electronics, and automotive industries use precision-engineered cores, often with specialized coatings. Japan also emphasizes sustainable materials, promoting recyclable and biodegradable packaging solutions.

South Korea Market Trends

South Korea’s robust electronics, industrial film, and consumer goods sectors drive demand for customized paper cores. The country focuses on high-performance and moisture-resistant core products, often used in cleanrooms and controlled environments. South Korea also invests in sustainable manufacturing practices, aligning with global green trends.

Indonesia Market Trends

Indonesia has a growing textile and packaging industry, along with a strong base in pulp and paper production, making it a key player in the regional market. With increasing foreign investments and expanding local manufacturing, the country is emerging as a competitive hub for cost-effective paper core production.

What Promotes the Growth of the Middle East and Africa in the Paper Cores Market?

The Middle East and Africa are experiencing rapid growth in the market due to several key factors. The expansion of e-commerce and retail sectors has significantly increased the demand for packaging materials, including paper cores used for winding films, tapes, and paper products. Rising urbanization and growing disposable incomes, particularly in countries like the UAE, Saudi Arabia, and South Africa, are driving the consumption of packaged goods across food, beverage, and consumer product sectors.

Government initiatives promoting sustainable and eco-friendly packaging are encouraging the shift away from plastic-based solutions toward recyclable paper cores. Investments in local manufacturing infrastructure, such as corrugated box production and recycled paper processing, are enhancing domestic capabilities and reducing dependency on imports. The region's strong food and beverage industry further contributes to increased use of paper-based packaging, where cores are essential in ensuring product stability and storage.

North America’s Growing Industrialization to Promote Notable Growth

North America’s paper cores market is growing notably due to a confluence of strategic drivers. Industries across the region, particularly packaging, textiles, and printing, rely heavily on paper cores for winding films, labels, paper rolls, and yarns. A strong emphasis on sustainability and recycling regulations has accelerated the adoption of eco‑friendly, recyclable core solutions over plastic or metal alternatives. Technological innovation, including automation and digital monitoring in manufacturing, supports high consistency, reduced waste, and efficient customization to meet strict industry specifications.

North America's mature industrial base and robust e‑commerce and logistics infrastructure ensure steady demand for winding applications. Major domestic producers such as Cascades and Domtar enable stable supply chains and foster innovation in high-strength, recycled-core products. Although recent softening in e‑commerce demand has prompted operational adjustments among large players like International Paper, the region’s strategic focus on custom packaging and sustainability continues to support steady growth.

Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Top Paper Cores Market Players

Latest Announcements by Industry Leaders

- Gerhard Niederreiter, Head of Nestlé’s Institute of Packaging Sciences, stated that in the U.S., Nestlé started using paperboard canisters for their Vital Proteins brand. Compared to earlier packaging, this design and material change reduce plastic usage by 90%. The new canister, which was created by specialists at Nestle Health Science’s R&D center in Bridgewater, New Jersey, in cooperation with outside partners, features a rigid proprietary coverlid and close. It makes it simple to open and close the canisters, is long-lasting for regular use, and is impervious to spills and leaks.

New Advancements in the Market

- In February 2025, DS Smith and International Paper, two of the top manufacturers of pulp products, containerboard, and sustainable packaging, joined forces on January 31, 2025, to establish a new global leader in environmentally friendly packaging options, with an emphasis on the lucrative North American and EMEA markets.

- In July 2025, Mondi, leading the in manufacturing environmentally friendly paper and packaging, took focal point of Fachpack 2025 in Nuremberg from September 23–25, displaying its distinctive array of packaging options, which include kraft corrugated solutions to functional barrier papers, paper, solid board, and flexible packaging made of plastic that is designed to satisfy the various needs of its clients.

Global Paper Cores Market Segments

By Type

- Spiral-Wound Paper Cores

- Convolute Paper Cores

- Parallel-Wound Paper Cores

- Fiber Cores

- Others

By Material Origin

- Virgin Paper

- Recycled Paper

By Paper Type

- Kraft Paper

- Chipboard

- Linerboard

- Paperboard

By Core Diameter

- Less than 50mm

- 50mm to 100mm

- 100mm to 200mm

- More than 200mm

By End-Use Industry

- Paper & Printing

- Textiles & Nonwovens

- Flexible Packaging

- Adhesive Tapes & Labels

- Construction Materials

- Metal Foils & Films

- Others

By Distribution Channel

- Direct Sales

- Industrial Distributors

- Online Channels

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait