December 2025

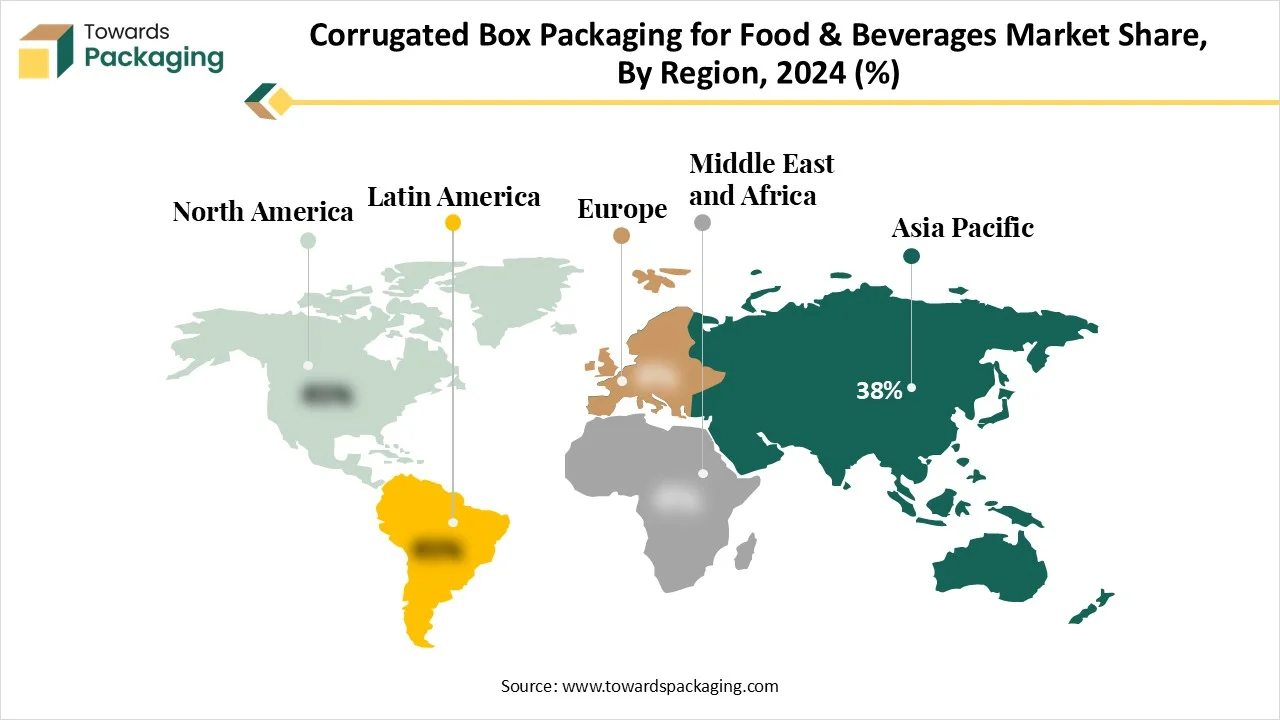

The corrugated box packaging for food & beverages market is expanding steadily, driven by rising demand for sustainable, durable, and cost-efficient packaging across global supply chains. The market surpassed significant revenue in 2024, with Asia-Pacific holding over 38% share, while North America is set for strong growth through 2034. Our report provides complete market size projections, segment-level data including recycled corrugated board holding 70% share and RSC boxes at 50% and regional insights across NA, EU, APAC, Latin America, and MEA. It also covers competitive analysis of major companies, trade statistics, value chain structure, manufacturing trends, and supplier networks powering this industry

The corrugated box packaging for food & beverages market refers to the global industry focused on the production and distribution of corrugated board-based packaging solutions tailored specifically for transporting, storing, and displaying food and beverage products. These boxes are made from fluted paperboard sandwiched between linerboards, offering a strong, lightweight, recyclable, and cost-effective packaging solution.

This market is growing rapidly due to the rise of e-commerce grocery platforms, sustainable packaging mandates, and the need for durable yet food-safe packaging across frozen, fresh, dry, and liquid categories. Corrugated packaging is favored for its customizability, printability, stack strength, and increasingly, its recyclable and biodegradable profile.

The incorporation of AI in the corrugated box packaging for the food & beverages market plays an important role in the reduction of wastage of raw materials by analysing the demand of the market. The requirement for unique designs for the branding of food outlets increases the incorporation of AI in this market. It is also widely used for inventory management by automatic replenishment and several other ways. AI supports the optimization of materials to develop eco-friendly packaging for products. These advanced technologies also play a significant role in the detection of food & beverage contamination, which has raised the adoption of such technology.

Rising Demand for Convenient Packaging Solutions

The growing demand for food packaging that is convenient to use is the major driving factor of the corrugated box packaging for food & beverages market. There are several other factors influencing the growth of the market, such as changing lifestyle, rapid urbanization, safety concerns, increasing party culture, changing dietary habits, and many others. Technological improvements like fit in products, contamination detection, and many more have enhanced the demand for this market. The growth of online grocery shops has demanded the utilization of strong packaging resources that can withstand the rigors of distribution, further influencing the demand for corrugated boxes.

Fluctuating Raw Material Charges

The continuous fluctuation in the raw material prices has hindered the growth of the corrugated box packaging for the food & beverages market. The rising fondness for alternative packaging resources, such as plastic and biodegradable choices, positions a competitive threat. While corrugated boxes packaging is extensively predictable for its sustainability, the appearance of advanced packaging resolutions can distract attention and investment from traditional corrugated choices. The challenge exists in balancing customer likes with sustainability and cost-efficiency.

Rapid Urbanization and Disposable Income

Rising urbanization and disposable earnings boost the opportunities of the corrugated box packaging for the food & beverages market. The changing lifestyle of people has raised the demand for packaged food products, which has also influenced the demand for this packaging. Such a huge demand has influenced the innovation of corrugated boxes for the packaging of food products. The increasing development of sustainable corrugated boxes has enhanced the opportunities in this sector. Increasing demand for customization in size, colour. With growing shift towards urban areas has enhanced demand for packaged food products, which has influenced research and development work in this sector.

The recycled corrugated board segment contributed a considerable share of the corrugated box packaging for the food & beverages market in 2024 due to biodegradability and eco-friendly packaging. The growing concern towards ecological issues has influenced the demand for this segment. Strict supervisory guidelines associated with this industry have also raised the demand for such packaging, which can be recycled multiple times. Advancements in recycling technology have also made this process effective and affordable, which boosts this segment to grow rapidly.

The coated corrugated board segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The increasing demand for superior quality safety has influenced the adoption of this segment. There is a huge concern regarding the ecological impact of food products while transporting, which boosts the demand for such packaging. The rising demand for packages that can enhance the shelf life of food products has played a significant role in the development of this sector.

The regular slotted containers segment is expected to have a considerable share of the corrugated box packaging for the food & beverages market in 2024 due to their effective patterns and flaps. These are versatile, suitable, and cost-effective solutions for packaging that are widely accepted by various brands in the food packaging sector. The huge demand for a variety of shapes and sizes of packaging boxes has influenced the demand for this segment. These are moisture-resistant, which protects food products from damage, and are suitable for the packaging of perishable food products.

The die-cut boxes segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The growing focus on sustainable packaging has influenced the development of this segment. These are also highly utilized for branding and marketing purposes. These boxes provide sufficient space for printing, captivating graphic designs, and brand awareness.

The flexographic segment is expected to have a considerable share of the corrugated box packaging for food & beverages market in 2024 due to its versatile printing process. These are non-toxic inks and quick-drying packaging. It can print on several variety of surfaces and help to generate unique designs. It reduces the requirement for extra elements such as tags, labels, and several such things. It can be done with water-based inks as well, which is considered to be ecologically friendly.

The digital segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to the increasing rate of online food ordering activities. Digital printing technology includes moisture-resistance, incorporation of smart technology, and UV protection. Adoption of customized graphic designs to attract a huge consumer base has notably evolved this segment.

The processed foods segment is expected to have a considerable share of the corrugated box packaging for the food & beverages market in 2024 due to increasing requirements for protective and convenient packaging. This packaging is highly preferred in this market due to the growing demand for eco-friendly packaging. The need for packaging that can be stored for a longer time and maintain the integrity of food products without any reaction has boosted the demand for this market in the processed food sector. Brands are looking for a hygienic option for the packaging of food products has influenced innovation in this market. It maintains the temperature of food products, which can help avoid the growth of any pathogens.

The fresh produce segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is highly influenced the growth of this market due to its versatile and protective nature. The rising adoption of sustainable packaging and e-commerce demand has influenced enhanced packaging facilities to maintain the freshness of food products. This type of packaging provides ventilation to the products, which has influenced the incorporation of corrugated box packaging for fresh food products.

The retail/FMCG segment is expected to have a considerable share of the corrugated box packaging for the food & beverages market in 2024 due to cost-effectiveness and sustainable packaging. These are recyclable packages that are considered to be an eco-friendly option for packaging purposes and attract a huge number of consumers towards this market. The expansion of the food industry also contributes significantly to the growing demand for this segment. The growing demand for ready-to-eat food products and the transportation of products requires such effective packaging.

The online grocery/e-commerce segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The growing demand for customized and cost-effective packaging has influenced the demand for this packaging market in this segment. The constant approach to meet consumers' demand has influenced the growth of corrugated boxes packaging in the online or e-commerce sector. The high-end protection of these packages for the smooth transportation of food products has raised the production of such packages.

Asia Pacific region held the largest share of the corrugated box packaging for food & beverages market in 2024, due to the improving economic condition of people. The growing number of working individuals has influenced the demand for packaged food products in countries like India, China, Japan, Thailand, South Korea, and several others. Rapid shift towards urban areas has also influenced the demand for high-quality packaged food. Such eco-friendly packaging helps brands to get attention from consumers and enhance the production process.

The North America region is estimated to grow at the fastest rate in the corrugated box packaging for food & beverages market during the forecast period. The rising demand for sustainable packaging has supported the growth of this market. Increasing awareness regarding ecological issues due to packages has raised the demand for this market. Innovation in packaging technology has also supported the growth of the packaging market.

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

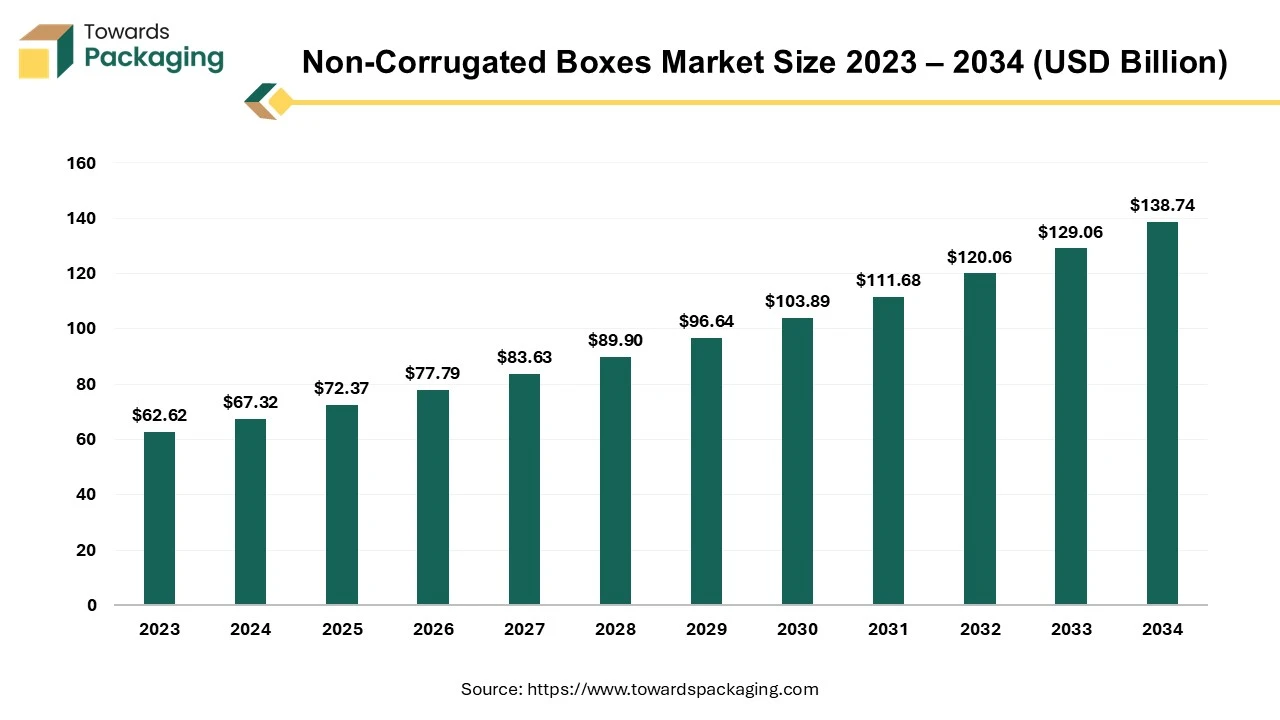

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

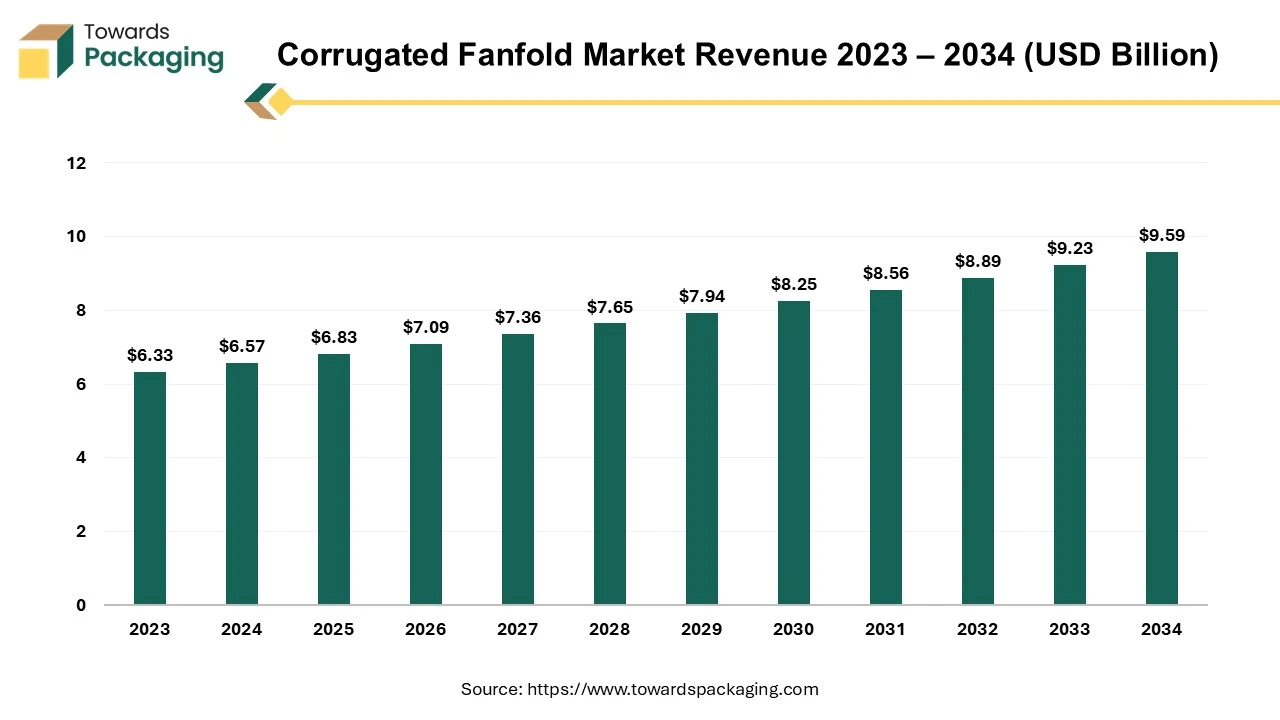

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

By Material Type

By Box Type

By Printing Technology

By Food & Beverage Application

By End-Use Channel

By Region

December 2025

December 2025

December 2025

December 2025