In-Mold Labels Market Size, Share, Trends and Forecast Analysis

The in-mold labels market is set to grow from USD 2.57 billion in 2026 to USD 3.87 billion by 2035, with an expected CAGR of 4.65% over the forecast period from 2026 to 2035. The demand for in-mold labels is due to developed product resistance and durability, as it serves extreme opposition to moisture, wear, and high temperatures, making the labels durable and long-lasting.

Key Highlights

- In terms of revenue, the market is valued at USD 2.46 Billion in 2025.

- The market is predicted to reach USD 3.87 Billion by the year 2035.

- Rapid growth at a CAGR of 4.65% will be officially experienced between 2025 and 2034.

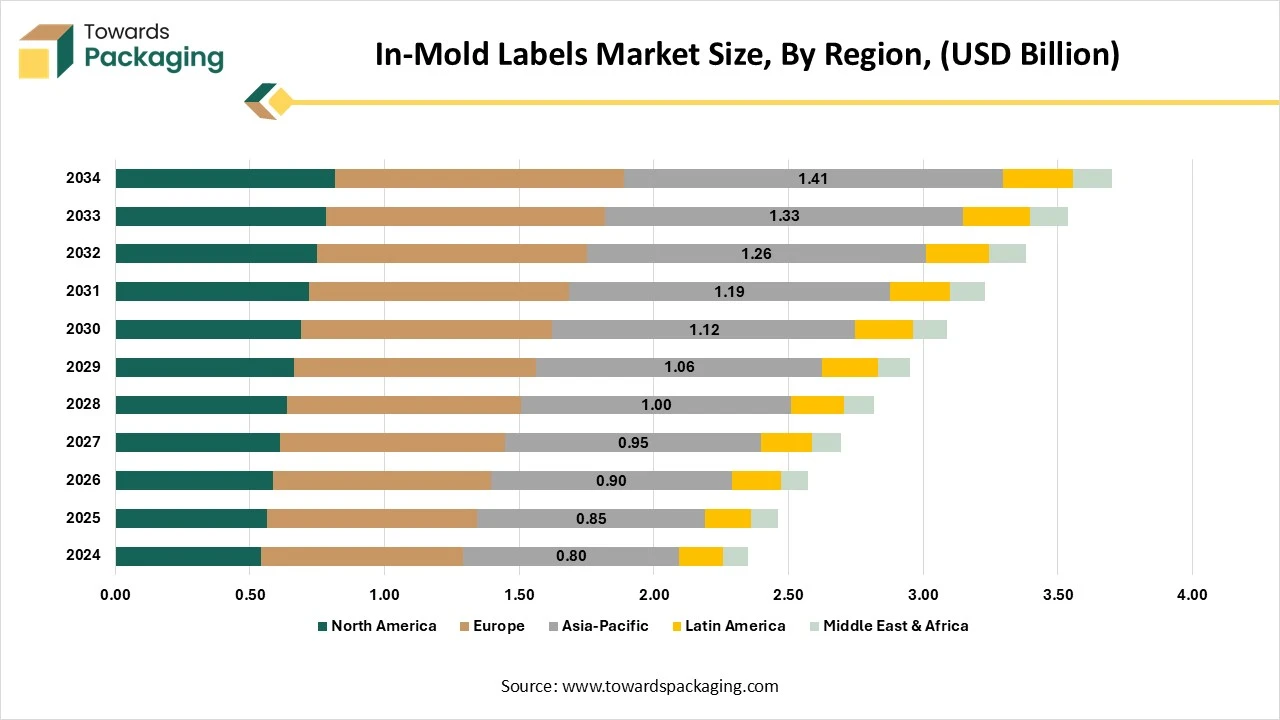

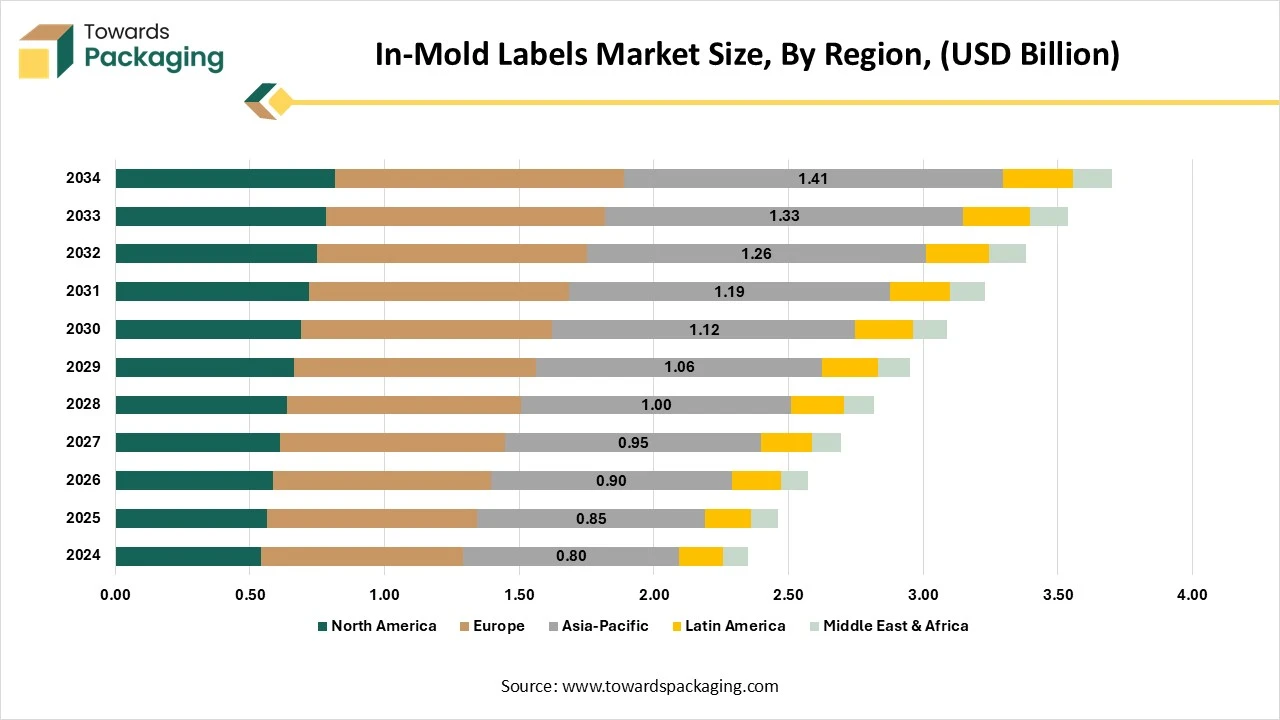

- By region, Asia Pacific dominated the market in 2024.

- By region, Europe expected to grow at a notable CAGR between 2025 and 2034.

- By material type, polypropylene segment contributed to the largest share in 2024.

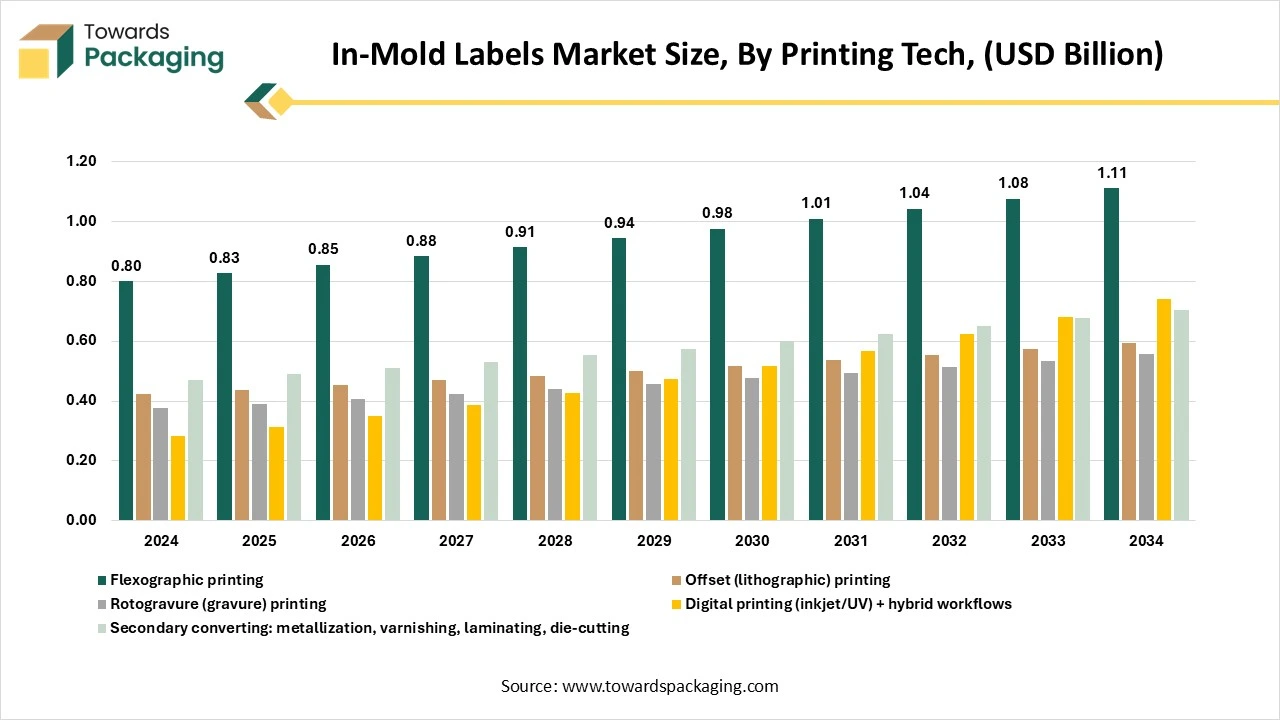

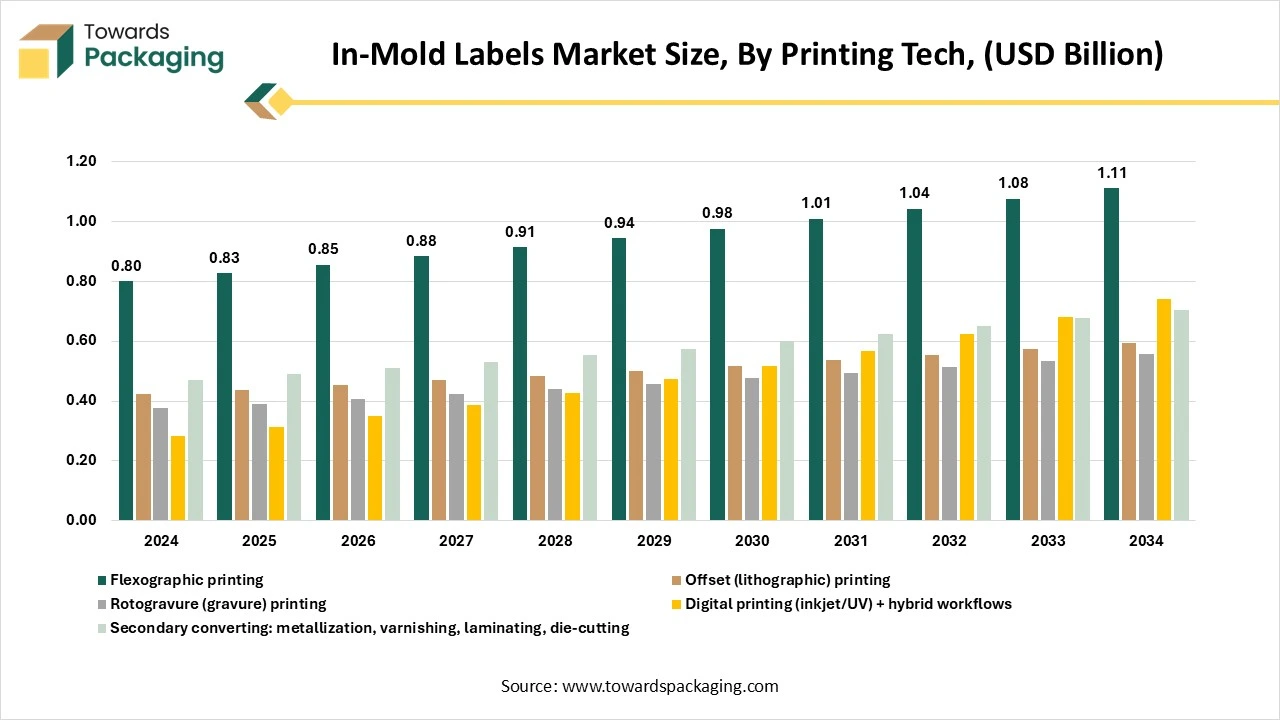

- By printing, flexography technology segment contributed to the largest share in 2024.

- By printing, digital printing segment will expand at a significant CAGR between 2025 and 2034.

- By end-use industry, food and beverage segment contributed to the largest share in 2024.

- By end-use industry, personal care and cosmetics segment will grow at a significant CAGR between 2025 and 2034.

- By functionality, standard decorative items segment contributed to the largest share in 2024.

- By functionality, RFID-enabled devices segment will expand at a significant CAGR between 2025 and 2034.

Market Overview

In-Mold Labels (IML) thin pre-printed film labels that are placed into a mold and become an integral, permanent part of a plastic part during the injection-molding or thermoforming process; used for high-quality decoration, durability, and elimination of post-molding labeling steps.

Emerging Trends in the In-Mold Labels Market

- Sustainable materials: Brands are increasingly moving towards eco-friendly label substrates like recycled papers and bio-based films. This change is driven by user demand for greener packaging solutions. It assists companies that align with sustainability goals and regulatory requirements.

- Smart Labels ( QR codes, NFC, and RFID): Smart Labels are gaining attention as they enhance user engagement through interactive product information. They also support supply chain transparency and track and trace solutions. Businesses use them to fight counterfeiting and ensure product authenticity.

- Premium finishes and aesthetics: In-labels with metallic films, embossing, and textured finishes are becoming popular to develop shelf appeal. Premium finishes help brands that stand out in highly competitive markets like cosmetics and beverages. These inventions also elevate perceived product value, pushing user trust and loyalty.

- Digital Printing and customization: Digital printing is changing in-label manufacturing by allowing short runs and fast turnaround times. It enables brands to experiment with personalisation, seasonal campaigns, and limited editions. This flexibility lowers inventory costs while meeting different consumer preferences.

- Security and regulatory compliance: Labels with tamper-evident and authentication features are in great demand, especially in food packaging and pharmaceuticals. These features protect users while ensuring brand credibility. At the same time, growing regulations encourage companies to accept compliant labelling technologies.

How Has Artificial Intelligence Developed The In-Mold Labels Market?

Artificial Intelligence and Technological advancements are reshaping the in-mold labels sector by developing design accuracy, production efficiency, and quality control. AI-powered vision systems are increasingly used to detect defects, ensure label alignment, and track consistency in high-speed manufacturing lines. Automation integrated with robotics enables quick label placement, reduced material waste, and flexible manufacturing for tailored designs. Moreover, AI-driven predictive analytics assist in optimizing machine performance, reducing downtime, and lowering operational costs. These innovations not only boost productivity but also assist sustainable manufacturing, allowing brands to align with growing consumer demand for visually appealing and eco-friendly packaging.

- In July 2025, Avery Dennison revealed the launch of the RFID-enabled In-Mold Label profile, a series of intelligent labels crafted to be embedded into plastic products during the injection-molding procedure. The IMLs are being marketed as serving heavy durability, perfect RFID performance, and assistance for circularity and reuse systems across many sectors.

Market Dynamics

Market Driver

Luxury Packaging Wins The In-Mold Labels Industry

The in-mold labels market is initially driven by the growing demand for luxury and visually appealing packaging that develops brand identity. Growth in the beverage, food, cosmetics, and household products sectors fuels acceptance, as IML serves durability, scratch resistance, and high-quality print effects. Additionally, the developing focus on sustainability and recyclable packaging materials assists market expansion, while technological advancements in automation and robotics further streamline production, making IML a cost-effective and smooth labelling solution.

Market Restraint

Disadvantages Of Machinery

The in-mold labels industry faces limitations despite its growing acceptance. The beginning setup costs for machinery, molds, and automation systems are high, making it less feasible for small and medium-sized manufacturers. Design changes or product variations need expensive mold modifications, which limit flexibility. Additionally, the procedure is more complicated and time-consuming than regular labelling, which may affect production efficiency. Recycling challenges can also grow if compatible materials are being used, restructuring widespread sustainability benefits.

Market Opportunities

E-Commerce Takes Over The In-Mold Labels Market

As e-commerce expands, lightweight yet durable packaging solutions are becoming a huge opportunity. While IML is rigid in food and beverages, its potential in home appliances and automotive remains underutilized. These sectors demand chemical-resistant, durable, and tamper-proof packaging that can deliver IML. This classification can make entirely new revenue streams. Although initial setup costs for IML are high, its integration and durability of label+ package is one complete process that lowers the attractiveness of brands seeking long-term ROI. With organizations increasingly focused on cost optimization, IML acceptance could grow.

Material Type

How Has The Polypropylene Segment Material Dominated The In-Mold Labels Market?

Polypropylene segment dominated the in-mold labels market in 2024 as it plays an important role in the market due to its perfect compatibility with injection molding and thermoforming processes. Its durable, lightweight, and cost-effective nature makes it a preferred material for generating high-quality labels with superior adhesion and resistance to chemicals, moisture, and wear. Polypropylene also supports vibrant printing and recyclability, aligning with sustainability trends and driving its widespread usage in packaging for food, beverages, and consumer goods.

Printing/Converting Technology Insights

How Did The Flexography /Offset Segment Dominate The In-Mold Labels Market?

Flexography technology segment dominated the market in 2024, as it is heavily used in this kind of industry, as it allows high-speed printing with perfect image quality on a wide range of substrates, including polypropylene. This technology supports vibrant colors, fine details, and cost-effective large-volume production, making it perfect for packaging industries. Its adaptability to eco-friendly inks and fast setup also enhances efficiency, driving the growing adoption of flexography in generating durable and visually appealing IML Solutions.

The digital printing segment is expected to grow in the market during the forecast period. This kind of technology plays a transformative role in the market by allowing customization, shorter print runs, and faster turnaround times as compared to regular methods. It enables brands to incorporate variable data, personalized designs, and high-resolution graphics that meet user demand for unique and attractive packaging. Moreover, digital printing lowers waste, lessens setup costs, and supports sustainable practices, making it an increasingly popular choice for current IML manufacturing.

End-Use Industry Insights

How Did Food And Beverage Dominate The In-Mold Labels Market?

Food and beverage segment have dominated the in-mold market in 2024 as they have become a preferred choice in the food and beverage sector due to their ability to integrate packaging and labeling in a single step, lowering production costs and improving efficiency. They are specifically popular in products like yogurt tubs, ice cream containers, tangerine cups, and beverage buckets, where durability and high resistance to moisture are required. IML also assists premium branding with photorealistic graphics, which makes products stand out on retail shelves. Moreover, since polypropylene-based IML packaging is fully recyclable, it meets sustainability goals and the rising demand for eco-friendly solutions.

The smooth integration of labels also prevents peeling, fading, or scratching to ensure long-lasting visibility of nutritional information, branding, and safety instructions. This has made IML a main driver of invention in food and beverage packaging.

Cosmetics and personal care segment are expected to grow in the market during the forecast period. In-mold labels are gaining attention in the cosmetics and personal care sectors as brands increasingly find premium, durable, and visually appealing packaging. IML allows the making of sleek, high-quality graphics on containers like shampoo bottles, cream jars, and makeup cases that develop shelf appeal and reinforce brand identity. The technology serves scratch-opposition and moisture-proof labelling, which is important for products stored in bathrooms or handled frequently. Additionally, the potential to mix transparent, 3D labels or metallic effects enables brands to convey a sense of luxury and exclusivity. Since IML packaging is also recyclable, it assists the growing consumer preference for eco-friendly personal care products, giving companies an added edge in sustainability and branding.

Functionality Insights

How Did The Standard Decorative IML Dominate The In-Mold Labels Market?

The standard decorative IML segment has dominated the market in 2024, as the IMI market refers to the usage of high-quality printed graphics and finishes that develop the visual appeal of packaging while being mixed into the container itself. This decorative approach serves a durable, consistent, and scratch-resistant design that stays intact throughout the product’s lifecycle. It enables bright colours, branding elements, and intricate designs to be directly molded into packaging, which avoids the demand for a secondary labelling procedure. Standard decorative IML is widely used in sectors like beverages, food, household products, and cosmetics, in which shelf impact and brand differentiation are complicated. Furthermore, it supports cost-efficiency by integrating decoration and molding into a single step, while ensuring long-lasting aesthetics and promoting sustainability.

The RFID-enabled devices segment is predicted to be the fastest-growing in the market during the forecast period. They are changing packaging by integrating smart tracking with decorative labelling. By embedding RFID tags directly into the molded labels, producers can allow real-time molded labels, manufacturers can enable real-time product checking, supply chain tracking, and anti-counterfeiting measures. This technology is especially useful in industries like food and beverages, pharmaceuticals, and luxury goods in which safety and authenticity are top priorities. RFID-enabled IML not only develops traceability but also develops efficiency in inventory management and logistics by providing instant data access. Moreover, it assists brand protection, regulatory compliance, and consumer engagement, which makes it a futuristic step in smart and intelligent packaging solutions.

Regional Insights

How Did The Asia Pacific Dominate The In-Mold Labels Market?

Asia Pacific dominated the market in 2024 as manufacturers are accepting IML because it assists in reducing overall packaging weight while tracking durability. This assists in both cost savings in logistics and compliance with regional plastic waste reduction initiatives. Just like western markets, IMl formats in Asia Pacific often include regional aesthetics, cultural motifs, and multilingual labelling, especially in India, Japan, and Southeast Asia. This drives customized label demand for local and global FMCG brands. With the growing urban middle class, there is a growing demand for packaged meals and beverages, in which IML serves tamper-resistance, premium branding, and sustainability appeal. Asia Pacific companies are increasingly investing in robotic IML systems, lowering labor dependency and making production more scalable for high-volume, low-cost user goods.

Europe expects the fastest growth in the market during the forecast period. The move towards digital and Hybrid Printing in IML, while regular offset printing dominates, European converters are heavily experimenting with digital, and hybrid presses for IML. This enables shorter runs, faster design changes, and more personalised packaging -especially in niche markets like limited-edition FMCG products. In Europe, IML is being paired with QR codes and NFC tags to meet user demand for product interaction and traceability. This is specifically relevant in high-value markets such as baby food, premium beverages, and pharmaceuticals. Beyond food and beverage, the cosmetics and luxury packaging sector in Italy and France is increasingly using IML to receive matte-metallic effects and texture-rich designs that substitute secondary packaging, lower waste, while developing shelf appeal.

Trend of In-Mold Labels in Germany

The German IML sector shows strong development, which is being driven by the developing user demand for sustainable packaging solutions and brand classification. The Food and beverage industry has dominated, accounting for over 60% of market share, and is being assaulted by developing regulatory pressures for eco-friendly packaging and strict EU compulsions on recyclability.

Also, the regional spots like Bavaria and the North Rhine-Westphalia have shown developed acceptance driven by high-level manufacturing centers and access to the raw material suppliers.

Furthermore, the developing move towards sustainable, digitally covered packaging solutions is linked with assistive regulatory frameworks, which have positioned Germany's industry for sustained growth. Possibilities linked to making biodegradable IML materials have expanded into new end-use segments like pharmaceuticals and cosmetics

Trend of In-Mold Labels Market in India

The Indian sector for the in-mold label is witnessing major development, which is being driven by the surge demand for luxury packaging, the growth of main industries like Fast-Moving Consumer Goods, and the sustainability. The developing food and beverage sector, particularly India’s huge dairy industry, is a main driver for the IML market. The strong manufacturing of milk and the developing sector for the value-added dairy items have made a big demand for good-quality packaging, like containers, bottles, and cups, which IML smoothly serves.

North America In-Mold Labels Market Size 2025 - 2035 (USD Billion)

In-Mold Labels Market - Value Chain Analysis

Material Processing and Conversion: The material processing and conversion of in-mould labels typically begin with polypropylene or other thermoplastic films, which are favored for their excellent compatibility with the injection and blow moulding procedure. These films are extruded, often in biaxially oriented form, to receive superior dimensional stability, heat resistance, and printability. To develop ink adhesion, the films undergo surface treatments such as corona or plasma treatment before entering the printing stage.

Package Design and Prototyping: This space plays an important role in the mold-labels industry as brands increasingly seek innovative packaging that develops shelf appeal and user experience. Designers use 3D Modelling and digital prototyping tools to visualize how labels will integrate with the container’s shape, ensuring a smooth finish and high-quality graphics. Prototyping allows producers to test various designs, materials, and label placements before mass production, reducing errors and saving costs.

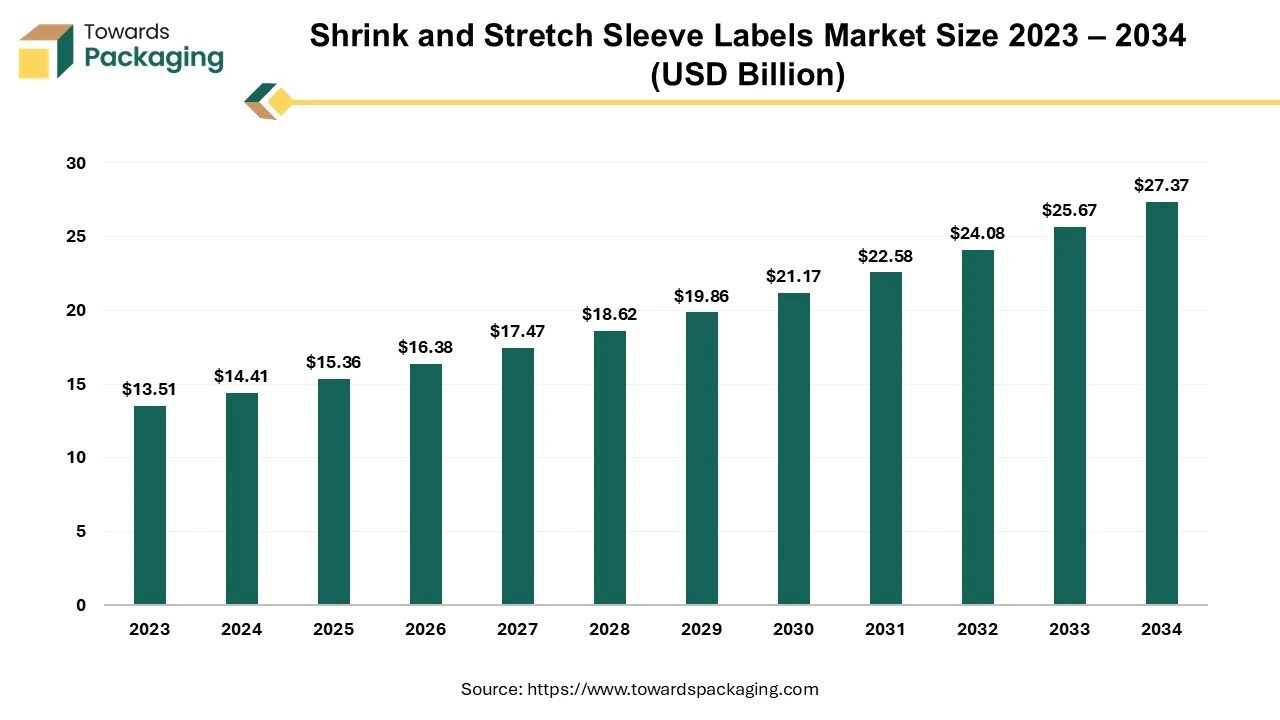

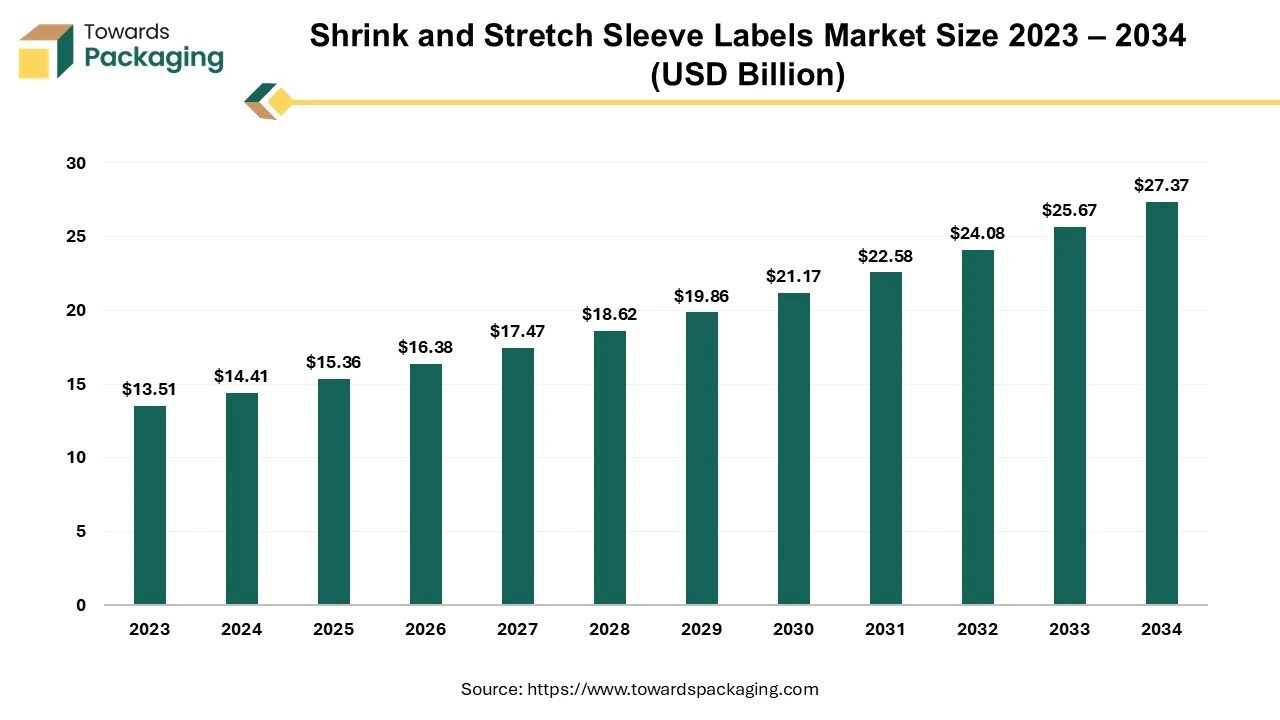

Future of Shrink and Stretch Sleeve Labels Market

The global shrink and stretch sleeve labels market size was evaluated at US$ 13.51 billion in 2023 and is expected to attain around US$ 27.37 billion by 2034, growing at a CAGR of 6.63% from 2024 to 2034.

The shrink and stretch sleeve labels market is anticipated to witness significant growth during the forecast period. Stretch and shrink sleeve labels are made of plastic or polyester and wrapped around a product, fitting the specific dimensions of the package. Stretch labels can be dragged across the product container since they are very elastic and usually made-up of LDPE. When exposed to the heat, shrink sleeves are applied loosely and adapt to the product package by passing the product via a heat tunnel. As they provide a 360-degree message branding that improves the product's effective presentation on the store shelf, stretch and shrink sleeve labels are becoming one of the most desired type of product labeling.

Future of Compostable Packaging Labels Market

The global compostable packaging labels market is experiencing rapid growth, with revenues expected to surge into the hundreds of millions between 2025 and 2034, fueling a transformation in sustainable transportation solutions.

The demand for compostable packaging labels is rising with the growing need for clear labelling. Key players operating in the market are using various strategies, such as acquisitions, partnerships, and mergers, to develop advanced technology for manufacturing compostable packaging labels, which is expected to drive the global compostable packaging labels market during the forecast period.

The compostable packaging labels basically explain the concept of biodegradable packaging. Compostable packaging labels are markings or certifications that designate a product or its packaging, which is manufactured from materials that can break down into non-toxic components naturally in a composting environment. These types of labels ensure that the materials utilized for manufacturing compostable packaging will decompose within a specific timeframe and contribute to nutrient-rich compost rather than continuing as waste in landfills. The labeling often adheres to specific standards set by organizations that assess the compostability of materials.

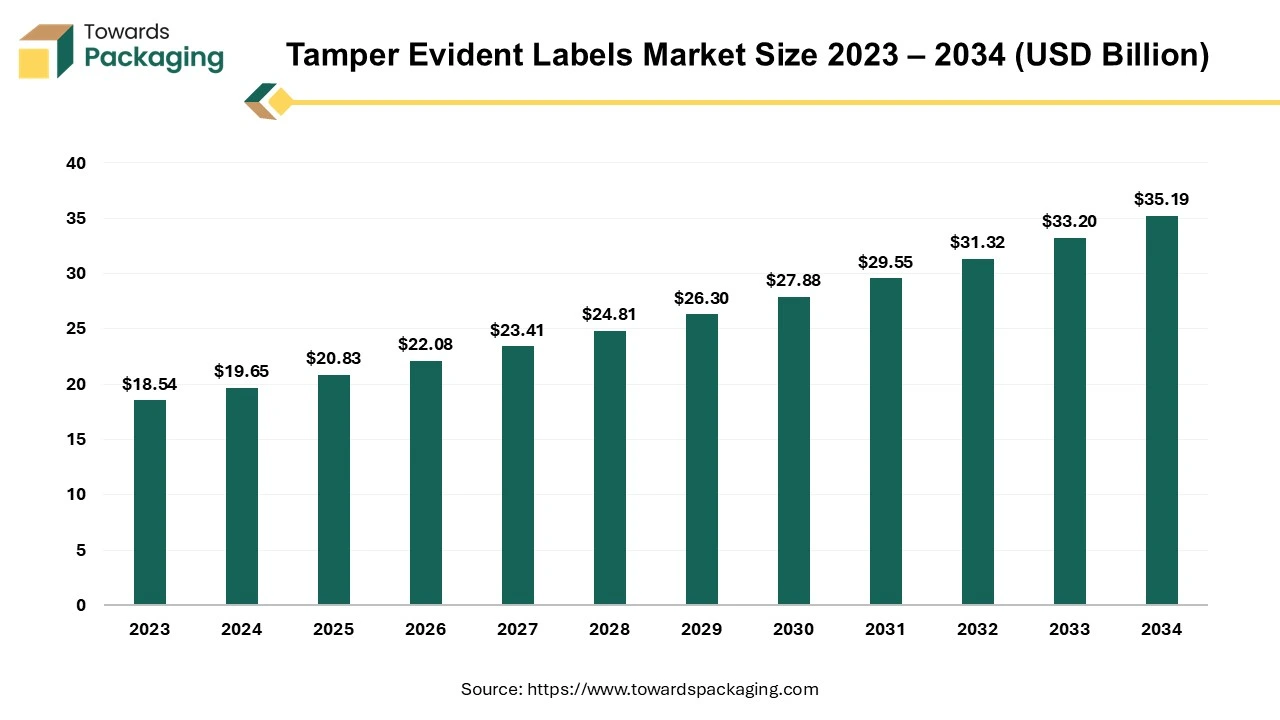

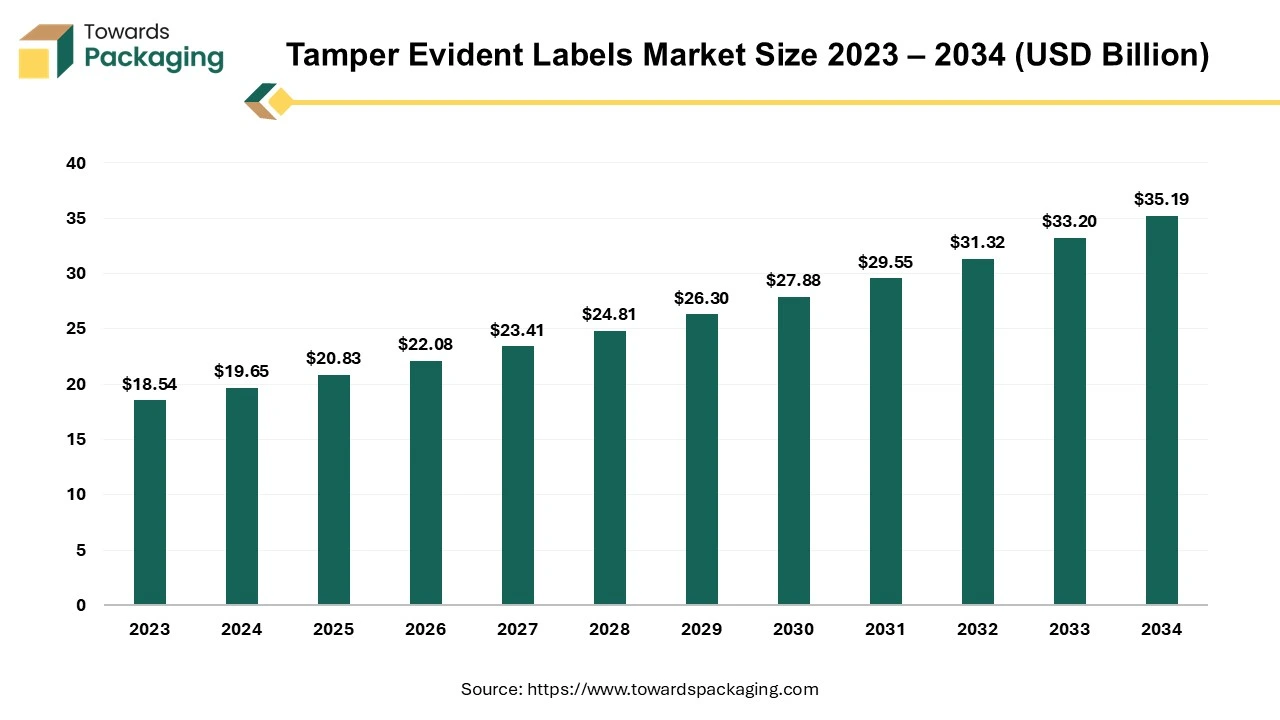

Future of Tamper Evident Labels Market

The tamper evident labels market is anticipated to grow from USD 20.83 billion in 2025 to USD 35.19 billion by 2034, with a compound annual growth rate (CAGR) of 6.00% during the forecast period from 2025 to 2034.

The tamper evident labels market is likely to register considerable growth during the projected period. The purpose of the tamper-evident labels is to prevent tampering and to provide visible proof of tamper or attempted tampering, thus securing the product to which they are attached. From valuable goods to important documents, the tamper-evident products are utilized in the security as well as protection of a wide range of objects. Once a security label has been applied, it will show signs of tampering. Each label product has a different tamper-evident feature. Product tampering, theft, and counterfeiting are constant issues that numerous organizations in a wide range of industries deal with. Due to this, the market for tamper-evident products is growing substantially and will continue to grow as more companies seek to safeguard their items, packaging and warranties.

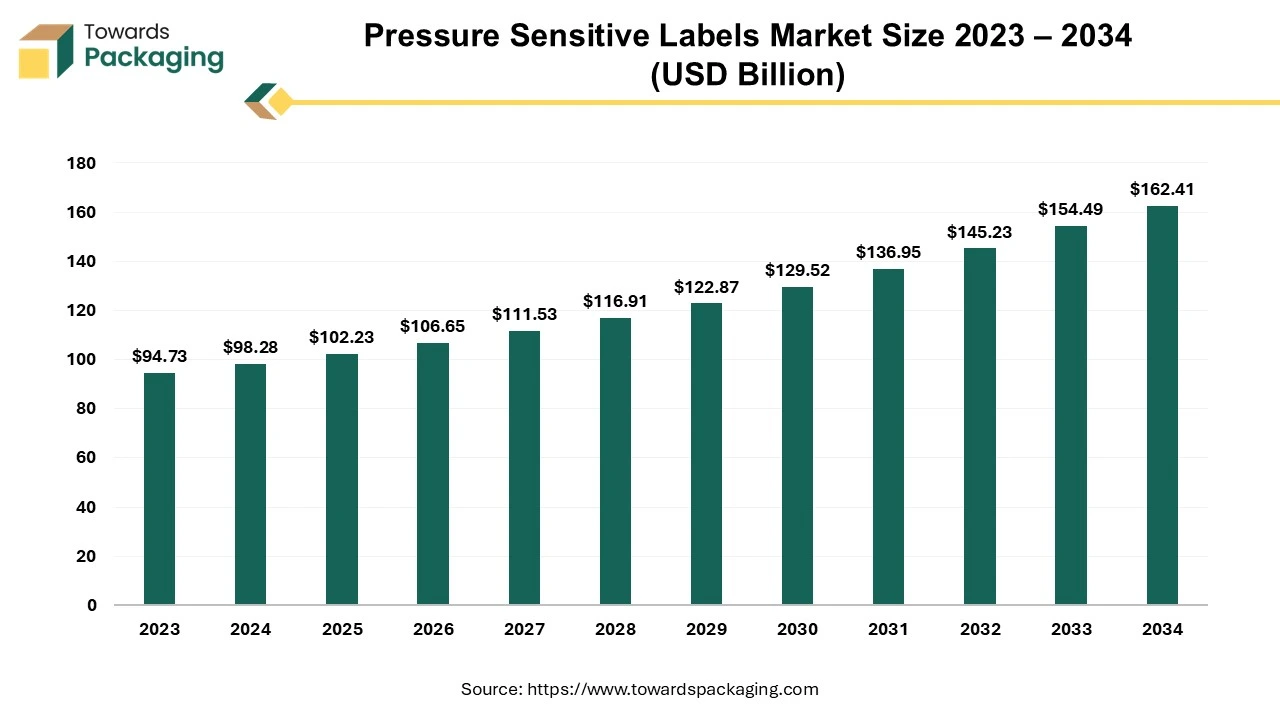

Future of Pressure Sensitive Labels Market

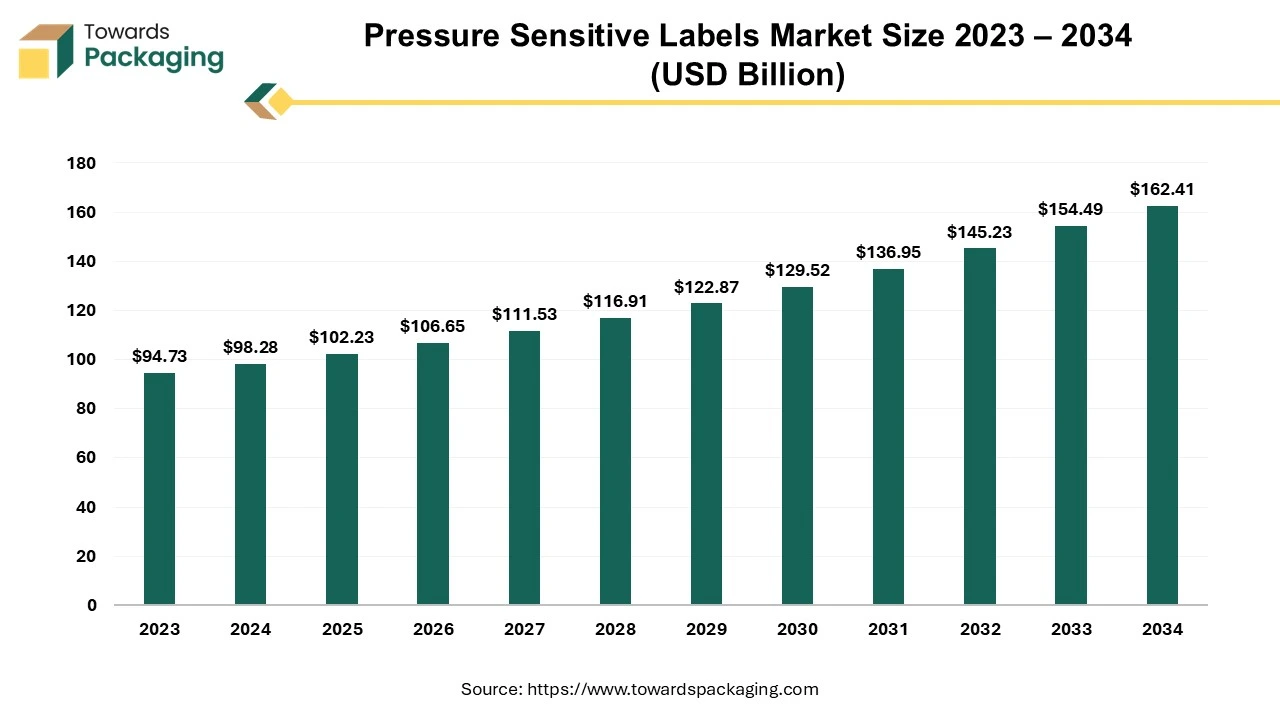

The global pressure sensitive labels market is estimated to reach USD 162.41 billion by 2034, up from USD 98.28 billion in 2024, at a compound annual growth rate (CAGR) of 5.15% from 2024 to 2034.

The pressure sensitive labels industry is projected to achieve remarkable growth over the forecast period. A pressure-sensitive label has three layers face stock, adhesive, and release liner. To generate a label material which can be imprinted on, laminated, die-cut, and then peeled off and attached to the product, all of these elements are sandwiched together throughout the manufacturing process. Over 80% of the labels supplied in the current market are pressure-sensitive labels, making them one of the most frequently utilized options. This is mostly because of how versatile they are. They are utilized in a wide range of products such as food containers, durable goods, toys, medical equipment, corrugated boxes, beer cans and bottles, plastic pouches, and much more. Furthermore, this sort of label works with a large range of printing technologies.

Top Companies in In-Mold Labels Market

- CCL Industries (incl. CCL Label)

- Avery Dennison.

- Constantia Flexibles.

- Coveris Holdings.

- Huhtamaki Group.

- Multi-Color Corporation (MCC / Multi-Color).

- Fuji Seal International.

- Jindal Films.

- Innovia Films (and other specialty film makers).

- Inland Label & Marketing Services / Inland Packaging.

- EVCO Plastics (converter & molder with IML capability).

- Cosmo Films.

- Taghleef Industries (film supplier).

- Mold-Tek Packaging (India) / Mold-Tek Group.

- Letra Graphix / ORIANA Décorpack / regional specialized converters (grouped representative).

Latest Announcements By Industry Leader

- In July 2025, Mold-Tek Packaging‘s pharma business is experiencing strong growth as Chairman and managing director Janumahanti Lakshmana Rao has urged and is selecting Quincy to bring more clients on board.

- https://www.cnbctv18.com/business/companies/mold-tek-packaging-cmd-sees-pharma-business-gaining-momentum-with-new-client-orders-19631943.htm

- In August 2025, Vinsak, a top company in printing and packaging technologies, together with its group company Rohatek Printing and Packaging Technologies, is ready to make a strong impact at LabelExpo Europe 2025 in Barcelona.

Recent Developments

- In October 2025, Walmart collaborated with Avery Dennisoon to reveal the radio-frequency identification (RFID) labelling for the fresh food spaces, which include bakery, meat, and deli, in a shift set to update the inventory management and lower waste too.

- In October 2025, Bobst disclosed its FlexJet module, which is a digital printing system that allows single-pass manufacturing of stretched content labels when it is mixed into a Bobst Digital Master Press.

- In June 2025, The Kroger Co. plans to add 80 of the latest protein-based products to its Simple Truth natural and organic brand. The Chairman and the interim chief executive officer, Ronald Sargent, have revealed the further rollout while reporting fiscal 2025 first-quarter outcomes.

- In March 2025, Crestview Partners, a top private equity firm, revealed today that it has completed the merger of Smyth companies, a luxury, full-service provider of pressure-sensitive labels in terms of in-mold labels, shrink-sleeve labels, and flexible packaging.

In-Mold Labels market Segment Covered

By Material / Film

- Polypropylene (PP) - oriented PP (OPP), biaxially oriented PP (BOPP), cast PP

- Polyethylene (PE) - HDPE, LDPE

- Polystyrene (PS) / OPS

- PET (polyethylene terephthalate)

- PVC (polyvinyl chloride)

- ABS & specialty resins

By Printing/Converting Technology

- Flexographic printing

- Offset (lithographic) printing

- Rotogravure (gravure) printing

- Digital printing (inkjet/UV) + hybrid workflows

- Secondary converting: metallization, varnishing, laminating, die-cutting

By End-Use Industry/Application

- Food & beverage (cups, tubs, trays, yogurt pots)

- Dairy (yogurt cups, cheese tubs)

- Home care & household chemicals

- Personal care & cosmetics

- Pharmaceutical & healthcare

- Automotive (interior trims, durable parts)

- Consumer electronics & appliances

- Industrial/technical parts (pails, buckets, crates)

By Functionality/Value-Add

- Standard decorative IML

- Functional IML: RFID-enabled / NFC / anti-counterfeit / tamper-evident

- Barrier/specialty coatings (UV, chemical resistance)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

Tags

FAQ's

Select User License to Buy

Figures (9)