Monodose Packaging For Probiotic and Nutraceutical Market Size and Regional Production Analysis

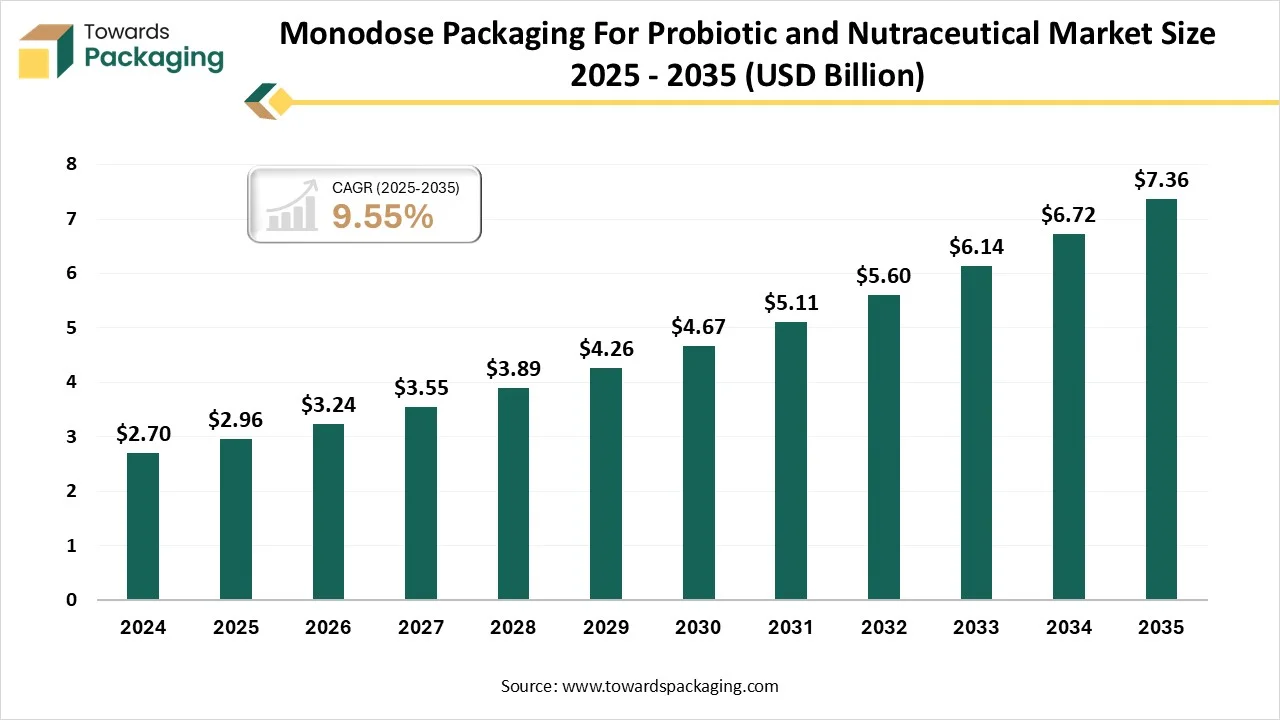

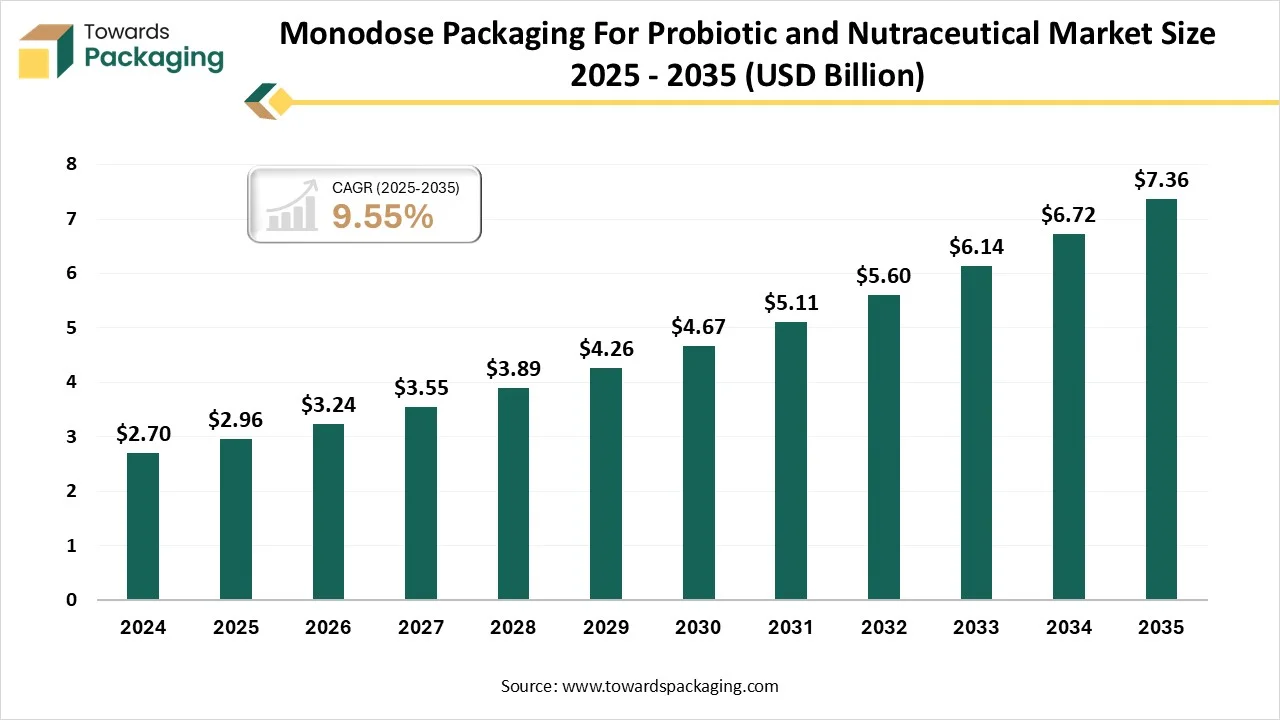

The monodose packaging for probiotics and nutraceutical market is forecast to grow at a CAGR of 9.55%, from USD 3.24 billion in 2026 to USD 7.36 billion by 2035, over the forecast period from 2026 to 2035. The growth is due to factors lie its potential to lower waste and develop hygiene., product control across different industries like cosmetics, pharmaceutical and food and beverages too along with ease.

Key Takeaways

- In terms of revenue, the market is valued at USD 2.96 Billion in 2025.

- The market is predicted to reach USD 7.36 Billion by the year 2035.

- Rapid growth at a CAGR of 9.55% will be officially experienced between 2025 and 2034.

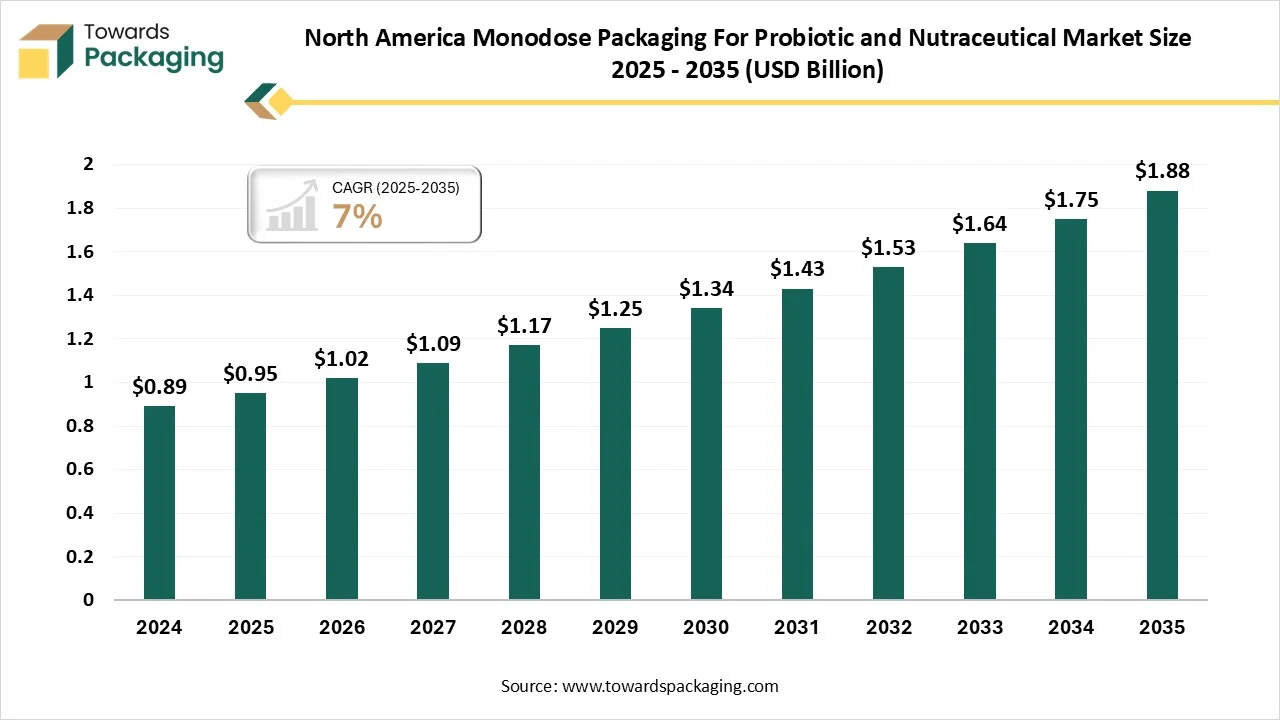

- By region, North America dominated the market, having the biggest share of approximately 30-35% in 2024.

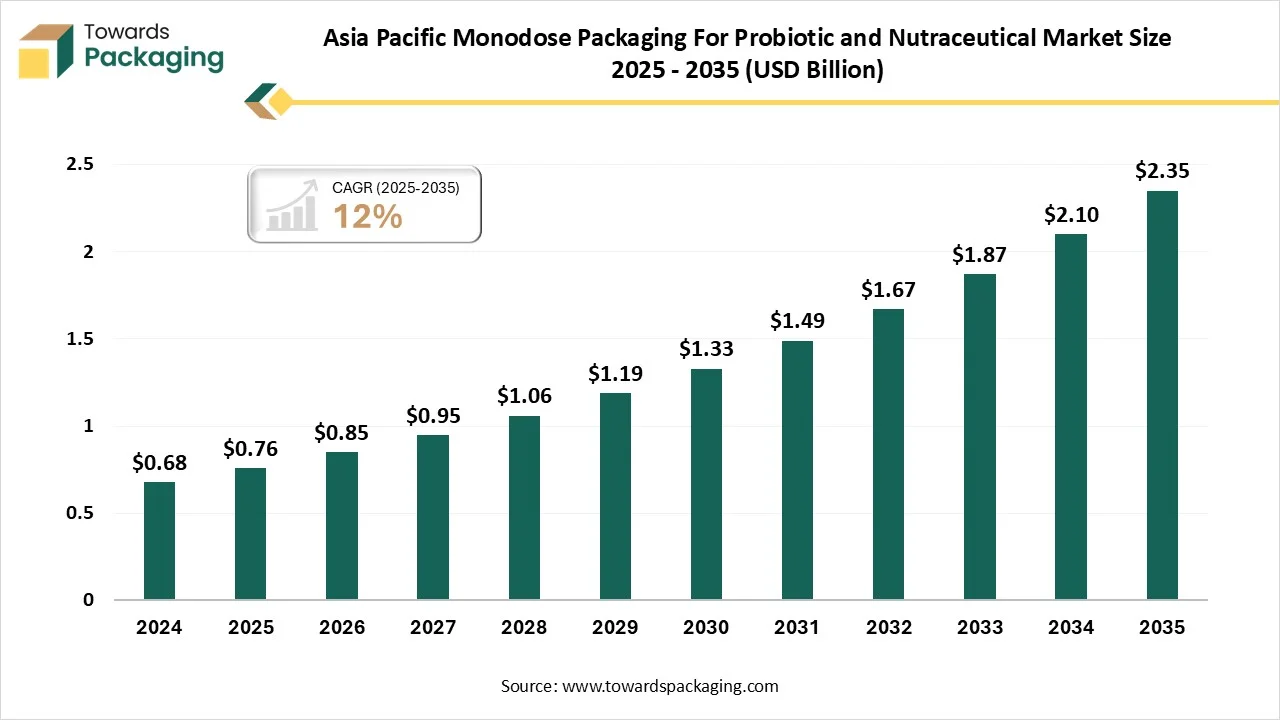

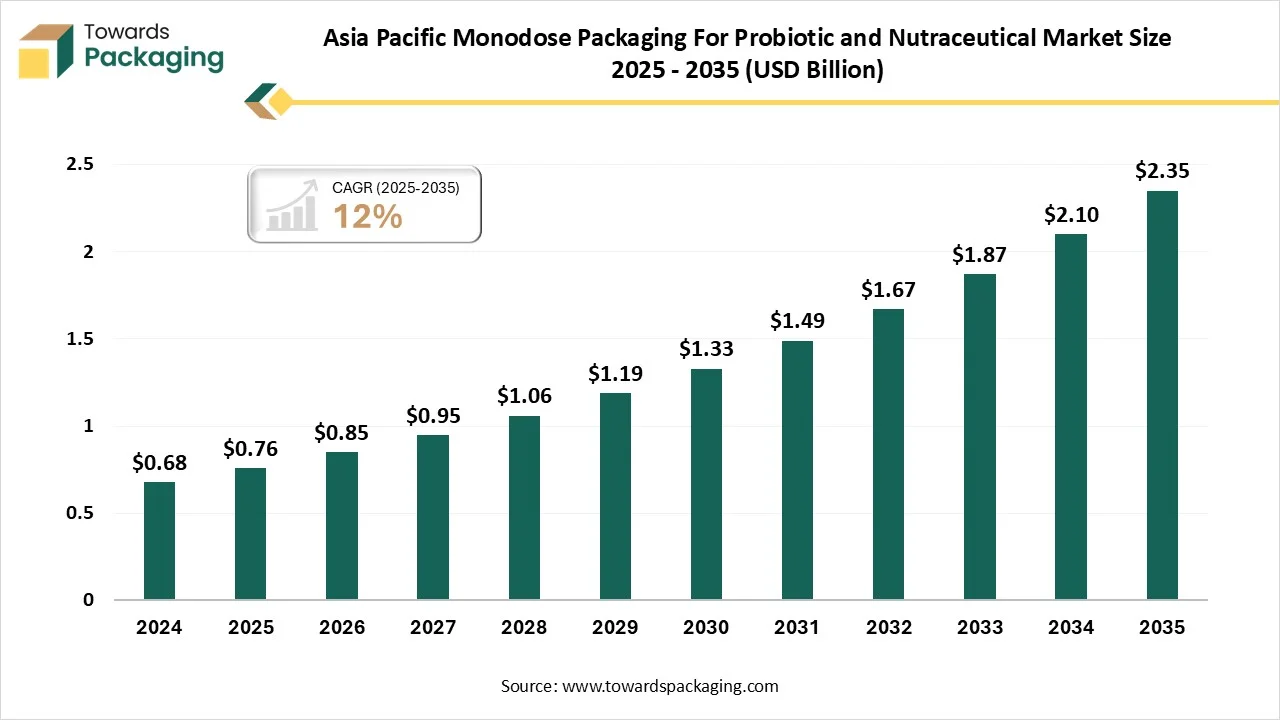

- By region, Asia Pacific is expected to rise at a notable CAGR between 2025 and 2034.

- By packaging type, sachets and stickpacks segment has contributed to the biggest share of approximately 45-50% in 2024.

- By packaging type, single-serve liquid pouches segment will grow at a notable CAGR of approximately 10-14% between 2025 and 2034.

- By packaging material, multi-layer laminated segment contributed to the biggest share of approximately 55% in 2024.

- By packaging material, mono-material recyclable films segment will grow at a notable CAGR of approximately 12-16 % between 2025 and 2034.

- By filling technology, the Form-fill-seal stickpack machines segment have contributed to the largest share in 2024.

- By filling technology, the Liquid filling & sealing (ampoules, pouches) segment will grow at a notable CAGR between 2025 and 2034.

- By product formulation, powdered probiotics and nutraceuticals segment have the largest share of approximately 50% in 2024.

- By product formulation, liquid probiotics segment will grow at a notable CAGR of approximately 11-15 % share between 2025 and 2034.

- By end-user industry, nutraceutical and supplement brands segment have contributed to the biggest share of approximately 40-45 % in 2024.

- By end-user industry, contract packers and subscription-based brands segment will grow at a notable CAGR of approximately 10% between 2025 and 2034.

- By distribution channel, retail and E-commerce segment have contributed to the biggest share of approximately 60% in 2024.

- By distribution channel, direct-to-consumer subscription channels segment will grow at a notable CAGR of approximately 12-18% between 2025 and 2034.

What Do You Mean By Monodose Packaging For Probiotics And Nutraceutical Market?

Growth is driven by rising health awareness, expansion of probiotic and functional supplement categories, and e-commerce adoption.

The Monodose Packaging for Probiotics and Nutraceutical Market refers to the global industry that designs and supplies single-serve (monodose) packaging solutions such as sachets, stickpacks, ampoules, vials, blisters, and unit-dose trays specifically tailored for probiotics and nutraceutical products. These formats ensure precise dosing, portability, hygiene, and preservation of product potency, which is particularly critical for live probiotic strains. They also align with consumer trends toward on-the-go consumption, subscription health models, and convenient trial packs.

Monodose Packaging For Probiotics and Nutraceutical Market Outlook

- Industry Growth Overview: Between the years 2025 and 2034, the growth factors include the demand for safe and smooth dosing, lower waste, and increased innovation in materials like water-soluble films, and the growth of e-commerce and direct-to-consumer sales channels.

- Sustainability Trends: The vitamin supplement industry and energy shot market are growing rapidly, and so are users' expectations. As sustainability and health run side by side, brands demand packaging that serves ease, responsibility, and impact. It is crafted particularly for high-development sectors such as collagen drinks, energy boosters, sports recovery formulas, and nootropics, so monodose solutions are being constructed to assist at every platform.

- Global Expansion: The global expansion of monodose packaging for nutraceuticals and probiotics is being driven by user demand for accurate dosage and convenience, along with technological advances in packaging. The industry is also filled with a global growth in health-conscious users finding preventive protection. While regions like Europe and North America are currently dominant, Latin America and the Asia Pacific are experiencing high-growth rates.

- Major Investors: The list mentioned is being spread across different countries, including Canada, the United States, and Italy, which replicates the overall demand for quality packaging solutions. The companies are Packlab, Mak Pharma, ENCAPLAST, and Viva Pharmaceutical Inc. Richmond, Ingersoll Paper Box, Ropack Pharma Solutions, and Feliu Packaging SI.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 2.96 Billion |

| Projected Market Size in 2035 |

USD 7.36 Billion |

| CAGR (2026 - 2035) |

9.55% |

| Leading Region |

North America |

| Market Segmentation |

By Packaging Type / Format, By Packaging Material, By Filling Technology / Closure, By Product Formulation (contents filled), By End-User / Buyer, By Distribution Channel and By Region |

| Top Key Players |

Amcor plc, Gerresheimer, Aptar, Alpha Packaging, ProAmpac, Constantia Flexibles, Sonoco, Uflex Limited, Comar LLC, Medifilm AG, CurTec |

Key Technological Shifts in the Monodose Packaging for Probiotics and Nutraceutical Market

Artificial Intelligence brands shift from generic supplements to accurate nutrition by tracking these multi-layered data sets and suggesting individualized supplement protocols. With the assistance of AI-driven nutrition suggestions, organizations can perfectly understand how elements like generic variations and microbiome composition affect every individual's different dietary needs and demands.

As the nutraceutical and monodose packaging is globally expanding, discovering user trends urges science-backed natural food products, which are important. Clinical trials and high-throughput screening play an important role in biomarker identification, making sure that the latest products not only align with health standards but also provide health advantages of natural ingredients.

Furthermore, market trend examination using AI tools in nutraceuticals enables the absorption of functional ingredients that solve health issues while depending on regulatory compliance. This procedure can be further developed by discovering how regulatory compliance is tracked through automation using AI.

- In May 2025, Hyperion Biosystems and Colorcon recently revealed a licensing collaboration to codify and market a jointly developed, anti-counterfeiting technology for solid oral dosage nutraceutical and pharmaceutical products.

Market Opportunity

Innovative Technology Is The Future Of Monodose Packaging

Inventive isolation technology has changed the pharmaceutical industry, serving as a strong solution for tracking operator safety and product sterility. These state-of-the-art systems are thoroughly crafted and constructed using high-grade stainless steel, ensuring compliance and durability with rigid GMP Grade A environmental standards (ISO 4.8). This unique attention to detail makes a managed environment that lowers the risk of pollutants and maximizes the product quality.

High-level machines further extend the smoothness of these isolators. Laminar airflow technology, which is linked with focused air handling units (AHU), ensures a continuous supply of clean air that protects against the ingress of airborne particulates. Integrated automatic leak tests and overall WIP/CIP machine guarantees the honesty of the isolation chamber and enables effective sterilisation procedures and cleaning too.

Market Restraint

Eco-Friendly Issues With Monodose Packaging

Monodose packaging raises the main environmental issues due to its widespread usage of single-use plastics. These small packets are generally made from multilayered materials, integrating aluminium, plastic, and paper, which complicates the recycling procedure. As a result, a big volume of sachets ends up in oceans, landfills, and other ecosystems that contribute to surrounding contamination. The efforts to develop sustainability include innovative materials in which the growth of compostable or biodegradable alternatives to lower waste and regulatory measures, such as government policies, which motivate eco-friendly designs and lower dependency on non-recyclable plastics.

Trade Analysis of Monodose Packaging For Probiotics And Nutraceutical Market: Import & Export Statistics

- The Indian nutraceutical and probiotics sector supplies over 50% of worldwide demand for different vaccines, 40% of usual demand in the US, and 25% of all medicines in the UK. This domestic sector counts a network of 3,000 drug companies and 10,500 production units.

- The domestic nutraceutical sector is expected to rise 8-10% in the current financial year 2023-2024, which shows that an examination done by CRISL, which is a worldwide analytical research and rating company.

- Exports of pharmaceuticals and drugs have recorded a year-on-year growth of 9.7% during April-March 2024. India’s probiotic and nutraceutical exports stood at USD 27.82 billion in 2024.

Emerging Trends in Monodose Packaging For Probiotics and Nutraceutical Market

- Personalized Prebiotics: One of the most captivating developments is the growth of personalised probiotic solutions. Organizations are now serving tailored probiotic mixtures depending on a particular microbiome profile. This personalised strategy goal is to serve more smooth and focused health benefits.

- Synbiotics: The Power Couple: Synbiotics, which integrate probiotics with prebiotics (food for advantageous bacteria), are gaining attention. The synergistic strategy goal is to develop the capability of probiotic supplements and functional foods.

- Innovative Delivery Formats: While supplements and prebiotic yogurts remain famous, we should find innovative delivery formats. From snacks and probiotic-infused beverages to skincare products and even oral care items, probiotics are making their way into different product categories.

- Every day, athletes drive sports nutrition: Performance-dependent supplements are additionally linked to athlete-type buyers. In current days, yoga buffs, weekend runners, and working-class singles seek assistance to develop their endurance, energy, and recovery, too. This function displays how wellness is being updated and how the democratization of sports nutrition is likely to align with the latest trend in the nutraceutical industry.

- Making Mental Wellness Mainstream: Lack of sleep, stress, and mental fatigue have controlled the world currently. Cognitive health is one of the biggest shifting fields in the nutraceutical field. From botanicals for stress assistance to natural sleeping aids, items for the barin are becoming as lavish as those for the body.

- Clean -labelled and Plant-based: Users are now becoming very health-conscious about labels. Herbal products that are marketed as sustainable, transparent, or plant-based are generally put in an unwanted category. Herbal botanics assist in movements that market ashwagandha, turmeric, and amla, too.

Value Chain Analysis of Monodose Packaging for Probiotics and Nutraceutical Market

- Material Processing and Conversion: The material processing and conversion of monodose packaging count on transferring raw materials like paper, plastic pellets, and foils into single-use designs such as stick packs, sachets, and vials. This heavily automated procedure, which is applied across the food, pharmaceutical, and cosmetic industries, is rapidly changing towards sustainable mono-material solutions.

- Package Design and Prototyping: The primary phase generates the product, brand positioning, and target audience, too. For monodose packaging, complicated research points count designers utilise the research to draw starting ideas on paper or a partnered whiteboard. This platform concentrates on discovering sizes, forms, and opening mechanisms.

- Logistics and Distribution: Logistics and distribution of monodose packaging concentrates on carrying small, single-use units that smoothly flow throughout the supply chain. This procedure involves tracking primary, secondary, and tertiary packaging surfaces to ensure streamlined transportation and product integrity, storage, and retail procedures, too.

Packaging Type Insights

How Did The Sachets/Stickpacks Segment Dominate The Monodose Packaging For Probiotics And Nutraceutical Market?

The sachets/stickpacks segment dominated the market with approximately 40-50% share in 2024, as stickpack packaging is one of the most popular and greatly used flexible packaging designs in the cosmetics, food, nutritional, pharmaceutical, and dairy industries, too. It is a flexible packaging having 3 packs, with two horizontal packs on the sides and one vertical seal. The design is generally narrow and long, although it is also possible in a square format. The stick pack design is perfect to carry with us in every possible way. The packaging is completely flexible as it protects against breakage and hence protects the content from spilling. Furthermore, as it is designed and crafted, which have minute quantities ranging from 5 to 15 ml, a size and weight lower than. With its convenient -opening system, no machines are required to open the packaging. Furthermore, the balance between consistency and elasticity of the film enables us to take medicine with overall peace of mind and to flavor your food and beverages, and even to use the product on your body, such as skin or hair.

The single-serve liquid pouch segment is expected to grow at the fastest CAGR of approximately 10-14 % during the forecast period. One of the biggest benefits of single-serve liquid packaging is its potential to prevent leaks and spills. The pouch is crafted to be leak-proof, making sure that the liquid stays inside the pouch and does not spill, especially during storage or transportation. This is particularly crucial for products that are transported over long distances or to various locations.

Another exceptional advantage of monodose packaging for dry packaging is its reliability. This kind of packaging can be created with materials that are lightweight, durable, and convenient to transport. This is specifically crucial for items that are shipped over long distances, in which packaging durability and weight are complicated elements.

Packaging Material Insights

How Did The Multi-Layer Laminated Films Segment Dominate The Monodose Packaging For Probiotics And Nutraceutical Market?

The multi-layer laminated films segment dominated the market with approximately 55% market share in 2024, as monodose packaging for probiotics and the nutraceutical industry with high-level barricade materials and technologies is crucial for lowering product loss and expanding the shelf life. These packaging solutions protect items from surrounding elements, which can devalue fragile ingredients. Oxygen scavengers and modified atmosphere packaging prevent oxidation-sensitive ingredients like probiotics and fish oils. On the other hand, multi-layer laminates and aluminium foil avert moisture ingress, which protects dry supplements and powders. Also, the dark -coloured bottles and opaque materials shield photosensitive elements from UV radiation.

The mono-material recyclable segment is predicted to grow at the fastest CAGR of approximately 12-16% CAGR during the forecast period. Mono-material packaging serves a main benefit in terms of recyclability. Using a single material ensures smooth recycling, avoids the demand for energy-intensive procedures, and lowers the environmental impact associated with waste management. This kind of packaging also needs fewer resources and less energy during manufacturing, which makes it a more innovative and sustainable alternative to multi-layer composite packaging.

Filling Technology/Closure Insights

The form-fill-seal stickpack machine segment dominated the market in 2024 as stickpack machines are being crafted, developed, and generated by the Schmucker manufacturing plant, which has huge experience in the production of this product at the global level. Stickpacks are tubular single-dose sachets that need up to 30% less packaging material than regular or same sachets that are packed on all 4 sides and are perfect for a variety of product types, including granules, powders, gels, and liquids. These machines are mainly used for the cosmetic, pharmaceutical, food, and chemical sectors. Their main elements include their extreme versatility, their convenience of usage, and their fast size-up after both width and length.

The liquid filling & sealing (ampoules, pouches) segment is predicted to grow at the fastest rate during the forecast period. And liquid filling machines are being crafted to automatically fill liquids into containers like jars, bottles, or pouches that are prevalently used in sectors such as pharmaceutical, food and beverage, chemicals, and cosmetics. These machines ensure smooth and accurate filling, lowering waste and increasing productivity. Relying on the liquid’s viscosity, several types of machines are being utilised, including low-viscosity liquids or gravity filling, piston filling for thicker liquids, and pressure-filling for foamy products and carbonated ones too.

How Did The Powdered Probiotics And Nutraceuticals Segment Dominate The Monodose Packaging For Probiotics And Nutraceutical Market?

The powdered prebiotics and nutraceuticals segment dominated the market with approximately 50% share in 2024, as powdered dietary supplements have been a main part of the nutraceutical and probiotic sector because of their efficacy, versatility, and complete user appeal. While some nutraceuticals are smooth in terms of units of microgram and milligram and can be conveniently fit into a tablet or capsule, they need grams in the range of 10 g, 5 g, and 20g or more. Several users currently choose powdered supplements over regular capsules in the needed dosage.

Furthermore, there are different types of powdered probiotics and nutraceuticals, such as

- Pre-Workout and Post-Workout Supplement Powders: It is usually formulated with ingredients like beta-alanine, electrolytes, creatine monohydrate, and black ginger extract to assist recovery and performance.

- Protein Supplement Powders: Famous sources count pea, soy, and brown rice proteins, which all serve evergreen selections for muscle assistance and meal substitution formulas.

- Greens Supplement powders: These usually include options such as algae ( chlorella spirulina ), prevalent green vegetables like spinach and broccoli, grasses ( barley grass, alfalfa, and wheat grasses ), and lastly sprouted versions like green and grass vegetables.

- Collagen Supplement Powders: Prevalent collagen sources include marine (fish), bovine, and porcine collagen peptides, which are all crafted to assist joint, skin, and connective tissue health.

The liquid probiotics segment are predicted to be the fastest in the market with a CAGR of approximately 11-15% during the forecast period. To track the potency and viability of liquid probiotics, producers use tailored packaging materials and technologies that serve to protect live micro-organisms from light, heat, and oxygen, too. This counts high-barrier crayons and bottles, as well as cutting-edge active packaging solutions. In order to challenge the volatility of liquid probiotics, producers also use inventive packaging technologies that go far beyond passive barricades. Caps with oxygen-scavenging liners or inventive dispenser caps, just like the KarmaCap, can assist in protecting the prebiotic cultures.

End-User Industry Insights

Why Did The Nutraceuticals And Supplement Brands Segment Dominate The Monodose Packaging For Probiotics And Nutraceutical Market?

The nutraceuticals and supplement brand segment dominated the market with approximately 40-45% share in 2024, as the nutraceutical and supplement company is experiencing a significant transformation, and the industry is increasingly moving towards pharmaceutical instead of food uses. This update is being driven by growing user demand for safety, quality, and traceability, as well as by increasingly rigid regulations. In recent years, the nutraceutical and supplements products sector has experienced a rising urge for single-serve formats, specifically for stick packs, that are hugely substituting the regular bottles.

The contract packers and subscription-based brands segment are expected to have the fastest CAGR of approximately 10% in the market during the forecast period. Contract producers are equipped with the resources compulsory to serve nutraceutical items to the industry smoothly while maintaining good-quality standards. When we select the accurate usage, the yield immediately grows while the manufacturing cost reduces. Nutraceuticals are a kind of dietary supplement that serve physiological benefits and the primary nutritional value that the body needs daily. Every stage in the nutraceutical and probiotic production procedure must be carefully tracked and documented to ensure that the finished goods are secure and align with regulatory requirements. This makes the process costly and time-consuming in an industry that is becoming increasingly competitive.

A subscription business model allows one to make regular payments, either monthly or yearly, in return for ongoing access to products or services. This move from one-time buyers to current billing and usage-based billing has updated how businesses link with their customers, creating longer-term value on both sides. For consumers, subscriptions serve a seamless experience. Once enrolled, they can depend on uninterrupted service or time-to-time product deliveries without the demand to place repeated orders.

Distribution Channel Insights

How Did The Retail And E-Commerce Segment Dominate The Monodose Packaging For Probiotics And Nutraceutical Market?

The Retail and E-commerce segment dominated the market with approximately 60% share in 2024 as selling monodose nutraceuticals via e-commerce is a rising industry, but it needs rigid adherence to regulations, specifically concerning manufacturing, labelling, and claims. Monodose packaging, such as capsules, sachets, and liquids, is a regulated format under Indian Law, which serves safety and quality standards that are aligned. Beyond usual nutraceutical regulations, online selling has further needs for constructing and managing operations and trust, too. Count third-party lab tests that report and connect to scientific proof to substantiate product claims, as users are more aware of health-related purchases.

The direct-to-consumer subscription-based channels segment are expected to have the fastest CAGR of approximately 12-18 % in the market during the forecast period. Delivering monodose packaged nutraceuticals online directly to consumers (D2C) is a big-market development, but it demands strategic marketing and precise compliance with regulations. Monodose packaging, such as sachets, stick packs, and vials, serves regular and accurate dosing, that are highly valued by users. Monodose packaging makes sure that the user takes the perfect suggestions in terms of serving, which is an important ingredient, just like probiotics. It also protects the product from pollutants from frequent handling and management. Monodose packing can assist in lowering the product waste, which is prevalent with heavier containers.

Regional Insights

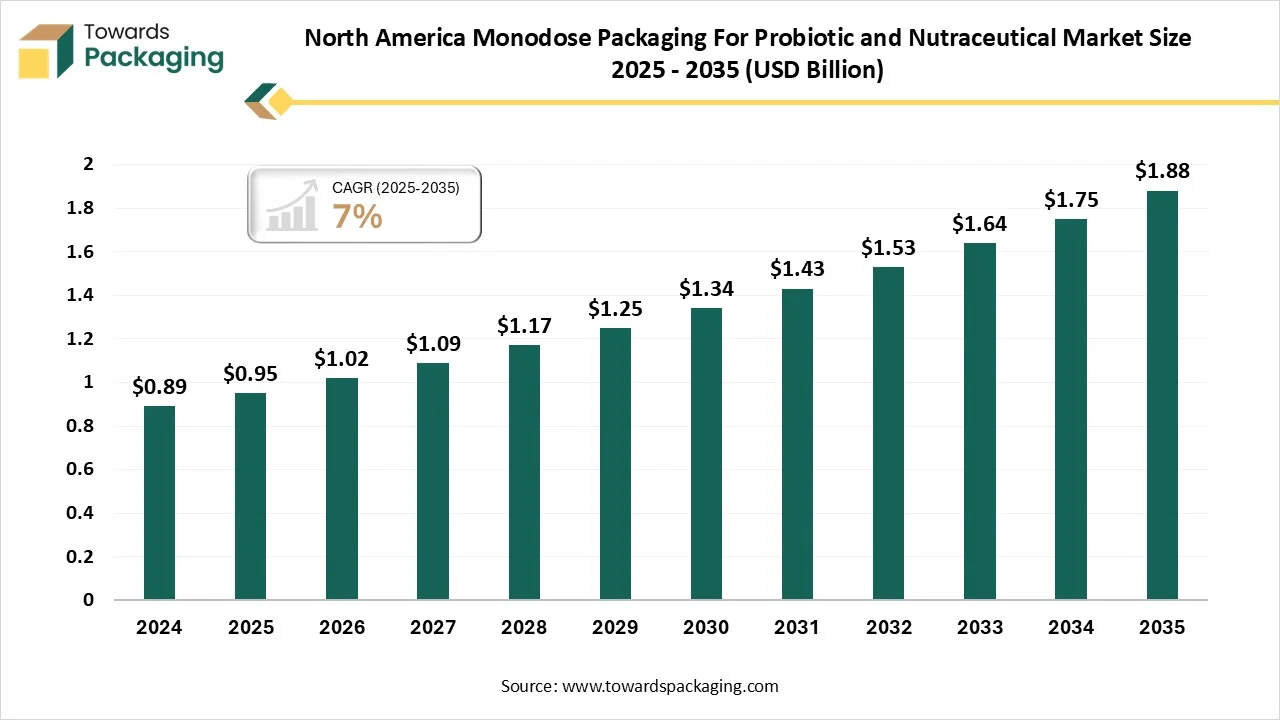

How Did The North America Region Dominate The Monodose Packaging For Probiotics And Nutraceutical Market?

North America dominated the market with approximately 30-35% share 2024 The urge for monodose packaging in North America is strong and rising, which is being driven by user choice for product portability, convenience, and accurate dosing. The market is increasingly encouraged by the strong pharmaceutical and user-packed goods sectors in the region, specifically in the United States. Single-dose patterns are famous in the nutraceutical and pharmaceutical industry as they ensure precise dosage and pollutant contamination. Probiotics and nutraceuticals are a main development area in North America with a rigid urge for packaging like ampoules, vials, and blister packs for vaccines, medications, and dietary supplements. The strict regulatory environment in Canada and the U.S supports this type of packaging, which develops product safety, stability, and traceability.

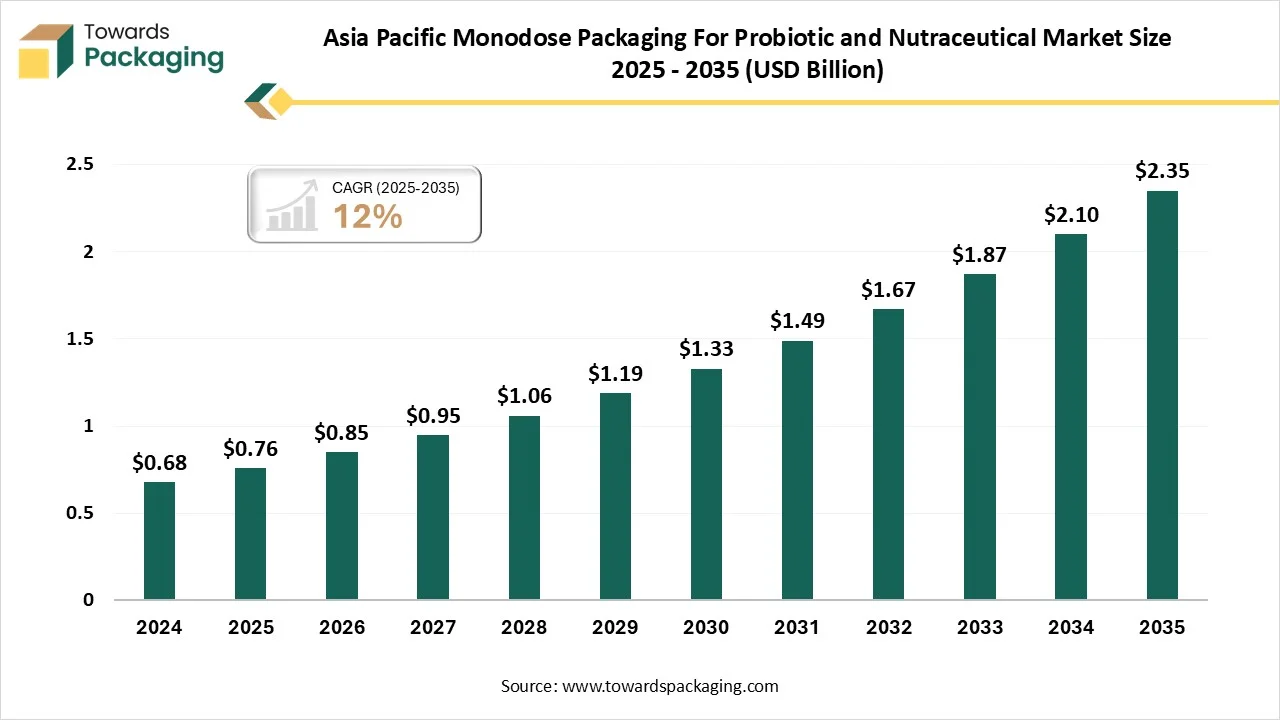

Asia Pacific is expected to be the fastest-growing in the market during the forecast period. The demand for monodose packaging for probiotics and nutraceuticals in Asian countries is witnessing major development, which is being driven by growing urbanization, heightened concentration on hygiene, convenience, and product safety. Main Factors are fulfilling the urge for food and beverages, pharmaceuticals, and cosmetics too. In rising Asian Countries like China, India, and Indonesia, single-dose packs serve a reliable penetration for users to try products like cosmetics, which drives the sales and market penetration.

Monodose designs prevent products from pollutants, which is important for cosmetics, food, and pharmaceuticals. This developed hygiene has gained importance following the COVID-19 pandemic.

Country-level Investments & Funding Trends for Monodose Packaging for Probiotics and Nutraceutical Market

- Main investments in monodose packaging for nutraceutical and probiotic occur at the organization level, which is being driven by user demand for accurate dosage and ease, sustainability issues, and technological advancements. While country-level policies like green taxes and regulations, encourage these investments, which fund monodose packaging inventions via direct government.

- Investments are focusing on alternative materials like biodegradable, paper-based, and water-soluble packaging to align with user expectations and regulatory needs for sustainability.

- Organizations are mixing smart technologies, such as RFID tags and QR codes, to develop consumer engagement, product traceability, and transparency. The investment that continues flexible packaging designs like sachets and stick packs due to their portability, convenience, and accurate dosage capabilities.

Recent Developments

- In November 2024, MilkyMist, which is a well-known dairy generator from South India, collaborated with SIG and AnaBio Technologies to reveal the World’s primary long-life probiotic buttermilk in aseptic carton packs. This cutting-edge growth, displayed at Gulfood Manufacturing 2024 in Dubai, has represented a breakthrough in the beverage sector, enabling probiotics to be included in shelf-stable drinks in aseptic cartons for the very first time.

- In August 2025, Rotzinger PharmaPack is revealing a latest filling and capping stage for over-the-counter items such as non-aseptic pharmaceuticals as well as liquid and solid items from the personal care, cosmetics, and nutraceutical industries.

- In September 2025, Bayer Consumer Health has been spotted with an untouched gut market health capability in Latin America because of common digestive health problems and rising regional demand for solutions. The organization revealed its first probiotics in the region last year.

- In July 2025, Rain Eye Drops LLC, a top company in preservative-free eye care solutions, has disclosed the launch of the RainDrop Dispenser Aid, a currently changed device exclusively licensed from the United States Department of Veterans Affairs. This patent-pending machine is crafted to assist Americans with a dry eye application of monodose eyedrop vials more precisely and conveniently.

Top Players in the Monodose Packaging for Probiotics and Nutraceutical Market

- Unit Pack Company: Unit Pack is an family-run and operated liquid single-dose packaging organization that has 50 years of experience.

- RPC Group: RPC Group is a United Kingdom-based company that is Europe’s biggest supplier of plastic packaging and is headquartered in New Jersey.

- PontEurope: Pont Europe was established in 1906 in Flevoland, Netherlands and is a Top pan-European supplier of plastic and glass containers, with jars and bottles, as well as linked accessories and closures.

- Origin Pharma Packaging: Origin Pharma Packaging is a manufacturer, designer, and supplier of packaging for pharmaceutical products. It is using its Pharmaceutical Packaging, Invention and Logistics Centre, the company has collaborated with a license holder and a contract production company.

- Lameplast: Lameplast is a top Italian producer of single-dose and multi-dose plastic packaging for medical devices, cosmetics, veterinary, food supplement, and diagnostic use with an emphasis on vaccines, ophthalmic, and inhalation solutions.

Monodose Packaging For Probiotic and Nutraceutical Market Players

Tier 1

Tier 2

Tier 3

- Comar LLC

- Medifilm AG

- CurTec

- Sonic Packaging

- Bison Bag

- Aranow

- ELIS Manufacturing / K-flex

Segmentation of the Monodose Packaging for Probiotics and Nutraceutical Market

By Packaging Type / Format

- Sachets / Stickpacks (powder dose)con

- Single-serve Pouches (liquid or powder)

- Ampoules & Vials (oral liquids, drops)

- Blister Packs / Unit-Dose Trays (capsules, tablets, softgels)

- Pre-filled Sachets & Strips

- Specialty child-friendly or spoon-integrated packs

By Packaging Material

- Multi-layer laminated films (PET/Alu/PE, BOPP laminates)

- Paper-plastic composites (sustainable variants)

- Mono-material PE / PP films (recyclable)

- Glass ampoules (liquid doses)

- Flexible barrier-coated pouches

By Filling Technology / Closure

- Form-fill-seal stickpack machines

- Vertical fill-seal sachet systems

- Liquid filling & sealing (ampoules, pouches)

- Blister filling (tablets/softgels)

- Pre-made pouch filling with spouts

By Product Formulation (contents filled)

- Powdered Probiotics (single-strain or blends)

- Liquid Probiotics (drops, suspensions)

- Capsules / Tablets / Softgels (nutraceutical actives)

- Gummies (unit-dose pouches)

- Synbiotic sachets (probiotic + prebiotic)

By End-User / Buyer

- Nutraceutical & Supplement Brands

- Probiotic Manufacturers

- Contract Packaging Organizations (CMOs, co-packers)

- Pharmacies & OTC Healthcare Brands

- Food & Beverage Companies (functional formats)

- Hospitality, Travel & Institutional Buyers

By Distribution Channel

- Direct B2B sales (to brands, OEMs)

- Retail (pharmacies, supermarkets)

- E-commerce & Subscription Models

- Institutional / B2B Supply (healthcare, travel kits)

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait