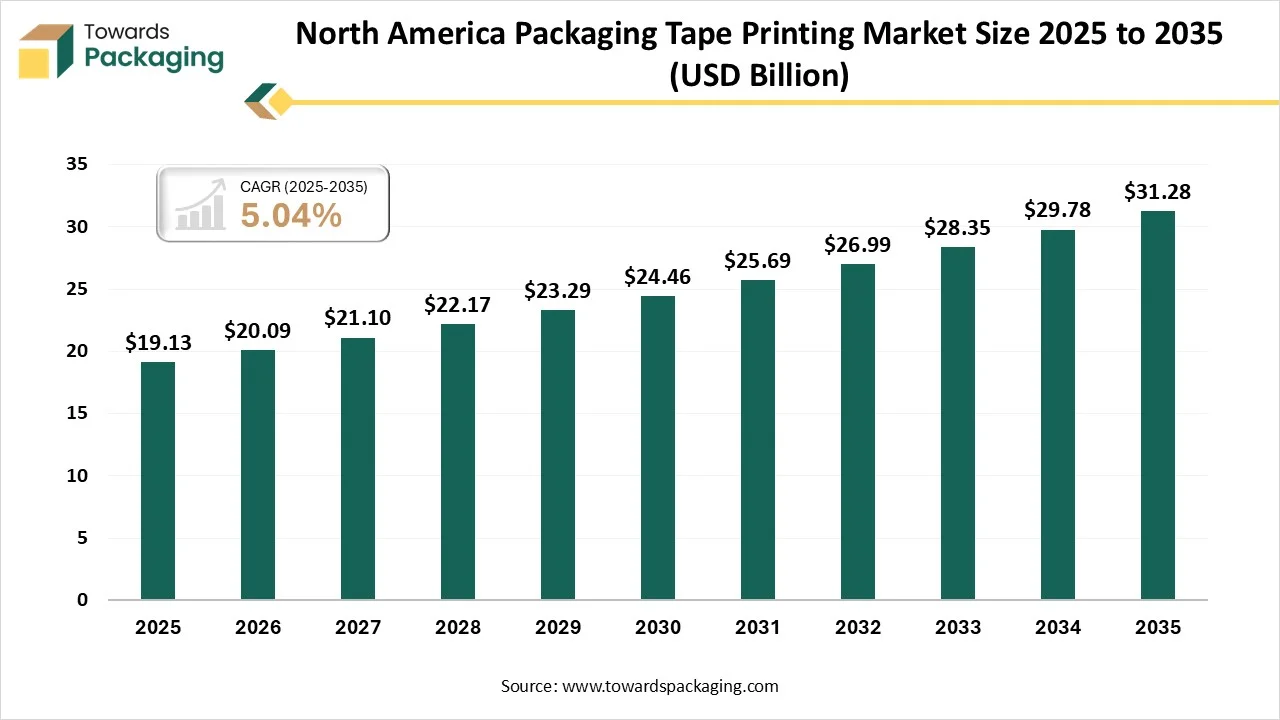

The North America packaging tape printing market is forecasted to expand from USD 20.09 billion in 2026 to USD 31.28 billion by 2035, growing at a CAGR of 5.04% from 2026 to 2035. It covers detailed trends such as digital printing adoption, sustainability, and tamper-evident packaging. The study includes full segmentation by tape type, technology, application, end user, and adhesive type, along with regional comparisons across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The report further includes competitive benchmarking of major players like 3M, IPG, Shurtape, Avery Dennison, value chain analysis, trade flow statistics, manufacturing capacity, and supplier ecosystem data.

The North America packaging tape printing market refers to the regional segment focused on manufacturing and supplying custom-printed adhesive tapes used in shipping, branding, security, and handling communication across various industries. This market is driven by the rapid growth of e-commerce, increased emphasis on tamper-evident packaging, and the rising demand for cost-effective brand marketing. With major logistics hubs, high packaging standards, and mature distribution channels, North America, particularly the U.S., leads in innovation and adoption of digitally printed, eco-friendly, and custom-branded tape solutions.

AI integration is significantly enhancing the packaging tape printing market by optimizing design, production, and quality control processes. Through AI-powered software, companies can automate the creation of customized tape designs, enabling faster turnaround times and more personalized branding. Machine learning algorithms analyze customer preferences and market trends to suggest high-impact visuals and layouts, improving marketing effectiveness. In production, AI-driven systems streamline operations by predicting maintenance needs, reducing downtime, and minimizing material waste.

Advanced computer vision is used for real-time quality checks, ensuring consistent print clarity, alignment, and color accuracy. AI also supports inventory management by forecasting demand patterns and automating stock replenishment, enhancing supply chain efficiency. Furthermore, AI aids in incorporating interactive elements like QR codes or smart labels, which enhance traceability and consumer engagement. As sustainability becomes a priority, AI tools help select eco-friendly materials and optimize energy use, making packaging operations smarter, faster, and more environmentally responsible.

Boom in E-commerce and Logistics

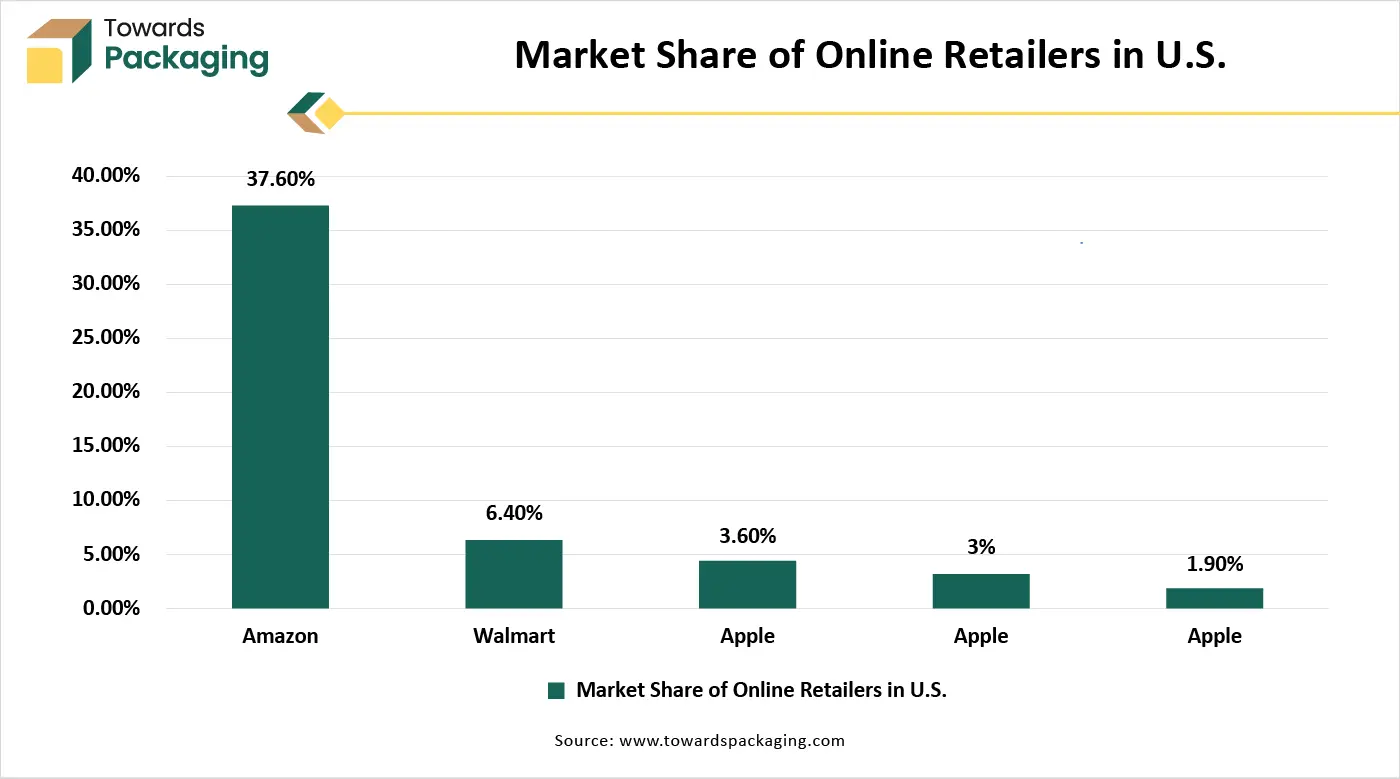

The rapid growth of online shopping has increased the demand for secure, branded packaging. Printed tapes are widely used in e-commerce shipments for tamper evidence, product authenticity, and marketing purposes. Fulfillment centers and logistics companies prefer customized tapes to streamline package identification and enhance customer experience.

Rising Demand for Brand Visibility

Companies are using printed tapes as an extension of their branding. Tapes with logos, slogans, or promotional messages help reinforce brand identity during product transit and improve recognition at the consumer’s doorstep, making them a cost-effective marketing tool.

Technological Advancements in Printing

The adoption of digital and flexographic printing technologies allows high-resolution graphics, short-run customization, and efficient color reproduction on tapes. These innovations make it easier to create diverse, vibrant, and personalized tape designs, increasing market appeal.

Emphasis on Product Security and Tamper Evidence

Printed tapes are used to prevent product tampering and counterfeiting. Industries like pharmaceuticals, electronics, and food packaging increasingly use tamper-evident tapes to comply with safety regulations and enhance consumer trust in product authenticity.

Customization and Personalization Trends

With growing preference for customized packaging, businesses are increasingly ordering short runs of uniquely printed tapes for seasonal promotions, product launches, and regional campaigns. This flexibility is especially enabled by digital printing technologies.

Regulatory Compliance and Labeling Requirements

Industries that require regulatory labeling, such as hazardous materials or pharmaceutical packaging, are using printed tapes to convey safety instructions, batch codes, and handling information, thereby boosting their functional value.

Environmental Concerns Related to Non-Recyclable Tapes & Limited Reusability, and Single-Use Nature

The key players operating in the market are facing issues due to limited reusability and environmental concerns, which are estimated to restrict the growth of the market. Many traditional printed tapes use plastic-based substrates and synthetic adhesives that are not biodegradable or easily recyclable. This leads to increased scrutiny from regulators and pressure from eco-conscious consumers, restricting the use of such tapes unless alternatives are developed. Packaging tapes are generally single-use products. The inability to reuse or repurpose them contributes to waste generation, making them less appealing in industries that are striving to reduce packaging waste and promote circular economy practices.

Consumers and regulators are pushing for eco-friendly packaging materials. Manufacturers are responding by offering recyclable, biodegradable, or plant-based printed tapes. This shift aligns with corporate sustainability goals and drives innovation in eco-conscious tape printing.

Sectors such as food & beverages, healthcare, automotive, and electronics are expanding their use of printed tapes for packaging and shipment purposes. This diverse demand base ensures consistent market growth across North America.

BOPP (biaxially oriented polypropylene) tape is the dominant segment in the North America packaging tape printing market due to its superior mechanical and barrier properties, cost-effectiveness, and compatibility with various printing technologies. It offers excellent tensile strength, durability, and resistance to moisture, chemicals, and abrasion, making it ideal for sealing and branding in shipping and packaging applications. BOPP tape also provides a smooth surface for high-quality printing, enabling clear, vibrant logos and messages. Its lightweight nature reduces shipping costs, while its recyclability aligns with sustainability goals. Widely used in e-commerce, logistics, and retail, BOPP tape's versatility reinforces its market leadership.

The Kraft paper tape segment is the fastest-growing in the North America packaging tape printing market, driven by increasing demand for sustainable and eco-friendly packaging solutions. Made from biodegradable and recyclable materials, kraft paper tape aligns with environmental regulations and corporate sustainability goals, especially among e-commerce and retail brands seeking plastic-free alternatives. It offers excellent printability for branding and messaging while providing strong adhesion, particularly in water-activated versions that bond securely to corrugated surfaces. As consumer awareness about environmental impact rises, businesses are shifting from plastic-based tapes to kraft paper alternatives to enhance brand reputation and reduce their carbon footprint, fueling rapid market growth.

The flexographic printing segment dominates the North America packaging tape printing market due to its high-speed production capabilities, cost-effectiveness for large-volume runs, and adaptability to a wide range of substrates, including BOPP and kraft paper tapes. Flexographic technology uses fast-drying inks and low-viscosity formulas, allowing for efficient, continuous printing with minimal downtime. It is well-suited for consistent, high-quality printing of logos, barcodes, and custom designs, meeting the needs of industries like logistics, e-commerce, and retail. The technology's ability to deliver sharp images at scale, combined with advancements in plate-making and automation, further solidifies its leadership in the regional market.

The digital printing segment is the fastest-growing in the North America packaging tape printing market due to its ability to offer high-quality, short-run customization with quick turnaround times. Unlike traditional methods, digital printing requires minimal setup, making it ideal for personalized and on-demand tape designs. This is particularly valuable for small businesses, seasonal promotions, and e-commerce brands seeking distinctive packaging. The technology allows for vibrant, full-color graphics and variable data printing, such as QR codes and batch information. Additionally, its flexibility in design changes and reduced material waste align with sustainability goals, making it an increasingly preferred choice among modern packaging solutions.

The branding and promotion segment holds dominance in the North America packaging tape printing market due to the growing emphasis on visual identity and customer engagement across industries. Companies increasingly use printed tapes as a cost-effective marketing tool to reinforce brand recognition during shipping and delivery. Custom-printed tapes featuring logos, slogans, and promotional messages help businesses stand out, especially in competitive markets like e-commerce, retail, and logistics. These tapes enhance unboxing experiences and communicate professionalism, while also serving functional purposes such as tamper evidence and package security. The ability to combine branding with utility makes this segment highly valuable and widely adopted.

The security and tamper-evidence segment is the fastest-growing in the North America packaging tape printing market due to rising concerns over product safety, counterfeiting, and unauthorized access during transit. Industries such as pharmaceuticals, electronics, and food rely heavily on tamper-evident tapes to ensure product integrity and comply with stringent regulatory standards. These tapes provide visible signs of tampering, enhancing trust and safety for both businesses and consumers. As e-commerce continues to expand, companies are increasingly investing in secure packaging solutions that protect goods and maintain brand credibility. Innovations in tape materials and printing technologies further support the growth of this critical segment.

The e-commerce and logistics segment is the dominant segment in the North America packaging tape printing market due to the region's rapidly expanding online retail ecosystem and the high volume of goods shipped daily. Printed packaging tapes serve multiple functions in this sector—ensuring package security, enhancing brand visibility, and improving customer engagement. Businesses use custom-printed tapes to differentiate shipments, provide tamper evidence, and reinforce brand identity at the point of delivery. Additionally, as delivery speed and package traceability become more important, printed tapes with barcodes, QR codes, and tracking information are increasingly adopted. This widespread, multifunctional use drives the segment's dominance.

The electronics and industrial goods segment is the fastest-growing segment in the North America packaging tape printing market due to rising demand for secure, durable, and clearly labelled packaging in high-value and sensitive shipments. These industries require printed tapes that not only seal but also convey critical information such as handling instructions, warnings, or product specifications. Tamper-evident and anti-counterfeit features are especially important for electronics, while industrial goods benefit from high-visibility branding and logistical labeling. As manufacturers increasingly prioritize safety, traceability, and regulatory compliance, the need for advanced, customized printed tapes is surging, accelerating growth within this specialized and high-performance segment.

Hot melt adhesive tapes are the dominant segment in the North America packaging tape printing market due to their strong bonding capability, fast application, and excellent performance across a variety of surfaces. These tapes offer superior initial tack and holding strength, making them ideal for high-speed packaging lines in industries like e-commerce, logistics, and retail. Their compatibility with different substrates, including BOPP and kraft paper, also makes them suitable for printed applications. In addition, hot melt adhesives perform well under varying temperature and humidity conditions, ensuring package integrity during transit. Their reliability and cost-effectiveness contribute significantly to their widespread adoption and market dominance.

The acrylic adhesive tape segment is the fastest-growing segment in the North America packaging tape printing market due to its excellent aging resistance, UV stability, and clarity, making it ideal for long-term packaging and storage applications. These tapes maintain strong adhesion over time, even in fluctuating temperatures and varying environmental conditions, which is crucial for industries such as electronics, pharmaceuticals, and food packaging. Additionally, acrylic adhesives are more environmentally friendly compared to solvent-based alternatives, aligning with growing sustainability trends. Their compatibility with high-resolution printing also supports branding and labeling needs, making them increasingly popular among businesses seeking durable and visually appealing packaging solutions.

North America's growth in the packaging tape printing market is supported by a strong industrial base, high e-commerce penetration, and growing demand for branded packaging solutions. The region's advanced printing technology infrastructure enables high-quality, customized tape production to meet diverse consumer and industrial needs. Major sectors like logistics, food and beverage, and pharmaceuticals heavily rely on printed tapes for branding and tamper evidence. Additionally, stringent regulations on packaging standards drive innovation in material quality and labeling practices. The presence of leading packaging companies and ongoing investments in sustainable and smart packaging solutions further reinforce North America's leadership in this market.

U.S. Dominates the North America Packaging Tape Printing Market

The U.S. holds a dominant position in the packaging tape printing market due to its advanced manufacturing capabilities, strong presence of key industry players, and high demand from sectors such as e-commerce, logistics, and food packaging. The country’s booming online retail industry significantly drives the need for branded and tamper-evident packaging solutions, where printed tapes play a vital role. U.S.-based companies are early adopters of innovative printing technologies, such as digital and flexographic methods, which support high-quality customization and short production runs. Additionally, the country’s stringent regulations around product labeling and safety compliance encourage the use of printed tapes for clear communication and traceability. A growing consumer preference for eco-friendly and visually appealing packaging further fuels demand, while consistent investments in R&D and automation strengthen market competitiveness.

Mexico is the fastest‑growing region in the North America packaging tape printing market, thanks to a convergence of strategic, economic, and industrial factors. Mexico’s manufacturing boom, notably in automotive, electronics, aerospace, and infrastructure, has intensified demand for adhesive tapes, including printed packaging variants. Proximity to the U.S. market, along with favourable trade agreements like USMCA, lowers logistics costs and facilitates export-led production in tape converters. Meanwhile, the country’s e‑commerce and packaging sector is rapidly expanding, boosting the need for branded, durable, and tamper‑evident tapes in parcel shipment and fulfillment operations. Additionally, rising investments in digital and flexographic printing technology, plus automation and green adhesives, enable high‑quality, customizable printing at lower costs. Mexico’s focus on sustainability, adopting recyclable substrates and plant‑based inks, further fuels market appeal amid growing regulatory and consumer eco‑awareness.

By Tape Type

By Printing Technology

By Application

By End User Industry

By Adhesive Type

February 2026

February 2026

February 2026

February 2026