Packaging Films Market Segment Analysis, Regional Breakdown (NA, EU, APAC, LA, MEA), Trade & Supply Chain Mapping

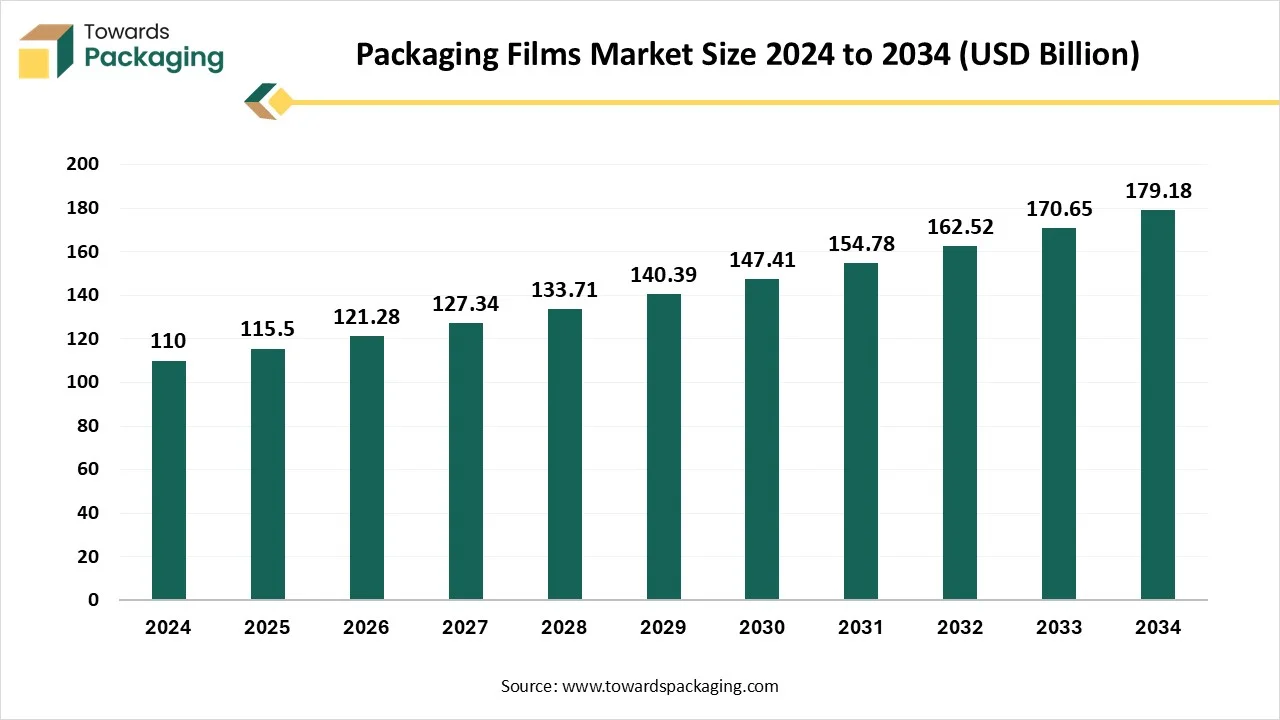

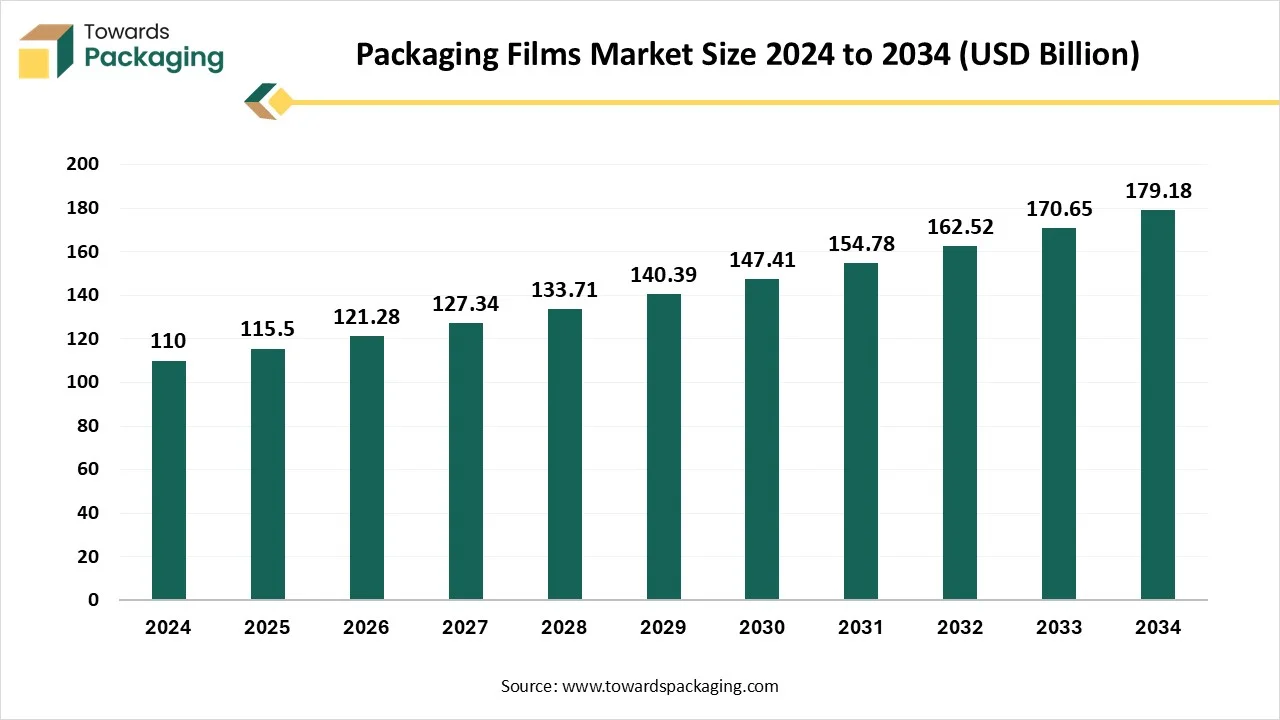

The packaging films market is forecasted to expand from USD 121.28 billion in 2026 to USD 188.14 billion by 2035, growing at a CAGR of 5% from 2026 to 2035. This study covers the market in human-friendly terms while providing full statistical detail, including breakdowns by material (PE, PP, PET, PVC, PA, EVOH, PLA/bioplastics, aluminum laminates, others), film structure (monolayer, 3-layer, 5-layer, 7-layer+), film type (stretch, shrink, barrier, thermoformable, metallized, antifog, decorative, release films), technology (blown, cast, biaxial orientation, coextrusion, coating), and applications across food, beverages, pharma, personal care, industrial and more.

Key Insights

- In terms of revenue, the market is valued at USD 115.5 billion in 2025.

- The market is projected to reach USD 188.14 billion by 2035.

- Rapid growth at a CAGR of 5% will be observed in the period between 2025 and 2034.

- Asia Pacific dominated the global packaging films market in 2024.

- North America is expected to grow at a significant CAGR in the market during the forecast period.

- The European market is expected to grow at a notable CAGR in the foreseeable future.

- By material type, the polyethylene (LDPE & LLDPE) segment dominated the market with the largest share in 2024.

- By material type, the bioplastics (PLA, PHA) segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By film structure, the multilayer films (3-layer) segment dominated the market in 2024.

- By film structure, the multilayer (7-layer and above) segment is expected to grow at the fastest CAGR in the forecast period.

- By film type, the barrier films segment dominated the market with the largest share in 2024.

- By film type, the antifog films segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By technology, the blown film extrusion segment dominated the market in 2024.

- By technology, the biaxially oriented films segment is expected to grow at the fastest CAGR in the forecast period.

- By end-user industry, the food & beverage segment dominated the market with the largest share in 2024.

- By end-user industry, the personal care & cosmetics segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

Market Overview

Packaging film refers to a thin, flexible material used to wrap, protect, or contain products across various industries, including food, pharmaceuticals, cosmetics, and consumer goods. It is typically made from plastic polymers such as polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), or biodegradable alternatives like PLA. Packaging films serve multiple functions, preserving freshness, preventing contamination, enhancing shelf life, and improving product presentation. These films can be transparent, opaque, or printed with branding and product information.

Common types include shrink film, stretch film, barrier film, and laminated film, each tailored for specific packaging needs like sealing, wrapping, or vacuum packaging. Packaging films are widely used in both primary packaging (in direct contact with the product) and secondary packaging (for bundling or protection during transport). With advancements in technology, modern films also offer properties like moisture resistance, UV protection, and recyclability, aligning with sustainability goals and evolving consumer expectations in the packaging industry.

What are the New Trends in the Packaging Films Market?

Sustainability & Circular Economy

- Recyclable mono-material films (e.g., BOPE, PE, PP) brands and converters are moving toward single-polymer structures that are easier to recycle. Biodegradable & compostable alternatives PLA, cellulose, and other bio-based films, are gaining traction, although industrial composting access remains a challenge. Advanced recycling tech resins like Dow’s INNATE TF 220 facilitate fully recyclable BOPE packaging, advancing circularity in flexible packaging.

Barrier Performance & Active Films

- Multi-layer high-barrier films enhance moisture, oxygen, and UV barriers, extending product shelf-life and preserving quality. Active packaging incorporating antimicrobials, oxygen scavengers, moisture controllers embedded additives improves food safety and reduces spoilage.

Smart & Interactive Packaging

- QR codes, RFID/NFC tags, and smart sensors driven by traceability, anti-counterfeiting, and consumer engagement initiatives. Smart packaging market expected to reach ~$78.91 billion by 2034. Battery-free sensing films, emerging tech combines freshness sensors and active compound release into flexible films.

Visual Innovation & Holography

- Holographic and premium aesthetics boost shelf presence and enhance anti-counterfeiting. Luxury finishes & tactile textures brands are pairing matte, soft-touch, and richly printed films with functionality.

E-commerce & Convenience Features

- Resealable zippers, stand-up pouches, and spouts opt for convenience, tamper evidence, and portability. Lightweight, protective materials and flexible films reduce shipping weight and protect contents during transit.

Digital Printing & Product Personalization

- Digital printing enables variable data, short runs, regional customization, and packaging personalization.

How Can AI Improve the Packaging Films Industry?

AI integration is revolutionizing the packaging films industry by enhancing efficiency, precision, and customization throughout the value chain. In production, AI-powered systems can monitor real-time data from machines to detect defects, predict maintenance needs, and optimize film quality, thereby reducing waste and downtime. Machine learning algorithms analyze consumer behaviour and market trends, allowing manufacturers to design films tailored to specific applications, improving performance and sustainability. In printing and converting, AI enables dynamic adjustments for color consistency, registration accuracy, and adaptive printing in short runs, crucial for personalized packaging.

AI also supports advanced inspection systems that identify micro-level inconsistencies in film thickness, seal strength, and barrier integrity. In logistics and inventory management, AI forecasts demand, reduces overproduction, and streamlines supply chains. Furthermore, AI enhances smart packaging by integrating QR codes, sensors, and data-driven features that improve traceability and consumer interaction. Overall, AI boosts productivity, innovation, and competitiveness in the packaging films industry.

Market Dynamics

Driver

Rising Demand from the Food & Beverage Sector & Innovation in Barrier and Active Films

Food and beverage manufacturers increasingly rely on packaging films for their excellent barrier properties, flexibility, and ability to preserve freshness. The growth of ready-to-eat meals, frozen foods, and snacks significantly boosts demand. Technological advancements in multilayer films, high-barrier coatings, and active packaging (antimicrobial, moisture control, oxygen scavenging) support product shelf life and safety, driving market adoption.

Restraint

Stringent Government Regulations & High Recycling and Disposal Costs

The key players operating in the market are facing issues due to stringent government regulations & high recycling and disposal costs, which are estimated to restrict the growth of the market in the near future. Most conventional packaging films are plastic-based and contribute to non-biodegradable waste. Growing environmental awareness and pressure to reduce single-use plastics hinder market growth, especially in regions with strict sustainability regulations. Governments worldwide are imposing bans or taxes on certain types of plastic packaging. Compliance with constantly evolving environmental and safety standards can increase production costs and limit product innovation.

Multi-layer films often contain mixed materials that are difficult to recycle, leading to high disposal and recycling costs. This affects the adoption of such films in eco-conscious markets. Packaging films depend on raw materials like polyethylene, polypropylene, and PVC, which are derived from petroleum. Volatile oil prices lead to unstable input costs, affecting profitability for manufacturers. While demand for sustainable films is rising, biodegradable or compostable options are often expensive and have limited functionality compared to traditional films, restricting their widespread use.

What are the Opportunities for the Growth of the Packaging Films Market?

Boom in E-commerce and Retail

- The rise in online shopping and home deliveries has created strong demand for durable, lightweight, and protective packaging films that prevent product damage and reduce shipping costs.

Shift Toward Flexible Packaging

- Flexible packaging films offer advantages like easy handling, lower material usage, resealability, and space savings, making them popular over rigid alternatives in industries like personal care, pharmaceuticals, and food.

Sustainability and Recyclability

- Increased environmental awareness and regulations are pushing the adoption of recyclable, biodegradable, and compostable packaging films. The development of mono-material films and bio-based plastics supports green initiatives.

Growth of the Healthcare and Pharmaceutical Industry

- Packaging films are essential in pharma for blister packs, medical device wraps, and sterile packaging. Rising healthcare needs and strict safety requirements fuel demand.

Segmental Insights

Why does the Polyethylene Segment Dominate the Packaging Films Market?

Polyethylene is the dominant material type segment in the packaging films market due to its excellent flexibility, durability, and cost-effectiveness. It offers strong moisture resistance and mechanical strength, making it ideal for applications in food, pharmaceuticals, and consumer goods packaging. Polyethylene is highly versatile, available in different forms like LDPE, LLDPE, and HDPE, each suitable for specific packaging needs. Its ease of processing, recyclability, and compatibility with advanced printing and sealing technologies further strengthen its widespread adoption in the market.

The bioplastic material-type segment is the fastest-growing in the packaging films market due to rising environmental concerns, supportive regulations, and technological advances. As consumers demand eco-friendly packaging, manufacturers increasingly adopt biodegradable options like PLA, PHA, and PBAT derived from renewable resources (corn, sugarcane, starch blends). Government incentives and bans on single-use plastics further facilitate adoption. Advances in production processes have improved barrier properties, durability, and cost-efficiency, enabling these films to compete with conventional plastics. As a result, flexible bioplastic films, especially in food and beverage packaging, are rapidly gaining market share.

Which Film Structure Dominated the Packaging Films Market in 2024?

The multi-layer (3-layer) film segment is the dominant film structure in the packaging films market due to its superior barrier properties, durability, and versatility. These films combine different materials in layers, each offering specific benefits like moisture resistance, oxygen barrier, strength, and heat sealability. This makes them ideal for food, pharmaceutical, and personal care packaging that demands extended shelf life and product protection. Their ability to incorporate functional and aesthetic layers also supports branding, regulatory labeling, and compatibility with sustainable film innovations.

The multi-layer (seven layers and above) film segment is the fastest-growing in the packaging films market due to its exceptional barrier performance against oxygen, moisture, and UV, critical for premium food and pharmaceutical applications. These complex structures enable precise layering of materials, combining strength, flexibility, heat-sealability, and tailored functionalities like anti-fog or antimicrobial properties. Technological advancements and digital co-extrusion methods facilitate cost-effective production of sophisticated structures. Additionally, regulatory requirements and consumer demand for extended shelf life, freshness, and product safety drive adoption, especially in high-value packaged foods and medications.

Why does the Film Type Segment Dominate the Packaging Films Market?

Barrier films are the dominant film type segment in the packaging films market due to their superior ability to protect products from moisture, oxygen, light, and other external factors that can degrade quality. These films are essential in preserving the freshness and shelf life of perishable goods, especially in the food and pharmaceutical industries. Their multi-layer structure enhances durability and functional performance while supporting printability and sealability. As demand for high-performance, safe, and reliable packaging grows, barrier films remain a preferred industry standard.

The anti-fog film segment is the fastest-growing type in the packaging films market due to rising demand for clear, moisture-resistant packaging, especially in fresh food, produce, and ready-to-eat meals. These films prevent condensation buildup, ensuring product visibility, freshness, and shelf appeal. With consumers prioritizing transparency and quality, brands increasingly adopt anti-fog films to maintain clarity and enhance purchasing decisions. Technological advancements have also improved coating durability and performance in various temperature conditions, making anti-fog films practical and cost-effective for refrigerated and high-moisture environments.

Which Technology Dominated the Packaging Films Market in 2024?

The blown film extrusion segment is the dominant segment in the packaging films market due to its cost-effectiveness, high versatility, and ability to produce films with excellent mechanical and barrier properties. This process allows manufacturers to produce single-layer and multi-layer films with uniform thickness, which are widely used in food packaging, agricultural films, and industrial wraps. Blown film extrusion supports a broad range of polymers like polyethylene and polypropylene, making it suitable for various applications. Additionally, it enables large-scale production with minimal material waste and supports customization in film width, strength, and clarity, which enhances its widespread adoption across multiple end-use industries.

The biaxially oriented films segment is the dominant technology segment in the packaging films market due to its superior mechanical strength, clarity, and dimensional stability. These films are stretched in both machine and transverse directions, enhancing barrier properties and printability, ideal for luxury and high-performance packaging. Commonly used in premium food, personal care, and cosmetic products, these films offer excellent gloss, stiffness, and shelf appeal. Their compatibility with laminates and coatings further enhances functionality, making them a preferred choice for high-end, value-added packaging solutions.

Why does the Food & Beverages Segment Dominate the Packaging Films Market?

The food & beverages end-user industry segment is the dominant segment in the packaging films market due to its continuous demand for effective, safe, and attractive packaging solutions. Packaging films offer essential benefits like moisture and oxygen barriers, extended shelf life, and product freshness critical for perishable goods. With growing urbanization, convenience foods, and ready-to-eat meal consumption, the need for flexible, lightweight, and resealable packaging has surged. Additionally, high-quality printing on films supports branding and regulatory labeling. The rise of e-commerce grocery delivery and consumer preference for visually appealing, hygienic packaging further strengthens the segment’s leading position in the global market.

The personal care and cosmetics sector is the fastest-growing end-user in the packaging films market due to several converging trends. As the beauty industry expands, fuelled by younger consumers, male grooming products, and skincare innovations, there is an increasing demand for eye-catching, functional, and sustainable packaging. Brands invest heavily in digital printing and premium laminates to offer customized, limited-edition, and refillable formats, especially for tubes, airless containers, and pouches. Eco-conscious consumer preferences and tightening regulations drive the adoption of biodegradable films and PCR plastics. Smart packaging features like QR codes and tamper-evident seals enhance brand experience and authenticity, particularly in prestige and luxury beauty. Altogether, these dynamics position personal care and cosmetics as the fastest-growing segment in packaging films.

Regional Insights

Which Region Dominated the Packaging Films Market in 2024?

Asia-Pacific is the dominant region in the packaging films market due to its large and rapidly growing consumer base, strong industrial expansion, and increasing demand for packaged goods. Countries like China, India, Japan, and South Korea have seen significant growth in food & beverage, pharmaceuticals, and personal care industries all major consumers of packaging films. Rapid urbanization, rising disposable incomes, and changing lifestyles are driving the demand for convenient, ready-to-eat, and hygienically packaged products. Additionally, the presence of low-cost manufacturing, abundant raw materials, and technological advancements in flexible packaging production support market leadership. Government initiatives promoting sustainable packaging and foreign investments in the region’s packaging infrastructure.

China Market Trends

China leads the region’s packaging films market due to its vast manufacturing base, high consumption of packaged foods, and strong e-commerce sector. The country's large-scale industrial output, combined with a growing middle class, boosts demand for flexible and specialty films. Additionally, government initiatives promoting green packaging solutions are encouraging the development of recyclable and biodegradable film technologies.

India Market Trends

India is one of the fastest-growing markets, driven by rapid urbanization, a booming food processing industry, and increasing demand for hygienic and shelf-stable products. Rising disposable incomes and a young population are fueling the growth of snacks, ready-to-eat meals, and personal care products, all of which rely heavily on flexible packaging films. The Make in India initiative also supports domestic manufacturing of packaging materials.

Japan Market Trends

Japan’s packaging film market is characterized by high-quality standards, innovation, and sustainability. The country is a pioneer in producing ultra-thin, high-barrier films for food preservation and advanced healthcare applications. Its aging population also drives demand for pharmaceutical and functional food packaging, where safety and barrier properties are critical.

South Korea Market Trends

South Korea is a technology-driven market where smart packaging and high-performance films are in demand. The country’s advanced printing and converting infrastructure supports the development of customized, high-barrier, and aesthetic packaging films. The cosmetics and electronics sectors are major end-users, contributing to steady growth.

Southeast Asia (e.g., Indonesia, Vietnam, Thailand) Market Trends

These emerging economies are experiencing rapid growth in consumer goods, food and beverage, and retail sectors. Increasing urbanization, rising incomes, and growing demand for processed foods and personal care products are expanding the need for packaging films. Moreover, multinational investments in packaging manufacturing facilities are strengthening the region’s capacity.

What Promotes the Growth of the North American Packaging Films Market?

North America is experiencing the fastest growth in the packaging films market due to a combination of advanced manufacturing technologies, strong consumer demand for convenience, and rising environmental awareness. The region has a highly developed food and beverage industry, which is a major end-user of packaging films for applications like sealing, wrapping, and preserving freshness. Additionally, the growth of e-commerce and home delivery services increases the need for durable, lightweight, and tamper-evident film packaging.

Technological advancements such as multilayer barrier films, biodegradable plastics, and smart packaging solutions are rapidly being adopted across industries. Moreover, stringent regulatory frameworks and corporate sustainability goals are pushing manufacturers to develop recyclable and compostable film alternatives. The presence of leading global packaging companies and high investment in R&D further supports innovation and scalability. These factors together position North America as the fastest-growing regional market for packaging films globally.

U.S. Market Trends

The United States dominates the North American packaging films market due to its advanced manufacturing infrastructure, high consumption of packaged goods, and strong presence of major packaging film producers. The country’s thriving food and beverage, pharmaceutical, and personal care industries drive continuous demand for flexible packaging films with enhanced barrier properties. The U.S. also leads in innovation, with rapid adoption of smart packaging technologies, digital printing, and recyclable film solutions. Increasing environmental regulations and consumer preference for sustainable packaging are accelerating the shift toward bio-based and mono-material films.

Canada Market Trends

Canada’s packaging films market is steadily growing, supported by its strong food processing sector and rising focus on eco-friendly packaging. The country has implemented strict environmental regulations that encourage the use of recyclable and compostable films. Consumers are highly conscious of sustainability, prompting brands to adopt biodegradable film solutions. Additionally, demand for convenient, resealable, and lightweight packaging formats is growing in sectors such as frozen foods, dairy, and organic products.

In Canada, the LDPE is created through the polymerization of polyethylene. At the time of this procedure, monomers link collectively to make elongated hydrocarbon chains. These chains then stretch out in different directions, with the branching design selecting the material's power and density. In essence, LDPE changes in terms of density, which makes it perfect for strength-concentrated uses, while LDPE proves more beneficial for uses needing flexibility. Because of its lower percentage of crystallinity, LDPE has a lower density than HDPE. This serves LDPE a smooth and more reliable quality while also slightly lowering its barrier potential.

Europe’s Strict Regulatory Laws to Promote Notable Growth

Europe is growing at a considerable rate in the packaging films market due to strong regulatory support for sustainable packaging, rising environmental awareness, and high demand for packaged goods across various sectors. The region has strict packaging waste directives and circular economy goals, which are driving innovation in recyclable, compostable, and bio-based film materials. Growth in industries such as food and beverage, pharmaceuticals, and personal care fuels continuous demand for high-barrier, lightweight, and flexible packaging films. Additionally, Europe’s advanced manufacturing infrastructure, along with the rising adoption of smart and active packaging technologies, supports product safety, shelf-life extension, and traceability.

Latin America

Latin America is experiencing constant development in the packaging films industry. The urge for smooth and inventive packaging solutions in sectors such as consumer goods, food and beverages, and healthcare is on a high note. Additionally, the growing export of packaged food products and the growth of e-commerce are positively encouraging the regional market.

Middle East and Africa

The Middle East and Africa is experiencing a huge expansion in the packaging films industry, driven by fast urbanization and growing user demand. The market in this space is also influenced by the development of sectors such as pharmaceuticals, food and beverages, and personal care. Growing investments in packaging technologies and the growth of a favourable business environment are predicted to drive development in the region.

Global Packaging Films Market Key Players

- Amcor plc

- Berry Global Inc.

- Sealed Air Corporation

- Mondi Group

- Huhtamaki Oyj

- Uflex Ltd.

- Taghleef Industries

- Jindal Poly Films Ltd.

- Toray Plastics (America), Inc.

- Cosmo Films Ltd.

- Polyplex Corporation Ltd.

- Klöckner Pentaplast

- Bemis Company, Inc. (now part of Amcor)

- Innovia Films

- AEP Industries Inc. (Berry Global)

- SABIC (film resins and partnerships)

- Coveris Holdings S.A.

- Mitsubishi Chemical Corporation

- RPC Group (part of Berry Global)

- Linpac Packaging (now part of Klöckner Pentaplast)

Latest Announcements by Industry Leaders

- In March 2025, Dr. Mahesh N. Gopalasamudram, JPFL Films Private Limited's Deputy CEO (Growth Division), stated that JPFL Films Private Limited is the first company to introduce the innovation to the Indian market with the launch of BOPA Nylon Films. Better mechanical fqualities and an aroma barrier are provided by this special product. Additionally, this will be crucial in providing solutions for applications in food, pharmaceutical, medical, and FMCG. t is important to note that, up until recently, all of these movies were imported.

New Advancements in the Market

- A subsidiary company of India’s huge flexible packaging company named JPFL Films Private Limited, Jindal Poly Films has become the primary player to reveal the disclosure of Biaxially oriented Polyamide (BOPA) nylon Films in India. It has invested Rs 120 crore in its state-of-the-art facility in Nashik, situated in Maharashtra.

- In July 2025, Herma has disclosed the latest PP Flex label films, which serve characteristics specifically linked with standard PE films, while utilising the selected lesser material. The items will be officially displayed for the first time at labelExpo Europe in Barcelona.

- In July 2025, Nobelus, a supplier of finishing technologies to the global label and packaging industry, is launching a range of high-end wet films made especially for flexible packaging. Five of the collection's eight print web videos are downsized versions of the company's well-known luxury label films, while three are brand-new to the European market. Since these specialist films don't contain an adhesive layer, they work well with solvent-based and solvent-less adhesives used in wet laminating systems and flexographic presses.

- British flexible packaging manufacturer KM Packaging has introduced a new mono polyethylene terephthalate (PET) lidding film specification called K-Pel aC. The company asserts that the goal of its product is to meet the evolving needs of the food packaging industry. The low seal initiation temperature of K-Peel 4G enables it to seal well even when impurities are present.

- Cosmo First, a world leader in synthetic paper, lamination, packaging, and labeling films, announces the successful commissioning of a new BOPP (Biaxially Oriented PolyPropylene) film line at its present Aurangabad, Maharashtra, manufacturing facility, with a capital expenditure of more than R 400 crores. Featuring the most cutting-edge technology in the world, the new line has an annual rated capacity of 81,200 MT. The new line's commissioning will boost the company's yearly BOPP capacity by about 40%, to 2.77.000 MT.

Global Packaging Films Market Segments

By Material Type

- Polyethylene (PE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Biaxially Oriented Polypropylene (BOPP)

- Cast Polypropylene (CPP)

- Polyethylene Terephthalate (PET)

- Biaxially Oriented PET (BOPET)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Ethylene Vinyl Alcohol (EVOH)

- Polylactic Acid (PLA) / Bioplastics

- Aluminum Foil Laminates

- Others (PVDC, PVOH, etc.)

By Film Structure

- Monolayer Films

- Multilayer Films (Co-extruded)

- 3-layer

- 5-layer

- 7-layer and above

By Film Type

- Stretch Films

- Shrink Films

- Barrier Films

- Thermoformable Films

- Decorative Films

- Metallized Films

- Antifog Films

- Release Films

By Technology

- Blown Film Extrusion

- Cast Film Extrusion

- Biaxial Orientation (BOPP, BOPET)

- Coextrusion

- Solvent Casting

- Water-based/Emulsion Coating

By Application

- Food Packaging

- Fresh Produce

- Meat, Poultry & Seafood

- Snacks & Confectionery

- Bakery

- Dairy Products

- Ready-to-Eat Meals

- Frozen Foods

- Beverage Packaging

- Pharmaceutical & Medical Packaging

- Personal Care & Cosmetics

- Industrial Packaging

- Chemical Packaging

- Building Materials

- Agricultural Products

- Others (E-commerce, Electronics, Household)

By End-Use Format

- Pouches (Stand-up, Spouted, Flat)

- Bags & Sacks

- Lidding Films

- Wrappers

- Blisters

- Labels

- Roll Stock

By End-User Industry

- Food & Beverage

- Pharmaceuticals

- Personal Care & Cosmetics

- Agriculture

- Consumer Electronics

- Retail & E-commerce

- Industrial

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (2)