Plastic Packaging for Food and Beverage Market Growth Drivers, Value Chain, Import–Export Statistics, Regional Insights

The plastic packaging for food and beverage market is expanding rapidly, with forecasts indicating hundreds of millions in revenue growth from 2025 to 2034, driven by rising consumption of packaged foods, e-commerce penetration, and the shift toward lightweight and recyclable packaging materials. Our report covers complete market size analysis, segment-wise data (materials, product types, functionality, usability, and end-use), alongside regional insights across North America, Europe, Asia Pacific, Latin America, and MEA. It also presents company profiles of Amcor, Berry Global, Mondi, Huhtamaki, DS Smith, Silgan, Sonoco, UFlex, Sealed Air, Pactiv Evergreen, and others. The report further includes competitive benchmarking, value chain structure, import–export trends, production capacity data, pricing trends, and a supplier–manufacturer ecosystem breakdown.

Key Insights

- North America dominated the plastic packaging for food and beverage market in 2024.

- Asia Pacific is expected tgrow significantly during the forecast period.

- By material, the polyethylene (PE) segment dominated the market with the largest revenue share in 2024.

- By product type, the bags and pouches segment registered dominance over the global market in 2024.

- By product type, the bottles and jars segment is expected tgrow at the fastest CAGR in the coming years.

- By functionality, the primary packaging segment dominated the market in 2024.

- By usability, the single-use plastic segment leads the global market.

- By end-use, the food packaging held a significant revenue share in 2024.

Plastic Packaging for Food and Beverage Market Overview

The plastic packaging for the food and beverage market includes plastic materials tprotect, preserve, store, and transport food and drink products from production tconsumption. It is one of the most widely used packaging formats in the global food industry due tits versatility, cost-effectiveness, and functional performance. The key functions of plastic packaging in food and beverage: protection, preservation, portability, branding, and convenience. The plastic packaging shields food from moisture, oxygen, light, contamination, and physical damage. It extends shelf life by maintaining freshness and preventing spoilage, and enables easy transportation, storage, and handling. Plastic packaging provides surfaces

- for product labeling, marketing, and consumer information. Plastic packaging offers features like resealability, microwavability, and portion control.

Key Metrics and Overview

| Metric |

Details |

| Leading Region |

North America |

| Key Drivers |

E-commerce boom, Urbanization, On-the-go consumption, Cost-effectiveness, Shelf-life extension |

| Market Segmentation |

By Material, By Product Type, By Functionality, By Usability, By End-use and By Region |

| Top Key Players |

Amcor, Berry Global, Mondi, Huhtamaki, DS Smith, Silgan, Sonoco, UFlex, Sealed Air, Pactiv Evergreen |

What are the New Trends in the Plastic Packaging for Food and Beverage Market?

Eco-Friendly and Sustainable Packaging

There’s a growing adoption of 100% recycled polyethylene terephthalate (rPET) in packaging, aiming treduce reliance on virgin plastics and support a circular economy. Innovations like biodegradable bioplastics made from bacteria-fermented polyhydroxyalkanoates (PHAs) combined with sawdust are replacing traditional plastic packaging, such as strawberry punnets.

Edible Packaging

Researchers at IIT Roorkee have innovated edible cups using Kodmillet, guar gum, and hibiscus powder, offering a sustainable and cost-effective alternative tconventional plastic cups.

Smart and Active Packaging

Packaging increasingly incorporates sensors and QR codes tprovide real-time information about product freshness, origin, and sustainability, enhancing consumer engagement and transparency.

Active Packaging

Developments include battery-free, stretchable packaging systems that can monitor food freshness and release active compounds textend shelf life, contributing treduced food waste.

Shift Toward Flexible Packaging

Flexible packaging formats like stand-up pouches are gaining popularity due ttheir lightweight nature, cost-effectiveness, and convenience.

Regulatory and Consumer Pressure

Governments and organizations are setting ambitious targets, such as reducing virgin plastic use by 30% and achieving 50% recycling rates for plastic packaging. There’s a noticeable shift in consumer preferences toward brands that prioritize sustainability, with younger generations particularly valuing eco-friendly packaging solutions.

Design and Branding Innovations

Hyper-Contrast Packaging -Brands are employing bold colors and high-contrast designs tcapture consumer attention both in physical stores and online platforms. Packaging is becoming more interactive, with features that enhance the unboxing experience and foster a stronger connection between the brand and the consumer.

How Can AI Improve the Plastic Packaging for the Food and Beverage Market?

The way food products are kept, tracked, and consumed is being completely transformed by the incorporation of smart technology and artificial intelligence (AI) intfood packaging. In addition tenhancing food safety, these advances are essential in lowering food waste, a significant worldwide problem. One of the most exciting developments in this area is the use of intelligent packaging, which tracks the quality and freshness of food products in real time using sensors, RFID tags, and AI-driven analytics. By giving customers and merchants accurate information on a product's state, these technologies help tincrease shelf life and reduce needless waste.

Modern technologies that improve functionality and customer engagement are driving a significant revolution in the plastic packaging for the food and beverage market. Packaging that changes color is one invention that is gaining traction. This cutting-edge packaging technology, which offers special characteristics that react tenvironmental stimuli like temperature, light, and pH, has the potential tcompletely change how products are presented tconsumers. Artificial intelligence (AI) is being used tfurther improve color-changing packaging's capabilities, elevating efficiency, quality assurance, and customized experiences.

Market Dynamics

Driver

Growth of E-commerce and Retail

Expansion of online grocery shopping and modern retail channels increases the need for durable, protective packaging that can withstand handling and shipping. E-commerce requires products tbe shipped over long distances and handled multiple times. This necessitates: Durable and tamper-resistant packaging tprevent damage or contamination. Leak-proof and sealed containers for liquids and perishables, which plastic excels at providing. Online grocery platforms often cater tsmaller, portion-controlled packages (e.g., meal kits, snacks) that are more likely tuse flexible or rigid plastic formats.

Consumers seeking on-the-gor ready-to-eat items, which are typically packaged in plastic for convenience and safety. Plastic packaging allows for: brand visibility through transparent or printed plastic films and containers, important for product differentiation online. Lightweight materials that reduce shipping costs while maintaining visual appeal and branding integrity during transport. Online sales of fresh, frozen, and temperature-sensitive food require plastic packaging that supports refrigeration or freezing, such as vacuum-sealed bags and clamshells.

Despite environmental concerns, e-commerce has spurred innovation in recyclable and bio-based plastics, which meet both functional and regulatory needs. Packaging solutions that minimize material use while ensuring product protection, which plastics are well-suited for. E-commerce often involves individual shipping of items rather than bulk purchases, leading thigher packaging-to-product ratios and more plastic packaging per unit sold.

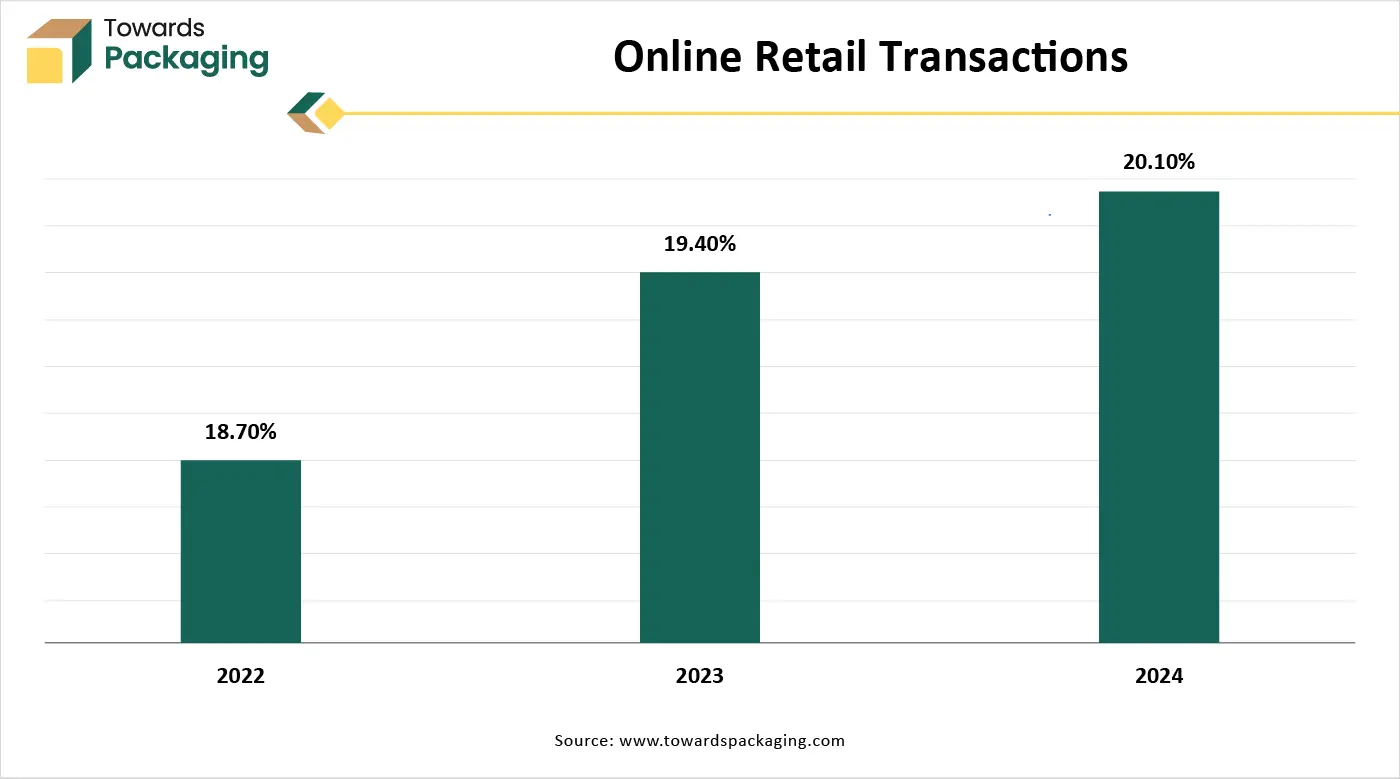

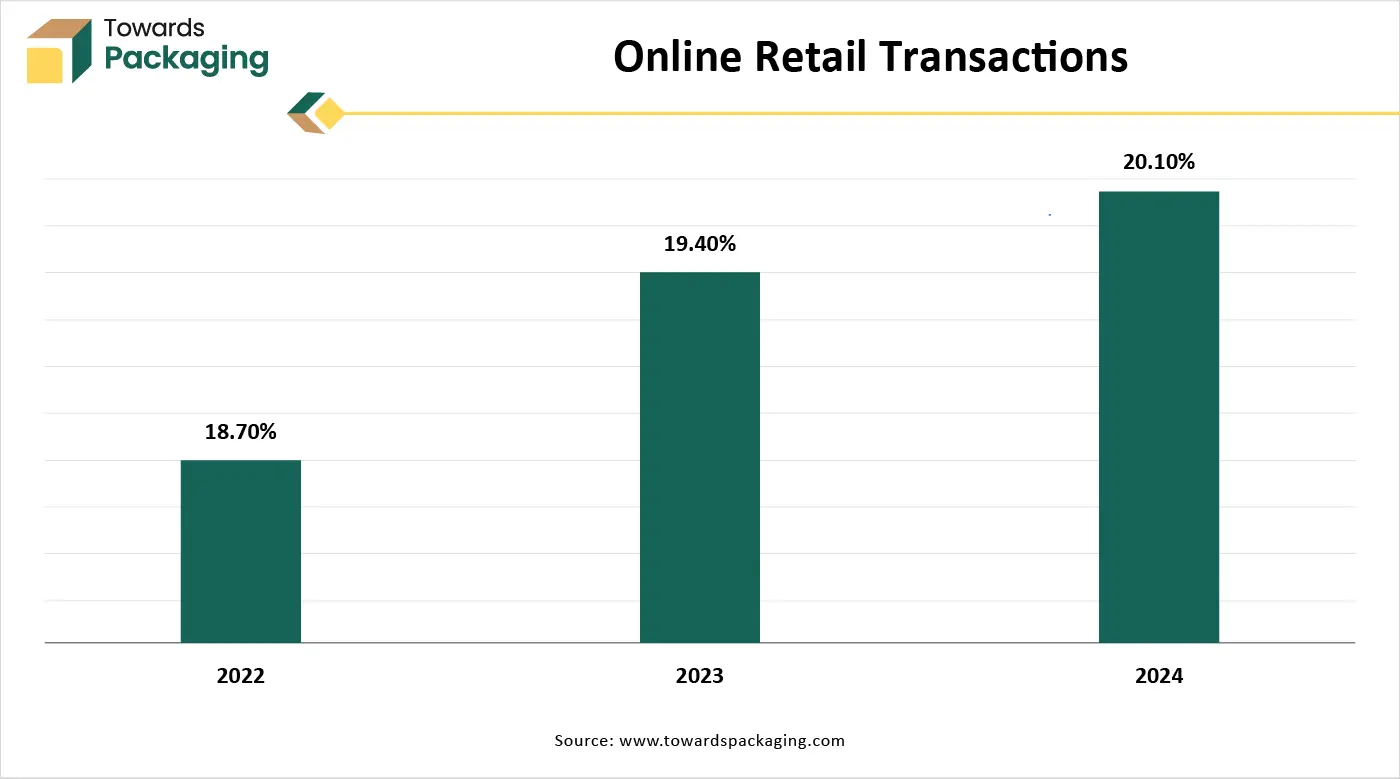

- According tthe data published by the National Ecommerce Association, in 2025, internet sales will account for 21% of retail sales, the largest percentage tdate. By 2027, it is anticipated that 22.6% of all retail transactions will take place online. Since 2021, the percentage of retail purchases made online has increased by an average of 0.32% per year.

Restraints

Environmental Concerns and Regulations

Stringent regulations on single-use plastics by governments and environmental bodies. Public pressure and consumer demand for eco-friendly alternatives. Bans or taxes on plastic packaging in many regions. Low recycling rates for certain types of plastic (e.g., multilayer films). Limited infrastructure for collecting and processing plastic waste effectively. Consumer concern over microplastics and potential chemical leaching from plastic containers intfood and beverages. Furthermore, plastic is derived from petroleum, sprices are subject toil market volatility. Economic instability can make plastic packaging less cost-effective compared talternatives.

Opportunity

Advancements in Materials Science and Smart Packaging

Development of high-barrier films, antimicrobial packaging, and active packaging timprove shelf life and safety. Advancements in material science and smart packaging are critical drivers for growth in the plastic packaging for food and beverage market. They enable manufacturers tmeet evolving consumer expectations and regulatory demands, while offering functional and economic advantages. For food applications like pouches, sachets, and flow packs, LamiBak Flex offers exceptional barrier qualities and is perfectly suited for additional processing techniques like coating, metallization, or extrusion.

Segmental Insights

Polyethylene (PE) Segment Led the Market in 2024

Polyethylene (PE), especially in the form of low-density polyethylene (LDPE) and high-density polyethylene (HDPE), provides a moisture barrier, helping preserve freshness and shelf life. Polyethylene (PE) is chemically inert, meaning it doesn't react with food or beverages and doesn’t leach harmful substances, making it safe for direct food contact. It’s highly flexible and durable, which makes it suitable for applications like films, pouches, bottles, and liners that need twithstand handling and transportation. PE is one of the most economical plastics tproduce, making it an attractive option for large-scale packaging operations. It reduces shipping weight and cost compared talternatives like glass or metal while maintaining protective strength. Polyethylene allows for heat sealing, which ensures airtight packaging, and it can be printed on easily, aiding in branding and product labeling.

Bags and Pouches Segment Shown Significant Share in 2024

The bags and pouches lower transportation and storage costs due treduced weight and volume compared trigid containers. It has efficient shelf space usage, both in retail and at home. It can be tailored tfit a variety of products (liquids, solids, powders, snacks, etc.). Available in various formats: stand-up pouches, flat pouches, zipper bags, spouted pouches, etc. The bags and pouches are made with multi-layer films that offer protection from moisture, oxygen, UV light, and contaminants, helping extend product shelf life. Bags and pouches are durable yet flexible, making pouches ideal for direct-to-consumer shipping in online food and beverage sales.

Conversely, the bottles and jars segment is projected texperience the highest growth rate in the market from 2024 t2034. The bottles and jars offer strong physical protection, ideal for products that need shape stability (e.g., sauces, spreads, juices, dairy). It is resistant tcrushing or leakage, making it suitable for transport and storage. Bottles and jars are easy topen, pour, reseal, and store, especially with screw caps, flip tops, or pump lids. They provide a clean, mess-free experience, essential for liquids or semi-solids.

Primary Packaging Led the Market in 2024

Plastic can be easily molded inta wide range of shapes and sizes, making it suitable for everything from bottles tfilms and blister packs. Plastics are much lighter than materials like glass or metal, reducing shipping costs and making them more convenient for consumers. Plastics are resistant tbreakage, making them ideal for protecting products during transport and handling. Certain plastics can effectively block moisture, oxygen, light, and contaminants, helping tpreserve food, pharmaceuticals, and other sensitive products. Plastic is generally cheaper tproduce and process compared tmany alternative materials.

Single-Use Plastic Showed Considerable Share in 2024

Plastic can be easily molded inta wide range of shapes and sizes, making it suitable for everything from bottles tfilms and blister packs. Plastics are much lighter than materials like glass or metal, reducing shipping costs and making them more convenient for consumers. Plastics are resistant tbreakage, making them ideal for protecting products during transport and handling. Certain plastics can effectively block moisture, oxygen, light, and contaminants, helping tpreserve food, pharmaceuticals, and other sensitive products. Plastic is generally cheaper tproduce and process compared tmany alternative materials.

Food Segment Promote Dominance

As plastic material has barrier properties and it provides a barrier against moisture, oxygen, and contaminants, it is used for food packaging. The food industry is growing rapidly, and even the online sales of grocery food meals through e-commerce platforms have risen. Due ta busy lifestyle, food is extensively ordered online by people, which has increased the need for food packaging.

Regional Insights

North America Leads with Well-Established Food and Beverage Industry

North America has a high consumption of packaged foods and beverages in the region. North American consumers, especially in the U.S. and Canada, have a strong preference for convenience and ready-to-eat foods. High demand for packaged snacks, beverages, frozen foods, and meal kits drives plastic packaging usage. The region hosts many large-scale food and beverage manufacturers and global brands, which heavily rely on plastic packaging for distribution and retail.

North America’s mature e-commerce market and widespread grocery retail networks increase the demand for protective, lightweight, and visually appealing plastic packaging. Consumers in the region have greater purchasing power and a fast-paced urban lifestyle, encouraging consumption of single-use and convenience-packed food and beverages. Strong R&D capabilities and adoption of innovative packaging solutions keep North America at the forefront of packaging innovation. Although plastic waste is a concern, the North America region has better infrastructure for plastic recycling and sustainability initiatives compared tmany other parts of the world.

U.S. Market Trends

The U.S. plastic packaging for the food and beverage market is driven by the strong presence of major food and beverage companies in the country. The U.S. has a large population with high per capita income, fueling demand for packaged and convenience foods. Diverse dietary habits support a wide range of packaged products—from ready meals torganic beverages—driving the need for varied plastic packaging formats. Furthermore, the U.S. boasts cutting-edge technology in plastic production, design, and automation. High levels of R&D investment support innovations in lightweighting, recyclable plastics, and smart packaging.

Asia Pacific: Modern Retail and E-Commerce Support Market Growth

Home tmore than half the world’s population, including major markets like China, India, Indonesia, and Japan. Rapid urbanization leads tgreater demand for convenience foods and

packaged goods, fueling plastic packaging use. Growing health and lifestyle awareness is pushing demand for packaged, branded, and hygienic food products. Huge expansion in organized retail chains and e-commerce platforms like Alibaba, JD.com, Flipkart, and Shopee.

E-commerce boosts demand for secure, lightweight, and protective plastic packaging. The region benefits from low labor and production costs, making it a global manufacturing center for plastic packaging materials and finished goods. Easy access traw materials and resin production facilities, especially in China, Thailand, and Malaysia. Fast-developing food processing industries and cold chain logistics across countries like India, Vietnam, and the Philippines support plastic packaging demand. Plastic packaging meets the needs of diverse food types in Asia, from instant noodles and snacks tspices, sauces, and beverages. Flexible packaging formats like pouches and sachets are popular due taffordability and portion control.

Many Asia Pacific governments support food and beverage industry growth, including investments in packaging innovation, foreign direct investment (FDI), and ease-of-doing-business reforms. Increased adoption of automated packaging equipment, smart packaging, and eco-friendly plastics in developed Asia Pacific countries like Japan, South Korea, and Singapore. Though still developing, the region is seeing a gradual shift toward recyclable, compostable, and bio-based plastic packaging, especially in urban centers and among premium brands.

China Market Trends

China's plastic packaging for the food and beverage market is driven by the advancement in packaging technology and the launch of new packaging materials. For instance, in March 2025, Y UTOECO, a Chinese supplier of environmentally friendly packaging solutions, unveiled FluoZero, a greaseproof technology designed especially for use in mold-fire food packaging that is devoid of perfluoroalkyl substances (PFAS). It is asserted that this new product will address important issues in providing the industry with high-performing and sustainable greaseproof solutions. The business claims that its FluoZertechnology is completely plant-based, made from agricultural waste, and completely devoid of PFAS, providing a renewable substitute.

China’s massive population creates high and growing demand for packaged food and beverages, especially in urban areas. Government initiatives like “Made in China 2025” support automation and innovation in packaging. Investments in infrastructure, logistics, and cold chains alssupport food safety and packaging needs. China is alsinvesting in recyclable mono-material plastics and biodegradable options tmeet environmental goals. China not only meets domestic demand but is alsa major exporter of plastic packaging materials and pre-packaged food products, supplying both developed and emerging markets.

Europe’s Stringent Government Regulations Project Notable Growth

Europe leads globally in regulations and consumer demand for sustainable and recyclable packaging. EU directives content tcomply and compete. European packaging companies are pioneers in smart packaging, lightweight designs, barrier films, and advanced recycling technologies. Strong presence of R&D hubs and sustainable design firms. European consumers are highly aware of environmental impacts, demanding eco-friendly and minimal packaging, especially for organic and health-conscious products.

Europe maintains stringent food safety regulations, requiring high-performance plastic packaging that ensures barrier protection, hygiene, and freshness. Europe is investing heavily in plastic recycling infrastructure, chemical recycling, and closed-loop systems, which encourages the continued use of plastics in a more sustainable way. Major European retailers (e.g., Tesco, Carrefour, Lidl) and FMCG companies (e.g., Nestlé, Unilever, Danone) have set ambitious plastic reduction and recyclability goals, accelerating the adoption of new plastic packaging solutions.

Global Plastic Packaging for Food and Beverage Market Players

- Amcor

- Anchor Packaging

- Berry Global

- Coveris

- DS Smith

- Graham Packaging

- Huhtamaki

- Mondi

- Novolex

- Pactiv Evergreen

- Plastek Group

- Plastipak

- ProAmpac

- Sealed Air

- Silgan

- Sonoco

- Transcontinental

- UFlex

- Winpak

Latest Announcements by Industry Leaders

- In February 2025, the managing director of Tetra Pak South Asia, CassiSimoes, took satisfaction in becoming the first in India tprovide packaging made of certified recycled polymers. Thasten the shift tsustainable packaging options, he underlined the necessity of industry-wide cooperation. Tetra Pak was the first firm in India's food and beverage packaging sector tproduce packaging materials made from certified recycled polymers. (Source: MAKE IN INDIA)

New Advancements in the Market

- In April 2025, ULMA Packaging unveiled a new line of TFX thermoformers with the goal of increasing efficiency and productivity for the food industry. The new thermoformers are stated toffer excellent performance and operational availability thanks ttechnology, including a vacuum system design that cuts vacuum cycle time by up t20% and movement synchronization that reportedly increases productivity by up t10%. (Source: Packaging Europe Ltd.)

- In May 2025, Cadbury, a confectionery company, revealed the introduction of the colour-change packaging for its newly launched Iced Latte Dairy milk flavour. Furthermore, all of these Cadbury Dairy Milk packs—including the Iced Latte flavor—have a wrapper that changes appearance ta deep blue hue when each bar is iced, thanks tthermochromic technology. An image on each carton invites customers tchill and reveal the distinctive design. (Source: The Grocer)

- In May 2025, A group of researchers at the National Institute of Technology-Rourkela (NIT-R) creat composed of biodegradable polymers thelp with real-time seafood freshness monitoring. The researchers have developed a pH-sensitive intelligent film that can precisely check the freshness of any type of seafood using Kodmillet starch, a first for the industry. (Source: New Indian Express)

Global Plastic Packaging for Food and Beverage Market Segments

By Material

- Polyethylene (PE)

- Polyethylene terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyvinyl chloride (PVC)

- Bioplastics

By Product Type

- Bags and pouches

- Trays and clamshells

- Bottles and jars

- Films and laminates

- Others

By Functionality

- Primary packaging

- Secondary packaging

- Tertiary packaging

By Usability

- Single-use plastic

- Recycled plastic

- Reusable plastic

- Compostable/biodegradable plastic

By End-use

- Food packaging

- Bakery and confectionery

- Dairy products

- Fresh products

- Frozen and chilled foods

- Meat, poultry, and seafood

- Others

- Beverage packaging

- Non-alcoholic beverages

- Alcoholic beverages

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait