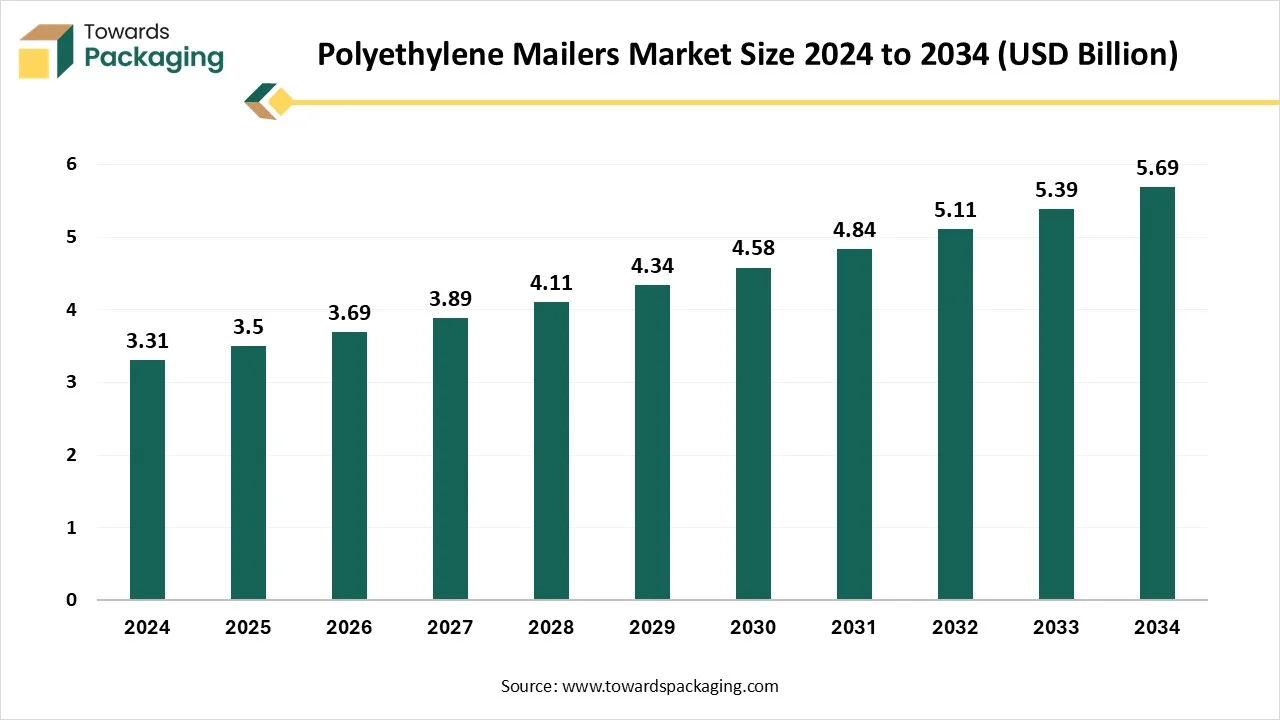

The polyethylene mailers market is forecasted to expand from USD 3.69 billion in 2026 to USD 5.99 billion by 2035, growing at a CAGR of 5.54% from 2026 to 2035. Regional insights cover North America, Europe, Asia Pacific, Latin America, and MEA, highlighting North America’s dominance in 2024 and Asia Pacific’s rapid growth trajectory.

The polyethylene mailers market is driven by the rising demand for secure, lightweight, and cost-effective packaging solutions, particularly in e-commerce and retail sectors. These mailers offer durability, moisture resistance, and tamper-evident features, making them ideal for shipping documents, apparel, and small goods. Sustainability concerns are encouraging innovation in recyclable and biodegradable polyethylene variants. Additionally, the increasing adoption of digital printing for branding and product differentiation enhances their appeal. Growth is further supported by expanding logistics networks and the global shift toward online shopping and direct-to-consumer delivery models.

Polyethylene mailers are lightweight, durable shipping envelopes made from polyethylene, a type of synthetic plastic. Most commonly, they are produced using low-density polyethylene (LDPE), which offers flexibility and strength, although high-density polyethylene (HDPE) may also be used in some variants. These mailers are designed primarily for shipping soft, non-fragile items such as clothing, documents, and small accessories. They typically feature an opaque design to ensure privacy, with a self-sealing adhesive strip that makes them easy to close securely. Some versions also include a bubble lining for added protection, often referred to as bubble mailers.

Polyethylene mailers are valued for being water-resistant, tear-resistant, and cost-effective, making them a popular choice among e-commerce businesses. Their lightweight nature helps reduce shipping costs, especially for bulk or high-volume orders. However, while these mailers are convenient and protective, they are usually non-biodegradable. Many are recyclable, and some are made from recycled materials, but proper disposal or recycling is necessary to minimize environmental impact. Overall, polyethylene mailers offer a practical and efficient solution for packaging and shipping a wide range of products.

| Metric | Details |

| Market Size in 2025 | USD 3.49 Billion |

| Projected Market Size in 2035 | USD 5.99 Billion |

| CAGR (2025 - 2035) | 5.54% |

| Leading Region | North America |

| Market Segmentation | By Capacity, By End-Use and By Region |

| Top Key Players | Sealed Air Corporation, Pregis LLC, Intertape Polymer Group Inc., PAC Worldwide Corporation, ProAmpac LLC, EcoEnclose |

The fashion and e-commerce industries are increasingly adopting sustainable packaging alternatives to reduce the environmental impact of single-use plastics. Brands like Kering, PVH, and Adidas are investing in recyclable alternatives, and innovations such as dissolvable polyvinyl alcohol (PVOH) bags and recycled plastic delivery satchels are gaining traction despite their higher costs. For instance, New Zealand-based designer brand Maggie Marilyn uses Better Packaging Company's ØPack, a commercially compostable waterproof bag made from 80% calcium carbonate sourced from quarry waste with 20% non-toxic recycled resin.

The adoption of circular economy principles is becoming more prevalent, with brands aiming to reduce waste and promote recycling. For example, Fashion for Good, an Amsterdam-based sustainable fashion accelerator, launched a circular polybag pilot program that tested polybags that de-ink and remove adhesives from consumer plastic waste, allowing it to be recycled into new polybags for a circular alternative.

Brands are focusing on optimizing packaging materials to reduce environmental impact. The Sustainable Packaging Coalition outlines criteria for sustainable packaging, including the use of renewable or recycled source materials, clean production technologies, and physical design to optimize materials and energy. Optimizing packaging materials and design can significantly help to optimize logistics by improving vehicle load, reducing emissions over time, and optimizing costs.

Eco-labels are playing a critical role in communicating sustainability efforts to consumers. These labels inform customers about social and environmental effects, possibilities of recycling the product and its packaging, methods of production, and the producer’s way of running the business. However, there is a challenge for consumers to recognize, understand, and cope with the sheer number of emerging labels that deal with specific aspects of the sustainability agenda.

Researchers are exploring alternative materials to replace conventional plastics. For example, dairy-based films composed of proteins such as casein and whey are being developed as biodegradable packaging alternatives. These films offer better oxygen barriers than synthetic, chemical-based films. However, more research is needed to improve the water barrier quality of these materials.

As consumer awareness about environmental issues grows, there is an increasing demand for sustainable packaging. Companies that highlight their environmental status to consumers can boost sales, reduce packaging costs, and enhance their brand image. This trend is leading to a more sustainable supply chain management in various industries

AI has the potential to significantly enhance the polyethylene mailers industry by driving improvements across manufacturing, logistics, sustainability, and customer engagement. In manufacturing, AI can optimize the production process by monitoring extruder temperatures, pressure, and speed, which helps reduce energy consumption and material waste. Predictive maintenance systems powered by AI can anticipate equipment failures, minimizing costly downtime, while computer vision technologies can perform real-time quality inspections to detect defects such as tears, incorrect dimensions, or poor sealing. On the design side, AI can simulate various polyethylene formulations to find the ideal balance of strength, flexibility, and cost-effectiveness, and it can forecast demand for custom-printed mailers based on market trends and customer behaviour.

In terms of supply chain management, AI helps optimize inventory by accurately forecasting raw material needs, preventing overstocking or shortages. It can also evaluate supplier performance and risks, allowing companies to make informed procurement decisions. AI plays a crucial role in sustainability by analyzing production waste patterns and recommending process improvements or alternative, eco-friendly materials. It can also assess the recyclability of different polyethylene blends and track the carbon footprint of the entire manufacturing and logistics chain, offering data-driven insights for greener operations.

From a business intelligence and customer service perspective, AI-powered systems can automate quoting processes, provide dynamic pricing based on material costs and order volume, and analyze customer feedback to inform new product development. In logistics, AI can optimize delivery routes for both raw materials and finished goods, reducing shipping costs and improving fulfillment times. Additionally, AI can assist in packaging selection by matching the most efficient mailer size and type to a given product, thereby reducing unnecessary packaging and minimizing shipping volume. Altogether, AI offers a transformative set of tools that can help polyethylene mailer manufacturers become more efficient, sustainable, and responsive to customer needs.

Expansion of the E-commerce Industry

The rapid growth of e-commerce, driven by increased online shopping and the rise of direct-to-consumer (DTC) brands, has significantly boosted the demand for efficient and cost-effective packaging solutions. Polyethylene mailers, known for their lightweight and durable nature, are increasingly preferred for shipping various products, including apparel, electronics, and accessories. According to the data published by the E-Commerce Professionals Association (ePA), commerce sales will total USD 2.51 trillion, a 21.25% rise over the USD 2.07 trillion in sales reported the year before. From 2018 to 2027, mobile commerce is predicted to increase at a rate higher than the average annual growth rate of 15.3%. By 2027, the market for mobile commerce will generate USD 3.44 trillion in sales. According to 73% of respondents in the United States, smartphones have become the preferred device for internet shopping worldwide. A startling 92% of respondents in China and 88% in India, respectively, use their phones for online shopping.

Environmental Regulations and Sustainability Concerns & Recycling Infrastructure Challenges

The key players operating in the market are facing issues due to environmental regulations and recycling infrastructure challenges. Polyethylene is non-biodegradable, and public awareness of plastic pollution is pushing companies to seek eco-friendly alternatives. Many countries are introducing or tightening regulations on single-use plastics, directly affecting polyethylene mailer production and usage. Companies are increasingly focused on meeting environmental, social, and governance (ESG) criteria, leading to a shift toward biodegradable or recyclable packaging. Although many polyethylene mailers are technically recyclable, infrastructure limitations and contamination issues reduce actual recycling rates. This inefficiency discourages continued use and spurs demand for more easily recyclable or reusable materials.

Advancements in printing technologies allow businesses to customize polyethylene mailers with logos, taglines, and other branding elements. This customization not only enhances brand visibility but also provides an opportunity for businesses to differentiate themselves in a competitive market.

There is a growing consumer preference for sustainable packaging solutions. Polyethylene mailers are increasingly being produced with recyclable materials, and companies are adopting eco-friendly practices in their manufacturing processes. This shift aligns with global sustainability trends and regulatory pressures to reduce plastic waste.

Innovations in material science have led to the development of more robust and eco-friendly polyethylene mailers. These advancements improve the strength, moisture resistance, and recyclability of the mailers, meeting the evolving needs of consumers and businesses alike.

The less than 500 g segment holds a dominant presence in the market owing to its low material cost, and is ideal for lightweight items. Polyethylene (PE) is inexpensive to produce compared to other packaging materials like paperboard or corrugated cardboard. Their low weight reduces shipping costs, especially for small parcels. Flat and flexible, they take up minimal space during storage and transport. Many e-commerce and retail items (e.g., clothing, accessories, small electronics, books) fall under 500 g, making these mailers perfectly sized. They provide sufficient protection for soft or durable goods that don’t require rigid packaging.

Polyethylene mailers resist moisture and tearing, which helps protect contents during transit. Many have self-seal strips that deter tampering and improve security. Quick to pack and seal, especially beneficial for high-volume shipping operations. The polyethylene mailers can be printed with branding or barcodes, and some versions include dual seals for return shipping. Many are made from recyclable LDPE (low-density polyethylene) or even recycled materials. Because they’re lighter and require less material than boxes, they often result in lower overall shipping emissions. The surge in online shopping has increased demand for low-cost, efficient, and scalable packaging solutions. PE mailers meet all these needs for low-weight items.

The 501 to 1000g segment is expected to grow rapidly in the polyethylene mailers market. Many e-commerce products—like clothing, accessories, books, cosmetics, and small electronics—fall into the 501–1000g weight range. These items are among the most frequently shipped, creating steady demand for mid-sized mailers. Mailers in this segment offer a balance between size and material use. This weight class typically avoids higher shipping brackets, making it economically viable for retailers. Less packaging waste than larger alternatives, appealing to cost- and sustainability-conscious businesses. The 501–1000g range can accommodate a variety of product types without being excessively large or too tight.

Often used in subscription services, small batch shipments, and retail returns, increasing their versatility. This capacity strikes a balance between volume and manageability in warehouses and during delivery. Fits standard courier guidelines for automated sorting and stacking, improving logistics efficiency. Brands aiming to reduce packaging waste prefer mid-sized polyethylene mailers. Easier to optimize for recycled or biodegradable materials without compromising protective features. Couriers and third-party logistics providers (3PLs) often standardize around this size bracket for streamlined operations. Retailers favour it for uniform packaging, branding, and inventory control.

The stationery items segment accounted for the dominant revenue share of the polyethylene mailers market in 2024. The polyethylene mailers are used extensively for packaging stationery items due to their lightweight and cost-effective packaging. Online sales of stationery (like pens, notebooks, files, and documents) have surged, particularly post-COVID, driving demand for secure and lightweight packaging. Polyethylene mailers offer cost-effective and protective solutions for shipping small, non-fragile items commonly found in stationery orders. Stationery items are typically non-bulky and non-fragile, which makes polyethylene mailers ideal for reducing shipping costs and avoiding over-packaging. These mailers are cheaper than boxes and still offer sufficient protection and tamper-evidence, crucial for sensitive documents or branded materials.

The high volume and frequency of orders in the stationery segment (e.g., office supply distributors, educational institutions) lead to a larger consumption of mailers. Bulk shipping of items like brochures, notebooks, and paper reams in polyethylene mailers is common. Many companies opt for branded mailers for marketing purposes. Polyethylene mailers can be easily printed with logos and designs, which is attractive for stationery suppliers who ship to end consumers and businesses. With rising sustainability awareness, many polyethylene mailers are now made from recycled or recyclable materials, aligning with the eco-friendly practices of stationery brands and institutions. Stationery items need to be protected from moisture, dust, and tampering during transit. Polyethylene mailers offer excellent barrier properties, especially important for documents and paper goods.

The pharmaceuticals segment is growing rapidly due to the security and safety provided by the polyethylene mailers as well as the growth of e-commerce & direct-to-consumer shipments of pharmaceutical products. The pharmaceutical industry is highly regulated, especially when it comes to the safe transportation of medications. Polyethylene mailers can be easily customized to meet regulatory standards for pharmaceutical shipping, which include requirements for tamper-evident seals, child-resistant features, and clear labeling. Packaging must ensure that products are protected from contamination, moisture, and tampering, and polyethylene mailers provide an affordable solution that meets these needs. Pharmaceutical shipments require packaging that ensures products haven't been tampered with. Polyethylene mailers can be designed with tamper-proof seals or security labels, which increase their suitability for pharmaceutical products. Many pharmaceutical products, such as vaccines, biologics, and temperature-sensitive drugs, require protective packaging to prevent exposure to light, moisture, or contamination during transit.

Polyethylene mailers can be lined or combined with additional protective layers to meet these demands. The pharmaceutical industry is embracing direct-to-consumer shipping models for both prescription medications and over-the-counter products. The rise of online pharmacies and home delivery services has created an increased demand for secure and reliable shipping solutions. Polyethylene mailers offer lightweight and cost-effective packaging for bulk shipping of pharmaceuticals, which is ideal for e-commerce fulfillment. Polyethylene mailers are lightweight, reducing shipping costs compared to other rigid or bulky packaging options. This is a key factor when shipping pharmaceutical products that need to maintain a specific cost per unit while also protecting the product. The flexibility of polyethylene allows for packaging that’s tailored to different product sizes, minimizing the need for excess material and reducing overall packaging costs. While insulated packaging might be required for temperature-sensitive pharmaceutical products, polyethylene mailers are often used in conjunction with cool packs or temperature-controlled solutions. These combined options help meet the cold chain logistics needs of the pharmaceutical industry.

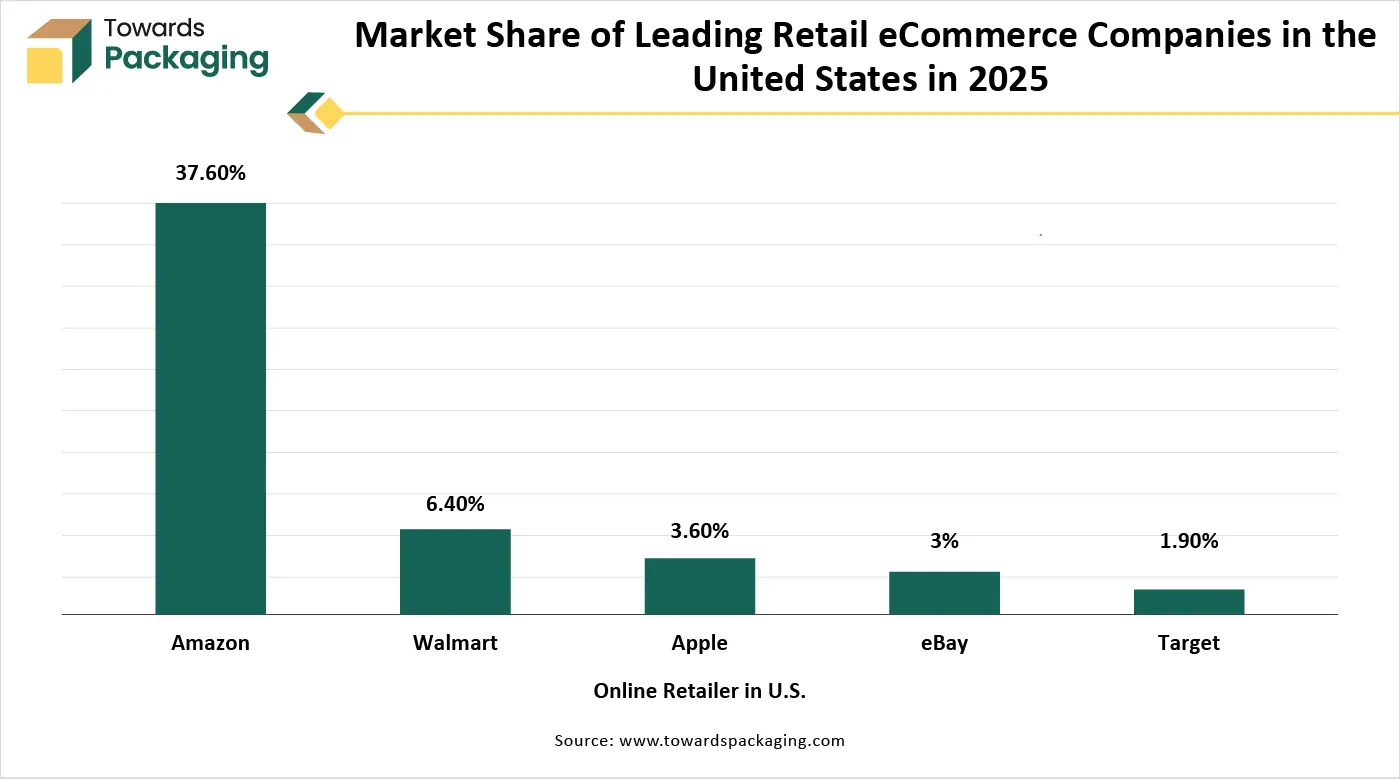

North America held the largest share of the polyethylene mailers market in 2024, owing to an established logistics and distribution network in the region. North America, particularly the U.S. and Canada, has one of the most advanced and fast-growing e-commerce markets in the world. The region sees billions of packages being shipped annually, creating a huge demand for reliable, cost-effective packaging solutions like polyethylene mailers. Consumers in North America increasingly demand fast, convenient, and affordable shipping, and polyethylene mailers are perfectly suited to meet these needs. The lightweight and space-efficient nature of polyethylene mailers aligns with the increasing trend toward direct-to-consumer shipping. North America has one of the most sophisticated logistics and distribution systems, including large-scale courier and postal services like UPS, FedEx, USP, and others, which require efficient and versatile packaging solutions.

Large online retailers such as Amazon, Walmart, and Target are major drivers of polyethylene mailer demand. These companies have a strong presence in North America and require bulk shipping solutions that are lightweight, protective, and cost-efficient, all of which polyethylene mailers provide. Retailers in North America also place a high value on customized packaging for branding and customer experience. Polyethylene mailers can be easily branded, printed with logos, and designed to enhance the unboxing experience. North America has some of the most stringent packaging and shipping regulations in the world, particularly for industries like pharmaceuticals, food and beverage, and cosmetics. Polyethylene mailers can easily be designed to meet these compliance requirements (e.g., tamper-evident features, child-resistant seals, etc.), which gives them an edge in the market.

North America leads in packaging innovation, and companies are continually developing smart packaging solutions. Polyethylene mailers in this region have been enhanced with features such as anti-static properties for electronics, insulation layers for temperature-sensitive products, and advanced sealing technologies. The North American market is also seeing increasing automation in warehousing and logistics. Polyethylene mailers are easy to handle in automated packaging systems, further boosting their demand. North American consumers are increasingly making purchase decisions based on the environmental responsibility of brands. This has led to a rise in demand for eco-conscious packaging solutions, including polyethylene mailers that can be recycled or made from post-consumer recycled (PCR) content.

The North American polyethylene mailer market serves a wide array of industries, including e-commerce, pharmaceuticals, consumer goods, fashion, and food delivery services. Polyethylene mailers are adaptable, cost-effective, and able to meet the specific needs of these diverse sectors. Consumers in North America are accustomed to fast and convenient delivery options, including same-day or two-day shipping. Polyethylene mailers, with their lightweight and ability to conform to the shape of products, help reduce shipping costs and improve delivery speed. North American consumers also prefer flexible packaging that can be adapted to a wide variety of products, from clothing and accessories to electronics and health products. Polyethylene mailers provide the flexibility needed for such diverse product ranges. North America has a well-established polyethylene production industry, with numerous resin manufacturers and access to high-quality materials. This ensures that the demand for polyethylene mailers can be met reliably and efficiently in terms of both cost and supply.

U.S. Market Trends

The U.S. polyethylene mailers market is driven by the advanced logistics infrastructure in the country. The U.S. is home to some of the world’s largest and most dynamic e-commerce platforms, such as Amazon, Walmart, eBay, and countless others. The sheer scale of online retail in the U.S. creates a huge demand for shipping solutions, and polyethylene mailers are perfectly suited for the high volumes of small, lightweight packages that are typical in e-commerce. Polyethylene mailers are easy to handle in automated sorting systems, making them an ideal choice for the highly automated U.S. warehouses and distribution centers that fulfill millions of orders every day. The country is home to a massive pharmaceutical industry, which requires highly secure and compliant packaging for medications, vaccines, and medical devices.

The U.S. has one of the world’s most advanced logistics and courier systems, including major players like FedEx, UPS, and USPS. Polyethylene mailers fit seamlessly into these established systems due to their lightweight and stackable design, helping to maximize efficiency in sorting, packing, and shipping. U.S. consumers increasingly expect same-day or 2-day shipping for online orders. Polyethylene mailers, being lightweight and compact, help reduce delivery time and costs, making them essential for meeting these fast-paced expectations. The U.S. is known for its strict regulatory standards when it comes to shipping pharmaceutical products, food, and other regulated goods. Polyethylene mailers are highly adaptable and can be customized to meet these regulations, including tamper-evident seals, security features, and child-resistant packaging for pharmaceuticals and over-the-counter products.

U.S. companies are under increasing pressure to reduce their environmental footprint, and sustainable packaging has become a critical part of their strategies. Polyethylene mailers can help companies meet these goals by offering a lightweight and recyclable alternative to other less eco-friendly packaging options. U.S. consumers place a high value on convenience and easy returns. Polyethylene mailers are ideal for this, as they are easy to open, flexible, and can fit a wide variety of products. The flexibility of polyethylene means it can conform to the shape of the item being shipped, offering protection without the need for excessive packaging materials. Consumers in the U.S. are increasingly seeking branded, high-quality packaging that enhances their unboxing experience. Polyethylene mailers can be customized with prints for branding and customer engagement, giving brands a way to stand out in a competitive market.

The U.S. is a leader in the development of new packaging technologies. Polyethylene mailers are often integrated with advanced sealing techniques, anti-static properties, and even QR codes for tracking shipments in real time. These innovations make them more attractive for companies looking to improve operational efficiency and customer experience. With the increasing use of automated systems in U.S. fulfillment centers, polyethylene mailers are easily handled by these machines, improving the speed and accuracy of order fulfillment. The U.S. has a well-established and abundant supply of polyethylene resins, which keeps the cost of production lower compared to other regions. This ensures that U.S. manufacturers have easy access to raw materials for polyethylene mailers, helping to maintain cost-efficiency and consistent supply.

Asia Pacific is expanding rapidly due to a combination of rapid industrialization, booming e-commerce growth, cost-effective manufacturing, and rising consumer demand. Countries like China, India, Indonesia, and Southeast Asian nations are experiencing exponential growth in online retail. Rapid urbanization, a growing middle class, and expanding logistics networks fuel high demand for lightweight, affordable packaging. Asia Pacific is also a global hub for textile and pharmaceutical exports, where polyethylene mailers are widely used. Additionally, rising environmental awareness and regulatory push for recyclable packaging are encouraging the adoption of sustainable polyethylene mailers across the region.

Polyethylene mailers can be produced at scale and low cost, making Asia Pacific not only a large consumer market but also a major exporter of mailers worldwide. Asia Pacific includes over 60% of the world’s population, with rising disposable incomes and urban migration. To support e-commerce, the region is seeing rapid investment in logistics, warehousing, and last-mile delivery infrastructure. Companies like Alibaba, JD.com, Flipkart, and Lazada rely heavily on polyethylene mailers for quick, cost-efficient packaging. Smart packaging innovations and digitally integrated logistics systems are making it easier for Asia Pacific-based companies to track shipments, reduce waste, and improve delivery accuracy.

Although late to sustainability compared to the West, Asia Pacific countries are now increasingly adopting recycled and biodegradable polyethylene mailers due to growing environmental awareness and government regulations. Countries like China and India are encouraging the use of recyclable packaging materials through plastic bans and eco-labeling mandates, prompting innovation in sustainable polyethylene variants. Asia Pacific region countries are leading exporters of textiles and fashion goods, with large volumes shipped globally in polyethylene mailers due to their lightweight and protective nature. Domestic retail brands and international companies with manufacturing bases in Asia Pacific use mailers for B2C and B2B shipments.

China Market Trends

China's polyethylene mailers market is driven by the booming e-commerce purchases in the country. China is the fastest-growing country in the polyethylene (PE) mailers market, driven by its position as the world's largest consumer of polyethylene. In 2023, China's PE consumption accounted for 34% of the global total, highlighting its significant role in the market. The country's robust manufacturing capabilities and extensive e-commerce sector further bolster the demand for PE mailers, which are favored for their lightweight, cost-effective, and durable shipping solutions. Additionally, China's well-established infrastructure and supply chain networks facilitate the efficient production and distribution of PE mailers, supporting the growth of the packaging industry.

India Market Trends

The Indian polyethylene mailers market is driven by the strong domestic polymer industry in the country. India has a large workforce available at relatively lower wages compared to Western countries and even some Southeast Asian nations. India is a major importer and processor of polyethylene and benefits from proximity to Middle Eastern suppliers of crude oil and natural gas, the primary feedstocks for PE production. Many Indian manufacturers operate at scale and use lean manufacturing practices, keeping production costs low. Major companies like Reliance Industries, Indian Oil Corporation, and GAIL have large-scale polymer production capacities, ensuring a steady domestic supply of polyethylene. Indian manufacturers are strategically located near ports, which facilitate easy access to global markets.

India's participation in regional and global trade agreements helps reduce tariffs and barriers to exports. Indian suppliers are known for customizing mailers to client requirements, which boosts demand from global e-commerce companies. The rapid growth of India's e-commerce sector drives local demand for packaging solutions, making the market more attractive for investment and innovation. India is becoming a key supplier of PE mailers to international e-commerce platforms looking for high-quality, affordable packaging solutions. The “Make in India” initiative campaign promotes local manufacturing and incentivizes exports through subsidies and easier compliance for MSMEs. Indian companies are adapting to global sustainability demands by offering recyclable and biodegradable mailers.

The Europe region is expected to grow at a notable rate in the foreseeable future. The EU has aggressive targets under the European Green Deal and Plastics Strategy, pushing packaging companies to innovate in sustainable PE solutions. Europe has one of the most advanced recycling systems globally, enabling a shift toward post-consumer recycled (PCR) polyethylene in mailers. European producers often lead in providing certified sustainable packaging. European companies are known for adopting multi-layer co-extrusion, digital printing, and automated converting lines, ensuring high precision and quality. Europe leads in developing bio-based polyethylene and compostable alternatives to traditional PE mailers. European polyethylene mailers are often designed for durability, tamper resistance, and reusability, especially for luxury brands and regulated sectors like pharma or electronics. Brands in Europe invest in mailer customization to enhance customer experience.

By Capacity

By End-Use

By Region

January 2026

January 2026

January 2026

January 2026