Sustainable Medical Packaging Market Size, Growth, Demand and Production Forecast

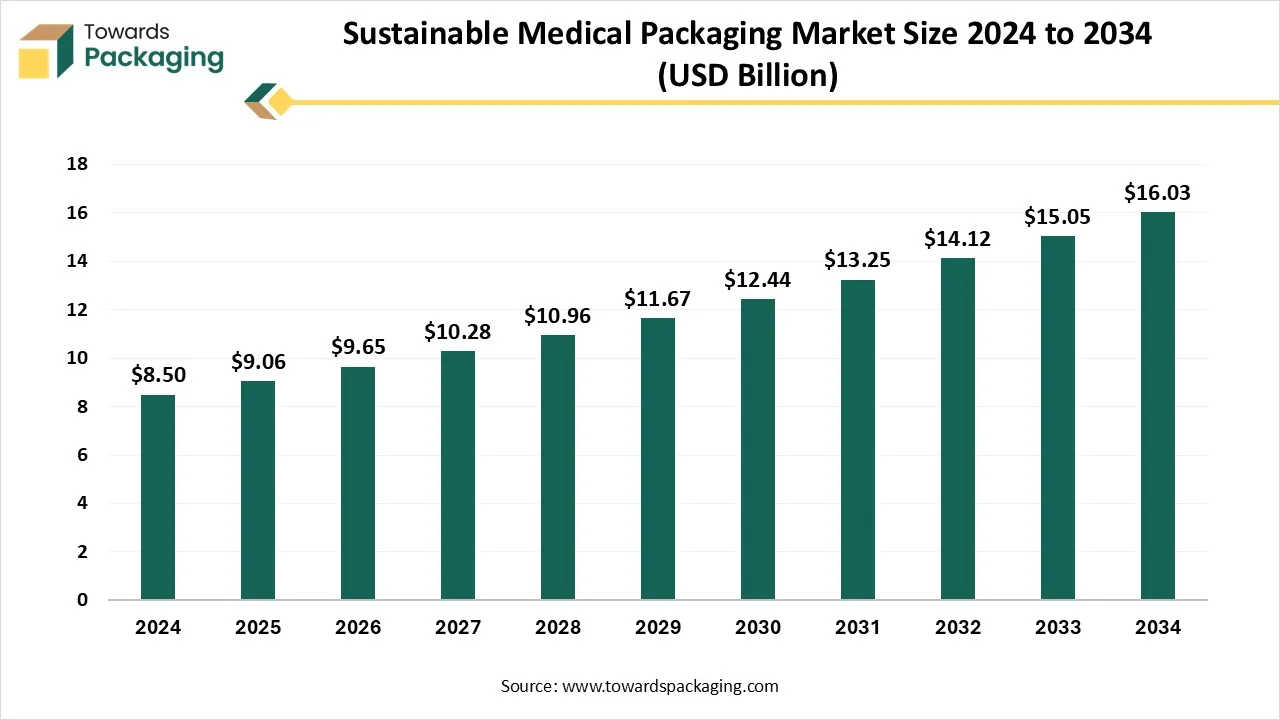

The sustainable medical packaging market is expected to expand from USD 9.65 billion in 2026 to USD 17.08 billion by 2035, growing at a CAGR of 6.55%. This report covers complete segmentation by packaging type, material type (bioplastics, paper, mono-material films), and application across pharmaceuticals, diagnostics, and medical devices. It includes detailed regional analysis for North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, along with profiles of leading companies, competitive benchmarking, value chain assessment, and trade flow data for imports and exports of sustainable medical packaging materials and finished products.

Key Insights

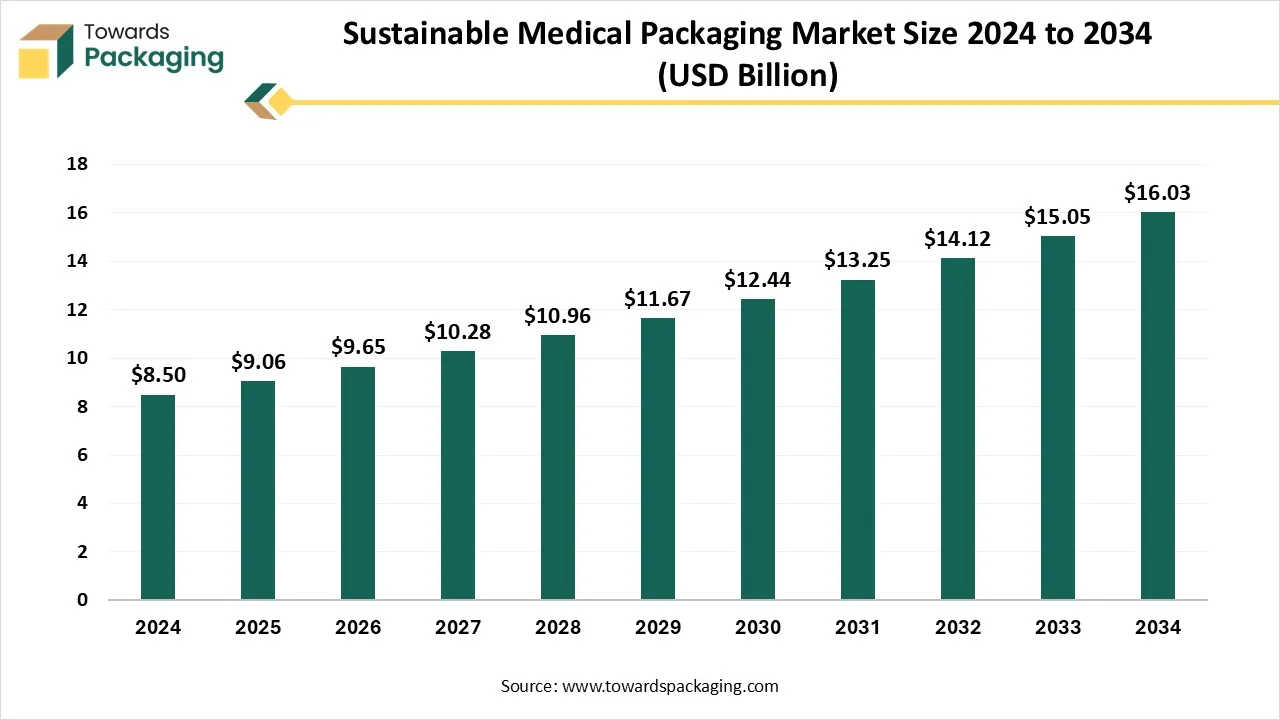

- In terms of revenue, the market is valued at USD 9.06 billion in 2025.

- The market is projected to reach USD 16.03 billion by 2034.

- Rapid growth at a CAGR of 6.55% will be observed in the period between 2025 and 2034.

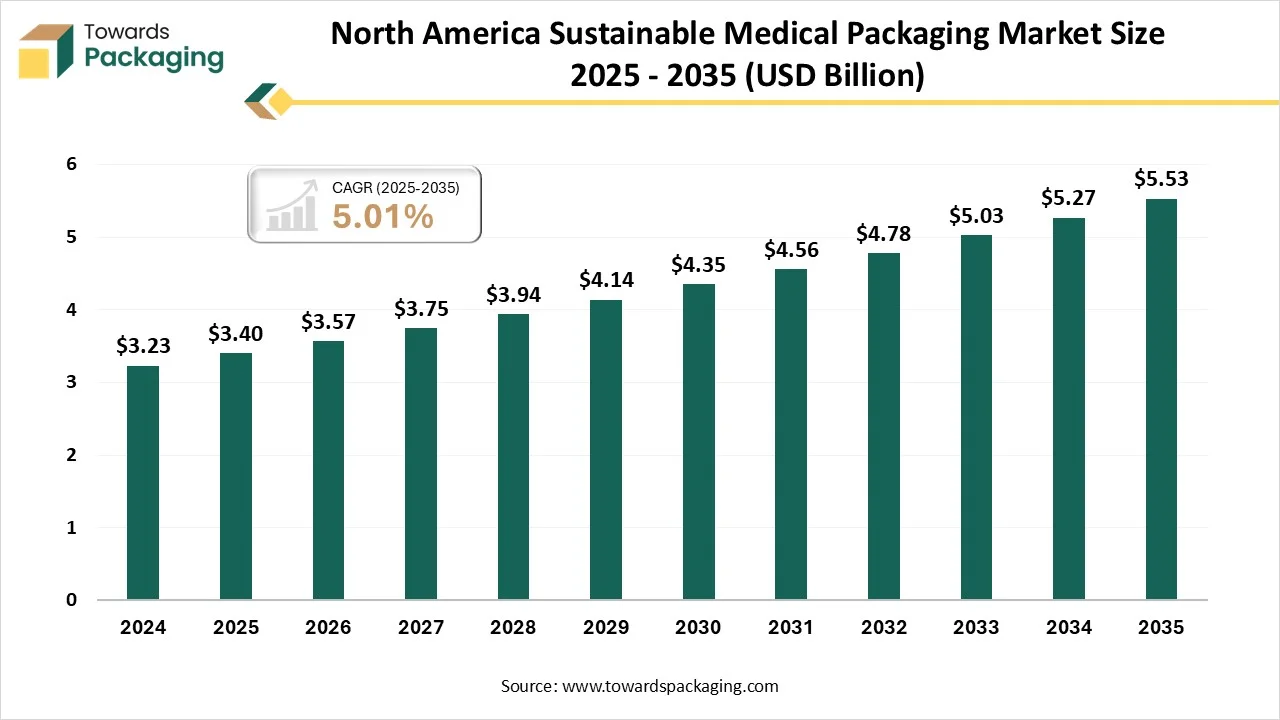

- North America dominated the global sustainable medical packaging market in 2024.

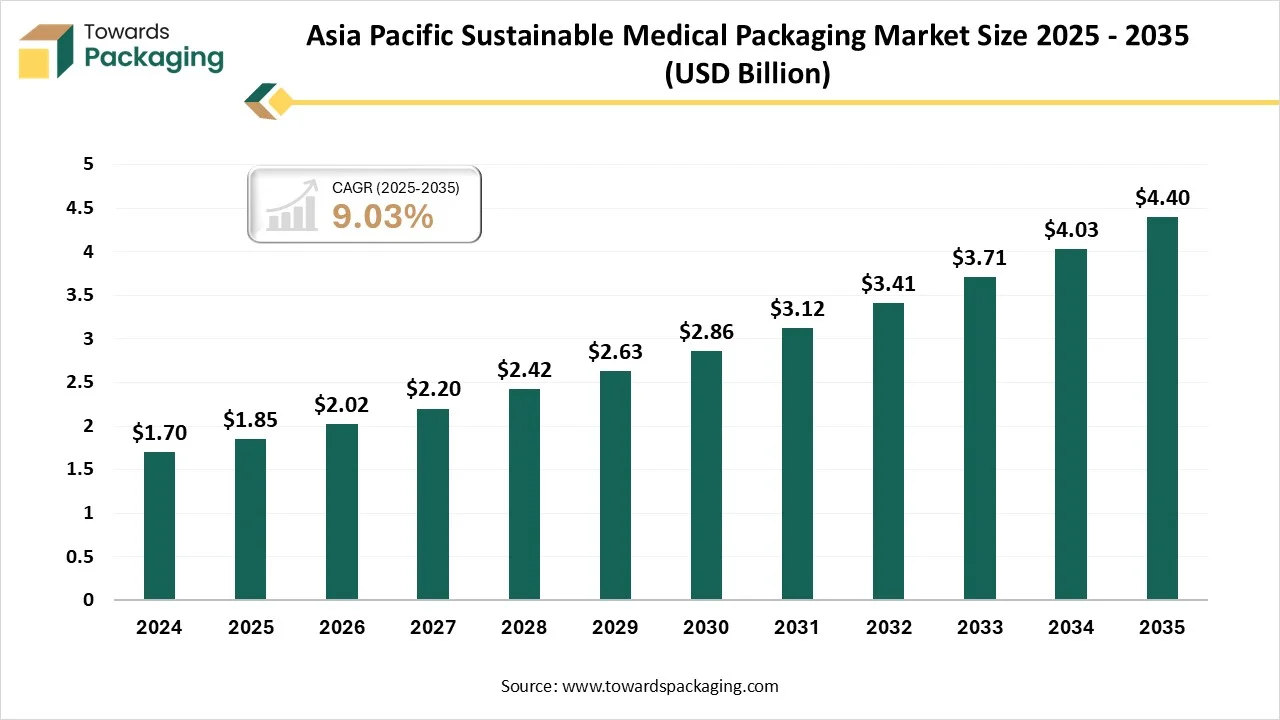

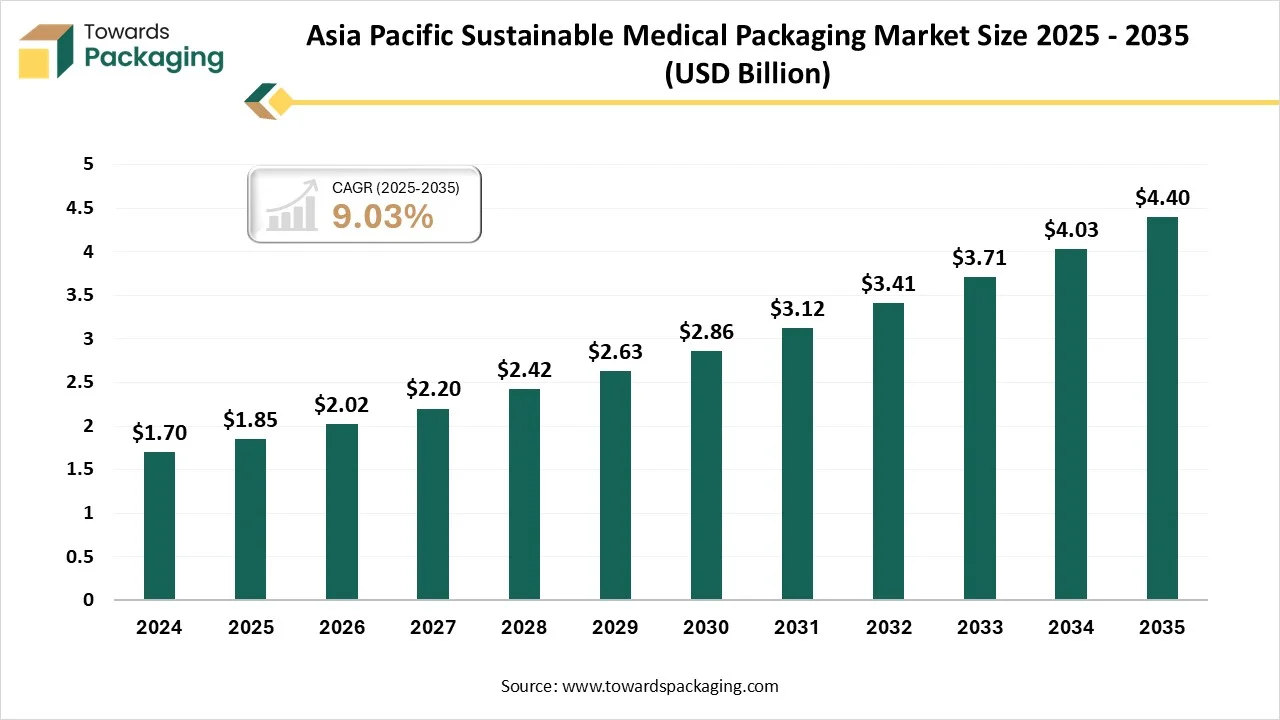

- Asia Pacific is expected to grow at a significant CAGR in the market during the forecast period.

- The European market is expected to grow at a notable CAGR in the foreseeable future.

- By material type, the plastic segment dominated the market with the largest share in 2024.

- By material type, the paper & paperboard segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By packaging type, the primary packaging segment dominated the market in 2024.

- By packaging type, the tertiary packaging segment is expected to grow at the fastest CAGR in the forecast period.

- By functionality, the protective packaging segment dominated the market in 2024.

- By functionality, the shelf life extension segment is expected to grow at the fastest CAGR in the forecast period.

- By end-user industry, the pharmaceuticals segment dominated the market with the largest share in 2024.

- By end-user industry, the medical devices & equipment segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

What is Meant by Sustainable Medical Packaging?

The Sustainable Medical Packaging Market refers to the sector of the healthcare industry focused on packaging materials and solutions that are environmentally friendly, energy-efficient, and made from renewable or recyclable resources. These packaging materials are designed to protect medical products like pharmaceuticals, medical devices, and diagnostics while minimizing environmental impact. Sustainable medical packaging is an essential element in the effort to reduce the carbon footprint of the healthcare sector and improve sustainability in the supply chain. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing sustainable medical packaging.

Sustainable medical packaging refers to the development and use of packaging materials and systems in the healthcare sector that minimize environmental impact while maintaining product safety, integrity, and regulatory compliance. It focuses on using renewable, recyclable, biodegradable, or reusable materials that reduce carbon footprint, energy consumption, and waste generation throughout the packaging life cycle. This approach includes optimizing packaging design to reduce material usage, selecting eco-friendly alternatives such as bioplastics or paper-based solutions, and adopting manufacturing practices that lower emissions and water usage. Sustainable medical packaging also ensures sterility, barrier protection, and durability, essential for maintaining the efficacy and safety of medical devices, pharmaceuticals, and diagnostic tools. Regulatory compliance with healthcare standards like ISO 11607, along with the integration of circular economy principles, supports the safe recovery or recycling of packaging after use.

What are the New Trends in the Sustainable Medical Packaging Market?

Material Innovation

- Biodegradable and Compostable Materials: There's growing adoption of biopolymers such as polylactic acid (PLA), starch-based films, and cellulose-derived materials, which break down naturally without harming the environment.

- Paper-Based and Fiber-Based Packaging: Recyclable paper trays and molded fiber are replacing traditional plastic in some non-critical applications, especially for secondary and tertiary packaging.

- Mono-Material Films: Single-polymer packaging films (like 100% polyethylene or polypropylene) are being used for easier recyclability compared to multi-layered composites.

Regulatory and Compliance-Driven Sustainability

- Extended Producer Responsibility (EPR): Governments in Europe and parts of North America are enforcing stricter EPR norms, pushing medical packaging manufacturers to invest in sustainable design and post-use collection programs.

- ISO 14001 and Life Cycle Assessments (LCA): Companies are increasingly aligning with international standards for environmental management and conducting LCAs to evaluate the carbon footprint of packaging.

Design Optimization and Lightweighting

- Minimalist Packaging: Reducing the volume and weight of packaging materials without compromising product protection is a key trend. This helps reduce transportation emissions and material usage.

- Smart Structural Design: Use of form-fitting packages that eliminate unnecessary padding and void spaces is becoming common, particularly for medical devices and diagnostic kits.

Digitalization and Smart Packaging

- QR Codes and Track-and-Trace Features: Digital elements embedded in packaging reduce the need for additional printed inserts, reducing paper waste. They also enhance traceability and compliance.

- Blockchain for Transparency: Emerging use of blockchain ensures full traceability of packaging materials through the supply chain, improving transparency and supporting green claims.

Recyclability and Circular Economy Focus

- Closed-Loop Recycling Initiatives: Manufacturers are participating in programs where medical packaging waste is collected, processed, and turned into new packaging products.

- Take-Back Schemes: Particularly in hospitals, reusable and recyclable containers are being implemented along with proper collection systems for sterilization and reuse.

Sustainable Inks and Coatings

- Water-Based and Soy-Based Inks: These alternatives to solvent-based inks reduce volatile organic compound (VOC) emissions and make packaging safer for incineration or recycling.

- Compostable and Barrier Coatings: Use of plant-based coatings on paper to provide moisture and oxygen barriers is on the rise, especially for unit-dose packaging.

Automation and Clean Manufacturing

Collaboration Across Supply Chain

- Cross-Industry Alliances: Packaging companies are increasingly collaborating with healthcare providers, recyclers, and material scientists to develop sustainable, compliant solutions.

- Supplier Audits and Certifications: More companies demand proof of sustainable sourcing and ethical practices from their packaging suppliers.

How can AI Improve the Sustainable Medical Packaging Industry?

Artificial intelligence (AI) integration can significantly enhance the sustainable medical packaging industry by driving efficiency, precision, and innovation across the value chain. AI can optimize packaging design by analyzing large datasets to recommend materials and structures that reduce waste while maintaining safety and regulatory compliance. Through predictive modelling, AI can forecast demand more accurately, minimizing overproduction and inventory waste. In manufacturing, AI-powered systems can detect defects, monitor machinery in real-time, and suggest process improvements that lower energy use and raw material consumption.

AI supports the development of intelligent packaging solutions, such as incorporating QR codes or sensors that monitor product condition and reduce unnecessary repackaging. In supply chain logistics, AI algorithms optimize transportation routes and load planning to cut down on emissions. Furthermore, AI can enhance recyclability by improving waste sorting technologies and identifying materials for reuse or recycling. Overall, AI integration promotes a smarter, more circular approach to sustainable medical packaging.

Market Dynamics

Drivers

Rising Environmental Concerns

Increasing awareness about plastic pollution and its harmful effects on the environment has pushed both consumers and manufacturers toward eco-friendly alternatives. This demand for greener solutions is encouraging the development of biodegradable, recyclable, and reusable medical packaging materials.

Strict Government Regulations

Governments and regulatory bodies around the world are implementing stringent environmental and packaging waste management policies. Compliance with regulations such as the European Union’s Packaging and Packaging Waste Directive and Extended Producer Responsibility (EPR) laws is prompting companies to adopt sustainable packaging practices.

Growth in Healthcare and Pharmaceutical Sectors

The expansion of the global healthcare and pharmaceutical industries, especially in developing regions, has increased the demand for medical packaging. With this growth comes a parallel push for sustainability as healthcare providers and pharmaceutical companies aim to reduce their environmental footprint.

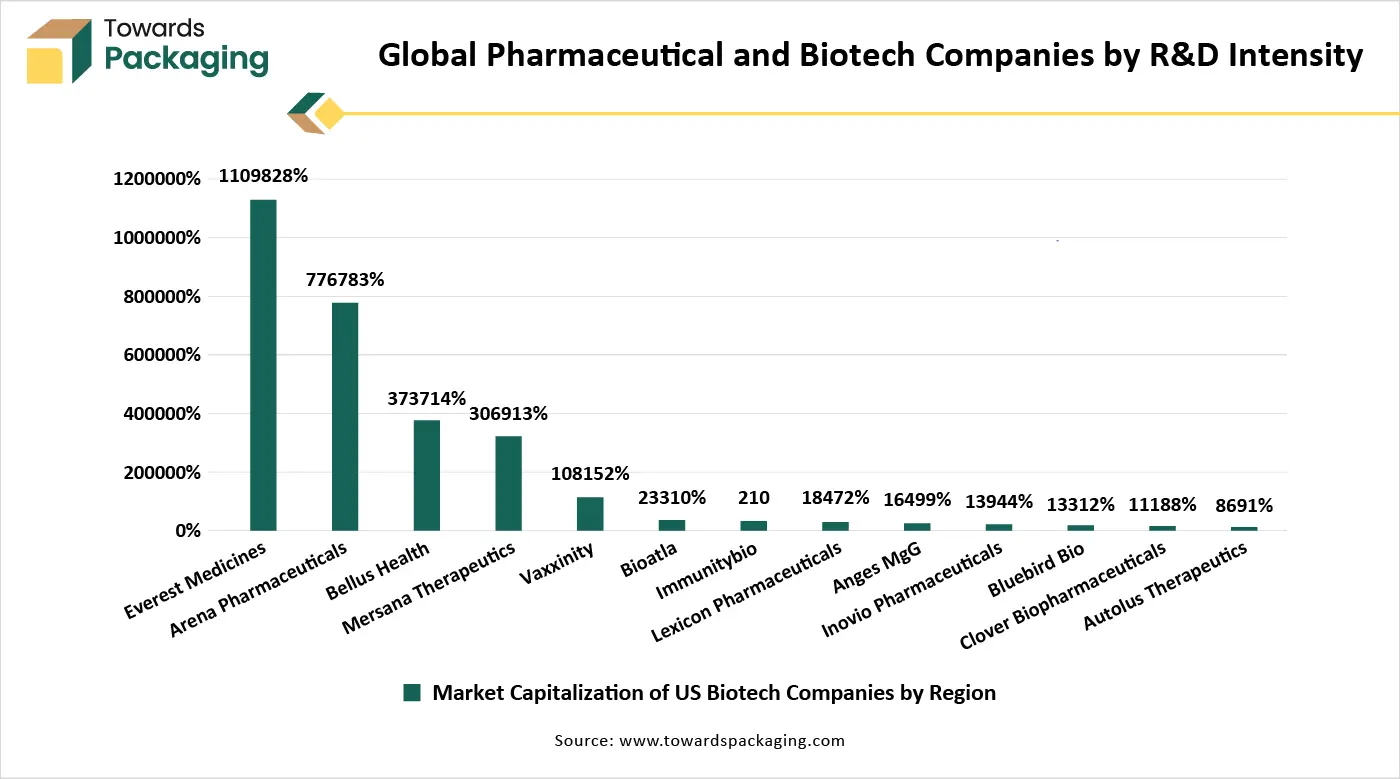

The pharmaceutical sector in India is specifically expected to expand by 7.8% annually in April 2025, propelled by robust demand and government initiatives. The pharmaceutical industry's global deal activity hit $6.96 billion with significant mergers and acquisitions in May 2025. Moreover, the sector is witnessing a transition to globally scalable models and a sustained emphasize on research and development, with businesses examining different tactics to improve their market positions.

Restraint

Stringent Regulatory Requirements & Limited Material Performance

The key players operating in the market are facing issues due to stringent regulatory laws and limited material performance, which is estimated to restrict the growth of the market over the forecast period. Medical packaging must comply with strict safety, sterility, and barrier protection standards. Sustainable materials sometimes struggle to meet these criteria, especially in terms of durability, contamination resistance, and shelf life, which limits their use in critical applications like surgical instruments or injectable drugs. Some eco-friendly materials may lack the mechanical strength, moisture resistance, or sealing properties required in certain medical environments. This performance gap restricts their application, particularly in primary packaging that comes in direct contact with medical products.

What are the Opportunities for the Growth of the Sustainable Medical Packaging Market?

Expansion in Emerging Markets

Developing regions in Asia, Africa, and Latin America are experiencing rapid growth in healthcare infrastructure. This expansion offers a significant opportunity for sustainable packaging companies to introduce eco-friendly solutions from the start, as these regions modernize their medical systems and become more environmentally conscious.

Rising Demand for Eco-Friendly Pharmaceuticals

Pharmaceutical companies are under growing pressure to adopt sustainable practices. As these companies shift toward green operations, there is increasing demand for sustainable packaging that aligns with their environmental commitments, creating a vast market opportunity.

Innovation in Biodegradable and Recyclable Materials

Ongoing research and innovation in materials science, such as advanced bioplastics, water-soluble films, and fiber-based composites, are opening up new avenues for high-performance sustainable packaging that meets medical standards. These innovations allow for broader adoption in primary and secondary packaging.

Government Incentives and Policies

Supportive government policies and funding for sustainable practices present opportunities for growth. Subsidies, tax breaks, and green procurement policies for healthcare institutions can accelerate the adoption of sustainable packaging across the public and private healthcare sectors.

Circular Economy and Waste Recovery Models

The shift toward circular economy models creates opportunities for companies offering reusable packaging solutions, take-back programs, and closed-loop recycling systems. Hospitals and healthcare providers are increasingly open to sustainable waste management partnerships.

Segmental Insights

Why does the Plastic Segment Dominate the Sustainable Medical Packaging Market?

The plastic segment holds dominance in the sustainable medical packaging market due to its versatility, durability, and superior barrier properties. Plastic materials offer excellent protection against moisture, contaminants, and physical damage, making them ideal for preserving the sterility and safety of medical products. Additionally, advancements in biodegradable and recyclable plastics have significantly enhanced the segment's sustainability profile, aligning with global environmental regulations and healthcare sustainability goals. The lightweight nature of plastic also reduces transportation emissions and logistics costs, further supporting its widespread adoption. Moreover, plastics can be easily molded into various shapes and formats, such as pouches, blister packs, and bottles, which cater to the specific needs of different medical products and devices. These combined advantages position plastic as the preferred material in sustainable medical packaging solutions.

Paper and Paperboard Segment Grow at Fastest Rate

The paper and paperboard segment is the fastest‑growing in sustainable medical packaging because it aligns strongly with eco‑friendly mandates and industry needs. Rising regulatory pressures and consumer demand are encouraging pharmaceutical firms to shift from plastics to recyclable and biodegradable paper-based options, especially where medical-grade coated paperboard now supports moisture‑proof, child‑resistant, tamper-evident designs while ensuring recyclability. Technological advances, including fiber-based barrier coatings and digital printing, enhance performance, brandability, and compatibility with automated packaging lines. Ultimately, paperboard offers a renewable, customizable, and trusted material that meets sustainability goals without compromising pharmaceutical packaging safety and functionality.

Which Packaging Type Dominated the Sustainable Medical Packaging Market?

The primary packaging segment dominates the sustainable medical packaging market due to its direct role in protecting and preserving the integrity of medical products. It serves as the first layer of containment, ensuring sterility, safety, and accurate dosage delivery for pharmaceuticals, medical devices, and diagnostic products. The demand for sustainable materials in primary packaging has grown as healthcare providers and regulators increasingly prioritize eco-friendly solutions without compromising product efficacy. Innovations in biodegradable plastics, recyclable blister packs, and compostable films have further strengthened this segment. Additionally, primary packaging is critical for patient compliance and regulatory labeling, reinforcing its indispensable role in medical packaging.

Tertiary Packaging Segment to Grow at Fastest Rate

The tertiary packaging segment is experiencing the fastest growth in sustainable medical packaging, largely due to its critical role in bulk transport, logistics efficiency, and environmental impact reduction. As pharmaceutical shipments scale up globally, the demand for sustainable solutions, such as recyclable or reusable shipping containers, pallets, and stretch films, has surged to minimize carbon footprints across long‐distance supply chains. Innovations in smart tertiary packaging, including IoT and RFID integration, support real‐time tracking and temperature monitoring, enhancing product safety and operational transparency. Combined with regulatory pressures and cross‑industry collaboration, these factors make tertiary packaging the fastest‑growing category in sustainable medical packaging.

Why does the Pharmaceutical Segment Dominate the Sustainable Medical Packaging Market?

The pharmaceutical segment dominates the sustainable medical packaging market primarily because pharmaceutical manufacturers themselves represent the largest and most direct users of medical packaging solutions. These companies are under increasing pressure from regulators, healthcare providers, and environmentally conscious patients to reduce waste, carbon footprint, and reliance on virgin materials, accelerating their shift toward recyclable, biodegradable, or renewable packaging systems. By actively collaborating on circular economy platforms, power‑purchase agreements, and shared sustainability targets across suppliers, pharmaceutical firms drive broad adoption of eco‑innovations such as plant‑based plastics, mono‑materials, and paper‑based blister packs. Their volume of production, global scale, and role as regulatory frontrunners reinforce their dominant position in shaping the sustainable packaging landscape.

Medical Devices and Equipment Segment to Grow at Fastest Rate

The medical devices and equipment segment is the fastest‑growing in the sustainable medical packaging market due to several converging trends. First, the rise in home‑healthcare and point‑of‑care devices demands sterile, user‑friendly packaging that supports patient self‑use and compliance. Second, regulatory standards (e.g., ISO 11607, FDA) drive innovators to adopt low‑carbon, recyclable materials like mono‑film barrier coatings and Tyvek trays that maintain sterilization integrity while lowering environmental impact. Third, demand for smart, traceable packaging embedding RFID, blockchain, and IoT sensors is rising sharply in device shipments to ensure safety and supply‑chain transparency. Finally, emerging market expansion in Asia Pacific, with rapidly growing device manufacturing and regulatory alignment, fuels packaging innovation and scale in this segment.

Why does the protective packaging Segment Dominate the Sustainable Medical Packaging Market?

The protective packaging segment dominates the functionality category in the sustainable medical packaging market due to its essential role in safeguarding medical products during storage, handling, and transportation. Medical items such as vaccines, diagnostic kits, surgical instruments, and sensitive devices require robust protection against physical damage, contamination, and temperature fluctuations. Sustainable protective solutions such as molded pulp inserts, biodegradable foams, and recyclable cushioning materials offer durability while meeting environmental goals. The growing emphasis on sterility, patient safety, and regulatory compliance further drives the need for high-performance protective packaging. Its ability to combine product safety with eco-friendliness positions this segment as the most dominant in functionality.

Shelf-Life Extension Segment to Grow at Fastest Rate

The shelf‑life extension segment is the fastest‑growing functionality category in sustainable medical packaging, driven by escalating demand for eco‑innovative solutions that preserve potency, sterility, and safety over longer periods. Active and high‑barrier films featuring oxygen/moisture scavengers and antimicrobial agents play a key role in preventing degradation and contamination during storage, reducing waste. These technologies, such as controlled-release antimicrobial coatings and gas-scavenging layers, maintain efficacy without sacrificing recyclability or biodegradability. Regulatory focus on sterile biologics and cold‑chain integrity further accelerates adoption. Moreover, sustainable barrier innovations extend shelf life while meeting pharmaceutical safety standards and environmental goals.

Regional Insights

Which Region Dominated in the Sustainable Medical Packaging Market?

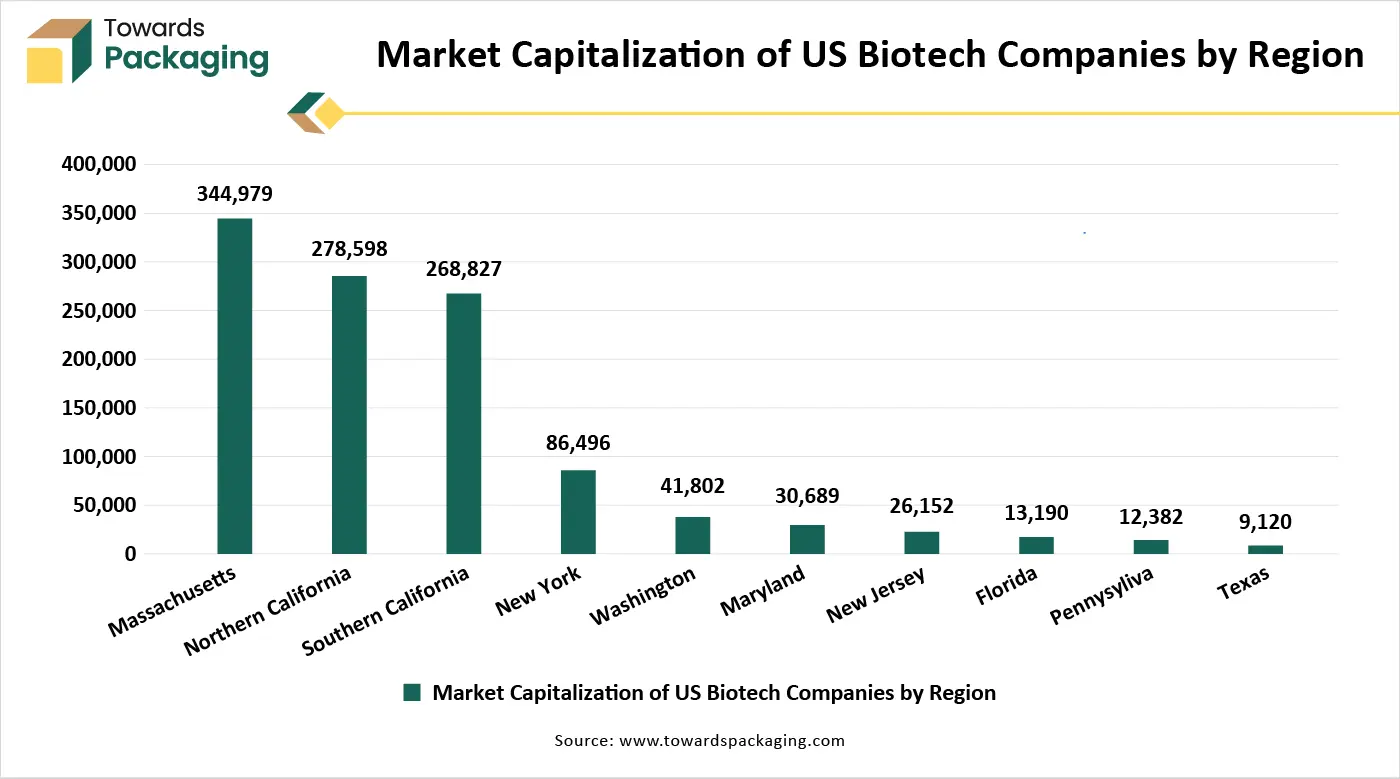

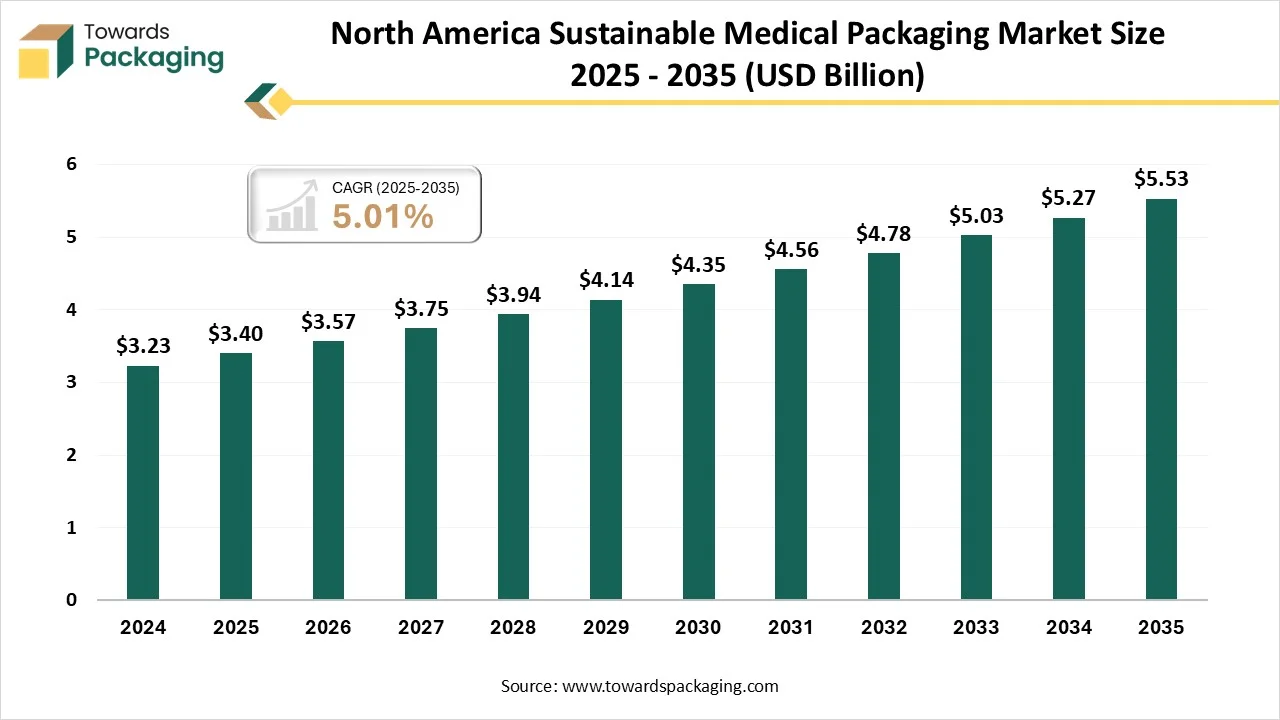

North America is the dominant region in the sustainable medical packaging market due to a combination of advanced healthcare infrastructure, strong regulatory frameworks, and high environmental awareness. The region has a well-established pharmaceutical and medical device industry that is increasingly adopting eco-friendly packaging solutions to meet both environmental goals and strict compliance standards.

Government regulations, such as those set by the U.S. Environmental Protection Agency and the Food and Drug Administration, encourage the use of recyclable and biodegradable materials in medical packaging. Additionally, North American companies invest heavily in research and development, promoting innovations in bioplastics, mono-material films, and reusable packaging systems. Consumer demand for sustainable healthcare products and institutional pressure further support the region’s leadership in this market.

U.S. Market Trends

The United States holds the largest share in the North American sustainable medical packaging market, driven by a mature healthcare system, strong regulatory compliance, and high investments in research and development. The presence of major pharmaceutical and medical device manufacturers fosters the rapid adoption of innovative, eco-friendly packaging materials. Regulatory bodies like the FDA and EPA encourage sustainable practices, while government initiatives and corporate sustainability goals push companies to use recyclable, reusable, and biodegradable materials. Additionally, consumer demand for green healthcare products and packaging is steadily rising, further reinforcing market growth.

Canada Market Trends

Canada is witnessing steady growth in the sustainable medical packaging market due to increasing environmental regulations, a proactive healthcare system, and growing public awareness. The Canadian government promotes the use of sustainable materials through green procurement policies in healthcare services. Canadian manufacturers are also adopting circular economy principles, encouraging the use of recyclable and compostable packaging. Support for healthcare innovation and clean technology makes Canada a promising market for advanced sustainable packaging solutions.

What Promotes the Growth of the Asia Pacific Sustainable Medical Packaging Market?

Asia-Pacific is the fastest-growing region in the sustainable medical packaging market due to the rapid expansion of healthcare infrastructure, increasing pharmaceutical production, and rising environmental consciousness across developing economies. Countries such as China, India, Japan, and South Korea are experiencing strong growth in their medical and pharmaceutical sectors, which is driving demand for reliable and eco-friendly packaging solutions.

Government initiatives promoting environmental sustainability, along with stricter regulations on plastic waste and packaging materials, are encouraging the adoption of recyclable and biodegradable options. Additionally, the growing middle-class population and increased healthcare access have led to higher consumption of medical products, thereby creating a greater need for sustainable packaging. Technological advancements and foreign investments in manufacturing facilities are further supporting innovation in sustainable materials and packaging formats across the region.

China Market Trend

China plays a leading role in the Asia-Pacific sustainable medical packaging market due to its vast pharmaceutical manufacturing base and strong government push toward environmental sustainability. The country has implemented stringent regulations on single-use plastics and packaging waste, prompting manufacturers to explore biodegradable and recyclable alternatives. Additionally, China’s investments in green technologies and eco-friendly materials support the rapid transition to sustainable packaging solutions in both public and private healthcare sectors.

India Market Trend

India is a major contributor to the region's growth, driven by its rapidly expanding pharmaceutical industry and growing awareness of environmental issues. Government initiatives such as the “Swachh Bharat Abhiyan” and policies promoting plastic waste reduction have encouraged the adoption of sustainable packaging in medical and healthcare products. The rise in domestic healthcare consumption and the presence of a large generics market provide a strong foundation for eco-conscious packaging innovations.

Japan Market Trend

Japan contributes significantly to the market through its advanced healthcare system, high environmental standards, and strong technological expertise. The country has strict waste management policies and promotes the use of recyclable and energy-efficient packaging materials. Japanese companies focus on minimalistic, high-performance packaging solutions that balance environmental impact with safety and regulatory compliance, making the country a key player in the region.

South Korea Market Trend

South Korea supports the market with its focus on digital healthcare, sustainable innovation, and eco-friendly regulations. The government actively promotes green technology in packaging and offers support for companies adopting low-impact materials. South Korean manufacturers are known for developing high-quality, sustainable medical packaging products that meet global standards.

Europe’s Stringent Regulations to Promote Notable Growth

Europe is growing at a notable rate in the sustainable medical packaging market due to its strong regulatory framework, high environmental awareness, and commitment to circular economy principles. The European Union's strict packaging waste directives and single-use plastic bans are driving the adoption of recyclable, biodegradable, and reusable materials in the medical sector. Countries like Germany, France, and the Netherlands are leading in the implementation of green healthcare practices. Additionally, investments in research and development, combined with well-established pharmaceutical and medical device industries, support innovation in eco-friendly packaging solutions that meet both sustainability goals and regulatory compliance.

Top Sustainable Medical Packaging Market Players

Latest Announcements by Industry Leaders

- In December 2024, LOG's chief executive officer, Shaul Bassi, stated that the new eco line product reflects LOG Pharma Primary Packaging company’s dedication to providing environment-friendly, sustainable barrier bottles at competitive prices. A number of barrier bottles that the R&D team has created offer outstanding defense against moisture and oxygen, great cost savings, and environmental friendliness.

New Advancements in the Market

- In April 2025, Nelipak Corporation, a leading global manufacturer of packaging solutions for diagnostic, pharmaceutical drug delivery, medical device, and other demanding applications, revealed the expansion of its Serve in the Asia-Pacific Region. Among the medical packaging products offered by Nelipak is are extensive selection of specially made sterile-barrier packaging options. The flexible packaging product from Nelipak Die-cut sheets and lids, bags, pouches, and coated roll-stock are all part of this line.

- In February 2025, Avantium N.V. and Amor Rigid Packaging USA, LLC signed a partnership to investigate the plant-based polymer from the expert in circular and renewable polymer materials -material PEF, Releaf. The two will collaborate to determine the material's potential when utilized with products such as food and drink in rigid containers, medical, personal, home, and pharmaceutical products.

Global Sustainable Medical Packaging Market

By Material Type

- Paper & Paperboard

- Biodegradable

- Recycled Paper

- Plastic

- Bio-based Plastics (e.g., PLA, PHA)

- Recycled Plastics (rPET, rHDPE)

- Biodegradable Plastics

- Glass

- Metals

- Aluminum

- Recycled Aluminum

- Composites

- Plant-based Composites

- Hybrid Materials

By Packaging Type

- Primary Packaging

- Blister Packs

- Bottles & Jars

- Pouches & Sachets

- Ampoules & Vials

- Tubes

- Secondary Packaging

- Tertiary Packaging

- Shrink Films

- Palletizing Films

- Strapping Materials

By End-User Industry

- Pharmaceuticals

- Medical Devices & Equipment

- Biotechnology

- Hospitals & Healthcare Providers

By Functionality

- Protective Packaging

- Shock & Vibration Protection

- Barrier Protection (e.g., moisture, light, air)

- Shelf Life Extension

- Tamper Evidence

- User Convenience

- Easy-to-Open Designs

- Ergonomics & Portability

By Region

- North America

- Europe

-

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait