The Corrugated Sheet Board market is booming, poised for a revenue surge into the hundreds of millions from 2026 to 2035, driving a revolution in sustainable transportation. This comprehensive report covers key market drivers including e-commerce expansion, sustainability demand, and technological advancements like AI and digital printing. It provides detailed segmentation by type, flute type, material, grade, printing technology, and end-use industries such as food & beverages, electronics, and FMCG.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing corrugated sheet board. The corrugated sheet board market has experienced steady growth due to rising demand for sustainable and lightweight packaging solutions across industries such as e-commerce, food and beverage, and electronics. Advancements in digital printing and automation have enhanced production efficiency and customization capabilities.

Corrugated sheet board, also known as corrugated cardboard, is a versatile packaging material made from a fluted corrugated sheet sandwiched between one or two flat linerboards. The fluted inner layer provides strength and cushioning, making it ideal for protecting goods during storage and transportation. Corrugated sheet boards are widely used in manufacturing boxes, cartons, and packaging containers for various industries, including retail, food and beverage, electronics, and logistics. They are lightweight, durable, and recyclable, offering both cost-effectiveness and environmental benefits. The structure of corrugated sheet board can vary depending on the application, with different flute sizes and board combinations offering varying levels of protection and rigidity. Due to their strength, adaptability, and eco-friendly nature, corrugated boards are a preferred choice in modern packaging solutions.

| Metric | Details |

| Key Drivers | E-commerce growth, Sustainability demand, Technological advancements |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Flute Type, By Material, By Grade, By Printing Technology, By End-Use Industry, and By Region |

| Top Key Players | International Paper, Georgia-Pacific, WestRock Company, Packaging Corporation of America, Stora Enso, Oji Holdings Corporation |

AI integration can significantly enhance the efficiency, quality, and sustainability of the corrugated sheet board industry by improving various stages of production and supply chain management. One of the primary benefits is predictive maintenance. By analyzing sensor data from machinery, AI can forecast when maintenance is needed, helping reduce unexpected breakdowns, lower maintenance costs, and extend the lifespan of equipment. In addition, AI-driven computer vision systems can be used for real-time quality control and defect detection, ensuring product consistency and minimizing waste by identifying issues such as warping, incorrect dimensions, or surface blemishes more accurately than manual inspection.

AI also plays a vital role in optimizing inventory and demand forecasting. By analyzing historical sales data, seasonal trends, and market patterns, AI algorithms can improve production planning, reduce overproduction, and prevent stockouts. This leads to more efficient inventory management and less material waste. Furthermore, AI can optimize manufacturing processes by adjusting parameters like temperature, pressure, and speed in real time, which increases throughput, reduces energy consumption, and improves overall production efficiency. In terms of supply chain management, AI can analyze logistics data and raw material trends to identify bottlenecks and predict price fluctuations, resulting in reduced procurement costs and more reliable delivery timelines.

Additionally, AI contributes to sustainability efforts by optimizing cutting patterns to reduce scrap, improving recycling processes, and lowering energy usage, ultimately helping companies reduce their carbon footprint and comply with environmental regulations. For example, a corrugated sheet plant that integrates an AI-powered vision system for quality control may achieve a 15% reduction in material waste and a 20% improvement in product consistency within six months. Overall, AI provides a transformative opportunity for the corrugated sheet board industry to streamline operations, cut costs, and meet evolving quality and environmental standards.

E-commerce Boom and Rise in Retail Sales

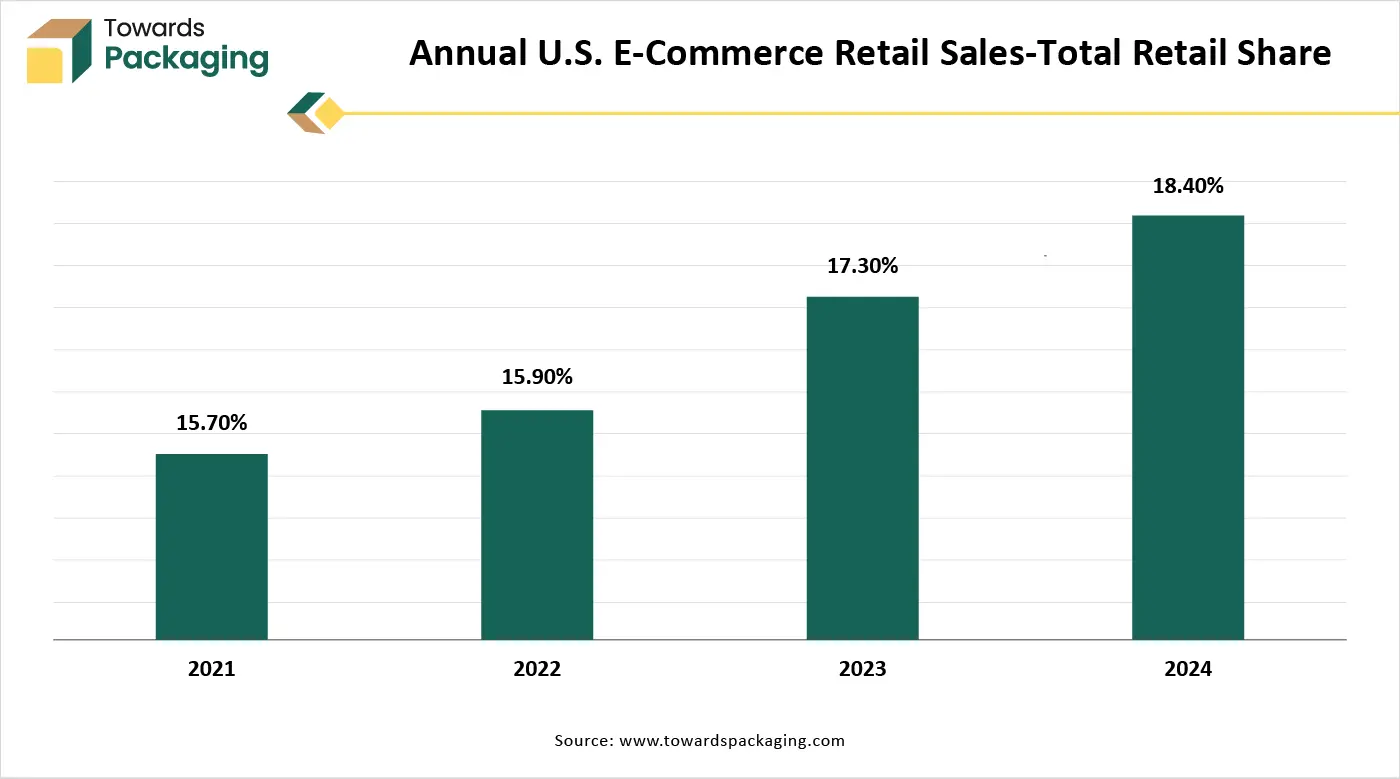

The rapid expansion of e-commerce and online retail is one of the most significant growth drivers. Corrugated boxes are widely used for packaging due to their lightweight, protective, and cost-effective nature. As more consumers shop online, especially post-pandemic, the demand for durable and sustainable packaging has surged. According to the data published by the National E-commerce Association, the U.S. is Amazon.com's biggest market, and Hobby and Leisure accounts for 37.7% of its total e-commerce sales. In 2024, Amazon's online sales reached USD$ 147.6 billion, a 6.22% increase over 2023.

Competition from Alternative Packaging Materials and High Energy Consumption in Manufacturing

Plastic, flexible packaging, rigid plastics, and biodegradable alternatives offer specific advantages like moisture resistance, durability, or lighter weight. Sectors like food and pharmaceuticals may favour alternatives over corrugated boards for better barrier properties. The production process is energy-intensive, particularly during pulping and drying. Rising energy costs can deter investment or strain operational costs.

Growing environmental awareness and regulations around plastic use have pushed businesses toward recyclable and biodegradable packaging options. Corrugated sheet boards are made primarily from paper and are recyclable, making them a preferred alternative to plastic-based packaging.

The food and beverage sector increasingly relies on corrugated packaging for both retail and transit packaging due to hygiene, customizability, and safety. Corrugated materials help maintain product integrity, especially in fresh produce, dairy, and beverages.

As emerging economies expand their manufacturing and logistics sectors, the need for protective, efficient packaging materials grows. Corrugated sheets provide the cushioning and durability needed to transport a wide range of industrial goods.

Modern production technologies like digital printing, automation, and AI integration have made it easier and more cost-effective to produce customized and high-quality corrugated boards. This has widened their applications and improved profit margins.

The rising demand for packaged personal care, household, and healthcare products increases the use of corrugated packaging. Its ability to be printed with branding and product information also supports marketing efforts in this highly competitive space.

With the growth of international trade, there is a greater need for reliable packaging that ensures product safety over long distances. Corrugated sheet boards are a go-to choice due to their strength, light weight, and stackability.

As urban populations grow and consumer habits shift toward convenience and delivery-based purchases, demand for smart, protective, and presentable packaging continues to rise. Corrugated packaging fits these needs effectively.

The single face segment holds a dominant presence in the market as it is lightweight yet strong. Single-face corrugated sheet board is extensively used in packaging due to its combination of lightweight structure, cost efficiency, and protective qualities. Comprising one flat liner and one fluted (corrugated) sheet, this material offers a high strength-to-weight ratio, making it ideal for protecting fragile items without significantly increasing overall package weight. This feature not only ensures product safety but also reduces shipping costs. Its flexible design allows it to conform easily to irregular shapes such as bottles or tools, making it especially useful for wrapping or cushioning products inside larger boxes.

Additionally, the fluted layer provides excellent shock absorption, helping to protect items from impact during transit. Single-face corrugated board is also an economical option, as it uses less material compared to double- or triple-wall corrugated boards, reducing manufacturing costs. It can be easily cut, folded, or customized into different shapes, offering versatility across a range of packaging applications. Furthermore, the linear surface allows for good printability, which is advantageous for labeling and branding. Being made from recycled materials and fully recyclable itself, it is an environmentally friendly choice that supports sustainable packaging practices. These combined benefits make single-face corrugated sheet board a popular and practical solution for a wide variety of packaging needs.

The c flute segment accounted for the dominant revenue share of the corrugated sheet board market in 2024. C-type corrugated flute sheet board is widely used in packaging due to its well-balanced combination of strength, cushioning, and versatility. The “C-flute” has approximately 38–41 flutes per linear meter and a thickness of about 3.5–4.0 mm, offering a good compromise between stacking strength and cushioning ability. This makes it ideal for a broad range of packaging applications, particularly where both protection and durability are essential. C-flute boards are strong enough to withstand crushing forces during shipping and stacking, making them suitable for packaging heavier or fragile products. At the same time, the flutes provide excellent cushioning, reducing the risk of damage during handling and transportation.

Additionally, C-flute has a relatively smooth surface, which supports high-quality printing and labeling, an important factor in retail and branded packaging. Its versatility allows it to be used for packaging across various industries, including food, electronics, consumer goods, and industrial parts. Moreover, like other corrugated boards, C-flute is often made from recycled paper, and it is fully recyclable and biodegradable, supporting environmentally conscious packaging practices. Due to its balance of strength, protection, and printability, C-type corrugated flute sheet board has become one of the most commonly used types in the packaging industry.

The recycled paper segment dominates the market due to environmental sustainability and energy, and water savings. Recycled paper is extensively used in manufacturing corrugated sheet board due to its cost-effectiveness, environmental benefits, and practical performance. It is cheaper than virgin paper and reduces the need for raw materials, conserving trees and lowering energy and water consumption. This makes it a sustainable choice, supporting eco-friendly practices and meeting increasing regulatory and consumer demand for green packaging. Despite being recycled, the paper maintains sufficient strength for packaging, especially when used in the corrugated structure that adds rigidity and cushioning. Recycled paper corrugated boards are lightweight, customizable, and recyclable, making them ideal for shipping, storage, and branding across various industries. Their balance of affordability, durability, and environmental friendliness makes them a preferred material for modern packaging solutions.

The linerboard segment accounted for the dominant revenue share of the corrugated sheetboard market in 2024. Linerboard grade corrugated sheet board is extensively used for packaging because it provides a strong, durable, and reliable outer surface for corrugated boards. Linerboard is typically made from kraft or recycled paper and serves as the flat, smooth facing on one or both sides of the fluted (corrugated) medium. Its primary function is to give the packaging structural strength, resistance to moisture, and surface quality for printing and labeling. This grade is ideal for packaging because it can withstand pressure, stacking, and handling stresses during shipping and storage. It also offers good printability, which is essential for branding and product information. Additionally, linerboard is available in various weights and finishes, making it adaptable for a wide range of packaging needs, from lightweight consumer goods to heavy industrial items. Its combination of strength, appearance, and cost-efficiency makes it a preferred material in the global packaging industry.

The flexographic printing segment dominates the market due to its suitability for printing on rough surfaces. Flexographic printing is used extensively for corrugated sheet board packaging because it is fast, cost-effective, and well-suited for printing on rough, absorbent surfaces like cardboard. This printing method uses flexible rubber or polymer plates and quick-drying, water-based inks, allowing for high-speed production and minimal setup time, which is ideal for large-volume packaging operations. One of the key advantages of flexographic printing is its versatility; it can print directly onto various types of corrugated board, including recycled materials, with consistent results. It supports simple graphics, barcodes, branding, and product information, which are essential for retail and logistics. Additionally, the equipment is relatively low-cost to operate, and the process is compatible with environmentally friendly inks, aligning with sustainable packaging practices. This combination of efficiency, adaptability, and eco-friendliness makes flexographic printing a dominant choice in the corrugated packaging industry.

The food and beverages segment accounted for the dominant revenue share of the corrugated sheet board market in 2024. Corrugated sheet board is extensively used for food and beverage packaging due to its strength, versatility, safety, and sustainability. It provides excellent protection against physical damage, such as crushing or impact, which is crucial for transporting perishable and fragile food items. Its cushioning properties help absorb shocks during handling and shipping, ensuring the contents remain intact and fresh. Corrugated board is also lightweight yet strong, which reduces transportation costs while maintaining durability. It can be customized in size and shape, making it suitable for a wide range of food and beverage products, from pizza boxes to bulk produce cartons. Moreover, it is often made from food-grade materials and can include special coatings for moisture and grease resistance, ensuring hygiene and product safety. In addition, corrugated packaging is highly printable, allowing for effective branding, product information, and compliance labeling. Being recyclable and biodegradable, it meets increasing consumer and regulatory demands for eco-friendly packaging, making it a sustainable choice in the food and beverage industry.

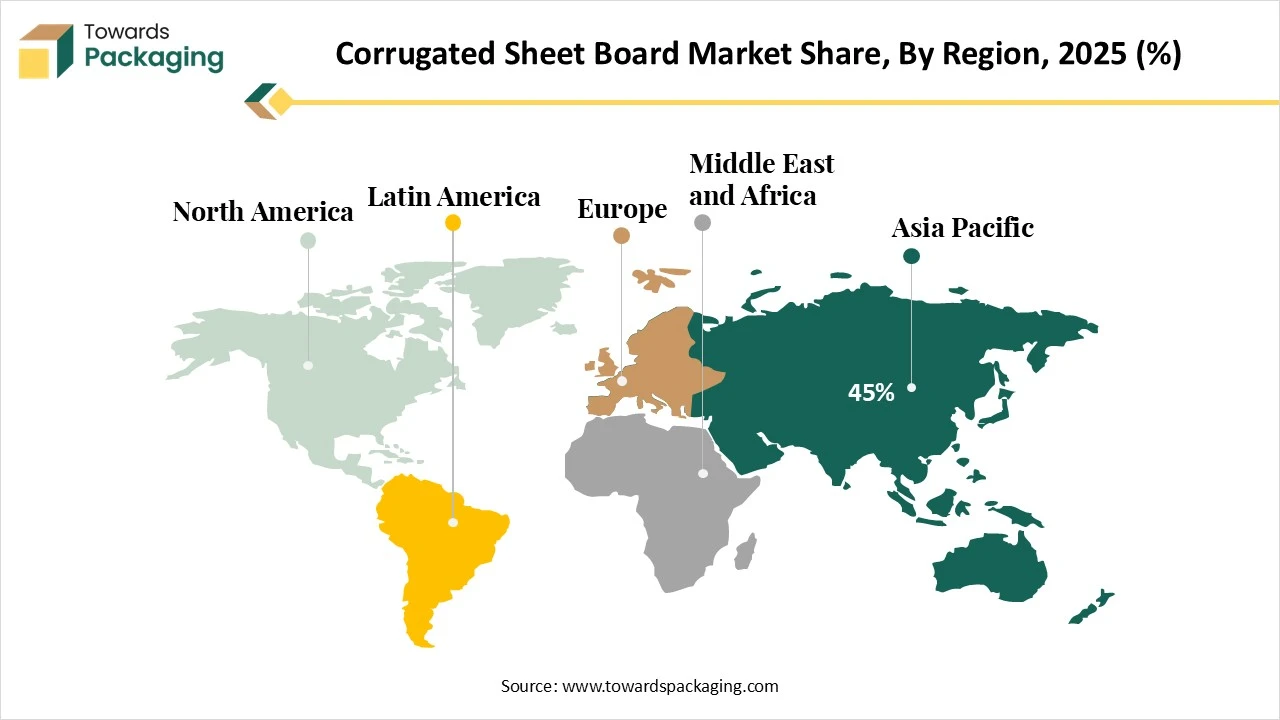

Asia Pacific held the largest share of the corrugated sheet board market in 2024, owing to high manufacturing and industrial activity in the region. China, India, Vietnam, Indonesia, and Thailand are major manufacturing hubs. Corrugated board is extensively used in packaging for electronics, consumer goods, automotive, and food and beverage products. The rise of export-oriented industries boosts demand for durable packaging materials. Asia Pacific has seen explosive growth in e-commerce, especially in China, India, and Southeast Asia. Corrugated boxes are the preferred packaging material due to their strength, recyclability, and cost-effectiveness.

Major players like Alibaba, JD.com, Flipkart, and Lazada are increasing their logistics operations, fueling packaging demand. Countries like China, Indonesia, and India have substantial forest resources and paper production facilities. Lower production and labor costs compared to Western countries help local corrugated board producers compete globally. Growth in fast-moving consumer goods (FMCG) and food delivery services (e.g., Meituan, Zomato, Swiggy) heavily relies on corrugated packaging. The growing processed food industry and ready-to-eat meals in urban areas require secure, reliable packaging solutions.

India Market Trends

India's corrugated sheet board market is driven by the booming retail and FMCG sector in the country. The “Make in India” initiative in the country has boosted the manufacturing of corrugated sheet board in the country. Urbanization and a growing middle class boost packaged goods demand. Sustainability drives the adoption of eco-friendly corrugated packaging, supported by abundant raw materials and recycling infrastructure in India. Technological upgrades and regional manufacturing hubs enhance productivity. Government initiatives like PM Gati Shakti and PLI schemes improve logistics and innovation. Additionally, rising pharmaceutical and agri-exports require durable packaging, further reinforcing India’s firm position in the market.

Japan Market Trends

The Japan corrugated sheet board market is driven by the advanced infrastructure available for manufacturing corrugated sheet board in the country. Innovations such as small flute technology and high-quality graphic boards have enhanced the functionality and appeal of corrugated packaging. These advancements have expanded the application of corrugated boards beyond traditional uses, including in high-end retail packaging. The manufacturing sector’s expansion, particularly in electronics and chemicals, has increased the demand for durable and protective packaging solutions. Corrugated boards provide the necessary strength and protection for transporting goods safely. The COVID-19 pandemic accelerated the shift towards online shopping and increased the consumption of packed goods.

The North America market is expanding rapidly due to the strong retail and consumer goods sector in the region. One of the most significant drivers is the explosive rise of e-commerce, which has dramatically increased the need for reliable, durable, and sustainable packaging materials. Corrugated sheet boards are particularly well-suited for this purpose due to their strength, lightweight nature, and recyclability. Major e-commerce players like Amazon and Walmart heavily rely on corrugated packaging to ensure the safe delivery of goods to consumers. In parallel, there is a growing emphasis on sustainability across industries, prompting both governments and corporations to seek environmentally friendly packaging solutions. Corrugated boards, being biodegradable and recyclable, are increasingly favoured over plastic-based alternatives.

Additionally, the food and beverage industry is contributing to this market surge, especially with the rise in home delivery services, meal kit subscriptions, and grocery deliveries. Corrugated packaging offers essential qualities like moisture resistance and insulation, which are vital for transporting perishable goods. Technological advancement is another contributing factor; North American manufacturers are leading in the adoption of automation and digital printing technologies that enhance production efficiency and customization in packaging solutions.

Moreover, North America’s well-established retail and consumer goods sectors, including big-box stores and electronics retailers, create a consistent demand for corrugated packaging. These businesses also frequently use corrugated materials for point-of-purchase displays, adding to the overall consumption. Regulatory support in the form of sustainability mandates and incentives for adopting green packaging solutions further accelerates market growth. Lastly, continued urbanization and industrial expansion across the region drive demand for efficient transport and warehousing packaging, making corrugated sheet boards an essential component of the supply chain.

U.S. Market Trends

The U.S. dominates the North American corrugated sheet board market due to its massive e-commerce sector, advanced manufacturing technologies, and strong retail infrastructure. Sustainability initiatives and consumer demand for eco-friendly packaging further boost market growth. The food delivery and electronics industries also contribute significantly to rising corrugated packaging consumption.

Canada Market Trends

Canada’s corrugated sheet board market is growing steadily, supported by government regulations promoting sustainable packaging and increased online retail activity. The country’s strong forestry resources provide raw materials for paper-based products. Growth in food packaging, healthcare, and e-commerce sectors is driving higher demand for lightweight, recyclable corrugated solutions.

Europe is expected to grow at a notable rate in the foreseeable future. EU policies like the Green Deal and Packaging Waste Directive promote recyclable alternatives to plastic, making corrugated board a preferred choice. Eco-conscious consumers and expanding e-commerce, especially in countries like Germany and the UK, further boost demand. The food, beverage, and FMCG sectors also rely on corrugated packaging for both protection and shelf appeal. Advances in digital printing and automation allow cost-effective customization, enhancing brand visibility. Additionally, Europe's robust recycling infrastructure and local material sourcing support a circular economy, reducing carbon footprints and ensuring supply chain efficiency, all of which contribute to the market’s accelerated regional growth.

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

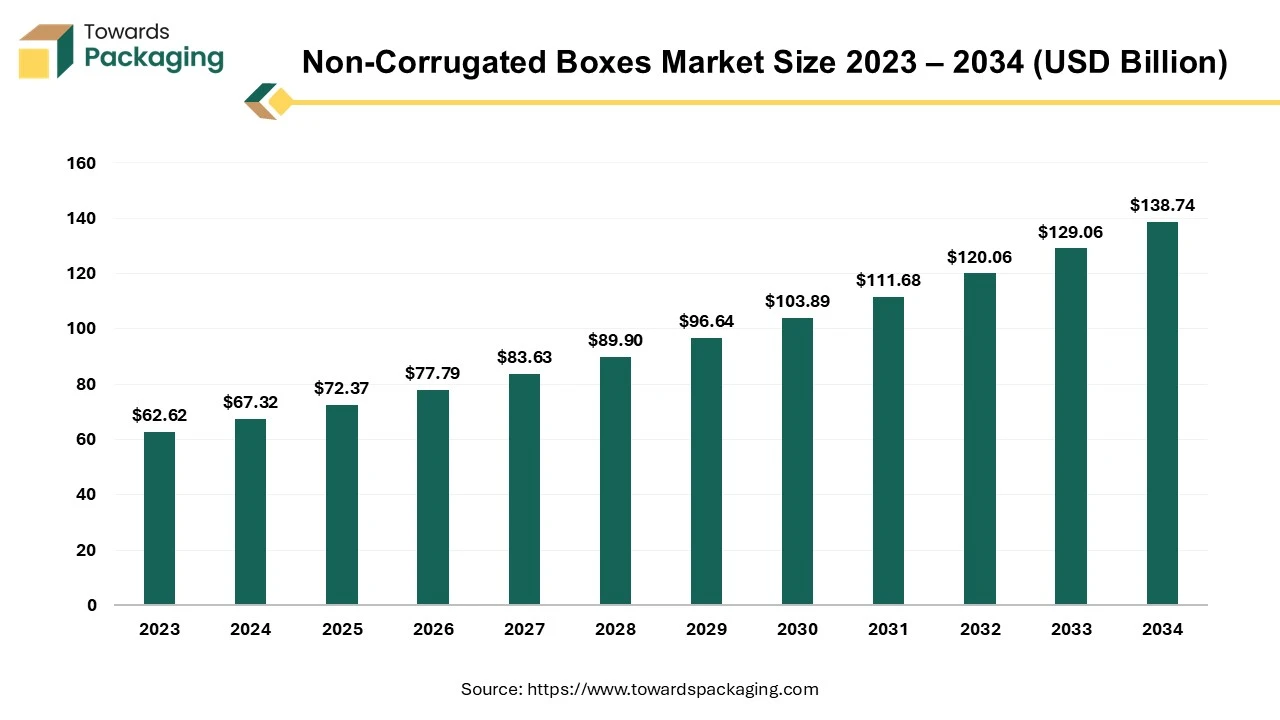

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

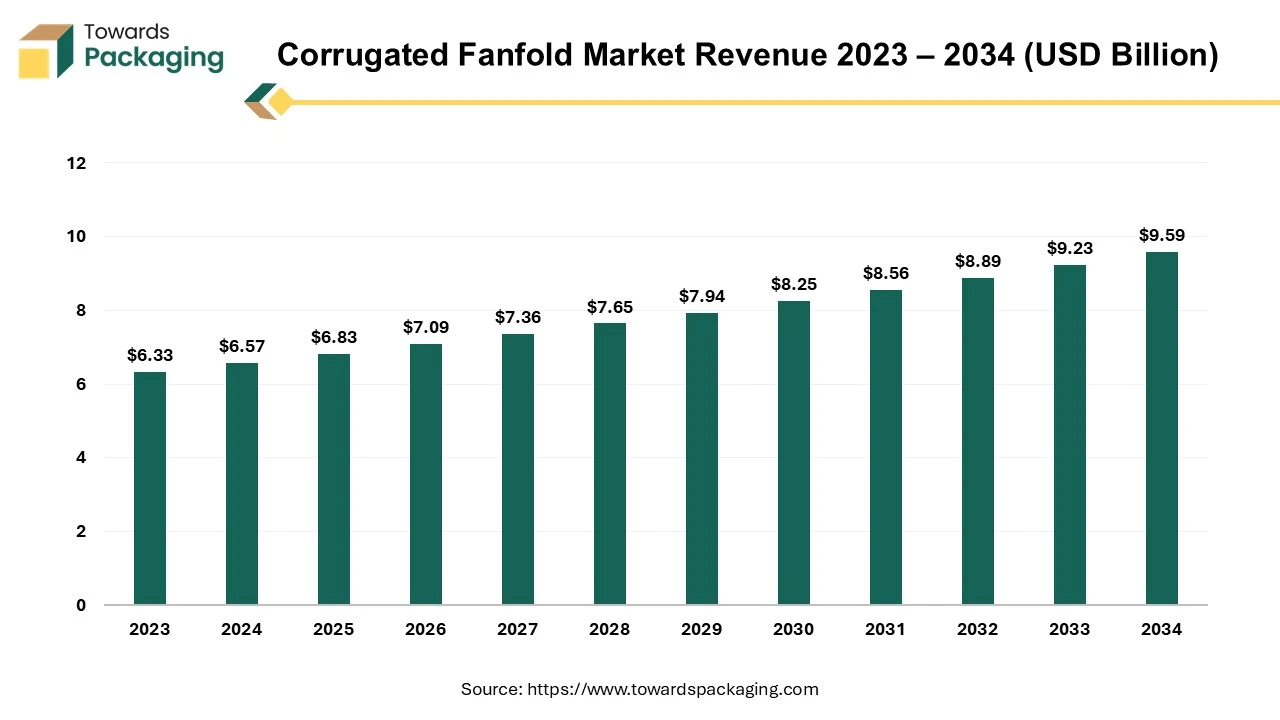

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

By Type

By Flute Type

By Material

By Grade

By Printing Technology

By End-Use Industry

By Region

February 2026

January 2026

February 2026

December 2025