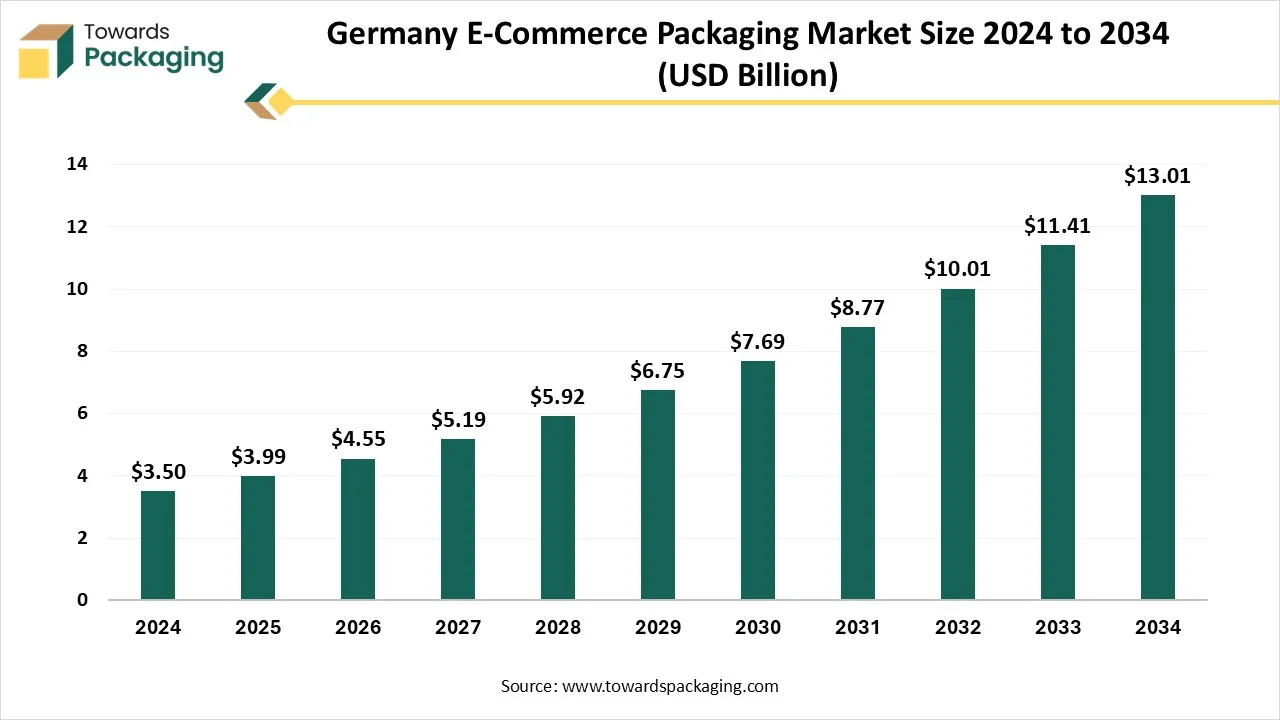

The Germany e-commerce packaging market is forecasted to expand from USD 4.55 billion in 2026 to USD 14.83 billion by 2035, growing at a CAGR of 14.03% from 2026 to 2035. The report covers complete statistical insights including market size, future forecasts, segment analysis (product types, materials, and end-use industries), value chain structure, and competitive benchmarking across leading players such as Amcor, Mondi, ALPLA, and Berry Global. Regional coverage spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, showcasing trade flows, import–export dynamics, and supply–demand gaps.

Trends such as AI-driven packaging automation, sustainable materials adoption, smart packaging (RFID, NFC), and expanding e-commerce infrastructure are deeply evaluated. The study also assesses Germany’s strong online spending (EUR 80.6 billion in 2024) and highlights manufacturer and supplier ecosystems with detailed mapping.

The Germany e-commerce packaging market refers to the segment of the packaging industry dedicated to solutions specifically designed for online retail logistics within Germany. This includes packaging types such as corrugated boxes, mailers, protective wraps, tapes, and bags, used primarily to ship goods purchased through e-commerce platforms.

According to the article published in April 2025, Germany is one of Europe’s largest economies, with a population of 83 million people and a high standard. 95 % of the German population has access to a 5G connection, which also makes it one of Europe’s strongest e-commerce markets. 80.6 billion euros in online revenue was generated in 2024. At least 80 % of Germans are now buying products online. In 2023, German online sales amounted to 79.7 billion euros. (Source: Ecommerce News)

In the rapidly evolving technological landscape, the integration of artificial intelligence (AI) holds great potential to reshape the entire landscape of e-commerce packaging by minimizing void space, reducing packaging waste, boosting sustainability, and lowering shipping costs. Artificial intelligence in e-commerce packaging is enhancing its various processes through its advanced capabilities. AI-powered automation is significantly transforming packaging production lines, enhancing both precision and speed. AI-powered design tools effectively analyze consumer preferences, market trends, and various environmental factors to develop innovative and appealing packaging designs.

How is the Rapid Expansion of the E-commerce Sector Impacting the Growth of the Germany E-commerce Packaging Market?

The surge in online shopping trends is expected to boost the growth of the German e-commerce packaging during the forecast period. The expansion of the e-commerce industry necessitates innovative packaging solutions that ensure product safety during shipping. Consumers are increasingly preferring online platforms for a wide variety of products, due to convenience and wide accessibility. E-commerce platforms are also offering more personalized packaging solutions to improve the customer experience. Automated packaging machines are widely adopted in the e-commerce industry to offer efficient, faster, and more customized packaging processes to meet delivery timelines. These automated packaging solutions assist in keeping up with high order volumes across the country and meet evolving customer demand. Therefore, with the surge in e-commerce activities, manufacturers are increasingly investing in automated and flexible packaging solutions to improve production efficiency and reduce labor costs.

High Cost of Sustainable Packaging Solutions

The high cost of sustainable packaging solutions is anticipated to hinder the market’s growth. The high prices of raw materials compared to traditional options, such as plastics, can adversely impact the budget of small to mid-sized companies. In addition, packaging machinery requires a high upfront investment, especially for automation and sustainable solutions, which may restrict the expansion of the Germany e-commerce packaging market.

Growing Consumer Demand for Sustainable Packaging Solutions

The rising consumer demand for eco-friendly packaging solutions is projected to offer lucrative growth opportunities to the market during the forecast period. Sustainability is significantly revolutionizing the landscape of the Germany e-commerce packaging market as biodegradable plastics, recycled content, and innovative renewable materials are increasingly prioritized. The market is witnessing significant growth in eco-friendly packaging materials, including paper, paperboard, corrugated board, bioplastics, and other sustainable packaging solutions, as companies strive to reduce packaging waste and align with environmental standards and consumer preferences for eco-friendly packaging. Several companies are increasingly replacing their conventional machines with the advanced packaging machine, which can process recycled and biodegradable materials.

The boxes segment held a dominant presence in the Germany e-commerce packaging market in 2024. The growth of the segment is mainly driven by the surge in e-commerce activities, rising consumer preference for online shopping, growing demand for sustainable packaging solutions, and rising demand for packaged goods from various industries. In addition, an increasing need for secure and customized boxes, bolstering the segment’s growth in the coming years. Several brands are heavily investing in customizable packaging to enhance the unboxing consumer experience and build brand recognition.

On the other hand, the protective packaging segment accounted for notable growth in the global Germany e-commerce packaging market over the forecast period, owing to the increasing need for safe and protective packaging solutions. The increasing need to safeguard products, especially fragile or delicate items, during handling and shipping, propels the demand for protective packaging such as bubble wrap and foam. Protective packaging adds an extra layer against contamination, damage, and other environmental conditions.

The plastics segment dominated the Germany e-commerce packaging market in 2024. Plastic is widely used in the packaging industry owing to its durability, versatility, strength, durability, cost-effectiveness, and stability. Plastic packaging is preferred for its unique properties, such as barrier protection, transparency, and resistance to heat and the environment. Several e-commerce platforms are increasingly preferring recycled and biodegradable plastics, owing to the rising environmental awareness and increasing regulatory pressures to align with the principle of the circular economy.

On the other hand, the corrugated board segment is expected to grow at a notable rate during the forecast period, owing to the rising trend of sustainability. The surge in environmental issues is compelling e-commerce businesses to adopt corrugated board as an eco-friendly packaging practices, which significantly promote environmental sustainability. The corrugated board plays a crucial role in the packaging of various products by enhancing protection and facilitating improved handling for logistics & transportation. Additionally, the integration of smart packaging solutions, such as NFC tags, RFID, and QR codes, to improve logistics, track products, and enhance customer engagement is expected to fuel the segment's growth in the coming years.

The apparel & accessories segment is dominating the market over Germany e-commerce packaging market in 2024. The growth of the segment is driven by the significant rise in the online sales of apparel & accessories across the country. Consumers are often purchasing apparel & accessories from e-commerce platforms, which increases the demand for protective and visually appealing packaging. Several prominent brands are increasingly investing in customized packaging solutions to enhance the overall unboxing experience of consumers and build brand loyalty. The market is experiencing an increasing trend toward sustainability, which has led to an increasing demand for biodegradable, recycled, and renewable packaging materials to reduce packaging waste and lower carbon footprints.

On the other hand, the consumer electronics & electricals segment is expected to witness remarkable growth during the forecast period, owing to the increasing consumer demand for convenient and secure packaging solutions and a growing emphasis on sustainability. As regulations tighten and rise in consumer expectations for eco-friendly packaging solutions rise, the market is moving towards circular packaging systems. Moreover, the surge in online shopping for consumer electronics such as laptops, smartphones, tablets, wearables, and other emerging technologies increases the need for secure and attractive packaging solutions, which further boosts the segment’s growth.

By Product Type

By Material Type

By End Use Industry

February 2026

February 2026

February 2026

February 2026