Glass Container Market Growth and Regional Production Analysis

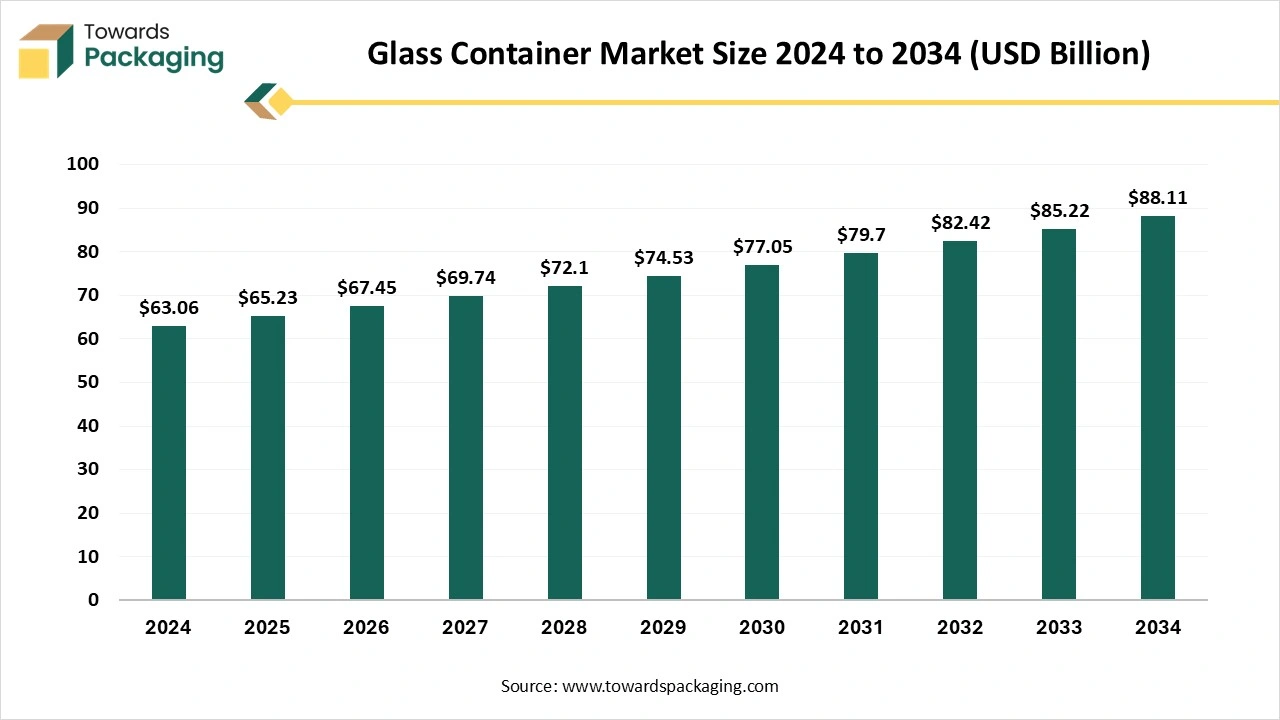

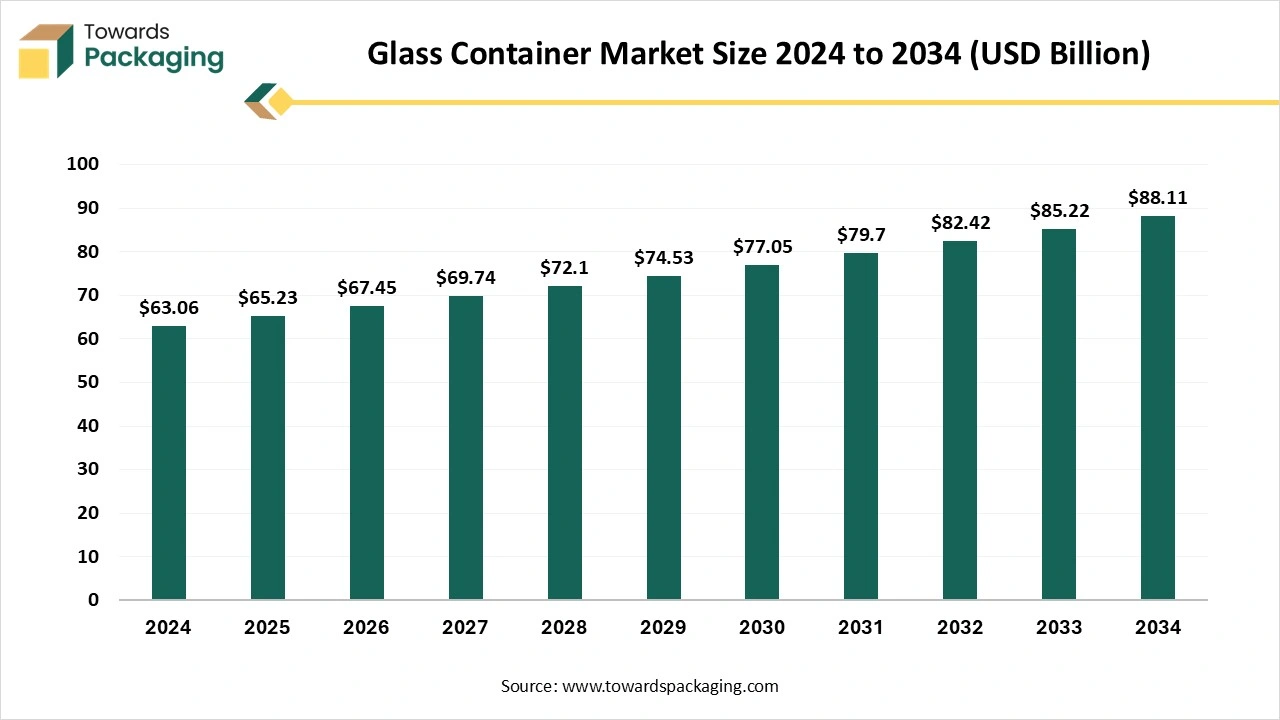

The glass container market is forecasted to expand from USD 67.42 billion in 2026 to USD 91.09 billion by 2035, growing at a CAGR of 3.4% from 2026 to 2035. This growth is driven by the increasing demand for beverages and the rising pharmaceutical industry. North America dominated the market in 2024, and Asia Pacific is anticipated to grow rapidly. Key segments include glass bottles, borosilicate glass, and the beverage sector. The market is also witnessing a shift towards eco-friendly packaging solutions, with major players such as AGI Glaspac and Hindusthan National Glass leading the way.

Major Key Insights of the Glass Container Market

- In terms of revenue, the glass container market is valued at USD 65.23 billion in 2025.

- The market is projected to reach USD 91.09 billion by 2035.

- Rapid growth at a CAGR of 3.4% will be observed in the period between 2025 and 2034.

- North America dominated the global market in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product type, the glass bottles segment held the largest market share in 2024.

- By product type, the ampoules segment is projected to grow at a CAGR between 2025 and 2034.

- By material type, the type 1 (borosilicate glass) segment dominated the global market in 2024.

- By material type, the type 4 (general purpose soda lime glass) segment is expanding at a significant rate.

- By capacity, in 2024, the 51 to 250 ml segment contributed the biggest market share .

- By capacity, the 1001 to 2000 ml segment will expand at a significant CAGR between 2025 and 2034.

- By end use, the beverage segment dominated the global market in 2024.

- By end use, the pharmaceuticals segment is expected to grow at a significant CAGR over the projected period.

- By distribution channel, the distributors segment contributed the biggest market share in 2024.

- By distribution channel, the e-retailers segment is growing rapidly.

Glass Container Market: Eco-Friendly Storage Solution

Glass containers are all the bottles, jars, tiffin, and other structures made up of glass and used for the storage of cosmetic products, foods, pharmaceutical products, juices, soft drinks, and several other things. This market is growing significantly due to rising ecological concerns among people, due to increasing awareness initiatives by the government. Glass is considered to be an eco-friendly option for the storage of various products. These containers are durable and can be recycled 100%, which makes them convenient to use. It does not react with any chemical products stored in this. The rising pharmaceutical industry has extensively adopted these containers. Glass is a healthy alternative to materials such as plastics, and it also tolerates heat if used in the microwave. These are aesthetic choices for the storage of products.

Key Metrics and Overview

| Metric | Details |

| Market Size in 2025 | USD 65.20 Billion |

| Projected Market Size in 2035 | USD 91.09 Billion |

| CAGR (2025 - 2035) | 3.4% |

| Leading Region | North America |

| Market Segmentation | By Product, By Material, By Capacity, By End Use, By Distribution Channel and By Region |

| Top Key Players | Ajanta Bottle Private Limited, AGI Glaspac, Hindusthan National Glass and Industries Ltd, Haldyn Glass, Borosil Glass Works Limited, Eagle Glass Deco Private Limited, Empire Industries Limited. |

What are the New Trends in the Glass Container Market?

Growing Demand for High-Durable Packaging

The growing demand for high durable containers that can be used several times has influenced the demand for this market. The long-lasting property and lower risk of breaking have influenced several brands towards this glass container market. These are extensively utilized for the storage of food products, which makes this durability property important for glass containers.

Growing Health Concern Among Consumers

The growing concern among users for rising health issues has increased the demand for glass containers as these are considered healthy materials for packing a wide variety of products from several sectors.

Increasing Usage of Sustainable Products

Glass is well-known as a sustainable material that can be used for the storage of products. Glass containers are healthy, reusable, highly recyclable, and innovative.

How Can AI Improve the Glass Container Market?

AI plays an important role in the evolution of the glass container market as it supports this industry in introducing innovative solutions to fulfill the demand of the customers. With the incorporation of artificial intelligence, the quality of the glass container improved and made it more sustainable. AI is extensively used for quality checking and gathering real-time data to analyse the requirements of the market. The growing concern regarding ecological issues has raised the demand for glass containers, and artificial intelligence helps to enhance the reliability of the brands towards the manufacturing process and material quality of the glass containers. The major aspects where artificial intelligence plays a vital role are in process optimization and predictive maintenance. AI helps in determining the production process and reducing waste generation. It is mainly used for the quality and durability checking process that helps to enhance the brand image.

Market Dynamics

Driver

Rising Demand for Sustainable Options Boosts the Glass Container Market

The increasing demand for sustainable storage or packaging options for a huge variety of products has influenced the demand for the glass container market. Glass containers are reusable and recyclable, aligning with these preferences, influencing their popularity in several markets. These containers are frequently linked with high quality and aesthetic demand. Brands are using exclusive shapes, embossing, and advanced labelling procedures to create individual and visually attractive packaging that stands out on the competitive market.

Growing consciousness regarding the harmful effects of non-degradable resources on the ecology has translated into growing acceptance of glass containers. Governments worldwide are concentrating on sustainability by implementing strict rules. This acquiescence with the directive executed in various countries is anticipated to flourish the industry. Glass has the potential to be recycled, which helps as an environment-friendly and effective packaging choice. The cosmetics business has observed exponential development influenced by high demand for perfumes and cosmetics. Glass containers offer premium and flexible packaging solutions for perfumes, which play an important role in brand diversity and customer appeal.

Restraint

High Cost of Top Glass Quality Containers

One of the major factors that is disturbing the growth of the market is the high price associated with the high quality of the glass material, which hinders the demand for such containers made from glass material. Several small to medium businesses are facing difficulties in adopting such high-end glass containers, which decrease their demand as well as scope for development.

Opportunity

Eco-Friendly Packaging Options

Due to the increasing demand for environment-friendly packaging choices, the global glass container market is escalating rapidly. There is a growing focus on reducing the ecological influence of several industries, including packaging, in the current ecologically aware society. These unique qualities and recycling potential, glass containers a popular choice for the sustainable packaging of products. The high-quality and pure glass can be recycled several times without compromising its quality. As a consequence, it is quite attractive to producers as well as customers actively searching for environment-friendly packaging options.

Glass containers can be recycled more efficiently and effortlessly than plastic or any other metal containers, which reduces the number of raw resources and energy required to manufacture new containers. This decreases the carbon footprint associated with the production of packaging resources and preserves natural resources. Glass containers are extremely reusable, which improves another step of sustainability. These containers can be easily recycled by customers and utilized again for the storage of things such as food, beverages, or other home products.

Glass packaging has various advantages for food and beverage storage. As it is impervious, the quality, taste, and scent of the packaged products are well-preserved because it has no contact with the packed products. Moreover, glass provides high-quality defence against ecological factors, including moisture, light, and air, to preserve the freshness of the products and enhance their shelf life. Furthermore, rising government regulation and programs helping organic packaging practices are majorly pushing the glass container market.

Segmental Insights

Glass Bottles Segment Shown Significant Share in 2024

The glass bottles segment accounted for a considerable share of the glass container market in 2024. The rising demand for beverages has influenced the usage of a variety of designs of glass bottles to enhance shelf life while storing. Following this, the ampoules segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. The continuous growth in the pharmacy sector and the advancement of chemicals have raised the demand in the market.

Chemical Resistance: The Type 1 (borosilicate glass) Industry to Promote Dominance

The type 1 (borosilicate glass) segment registered its dominance over the premium packing material market in 2024. These are highly preferred due to their high resistance to chemical reactions. The rising pharmacy industry has raised the demand for borosilicate glass. On the other hand, the type 4 (general purpose soda lime glass) segment is anticipated to grow with the highest CAGR in the market during the studied years. The rapid shift towards urban areas has enhanced the demand for soda lime water, which boosts the development of these glasses.

Convenience and Suitability Influence 51 to 250 ml Containers to Promote Dominance

The 51 to 250 ml segment registered its dominance over the glass container market in 2024. This is due to the convenience and suitability of transporting these containers over a certain distance. These are primarily used in the healthcare sector as it is required to carry several medicines to various areas that demand packaging that is suitable for transportation. The 1001 to 2000 ml segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. This surge is due to the growing adoption of alcoholic and non-alcoholic beverages in various regions. The growing demand for products such as sauces, juices, alcohol, and many other products requires bigger containers for storage and transportation.

Recyclability Ability of the Beverage Industry to Promote Dominance

The beverage segment registered its dominance over the glass container market in 2024. This segment is dominating due to the high potential for recyclability of the glass containers, which make it an eco-friendly option suitable for both transportation as well as storage of beverages. On the other hand, the pharmaceuticals segment is expected to grow at the fastest rate during the forecast period of 2024 to 2034. Glass is considered suitable for the storage of chemicals as it does not react with them, which enhances its usage in the pharmacy industry.

Distributors Segment Shown Significant Share in 2024

The distributors segment accounted for a considerable share of the glass container market in 2024. These distributors contribute profoundly to widening the range of glass containers. Similarly, the e-retailer segment is anticipated to grow with the highest CAGR in the market during the studied years. These are growing rapidly due to the expansion of digital platforms with the evolution in the behavior of customers.

Regional Insights

Strong Demand for Sustainable Packaging in North America Promotes Dominance

North America region held the largest share of the glass container market in 2024, due to the high demand of the customers for sustainable packaging options for several products such as beverages, cosmetics, pharmacy products, and many others. In countries such as the U.S. and Canada, there are strict government rules towards packaging that encourage the usage of glass containers. The high consumption of beverages such as beer, wine, carbonated drinks, and other drinks has influenced the demand for such glass containers.

Asia’s Rapidly Growing Usage of Cosmetics and Personal Care Supports Growth

The Asia Pacific region is anticipated to grow at the fastest rate in the glass container market during the forecast period. In countries such as India, China, Japan, South Korea, Thailand, and several others, there is a huge upsurge in the demand for cosmetic products and personal care has raised the demand for glass containers. These containers protect products from outer pollutants such as dust, air, moisture, and light, which enhances the shelf life of the cosmetics and personal care products.

Latin America Market Trends

In Latin America, with many fastly developing nations, the growing demand for eco-friendly and sustainable packaging solutions is a main growth driver. Glass packaging, being reusable, recyclable, and environmentally friendly, has gained attention among users and manufacturers. Inventions such as lightweight glass and efficient recycling procedures are driving market growth. High manufacturing techniques, particularly the introduction of thin-walled and lightweight glass containers, have a smooth manufacturing procedure. Notably, the Blow Procedure has played a significant role in reducing the weight of glass bottles manufactured in Latin America.

Middle East and Africa Market Trends

Fast urbanization is associated with increased per-capita purchases of branded food, personal care products, beverages, and other items that often utilize glass packaging. In the UAE, a large population drives a demand for luxury imported goods, often displayed in Flint bottles, while half of Saudi Gen Z buyers actively seek environmentally friendly packaging. The region's e-commerce value is expected to rise, which signifies the demand for tamper-evident and strong glass that withstands long-mile logistics.

Glass Container Market Key Players

- Ajanta Bottle Private Limited

- AGI Glaspac

- Hindusthan National Glass and Industries Ltd

- Haldyn Glass

- Borosil Glass Works Limited

- Eagle Glass Deco Private Limited

- Empire Industries Limited

- Pragati Glass Private Limited

- La Opala RG

- Glass Guru India Pvt. Ltd

Latest Announcements by Glass Container Market Leaders

- In March 2025, President and CEO of AGP-North America, Brian Brandstatter, said, “Beyond protecting the environment, we are investing in our local community and our customers. By enhancing our sustainability efforts, we are ensuring long-term value, reliability, and cost-effective solutions for the brands that rely on us. This initiative underscores our dedication to being a responsible and forward-thinking glass container manufacturer in California.”

New Advancements in the Glass Container Market

- In August 2025, Invopak unveiled a new glass container series as part of its commitment to serving sustainable packaging solutions to the UK market. The revelation aligns with the UK government’s Resources and Waste procedure, which prioritizes infinitely recyclable materials.

- In August 2025, Tupperware is launching Voila Glass, a new line of borosilicate glass food storage containers as part of its brand reinvention. The oven- and freezer-safe range includes square, round, and extra-large rectangle options, all featuring BPA-free lids, built-in vents, grippy rims, and volume markers for versatile, non-toxic storage and cooking.

- In March 2025, Ardagh Glass Packaging powered the California Glass Packaging facility with a solar field.

- In November 2024, Farmery, a brand focused on delivering fresh, farm-to-table food, announced the launch of its A2 Cow Milk in eco-friendly glass bottles. The 1-litre bottle is made of eco-friendly glass.

- In October 2024, Switch Energy Drink announced its partnership with Halewood South Africa to launch its new premium 275ml glass bottle range.

- In September 2024, Albertsons Companies, Inc. announced the launch of Bee Lightly, which is a unique flat bottle design crafted from 100% recycled polyethylene terephthalate (PET).

Glass Container Market Segments

By Product

- Glass bottles

- Glass jars

- Glass vials

- Ampoules

- Syringes

By Material

- Type 1 (borosilicate glass)

- Type 2 (treated soda lime glass)

- Type 3 (regular soda lime glass)

- Type 4 (general purpose soda lime glass)

By Capacity

- Up to 50 ml

- 51 to 250 ml

- 251 to 1000 ml

- 1001 to 2000 ml

- Above 2000 ml

By End Use

- Cosmetics and perfumery

- Beverage packaging

- Food packaging

- Pharmaceuticals

By Distribution Channel

- Direct sales (manufacturers)

- Distributors

- Retailers

- E-retail

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (2)