Insights on the Thin Wall Packaging Market: Size, Trends, and Strategic Opportunities for Growth

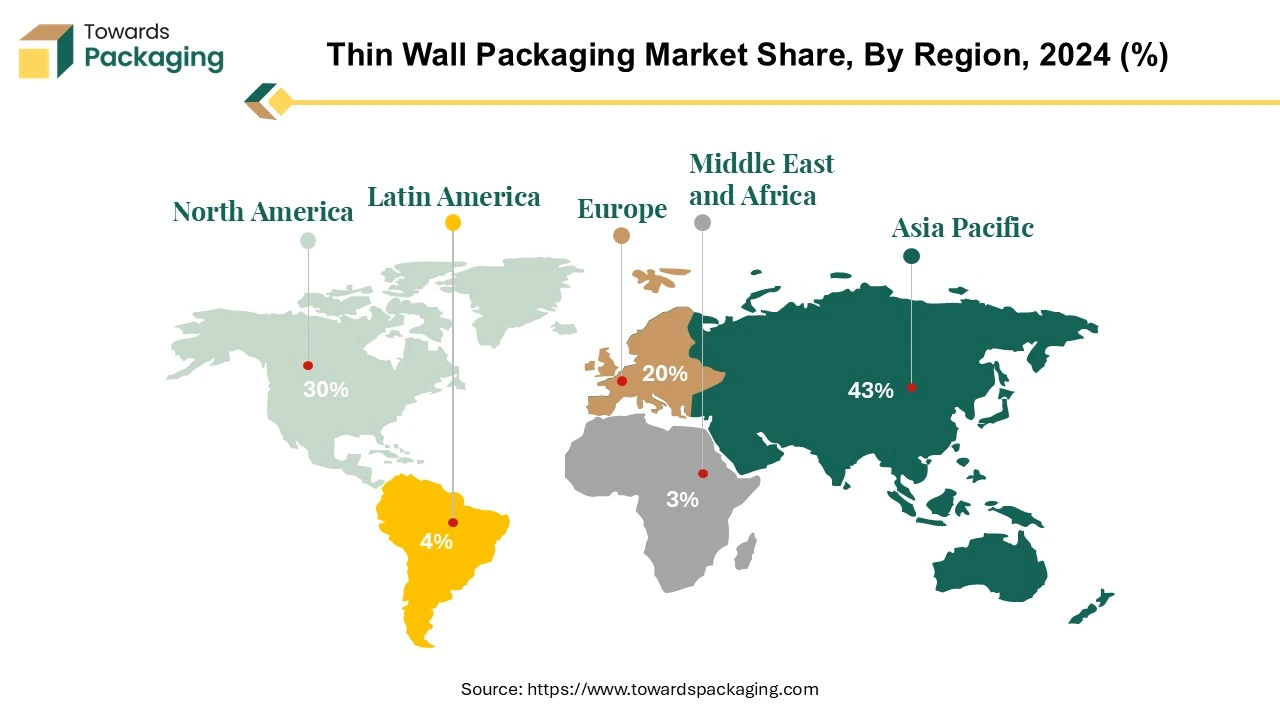

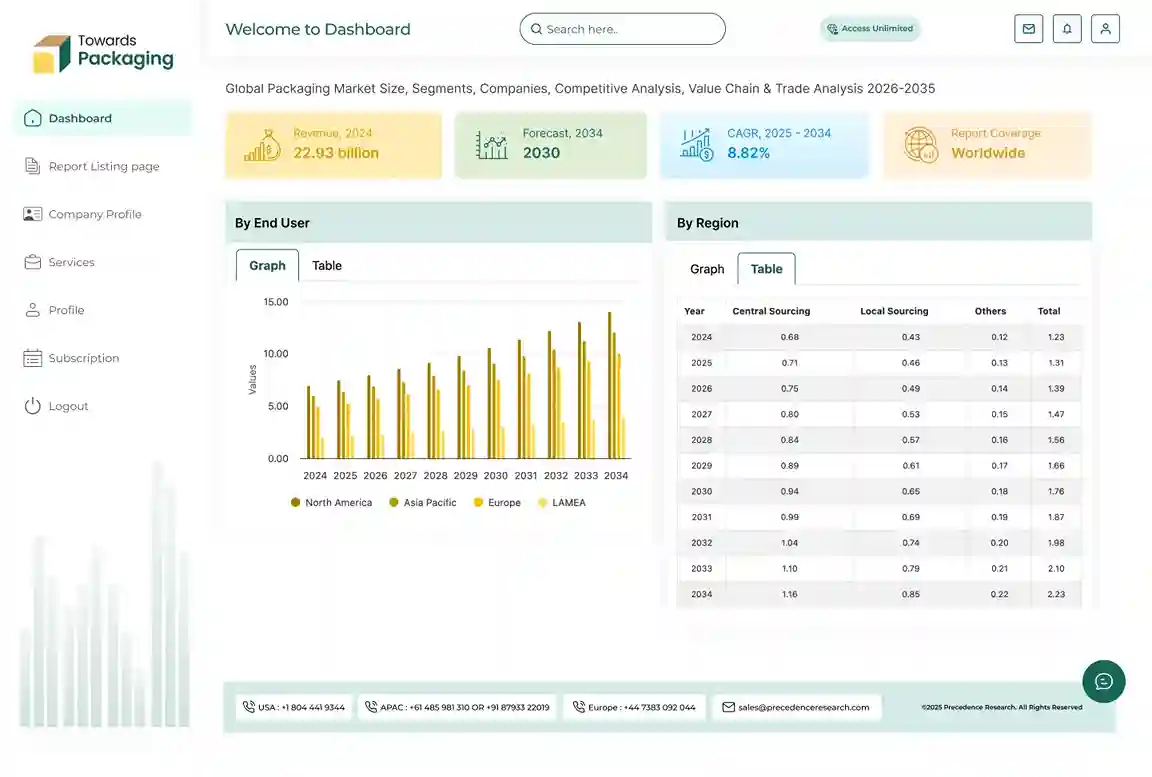

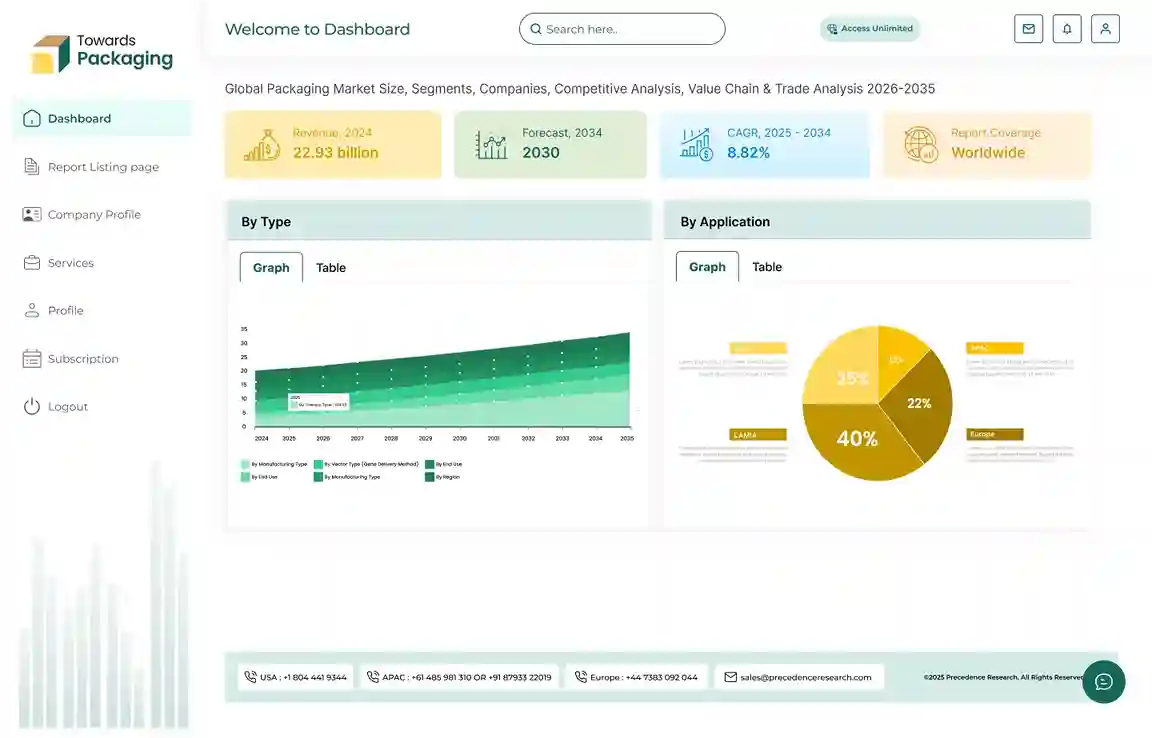

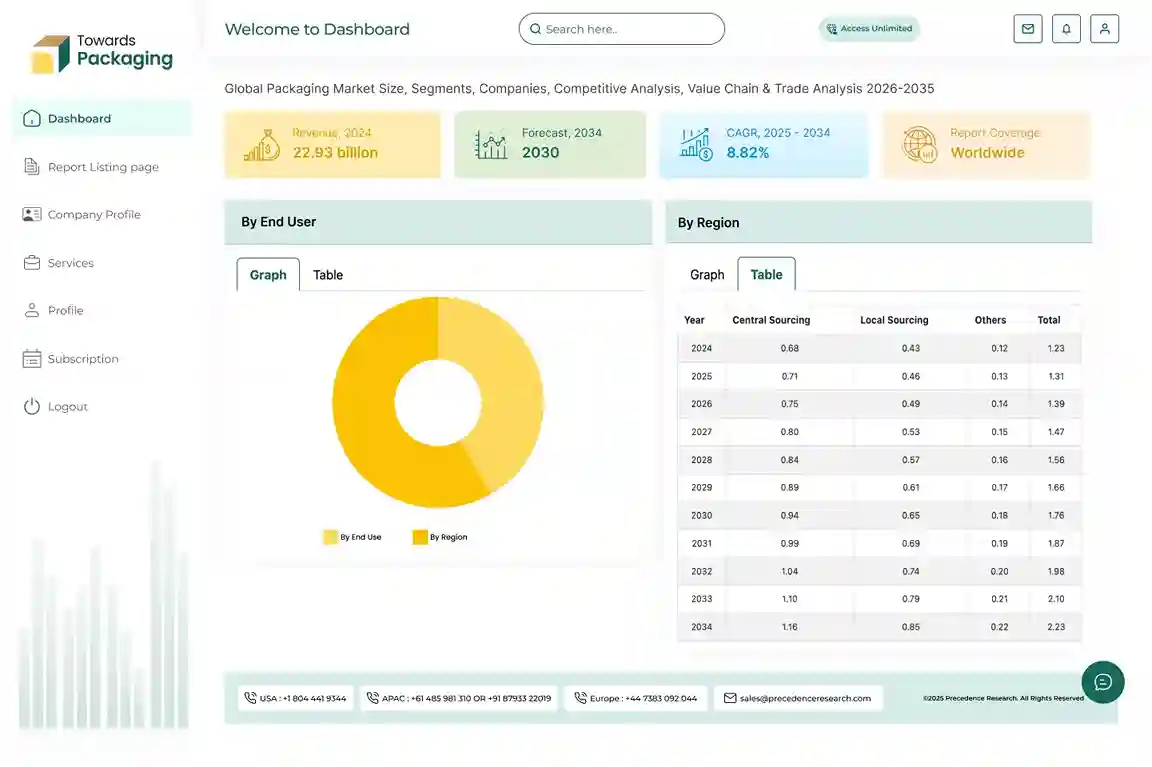

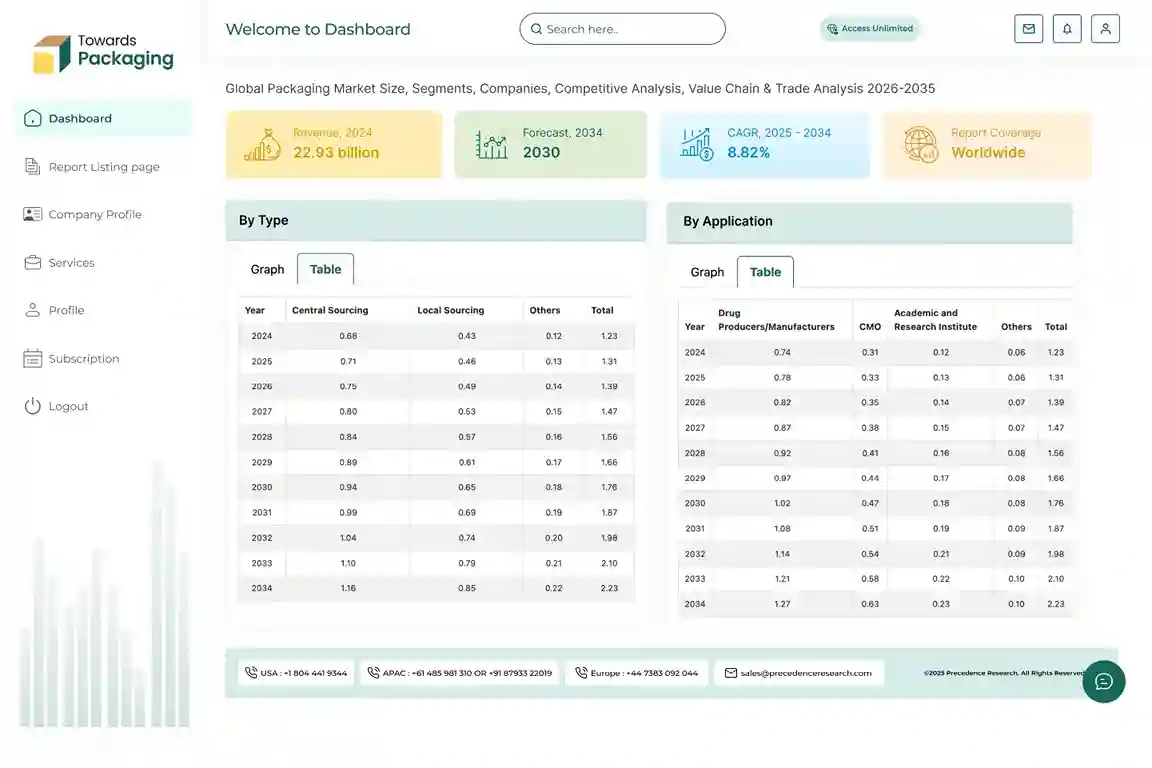

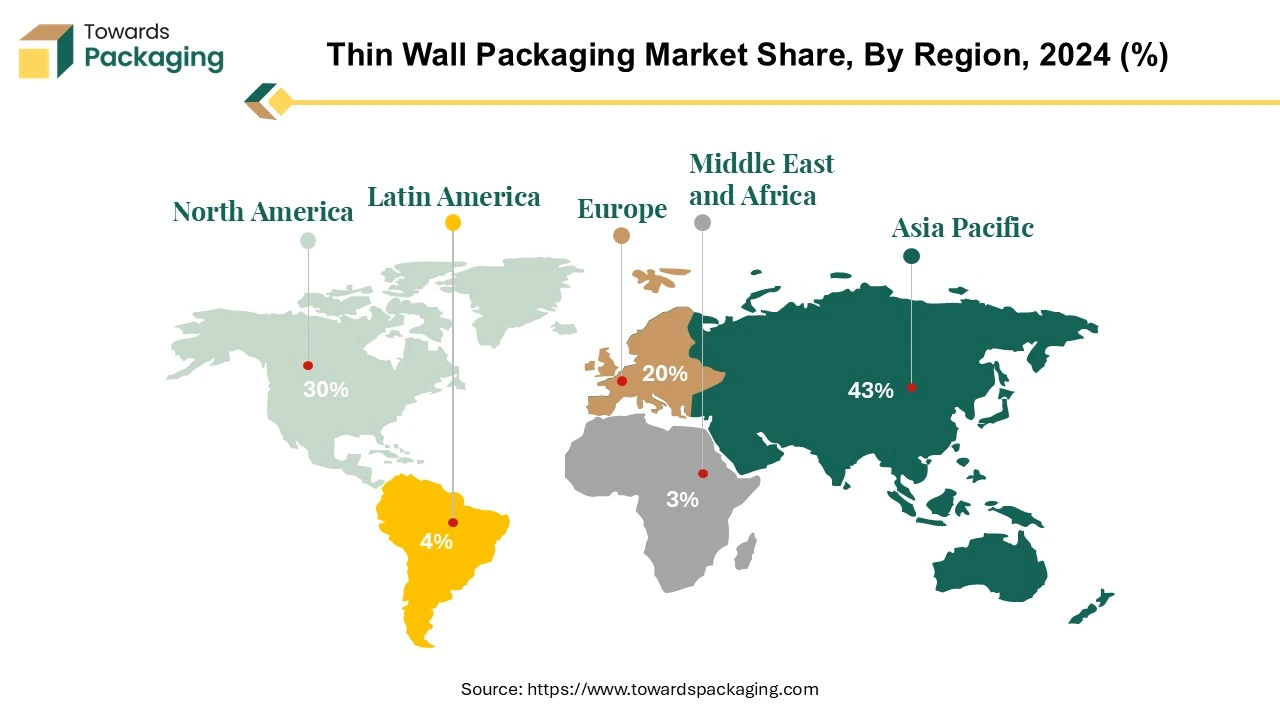

The thin wall packaging market is forecasted to expand from USD 52.91 billion in 2026 to USD 92.48 billion by 2035, growing at a CAGR of 6.4% from 2026 to 2035. This market is segmented into materials like Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), and Polyethylene Terephthalate (PET), with key product types including boxes, tubs, jars, cups, and trays. Leading companies such as Berry Global, Amcor, and Greiner Packaging dominate the market. Asia Pacific leads with over 50% of global production, while North America and Europe continue to drive demand for sustainable packaging solutions.

Key Insights and Strategic Revelations: Uncovering the Latest Trends in the Thin Wall Packaging Market

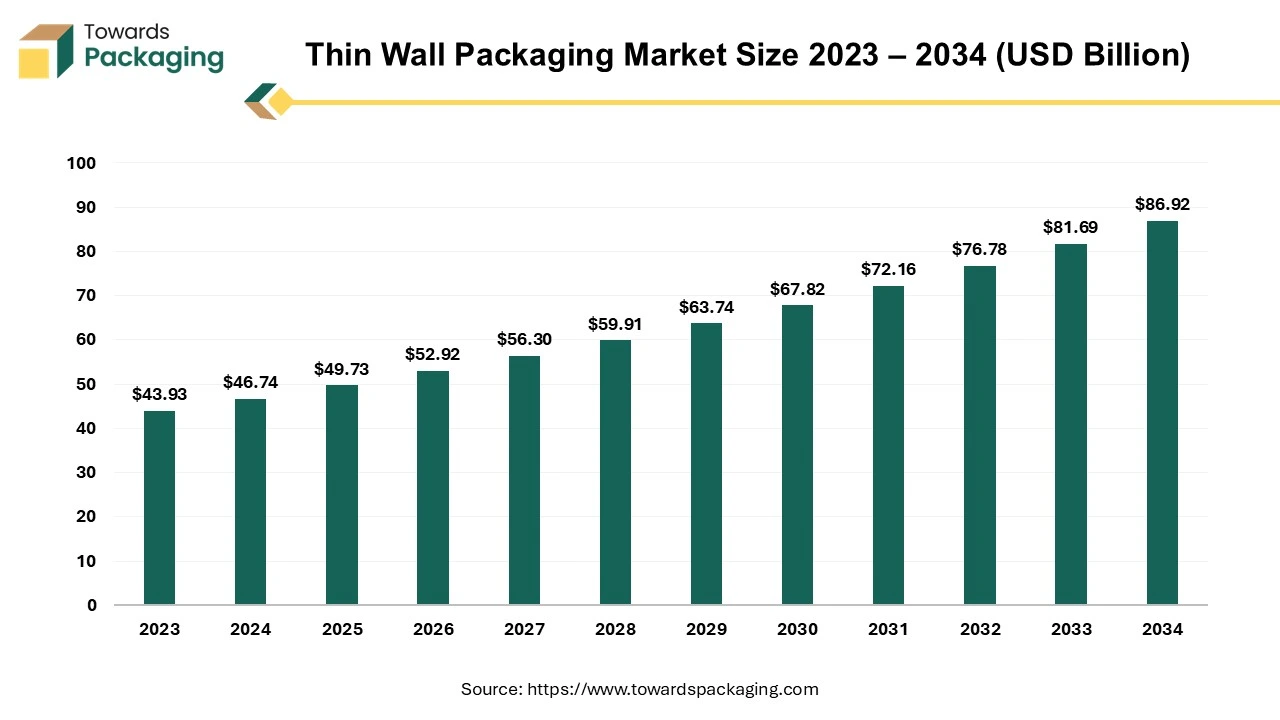

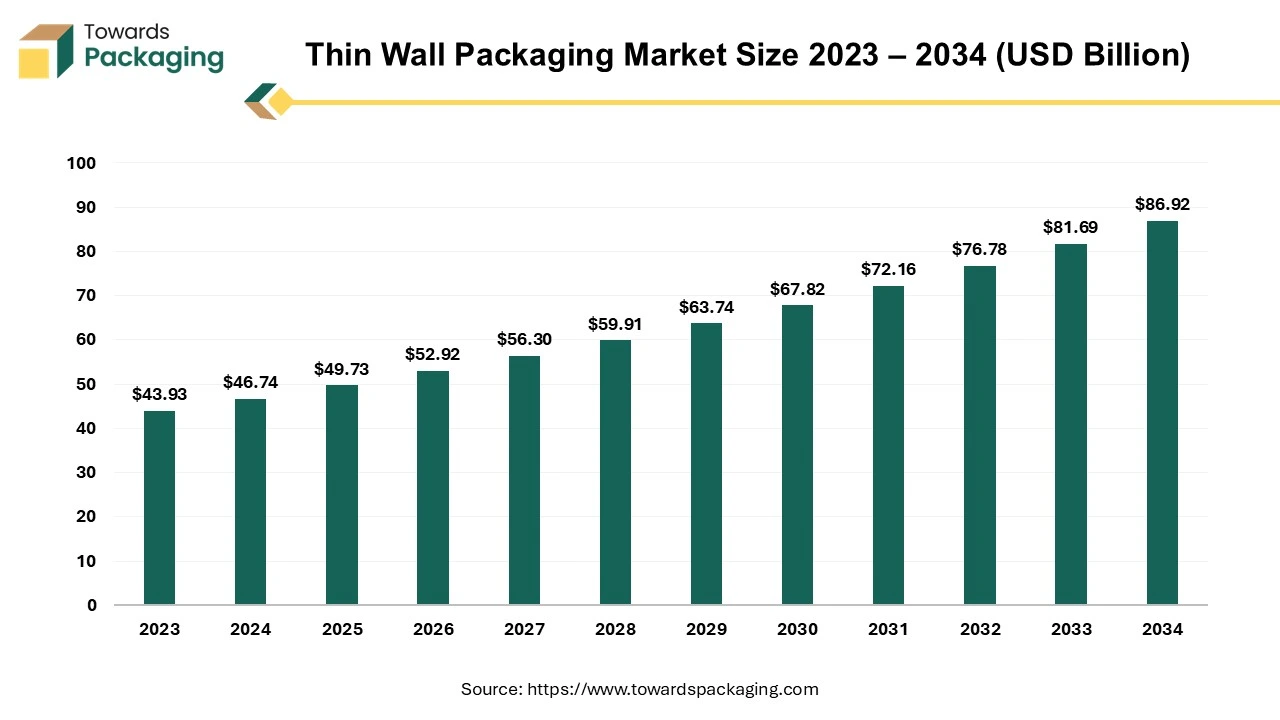

- Market Growth and Size: The Thin Wall Packaging Market is expected to grow from USD 49.73 billion in 2025 to USD 86.92 billion by 2034, with a CAGR of 6.4%.

- Sustainability and Efficiency: Thin wall packaging is becoming popular for its lightweight design, which reduces plastic use and transportation energy costs, offering an eco-friendly alternative.

- Key Material: Polypropylene (PP): Polypropylene is the leading material in thin wall packaging due to its durability, lightweight nature, and suitability for the TWIM process.

- E-commerce Impact: The rise of e-commerce is pushing the demand for thin wall packaging, focusing on cost-effectiveness, protection, and sustainability during shipping.

- Asia Pacific Market Growth: Asia Pacific, especially China and India, leads in thin wall packaging demand, contributing over 50% of global plastic production.

- Leading Companies in the Market: Major companies like Berry Global, Amcor, and Greiner Packaging lead the market through innovation, acquisitions, and global expansion.

- Recent Developments: Companies are investing in sustainable packaging solutions, such as Sabic’s bio-sourced in-mould labelling and collaborative recycling initiatives.

Thin Wall Packaging Market" refers to the industry involved in the production, distribution, and sale of packaging materials that are characterized by their thin and lightweight design. Thin wall packaging typically involves the use of materials such as plastics, including polyethylene terephthalate (PET), polypropylene (PP), and other lightweight materials.

Thin wall packaging plays a pivotal role in advancing sustainability objectives by reducing plastic usage and optimizing the overall weight of packages. This lightweight design translates into lower energy requirements for transportation. It's noteworthy that plastic packaging generally holds distinct advantages over alternatives such as paper, glass, or aluminium, and thin wall packaging takes these advantages to the next level. Anticipated growth in the demand for thin wall packaging is poised to outpace the broader packaging market.

A substantial portion of global polypropylene consumption, exceeding 40%, is attributed to packaging applications. The use of polypropylene in rigid packaging is witnessing an annual growth rate exceeding 8%, with approximately 3% of this growth attributed to the substitution of other plastics. This success positions polypropylene as one of the most thriving polymers in the packaging market. Packaging's substantial share in global polypropylene consumption underscores the industry's significance, especially as the adoption of thin wall packaging continues to gain momentum.

Unprecedented Growth in Thin Wall Packaging Market Demand

The demand for thin wall packaging is escalating due to its pivotal role in enhancing sustainability and operational efficiency. With a lightweight design, thin wall packaging reduces plastic consumption, lowering transportation energy costs. Notably surpassing alternatives like paper and aluminium, thin wall packaging capitalizes on the inherent advantages of plastic. This trend, driven by the imperative for eco-friendly solutions, is expected to outpace the broader packaging market. The thriving demand aligns with the global push for sustainable practices and positions thin wall packaging as a critical driver in evolving efficient and environmentally conscious packaging solutions.

Trends

| Trends | |

| Advancements in Material Technology | Ongoing innovations in material science influence thin wall packaging trends. Developing high-performance, lightweight materials and improved barrier properties enhance product protection, extend shelf life, and meet evolving consumer expectations. |

| E-commerce Packaging Optimization | As e-commerce gains prominence, thin wall packaging is adapting to meet the specific demands of online retail. The focus is on creating packaging solutions that balance protection, aesthetics, and cost-effectiveness while minimizing environmental impact during shipping. |

| Customization and Branding | As e-commerce gains prominence, thin wall packaging is adapting to meet the specific demands of online retail. The focus is on creating packaging solutions that balance protection, aesthetics, and cost-effectiveness while minimizing environmental impact during shipping. |

| Sustainable Packaging Mandate | The push for sustainability continues to drive thin wall packaging trends, with businesses increasingly adopting eco-friendly solutions. Consumers and regulatory pressures are prompting the industry to reduce material usage and enhance recyclability, positioning thin wall packaging as a frontrunner in meeting these demands. |

Asia Pacific’s Strategic Focus on Advancing Sustainable Thin Wall Packaging Solutions

The Asia-Pacific (APAC) region played a pivotal role in the global plastics landscape, contributing over half of the world's plastic production at 51% of the total 390.7 million metric tons. As a major hub for plastic manufacturing, the APAC region stands poised to lead the transition towards a circular economy for plastic packaging. China, the largest global consumer of plastics, and India represent key markets for plastic packaging within the APAC region, experiencing heightened demand as consumers shift towards packaged goods.

China, responsible for 31% of the world's plastic production, spearheads the region's dominance in plastics manufacturing. Other Asian nations, including Japan, contribute significantly, making up 3% of global plastic production, with the rest of Asia accounting for 16%. The APAC single-use plastic packaging market is anticipated to grow at a CAGR of 5.66% until 2030, emphasizing the region's continued influence in the global plastic packaging landscape.

China's commitment to environmental sustainability is evident in its five-year action plan unveiled in 2021, aimed at reducing plastic pollution. Initiatives include bans on non-biodegradable plastic bags in supermarkets, shopping malls, major cities, and food delivery services. This underscores the region's proactive approach to addressing environmental concerns associated with plastic use.

The APAC region, driven by factors such as a high demand for lightweight and durable packaging like thin wall packaging, has witnessed significant business growth. Factors like isolation, an expanding affluent middle class, and increased trade activities contribute to the expansion of the thin wall packaging industry. The market's growth is further propelled by consumer preferences for ready-to-make products. Overall, the APAC region's dominance in plastic production and its commitment to sustainable practices position it as a key player in shaping the future of the thin wall packaging market.

- In October 2023, Cosmo Films, Asian global leader in packaging Launched new business, Cosmo plastech, offers thin wall sheets and containers.

With its substantial plastic generation, North America is a significant player in the thin wall packaging market. The United States alone, as per the American Chemistry Council, produced 36.7 million tonnes of plastics in 2022, making up 12.2 per cent of Municipal Solid Waste (MSW) generation. This significant production volume accentuates North America's pivotal role in the global plastic industry.

The key lies in devising end-of-life solutions for these plastics, with a strong focus on fostering a circular economy. The goal is to repurpose spent plastics into new materials, avoiding disposal. This circular strategy is in line with sustainable practices and is aimed at minimizing environmental impact. It's worth noting that around 60% of North American plastic production, which stays within the region and isn't exported, is used to manufacture durable goods.

This emphasis on converting spent plastics into new materials addresses environmental concerns and aligns with the broader global trend toward sustainability. North America's commitment to circular economy principles positions it as a key player in shaping the future of the thin wall packaging market. As industries and consumers increasingly prioritize environmentally friendly solutions, the region's focus on finding sustainable end-of-life solutions for plastics reinforces its standing as a significant contributor to North America's growth and evolution of the thin wall packaging industry.

- In January 2023, Sustain Pac and PulPac collaborate to deliver Dry Moulded Fibre food service packaging materials to the North American QSR sustainability market.

Polypropylene (PP): Driving Growth in the Thin Wall Packaging Market with Lightweight and Cost-Effective Solutions

Polypropylene (PP) containers stand out as a leading material in the thin wall packaging market, particularly in scenarios where cleanliness and sustainability are paramount. These containers replace single-use packaging made from alternative materials, offering a solution that is not only eco-friendly but also addresses concerns related to hygiene. The Thin Wall Injection Molding (TWIM) process for PP containers enhances their versatility, making them suitable for freezer and microwave use. As a result, they emerge as efficient, reusable options for food storage, ensuring the prolonged freshness and healthiness of stored items.

Despite the prevalent use of plastic in packaging across Europe, accounting for approximately 40% of total demand, the disposability of packaging materials raises environmental concerns. The lack of design guidelines or legal requirements often results in creating single-use products, contributing to increased consumption and a need for improved end-of-life recyclability. Recognizing these challenges, the goal is to promote the adoption of PP containers. This eco-friendly material is lightweight, affordable, and versatile for daily food storage, delivery, and various occasions.

It's crucial to highlight the potential environmental impact of disposable packaging, mainly when not correctly disposed of. With a significant portion of plastics ending up as marine litter due to their disposable nature, there is a growing need to encourage sustainable practices and proper waste management. Additionally, since most plastics have limited recyclability, identifying viable end uses for recycled materials becomes essential to establish a closed-loop system and mitigate the environmental footprint associated with plastic packaging.

- In September 2023, Sabic collaborators on a bio-sourced in-mould labelling solution. Sabic produced mono-PP thin wall containers with in-mould branding in an integrated single-step injection moulding process with three partners.

How is Artificial Intelligence Transforming the Thin Wall Packaging Market?

Artificial intelligence is increasingly reshaping the thin-wall packaging market through increasing cost-effectiveness, speed, and precision in all manufacturing processes. AI-powered systems are being used to guarantee consistent wall thickness, minimize material waste, and optimize injection molding parameters, all of which are essential for lightweight and environmentally friendly packaging. In addition, AI-driven quality inspection tools help detect defects in real time, minimizing rejections and downtime. The integration of predictive maintenance and demand forecasting through AI is also enabling manufacturers to enhance operational efficiency, respond faster to changing consumer needs, and support the growing demand for high performance eco friendly thin wall packaging solutions.

Opportunities

- Growing Demand in Food & Beverages – Thin-wall cups, trays, and containers are increasingly used for dairy, frozen foods, ready-to-eat meals, and drinks.

- Sustainable & Lightweight Packaging – Companies are moving toward lighter, recyclable, or biodegradable materials to reduce environmental impact.

- Expansion in Emerging Markets – Rising incomes and urbanization in Asia-Pacific, Latin America, and other developing regions are driving demand.

- Advancements in Manufacturing Technology – High-speed injection molding, automation, and modern tooling help reduce costs and improve production efficiency.

- Use of Biopolymers & Recycled Materials – Eco-friendly materials are creating new product lines and supporting green initiatives.

- Smart & Functional Packaging – Adding features like tamper evidence, better barriers, and smart labels enhances product safety and shelf life.

- Customization & Innovative Designs – Unique shapes, integrated lids, and branded packaging help companies differentiate their products.

- E-commerce & Convenience Products – Online retail, food delivery, and meal kits increase the need for durable, lightweight, and easy-to-transport packaging.

Thin Wall Boxes: Leading the Charge in Innovative and Dynamic Packaging Solutions

Boxes have emerged as the leading product in the thin wall packaging sector due to their versatility, practicality, and widespread applicability. These thin wall boxes, often made from materials like polypropylene (PP) through processes such as Thin Wall Injection Molding (TWIM), offer a lightweight yet robust solution for packaging various goods. The design of thin wall boxes caters to diverse industries, including food packaging, consumer goods, and electronics.

- In October 2023, Netstal launched a lightweight ICM thin wall cup made completely of PP.

Their popularity is attributed to several factors, including cost-effectiveness, ease of manufacturing, and the ability to accommodate intricate designs. Thin wall boxes efficiently balance the need for durable packaging with reduced material usage, aligning with sustainability goals. They provide excellent protection for products while optimizing space and reducing transportation costs.

Furthermore, thin wall boxes are favoured for their eco-friendly attributes, contributing to the shift towards sustainable packaging solutions. As consumers and industries increasingly prioritize environmental considerations, thin wall boxes stand out as a leading product, meeting the demands of functionality and environmental responsibility in the dynamic landscape of modern packaging.

Thin Wall Packaging: Dominating the Dairy, Frozen Foods, and Expanding Across Industries

Thin wall plastic packaging has become integral in various industries, notably the food and beverage sector, showcasing its versatility and widespread application. In the food and beverage industry, thin wall packaging is extensively employed for dairy containers, including yoghurt cups and yellow fats, frozen foods, fruits, vegetables, bakery items, ready meals, juices, soups, and meats. Its usage extends beyond traditional applications, finding new roles as a replacement for glass and cans in commodities such as meat and preserves. This not only reduces weight but also opens up innovative design possibilities.

- In October 2022, OQ, an Oman-based fast-growing firm, expands its product line with the introduction of Luban HP2151T, a high-flow reactor (60 MFI) grade PP homopolymer aimed for thin wall packaging applications.

Two main components stand out within the thin wall packaging market: open-top containers and lids. These components serve diverse purposes in both food and non-food applications. Open-top plastic containers, a prevalent choice in this market, are commonly utilized for packaging frozen food or fresh food items and in industries like paint, adhesives, cosmetics, and pharmaceuticals. The adaptability of thin wall packaging in the food and beverage industry addresses the specific needs of various products. It contributes to overall sustainability efforts through reduced material usage and weight optimization. The ongoing innovations and applications of thin wall packaging underscore its significance in enhancing efficiency, reducing environmental impact, and meeting the evolving demands of the food and beverage market.

- In November 2023, TWI-PET, a novel technology developed by ITC Packaging in collaboration with BMB SPA and Novapet, is a one-step injection moulding technique that produces thin wall, flexible PET packaging.

Value Chain Analysis

R&D

Thin-wall packaging mainly uses PP and PE (HDPE, LDPE), with growing use of recycled plastics (PCR) for eco-friendly solutions.

Key suppliers are Borealis AG, SABIC, Plastipak Industries, and Manjushree Technopack. Lightweight design and fast production cycles make it ideal for food and beverage applications.

Logistics & Distribution

Distribution targets food & beverage brands, retailers, and FMCG companies, with plants often near high-demand areas.

Major players include Amcor, Berry Global, and Pactiv / Reynolds Group. Efficient logistics help ensure products reach markets quickly while maintaining quality.

Recycling & Waste Management

Recycling focuses on mono-material and PCR-based packaging.

Key players include Amcor, Berry Global, Smurfit Kappa, DS Smith, Veolia, and SUEZ. Increased collaboration with recycling partners ensures circularity and reduces environmental impact.

Competitive Landscape: Key Players and Strategic Movements in the Thin Wall Packaging Market

Several key players characterize the competitive landscape of the thin wall packaging market. Major companies in this market include Berry Global, Amcor, Sem Plastik, Double H Plastics, Greiner Packaging, Tek Pak, RPC Group, Reynolds Group, Sanpac and Plastipak Industries Inc. These companies focus on strategies such as mergers and acquisitions, product innovations, and expanding their regional presence to gain a competitive edge. The market is also influenced by changes in regulatory requirements and consumer preferences shifts, driving the need for innovative and sustainable thin wall packaging refrigerant solutions.

Key Players Driving Innovation and Growth in the Thin Wall Packaging Market

- Amcor

- Sem Plastik

- Double H Plastics

- Greiner Packaging

- Tek Pak

- RPC Group

- Reynolds Group

- Sanpac

- Plastipak Industries Inc.

Recent Developments

- In December 2025, Amcor announced the launch of new de-icing salt packs made with up to 100% Post-Consumer Recycled (PCR) content. These thin-wall bags are designed for durability in extreme winter temperatures while reducing reliance on virgin plastics.

- In November 2025, Quadpack announced the launch of the Serenity Tube, a thin-wall skincare packaging solution. The tube features a flexible applicator for precise delivery and offers sustainability options including a cap made from 100% recycled material and a sleeve with up to 50% PCR content. This product targets the premium "wellness" market, providing a monomaterial-style aesthetic.

- In October 2025, Amcor announced the launch of its new APET-based AmSecure thermoformed trays and rollstock as a sustainable alternative for medical device packaging. The thin-wall solution is presented as cost-effective, offering clarity and durability, and is compatible with standard sterilization methods.

- On 02 February 2025, Tetra Pak announced the launch of food and beverage cartons in India using ISCC PLUS certified recycled polymers, a first for the Indian packaging industry. The new packaging incorporates chemically recycled plastic in caps and laminates to decrease dependence on virgin fossil-based materials. This effort aligns with the company's circular economy goals and assists brands in meeting global plastic-waste compliance standards

Key Market Segments Driving Growth in the Thin Wall Packaging Industry

By Material

- Polypropylene (PP)

- Homopolymer PP

- Random Copolymer PP

- Block Copolymer PP

- Biopolymer PP

- High Impact PP

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Biodegradable PE

- Recycled PE

- Polystyrene (PS)

-

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expanded Polystyrene (EPS)

- Crystal Polystyrene

- Biodegradable PS

-

- Polyethylene Terephthalate (PET)

- Clear PET

- Colored PET

- PET Recycled Resin (rPET)

- Bio-based PET

- Barrier PET

- Others

- Polycarbonate (PC)

- Polyamide (PA)

- Polylactic Acid (PLA)

- Polyvinyl Chloride (PVC)

- Cellulose-Based Plastics

By Product Type

- Boxes

- Rectangular Boxes

- Square Boxes

- Custom-Shaped Boxes

- Food Packaging Boxes

- Retail Packaging Boxes

- Tubs

- Round Tubs

- Oval Tubs

- Square Tubs

- Multi-compartment Tubs

- Stackable Tubs

- Jars

- Plastic Jars

- Glass Jars

- Flip-top Jars

- Screw Cap Jars

- Wide-mouth Jars

- Cups

- Plastic Cups

- Foam Cups

- Paper Cups

- Compostable Cups

- Single-Serve Cups

- Trays

- Food Trays

- Medical/Pharmaceutical Trays

- Bakery Trays

- Retail Display Trays

- Multi-compartment Trays

- Bowls

- Plastic Bowls

- Paper Bowls

- Foil Bowls

- Biodegradable Bowls

- Soup and Salad Bowls

- Lids

- Snap-on Lids

- Screw Lids

- Peel-off Lids

- Dome Lids

- Leak-proof Lids

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

-

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

-

Tags

FAQ's

Select User License to Buy

Figures (3)