Recyclable Plastic Market Size, Share and Trends, Import & Export Analysis

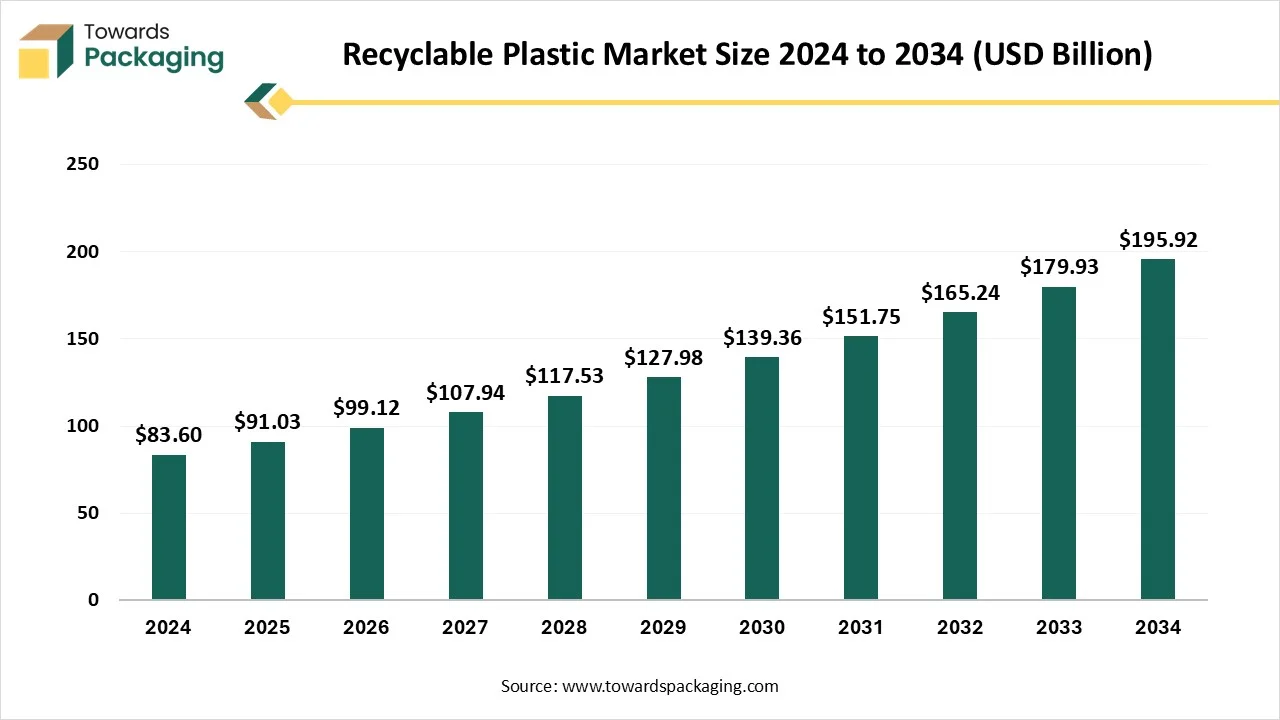

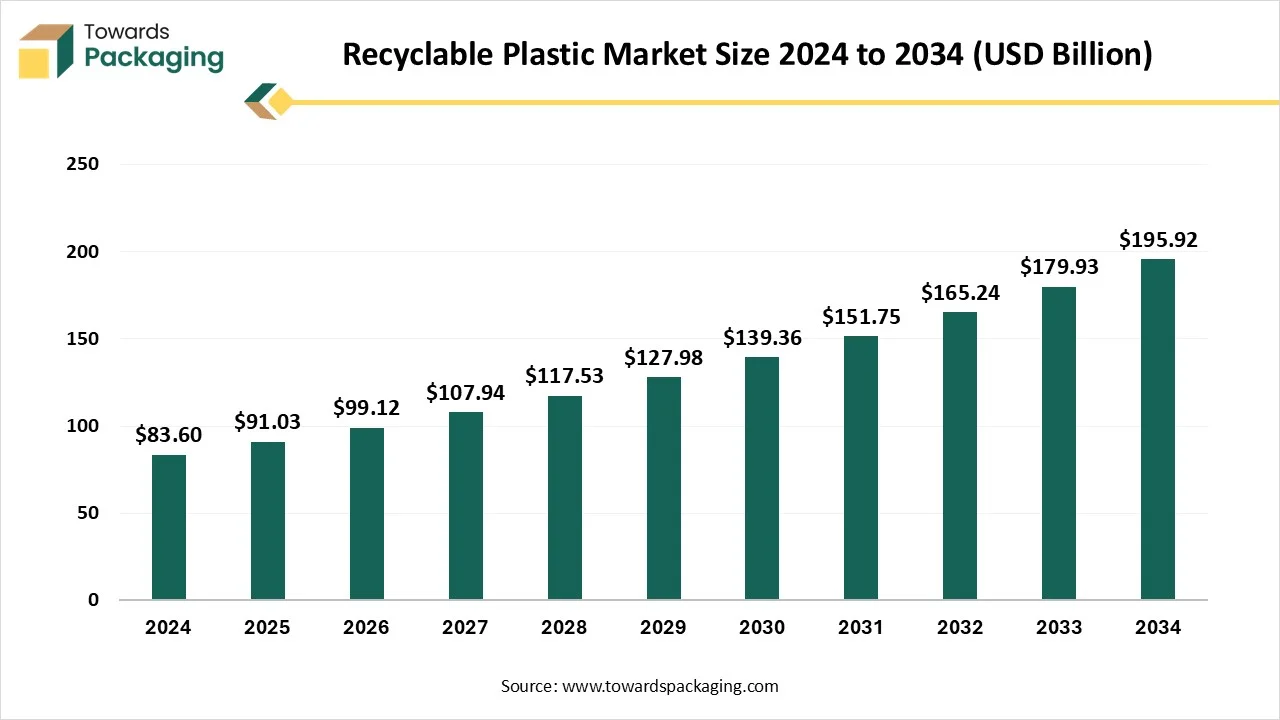

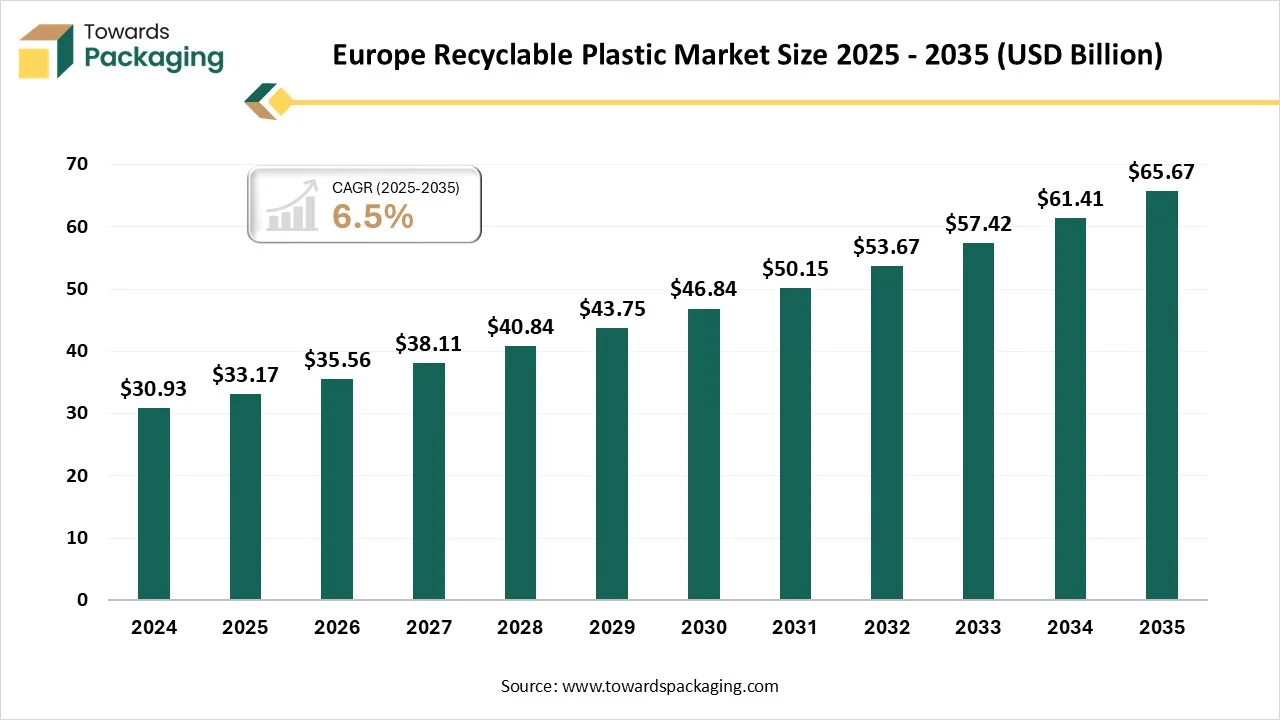

The recyclable plastic market is projected to grow from USD 99.12 billion in 2026 to USD 213.34 billion by 2035, registering a strong CAGR of 8.89% from 2025 to 2034. This report covers a complete breakdown of market segments by plastic type, recycling technology, and end-use industries, along with a regional analysis for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It also includes company profiles, competitive benchmarking, value chain structure, trade flow data, and detailed insights into global manufacturers and suppliers.

Key Insights

- In terms of revenue, the market is valued at USD 91.03 billion in 2025.

- The market is projected to reach USD 195.92 billion by 2034.

- Rapid growth at a CAGR of 8.89% will be observed in the period between 2025 and 2034.

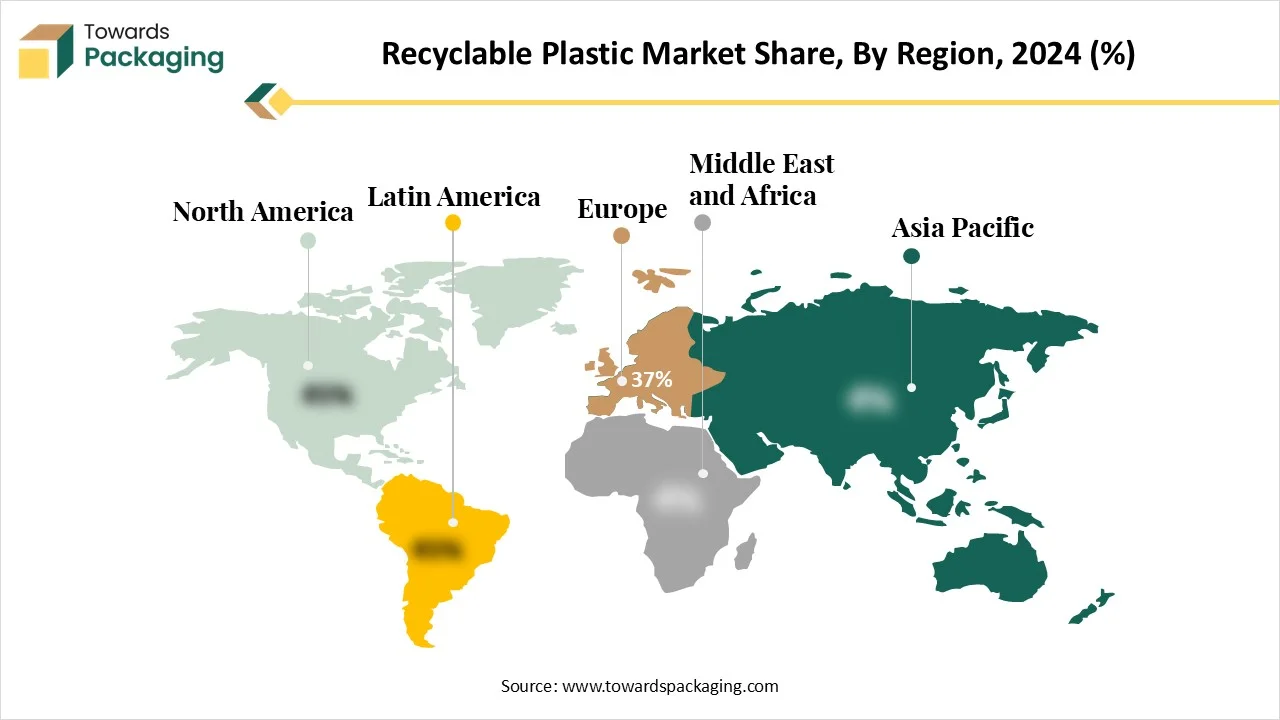

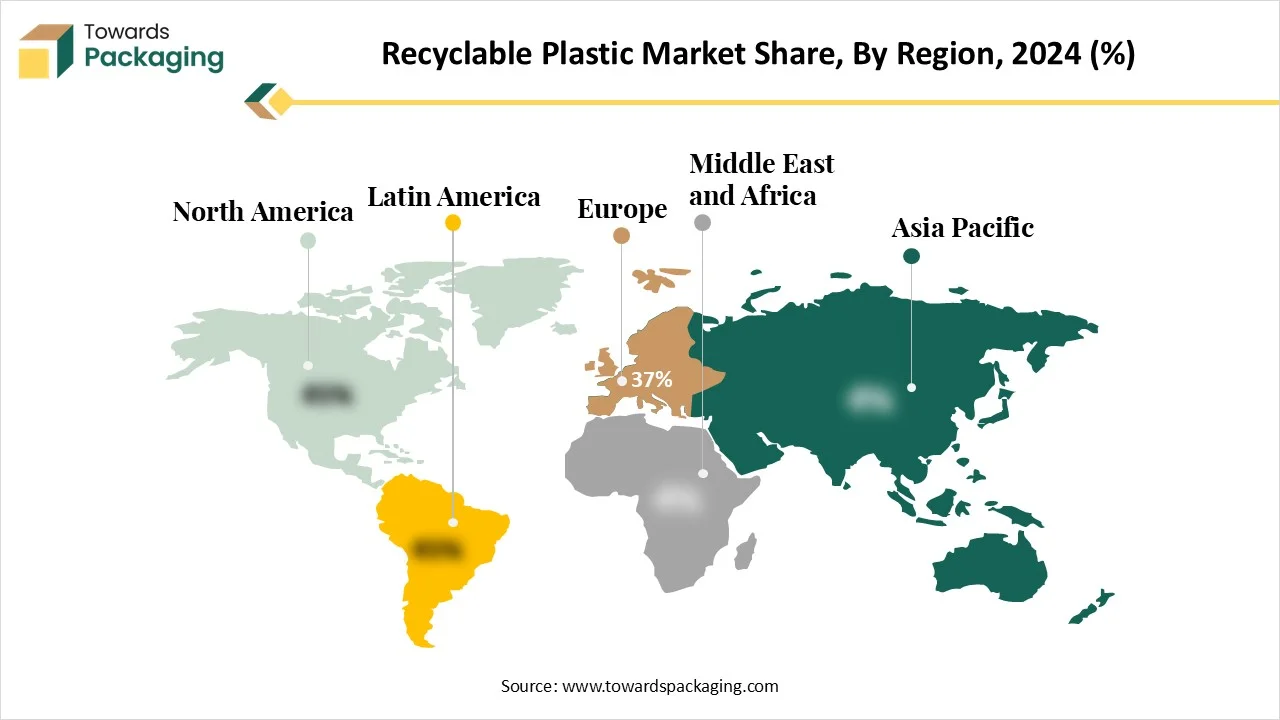

- Europe dominated the global market by holding more than 37% of the market share in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By plastic type, the PET segment contributed the biggest market share of 35% in 2024.

- By plastic type, the Polypropylene (PP) & LDPE segments will be expanding at a significant CAGR between 2025 and 2034.

- By recycling method, the mechanical recycling segment contributed the biggest market share of 62% in 2024.

- By recycling method, the chemical recycling segment is expected to expand at a significant CAGR between 2025 and 2034.

- By source, the post-consumer recycled plastics segment contributed the biggest market share of 59% in 2024.

- By source, the ocean-bound & marine plastics segment is expanding at a significant CAGR between 2025 and 2034.

- By application, the packaging segment held the major market share of 43% in 2024.

- By application, the textiles & automotive segment is projected to grow at a CAGR between 2025 and 2034.

- By end-use industry, the food & beverage segment contributed the biggest market share of 38% in 2024.

- By end-use industry, the retail, apparel & e-commerce packaging segment is expanding at a significant CAGR between 2025 and 2034.

Market Overview

The recyclable plastic market encompasses the production, collection, processing, and reuse of plastic materials that can be reprocessed into new products after their initial use. These plastics are designed to minimize environmental impact by reducing landfill waste, lowering carbon emissions, and supporting a circular economy. The market includes various mechanically and chemically recyclable polymers, used widely across packaging, automotive, construction, electronics, textiles, and consumer goods industries. As global sustainability regulations tighten and demand for post-consumer recycled (PCR) content rises, this market is experiencing rapid innovation and scaling.

Future Demands

- Fast-growing demand due to environmental regulations and recycling mandates.

- Companies will increasingly use recycled content in packaging to meet sustainability goals.

- Consumer preference for eco-friendly and low-waste products will push adoption.

- The market will expand quickly as brands move away from single-use, non-recyclable plastics.

- Demand will rise for advanced sorting and recycling technologies to improve material quality.

- Growth in PCR (post-consumer recycled) resins for bottles, trays, and films.

- Investments in closed-loop recycling systems by major FMCG and beverage brands.

- Partnerships between packaging firms and recyclers will support large-scale material recovery.

Emerging Technologies

- Monomaterial packaging structures (PE-only, PP-only) that improve recyclability at scale.

- Advanced chemical recycling technologies convert waste plastics into virgin-like polymers.

- Near-infrared detectable plastics are improving sorting efficiency in waste management facilities.

- Bio-based recyclable plastics from renewable feedstock offering low carbon footprints.

- Smart additives for recyclability enhancement, enabling better melting, color removal, and odor control.

- Closed-loop recycling platforms integrated with blockchain for traceability and certification.

Sustainability Trends

The recyclable plastic market is increasingly driven by sustainability emphasizing the use of bio-based substitutes and post-consumer recycled plastic to lessen dependency on virgin materials. Material recovery and circularity are being improved by better recycling technologies, and the packaging, automotive, and consumer goods industries are seeing an increase in demand for recyclable plastics due to regulatory pressures, corporate sustainability goals, and consumer preference for eco-friendly products.

Regulatory Landscape of Recyclable Plastic Market

Regulatory changes in the recyclable plastic market are focused on reducing plastic waste and promoting circular plastics, and setting mandatory recycling targets for manufacturers and brand owners. Extended producer responsibility laws hold businesses responsible for end-of-life packaging, and food contact and safety regulations mandate that recycled plastics meet stringent quality standards. Policies that restrict hazardous additives and promote the use of post-consumer recycled content are also promoting the development and uptake of sustainable plastic solutions.

Major Trends in the Industry

- Increased Use of Post-Consumer Recycled (PCR) Plastics: Companies are integrating PCR content into packaging and products to reduce environmental impact.

- Shift Toward Bio-Based and Alternative Plastics: Growing demand for biodegradable and bio-based polymers is shaping sustainable product development.

- Advanced Recycling Technologies: Mechanical, chemical, and enzymatic recycling methods improve efficiency and enabling closed-loop recycling.

- Design for Recyclability: Simplified polymer blends, fewer additives, and modular packaging designs enhance material recovery.

- Regulatory Compliance and Circular Economy Initiatives: Policies like single-use plastic bags, EPR regulations, and recycling mandates are influencing production and packaging strategies.

- Consumer Awareness and Demand: Eco-conscious consumers are driving brands to adopt greener plastics and sustainable packaging solutions.

- Industry Collaboration: Partnerships among manufacturers, recyclers, and governments are increasing to improve collection, sorting, and recycling infrastructure.

Innovations

- Chemical Recycling Technologies: Converting plastic waste back into monomers or fuels, allowing hard-to-recycle plastics to re-enter the production cycle.

- Enhanced Sorting and Identification Systems: Use of AI, robotics, and near-infrared (NIR) technology to improve sorting efficiency and purity of recyclable plastics.

- Bio-Based and Biodegradable Plastics: Development of plastics from renewable resources like plant-based polymers that are compostable or easier to recycle.

- Lightweight and Multi-Functional Packaging: Designing plastics that use less material without compromising strength, improving recyclability, and reducing carbon footprint.

- High PCR Content Materials: Innovations in processing techniques that allow higher percentages of post-consumer recycled plastics in products without affecting quality.

- Barrier and Coating Technologies: Development of recyclable coatings that replace multi-material laminates, enabling full recyclability of packaging.

- Closed-Loop Systems: Brand and manufacturer initiatives to collect and recycle plastics in-house or through partnerships, promoting circular economy models.

Sustainability and Compliances on Recyclable Plastic Market

Global regulations aimed at plastic circularity, waste reduction, and chemical safety have a significant impact on the market for recyclable plastics. Governments are pressuring companies to switch from single-use mixed plastics to monomaterial recyclable designs that work with current recycling infrastructure. To verify recyclability claims and direct packaging redesign choices, compliance standards such as APR and RecyClass are becoming increasingly important.

In the meantime, chemical recycling technologies are becoming more popular, but to be widely adopted, they must fulfill safety certification and traceability requirements. Additionally, carbon neutrality, the use of renewable energy, and quantifiable waste reduction are highlighted by sustainability initiatives, which encourage producers to use third-party audits and more transparent reporting to demonstrate their progress.

How Can AI Improve the Recyclable Plastic Market?

The incorporation of AI in the recyclable plastic market plays an important role in enhancing the sustainability, efficacy, and accuracy of the packaging. AI promotes designs and material innovation in this market. It has enhanced the process of material identification and sorting for the production of top-quality plastics. It optimizes the recycling process and predicts the maintenance required for the recycling equipment to process efficiently. Incorporation of AI supports the development of sustainable resources.

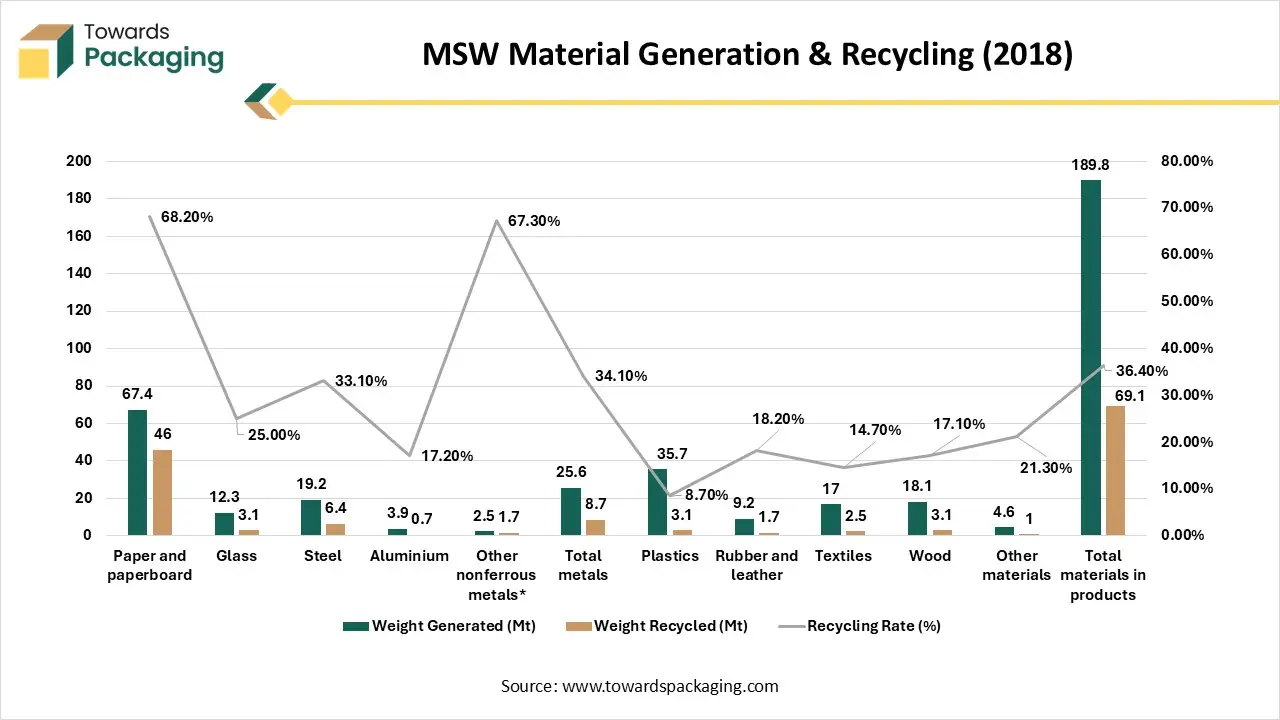

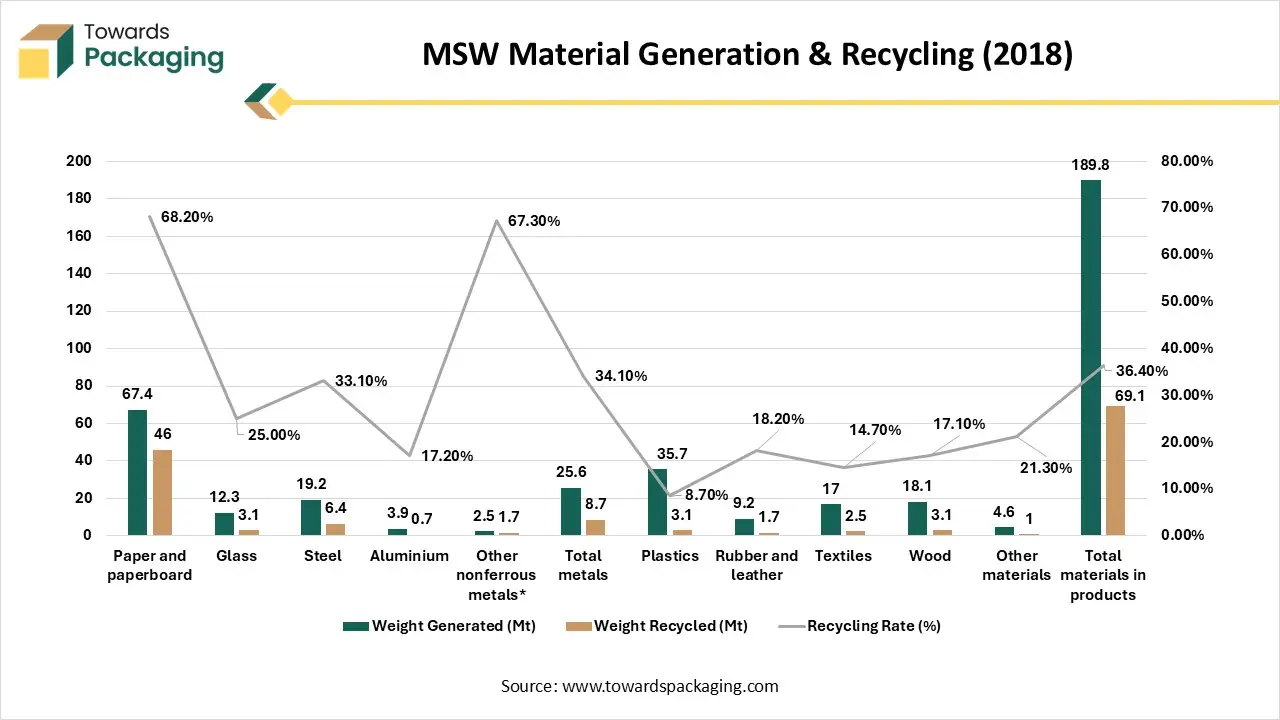

MSW Material Generation & Recycling (2018)

The graph illustrates the trends in the production and recycling of municipal solid waste (MSW) materials in 2018, emphasizing distinct variations among material types. Metals like steel and aluminum also showed comparatively high recycling efficiency, but paper and paperboard have the highest recycling rate at roughly 68%, owing to established collection networks and robust end market demand. Despite producing a significant amount of waste, plastics have a low recycling rate of about 9%, indicating problems with material complexity, contamination, and limited recycling capacity. Only roughly 69million of the nearly 190 million tonnes of materials produced overall were recycled, highlighting a sizable recovery gap. The data make it abundantly evident that to increase recycling rates, particularly for plastics textile rubber, and mixed materials, better recycling technologies, better waste segregation, and stricter regulations are required.

Market Dynamics

Drivers

Rising Innovative Technology

The rising innovation in recycling technology and trash management has driven the recyclable plastic market. Several development possibilities have raised the adoption of recyclable plastics in the packaging industry globally. Increasing collaboration among companies and continuous investment have enhanced the utilization of recyclable plastics. Rising concerns to reduce landfills have increased the demand for this industry. The recycled packaging has attracted a huge number of consumers due to its benefits for the environment has enhanced the usage of these plastics.

Challenges and Restraints

Increasing Preference Towards Virgin Plastics

The increasing demand for virgin plastics has hindered the growth of the recyclable plastic market. The huge investment in setting up has restricted the expansion of this recyclable plastic market. Many other reasons, such as limitations of infrastructure, inconsistent quality, and high charges required for recycling of plastics, have hindered the development of this market.

Opportunity

Rising Government Initiatives

The rising initiatives of the government toward ecological issues due to plastic have enhanced the opportunities to grow for the recyclable plastic market. Several policies of the government have promoted the development of recycled and recycling plastic packages. Several sectors have started adopting recycled plastic for various purposes, such as manufacturing carpets, clothing, and various other products. Innovation in this field has raised numerous opportunities, which have encouraged the growth of the market.

EU Packaging & Packaging Waste Directive

The EU Packaging & Packaging Waste Directive sets recycling targets to reduce environmental impact and push member states toward a circular economy. By 2025, the EU requires that 65% of all packaging be recycled, increasing to 70% by 2030. Paper and cardboard have the highest targets due to their strong recycling infrastructure, rising from 75% in 2025 to 85% in 2030. Glass also has ambitious goals, moving from 70% to 75%, while plastics more difficult to recycle have lower targets of 50% by 2025 and 55% by 2030. Wood packaging has the lowest requirements, improving slightly from 25% to 30% by 2030.

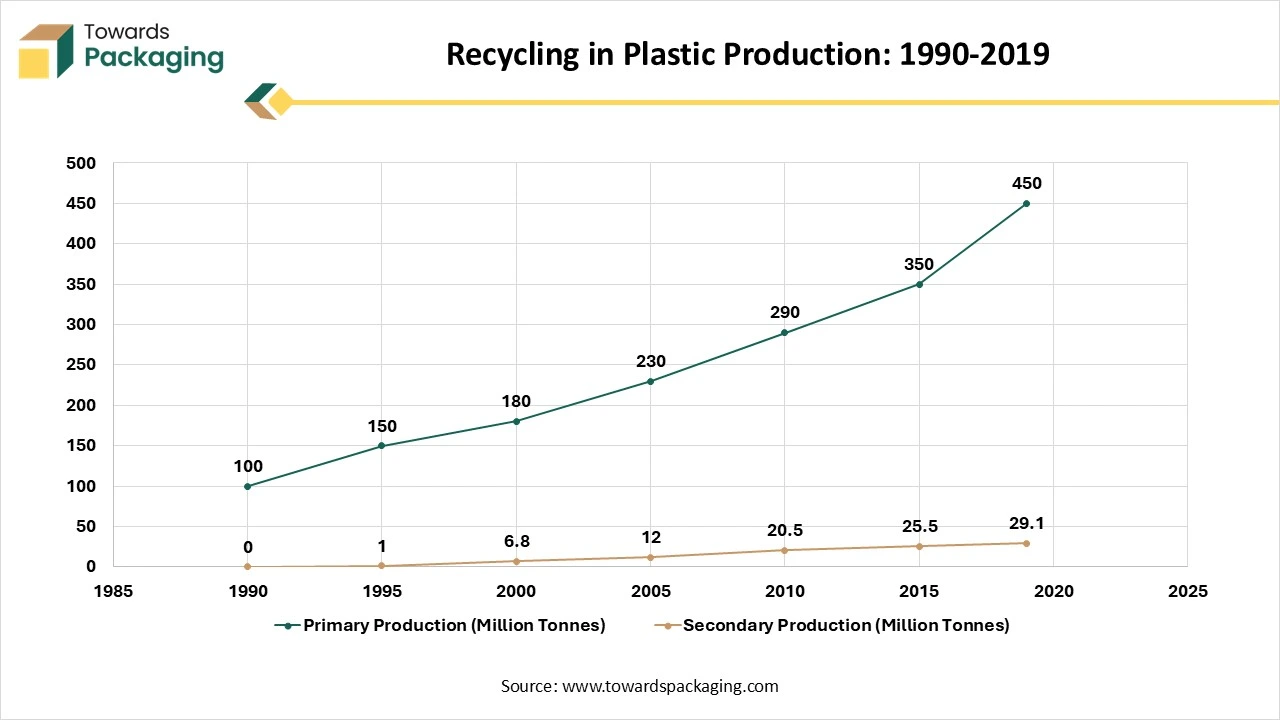

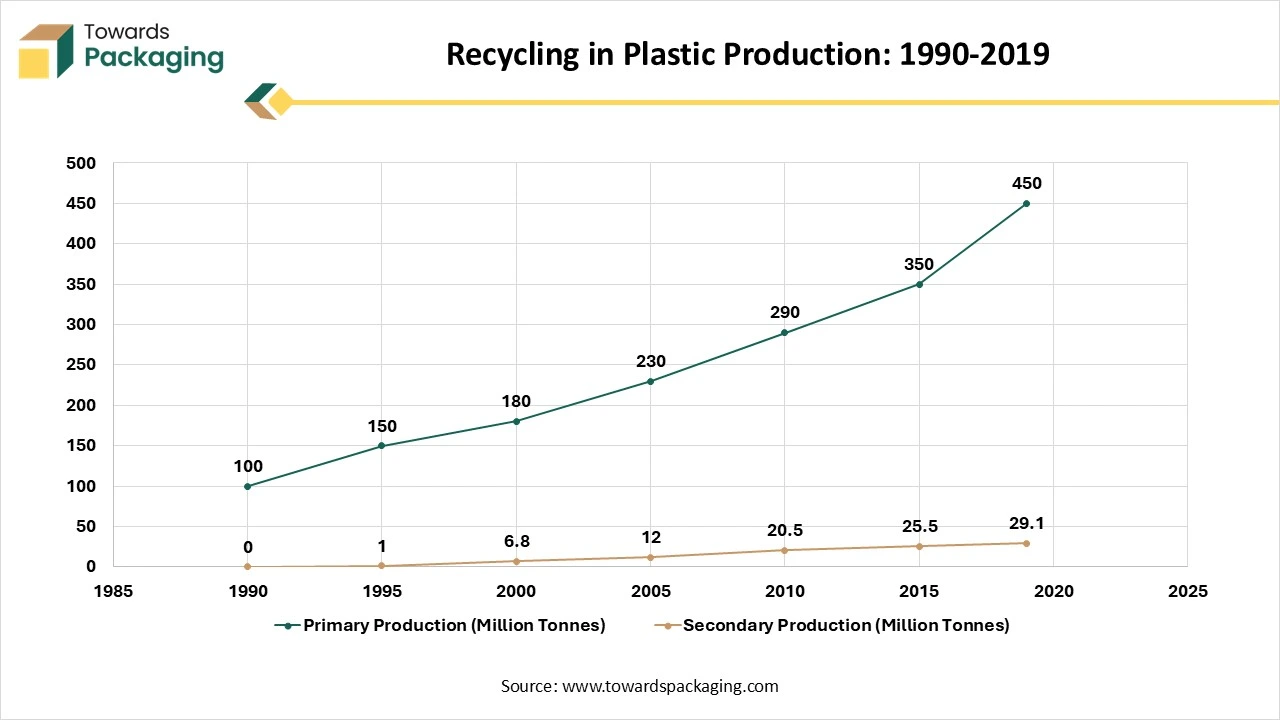

The Role of Recycling in Plastic Production: 1990-2019

Despite recycling efforts growing from 6.8 million tonnes (Mt) in 2000 to 29.1 Mt in 2019, secondary plastics only make up 6% of the overall feedstock for new plastics globally. While recycling plays a vital role in reducing environmental impact by diverting plastics from harmful waste management practices, the amount recycled is still a small fraction compared to primary plastic production.

Segmental Insights

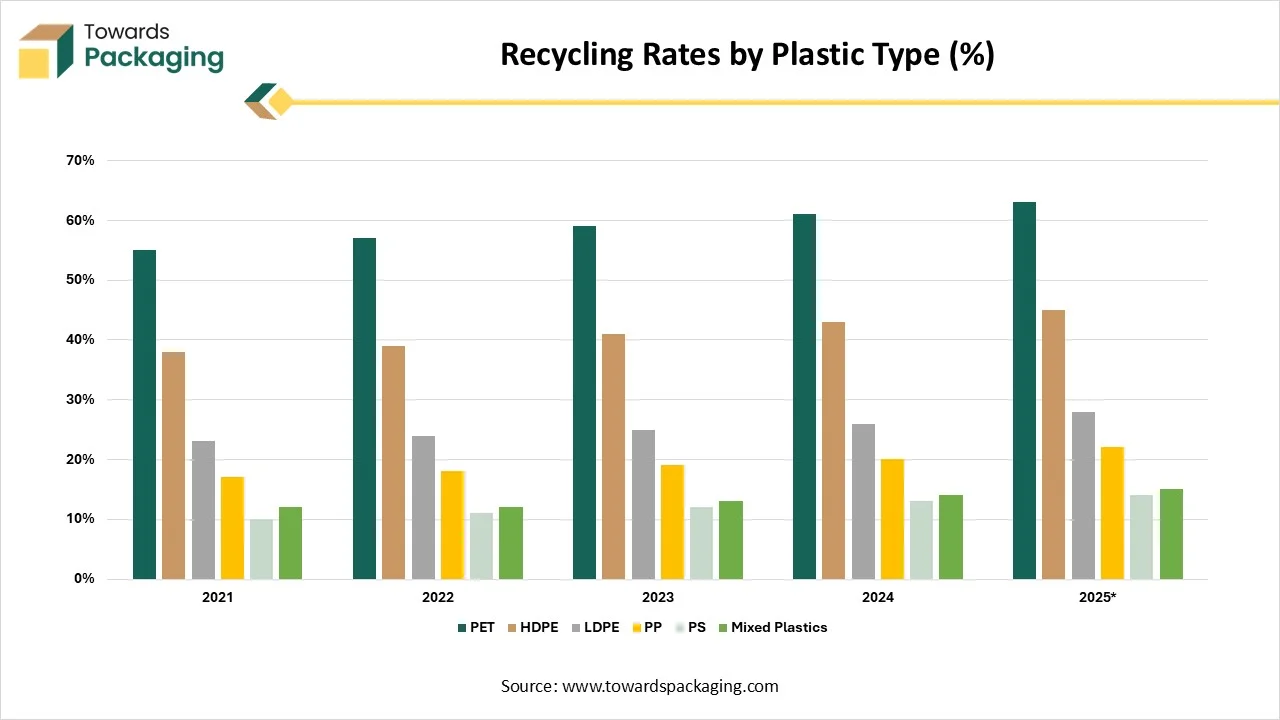

Why PET Segment Dominated the Recyclable Plastic Market in 2024?

The PET segment contributed a considerable share of the recyclable plastic market in 2024 due to rising demand for the manufacturing of containers and bottles. PET containers have a high recyclability rate that can be easily processed to generate new products. The rising demand for sustainable packaging has enhanced the demand for this segment. Adoption of major market players has improved the innovation process in the recycled plastic market.

The Polypropylene (PP) & LDPE segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing significant development due to its versatility, widespread usage, and durability. It is a thermoplastic polymer that is widely recognized for its weldability, high chemical resistance, and fatigue resistance.

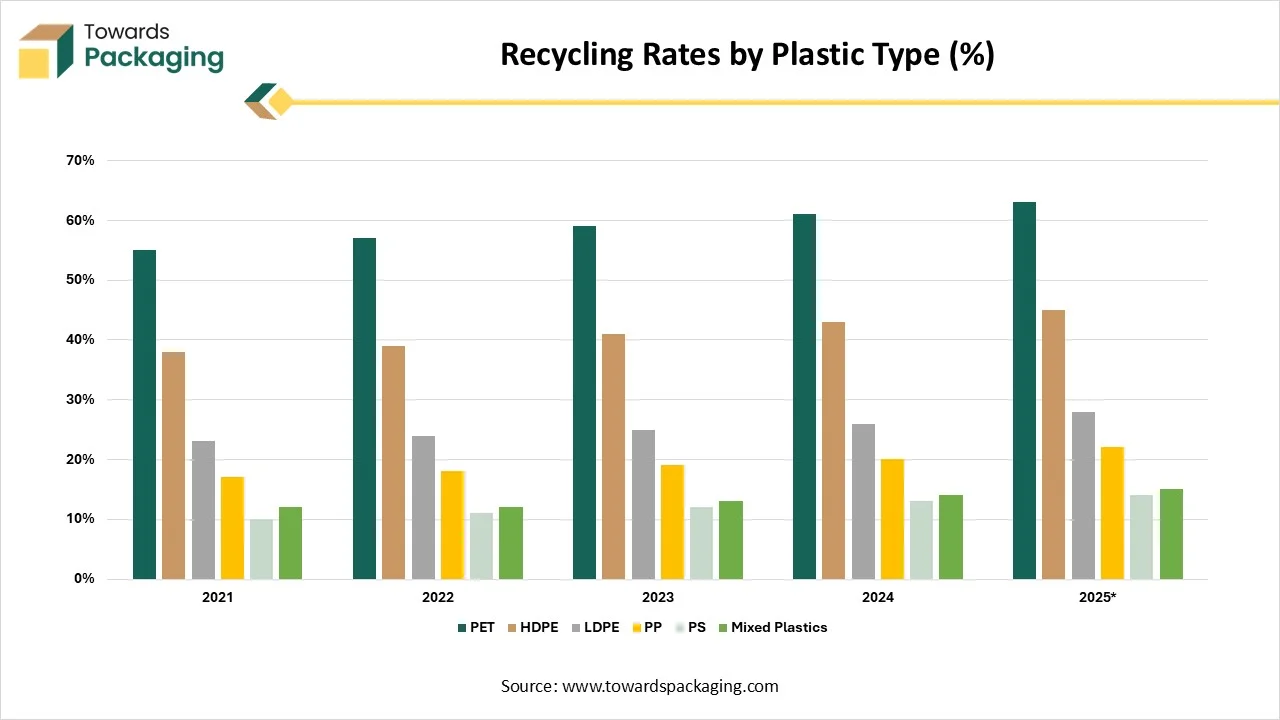

Recycling Rates by Plastic Type (%)

| Plastic Resin |

2021 |

2022 |

2023 |

2024 |

2025 |

| PET |

55% |

57% |

59% |

61% |

63% |

| HDPE |

38% |

39% |

41% |

43% |

45% |

| LDPE |

23% |

24% |

25% |

26% |

28% |

| PP |

17% |

18% |

19% |

20% |

22% |

| PS |

10% |

11% |

12% |

13% |

14% |

| Mixed Plastics |

12% |

12% |

13% |

14% |

15% |

The chart shows a steady improvement in recycling rates across all major plastic types from 2021 to 2025 due to robust collection and processing systems. PET continuously leads recycling performance, increasing from roughly 55% to over 60%. Additionally, HDPE and LDPR exhibit steady growth, pointing to better demand and infrastructure for recycling. PP, PS, and mixed plastics, on the other hand, continue to be lower but show gradual but encouraging growth, underscoring the continued difficulties in recycling more complicated plastic streams.

Why Mechanical Recycling Segment Dominated the Recyclable Plastic Market in 2024?

The mechanical recycling segment is expected to have a considerable share of the recyclable plastic market in 2024 due to its scalability and cost-effectiveness. Mechanical recycling methods like re-extrusion, shredding, and washing are widely used by various industries. It has the capacity to recycle a huge number of plastics, which has raised the usage of this segment. Presence of infrastructure for processes such as collection, sorting, and processing services.

The chemical recycling segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is expanding due to the recycling of contaminated and mixed plastics. The rising demand for sustainability has influenced the demand for this market. This segment plays a significant role in the textile, electronics, and automotive industries.

Why the Packaging Segment Dominated the Recyclable Plastic Market in 2024?

The packaging segment is expected to have a considerable share of the recyclable plastic market in 2024 due to strict guidelines for the packaging industry and rising ecological concerns. The growing demand for premium packaging in several sectors to enhance the branding strategy has led to the increasing adoption of recyclable plastics. Continuous increasing concern of the consumers towards ecological issues has enhanced the recyclability technology. It enhances the brand image and helps to attract a huge number of consumers.

The textiles & automotive segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing significant growth due to the increasing sustainability goals of the automotive industry. These sectors utilize rPET and PP (rPP) for several parts such as insulation materials, dashboards, seat panels, and many others.

Why the Food & Beverage Segment Dominated the Recyclable Plastic Market in 2024?

The food & beverage segment is expected to have a considerable share of the recyclable plastic market in 2024 due to the rising adoption of packaged products. These are lightweight and non-toxic substitutes that can keep the quality of the food products intact for a longer period. The increasing usage of flexible packages like pouches and rigid packages such as boxes has enhanced the demand for this segment. These are the cost-efficient solutions for the food & beverages industry.

The retail, apparel & e-commerce packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The increasing demand for packaging that can reduce packaging pollution has attracted various sectors rapidly. Biodegradability and recyclability are the primary focus in these industries for the packaging of products.

Why Post-Consumer Recycled Plastics Segment Dominated the market in 2024?

The post-consumer recycled plastics segment is expected to have a considerable share of the recyclable plastic market in 2024 due to rising consumer consciousness. The rising focus on sustainable packaging by companies has influenced the demand for this segment. The increasing advancement of technology has helped to introduce innovation in this segment. The post-consumer recycled ensures the reduction of packaging wastage has raised the demand for this market.

The ocean-bound & marine plastics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This is due to the increasing prevalence in coastal areas. The increasing concern towards marine pollution has raised the adoption of recyclable plastic containers.

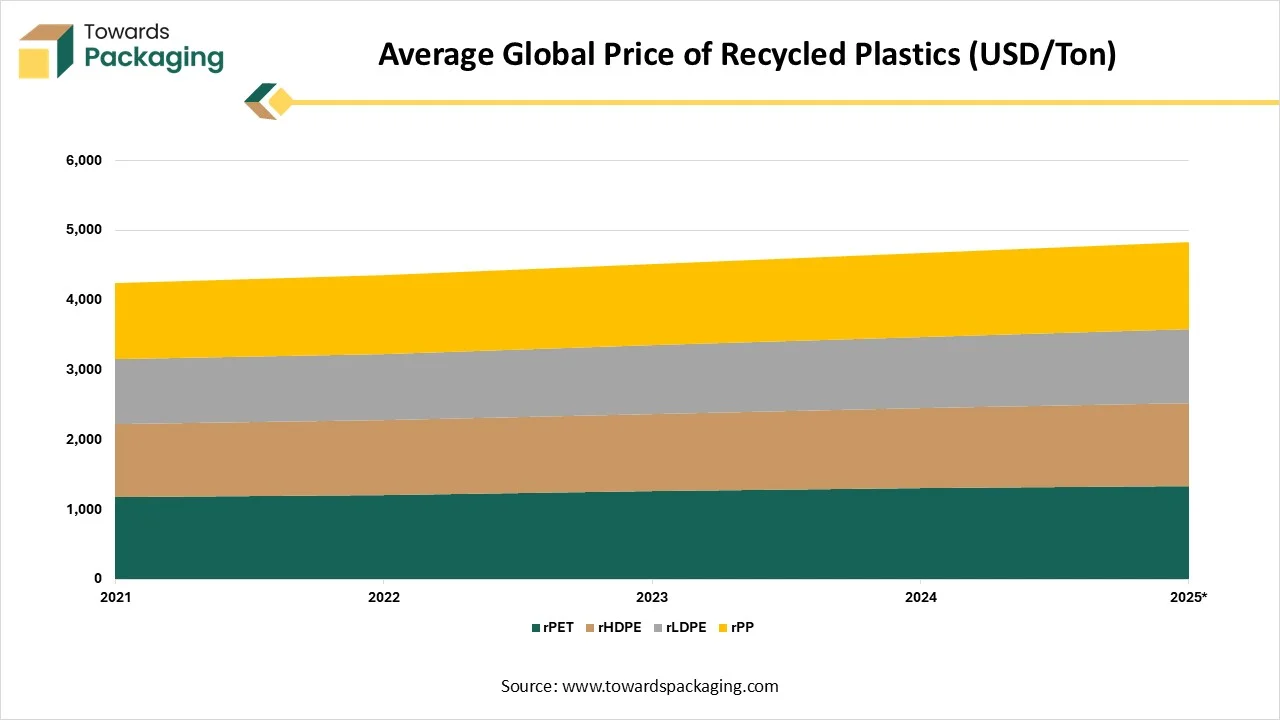

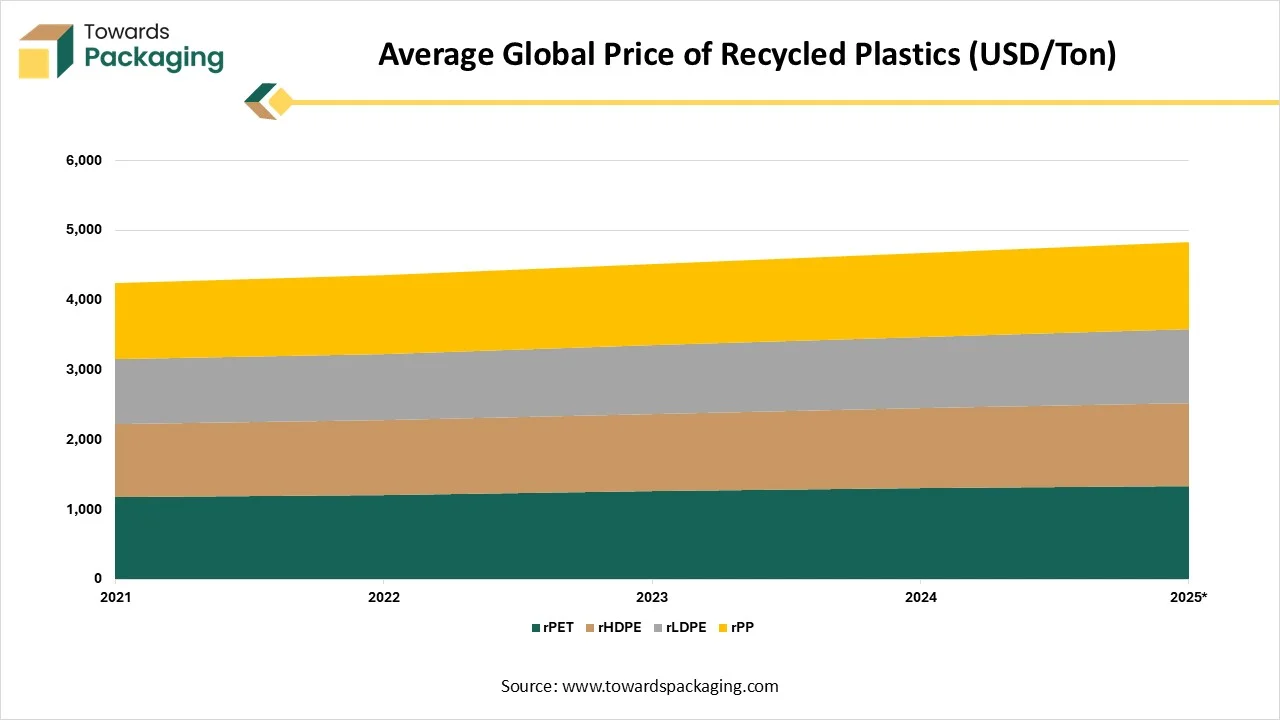

Average Global Price of Recycled Plastics (USD/Ton)

| Resin |

2021 |

2022 |

2023 |

2024 |

2025 |

| rPET |

1,180 |

1,210 |

1,255 |

1,298 |

1,336 |

| rHDPE |

1,045 |

1,073 |

1,116 |

1,157 |

1,194 |

| rLDPE |

925 |

948 |

981 |

1,014 |

1,049 |

| rPP |

1,095 |

1,123 |

1,166 |

1,207 |

1,249 |

The data shows a steady rise in average global prices of recycled plastics from 2021 to 2025 across all resin types, rising from USD 1180/ton in 2021 to roughly USD 1336/ton in 2025 due to high demand from beverage and packaging applications. rPET continues to be the most expensive resin. Additionally, rHDPE and rPP exhibit steady growth, indicating increased use in consumer goods and rigid packaging. In the meantime, rLDPE exhibits comparatively lower prices but a similar upward trend, suggesting that recycled materials are becoming increasingly popular worldwide.

Regional Insights

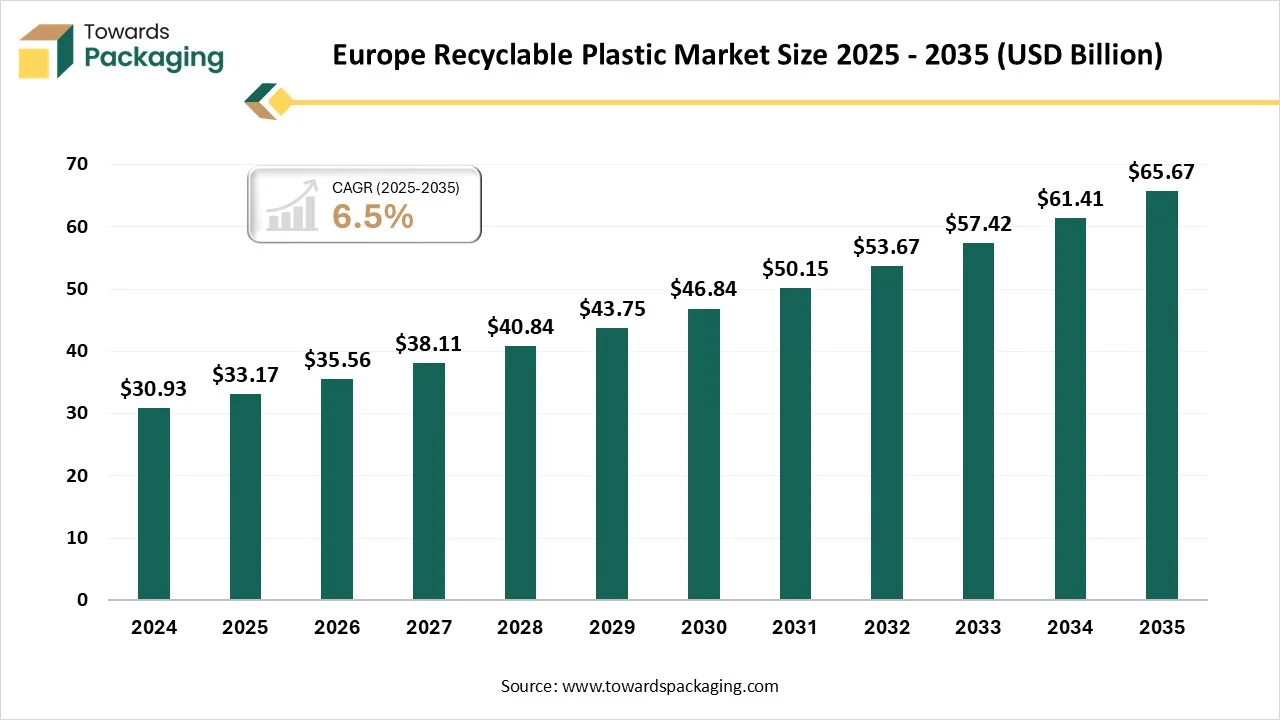

Rising Ecological Awareness in Europe Promotes Dominance

Europe held the largest share of the recyclable plastic market in 2024, due to the rising ecological awareness, increasing concentration towards circular economy, and strict guidelines. Huge recycling rates and technological advancements have influenced the development of recyclable plastic. The presence of advanced technology for the management of plastics has raised the market in this region.

Trend of Recyclable Plastic in Germany

The urge for recycled plastic in Germany is developing and strong too, which is being driven by the combination of passionate recycling policies, user choice, and use in main sectors like automotive and packaging. Germany's complete circular economy method gives importance to recycling and reuse to reduce waste. Initiatives promote eco-design to create plastic products that are convenient to recycle and mix back into the manufacturing cycle.

This is the biggest and most important end-use for the recycled plastics that has dominated the market. The usage of recycled polyethylene terephthalate (PET) and other plastics is developing for everything that creates shipping envelopes.

Asia Pacific’s Increasing Industrialization Supports Growth

The Asia Pacific region is estimated to grow at the fastest rate in the recyclable plastic market during the forecast period. Some of the major factors behind the growth of this market in this region are supportive government policies, robust economic development, and rising industrialization. In countries such as China, India, Vietnam, and many others, this market is growing due to rapid technological advancements.

China

China has implemented strict waste import regulations that significantly impact global plastic-waste flows. Policies like Operation National Sword banned the import of contaminated plastic waste and many categories of foreign waste. This move restricted global export of plastic waste to China and forced producers and recyclers worldwide to better manage plastic waste domestically, increasing demand for local recycling infrastructure and raising the value of clean, recyclable plastic streams. Domestically, China has also limited the use of non-degradable plastic bags and single-use plastics in major cities and phased out such items nationwide. These restrictions encourage the switch to recyclable or biodegradable plastics.

Trend of Recyclable Plastics In India

The urge for recyclable plastic in India is on a main upward trajectory, which is being driven by the corporate sustainability goals, government regulations, and the developing user awareness. The industry is expected to more than double in size from 2024 to 2033, which makes a rigid market for the recycled materials. The Fast-moving Consumer Goods organizations and the automotive production are developing the choice for items with environmentally friendly or recycled packaging. This user demand is overall comparing the organizations in order to accept the more sustainable practices that count sourcing recycled plastics.

India has implemented several national regulations under the Plastic Waste Management Rules to manage plastic waste, phase out certain non-recyclable and single-use plastics, and enforce segregation, recycling, and producer accountability. These regulations push plastic producers and packaging manufacturers to shift toward recyclable or reusable materials. Additionally, India has promoted public awareness campaigns, waste-collection drives, and the establishment of recycling infrastructure to build robust plastic recovery systems, increase recycling rates, and reduce plastic pollution.

North American market for recyclable plastics is growing steadily, motivated by corporate sustainability initiatives stringent government regulations and growing environmental consciousness. Construction and automotive materials are the next most popular application areas after packaging. The most common recycled plastics are polyethylene (PE) polypropylene (PP) and PET. The efficiency and quality of recycled materials are being enhanced by technological advancements in recycling such as mechanical and chemical recycling.

U.S. holds a major share of North Americas recyclable plastics market. Growth is driven by strict government regulations business pledges to use more recycled materials and growing demand from the consumer goods and packaging industries. Bottles and containers are the main source of recycled material and PE and PP predominate in the product mix. Difficulties include the need for improved sorting and processing technologies as well as uneven recycling infrastructure among states.

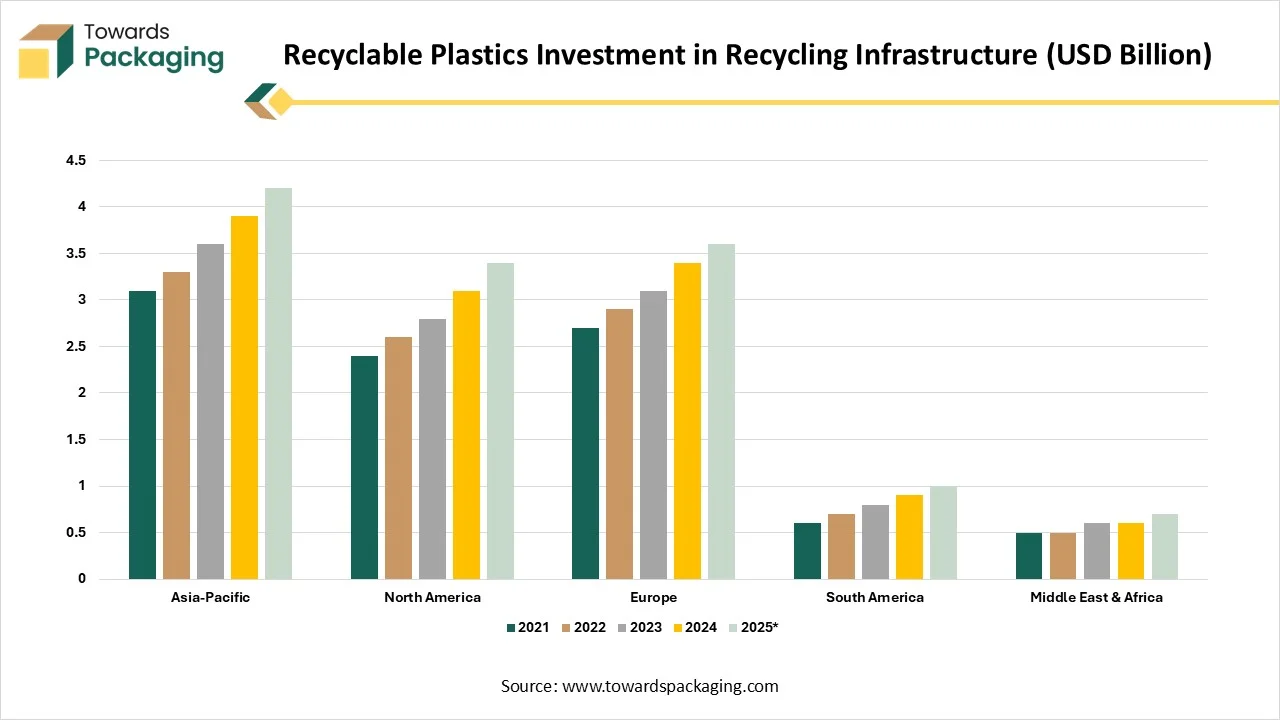

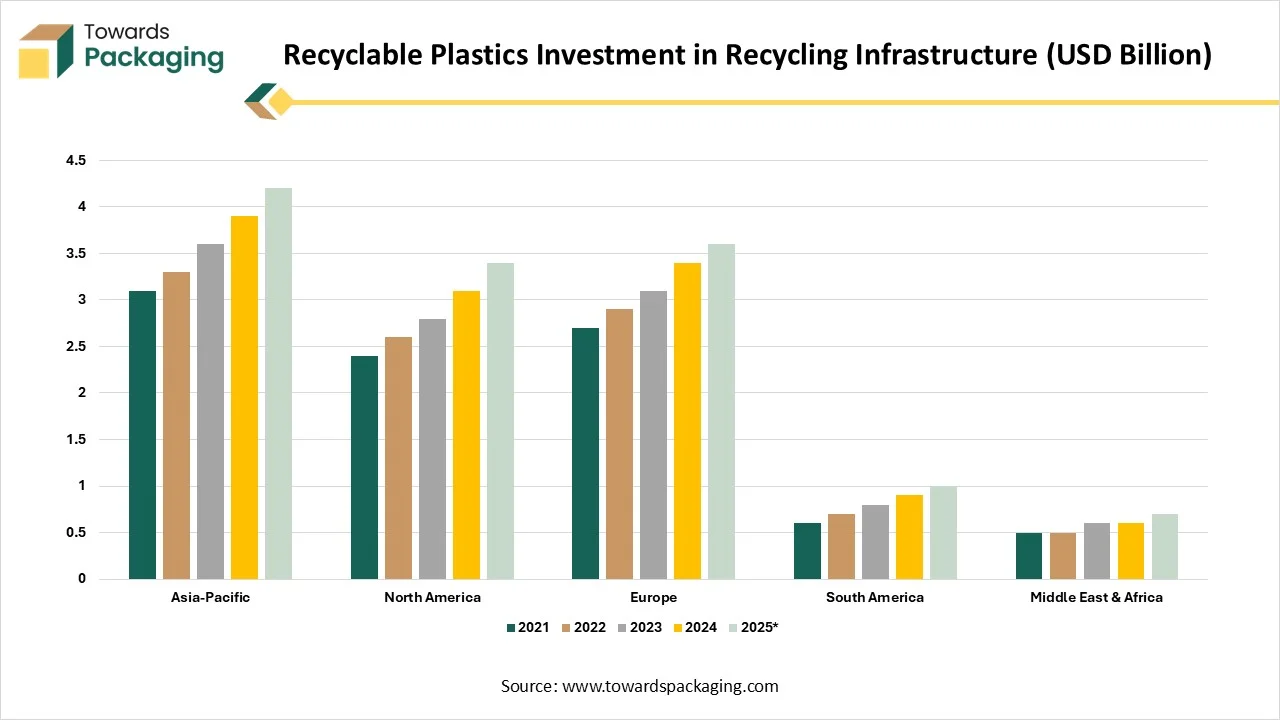

Recyclable Plastics Investment in Recycling Infrastructure (USD Billion)

| Region |

2021 |

2022 |

2023 |

2024 |

2025 |

| Asia-Pacific |

3.1 |

3.3 |

3.6 |

3.9 |

4.2 |

| North America |

2.4 |

2.6 |

2.8 |

3.1 |

3.4 |

| Europe |

2.7 |

2.9 |

3.1 |

3.4 |

3.6 |

| South America |

0.6 |

0.7 |

0.8 |

0.9 |

1 |

| Middle East & Africa |

0.5 |

0.5 |

0.6 |

0.6 |

0.7 |

Non-Recyclable Plastic Packaging Market Size, Analysis, Demand, and Growth Rate Forecast

The non-recyclable plastic packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. This market is driven by factors such as low cost, specific barrier properties, and ease of manufacturing. However, it faces intense pressure from environmental regulations, increasing consumer demand for sustainable alternatives, and a global push towards a circular economy, leading to efforts to minimize its usage and develop recyclable alternatives. The region, Asia Pacific, holds the greatest share in 2024, and the Middle East and Africa are the fastest-growing segments.

The non-recyclable plastic packaging market is expanding quickly. The most popular material type was multi-layered /compostable plastics, but PVC packaging is predicted to rise significantly. Flexible films and wraps were dominated by product type, and the market for reusable and blister packaging will grow considerably. Food and beverages accounted for the largest end use, while healthcare and pharmaceuticals are set to grow quickly.

Top Companies in the Recyclable Plastic Market

- Veolia Environnement

- SUEZ

- Waste Management, Inc.

- Indorama Ventures Public Co. Ltd.

- BASF SE

- LyondellBasell Industries

- Plastipak Holdings, Inc.

- Berry Global, Inc.

- ALPLA Group

- Dow Inc.

- Covestro AG

- Neste

- Unilever (PCR initiatives)

- MBA Polymers

- Loop Industries

- Green Dot Bioplastics

- PureCycle Technologies

- PETCO (South Africa)

- CarbonLite

- Envision Plastics

Latest Announcements by Industry Leaders

- In March 2025, Resynergi CEO Brian Bauer expressed, “The commercial offering of our Resynergi Modules is a crucial milestone in the viability, speed, and impact of a circular future for plastic. We’re proud to have Lummus Technology as our trusted partner to bring our Resynergi Modules to market and make advanced recycling not only possible and profitable but friendly, safe, and clean for local municipalities.”

New Advancements in the Market

- In July 2025, TerraSafe, a North Carolina-based materials invention company, revealed its collaboration with DisSolves, which is a dissolvable film packaging startup. The company integration has paved the path for two plastic-free items to market in water-soluble laundry detergent sheets and the edible pod packaging that are currently available for pre-order.

- In May 2025, Toyoda Gosei Co., Ltd. announced the development of a new technology to recycle high-quality plastic from end-of-life vehicles (ELV) in order to meet the growing demand for recycled plastic in the automotive industry against strengthened environmental regulations. This technology will contribute to a decarbonized, circular economy through its use in various vehicle models, starting with the Toyota Camry.

- In March 2025, Agilyx announced the launch of Plastyx Ltd. in collaboration with Plastic Energy founder Carlos Monreal, designed to source and supply feedstock for Europe’s advanced plastic recycling market.

- In February 2025, Berry Global Group partnered with the top treats and snacks company, Mars, to transform its pantry jars for the M&M’s, SKITTLES, and the STARburst Company to 100% recycled plastic packaging, which is new to jar lids.

- In January 2025, Polycycl, a circular economy technology startup company in Chandigarh, revealed its patented ContiFlow Cracker Generation VI chemical recycling pyrolysis technology. This completely innovative solution solves India’s increasing pyrolysis technology.

Recyclable Plastic Market Segments

By Plastic Type

- Polyethylene Terephthalate (PET)

- Clear PET (Bottles, Containers)

- Colored PET

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Polystyrene (PS) – Selectively Recyclable

- Polyvinyl Chloride (PVC) – Limited/Conditional

- Bio-Based & Biodegradable Plastics (Recyclable under Specific Conditions)

By Recycling Method

- Mechanical Recycling

- Sorting, Washing, Shredding, and Pelletizing

- Chemical Recycling

- Pyrolysis, Depolymerization, Solvolysis

- Closed-Loop Recycling

- Open-Loop (Downcycling)

- Advanced Recycling Technologies

By Source of Recyclables

- Post-Consumer Recycled (PCR) Plastics

- Post-Industrial Recycled (PIR) Plastics

- Ocean-Bound Plastics / Marine Plastics

By Application

- Packaging

- Bottles, Containers, Films

- Textiles & Fibers

- rPET Fabric, Polyester Yarns

- Automotive

- Building & Construction

- Pipes, Insulation, Panels

- Consumer Goods

- Electronics Housings, Furniture

- Industrial Components

By End-Use Industry

- Food & Beverage

- Retail & E-Commerce

- Textiles & Apparel

- Automotive & Transportation

- Electronics & Appliances

- Construction & Infrastructure

- Healthcare & Pharma

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa