Biofoam Packaging Market Market Size, Share, Trends and Forecast Analysis

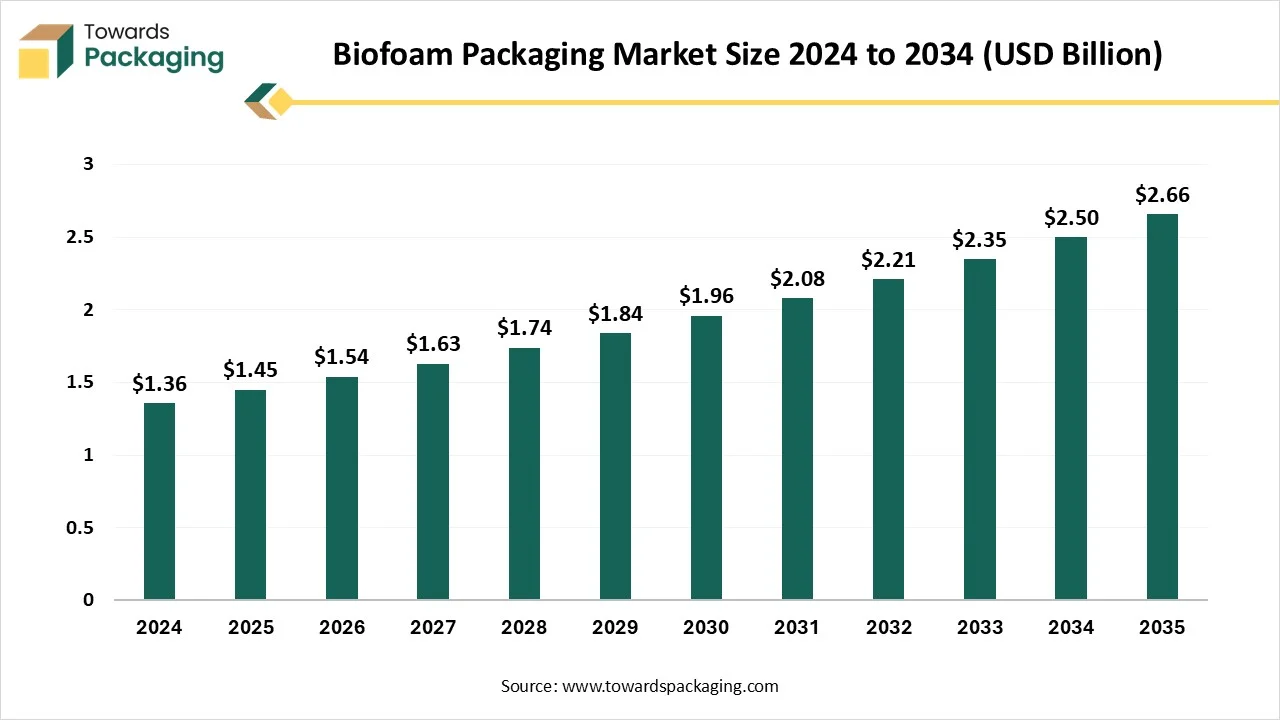

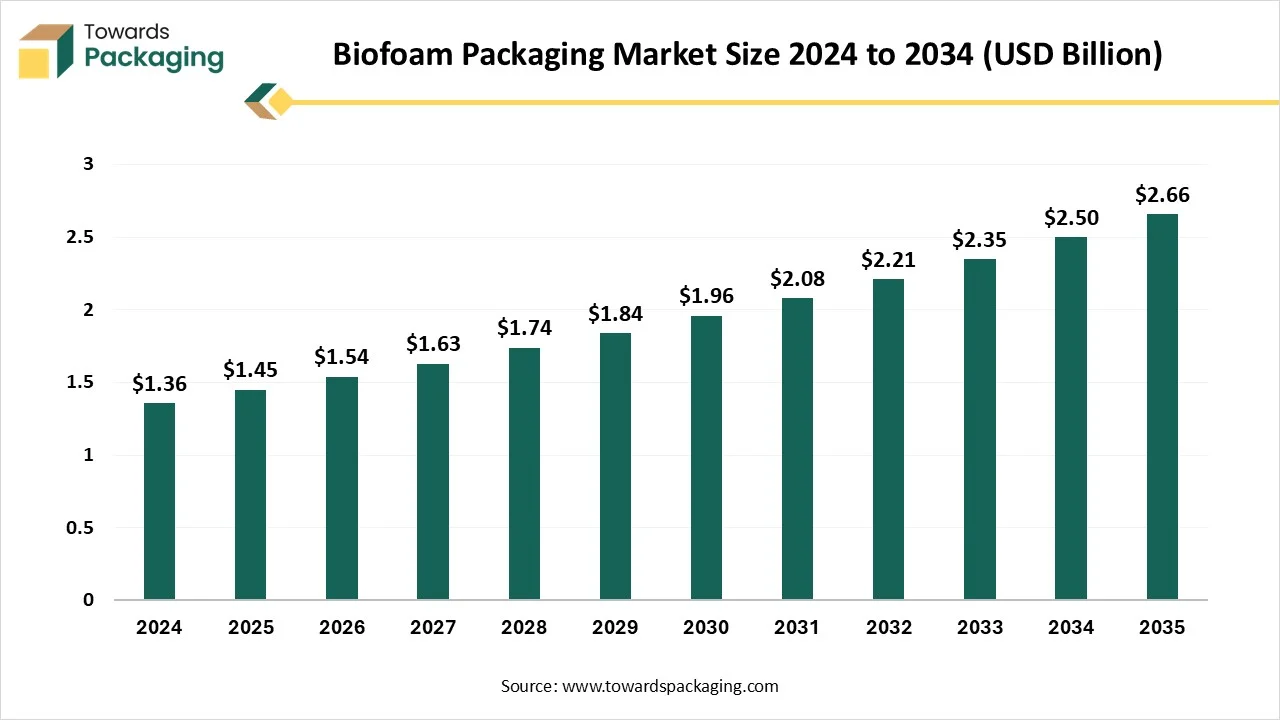

The biofoam packaging market is forecasted to expand from USD 1.91 billion in 2026 to USD 8.80 billion by 2035, growing at a CAGR of 18.5% from 2026 to 2035. The rising concern towards ecological issues has influenced the demand for this market and has raised the innovation process as well. Increasing e-commerce industry and technological innovation are the major factors driving the growth of this market.

Major Key Insights of the Biofoam Packaging Market

- In terms of revenue, the market is valued at USD 1.54 billion in 2026.

- The market is projected to reach USD 8.80 billion by 2035.

- Rapid growth at a CAGR of 18.5% will be observed in the period between 2025 and 2035.

- By region, Asia Pacific dominated the global market by holding highest market share of 36% in 2024.

- By region, North America is expected to grow at a notable CAGR from 2025 to 2035.

- By type, the starch-based biofoam segment contributed the biggest market share of 40% in 2024.

- By type, the polyhydroxyalkanoates (PHA)-based biofoam segment will be expanding at a significant CAGR in between 2025 and 2035.

- By application, the protective & cushioning packaging segment contributed the biggest market share of 35% in 2024.

- By application, the foodservice & disposable food packaging segment is expanding at a significant CAGR in between 2025 and 2035.

- By form, the molded foam inserts / parts segment contributed the biggest market share of 42% in 2024.

- By form, the loose-fill / peanuts / pads segment is expanding at a significant CAGR in between 2025 and 2035.

- By end-user industry, the e-commerce & retail packaging segment contributed the biggest market share of 28% in 2024.

- By end-user industry, the food & beverage (foodservice, packaged foods) segment is expanding at a significant CAGR in between 2025 and 2035.

What is Biofoam Packaging Market?

The biofoam packaging market comprises protective and cushioning packaging materials produced from renewable, bio-based or compostable feedstocks (for example mycelium/mushroom composites, starch-based foams, cellulose foams and bio-polymer foams such as PLA/PHA blends). These biofoams are designed to replace traditional fossil-based foams (EPS, EPE) by offering comparable protective performance while reducing lifecycle greenhouse-gas emissions, enabling industrial or home compostability, and meeting increasing regulatory and corporate sustainability requirements across electronics, food, medical and consumer goods packaging applications.

Biofoam Packaging Market Outlook

- Market Growth Overview: The biofoam packaging market is expected to raise significantly, influenced by sustainability guidelines, technological advancement, and e-commerce expansion.

- Global Expansion: Regions such as North America, Asia Pacific, Europe, Latin America, Middle East & Africa are witnessing strategic alliances, industrial demand, and sustainable solution are the major factors behind the growth of this market.

- Major Market Players: Biofoam packaging market comprises Sealed Air Corporation, Woodbridge Foam Corporation, Stora Enso, Braskem, BASF SE, and Cargill, Inc., Bewi Group, Braskem, INOAC Corporation, and Trocellen GmBh.

- Startup Ecosystem: The startup industries are majorly influenced by the enhancing ecological concern, strict guidelines, and corporate sustainability goals. The rising consumer demand, circular economy adoption, e-commerce industry, technological innovation, and regulatory pressure are the major concern of the companies in this market.

Advancement in Manufacturing Technology in Biofoam Packaging Market

The biofoam packaging market is experiencing major advancement in the manufacturing process with the expansion of recyclable, renewable, and biodegradable bio-based polymers. The huge demand for enhanced barrier properties has raised the demand for this market. The advancement of reusable biofoam packages without compromising with its quality.

For instance, Woamy’s origin invention in a foam wood research program directed at Aalto University in which Woamy’s initiators were part of evolving the original biofoam technology. Analysing its capacity to replace fossil-founded plastic foams, they created the corporation to link the gap between study and real-world utilization.

Trade Analysis of Biofoam Packaging Market: Import & Export Statistics

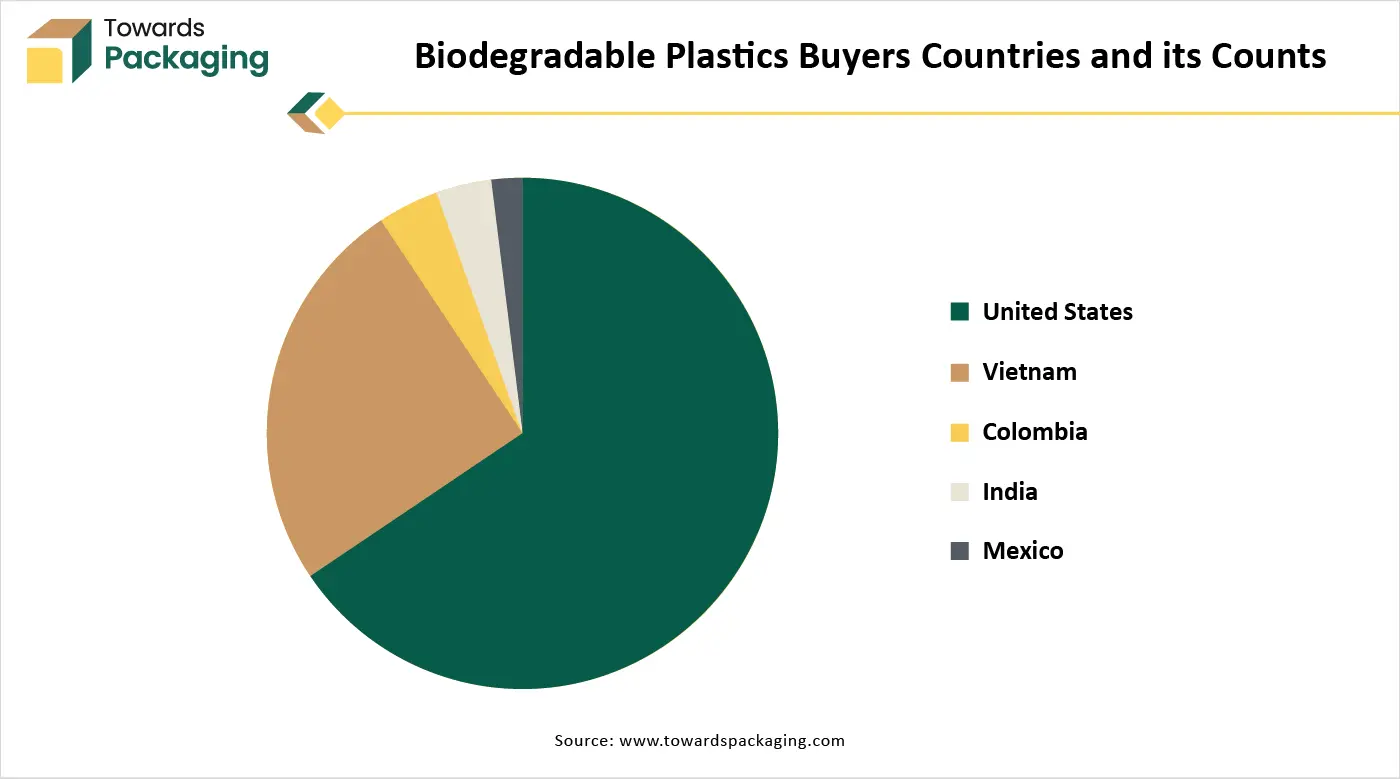

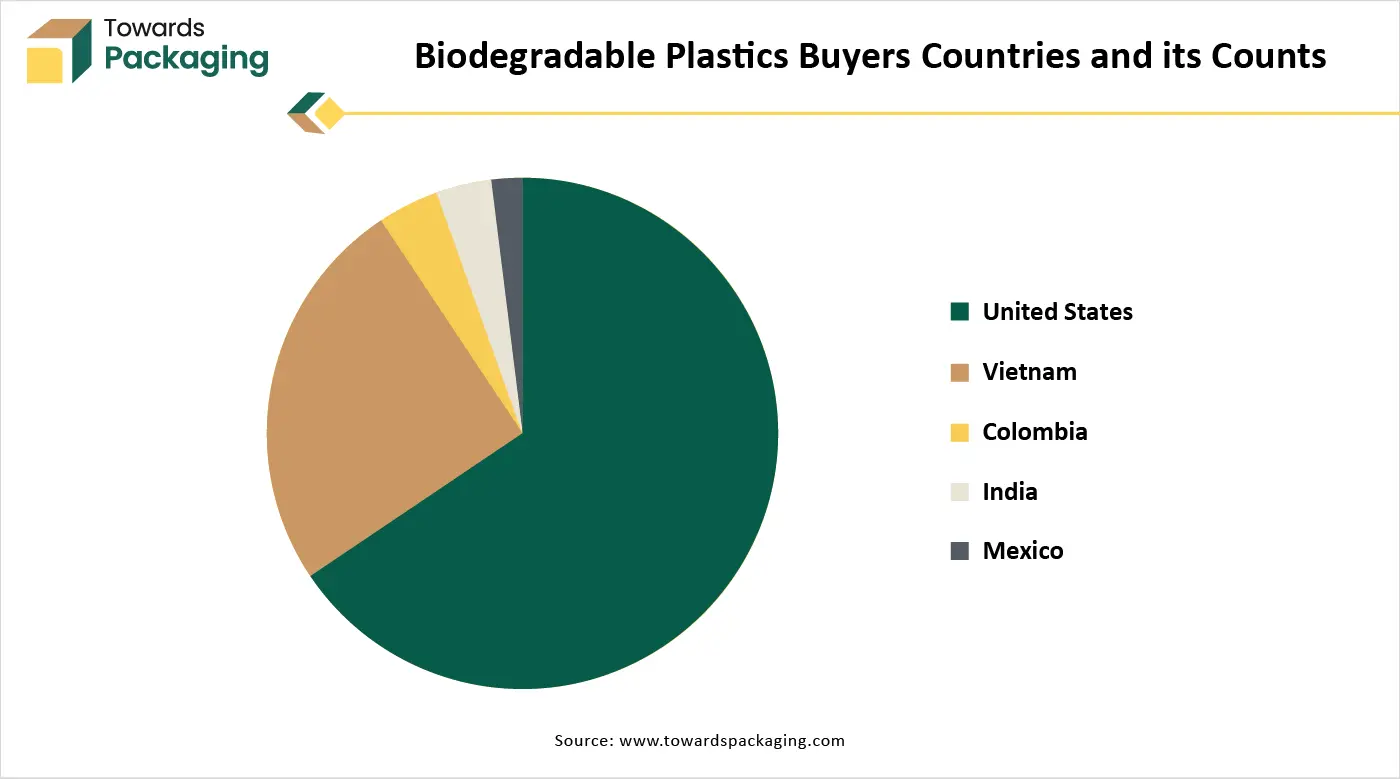

- Vietnam: It leads the as an exporter of the foam products with 192,795 shipments till August 2025.

- China: It is the second largest exporter of the foam products till August 2025 with recorder shipments of 53,373.

- South Korea: It is positioned in the third place for exporting foam products with around 9,429 shipments up to 2025.

Biofoam Packaging Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are extracted from agricultural products such as sugarcane, corn starch, vegetables fats & oil.

- Key Players: Corbion, Praj Industries

Component Manufacturing

The component manufacturing in this market comprises agricultural waste, cellulose, starches, and vegetable oils.

- Key Players: Stora Enso, BASF SE

Logistics and Distribution

This segment comprises enhanced R&D, improve consumer protection, and strategic partnership.

- Key Players: iBOXiT, UFP Technologies

Type Insights

Why Starch-based Biofoam Segment Dominated the Biofoam Packaging Market In 2024?

The starch-based biofoam segment dominated the market with 40% share in 2024 due to its biodegradability and availability. It is highly driven by the increasing e-commerce industry and huge demand for biodegradable packaging substitute. Starch-derived resources are measured ecologically and financially profitable, mainly when obtained from engineering by-products. The enhancement in e-commerce sector is highly influenced by biofoam packing demand across several industries such as consumer goods, automotive, and electronics.

The polyhydroxyalkanoates (PHA)-based biofoam is the fastest-growing in the market with a CAGR of 12%, as it includes strong ecological profile, versatile properties, superior biodegradability, and source flexibility. This segment has been accepted for utilization in food contact requests, like disposable cups and cutlery.

The Polylactic Acid (PLA)-based biofoam segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to strict regulatory guidelines associated with this segment. It is a biopolymer extracted from renewable plant bases such as cassava, cornstarch, and sugarcane making it an environment-friendly substitute to plastic based on fossil. These foams provide main properties equivalent to outdated foams, like insulation and cushioning, making it appropriate for a huge variety of applications, comprising food & beverage, consumer goods, and electronics.

Application Insights

Why Protective & Cushioning Packaging Segment Dominated the Biofoam Packaging Market In 2024?

The protective & cushioning packaging segment dominated the market with highest share in 2024 due to its safe transportation capacity. Advancement in production techniques have improved the presentation of biofoams, enhancing their moisture resistance, thermal lining, and mechanical strength. This promotes biofoams as a commercially feasible and high-execution additional for old-style foams used in protecting purpose. Biofoam are used as a biodegradable substitute to traditional packaging peanuts for invalid filling and common cushioning usages.

The foodservice & disposable food packaging segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing demand for hygienic and innovative packaging solution. It is highly influenced by the rising demand for sustainable packing resolutions that fulfil supervisory needs and customer preferences. Biofoam packing is mainly common for fresh production, dairy items, and ready-to-eat mealtimes, where it provides superior insulation and shield against pollution.

The thermal / insulative packaging is the fastest-growing in the market with a CAGR of 15%, as there is a huge demand for sustainable insulations resources. Within temperature-measured packing, insulated vessels are the significantly growing segment, utilized in shipping sensitive goods in several quantities. These are cost-effective and provide exceptional insulation properties.

Why Molded Foam Inserts / Parts Segment Dominated the Biofoam Packaging Market In 2024?

The molded foam inserts / parts segment dominated the market with highest share in 2024 due to huge adoption for customized packaging. The growth of e-commerce has resulted in a noteworthy increase in the requirement for protective packing, improving demand for this segment for transporting electronic and fragile products.

The loose-fill / peanuts / pads segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to huge demand for flexible packaging in various industries. It offers biodegradable as well as environment-friendly packaging substitute which help in the growth of the market. As customers and industries become more ecologically aware resulting in the rise of the demand for biofoam loose-fill and several other sustainable packing.

The foam sheets / rolls / liners are the fastest-growing in the market with a CAGR of 15%, as there is a huge demand for versatile and protective packaging. The increasing demand for flexible biofoam has enhanced by various trends, comprising the rapid extension of e-commerce industry and a growing customer preference for biodegradable and sustainable packaging substitutes. In specific, biofoam rolls and sheets are appreciated for their protective and cushioning goods during transportation.

End User Industry Insights

Why E-commerce & Retail Packaging Segment Dominated the Biofoam Packaging Market In 2024?

The e-commerce & retail packaging segment dominated the market with highest share in 2024 due to rising construction of buildings. The increasing electronics, healthcare, automotive, and food & beverages has influenced the demand for this segment. The growth in online shopping and customer demand for eco-friendly delivery choices has resulted in rapid growth in biofoam acceptance within the e-commerce and trade logistics chains.

The food & beverage (foodservice, packaged foods) segment is expected to grow at the fastest CAGR during the forecast period. This segment is increasing because of regulatory guidelines and consumer preferences. Governments across the globe are applying stricter guidelines and bans on one-time plastics usage. This boosts food & beverage producers to find biodegradable and compostable substitute.

The electronics & consumer durables segment expects the significant growth in the market, as there is a huge demand for protective packaging. Well-known electronics brands are progressively accepting sustainable packing to decrease their ecological appeal and footprint to environment-conscious customers. The requirement for defensive packing for a wide range of products sold online influences demand for biofoam packaging as a cost-efficient and ecologically friendly pitch.

Regional Insights

How Asia Pacific is Dominating in the Biofoam Packaging Market?

Asia Pacific held the largest share in the biofoam packaging market in 2024, due to rising demand for sustainable packaging solution. Rapid population increase and industrialization, mainly in countries such as Japan, China, India, South Korea, Taiwan, and various other are generating high demand for packing resolutions across several sectors. The huge development of e-commerce industries in the region influences a requirement for sustainable and protective packaging for transportation of products. Investments in production technology and invention are offering to the growth and manufacture of biofoam products.

How Biofoam Packaging Market is Transforming in China?

China has huge e-commerce sector which is fuelling the growth of market. It generates a huge requirement for sustainable, lightweight, and protective packaging which biofoam delivers. China has a widespread industrial improper with cultured manufacturing potentials, permitting it to rapid scale up the production of sustainable resources such as cornstarch biofoam. This offers a cost-operative and effectual distribution chain.

Why Biofoam Packaging Market is Growing Rapidly in North America?

Rapid advancement in the production process has influenced the growth of the market in North America. There is huge customer demand for environment-friendly and sustainable packaging substitutes. Strict ecological guidelines and strategies are boosting the market to adopt biodegradable solution. It is profoundly supported by government guidelines promoting environment-friendly resources and the occurrence of main end-use sectors such as furniture, packaging, and automotive.

How Industries are Attracting Huge Consumer Base in the U.S.?

Several industries are attracting a huge number of consumers base with the adoption of eco-friendly packaging choices. It is influenced by strong customer demand for the production of sustainable packaging and strict guidelines on one-time usage of plastics. Supportive government creativities and early acceptance of new technologies boost this development. Innovations in resources, such as fungi-based and plant-based foams, are also enhancing the market.

Which Factor is Responsible for Notable Growth of Biofoam Packaging Market in Europe?

The major factor influencing the growth of market is the increasing public awareness. Production of cellulose-based packaging has raised this market to grow significantly in this region. The demand for lightweight, durable, and safe packaging has enhanced the demand for huge production of this type of packaging.

Why Germany is Adopting this Packaging Significantly?

Germany is rapidly adopting biofoam packaging due to enhanced production process as well as continuous innovation in this. The expansion of online retail has enhanced the demand for sustainable, protective and lightweight packaging. Biofoam offers exceptional thermal and cushioning protection while fulfilling the requirement for environment-friendly delivery materials.

What are the Major Factors Boost the Biofoam Packaging Market in Latin America?

The major factors influencing the growth of the market in Latin America are rapid growth of e-commerce sector, increasing ecological concern, supportive government guidelines, and technological innovation. Presence of huge number of market players has also support in the expansion of this market. Its premium packaging quality has also enhanced this market expansion.

How Presence of Abundant Natural Resources Affect this Market in Brazil?

The huge production of sugarcane fiber based biofoam is increasing due to the increasing concern towards bio-based plastic packaging. This natural resource abundance helps a competitive and increasing local bio-based plastics sector. Ecological awareness is growing among customers in Brazil, and showing huge willingness to recompence a premium for environment-friendly packing. This trend is mainly visible in personal care products, food & beverage.

What Factors Accelerate The Market Expansion In The Middle East

The market in the Middle East is experiencing rapid growth, driven by rising environmental awareness, regulatory push against single-use plastics, and increasing demand from food, e-commerce, and consumer goods sectors. Challenges include high production costs, limited composting infrastructure, and material performance in hot, humid climates. Opportunities exist in targeting premium segments, forming local partnerships, and aligning with sustainability regulations. Overall, the Middle East presents a promising yet emerging market for eco-friendly biofoam packaging solutions.

Saudi Arabia Biofoam Packaging Market Trends

In Saudi Arabia, the biofoam packaging market is growing rapidly, driven by government initiatives, rising environmental awareness, and increasing demand from food, e-commerce, and consumer goods sectors. Although compostable packaging is still emerging, it is anticipated to grow steadily. Overall, Saudi Arabia presents a promising market for eco-friendly packaging solutions, supported by regulatory support and sustainability investments.

Recent Development

- In July 2025, Stora Enso collaborated with Novapor to develop Papira solution which is a cellulose-based foam packaging material. It is a substitute of durable and eco-friendly packaging for several sectors.

- In November 2022, B.C. scientists collaborated with First Nation to produce decomposable 'biofoam' packaging from wood waste. This partnership is about three years ago among Jiang and Reg Ogen, president and CEO of the First Nation's Yinka Dene Economic Development Limited Partnership, at an encounter arranged by the B.C. Forests Ministry.

Top Companies in the Biofoam Packaging Market

Ecovative Design LLC

Corporate Information

- Founded: 2007

- Headquarters: Green Island, New York, USA.

- Founders: Eben Bayer and Gavin McIntyre (while at Rensselaer Polytechnic Institute).

- Industry: Biomaterials / sustainable materials specializing in mycelium (fungal rootstructure)based foams and composites, used for packaging, insulation, fashion/textiles, and other applications.

History and Background

- Origin: The idea grew from a design/engineering project at Rensselaer in a course led by Burt Swersey, where Bayer and McIntyre developed a method to use fungal mycelium to bind agricultural byproducts into materials.

- 2007: Company founded, after early prototyping of what was initially called “Greensulate” (mushroombased insulation) and then pivoting to protective packaging using mycelium.

Key Developments and Strategic Initiatives

- Shift from purely packaging to a platform for “mycelium materials” across diverse industries: packaging, building/insulation, textiles/fashion, food (plantbased mycelium proteins).

- Scaling manufacturing: They built a “Mycelium Foundry” / “AirMycelium™” platform to accelerate growth of mycelium materials at scale.

Mergers & Acquisitions

- I did not find major public records of acquiring large companies by Ecovative. There are some mentions of acquisition of a “stateoftheart raw materials facility in the Netherlands” in 2023 (see below under innovations/news) but not a highprofile M&A list.

- Strategic facility acquisitions rather than large company mergers appear more common.

Partnerships & Collaborations

- Early partnership: Sealed Air Corporation (packaging giant) in 2012 they announced collaboration to accelerate production, sales and distribution of EcoCradle mushroom packaging.

- Brand & industry collaborations: In the food/fashion/materials domain, they have product development agreements with over 15 leading global brands for integrating mycelium materials (e.g., in fashion/footwear).

Product Launches / Innovations

- EcoCradle®: the mushroombased protective packaging material (launched around 2010) used by companies such as Dell Inc. and Steelcase Inc.

- AirMycelium™ / Mycelium Foundry: platform for large scale production of pure mycelium slabs and sheets for insulation, structural, materials applications.

Key Technology Focus Areas

- Mycelium growth and materialization: Using fungal mycelium to bind agricultural products (lignocellulosic waste) into rigid or flexible foams/composites.

- Substrate engineering: Optimizing agricultural waste combinations, growth conditions, strain development to tune material properties (density, mechanical strength, fire resistance, etc).

- Morphogenesis / environmental programming: Controlling the growth behavior of mycelium (structure, shape, performance) via environmental cues and strain engineering.

R&D Organisation & Investment

The company reports federal funding: e.g., “Federal Partners: $26.2 M through 2024” per their website.

Raised substantial venture/scale funding:

- 2021: ~$60 million Series D to scale mycelium applications.

- 2023: Series E round > $30 million (initial closing) bringing total raised to ~$120 million.

SWOT Analysis

Strengths

- Unique, proprietary technology: Myceliumbased materials are a strong differentiator and have been commercialized.

- Sustainability credentials: Strong appeal in ecopackaging, circular materials, low fossil‐feedstock, compostable endoflife.

- Early mover/firstmover advantage in the mycelium materials space.

- Broad application scope: packaging, insulation/construction, textiles, food/alternative proteins.

- Partnerships & licensing model enable scalability and reach.

Weaknesses

- Scale & cost: While commercialized, achieving cost parity with petrofoams and scaling production globally remains a challenge.

- Market adoption: Many large industries are conservative; switching materials requires validation, certification (e.g., fire safety, strength, supply chain).

- Supply chain complexity: Agricultural waste substrate, mycelium growth, manufacturing all require new infrastructure; risk of supply constraints.

- Diversification risk: Broadening into textiles/food may distract from core packaging business and introduce new regulatory & consumer risks.

Opportunities

- Huge addressable markets: global foam/packaging market, large plastics substitution potential, textiles & fashion integration, automotive/transport materials.

- Regulatory & consumer push: Growing drive for sustainable materials, plastic bans, corporate ESG goals.

- Licensing & global manufacturing partnerships: can accelerate growth via local production using their IP.

- Innovation spinouts: e.g., food/alternative proteins (MyForest Foods) open additional revenue streams.

Threats

- Competition: Other biofoam, biocomposite, myceliumbased or other alternative materials companies may emerge or scale faster.

- Raw material / substrate volatility: Dependence on agricultural byproduct streams may face variability or cost increase.

- Technology risk: Achieving consistent performance (mechanical, fire, regulatory) at scale is nontrivial.

- Market risk: If costs remain higher than conventional foams or if supply chain/logistics aren’t competitive, adoption will slow.

- Regulatory/biological risk: Use of fungi/mycelium at industrial scale may face unforeseen regulatory or environmental challenges (e.g., biosafety, contamination).

Recent News & Strategic Updates

- In June 2023: Ecovative announced the initial closing of a Series E raise of over US$30 million. The funding will support scaling its Forager business (textiles/foam) and investing $15 million into its MyForest Foods subsidiary (myceliumbased food). Investors included Viking Global Investors, Standard Investments, FootPrint Coalition Ventures, AiiM Partners; total capital raised to date ~US$120 million.

- In 2024: Named designer Patrick McDowell as global design ambassador for their Forager mycelium materials in fashion.

Key Market Players

- BEWi (Bewi): It offers comparable properties to old-style extended polystyrene comprising superior insulation as well as shock absorption. It is appropriate for both cut and molded applications.

- Stora Enso: The biofoam portfolio of the company comprises Papira® and Fibrease®. Papira® which is a rigid, bio-based, and biodegradable foam where Fibrease® is more flexible, wood-fiber composite foam.

- PaperFoam: The last product is shock-absorbing, lightweight, and completely biodegradable. Its exclusive production process permits for fine detailing, complex, and customized shapes.

- Cruz Foam: It offers a wide variety of compostable and curbside-recyclable shielding packaging products, comprising Cruz Cool™ for cold chains, Cruz Cush™, Cruz Pack™, and Cruz Wrap™.

- Others: Synbra Technology BV, BASF SE, Sealed Air Corporation, Zotefoams Plc, Recticel, Woodbridge Foam (The Woodbridge Company), NatureWorks LLC, Eco-Global Manufacturing, All Foam Products Co., Inc., Grown.bio, Mogu (Mogu Group), Magical Mushroom Company, Mycrobez AG, BioViron (Composta Foam), MadeRight / Maderight.

Packaging Market Segments Covered

By Type

- Starch-based Biofoam

- Thermoplastic Starch (TPS) Foams

- Starch–PLA Blends

- Polylactic Acid (PLA)-based Biofoam

- Pure PLA Foams

- PLA–Plasticizer Blends

- Polyhydroxyalkanoates (PHA)-based Biofoam

- PHB (polyhydroxybutyrate) Foams

- PHBV and Copolymer Foams

- Mycelium-based Biofoam

- Grown Mycelium Blocks

- Mycelium Molded Parts

- Cellulose / Nanocellulose Foams

- Microfibrillated Cellulose Foams

- Cellulose Aerogels

- Bagasse / Sugarcane Fiber Foams

- Molded Bagasse Foam

- Bagasse Composite Foam

- Protein-based & Other Biopolymer Foams

- Soy/Casein-based Foams

- Alginates / Chitosan Foams

By Application

- Protective & Cushioning Packaging

- Electronics cushioning inserts

- Appliance and glassware protection

- Foodservice & Disposable Food Packaging

- Clamshells and trays

- Takeaway containers and cups

- Thermal / Insulative Packaging

- Cold-chain inserts

- Insulating liners and shippers

- E-commerce & Transit Void-fill

- Loose-fill peanuts and pads

- Molded parcel inserts

- Cosmetics & Personal Care Packaging

- Protective inserts for bottles/jars

- Gift-box cushioning

- Industrial & Heavy Equipment Packaging

- Pallet dunnage and blocking

- Heavy-part molded supports

- Others (Medical devices, Specialty)

- Sterile device transit supports

- Custom specialty applications

By Form

- Molded Foam Inserts / Parts

- Loose-fill / Peanuts / Pads

- Foam Sheets / Rolls / Liners

- Foam Trays & Clamshells

- Blocks & Cut-to-size Foam

- Pelletized / Injection-molded Foam Components

By End-User Industry

- E-commerce & Retail Packaging

- Online retailers

- Third-party logistics (3PL) providers

- Food & Beverage (Foodservice, Packaged Foods)

- Quick-service restaurants

- Packaged food brands

- Electronics & Consumer Durables

- Consumer electronics manufacturers

- Home appliance OEMs

- Household & Industrial Cleaning

- Fragile cleaning-product packaging

- Detergent/consumer goods brands

- Healthcare & Medical Devices

- Medical device manufacturers

- Pharmaceutical cold-chain support

- Automotive & Industrial Manufacturing

- Parts suppliers

- OEM spare-part packaging

- Others (Cosmetics, Luxury goods, Construction)

- Cosmetic brands

- Specialty industrial uses

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA