Foam Protective Packaging Market Dynamics, Competitive Forces & Strategic Pathways

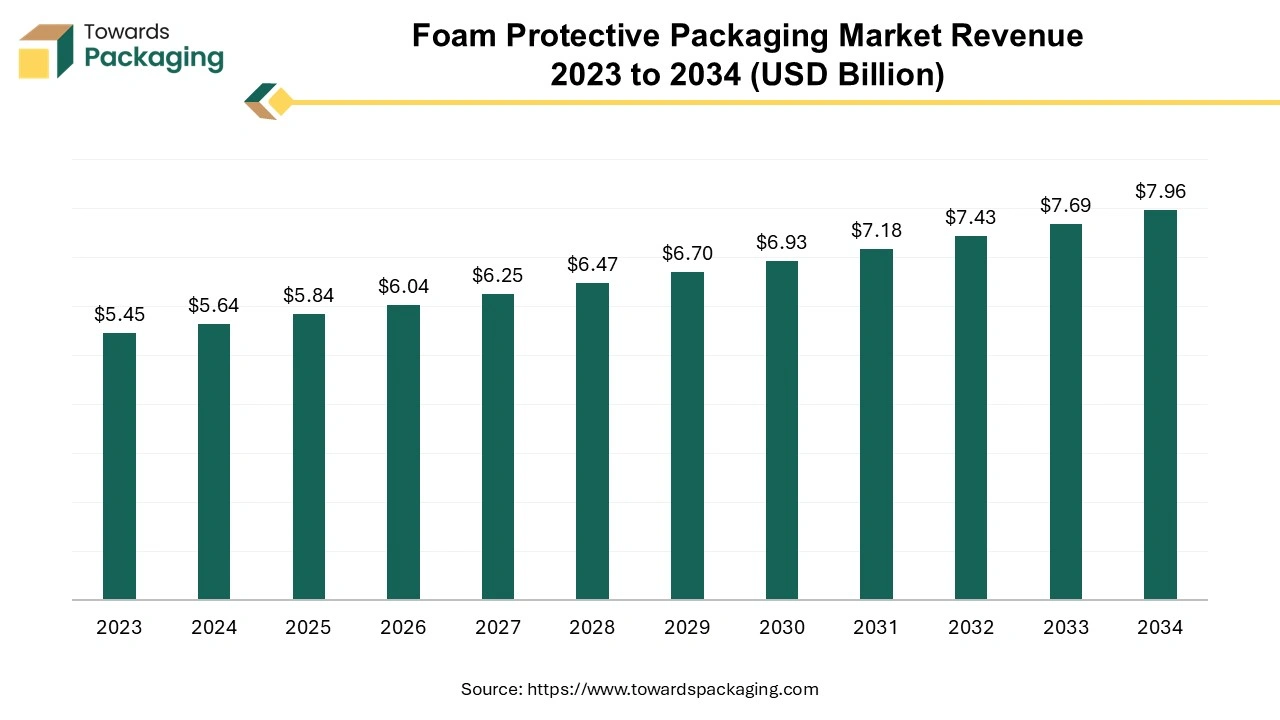

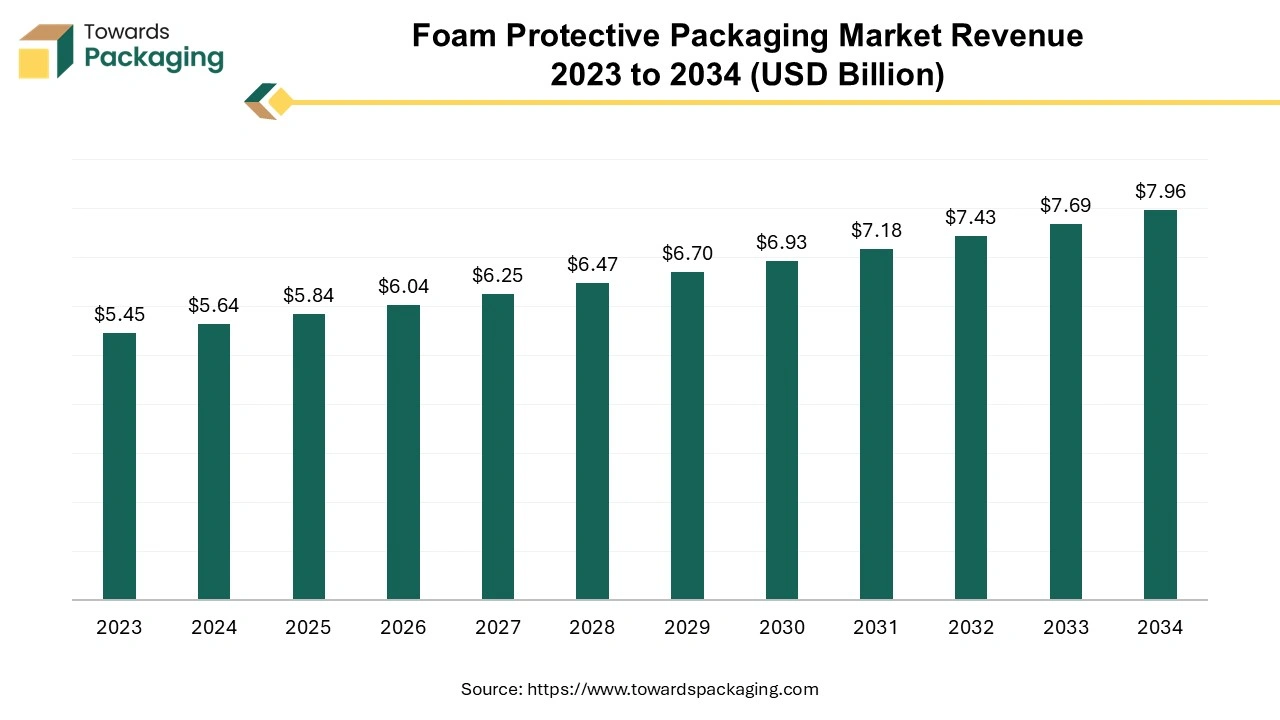

The foam protective packaging market is forecasted to expand from USD 6.04 billion in 2026 to USD 8.23 billion by 2035, growing at a CAGR of 3.5% from 2026 to 2035. The market growth is driven by rising e-commerce activities, demand for protective solutions in electronics and automotive industries, and the development of biodegradable foam materials. This report covers market size, volume analysis, regional growth (NA, EU, APAC, LA, MEA), and emerging technological advancements influencing foam packaging applications worldwide.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing foam packaging which is estimated to drive the global foam protective packaging market over the forecast period.

Major Key Insights Driving the Growth of the Foam Protective Packaging Market

- The foam protective packaging market is projected to grow from USD 5.84 billion in 2025 to USD 7.96 billion by 2034, expanding at a CAGR of 3.5%.

- Foam protective packaging is widely used in industries like electronics, automotive, and consumer goods to protect fragile products from shocks, impacts, and vibrations.

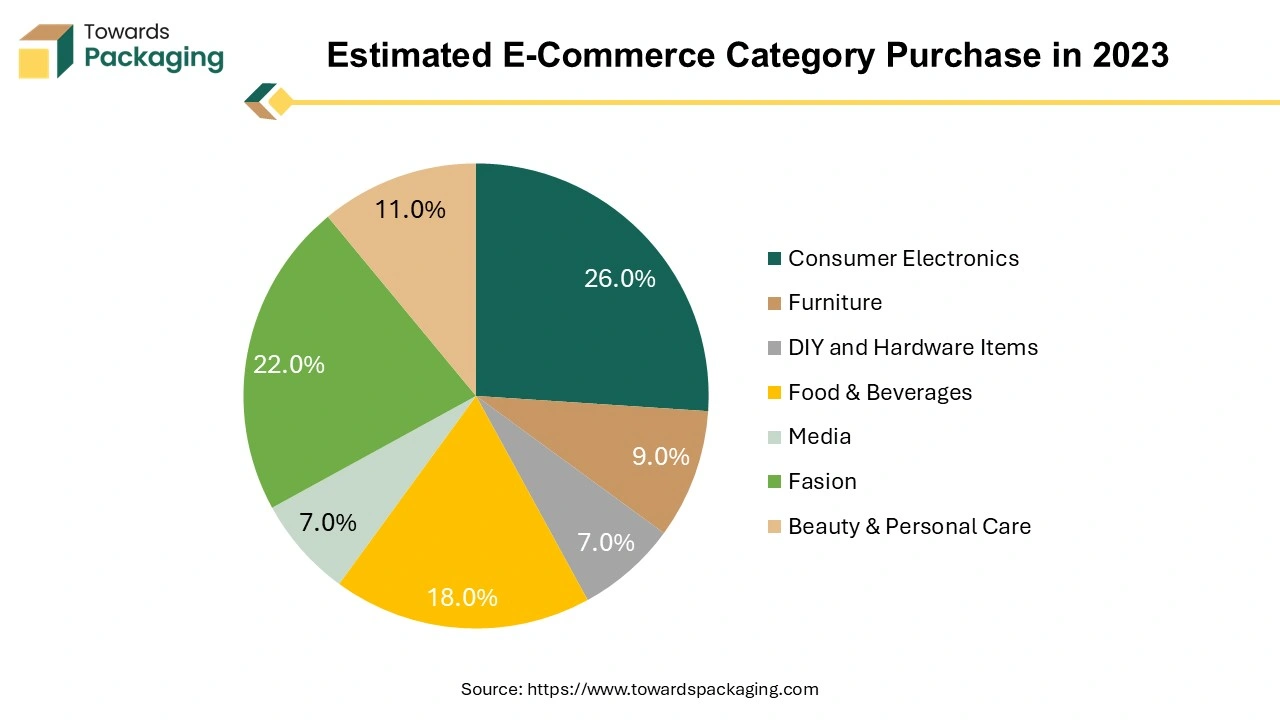

- The rise of e-commerce, especially in electronics and consumer goods, is driving the demand for foam packaging solutions to ensure product safety during shipping.

- The Asia Pacific region holds the largest market share in foam protective packaging due to industrial growth and increasing demand in electronics and e-commerce.

- Polyurethane foam leads the market in 2024 due to its excellent impact absorption, customization ability, cost-effectiveness, and thermal insulation properties.

- The automotive and auto components segment dominates the market, as foam packaging provides cushioning, reduces shipping costs, and ensures safe transport of fragile parts.

- Key players in the market are focusing on inorganic growth strategies like acquisitions, mergers, and collaborations to enhance product innovation and expand their market presence.

- Growing consumer demand for sustainable and recyclable packaging materials is pushing companies to develop biodegradable foam packaging options.

- The foam protective packaging market faces challenges such as increasing regulations on plastic use, fluctuating raw material costs, and consumer preference for eco-friendly products.

- Advancements in packaging technology, such as automation and smart materials, are driving innovation in the foam protective packaging industry.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 5.84 Billion |

| Projected Market Size in 2035 |

USD 8.23 Billion |

| CAGR (2025 - 2035) |

3.5% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Type, By Application and By Region |

| Top Key Players |

Sonoco Products Company, Sealed Air Corporation, Pregis Corporation, Atlas Molded Products, Rogers Foam Corporation, Altor Solutions. |

Foam Protective Packaging Market: Ensuring Safe and Secure Packaging Solutions

Foam protective packaging refers to materials made from foam, typically used to cushion and protect items during shipping and storage. This type of packaging helps absorbs shocks, impacts, and vibrations, preventing damage to fragile products. Common forms include foam sheets, inserts, and molded foam designed to fit specific items. It's widely used in industries like electronics, automotive, and consumer goods due to its lightweight nature and effectiveness in safeguarding products. The different types of foam packaging are polyethylene foam, polyurethane foam, expanded polystyrene (EPS).

Foam packaging is widely used to protect fragile electronic components like circuit boards, screens, and appliances from static electricity and physical damage. Foam packaging is widely used to protect fragile electronic components like circuit boards, screens, and appliances from static electricity and physical damage. Delicate automotive components, such as sensors and glass parts, benefit from the protective qualities of foam packaging. Products such as glassware, ceramics, and high-end cosmetics often utilize foam packaging to ensure they remain intact during transport.

Expansion of E-Commerce: The Key Driver Behind the Growth of the Foam Protective Packaging Market

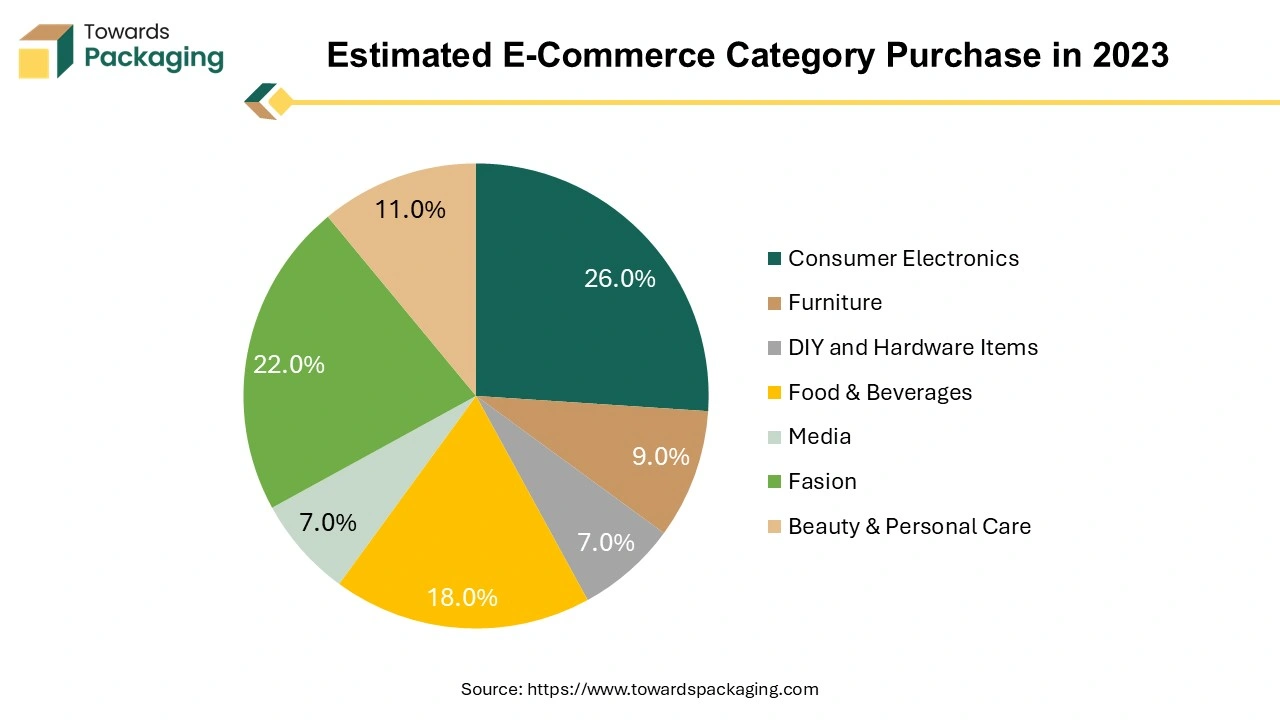

The rise of online shopping increases demand for protective packaging to ensure products arrive safely. The growing market for fragile consumer electronics necessitates effective protective solutions. Rising sales of consumer electronics through e-commerce platform has driven the growth of the demand for the foam packaging for protection of the electronic gadget while shipment. These factors combined drive the growth of the foam protective packaging market in the near future.

According to estimates released by the Direct Selling Association in March 2024, there will be 2.71 billion online shoppers globally by that time. This shows that 33% of people worldwide shop online. This represents a 2.7% increase from the previous year. 2.77 billion people will shop online by 2025, a number that reflects the expansion of eCommerce due to the ease and increasing usage of the internet. China leads this trend with 915.1 million online shoppers, followed by the US with 270.11 million in 2024.

Top 10 Key Factors Driving the Foam Protective Packaging Market

- The key players operating in the market are focused on geographic expansion and launching their brand in other countries which is expected to drive the growth of the foam protective packaging market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Emerging markets and trends for foam packaging is expected to drive the growth of the global foam protective packaging market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of foam protective packaging is estimated to drive the growth of the global foam protective packaging market in the near future.

- The need for lightweight, protective packaging in shipping automotive parts supports foam protective packaging market growth.

- Innovations in logistics require reliable packaging solutions to minimize damage during transit.

- Foam packaging can be tailored to fit various products, enhancing its appeal across industries.

- Increasing international trade leads to a higher demand for protective packaging solutions.

- Foam packaging offers a lightweight, cost-efficient solution that reduces shipping costs while ensuring product safety.

- Manufacturers are increasingly seeking customized packaging solutions to better protect their specific products, driving demand for diverse foam types.

Emerging Trends Shaping the Foam Protective Packaging Market

Automation and Smart Packaging

- The integration of technology in packaging processes, such as automated packaging systems and smart materials, is on the rise.

Customization

- Increasing demand for tailored packaging solutions that provide specific protection for unique products, especially in sectors like electronics and pharmaceuticals.

Health and Safety Standard

- Increasing focus on compliance with health regulations is pushing demand for high-quality, protective packaging solutions.

Untapped Market Opportunities in the Foam Protective Packaging Industry

Adoption of Inorganic Growth Strategies and Innovations Driving the Foam Protective Packaging Market

The key players operating in the market are focused on developing biodegradable and recyclable foam options can attract environmentally conscious consumers and businesses. Customizable and lightweight packaging solutions can cater to diverse industries, enhancing product safety and reducing shipping costs. The key players operating market are focused on adopting inorganic growth strategies like collaboration for developing and launching the foam protective packaging, which is estimated to create lucrative opportunity for the growth of the foam protective packaging market in the near future.

- For instance, in February 2024, Pregis LLC, subsidiary of Pregis Holding II CORP headquartered in U.S. and a packaging solutions manufacturer, signed collaboration with Exxon Mobil Corporation and revealed the launch of the updated version protective foam packaging, which consists of certified-circular polyethylene (PE) resins.

Key Challenges Impacting the Foam Protective Packaging Market

Several factors restraining the growth of the foam protective packaging market. Increasing regulations on plastic use and waste management due to environmental impact can limit foam packaging options. Cost of Raw Materials Fluctuating prices of raw materials, such as polyurethane and polystyrene, can impact production costs and pricing. The rise of sustainable and biodegradable packaging alternatives may draw demand away from traditional foam options.

In some regions, the market may be saturated, limiting opportunities for growth and new entrants. Consumer Preferences- Growing consumer preference for eco-friendly products can push companies to adopt more sustainable packaging solutions. Issues such as transportation delays or sourcing challenges can hinder production and availability.

Regional Insights and Growth Potential in the Foam Protective Packaging Market

Asia's Expanding Electronics Market and Industrialization: Key Factors Supporting Dominance in the Market

Asia Pacific region is held the largest share of the foam protective packaging market in 2024. The region has seen significant industrial growth, particularly in sectors like electronics, automotive, and e-commerce, driving demand for protective packaging. The surge in online shopping has increased the need for effective protective packaging solutions to ensure safe delivery of products. Many countries in Asia Pacific offer lower labor and manufacturing costs, making foam packaging production more economical. A growing middle class with increasing disposable income is boosting demand for packaged goods, which drives packaging needs.

Increasing launch of the advanced program and technology for foam packaging in Asia Pacific region is estimated to drive the growth of the foam protective packaging market in the region.

- For instance, according to the data published in July 2024, during the two-day event on June 27 and 28, 2024, BOBST Southeast Asia-Pacific formally launched BOBST Connect in this region. Around 200 BOBST customers and 35 industry partners, including IPP Malaysia, DIC, Miracion, CITO, SHARP (Malaysia), Siegwerk, KURZ, Tesa, Baumer hhs, Apex Asia, Henkel, and AV Flexologic, were among the more than 300 people who attended the company's exciting events in this region. One of Bobst Connect's primary characteristics is its ongoing evolution in foam packaging.

- In June 2024, BOBST has introduced a number of new products and solutions based on equipment monitoring and performance management of packaging. Unprecedented control over TooLink-equipped dies is provided by the Tool Management solution for foam packaging, which integrates tool makers and tracks tool performance, feedback, maintenance, and orders. Its user-friendly interface offers a wealth of data-driven insights to help in advance tool management.

China Foam Protective Packaging Market Trends

China foam protective packaging market is driven by expansion of consumer electronics and electric vehicles manufacturing in the country. China’s position as a global manufacturing hub for consumer electronics amplifies the need for protective packaging. Delicate components such as semiconductors and circuit boards require foam packaging solutions, like anti-static and wafer foams, to prevent damage from shocks and electrostatic discharge during shipping and electrostatic discharge during shipping and storage.

China leads globally in e-commerce, with over 915 million online shoppers as of 2024. The surge in online retail, particularly for fragile items like electronics and glassware, necessitates effective protective packaging to ensure product safety during transit. Foam materials, known for their cushioning and shock-absorbing properties, are increasingly utilized to meet this demand. The rapid development of China’s automotive sector increased the demand for foam protective packaging.

India Market Trends

The India foam protective packaging market is driven by the booming e-commerce and electronics sectors in the country. India’s fast-growing e-commerce market, led by companies like Flipkart, Amazon, and Reliance Retail, is driving massive demand for protective packaging to ensure safe delivery of fragile items. The electronics sector, especially smartphones and consumer appliances, uses foam packaging extensively to prevent damage during transit. India is witnessing significant growth in manufacturing under initiatives like “Make in India”.

Industries such as automotive, appliances, pharmaceuticals, and electronics require robust protective packaging, boosting foam packaging usage. India has low-cost labor and a well-established polymer industry, making it highly cost-effective to produce polyethylene (PE), polyurethane (PU), and expanded polystyrene (EPS) foams locally. This gives domestic players a competitive advantage in bot price and supply capacity. India is a major exporter of electronics, pharmaceuticals, and auto components, which require protective packaging for international shipping. This international trade stimulates demand for foam packaging to maintain product integrity.

North America's Robust Manufacturing Base: A Strong Driver of Growth in the Market

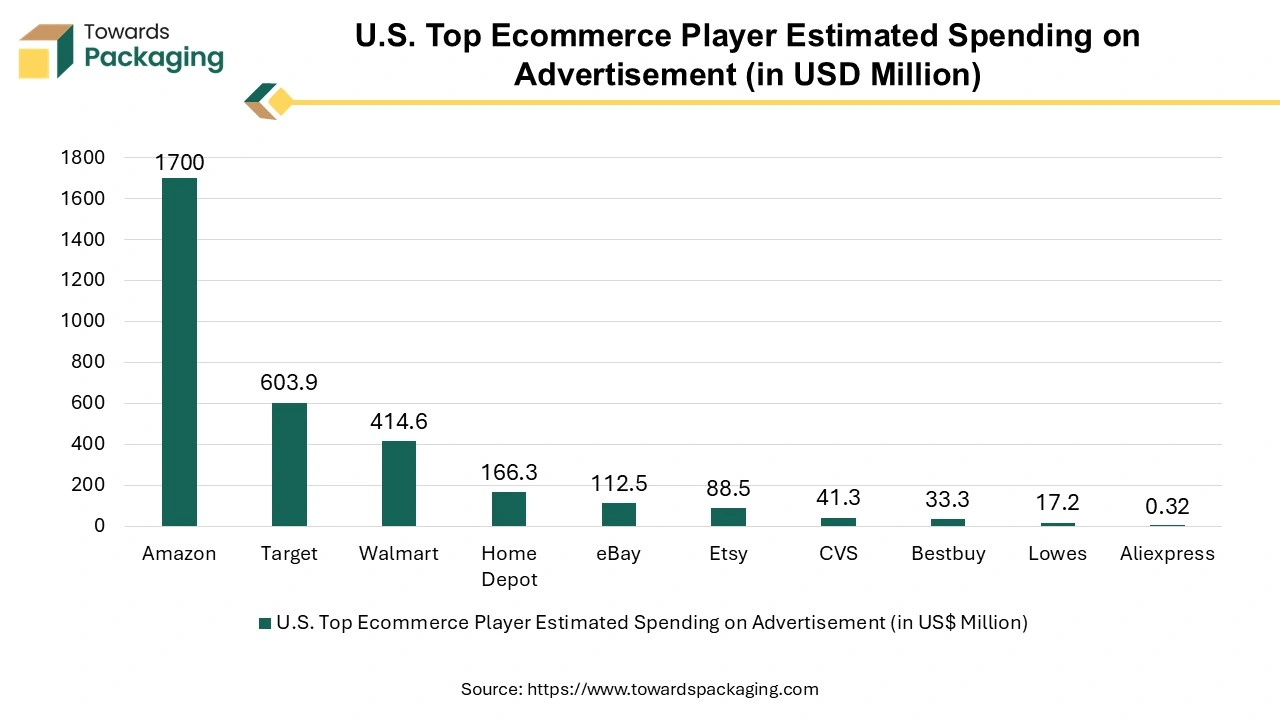

North America region is anticipated to grow at the significant rate in the foam protective packaging market during the forecast period. The rapid growth of online shopping has increased demand for protective packaging to ensure safe delivery of goods. These sectors require robust packaging solutions to protect sensitive components during shipping.

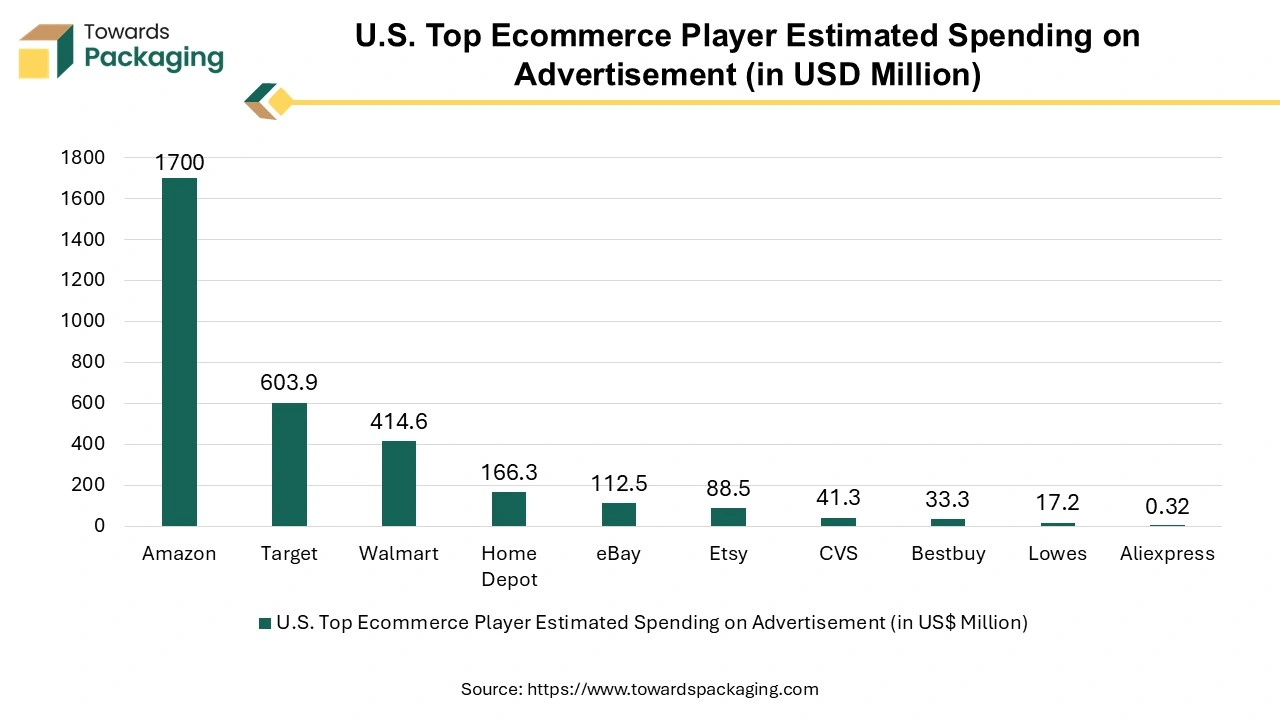

- In the second quarter of 2024, U.S. e commerce sales totalled US $291.6 billion, up 6.8% from the same period the year before and 0.82% from the previous quarter. As of the first half of 2024, this amounts to US$579.45 billion in total e-commerce sales in the nation. Sales are expected to reach $1.26 trillion by year's end and US$1.72 trillion by 2027, according to experts. About 22.6% of all US retail sales will occur online by that time. For more than ten years, e-commerce sales in the US have been rising gradually, reaching a record high of US$1.12 trillion in 2023.

U.S. Market Trends

U.S. foam protective packaging market is growing owing to smart packaging infrastructure and safety compliance. The U.S. electronics and automotive industries require protective packaging to prevent damage to sensitive components during shipping and handling. Foam materials, especially polyethylene (PE) and polyurethane (PU), are favoured for their durability and protective qualities.

Canada Market Trends

The Canada foam protective packaging market is driven by the industrial & export growth in the country. Expansions in electronics, automotive parts, pharmaceuticals, and HVAC sectors are increasing the need for foam solutions. Growing exports and cross-border logistics into the U.S. and beyond further amplify this demand. Canada is tightening environmental regulations, such as bans on polystyrene foodware, and encouraging recyclable, bio-based, and reusable foam materials. This shift is pushing manufacturers to innovate sustainable solutions.

Europe’s Strong Regulatory Framework to Project Steady Growth

The Europe region is expected to grow at a notable rate in the foreseeable future. Countries like Germany, Italy, and France have robust automotive and electronic manufacturing sectors, which require protective foam packaging for components and finished goods. This industrial base drives consistent demand for custom foam inserts, molded foams, and anti-static packaging. Europe is a global leader in pharmaceutical production, especially in Switzerland, Germany, and Ireland. Foam packaging is widely used for: Shock-absorbing transport of fragile medical devices and Thermal-insulating packaging for temperature-sensitive drugs and vaccines. The EU’s push for a circular economy promotes the reuse and recycling of packaging materials. As a result, companies are investing in foam materials that align with EU sustainability targets, supporting innovation and higher adoption rates.

Polyurethane Foam: Set to Lead the Foam Protective Packaging Market in 2024

- The polyurethane foam segment held a dominant presence in the foam protective packaging market in 2024.

- Polyurethane foam is effectively absorbing impact and vibrations, protecting fragile items during transit. Its low density reduces shipping costs while still providing robust protection.

- Polyurethane foam can be easily molded into various shapes and sizes, allowing for customized packaging solutions. It is resistant to wear and tear, ensuring long-lasting protection.

- The foam provides thermal insulation, which is beneficial for temperature-sensitive products. Its manufacturing process is relatively inexpensive, making it a cost-effective choice for many businesses.

- Polyurethane foam can withstand exposure to various chemicals, further broadening its application range. These properties make polyurethane foam an ideal choice for diverse industries requiring reliable protective packaging.

Expansion of the Automotive Industry: A Key Driver for Foam Protective Packaging Market Dominance

- The automotive and auto components segment registered its dominance over the global foam protective packaging market in 2024. Automotive parts are often fragile and can be easily damaged during transportation. Foam packaging provides excellent cushioning and shock absorption.

- Foam can be molded to the specific shapes of various parts, ensuring a snug fit that minimizes movement and reduces the risk of damage. The foam protective packaging reduces the overall weight of packaging helps lower shipping costs and improves fuel efficiency during transport.

- Foam packaging is resilient and can withstand the rigors of shipping and handling, ensuring parts arrive in optimal condition.

- Some automotive parts require temperature control during transport, and foam can provide thermal insulation to protect sensitive components. These factors make foam protective packaging essential in the automotive industry, ensuring that parts arrive safely and in good condition.

Exploring New Advancements and Innovations in the Foam Protective Packaging Industry

- In March 2025, WeatherFlow-Tempest, a company that provides weather technology solutions collaborated with Cruz Foam, a company focused on manufacturing sustainable materials, to launch the eco-friendly foam option for its products. The program supports Tempest's mission to lessen its environmental impact and promote sustainability in the technology industry. Through this partnership, Tempest will transition to Cruz Foam's biodegradable and compostable protective packaging, which is marketed as a substitute for conventional foams made of petroleum.

- In April 2025, Useon and TotalEnergies Corbion signed a strategic partnership to accelerate the development and global adoption of EPLA (Expanded PLA) molded products, a novel, sustainable foam solution made from Luminy PLA bioplastics. This partnership combines state-of-the-art materials with advanced manufacturing technology to introduce a high-performance alternative to conventional foams. EPA is a bio-based, industrially compostable material intended for molded applications like food service products, insulation, and protective packaging. Using Useon's exclusive direct bead foaming technology and TotalEnergies Corbion's Luminy PLA, EPLA offers a new circular solution in the foam market, which has historically been dominated by non-renewable expanded polystyrene (EPS) products.

- In February 2024, Pregis, a company that manufactures protective packaging solutions worldwide, introduces a new foam technology backed by certified circular polyethylene resins. Pregis has partnered with ExxonMobil, a pioneer in cutting-edge recycling technology, to provide protective foam packaging to assist clients in achieving their circularity objectives for plastics. This discovery stemmed from the requirement for packaging that enables companies to satisfy consumer demand for more circular plastic products while maintaining the superior protective qualities of polyethylene foam. Certification-circular resins have been used into more circular packaging applications without sacrificing performance thanks to ExxonMobil's investment in cutting-edge recycling technology and Pregis' comprehensive approach to circular design.

- In July 2024, ProAmpac, a flexible packaging and material sciences company, revealed the introduction of the polypropylene-based foam proactive recyclable fresh tray FT-1000 solution for the food companies.

- In March 2024, Seawise, innovative packaging company, revealed the introduction of the upgraded alternative option of packaging engineered to replace extensively used extruded polystyrene (EPS) foam, commonly known by the brand name Styrofoam.

Leading Companies Shaping the Future of the Foam Protective Packaging Market

Breakdown of Foam Protective Packaging Market Segments

By Type

- Polyurethane Foam

- Expanded Polystyrene

- Expanded Polyethylene

- Expanded Polypropylene

- Others

By Application

- Automotive and Auto Components

- White Goods and Electronics

- Pharmaceutical and Medical Devices

- Daily Consumer Goods

- Food

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait