Plastic Healthcare Packaging Market Growth Opportunities and Competitive Analysis

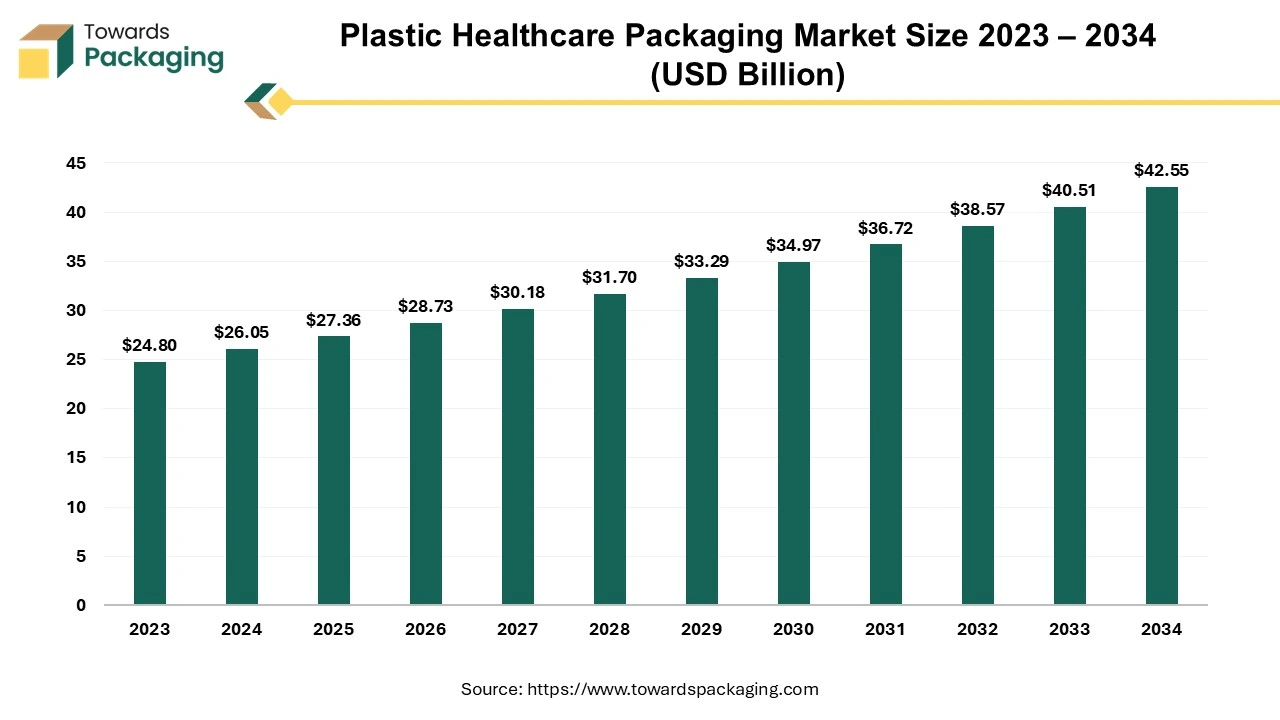

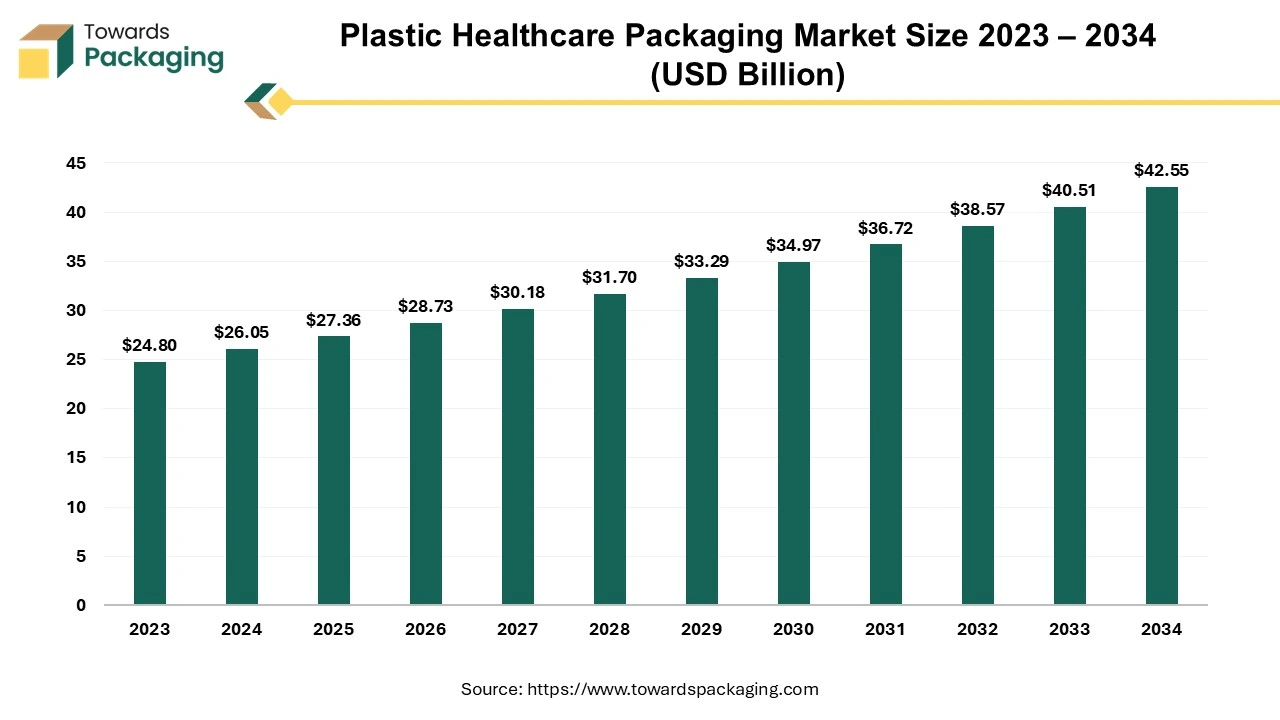

The plastic healthcare packaging market is forecasted to expand from USD 28.74 billion in 2026 to USD 44.69 billion by 2035, growing at a CAGR of 5.03% from 2026 to 2035. The increasing demand for user-friendly packaging and regulatory support for eco-friendly materials are key market drivers. Notable advancements in the industry include the development of personalized medicine packaging and RFID tracking solutions, which are expected to boost market growth, particularly in North America and Asia Pacific.

The key players operating in the healthcare sector are influenced by the benefits offered by the plastic packaging, which has risen the demand for the plastic healthcare packaging and is estimated to drive the growth of the plastic healthcare packaging market over the forecast period.

Key Takeaways: Strategic Insights and Market Trends in Plastic Healthcare Packaging

- Market Growth: The global plastic healthcare packaging market is projected to grow from USD 27.36 billion in 2025 to USD 42.55 billion by 2034, driven by factors like expanding healthcare services, emerging markets, and increasing regulatory support.

- Key Drivers: Expansion of healthcare services, emerging markets for medical packaging films, and increasing regulatory support are major drivers of market growth.

- Market Opportunities: Integration of software for innovative packaging solutions and monitoring packaging equipment, along with the rising demand for easy-to-use and personalized packaging, presents significant market opportunities.

- Segment Performance: The bottles segment currently dominates the market, while the vials & ampoules segment is projected to witness the fastest growth.

- Regional Insights: North America currently holds the largest market share, while Asia Pacific is expected to exhibit the fastest growth rate.

- Key Players: Major players in the market include Bilcare Limited, Gerresheimer AG, Amcor Limited, Schott AG, and Constantia Flexibles Group.

- Recent Developments: Key companies are focusing on innovations like sustainable packaging solutions, improved user-friendliness, and advancements in materials to enhance their market position.

- AI Impact: AI is playing an increasingly important role in the plastic healthcare packaging industry, enabling advancements in safety, accessibility, and sustainability through applications like RFID tracking, personalized packaging, and anti-counterfeiting measures.

The science, art, and technology of enclosing or safeguarding goods for use, sale, distribution, and storage is known as packaging. Packaging also includes the process of creating, assessing, and designing packages. The affordable means of supplying presentation, protection, identity, information, convenience, compliance, integrity, and stability of the product is known as pharmaceutical packaging. The selection of materials used in pharmaceutical packaging is essential to ensuring the integrity, safety, and sustainability of the product for the environment.

The packaging is mainly divided into three types, primary packaging, secondary packaging and tertiary packaging. The material that first encloses and holds the product is known as primary packaging. This is typically the distribution or use unit that is the smallest; example a bottle, blister packs, and aerosol spray can. Outside of the primary packaging, secondary packaging may be used to bundle primary packages together.

Plastic bottles made of polyethylene terephthalate (PET) are becoming more and more popular as the industry's preferred packaging option. It is crucial to guarantee the safety and adherence of pharmaceutical packaging. Polyethylene Terephthalate (PET) plastic bottles adhere to the strict quality standards and legal criteria established by organizations such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA).

Leveraging Artificial Intelligence (AI) in Plastic Healthcare Packaging: Innovations, Benefits, and Future Trends

Artificial Intelligence (AI) is finding different uses in the packaging industry. The plastic healthcare packaging industry is embracing technological advancements. Using innovative technologies like – AI, there is an improvement in safety, accessibility and sustainability for the patients. AI integration has a lot of benefits for this industry. New tools like RFID tags, QR Codes, micro-electromechanical systems track, software for managing and maintaining patient records, medical adherence and even personalized medicine packaging are made possible with AI-based technology implementations. Counterfeiting is a serious issue in healthcare; technologies like blockchain have helped mount anti-counterfeiting efforts to ensure original and authentic medicines are reaching the consumers.

Growth Factors Driving the Plastic Healthcare Packaging

- Expansion of the healthcare services can foster the growth of the plastic healthcare packaging market in the near future.

- Emerging markets and trends for medical packaging films is expected to drive the growth of the market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Increasing in adoption of the advanced technology for the production of medical packaging films and vials is estimated to drive the growth of the global plastic healthcare packaging market in the near future.

- Increasing launch of the new policy by the government to support pharmaceutical packaging and monitoring solution is expected to drive the growth of the market over the forecast period.

- The key players operating in the market are focused on geographic expansion and launching their brand in other countries which is expected to drive the growth of the plastic healthcare packaging market in the near future.

Market Opportunities in Plastic Healthcare Packaging

Integrating Software for Innovative Packaging Solutions

Easy-to-use package alternatives that enhance medication adherence are precisely modern patients seek. Market research indicates that single-dose packaging, child-resistant closures, and easy-to-open features are becoming more and more common. Personalized packaging that has precise directions and dosing information is also growing in popularity. This development is being driven by an increase in occurrences of chronic illnesses and an aging population. In an attempt to boost efficiency and enhance patient safety, the healthcare industry is implementing smart packaging. The latest packaging technologies include sensors and extra functionalities to oversee product quality, measure temperature and humidity, and provide instantaneous data for enhanced supply chain management.

For instance,

- In May 2024, Trelleborg Medical Solutions, engineers innovative solutions providing company, unveiled the introduction of Innovation Center in Minnesota, US. A newly launhced single center for design, quick prototyping, development, and serial manufacturing, it offers Trelleborg's global healthcare and medical clients cost control and scalability of their solutions. It is an extension of the earlier quick Development Center.

Global Support for Reducing Plastic Production and Promoting Reusable Alternatives

A recent expert survey reveals strong global support for cutting plastic production and addressing plastic pollution. Conducted across 19 countries, the survey highlights a significant public consensus on the need to tackle plastic waste and prioritize sustainable solutions.

Key insights from the survey include:

- 82% of participants advocate for reducing plastic production to combat plastic pollution.

- 80% support efforts to protect biodiversity and combat climate change through decreased plastic production.

- 90% endorse moving away from single-use plastic packaging in favor of reusable and refillable alternatives.

- 75% back a ban on single-use plastic packaging.

- 80% of respondents are concerned about the health impacts of plastic on their loved ones, with 84% of parents expressing particular concern about the effects on their children.

The survey underscores a clear global demand for stronger measures to reduce plastic use and promote more sustainable packaging solutions.

U.S Import Data for Healthcare Industry Consignees and Suppliers

Consignee: GRIFOLS THERAPEUTICS LLC

- Shipper: NIHON TAISANBIN GLASS BOTTLE MFG CO

- HS Code: 701090 (Glass containers excluding bottles, jars, ampoules)

- Loading Port: Pusan (58023)

- Unloading Port: Wilmington, NC (1501)

- Quantity: 6,999,264 units

- Weight: 641,328 kg

Consignee: SRC MEDICAL INC

- Shipper: WEST PHARMACEUTICAL SERVICES BRASIL

- HS Code: 401490 (Hygienic or pharmaceutical articles of vulcanized rubber)

- Loading Port: Sao Paulo (35177)

- Unloading Port: Newark, NJ (4601)

- Quantity: 1,340 units

- Weight: 12,629 kg

Consignee: FARALLON BRANDS

- Shipper: WUXI HUIDE INTERNATIONAL CORP LIMITED

- HS Code: 401490 (Hygienic or pharmaceutical articles of vulcanized rubber)

- Loading Port: Shanghai (57035)

- Unloading Port: Oakland, CA (2811)

- Quantity: 1,276 units

- Weight: 5,741 kg

Consignee: SIGMA ALDRICH CO LLC

- Shipper: LMS CONSULT GMBH AND CO

- HS Code: 701790 (Laboratory, hygienic or pharmaceutical glassware)

- Loading Port: Bremerhaven (42870)

- Unloading Port: Newark, NJ (4601)

- Quantity: 1,600 units

- Weight: 1,880 kg

Consignee: NIKON INSTRUMENTS INC

- Shipper: NANJING JIANGNAN NOVREL OPTICS CO

- HS Code: 701790 (Laboratory, hygienic or pharmaceutical glassware)

- Loading Port: Shanghai (57035)

- Unloading Port: Los Angeles, CA (2704)

- Quantity: 1,592 units

- Weight: 10,048 kg

Segment Insights

Dominance of Plastic Bottles in the Healthcare Packaging Market & Growth of Vials and Ampoules Segment

The bottles segment held the dominating share of the plastic healthcare packaging market in 2024. Pharmaceutical items are shielded from moisture, light, and oxygen by plastic bottles, which has excellent barrier qualities and keeps them stable and effective. This preserves the strength and caliber of drugs, guaranteeing that patients will benefit from them. Pharmaceutical products are shielded from moisture, light, and oxygen by plastic bottles, which has excellent barrier qualities and keeps the items stable and effective. This preserves the strength and caliber of drugs, guaranteeing that patients will get 100% drug efficacy from medicine stored in the bottle. As the plastic bottles are transparent, both patients and medical physician are able to visually examine the contents, confirm that labels are accurate, and look for any indication of contamination or tampering.

Increased safety and rise in the pharmaceutical supply chain are result of transparency provided by the plastic bottle usage. Due to their light weight, plastic bottles have a lower environmental impact and lower shipping costs. Owing to its longevity, there is less chance of harm during handling, transportation, and storage of medications. Pharmaceutical goods in a variety of forms and sizes, including liquids, powders, and solid doses, can be inserted into plastic bottles through moulding. By virtue of its adaptability, packaging solutions can be tailored to fit particular requirements and increase user convenience.

The vials & ampoules segment is estimated to grow at fastest rate over the forecast period. Plastic ampoules and vials are usually thin-walled plastic containers, which are filled and sealed using techniques like tip sealing or pull sealing. The method for opening the plastic ampoules is generally carried out by snapping off the upper neck of the container. The plastic vials and ampoules is right choice for storing unstable and chemically active elements as the seal protects the compound from degradation and contamination. Certain special grade of plastic is used for manufacturing the vials and ampoules, which is made up of low-density and high density plastic materials. Focusing on the key benefits offered by the plastic vials and ampoules the key players operating in the market are focused on developing new plastic material vials and ampoules which is estimated to fuel the growth of the segment over the forecast period.

For instance,

- In November 2023, Gerresheimer AG, pharmaceutical company, announced the introduction of the COP (Cyclic Olefin Polymer) vials which is made out of thermoplastic material. The newly launched COP (Cyclic Olefin Polymer) vials standard solution for filling and storage of highly sensitive biologics. They are appropriate for storage of mRNA active ingredients at -80°C and cryogenic temperatures.

The blister segment is observed to be the fastest growing segment over the forecast period. Blister packs, also known as blister packaging, are pre-made materials for packaging that consist of a flexible top and a thermoformed plastic cavity. The substance is held within blister-like, deeply cut pockets or cavities in this kind of packaging. A heat seal is used to fuse the two structures together after a backing material, also known as lidding, is matched to the flat portion of the plastic cavity containing the object.

There are several forms of blister packaging, depending on the need. Blister packs are most commonly used for packing pharmaceutical items such tablets, lozenges, pills, and capsules. Owing to their inexpensive raw materials, quick operation, and low cost, they are also utilized in the packaging of consumer goods such toys, food, electronics, and equipment. The key players operating in the market are focused on launching new blister packaging which is expected to drive the growth of the segment over the forecast period.

For instance,

- In May 2024, TerraCycle, waste management company, revealed the launch of the TerraCycle BlisterBack. In order to unite the health industry in the fight against plastic waste and prevent empty pharmaceutical blister packs from being burned or dumped in a landfill, TerraCycle introduced TerraCycle BlisterBack, a UK solution.

Polyethylene Dominates the Healthcare Packaging Market, While Polypropylene Sees Rapid Growth

The Polyethylene segment held the dominating share of the plastic healthcare packaging market in 2024. The polyethylene material is mainly used in healthcare sector for packaging purpose. It is generally utilized in packaging of medical devices and pharmaceutical products, specifically for the production of bottles for liquid medicines. As the polyethylene material is precisely resistant to negative impact that the presence of oxygen could have on medicines, it is used widely for pharmaceutical products packaging. The key players operating in the market are focused on developing and launching the polyethylene material sustainable packaging for medical devices which is estimated to drive the growth of the segment over the forecast period.

For instance,

- In November 2023, Amcor plc, packaging company, revealed the introduction of the next generation of its Medical Laminates solutions. The next generation of its Medical Laminates solutions from Amcor makes it possible to create recyclable all-film packaging in the polyethylene stream. By lowering the final package's carbon footprint and preserving device applications' performance requirements, the novel approach enables medical enterprises to advance their sustainability objectives without endangering patient safety. A mono-material polyethylene (PE) laminate that can be applied to a variety of package types is the new packaging solution.

The polypropylene segment is expected to grow at fastest rate over the forecast period. Polypropylene is a multipurpose material that may be used for many different applications. It is also one of the most prevalent plastics used in packaging. Because of its strong and chemical-resistant qualities, it is particularly well-liked in the pharmaceutical sector. A form of thermoplastic utilized in many different sectors and applications is called polypropylene (PP). It is renowned for being strong, inexpensive, and versatile.

For instance,

- In March 2024, TOPPAN Inc., packaging and printing company, announced the development of the GL-SP, a barrier film that uses biaxially oriented polypropylene (BOPP) as the substrate for sustainable packaging. GL-SP is a newly developed addition to the range of products for sustainable packaging in the TOPPAN Group’s GL BARRIER1 series of transparent vapor-deposited barrier films for pharmaceutical grade packaging.

Pharmaceutical Segment Leads Plastic Healthcare Packaging Market, While Medical Devices Segment Shows Rapid Growth

The pharmaceutical segment held the dominating share of the plastic healthcare packaging market in 2024. The need for advanced packaging solutions is being driven by both the rapid urbanization and changing lifestyles that are leading to an increase in healthcare requirements due to the rising number of lifestyle disorders. Increasing launch of the new pharmaceutical medicines and tablets is rising the demand for the plastic packaging, as the plastic packaging is appropriate solution for restricting the reaction of product with container. The increasing need for packaging solutions, like blister packaging, for customized and precision medicine underscores the market's growth prospects over the forecast period. The key players operating in the market are focused on adopting the inorganic growth strategies like partnership to develop pharmaceutical packaging, which is estimated to drive the growth of the segment over the forecast period.

For instance,

- In January 2024, Bormioli Pharma, a company focused on developing medical devices and pharmaceutical packaging signed partnership with Loop Industries, Inc., a clean technology company to develop a pharmaceutical packaging bottle manufactured with 100% recycled virgin quality Loop polyethylene terephthalate resin.

The medical devices segment is expected to grow at fastest rate during the forecast period. The medical equipment must be packaged to reduce the chance that patients may be exposed to pollutants and residues. The package must guarantee that the contents remain sterile until they are broken. Systems for packaging non-sterile devices must preserve the product's purity and integrity. To prevent contamination of medical products and devices, the healthcare industry depends on this technology.

Medical equipment makers and institutions are guaranteed to adhere to industry norms through the use of sterile packaging. Assuring that medicinal product is safe and secure during transit and storage, as well as in pristine condition and ready to use when opened, medical device packaging is an essential step in the production process. Displaying essential product information and promoting a brand are two further uses for packaging. Product recalls, sterility loss, product damage, and reduced performance are all possible consequences of improper product packaging. Penalties, reputational harm, and expensive market delays are possible outcomes. Moreover, the key players operating in the market are focused on adopting inorganic growth strategies like collaboration for developing new packaging solution for addressing the challenges occurring while packaging the medical device, which is estimated to drive the segment over the forecast period.

For instance,

- In February, 2024, AptarGroup, Inc., a company focused on developing drug and consumer product dispensing, dosing and protection technologies signed collaboration with ProAmpac, company providing material science and flexible packaging, to innovate and introduce ProActive Intelligence Moisture Protect (MP-1000). With the help of this next-generation platform technology, Aptar CSP's exclusive 3-Phase Activ-Polymer technology and ProAmpac’s flexible blown film technology work together to create a flexible medical device packaging solution that absorbs moisture and is patent pending. This is the first in a line of packaging solutions for active microclimate control designed to reduce the risk of degradation, preserve potency, and enhance product performance.

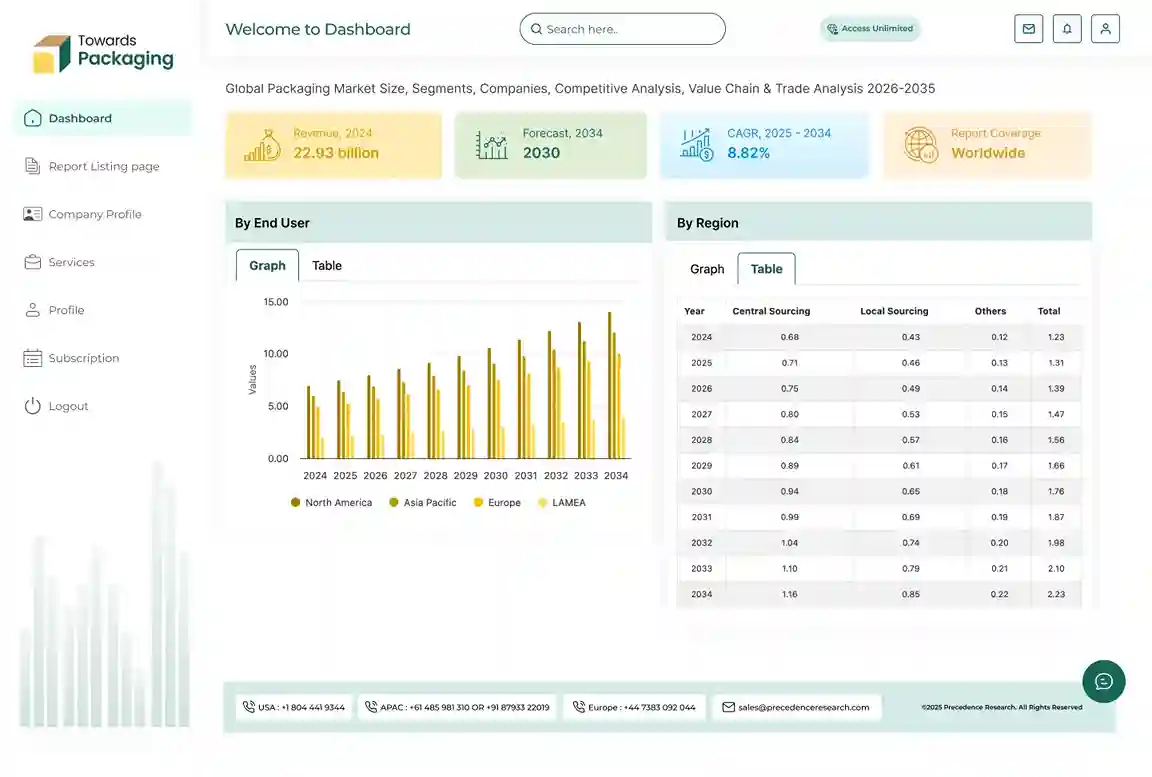

North America Dominates Plastic Healthcare Packaging Market, While Asia-Pacific Emerges as Fastest-Growing Region

North America witnessed the highest revenue share for the year 2024 in the plastic healthcare packaging market owing to rapid technology advancements, high level of medical awareness, and a robust healthcare infrastructure. The need for sophisticated packaging solutions has been heightened by the notable rise in healthcare spending in the area. Pharma and medical device industries in North America have also made investments in creative and environmentally friendly packaging solutions due to strict regulatory requirements and a focus on sustainability.

The market will present profitable prospects for the players as long as the area prioritizes healthcare developments. The market's growth in North America is expected to be emphasized during the forecast period by the industry's increasing attention on the development and deployment of bioplastics and other sustainable packaging solutions. In addition, the presence of major important players in the region is contributing to the market's growth. One of the most advanced and contemporary industries in North America is the pharmaceutical industry. The key players operating in the market are focused on expansion of the production capacity to meet the increasing demand of packaging which is expected to drive the growth of the plastic healthcare packaging market in the North America region.

For instance,

- In February, 2024, Amcor plc., packaging company, revealed the expansion of its thermoforming production capacity in North America. At its Oshkosh, Wisconsin, U.S., healthcare manufacturing facility, the company has expanded by installing state-of-the-art automated thermoforming technology. This calculated action aims to meet the needs of healthcare consumers in the area's pharmaceutical, consumer health, and medical industries. With the expansion, these clients will be able to enhance product distribution and manufacturing by obtaining thermoforms and matching die-cut lids from a single supplier.

Asia Pacific is the most fastest growing and lucrative market, significantly driven due to launch of the new product by the key players operating in market to meet high clinical needs. The region is expected to grow at the fastest rate in the market analysis due to the need for pharmaceutical and medical products in developing countries like China, India, Indonesia, and Malaysia, as well as the region's expanding middle class and discretionary money.

The increasing prevalence of kidney disease in Asia created a demand for novel treatments, including high-tech tools to improve care. Renal disease is on the rise in Asia due to rising incidence of diabetes and hypertension. Furthermore, the need for packaging film in the medical and healthcare sectors increased due to the emphasis on extending the life of medical supplies and equipment and eliminating the possibility of bacterial or viral contamination. Plastic medical packaging has grown rapidly in many developing countries, including China and India, because plastic healthcare packaging offer benefits like cost savings, sustainability, and product safety.

Furthermore, the Asia-Pacific region is expected to lead the market in terms of volume and value due to the region's strong industrial base, growing need for ecologically friendly packaging choices, and concentration of large manufacturers. Increasing initiative by the government to bring advanced technology in the Asia Pacific region for accelerating the production of the plastic medical packaging solution, which is estimated to drive the growth of the plastic healthcare packaging market in Asia Pacific region over the forecast period.

For instance,

- In June 2024, the Ministry of Electronics and Information Technology (MeitY), government agency, based in India, announced the launch of the national additive manufacturing symposium in India. The newly launched National Additive Manufacturing Symposium (NAMS) brought advanced manufacturing technologies for pharmaceutical grade packaging in India.

Europe is expected to be experience a notable rate of growth during forecast period owing to increasing launch of the plastic medical packaging solution by the key players operating in the Europe region.

- For instance, in November 2023, Coveris Flexibles UK, packaging solutions providing company, announced the introduction of the Formpeel P. The newly launched Formpeel P is recyclable, flexible thermoforming film solution utilized in various medical packaging applications.

How Will Europe Surge in the Plastic Healthcare Packaging Market?

Europe is projected to experience significant growth in the plastic healthcare packaging market soon. This expansion can be attributed to the region's robust healthcare sector, which includes pharmaceutical and medical device manufacturing, a strong emphasis on sustainability, and advanced technological developments that drive demand for plastic packaging. Additionally, the increasing population of elderly individuals in Europe is boosting the demand for medical devices and pharmaceuticals, thereby increasing the need for specialized packaging. Several European companies, such as Securikett, Avery Dennison, Sealed Air, and Essentra Packaging, are leading the way in creating innovative packaging solutions, including smart labels, tamper-evident seals, and child-resistant closures.

- In June 2024, Amcor announced the expansion of its packaging innovation hubs globally. Alongside its existing centers in the U.S., South America, and the Asia Pacific, Amcor opened the Amcor Innovation Center Europe in Ghent, Belgium. This center aims to drive advancements in material technologies to make packaging more sustainable and effective while concentrating on designs that attract consumers in stores and enhance usability by making a significant investment in more sustainable, circular, and innovative packaging solutions.

How Will Latin America Emerge in the Plastic Healthcare Packaging Market?

Latin America also plays a unique role in the plastic healthcare packaging market. The region is experiencing a rise in pharmaceutical manufacturing, particularly in countries like Brazil and Mexico, which is fueling demand for packaging solutions. This growth is further supported by a strengthening economy, an expanding pharmaceutical industry, and an increasing focus on chronic disease management. Additionally, there is a growing emphasis on sterile packaging formats, such as pre-filled syringes and blister packs, to ensure product integrity and patient safety. Investments in manufacturing facilities, a commitment to sustainable packaging solutions, and the adoption of advanced packaging technologies like cold-formed blisters are contributing to the expansion of the market.

Key Developments in Plastic Healthcare Packaging

- In January 2024, Berry Global Healthcare, a patient-centred package design company, revealed the introduction of the new dry powder inhaler at Pharmapack 2024.

- In April 2024, SnapSlide, packaging solution providing company, announced the launch of the line of no-torque, child-resistant caps for medicinal drug capsule bottles as well as tablet bottles. With its innovative sliding two-step opening mechanism, SnapSlide's ergonomic design permits one-handed opening and closing while preserving kid resistance. The cap closure technology was specifically designed to help millions of customers who have physical restrictions and disabilities. Unlike the push-and-turn technology now in use, the slide-to-open/close capability requires less force and dexterity to operate. The cap itself is securely fastened to the vials, offering a further layer of security and ease of use in addition to simple, metered dosage.

Plastic Healthcare Packaging Market Key Companies

- Bilcare Limited

- Gerresheimer AG

- Amcor Limited

- Schott AG

- Constantia Flexibles Group

- Alexander (James) Corporation

- Klockner Pentaplast Group

- Becton & Dickinson Company

- Clondalkin Group

- Berry Global, Inc

- Comar LLC

- Nipro Corporation

- Mondi Group plc

- Adelphi Healthcare Packaging

- Wipak Ltd.

- Aptar Group, Inc.

- West Rock Company

- West Pharmaceutical Services, Inc.

- McKesson Corporation

- Novio Packaging

Plastic Healthcare Packaging Market Segments

By Product Type

- Vials & Ampoules

- Blisters

- Bottles

- Dropper Bottles

- Nasal Spray Bottles

- Liquid Bottles

- Bags, Pouches & Sachets

- IV Bags

- Medical Specialty Bags

- Prefilled Inhalers, Syringes & Cartridges

- Containers & Jars

- Caps & Closures

- Trays

- Medication Tubes

By Material Type

- Polyethylene

- Low Density Polyethylene (LDPE)

- High Density Polyethylene (HDPE)

- Linear Low Density Polyethylene (LLDPE)

- Polyvinyl Chloride

- Polystyrene

- Polypropylene

- Bi-axially Oriented Polypropylene (BOPP)

- Cast Polypropylene (CPP)

- Polyethylene Terephthalate

- Bi-axially oriented Polyethylene Terephthalate (BoPET)

- Metallized PET

- Others (Polycarbonate)

By Application

- Pharmaceuticals

- Medical devices

- Sterile packaging

- Non sterile packaging

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (2)