Shrink Label Films Market Dynamics, Emerging Trends, Segment Insights, Regional Share (NA, EU, APAC, LA, MEA), Manufacturers & Suppliers, and Forecast 2025–2034

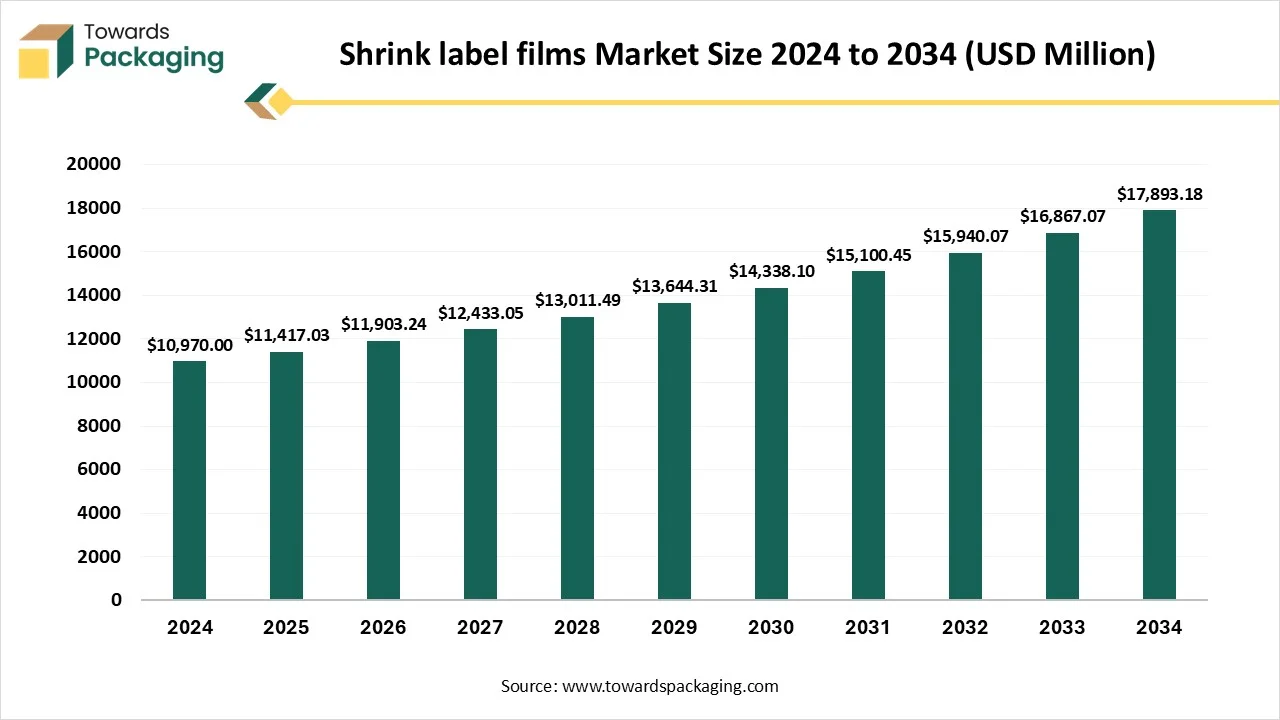

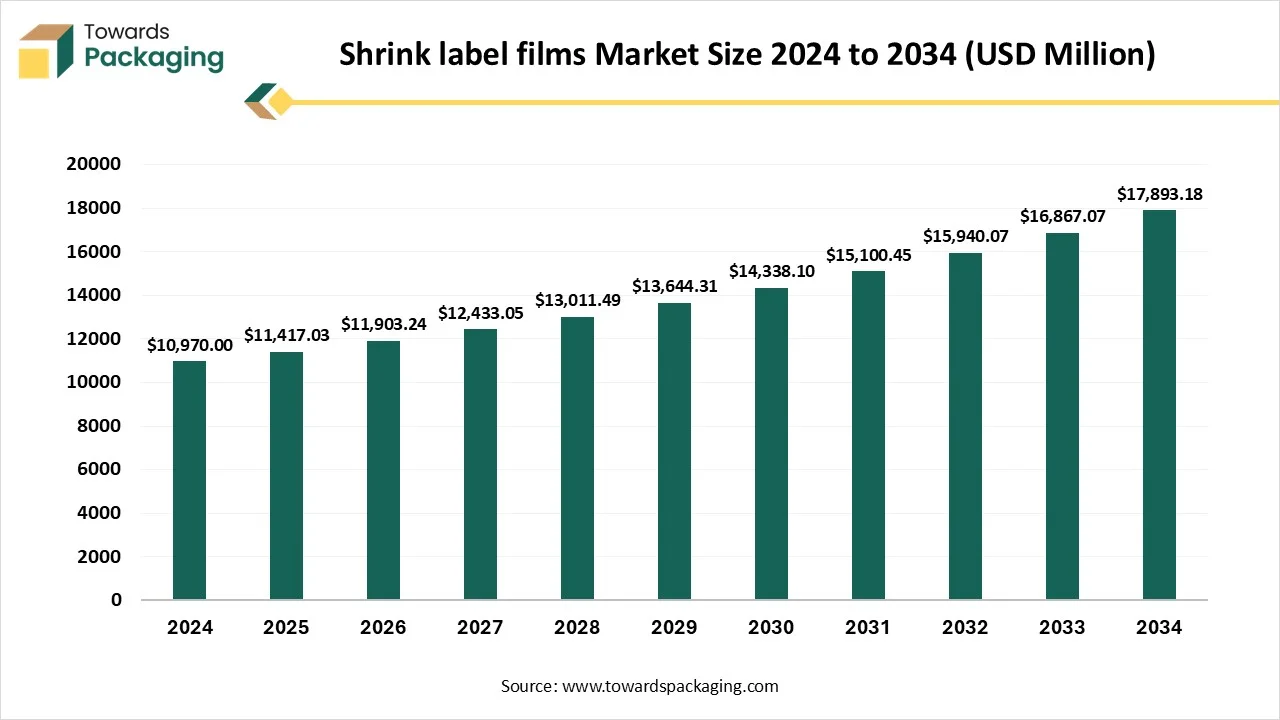

The shrink label films market is experiencing strong expansion, reaching USD 10,970 million in 2024 and projected to grow to USD 17,893.18 million by 2034 at a CAGR of 5.12%. We cover complete insights on market size, trends, and segmentation across material types (PVC, PETG, PLA, PE), product types, application methods, and end-use industries. Our report includes regional analysis across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, highlighting APAC’s 40% share in 2024 and North America’s strong future growth. The study profiles leading companies, compares competitive strategies, maps the full value chain, and includes trade data, manufacturer listings, and supplier intelligence to support business decision-making.

Key Highlights

- In terms of revenue, the market is valued at USD 10,970.00 million in 2024.

- The market is predicted to reach USD 17,893.18 million by the year 2034.

- Rapid growth at a CAGR of 5.12% will be officially experienced between 2025 and 2034.

- Asia Pacific dominated the region, having the largest share of 40% in 2024.

- North America is expected to rise at a notable CAGR between 2025 and 2034.

- By material type, polyvinyl chloride and polyethylene terephthalate glycol-modified segment contributed to the largest share of 55% in 2024.

- By material type, the polylactic acid and PE-based recyclable films segment will grow at a notable CAGR between 2025 and 2034.

- By product type, the shrink sleeves segment has contributed to the biggest share of 705 in 2024.

- By product type, the tamper-evident bands segment will grow at a notable CAGR between 2025 and 2034.

- By application method, the full-body sleeves segment has contributed to the biggest share of 58% in 2024.

- By application method, the tamper-evident bands and combo packs segment will grow at a notable CAGR between 2025 and 2034

- By end-user industry, the food and beverage segment has contributed the biggest share of 40% in 2024.

- By end-user industry, pharmaceuticals and healthcare will grow at a notable CAGR between 2025 and 2034.

Market Overview

The shrink label films market refers to the industry for thin, flexible plastic films designed to shrink tightly around a container when heat is applied, conforming to its shape. This process creates a full-body, 360-degree label that is highly durable, tamper-evident, and provides a premium, high-impact visual for branding.

Shrink labels are being prepared into a cylindrical shape by inserting the sheets together. It can be produced from the same material as shrink film. Furthermore, shrink labels are utilised to protect and decorate the tubular products such as PET bottles, as they are created from a material that shrinks in a horizontal way, having almost no vertical shrinkage.

Shrink labels, prevalently known as “shrink sleeves “, are personalised print products that form-fit a container with 360-degree graphics coverage. Shrink sleeves are being printed on the interior of the durable film, which protects the printed image from abrasion and moisture.

Emerging Trends in the Shrink Label Films Market

- Shift towards polyolefin for safer and evergreen packaging: Regularly, polyvinyl chloride (PVC) was the hugely utilised shrink film, commended for its convenience and cost-effectiveness. Hence, in recent years, polyolefin has become the preferred choice, initially due to its adaptability and lower health and environmental effects. Polyolefin shrink film has gained attention in terms of food packaging, as it is FDA-approved for direct food contact, just like PVC.

- Increased demand for recyclable and eco-friendly options: The growth in worldwide awareness about plastic pollution has compelled the packaging sector to adopt sustainable alterations. While regular shrink film, such as PVC and standard polyolefin, is challenging to invent, recyclers are creating environmentally friendly options that are increasingly available.

- No Heat or heat Shrinking: Regular labelling procedures often need adhesives or heat shrink technology, both of which have main environmental effects. Stretch sleeve labels avoid the demand for these procedures, lowering the energy usage during application.

- The Sustainability Edge: Shrink label meets with the principles of the circular economy, which gives importance to lowering the waste and storing the materials for as long as possible. By utilising the recyclable materials and lowering the energy consumption, these labels assist manufacturers in achieving the sustainability goals while tracking the high-quality branding.

Market Dynamics

Driver

Characteristics of Shrink Label Films

Shrink label film acts as a protective barrier, protecting the products from every external factor, such as dust, moisture, and pollutants. This is particularly crucial for food and beverage products, in which safety and freshness are the main priorities. By packing products tightly, shrink film protects their quality during transportation and storage. Furthermore, shrink labels for bottles serve to add longevity to prevent leaks and spills.

It is a trusted choice for preserving sensitive goods, serving both consumers' and manufacturers' peace of mind. Shrink packaging is more than just a secure layer-it is a calculated asset in user goods packaging. From developing the visual appearance and protecting the products to allowing cost-efficient activities and expanding the brand identity, shrink film plays a crucial role in developing the product appearance.

Restraint

Restrictions with Respect to Light, Air and Moisture

Shrink film often delivers less opposition to oxygen, moisture, and UV as compared to multilayer or rigid packaging, which can lower product shelf life. Several shrink films are created from plastics like PVC or polyolefins, which pose recycling challenges and add to plastic waste problems. The shrinking process needs heat tunnels or guns, leading to bigger energy consumption and operational costs. Apart from this, shrink films can be prone to tearing or puncturing, especially during transport or handling. Rising environmental regulations on single-use plastics are making compliance difficult.

Opportunity

Innovations associated with Branding

Effective branding is compulsory for making a lasting impression and developing customer commitment. Shrink wrap packaging delivers as a powerful tool for showcasing the brand’s identity. Personalized with bright graphics, text, and logos, shrink film changes the packaging into a canvas for storytelling. For instance, shrink wrap for bottles can count the complex designs that signify a brand’s messaging, which makes the product instantly identifiable.

This personalization not only develops the brand visibility but also transmits the sense of attention and quality to detail. With shrink film, organizations can classify their products and link with users on a deeper level.

Shrink label makes a way for care and sophistication, showing users that the product is worth the investment. Its potential is to track the product’s perfect condition throughout the journey in order to keep shelf replenishment satisfaction and trust.

How is Artificial Intelligence Being Utilized in Shrink Labels?

A heavy-performance packaging system known as a fully automatic (machine learning-based) shrink wrapping machine works to streamline and automate the shrink wrapping procedure. The machine protects the product within the shrink film and utilises the heat to create tamper-proof and protective packaging. These machines change and update operations by lowering the human mediation during work while at the same time increasing the rate of packaging and tracking high-quality standards.

Many industries, including food production, pharmaceuticals, beverage production, electronics, and consumer goods, use shrink wrapping technology greatly. When heated, shrink film prevents moisture, dust, and bacteria from developing on the products ' shelf. Complete shrink wrapping machines run with less human input, making them ideal for large-scale manufacturing settings just like semi-automatic equivalents.

- In May 2025, the Beijing International Printing Technology Exhibition, which is the biggest global printing event of 2025, took place from May 15-19 at the Beijing China International Exhibition Center. HP Indigo will showcase its main products as it develops the underpinned technology by artificial intelligence and inventive printing technologies, as well as two of the latest digital printing procedures, which are officially launched in Asia.

By Material type

How Have the Polyvinyl Chloride (PVC) and the Polyethylene Terephthalate Glycol-modified (PETG) Dominated the Shrink Label film market?

The polyvinyl chloride and polyethylene teraphthalate glycol-modified segment has dominated the shrink label film market in 2024 as PVC heat shrink film serves complete personalisation, enabling brand logos, marketing messages, and product details to be closely displayed with the assistance of good quality multi-color printing, developing the brand recognition. Beyond perfect product security, these labels deliver as an effective promotional and branding tool, ensuring bright,distortion-free printing with the assistance of a high-level processing method. This makes sure that designs and logos track their integrity, supporting a rigid and professional brand image.

PETG shrink labels protect the complete surface area of a container, just like regular labels, which only cover a portion. This enables a more storytelling area, regulatory information, and ingredients, too, as well as creative branding possibilities. For the latest or main brands, this extra space is gold. It gives them space to educate users, display certifications like vegan, recyclable, or cruelty-free, which stand out without increasing the packaging size.

The polylactic acid and PE-based recyclable films segment is predicted to be the fastest in the market during the forecast period. They are eco-friendly and biodegradable alternatives to regular shrink films like POF shrink film, crafted to align with current sustainability demands. IT is created from renewable resources like corn starch, as it serves unique shrink characteristics while lowering the environmental impact. Just like POF Shrink film, PLA lowers the plastic waste, and it is compostable, which makes it a perfect choice for organizations giving importance to green packaging. With perfect clarity, heat shrinkability, and durability, PLA Shrink film serves superlative protection for products while contributing to a cleaner surrounding. It is perfect for sectors like retail, food packaging, and consumer goods; it ensures product sustainability and safety, too.

Polyethylene-based shrink film is one of the most prevalent thermoplastic polymers utilised in the manufacturing of polyolefin shrink film. It is a sophisticated polymer as an integration of repeated units of ethylene, which directly comes from crude oil or natural gas. PE includes the main properties of the film, such as clarity, flexibility, and opposition to moisture, which makes it ideal for food and consumer goods packaging.

By Product Type

How did the Shrink Sleeves Segment Dominate the Shrink Label Films Market?

The shrink sleeve films have dominated the market in 2024 as they are created from heat-shrinkable plastic films, crafted to cover around a product and shrink heavily whenever it is exposed to heat. They serve overall series, which makes them perfect for product information and branding showcase, specifically for containers with different shapes in which regular labels might fail. Shrink sleeves are also called shrink sleeve labels, which are of high-quality, high-effect labelling products.

They develop branding real estate, covering around your container for attention-grabbing 360-degree shelf presence. It delivers both brand visibility and product security. Using heat shrink technology, the film tightly covers the product, serving as dust-proof, moisture-proof, and impact-resistant protection. Using heat shrink technology, the film tightly covers the product, serving moisture-proof, impact-resistant, and dust-proof. Furthermore, it supports printed branding elements, developing the product's appearance and attracting user attention.

The tamper-evident bands are predicted to be the fastest in the market during the forecast period. Tamper-evident shrink bands are the most money-saving tamper-proof packaging that is available for containers, lids, caps, and other closures, too. Tamper bands and sleeves can be used either manually by operators or automatically by the use of machinery. Organizations around the globe use tamper-proof shrink bands and sleeves in order to save money and give users the confirmation provided by the tamper-proof seal and packaging. Packaging look is the initial development. In order to align with strict safety guidelines, producers often count on the product guarantee on the packaging, along with packaging the product with tamper-proof shrink bands and sleeves. When a user purchases the products and the tamper-proof packaging is unbroken, producers know that the product is being overall protected.

By Application Method

How did the Full-body Sleeves Segment Dominate the Shrink Label Films Market?

The full-body sleeves segment has dominated the shrink label films in 2024 as they are the perfect choice for producers who use tailor-made containers with curves, which are hard to label. The shrink sleeve will comply with the container’s shape and emphasize the container's pattern. Integrating the high-quality printed shrink sleeve and tailored bottle can generate stellar results for a brand seeking to differentiate on the shelf. For full-body shrink labelling, the sleeve slips over the products with the assistance of a shrink sleeve labelling machine, and when the label is applied to the sleeve, the sleeve will automatically lower down and meet the bottle.

Tamper-evident bands and combo packs are expected to be the fastest in the market during the forecast period. Tamper-evident packaging is a protection for other products and food. It displays whether someone has opened or altered the contents. This highlights the need for any food organisation to serve customers with confirmation. It utilises the apparent directions in the border to display whether tampering has taken place.

The combo pack's sleeve integrates several products together. They are specifically used for the marketing packs. On the other hand, the combopack label is created from heavily transparent foil. Just like other labels created from heat-shrinkable foil, the combopack label can be made on its complete surface in a different way.

It is being greatly used in promotional campaigns, which include combining the different types of products. Every limitless capability of shrink film enables you to make sets of products of the same or different shapes or sizes, and add free products too. The combo pack is progressively used in marketing campaigns in which a free sample of the product is linked to the product that is being sold.

By End-use industry

How did the Food and Beverage Segment Dominate the Shrink Label Films Market?

The food and beverage is not only about the shelf appearance, but also about storing the food and keeping it safe from toxic tampering and elements, which is important for user trust. By utilising the heat tightly, it seals the products with plastic wrap, which smoothly prevents dust, moisture, and dirt too for freshness and competitors. Hence, it supports protecting the quality of food during shipping and storage by lowering the air exposure. This procedure proves specifically advantageous when engaging with bar sealer technology. It develops the product effectiveness for different product sizes while tracking transparency against the tears and punctures.

Shrink label films expand the shelf life of food products. By securely sealing the items, it lowers the air exposure. It also behaves as a barrier against contaminants and moisture from the surroundings. This is crucial for food vulnerability to bacterial development whenever exposed to humidity or air.

The pharmaceuticals and healthcare segment is expected to be the fastest in the market during the forecast period. Labels in the healthcare and pharmaceutical industry serve a main role by communicating important information about the medical products and drugs, ensuring the safe and effective usage. The printing of such pharma labels is a different procedure, including the many complicated characteristics that promote patient safety, effective medication, and precise dosing tracking throughout the supply chain. Shrink label films are widely used in the pharmaceutical and healthcare packaging, initially for creating tight, protective coverings around the products.

This film shrinks whenever the heat is applied, serving as a perfect and tamper-evident seal that prevents the product and its contents from being tampered with. Apart from this, healthcare organizations and hospitals make use of shrink film in order to protect the products during shipping. Sensitive medical products like laboratory bottles are perfectly protected by LDPE shrink wrap.

- In September 2025, a professional multinational labelling solution for the healthcare and pharmaceutical industry, named IL Group, played a main role in assisting ExelaPharma Sciences, which is a U.S.-based specialty pharmaceutical organisation and contract development and manufacturing organisation, in revealing a series of prefilled syringe products that need personalized tamper-evident solutions.

By Region

How did the Asia Pacific Region Dominate the Shrink Label Films Market?

The Asia Pacific region has completely dominated the shrink films market in 2024 as the region is experiencing strong development, and the growing demand for secure, attractive packaging in food, beverage, and consumer goods. The APAC stretch and shrink film market was valued at a high CAGR, making it the fastest-growing global market. China and India are at the center of this expansion, assisted by large consumer bases and investments in current packaging infrastructure. Urge is fueled by growing consumption of packaged food and beverages, development in pharmaceutical packaging, and the surge in online retail, where shrink films are widely used for bundling, wrapping, and logistics protection.

The North America region is predicted to be the fastest-growing in the market during the forecast period. The production and urge for shrink films remain rigid, with the market driven by heavily due to food and beverage, e-commerce and pharmaceuticals,and e-commerce industries. The region has a mature but steadily growing packaging sector, with shrink films greatly used for product protection, bundling, and tamper resistance, as well as high-quality labelling. The market is predicted to rise at a moderate pace, assisted by growing demand for packaged and ready-to-eat foods, frozen products, and beverages that depend on shrink sleeves for branding and shelf appeal.

Shrink Label Films Market value chain analysis

Material Processing and Conversion: Material processing and conversion of shrink films involves changing raw polymers such as polyolefin (POF), polyethylene (LLDPE), PVC, or PET into finished shrink film products through orientation and extrusion techniques. In processing, the polymer resin is melted and extruded into thin films, which are then biaxially oriented to develop strength, clarity, and shrink characteristics. During conversion, these films are cut, laminated, printed, or treated to align with particular end-use requirements like labelling, bundling, or wrapping.

Package Design and Prototyping: Package design and prototyping in shrink films concentrate on making functional, visually appealing, and brand-developing packaging solutions before large-scale manufacturing. The procedure starts with design concepts personalised to product protection, consumer convenience, and shelf visibility. Prototyping uses digital printing, 3D modelling, or short-run film samples in order to test shrink performance, color accuracy, and print quality.

Logistics and Distribution: Logistics and distribution of shrink films count on smooth handling, storage, and transportation from producing plants to converters, brand owners, and end-users across sectors. Because shrink films are lightweight but voluminous, they need optimized palletization and protective secondary packaging to minimize space and damage during transit.

Leading Companies in the Shrink Label Films Market

- CCL Industries

- Fuji Seal International

- Amcor PLC

- Berry Global Group, Inc.

- Klöckner Pentaplast

- Constantia Flexibles

- Jindal Poly Films Ltd.

- Huhtamaki Oyj

- Sealed Air Corporation

- Dow Chemical

- Avery Dennison Corporation

- WestRock Company

- InterFlex Group, Inc.

- Uflex Ltd.

- Multi-Color Corporation

- PDC International Corp.

- Macfarlane Group PLC

- Berry Plastics

- Yinjinda (Henan Yinjinda)

- Wifag-Polytype

Latest Industry Leader Announcements

- In May 2025, Taghleef Industries has made official the disclosure of its current invention, named SHAPE360 TDSW, which is a big performance floatable white polyolefin TD Shrink sleeve label film. This latest film serves optimal opacity by tracking the important low-density characteristics, which are important for recyclability, reflecting its main space, SHAPE360 TDS.

- In October 2024, Magnomer and Selenis revealed a scheme merger in order to deliver recyclable PETG shrink sleeves with the assistance of coating technology, which aims to serve convenient classification and gain sleeves in current recycling systems.

- In May 2025, one of the French producers, DCM ATN, has verified that it will showcase its future-generation shrink sleeve label manufacturing machine at the upcoming Labelexpo Southeast Asia in Bangkok in the month of May.

Recent Developments

- In December 2024, Multi-Color Corporation, one of the largest label companies in the world, revealed the merger of the Mexico-based Eximpro, a shrink-sleeve label solutions provider.

- In March 2025, Coveris, which is a packaging producer, revealed the SleeveFlexR stretch, a latest circular stretch sleeve established using up to 75% recycled content. The product has developed sustainability in the stretch sleeve industry and is capable of meeting the Packaging and Packaging Waste Regulation.

- In March 2025, Crestview Partners, a top company in equity firms, disclosed that it had gained the partnership of Smyth companies, a luxury and complete-service provider of pressure-sensitive labels,in-mold labels, shrink sleeves, flexible packaging, and glue-applied labels.

Segmentation of the Shrink Label Films Market

By Material Type

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate Glycol-Modified (PETG)

- Oriented Polystyrene (OPS)

- Polylactic Acid (PLA)

- Polyethylene (PE)

- Other Materials

By Product Type

- Shrink Sleeves

- Roll-Fed Shrink Labels

- Tamper-Evident Bands

- Multi-Packs

By Application Method

- Full-Body Sleeves

- Partial-Body Sleeves

- Tamper-Evident Bands

- Combo-Packs & Multi-Packs

By End-Use Industry

- Food & Beverages

- Pharmaceuticals & Healthcare

- Cosmetics & Personal Care

- Household & Home Care

- Consumer Goods & Electronics

- Industrial Packaging

- Automotive

- Other End-Use Industries

By Printing Technology

- Rotogravure Printing

- Flexographic Printing

- Digital Printing

- Other Printing Technologies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa