The sustainable food packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The growing popularity of sustainable food packaging, rising innovation in sustainable packaging materials, growing consumer awareness, increasing regulatory pressures, rapid expansion of the food industry, and rising focus on aligning with corporate sustainability goals are expected to drive the growth of the global sustainable food packaging market over the forecast period.

The market spans a wide range of materials such as bioplastics, paper & paperboard, molded pulp, and plant-based films. It plays a vital role in reducing carbon footprints, food waste, and plastic pollution across retail, foodservice, and food manufacturing industries. Sustainable food packaging is increasingly becoming the key focus in the food industry. Several companies operating in the market are focused on adopting sustainable food packaging materials to align with the principles of the circular economy. Additionally, the market is expanding rapidly in Europe, fuelled by stringent government regulations on single-use plastics, rising consumer awareness of sustainable food packaging, and surging demand from the food industry.

| Packaging Type | 2024 Share | 2025 Share |

| Recyclable Packaging | 39% | 42% |

| Compostable Packaging | 4.80% | 6.10% |

| Bio-Based Plastics | 3.90% | 5.20% |

| Lightweight Plastic Reductions | 11% | 13% |

| Paperization (plastic → paper shift) | 14% | 16% |

The packaging industry is clearly shifting toward more sustainable formats between 2024 and 2025. As brands prioritize circular economy models, recyclable packaging has increased its share from 39% to 42%, maintaining its dominant position. With increased consumer awareness and a stronger regulatory push, compostable packaging is steadily gaining trcation going from 4.80% to 6.10%. Due to advancements in renewable materials, bio-based plastics also exhibit significant growth, rising from 3.9% to 5.20%. A reduction in lightweight plastic increased from 11% to 13%, indicating attempts to use less material without sacrificing functionality. Paperization, the transition from plastic to paper, increased from 14% to 16%, demonstrating the popularity of fiber-based substitutes in packaging.

The sustainable food packaging market refers to the development, production, and application of packaging materials and solutions that minimize environmental impact while preserving food quality and safety. Sustainable food packaging can be recyclable, compostable, biodegradable, reusable, and renewable-based packaging materials. Plastic takes nearly 1000 years to decompose, which has increased the demand for sustainable food packaging materials. Sustainable food packaging is manufactured to align with principles of the circular economy by focusing on reducing the landfill of food packaging plastics and boosting sustainability in the ecosystem.

| Format Type | Share (%) |

| Flexible Packaging | 42.20% |

| Rigid Packaging | 34.80% |

| Cups & Containers | 8.50% |

| Bags & Pouches | 7.50% |

| Trays & Clamshells | 4.10% |

| Wraps & Films | 2.30% |

| Others | 0.60% |

The packaging format distribution is led by flexible packaging with a 42.20% share, supported by its lightweight design, material efficiency, and widespread use in food, beverage, and FMCG products, followed by rigid packaging at 34.80%, which benefits from strong durability and superior product protection in sectors such as pharmaceuticals and personal care. Cups & containers (8.50%) and bags & pouches (750%) reflecting growing demand for convenient and portable packaging formats, particularly for on-the-go consumption. Meanwhile, trays & clamshells (4.10%), wraps & films (2.30%), and other formats (0.60%) cater to niche requirements, including fresh food packaging, industrial uses, and specialized applications.

As technology continues to advance, the integration of artificial intelligence holds great potential to reshape the landscape of sustainable packaging films by improving manufacturing efficiency, reducing wastage, optimizing material usage, promoting sustainability, and enhancing supply chain transparency. Machine Learning (ML) and Automation are emerging technologies that are widely used in food packaging for quality control and optimization.

Several prominent companies are adopting AI to improve recyclability, track regulatory compliance, and enable advanced features such as real-time condition monitoring. AI-powered recycling solutions address the issue of packaging waste and optimize the use of recycled materials. Machine learning (ML) algorithms can effectively identify, sort, and process recyclable materials. AI-driven solutions in sustainable food packaging offer new and innovative ways to enhance recyclability and eliminate the chances of human error.

The market for sustainable food packaging is anticipated to expand gradually in the future due to growing environmental consciousness, more stringent laws about single-use plastics, and the growing use of eco-friendly packaging by food producers and retailers. Customers are actively pushing brands to switch to sustainable options for packaged food, drinks, and ready-to-eat goods by favoring recyclable, compostable, and biobased packaging from food producers and retailers. Customers are actively pushing brands to switch to sustainable options for packaged foods, drinks, and ready-to-eat goods by favoring recyclable, compostable, and biobased packaging options.

Furthermore, advancements in paper-based packaging, biodegradable films, and recyclable flexible formats that enhance performance and shelf life are driving market demand. Long term demand is further supported by the expansion of organized retail plant-based food products and e-commerce food delivery, making sustainable food packaging a crucial pillar of the future of the global food industry.

Rising Consumer Awareness of Environmental Issues

The increasing consumer awareness of environmental issues is expected to fuel the growth of the sustainable food packaging market during the forecast period. Fossil-based plastics linger in the environment for centuries and break down into microplastics, which results in polluting natural habitats. The adverse impact of fossil-based plastics has led the world to move away from them and shift towards sustainable alternatives. These non-degradable packaging-like conventional plastics pose threats to both human health and ecosystems, which further increases the need to minimize their usage to potentially save the ecosystem of Earth.

Consumers are increasingly preferring sustainable packaging solutions by replacing traditional packaging materials, such as plastics and polystyrene, which contribute to an increase in pollution levels, marine debris, and landfill overflow. The use of sustainable food packaging focuses on reducing the depletion and exploitation of natural resources, which ensures an ecological environment. Several packaging businesses are progressively opting for sustainable food packaging practices to create a positive brand image in the market.

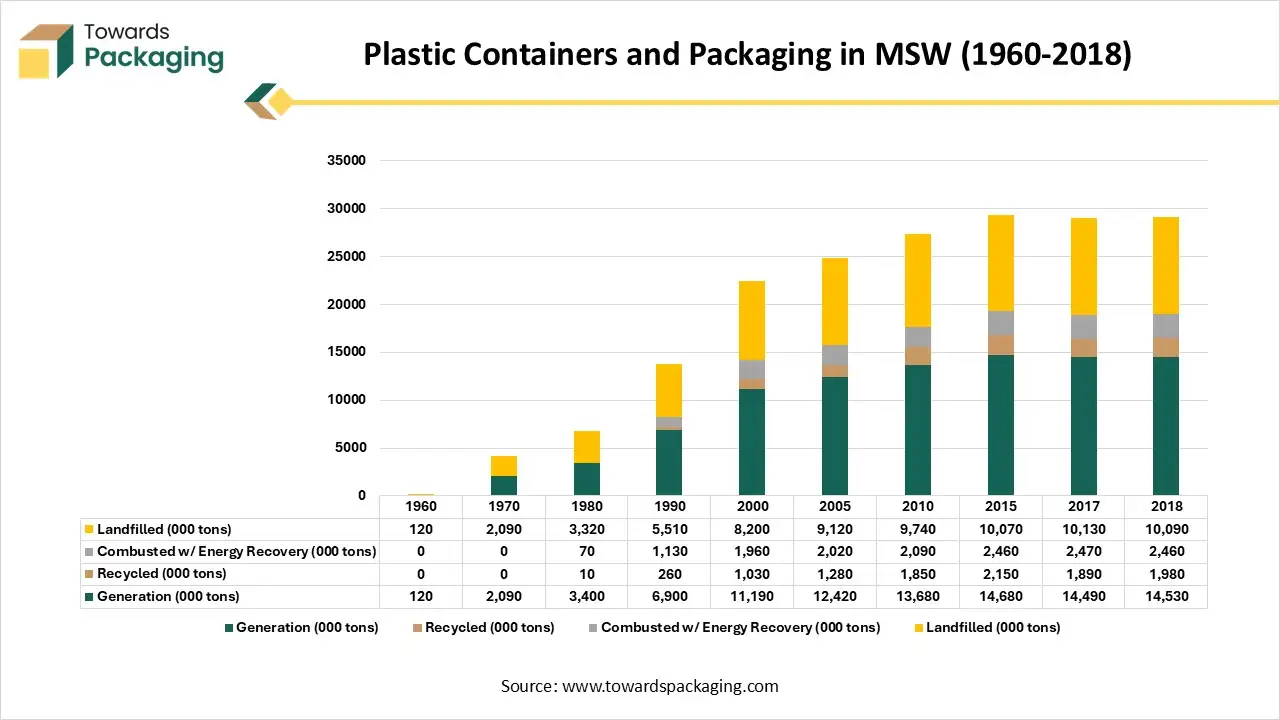

In 2018, the U.S. generated 14.53 million tons of plastic packaging waste about 5% of total MSW with only 1.98 million tons recycled, reflecting a low 13.6% recycling rate. PET bottles and jars achieved a 29.1% recycling rate, while HDPE natural bottles reached 29.3%. About 16.9% of all plastic packaging waste was combusted with energy recovery, but landfilling remained dominant, with 10.09 million tons over 69% ending up in landfills. Long-term trends show plastic packaging generation has surged 121× from 1960 to 2018, while recycling gains have largely plateaued since around 2010, leaving landfilling persistently high despite ongoing industry initiatives.

Rising Recycling Issues

The recycling issues related to plastic waste are expected to hamper the market's growth. The market often faces the complexity of recycling issues, particularly in underdeveloped countries, owing to limited access to recycling infrastructure. In addition, the volatility in the price of raw materials used in sustainable food packaging can adversely impact the profitability of manufacturers. Such factors may hinder the growth of the global sustainable food packaging market during the forecast period.

How is the Focus on the Circular Economy and the Regulatory Pressures Impacting the Growth of the Market?

The rising emphasis on the circular economy and the regulatory pressures are projected to offer lucrative growth opportunities to propel the growth of the sustainable food packaging market. The emerging trend of sustainable packaging within the food industry is a major shift towards long-term viability and environmental responsibility. The market is experiencing a significant shift towards recyclable or reusable, and biodegradable packaging usage for reducing greenhouse gas emissions and achieving the goal of global ecological development. Sustainability plays a crucial role in the food packaging industry, encouraging food packaging businesses to invest in eco-friendly packaging solutions like mono-materials.

The shift towards a circular economy, which focuses on minimizing wastage, reusing packaging materials, and driving innovations such as biodegradable plant-based plastics, edible packaging, and recycled materials. Several governments around the world have implemented stringent regulations and standards to promote a circular economy. Additionally, the rise in the number of awareness campaigns and implementation of various strategies for zero–plastic waste is expected to fuel the market’s expansion in the coming years.

The rigid packaging segment accounted for the dominating share in 2024. The segment’s growth is attributed to the rising demand for durable and sustainable packaging solutions. Sustainable rigid food packaging is generally made from materials such as cardboard, paper, glass, recyclable PET or HDPE plastics, and other compostable options like PLA. Rigid food packaging offers excellent protection for food products and ensuring freshness as well as preventing spoilage. Additionally, the growing focus on circular economy principles and rapid advancements in materials science is expected to boost the expansion of the market.

On the other hand, the flexible packaging segment is expected to witness a significant share during the forecast period, owing to the increasing environmental awareness and stringent regulations on traditional plastic usage. Flexible packaging requires less material and produces less waste than compared to rigid packaging, making it a more sustainable choice. Consumers are increasingly prioritizing sustainability and are more inclined to purchase products with flexible packaging options like pouches and films.

The trays & clamshells dominated the sustainable food packaging market in 2024, owing to the increasing consumer preference for sustainable packaging solutions. Trays and clamshells are widely adopted for packaging fresh produce, ready-to-eat meals, and various other food items. The trays & clamshells offer excellent product visibility and provide superior protection against damage or contamination during handling and transportation, extending the shelf life of products. Several businesses are heavily investing in developing innovative materials for achieving the circular economy.

On the other hand, the pouches & bags segment is expected to grow at a notable rate during the forecast period. Sustainable pouches and bags are lightweight, require less transportation costs, and significantly reduce the carbon footprint in the ecosystem. They are reusable, recyclable, and biodegradable, which meet sustainability goals. The surge in e-commerce activities increases the need for protective and sustainable pouches and bags, often preferred for their lightweight and space-saving attributes. Additionally, the government regulations and policies, such as Extended Producer Responsibility (EPR), are expected to accelerate the adoption of sustainable pouches & bags during the forecast period.

The paper & paperboard segments held a dominant presence in the sustainable food packaging market in 2024, owing to the increasing expansion of the e-commerce sector and rising awareness of the environmental impact of traditional packaging materials, particularly plastics. Paper and paperboard are generally more cost-effective than other sustainable alternatives, making them a preferable choice for food packaging businesses. The increasing concern regarding the impact of packaging waste materials on the environment, which are not easily degradable in the water or soil, further boosts the demand for paper & paperboard as sustainable packaging options.

On the other hand, the bioplastics segment is expected to grow at a significant rate, due to its owing to their efficient recyclability and biodegradability nature, which makes them an attractive option for sustainable food packaging. Bioplastics, such as Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), and Polybutylene Succinate (PBS) They offer a more sustainable alternative to conventional fossil fuel-based plastics and significantly assist in reducing carbon footprint and boost biodegradability.

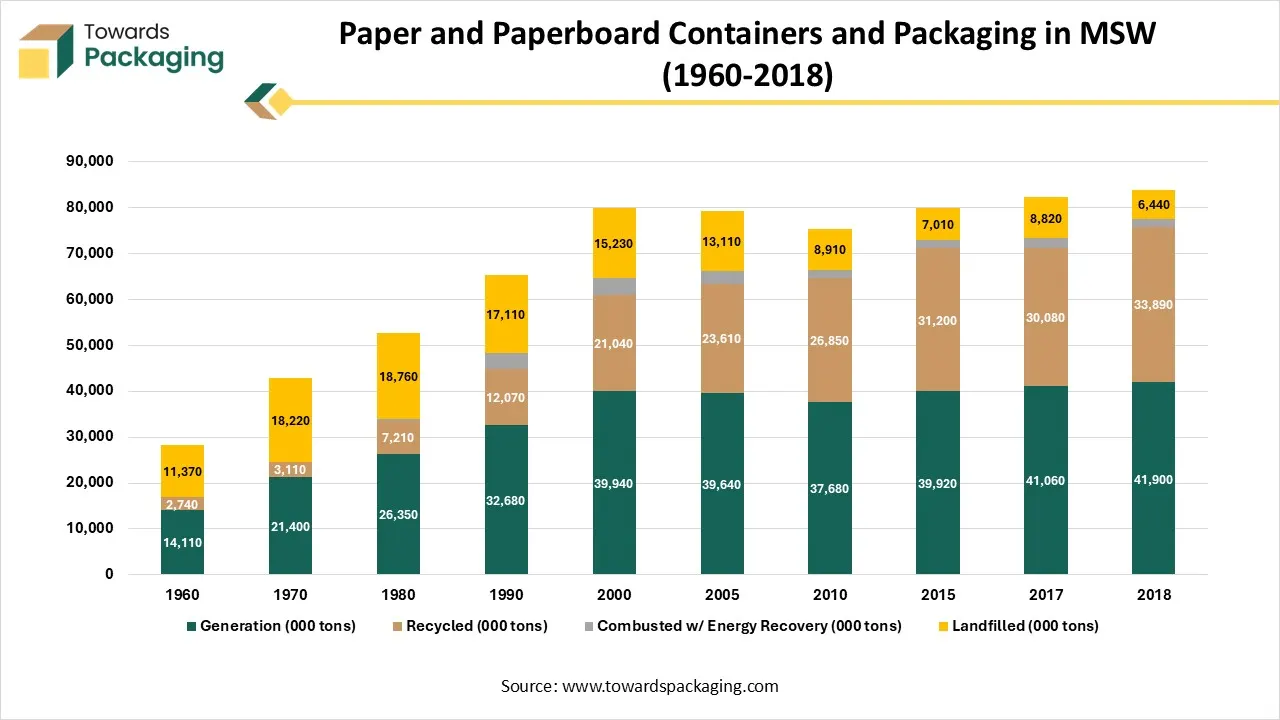

Paper and paperboard packaging especially corrugated boxes make up the largest share of packaging waste in U.S. municipal solid waste (MSW). In 2018, total generation reached 41.9 million tons, which accounted for 14.3% of all MSW. Corrugated boxes dominate this category and achieved an exceptionally high recycling rate of 96.5% in 2018. Out of all paper packaging recycled that year (33.9 million tons), 32.1 million tons came from corrugated boxes alone. Overall, paper and paperboard packaging had an 80.9% recycling rate in 2018 one of the highest among all packaging materials. Only 3.7% was combusted for energy recovery and 15.4% was landfilled.

The ready-to-eat meals segment accounted for a significant share of the sustainable food packaging market in 2024, owing to rapid urbanization, rising expansion of online retail networks, changing lifestyles, and rising disposable income. Ready-to-eat meals offer a convenient and time-saving solution for consumers. Companies are increasingly focusing on developing innovative packaging solutions that enhance recyclability, improve food preservation, and reduce material usage. In addition, stringent environmental regulations are promoting the use of biodegradable and compostable materials in the ready-to-eat meals segment.

Food Packaging Recycling Rates by Region (2025)

| Region | Recycling Rate (%) |

| Europe | 63% |

| North America | 49% |

| Asia-Pacific | 38% |

| Latin America | 32% |

| Middle East | 24% |

| Africa | 21% |

On the other hand, the foodservice & delivery segment is expected to grow at a notable rate during the projection period, owing to the rising need for safe, secure, and sustainable packaging solutions in the foodservice & delivery services. Sustainable packaging solutions, using recyclable and biodegradable materials, assist in maintaining food freshness and quality while reducing environmental impact. Businesses involved in the foodservice and delivery services are increasingly seeking eco-friendly options to align with customer expectations. Additionally, rapid expansion of online food delivery services and stringent environmental concerns, such as bans on single-use plastics, are expected to drive the segment’s growth during the forecast period.

| Material | Cost Contribution (%) |

| Plastic Resins (PE/PP/PET) | 37% |

| Paper & Board | 29% |

| Glass | 11% |

| Metals (Alu/Tinplate) | 14% |

| Bio-based Materials | 6% |

| Others (inks, adhesives) | 3% |

The retail packaging segment held a dominant presence in the sustainable food packaging market in 2024. Retailers are increasingly focusing on expanding their product portfolios to meet diverse consumer preferences, which often includes product variety, convenience, and sustainability. Governments' stringent regulations and polices on reducing greenhouse gas emissions compel retail packaging businesses to adopt sustainable packaging solutions.

On the other hand, the e-commerce packaging segment is expected to grow at a notable rate. The growth of the segment is mainly driven by the rising regulatory pressures, rising environmental awareness of plastic pollution, and increasing consumer preferences for eco-friendly packaging. Online businesses are actively participating and adopting circular economy packaging practices by increasingly adopting recyclable, biodegradable, and reusable packaging.

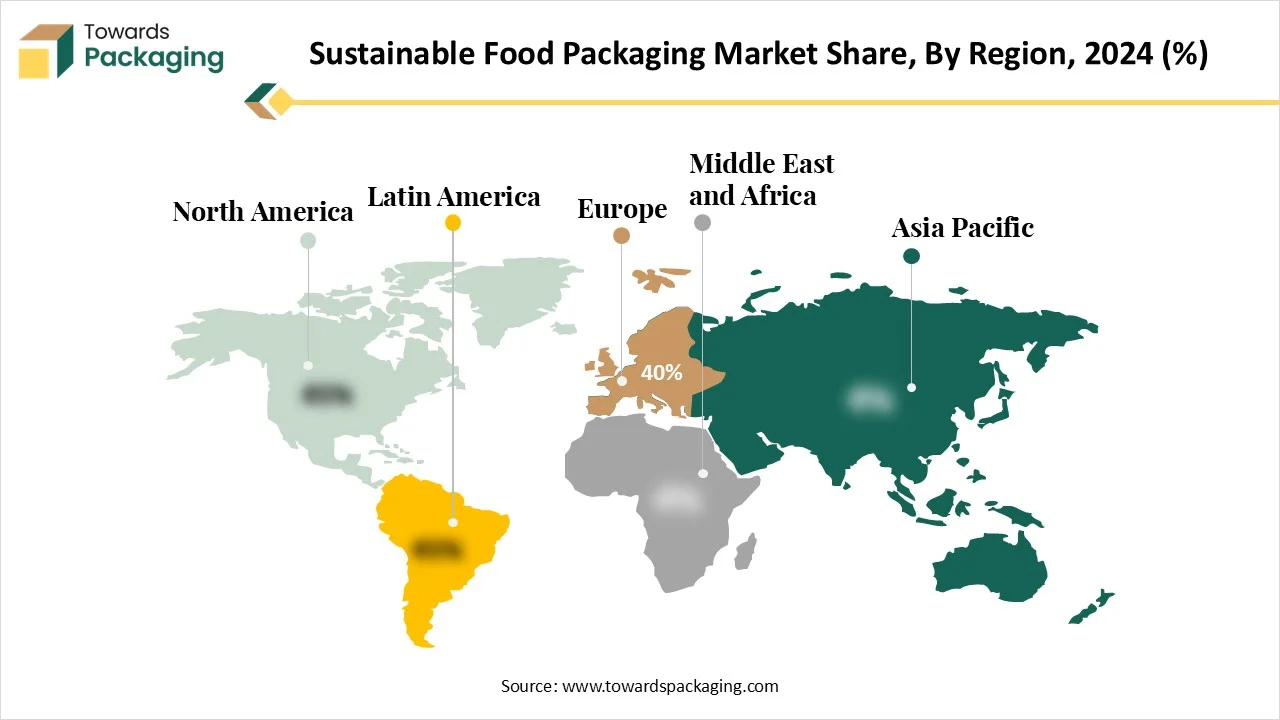

Europe held the dominant share of the sustainable food packaging market in 2024. The European region has an established food packaging sector, with major users of sustainable packaging solutions. The rapid shift toward recyclable, compostable, biodegradable, reusable, and renewable-based packaging materials, mainly due to the rising government standards and regulations for minimizing carbon emissions and boosting environmental sustainability, is contributing to the regional market’s growth. The region's high per capita income drives demand for fresh & packaged foods such as processed meats, sausages, fruits & vegetables, bakery, dairy, and others.

Consumers are increasingly inclined towards eco-friendly food packaging materials and even willing to pay more as they provide convenience and comply with regulations for environmental protection. Several key market players are innovating ways to manufacture sustainable food packaging are and which creates a lucrative opportunity to expand the market in the region. Additionally, the integration of smart packaging technology, rapid advancement in recycling technologies, and the rising expansion of the e-commerce industry are expected to support the growth of the sustainable food packaging market during the forecast period.

Trend of Sustainable Food Packaging in Germany: The packaging sector in Germany is experiencing a major move towards sustainability, which is being driven by innovations in environmentally friendly materials. Developments in technology are mainly affecting the sustainable packaging industry in Germany, with a concentration of inventive materials that are eco-friendly and cost-effective too.

The application of environmentally friendly materials is becoming increasingly common in the German packaging sector. Transformations in biodegradable materials, such as plant-based packaging, are serving as viable alternatives to regular plastics. Additionally, growth in recycling technologies is developing the recyclability of packaging materials, which further reduces waste.

Some of the main environmentally friendly materials gain attention that counts:

On the other hand, the Asia Pacific is expected to grow at the fastest CAGR. The growth of the region is driven by the increasing awareness of its environmental benefits, rising restrictions on single-use plastics, rapid urbanization, growing consumer demand for processed foods, and surging investment in recycling infrastructure. Government-led sustainability initiative promoting the use of sustainable food packaging and reducing reliance on fossil-based plastics to improve sustainability. Several countries in the Asia Pacific region are aggressively implementing strict regulations to reduce plastic waste and encouraging the adoption of sustainable packaging practices.

Asia Pacific has an ever-growing population base, wide availability of raw materials, high consumer spending, and increasing expansion of food packaging operations. Furthermore, the expansion of the e-commerce sector, coupled with rapid technological innovation, includes new material formulations to enhance the strength, functionality, and flexibility of sustainable food packaging, propelling the market’s revenue in the region.

The user and food alike are shifting towards sustainable food wrap selections. Materials like the compostable containers, biodegradable wraps, and the butter wraps are gaining attention for their less eco-unfriendly effect. Butter paper, in particular, has become a favourite because of its eco-friendliness and reliability too. Originally crafted for covering butter, it has been included in a multi-purpose solution good for wrapping, baking, and even crafting, too. With characteristics like being non-stick, breathable butter paper, and the moisture-opposite, it is not only a sustainable option but also a practical one too.

| Region | Exports (Million Tons) | Imports (Million Tons) |

| Asia-Pacific | 22.4 | 17.1 |

| Europe | 15.3 | 14.7 |

| North America | 11.8 | 9.6 |

| Latin America | 6.5 | 7.2 |

| Middle East | 3.8 | 5.1 |

| Africa | 2.1 | 4.3 |

By Material Type

By Packaging Format

By Packaging Type

By End-Use

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026