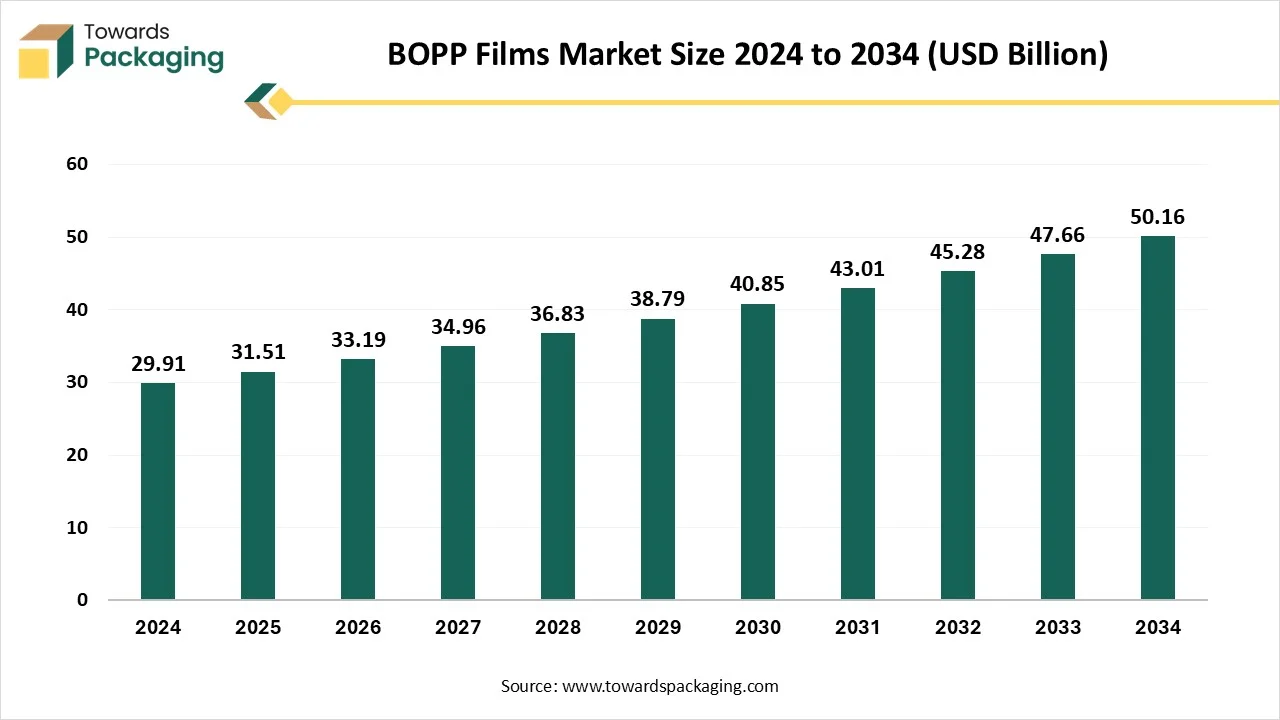

The BOPP Films market is forecasted to expand from USD 33.19 billion in 2026 to USD 53.01 billion by 2035, growing at a CAGR of 5.34% from 2026 to 2035. This report covers key market trends, segmental insights by type, thickness, production process, and applications, as well as regional data across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. We analyze top manufacturers such as Cosmo Films Limited, Taghleef Industries, Jindal Poly Films, and CCL Industries, along with their strategies, market shares, and the overall competitive landscape. The value chain, trade data, and suppliers are also comprehensively examined to offer an end-to-end market understanding.

The market is driven by rising demand across packaging, labeling, and industrial applications due to their durability, clarity, and cost-effectiveness. Increasing consumer preference for lightweight, recyclable materials supports market growth. Food and beverage, pharmaceutical, and personal care industries are key end-users. Technological advancements and innovations in film coatings enhance product performance. Additionally, sustainability concerns are encouraging the development of eco-friendly BOPP film alternatives, while Asia Pacific remains a dominant region due to robust manufacturing.

Biaxially oriented polypropylene films are a type of polypropylene film stretched in both machine and transverse directions, enhancing their strength, clarity, and barrier properties. These films are widely used in the packaging industry due to their excellent moisture resistance, printability, and cost-effectiveness. In food packaging, BOPP films are utilized for wrapping snacks, confectionery, and fresh produce, preserving freshness and extending shelf life. In the pharmaceutical sector, they provide hygienic and tamper-evident packaging for medicines. BOPP films are also prominent in labeling applications, offering superior gloss and adhesion for labels on bottles and containers. Additionally, they are employed in the personal care and tobacco industries for wrapping products attractively and securely. Their recyclability and lightweight nature make them a preferred choice for eco-conscious packaging solutions in global markets.

| Metric | Details |

| Market Size in 2025 | USD 31.51 Billion |

| Projected Market Size in 2035 | USD 53.01 Billion |

| CAGR (2025 - 2035) | 5.34% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Thickness, By Production Process, By Application and By Region |

| Top Key Players | Cosmo Films Limited, Taghleef Industries, CCL Industries, Jindal Poly Films, Sibur Holdings |

AI integration is poised to significantly transform the BOPP (Biaxially Oriented Polypropylene) films market by enhancing manufacturing efficiency, improving product quality, and driving innovation. In production, AI-powered predictive analytics can optimize processes by analyzing data from machines and sensors in real time, which reduces material waste, energy consumption, and ensures consistent film quality. AI-enabled vision systems also play a critical role in quality control, quickly detecting defects such as pinholes or uneven coatings, thereby increasing accuracy and reducing human error. In terms of supply chain and inventory management, AI can forecast demand more accurately by analyzing market trends, seasonal patterns, and historical data, enabling companies to reduce overproduction and better meet market needs.

AI supports product innovation by identifying emerging trends and suggesting new BOPP film formulations, such as biodegradable or high-barrier films for specialized uses. It also enhances logistics through optimized routing and risk management, ensuring efficient and timely delivery of materials. Finally, AI contributes to sustainability by monitoring energy use, minimizing emissions, and helping manufacturers recycle production scrap, aligning operations with global environmental goals. Overall, AI integration offers a comprehensive advantage, making the BOPP film industry more efficient, responsive, and sustainable.

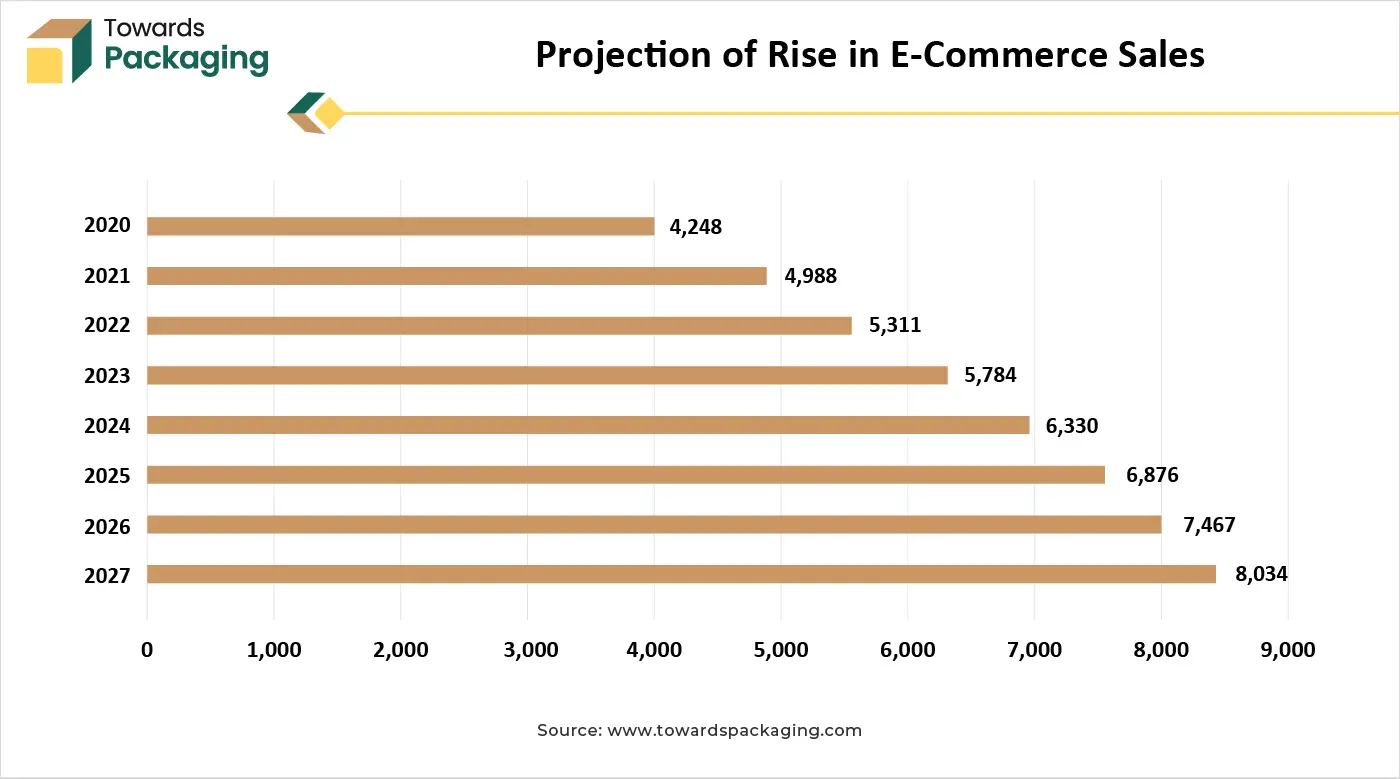

Rapid Growth of E-Commerce and Retail Sector

The e-commerce boom has led to higher demand for efficient and attractive packaging. BOPP films, with their aesthetic appeal and strength, are ideal for product labeling and retail packaging. The rapid growth of e-commerce is significantly driving the BOPP (Biaxially Oriented Polypropylene) films market by increasing the demand for secure, attractive, and functional packaging solutions. As more products are sold online, especially in sectors like food, cosmetics, electronics, and pharmaceuticals, manufacturers require packaging that ensures product safety during transportation and enhances shelf appeal. BOPP films offer excellent strength, moisture resistance, and clarity, making them ideal for labeling, wrapping, and flexible packaging.

Additionally, the growing consumer demand for eco-friendly packaging is driving preference for recyclable materials like BOPP. The films' lightweight nature and barrier properties make them suitable for global shipping logistics, protecting products from moisture, oxygen, and handling damage. Overall, the expansion of e-commerce platforms is accelerating the need for advanced packaging materials, directly supporting the growth of the BOPP films market. BOPP films are widely used in flexible packaging due to their durability, transparency, and moisture resistance. With increasing demand for packaged foods, snacks, and ready-to-eat meals, especially in urban and emerging markets, the need for BOPP films is rising.

Environmental and Regulatory Challenges and Availability of Alternative Materials

The key players operating in the BOPP films market are facing issues due to environmental laws, regulatory challenges, and the availability of alternative materials in the market. Non-biodegradable nature of BOPP films raises environmental concerns, particularly with increasing anti-plastic regulations worldwide. Government bans and restrictions on single-use plastics in several countries limit the demand for BOPP in flexible packaging.

The BOPP film industry is highly competitive, with many global and regional players offering similar products. This leads to price wars and margin pressures, especially in commoditized segments of the market. Rising demand for eco-friendly and biodegradable packaging materials like PLA, PHA, and paper-based films is drawing customers away from BOPP. Companies are seeking alternatives that align with sustainability goals.

Developing countries, especially in the Asia Pacific, are experiencing rapid industrialization and urbanization. This boosts consumption of packaged goods and drives the expansion of the packaging industry, thus increasing BOPP film usage.

Innovations such as metallized, pearlized, and matte BOPP films are expanding the application range across various industries. Enhanced film properties like heat resistance and printability are adding value to packaging solutions.

As environmental concerns grow, industries are adopting recyclable packaging materials. BOPP films are recyclable and align with global sustainability goals, encouraging their use in eco-friendly packaging solutions.

The bags and pouches segment holds a dominant presence in the market owing to its high strength and durability. BOPP films are widely used for manufacturing bags and pouches due to their excellent balance of strength, aesthetics, and functional properties. The biaxial orientation process enhances their tensile strength and tear resistance, making them highly durable for packaging applications. BOPP films offer exceptional clarity and gloss, giving packaged products a premium, attractive look that improves shelf appeal. They also provide a good moisture barrier, helping to keep contents fresh and dry, ideal for snacks, cereals, and dry foods.

Additionally, BOPP films are highly printable, supporting high-quality graphics and branding through various printing techniques. Their lightweight nature reduces transportation costs, and they are more cost-effective compared to many alternatives. Heat-sealable versions can be used with high-speed packaging machines, enhancing manufacturing efficiency. BOPP also resists chemicals, oils, and abrasion, making it suitable for a wide range of products, including food and personal care items. As a recyclable polyolefin material, BOPP supports sustainable packaging initiatives, especially in mono-material formats. This combination of performance, visual appeal, and environmental compatibility makes BOPP films a preferred choice for flexible packaging.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Bags and Pouches | 10.899 | 11.746 | 12.380 | 12.874 | 13.206 | 14.365 | 15.425 | 16.344 | 16.418 | 17.837 | 18.541 |

| Wraps | 7.548 | 8.363 | 8.791 | 9.013 | 9.333 | 9.496 | 9.818 | 9.825 | 11.059 | 11.494 | 12.678 |

| Tapes | 5.758 | 5.646 | 5.798 | 6.124 | 6.635 | 6.853 | 6.628 | 6.454 | 6.669 | 7.711 | 7.799 |

| Labels | 5.706 | 5.752 | 6.221 | 6.951 | 7.655 | 8.082 | 8.996 | 10.427 | 11.203 | 10.728 | 11.304 |

The 15-30 microns segment dominates the market due to optimal strength and flexibility, and compatibility with high-speed machines. Films in the 15–30 microns range offer adequate tensile strength and flexibility, making them suitable for a wide variety of packaging needs, from snack food pouches to overwraps. Thinner films (within this range) use less raw material, reducing production costs without significantly compromising performance. This makes them ideal for mass-market applications where cost control is critical. Their manageable thickness makes them suitable for use in automatic form-fill-seal machines, which demand consistent thickness for proper sealing and cutting. BOPP films in this range allow excellent print quality and adhesion to inks and coatings, making them a top choice for multi-layer laminates used in consumer packaging.

The tenter production process segment accounted for the dominant revenue share of the BOPP films market in 2024. The tenter production process is extensively used in the manufacture of BOPP (Biaxially Oriented Polypropylene) films because it provides precise control over film orientation and quality. In this process, the polypropylene film is stretched in both the machine direction (MD) and the transverse direction (TD), allowing for independent and accurate control of biaxial orientation. This stretching significantly enhances the film’s mechanical properties, such as tensile strength, dimensional stability, and resistance to tearing, while also improving optical properties like clarity and gloss.

The tenter process also ensures uniform film thickness and flatness, which are critical for both visual appearance and consistent performance in downstream applications such as printing and lamination. Another key advantage is the process’s ability to control temperature and tension precisely during stretching and annealing, which improves crystallinity and reduces internal stresses in the film. This results in a more stable and high-performance final product. Additionally, the tenter method supports high-speed, large-scale production, making it highly efficient and cost-effective for industrial manufacturing. It is also versatile, allowing for the production of various BOPP film types, including plain, metallizable, pearlized, and heat-sealable films.

The food segment registered its dominance over the BOPP films market in 2024. BOPP (Biaxially Oriented Polypropylene) films are widely used in food packaging due to their excellent moisture barrier, high clarity, and strong mechanical properties. They are lightweight, heat-sealable, and easily printable, making them ideal for efficient, attractive packaging. BOPP is also non-toxic, food-safe, and cost-effective compared to other materials. Its recyclability adds environmental value, especially as infrastructure improves. These qualities make BOPP suitable for packaging various food products, including snacks, baked goods, confectionery, and frozen foods.

Asia Pacific held the largest share of the BOPP films market in 2024, owing to rising industrialization and the booming e-commerce industry in the region. Rapid industrialization and urbanization in countries like China, India, and Japan have significantly increased demand for flexible packaging solutions across various industries, including food, pharmaceuticals, and cosmetics. The region's growing middle class and rising disposable incomes have further fuelled the need for packaged goods, driving the consumption of BOPP films. Additionally, Asia Pacific's robust manufacturing infrastructure and investments in production capacity have enhanced the availability and affordability of BOPP films, solidifying the region's dominance in the market.

The development in e-commerce in terms of the Asia Pacific region, which calls for luxury packaging materials, is further driving the urge for BOPP films. Due to the growing per capita usage of packaged products and beverages, the food and beverage sector has dominated the BOPP Film usage. Furthermore, rising applications of personal care and beauty products, along with rising awareness about personal hygiene in the space, are further developing the demand for BOPP films.

Depending on the factors, consumption of milk and dairy products needs to be carefully kept and protected from air and light, which is why they are hence used with BOPP films for packaging purposes. Dairy manufacturing is experiencing constant growth across the Asia Pacific region, which is driving the BOPP film industry, which is experiencing constant development.

India’s rigid position in the BOPP export industry creates huge opportunities for exporters. As worldwide demand develops, Indian exporters have the chance to enter into the latest markets and expand their presence. Main opportunities include:

China Market Trends

China's BOPP films market is driven by several interrelated factors. The country's robust manufacturing infrastructure, characterized by advanced production facilities and economies of scale, enables China to produce BOPP films at competitive costs. This cost-effectiveness has positioned China as a leading exporter of BOPP films, supplying markets in regions such as Southeast Asia, North America, and Europe. Additionally, China's rapidly expanding consumer goods sector, particularly in food and beverage packaging, has significantly increased domestic demand for BOPP films. The growing preference for flexible packaging solutions among consumers further fuels this demand.

Moreover, China's strategic investments in research and development have led to technological advancements in BOPP film production, enhancing product quality and functionality. These innovations have expanded the application range of BOPP films, making them suitable for various industries beyond packaging, such as electronics and pharmaceuticals. Collectively, China's manufacturing capabilities, domestic market growth, and technological innovations have established it as a dominant force in the global BOPP films market.

North America's BOPP (Biaxially Oriented Polypropylene) films market is experiencing robust growth, driven by several key factors. The region's substantial demand for flexible and sustainable packaging solutions, particularly in the food and beverage sector, is a primary driver. BOPP films offer excellent barrier properties, protecting food products from moisture, oxygen, and other contaminants, thereby preserving freshness and extending shelf life.

U.S. Market Trends

The U.S., in particular, plays a significant role, with a strong emphasis on innovative packaging technologies and a well-established food processing industry. The growing preference for ready-to-eat and convenience foods further propels the use of BOPP films. Additionally, advancements in film manufacturing and the development of bio-based BOPP films are expected to further drive market growth in the U.S.

Canada Market Trends

Canada's BOPP films market is driven by the growing industrial area in Canada. The nation's robust manufacturing infrastructure supports high-quality film production, catering to diverse industries such as food, beverages, pharmaceuticals, and personal care. Canada's commitment to sustainability and recyclability has led to the development of eco-friendly BOPP films, meeting the growing demand for environmentally conscious packaging solutions. Moreover, the expansion of e-commerce has increased the need for durable and lightweight packaging, further boosting the demand for BOPP films. The presence of major players like CCL Industries, a global leader in specialty films, underscores Canada's significant role in the BOPP films market. These factors collectively position Canada as a key player in the global BOPP films industry.

Europe is expected to grow at a notable rate in the foreseeable future. Europe's robust food and beverage industry, particularly in countries like Germany and Italy, drives substantial demand for flexible packaging solutions. BOPP films offer excellent barrier properties, preserving product freshness and extending shelf life, making them ideal for packaging perishable goods. Additionally, the increasing prevalence of tobacco consumption in Europe further fuels the demand for BOPP films, as they are widely used in tobacco packaging.

The rise of e-commerce has also contributed to the growth, as online retailers require efficient and attractive packaging solutions to enhance product appeal. Furthermore, advancements in film production technologies and a strong emphasis on sustainability have led to the development of eco-friendly BOPP films, aligning with the region's environmental goals and consumer preferences. These factors collectively position Europe as a dominant player in the global BOPP films market

BOPP films are hugely accepted in the sector of applications, like labeling, packaging, and lamination. These films are selected substrates for food packaging across the globe, owing to the essential moisture barrier characteristics, high clarity, sealability, shelf life, and graphic reproduction with the best possibilities of the package being a homogenous and monolayer structure. The growing demand to stretch the shelf life of tracking and products of sustainability, quality, density, and aesthetics is one of the main factors that is attention-grabbing to the vendors in the sector to accept BOPP films. This is predicted to fulfill the market development over the forecast period. Latin America is witnessing huge investment in BOPP manufacturing as enterprises' tendency toward local production is growing.

Due to rising interest in traditional rigid packaging, sustainability is being substituted by inventive and more practical flexible packaging. The growing demand for user-friendly packaging and developed product protection is driving the urge for BOPP film packaging as a feasible and cost-effective alternative in the country. Market players are concentrating on growing the manufacturing line for films. Tempo packaging had revealed that it had an increase of 30% in its production potential by the year 2023, and Flexipack had aimed to reveal two BOPP lines. Furthermore, some companies are concentrated on investing in CPP (cast Polypropylene) lines and blow film lines.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 6.199 | 6.541 | 6.484 | 6.935 | 7.193 | 8.171 | 8.812 | 9.413 | 10.377 | 11.494 | 11.254 |

| Europe | 5.610 | 5.976 | 6.136 | 6.719 | 6.686 | 7.488 | 8.311 | 9.360 | 9.916 | 9.791 | 11.046 |

| Asia-Pacific | 11.588 | 12.107 | 12.735 | 13.007 | 13.979 | 14.274 | 14.461 | 15.028 | 15.718 | 16.021 | 17.721 |

| Latin America | 3.214 | 3.426 | 3.864 | 4.250 | 4.232 | 3.813 | 3.915 | 3.327 | 2.637 | 3.121 | 2.498 |

| Middle East & Africa | 3.299 | 3.458 | 3.971 | 4.052 | 4.738 | 5.051 | 5.368 | 5.921 | 6.701 | 7.344 | 7.803 |

By Type

By Thickness

By Production Process

By Application

By Region

January 2026

January 2026

January 2026

January 2026