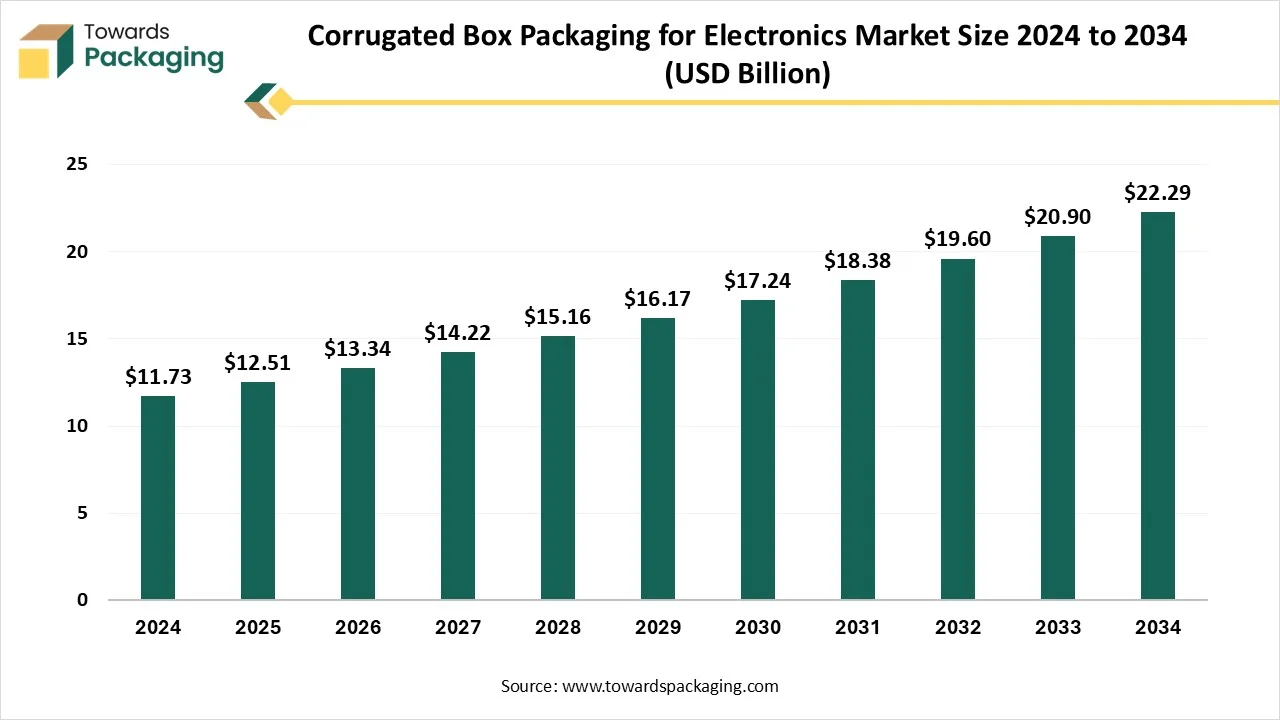

The corrugated box packaging for electronics market is forecasted to expand from USD 13.34 billion in 2026 to USD 23.77 billion by 2035, growing at a CAGR of 6.63% from 2026 to 2035.It explains in simple terms how e-commerce expansion, rising consumer electronics demand, and sustainability trends are driving the use of regular slotted containers, die-cut boxes, single- and double-wall corrugated, and anti-static/ESD-safe packaging.

The study includes detailed segment data (box type, wall type, add-on features, applications, and distribution channels), regional breakdown across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and statistical highlights such as 52% share for RSC, 58% for single-wall, 60% for anti-static boxes, 46% for consumer electronics, and 65% for direct-to-OEM in 2024, along with profiles of leading manufacturers, competitive analysis, value chain mapping, and trade statistics.

The global corrugated box packaging for electronics market involves the design, manufacturing, and distribution of corrugated boxes specifically intended to protect, ship, and store electronic products. These boxes are engineered to prevent impact, moisture, electrostatic discharge, and tampering, making them ideal for both consumer and industrial electronics. Corrugated boxes have been a staple for years, and they remain a popular packaging solution in the electronics sector due to their durability and cost-effectiveness. They are made of rigid materials and serve as perfect protection against shock and impact.

Corrugated boxes can be tailored to meet the specific needs of the electronics being shipped. The pattern of electronic packaging plays a crucial role in the safe transportation and protection of electronic products. Corrugated electronics packaging, along with other innovative packaging solutions such as foam inserts, anti-static packaging, air cushions, vacuum packaging, smart packaging, and tailored packaging, are transforming the perspective on how electronics are packaged and shipped. As the electronics sector continues to grow, inventive packaging solutions will constantly play a crucial role in aligning with the growing demand of users and advancements in technology.

Artificial intelligence can unlock data that corrugated poland can utilise to update product design, predict equipment failures, and prevent supply bottlenecks, but there are some steps for box creators that make harnessing AI Capabilities Easier. AI-powered product designs enable product designers to leverage vast amounts of data to predict design outcomes, tailor products to specific needs, and update design elements in real-time. Machine Learning helps in creating and developing product designs, primarily reducing the cost and time associated with the traditional design process.

With the assistance of artificial intelligence, corrugated producers can anticipate machine failures before they occur, significantly reducing downtime and maintenance costs. This is achieved by examining huge quantities of data from sensors and historical maintenance costs, allocating ML Algorithms and anomalies using signal-capable issues. One of the main technological advancements in corrugated packaging manufacturing is the mixture of robotics and automation. Automated systems are now capable of handling everything from material carrying to box creating. Gluing and even quality checking.

As online orders increase, the demand for individual packaging also rises. Similar to brick-and-mortar sales, in which products are sold in huge quantities or without packaging, e-commerce requires high-level shipping, and every unit needs a box. DSC organisations that bypass manufacturers and sell straight to users have seen huge growth. Brands like Glossier, Warby Parker, and Allbirds all depend on tailor-made corrugated packaging, which not only serves as a product container but also develops the unboxing experience.

The acceptance of subscription boxes, including meal kits, curated lifestyle products, and cosmetics, has created both current and anticipated demand for tailored corrugated packaging. Each monthly shipment demands a box that is convenient to assemble, visually appealing, durable, and perfect for multiple product types. The last mile, the final leg of the delivery path, can be the most practical, complicated, and costly. Packages are meant to provide more carrying and surrounding exposure.

Corrugated packaging can be conveniently affected by the weather. They are not waterproof, which means snow or rain can easily damage them. This is a significant issue if you ship or store items outside of the country. These boxes can carry normal shipping loads but are not rigid enough to withstand heavy pressure. This could cause them to failure or crumple. It's essential to verify that our items are not too heavy for these boxes. Corrugated boxes are not functional, just like plastic or metal. This means we need to buy more frequently, which can lead to increased costs. Businesses might seek other options that can be utilised several times.

Smart packaging is transforming how organizations interact with their users. From QR codes and RFID technology to NFC-enabled labels, these advancements are adding convenience and value. Users can scan a package to access product information, sustainability details, and promotions, which makes for deeper engagement and loyalty. For organizations, smart packaging includes supply chain management by providing real-time data on inventory and tracking. Automation is changing the packaging procedure.

With state-of-the-art systems, companies can reduce labor costs, achieve consistency, and efficiently handle high production volumes. For sectors experiencing growing demands, automation ensures effectiveness without compromising quality. Technology, automation, and sustainability are transforming the packaging sector, creating exciting opportunities for organizations to adapt and thrive. By adopting eco-friendly practices, such as smart packaging and leveraging automation, companies can align with current users while preparing for the future.

The regular slotted container has dominated the box type due to the most effective way of production in corrugated cardboard boxes. They are a perfect packaging option for products seeking for cheap and basic shipping service. The corrugated RSC is truly made of corrugated paperboard material. The column stores the air that behaves as a cushioning and develops the strength of the box. The continuity of corrugated box sheets depends on the procedure followed by the producer. Several types of corrugated containers are manufactured by assembling a variety of cardboard, paper, and adhesives under pressure and heat. They are the most economical option for producers and users, as they can be utilised to ship all types and sizes of products, from light-weight to heavy-weight. RSC Shipper boxes are made from recyclable cardboard, allowing them to be reused. No hidden costs are included; however, you will need to provide gluing, stapling, and taping materials to complete the packing.

Die-cut corrugated boxes are personalised to your product’s shape, size, and needs. This enables us to customize your packaging to perfectly fit your product and ensure it's crafted with the necessary protection. Whether you have smaller, sensitive products that require strategic packaging to prevent movement, or different-shaped products that exceed the size of standard boxes typically used for electronics packaging, with die-cut corrugated boxes, we can minimize wasted space because the packaging is space-efficient and designed to fit your product accurately. This increases the number of packages we can ship per batch, maximizing the value of your investment.

Single-wall corrugated boxes are commonly used for shipping products that are lightweight, such as small components, electronic items, non-sensitive goods, and retail items. These boxes are constructed with a single layer of fluted corrugated sheet, sandwiched between two linerboards. This design provides sufficient power for various industrial applications while keeping material costs and shipping expenses low. They work perfectly for organizations that require rigid packaging but not excessively large quantities. Another benefit is its flexibility in the pattern. They can be easily tailored in terms of print, size, and coatings, which makes them suitable for branded packaging. For businesses that require packaging for low-risk, repetitive shipments, single-wall boxes are an economical and effective solution.

Double-wall corrugated boxes consist of two layers of fluted corrugated sheets, separated by three liner boards. This added support makes the more resistant to punctures, crushing, and stacking pressure. They are broadly used in industrial equipment, electronics, and machinery components. The extra layer of protection ensures that products remain secure even when boxes are piled in warehouses or during transportation, thereby serving as a more dependable solution for industries that carry large shipments, fragile items, and heavy parts. The box personalization option further develops their usability. Organizations can select coating for moisture resistance, printed branding for developed presentation, and reinforced corners for added stability.

Anti-static packaging covers any packaging that prevents electrostatic discharge from damaging products. This includes anti-static packaging, which prevents the generation of electrostatic charge when products come into contact with other surfaces and objects. Conductive packaging manages any capable static charges away from sensitive parts that keeping any flow of electricity under control. It does not compile static charges. And dissipative packaging - this kind of packaging directs the flow of static charges, rather than directing them like conductive packaging. Antistatic boxes safeguard electronic components from electrostatic discharge during handling and storing in managed environments. These boxes utilize conductive corrugated fiberboard to dissipate static charges and help prevent damage securely. Our series includes component and conductive boxes, transit packs, and chip boxes created from strong materials that provide perfect durability and shielding.

ESD is the fastest-growing add-on feature in the electronics market for corrugated box packaging, as these boxes are crucial for securing sensitive electronics or components that may be vulnerable to static damage. Electrostatic discharge (ESD) boxes are used for safely storing and shipping items that static charges may damage. They specifically contain a special coating that makes a Faraday cage. This medium static surrounds the exterior of the pack, which protects the items within. ESD boxes are renowned for protecting PCBs, microchips, specialized electronics, and semiconductors.

Consumer electronics have dominated the corrugated box packaging market when shipping electronic components and electronics, making it crucial to choose the correct packaging due to the sensitive nature of these items. Indelicate packaging can easily outcome in damage. Corrugated boxes are commonly used in conjunction with packing materials to provide extra protection. The main issue is the stress placed on elements during handling, which can cause circuit damage or loss of connections. The buffer inside corrugated boxes helps alleviate these risks, ensuring that electronics products arrive safely and in perfect condition. The multi-layered structure helps absorb impact during transportation. Additionally, corrugated boxes are recyclable, lightweight, and can be tailored for branding or fitted inserts, which enhances both product safety and consumer appeal. As e-commerce continues to grow, the demand for corrugated packaging in the electronics industry is steadily increasing. These boxes serve as perfect protection against shocks, external pressure, and vibrations, which makes them ideal for shipping delicate electronics, such as laptops, smartphones, and appliances.

Corrugated boxes provide perfect protection and durability for items during transit. They can absorb impacts and serve as cushioning assistance, which makes them perfect for shipping. These boxes can withstand harsh conditions without compromising the elements and provide an effective barrier against the elements, making them ideal for e-commerce packaging. Sustainability is becoming heavily crucial, specifically in packaging. Corrugated cardboard is a top choice for a sustainable packaging option because it is made from recycled fibers, making it convenient to recycle.

Direct-to-OEM (Original Equipment Manufacturer) supply chains have primarily dominated the corrugated boxes segment in the electronics packaging industry due to their cost efficiency, bulk ordering capabilities, and customization options. OEMs choose to work directly with packaging manufacturers to streamline procurement, ensure tailored packaging, and minimize middleman costs by designing packaging that matches particular product dimensions and branding. This direct link enables just-in-time delivery, rapid innovation, and enhanced quality control. , which is crucial in the rapidly evolving field of electronics. As a result, OEM partnerships have become a strategic edge in protecting reliable, scalable, and sustainable corrugated packaging solutions.

Corrugated boxes have emerged as a selected packaging solution that combines durability, eco-friendliness, and versatility. With a growth in demand from e-commerce packaging, consumer durables, and retail packaging solutions, corrugated packaging ensures sustainability, safety, and cost-effectiveness. These kinds of boxes are making their way with their recyclable materials and lower environmental effect. Their lightweight nature and tailored sizes make them ideal for a variety of products, from apparel to electronics, ensuring protection during transit while minimizing their carbon footprint. This makes them not just a packaging option, but a strategic selection for organizations to develop their brand reputation and lower environmental impact.

The demand for corrugated boxes in the North America electronics sector is experiencing constant growth, driven by the booming e-commerce industry, growing electronics sales, and the need for secure, eco-friendly packaging. Electronics companies in the U.S and Canada are increasingly accepting custom-designed, corrugated packaging to protect devices during transformation and reduce returns caused by damage. Additionally, the move towards recyclable and sustainable materials is encouraging manufacturers to favor corrugated solutions. The demand is further supported by the growth of smart devices, home electronics, and wearables, making North America a main market for high-performance corrugated packaging.

Asia -Pacific had dominated the corrugated box packaging for electronics industry as the various demands in Asian countries market, driving the growth of corrugated packaging industry, as well as fast development of rising industries like e-commerce and retail in addition to regular commodity and travelling demands, packaging producers have experienced growing demand for short-order equipment, folding carton processing equipment, corrugated paper processing equipment and food container processing container too. According to the Southeast Asian corrugated packaging industry, it is expected to have a compound annual growth rate of 4% during the 2021-2026 forecast period.

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

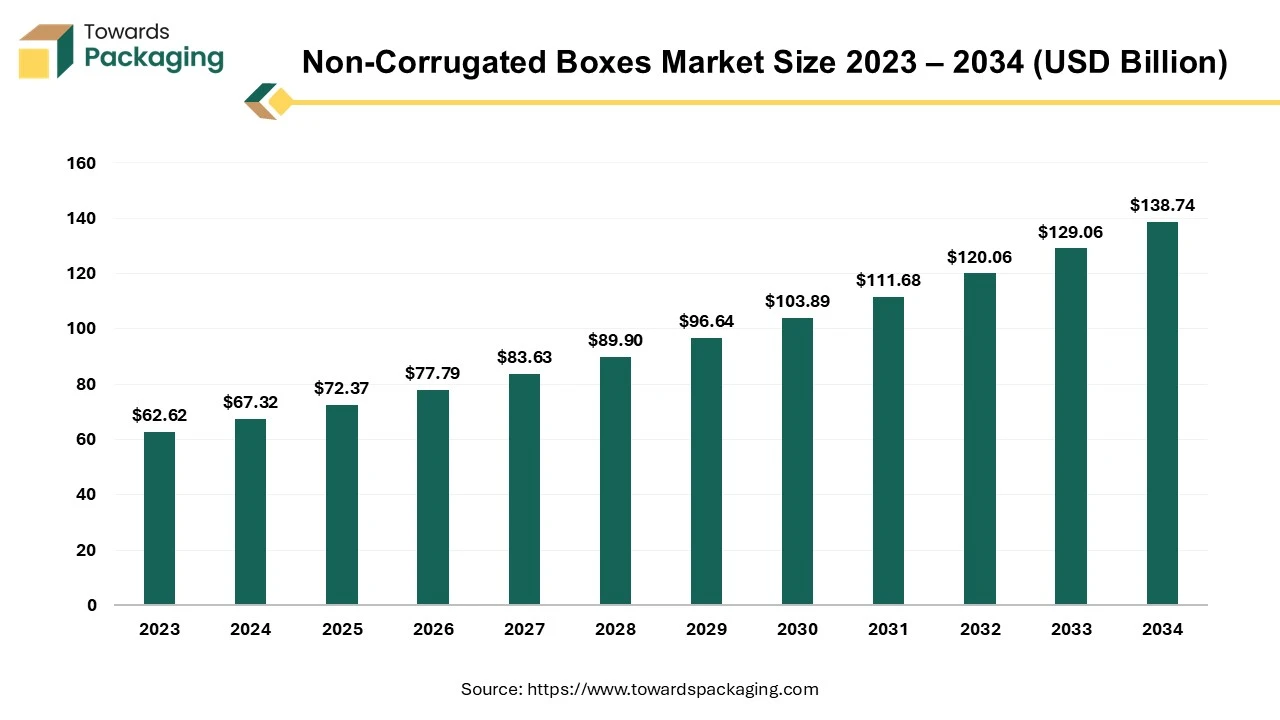

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

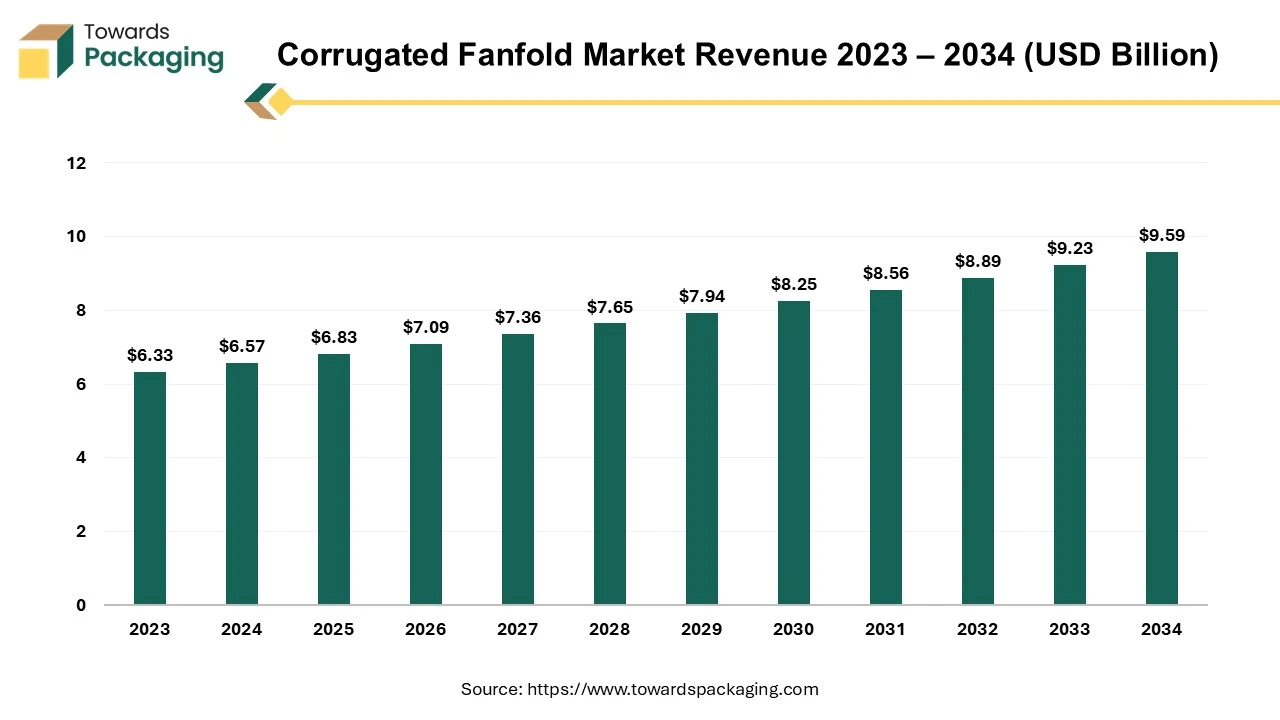

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

By Box Type (Product Type)

By Wall Type

By End-Use Application

By Add-On Features

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026