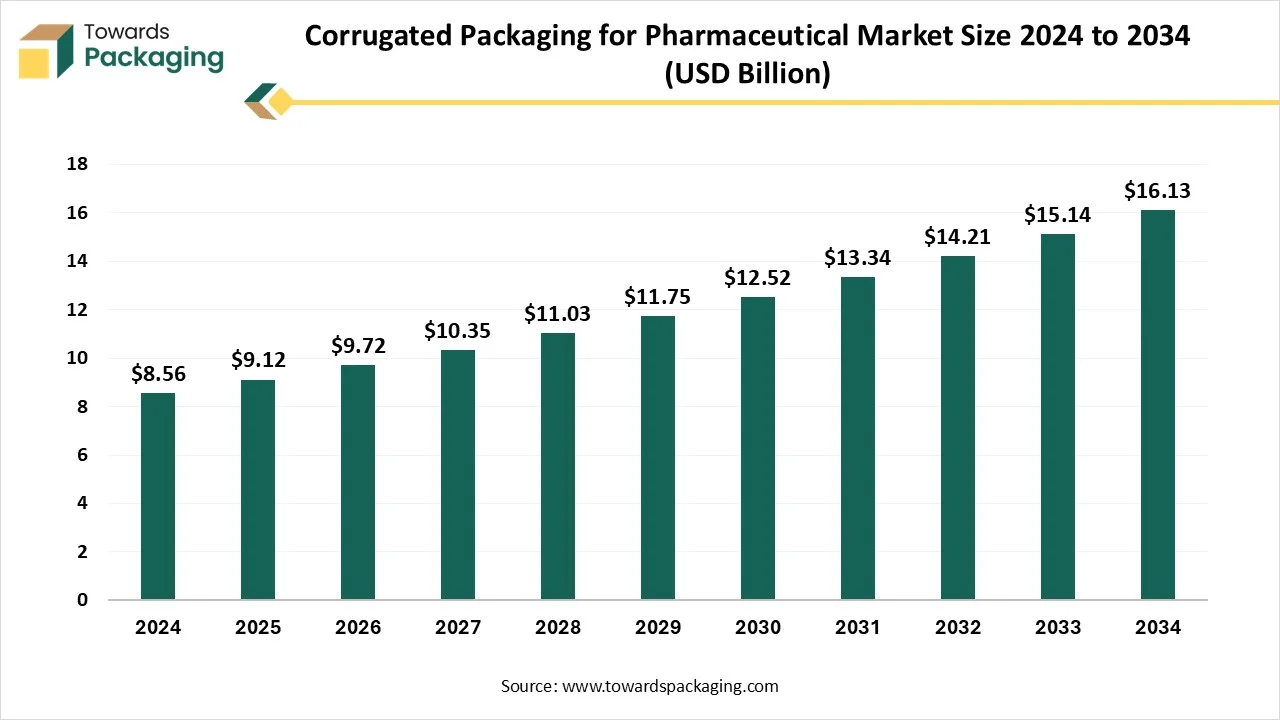

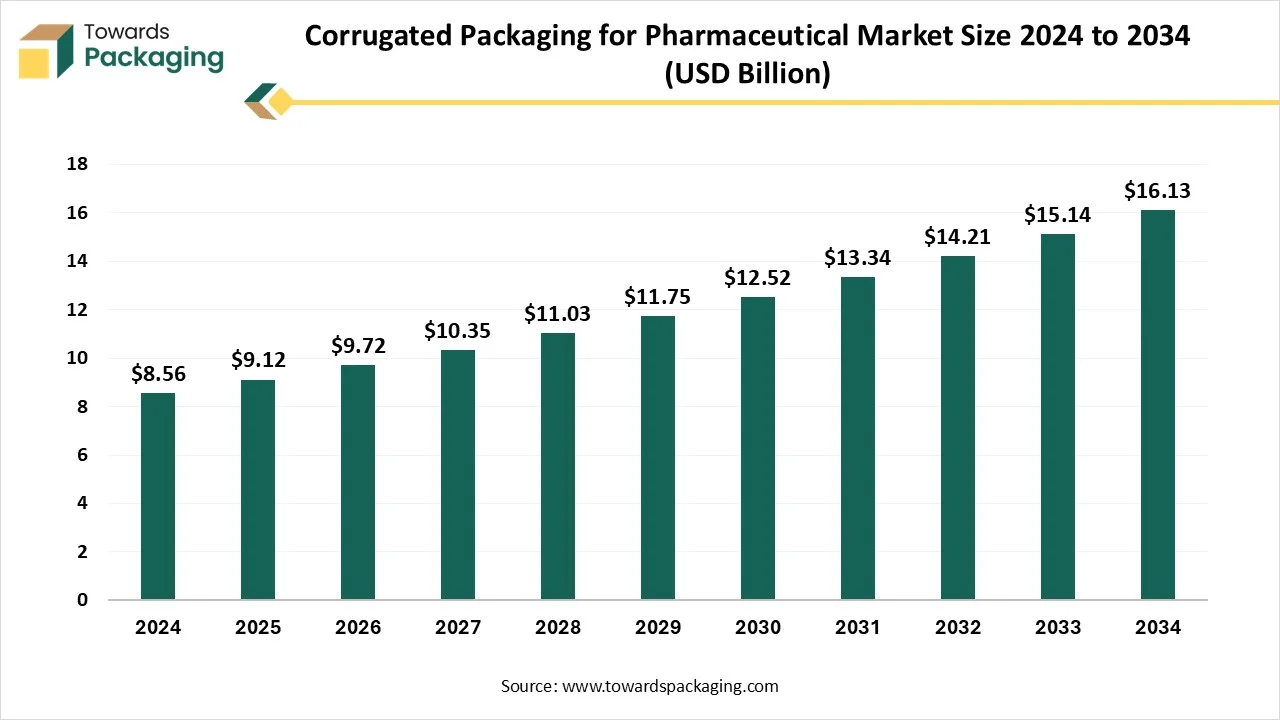

The corrugated packaging for pharmaceutical market is forecasted to expand from USD 9.72 billion in 2026 to USD 17.18 billion by 2035, growing at a CAGR of 6.54% from 2026 to 2035. This study covers all major segments including box type (RSC dominating with 55% share in 2024), wall type (single-wall leading with 62%), add-on features (tamper-evident seals at 50% share), applications (oral solid dosage at 45%), and distribution channels (direct to OEMs holding 60%). It includes a complete regional analysis where North America leads with 38% share, and APAC is the fastest-growing region.

Key Insights

- In terms of revenue, the market is valued at USD 9.12 billion in 2025.

- The market is projected to reach USD 17.18 billion by 2035.

- Rapid growth at a CAGR of 6.54% will be observed in the period between 2025 and 2034.

- North America dominated the global market by holding more than 38% of the market share in 2024.

- North America dominated the global market with the largest share in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By box type, the regular slotted container (RSC) segment contributed the biggest market share of 55% in 2024.

- By box type, the die-cut / sleeve-style boxes segment will be expanding at a significant CAGR between 2025 and 2034.

- By wall type, the single-wall corrugated segment contributed the biggest market share of 62% in 2024.

- By wall type, the double-wall for high-value/fragile goods segment is expected to expand at a significant CAGR between 2025 and 2034.

- By add-on features, the tamper-evident seals segment contributed the biggest market share of 50% in 2024.

- By add-on features, the barrier-coated boards segment is expanding at a significant CAGR between 2025 and 2034.

- By application, the oral solid dosage segment held the major market share of 45% in 2024.

- By application, the injectables & biologics segment is projected to grow at a CAGR between 2025 and 2034.

- By distribution channel, the direct to pharmaceutical OEMs segment contributed the biggest market share of 60% in 2024.

- By distribution channel, the Contract Packaging & CMOs segment is expanding at a significant CAGR between 2025 and 2034.

Market Overview

The global corrugated packaging for pharmaceutical market focuses on corrugated board boxes used for secondary packaging of pharmaceutical products, such as vials, tablets, injectables, and medical devices. These corrugated boxes offer strength, stability, and moisture protection and are often enhanced with anti-tamper features, printed instructions, or cold-chain compatibility. Their advantages in sustainability, cost-efficiency, and regulatory compliance make them the preferred choice in pharma logistics.

What are the New Trends in the Global Corrugated Packaging for Pharmaceutical Market?

Rising Focus on Eco-friendly Packaging

Constant Technological Advancement

- The constant growth in packaging technology of pharmaceutical products has increased the demand in the market.

Increasing Customized Packaging Demand

- The huge customization demand for marking brand identity has raised the demand for this packaging market innovation.

How Can AI Improve the Global Corrugated Packaging for Pharmaceutical Market?

The incorporation of AI in the global corrugated packaging for the pharmaceutical market plays an important role in increasing efficiency, equality, and sustainability of the packages. It enhances the productivity of the market by monitoring the safety and integrity while manufacturing this packaging. AI can predict market trends and design unique patterns of corrugated packaging that raise the adoption of such packaging for pharmaceutical products. It controls the quality of the production, which enhances the reliability of the packages.

Market Dynamics

Drivers

Growing Adoption of Eco-friendly Packaging in the Pharmaceutical Industry

The rising ecological issue and consumer awareness have encouraged the usage of eco-friendly packaging for developing pharmaceutical products, which further enhances the global corrugated packaging for the pharmaceutical market. Corrugated packaging delivers benefits like superior recyclability, lightweight properties, and durability, which bring into line with the pharmaceutical industry’s requirement for safe and environment-conscious resolutions.

The rising pharmaceutical sector, especially in emerging regions, has seen a yearly upsurge in demand for sustainable packaging choices, accompanied by progressions in logistics and e-commerce that have sharpened the requirement for strong packaging to avoid product injury during transportation. Furthermore, discriminating customer consciousness about drug security and quality additional to supporting the fondness for corrugated packaging, shows that customers are more expected to select products with sustainable packing.

Challenges and Restraints

Increasing Demand for Temperature-Controlling Packaging

The increasing demand for temperature-controlled packaging in the pharmaceutical industry has hindered the demand for global corrugated packaging for the pharmaceutical market. The constant disruption of the supply chain distribution has decreased the expansion of the market. The growing operational charges because of the requirement for specialized testing tools have decreased the expansion of the market.

Opportunity

Rising Protective Packaging

The growing demand for protective packaging is boosting the global corrugated packaging for pharmaceutical market. The increasing importance of ecological sustainability and the acceptance of biodegradable resources are generating an abundant ground for invention in corrugated packaging. Pharmaceutical corporations are shifting in the direction of environment-friendly packaging to fulfill regulatory needs and customer preferences, providing producers with the options to grow advanced, lightweight, and recyclable corrugated materials.

The rising e-commerce segment, which demands safe and strong packaging to confirm product security during transportation, offers a substantial development avenue for this industry. This extension is generating a demand for pharmaceutical packing that fulfils international values of quality and security. The requirement to provide to these developing markets is reassuring packaging corporations to capitalize on new production services and develop packing solutions that are both cost-effective and compliant with worldwide values.

Segmental Insights

Why the Regular Slotted Container (RSC) Segment Dominated the market in 2024?

The Regular Slotted Container (RSC) segment contributed a considerable share of the global corrugated packaging for the pharmaceutical market in 2024 due to e-commerce expansion, effective, and affordable packaging demand. The growing availability of material efficacy, sustainability, and automated packaging processes has raised the demand for this segment. Repeated process results in bulk production of packages with the help of advanced technology. The growing demand for sustainable packaging in the pharmaceutical sector has influenced the demand for this segment.

The die-cut / sleeve-style boxes segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The increasing demand for customization options has influenced the market to generate unique packaging for pharmaceutical usage. The acceptance of smart packaging resolution, comprising temperature sensors and QR codes, has raised innovation in this market.

Why Single-Wall Corrugated Segment Dominated the Market in 2024?

The single-wall corrugated segment is expected to account for a considerable share of the global corrugated packaging for pharmaceutical market in 2024 due to the growing demand for enhanced protection and cost-efficacy. The rapid expansion of telemedicine supply and sustainable packaging has influenced the demand for such segment, which provides superior quality protection to the products. Strict packaging guidelines have also increased the inclination of brands towards single-wall corrugated packaging. Continuous technological advancement in this sector has raised the demand for this segment.

The double-wall for high-value/fragile goods segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The continuous innovation in the pharmaceutical industry has enhanced the demand for extra protective packaging. These boxes are designed in a certain way where two layers of fluted cardboard are used, which increases the protection level of the products.

Why Tamper-Evident Seals Segment Dominated the Market in 2024?

The tamper-evident seals segment is expected to have a considerable share of the global corrugated packaging for pharmaceutical materials market in 2024 due to rising concern for the superior quality protection of advanced medicines. The requirement for safe and consistent packaging resolution. Corrugated packaging provides safety in transporting sealed products over a certain distance and helps them to store for a prolonged period. This segment plays a significant role in secondary packing, mainly for the transportation of label seals, security tapes, and adhesive seals.

The barrier-coated boards segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. These boards provide protection from microbial activities, moisture, grease, oxygen, and many others. These are highly compostable and recyclable, which enhances the acceptance for this market. This segment is popular for secondary packaging of pharmaceutical products.

Why the Oral Solid Dosage Segment Dominated the Market in 2024?

The oral solid dosage segment is expected to have a considerable share of the global corrugated packaging for pharmaceutical market in 2024 due to its enhanced strength and durability. Its strong cushioning effect helps to keep fragile containers of medicines safe while transporting or storing for a longer period. The development of the pharmaceutical e-commerce sector has influenced the demand for oral medication, which is easy to store and transport over longer distances. Oral solid dosage, such as tablets, capsules, granules, and powders, is convenient for consumption by patients and has enhanced the demand for this segment.

The injectables & biologics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. With the expanding pharmaceutical industry, the packaging requirements of this market are also increasing. Evolving regulations for the packaging of such injectables have influenced the demand for this market. The requirement for protection from contamination due to various factors has raised the demand for corrugated packaging.

Why Direct to Pharmaceutical OEMs Segment Dominated the Market in 2024?

The direct to pharmaceutical OEMs segment is expected to have a considerable share of the global corrugated packaging for pharmaceutical materials market in 2024 due to its structural patterns and protective services. Suppliers sometimes customize structural patterns, brand-specific printing, regulatory-compliant materials, and protective features, which raises the demand for this segment notably. Rising e-pharmacy, sustainability trend, and regulatory demands have influenced the demand for this segment. Customized inventions like serialization-embedded cartons raised the demand for this segment.

The contract packaging & CMOs segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to increasing demand for transit protection, regulatory compliance, and brand presentation. It is rising significantly because of the sustainability demand in the pharmaceutical packaging sector. Growing utilization of recyclable paperboard, lightweight, and biodegradable packages has raised the demand for this segment.

Regional Insights

Developing E-commerce Infrastructure Demand in North America Promotes Dominance

North America region held the largest share of the global corrugated packaging for pharmaceutical materials market in 2024, due to the rising e-commerce infrastructure, which is increasing superior quality packaging. The rising pharmaceutical industry has influenced the standard packaging demand has evolved the market profoundly. The innovative packaging technology has raised the production of high-quality packages that prevent the leakage of products. The rising concentration on environment-friendly and recyclability of the packages influenced the investment in this industry.

Asia Pacific’s Rising Lightweight Packaging Supports Growth

The Asia Pacific region is estimated to grow at the fastest rate in the global corrugated packaging for pharmaceutical materials market during the forecast period. Countries such as India, Japan, China, and several others are rapidly developing their packaging standard due to the huge export business of the pharmaceutical industry. It includes contract, blister, corrugated, and primary packaging. It is developing as a lucrative market, influenced by the rapid extension of pharmaceutical production hubs.

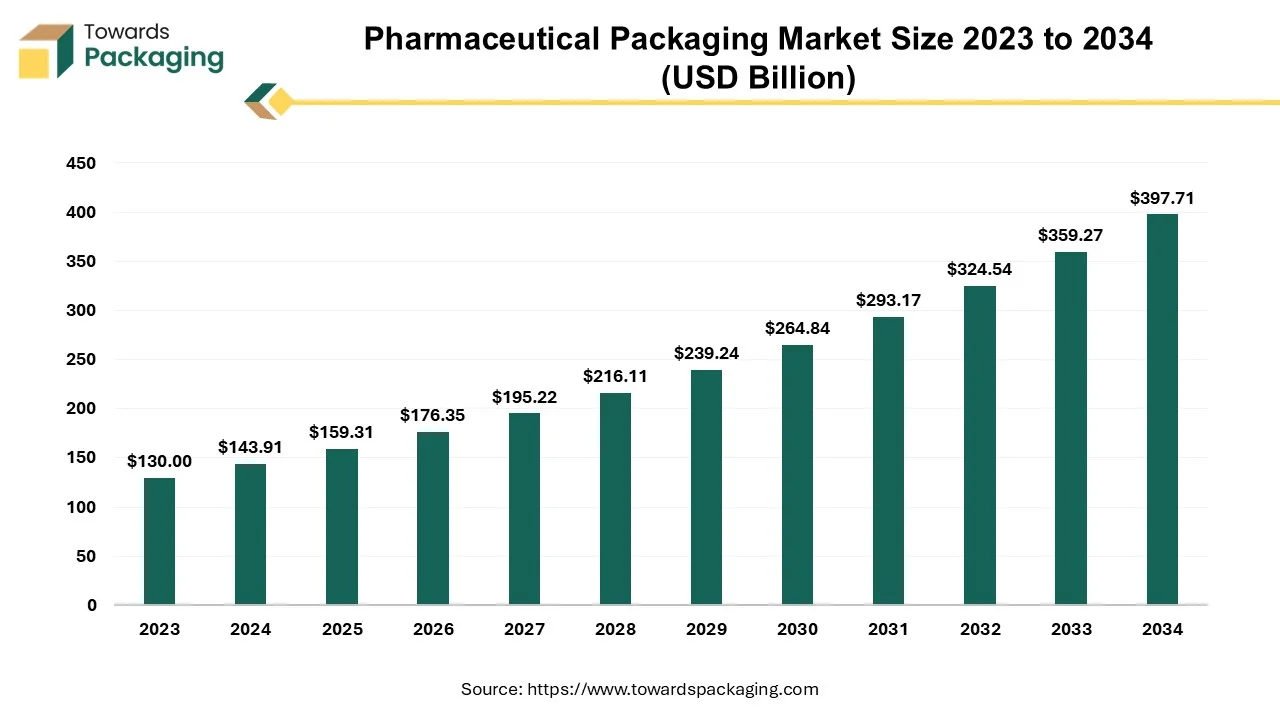

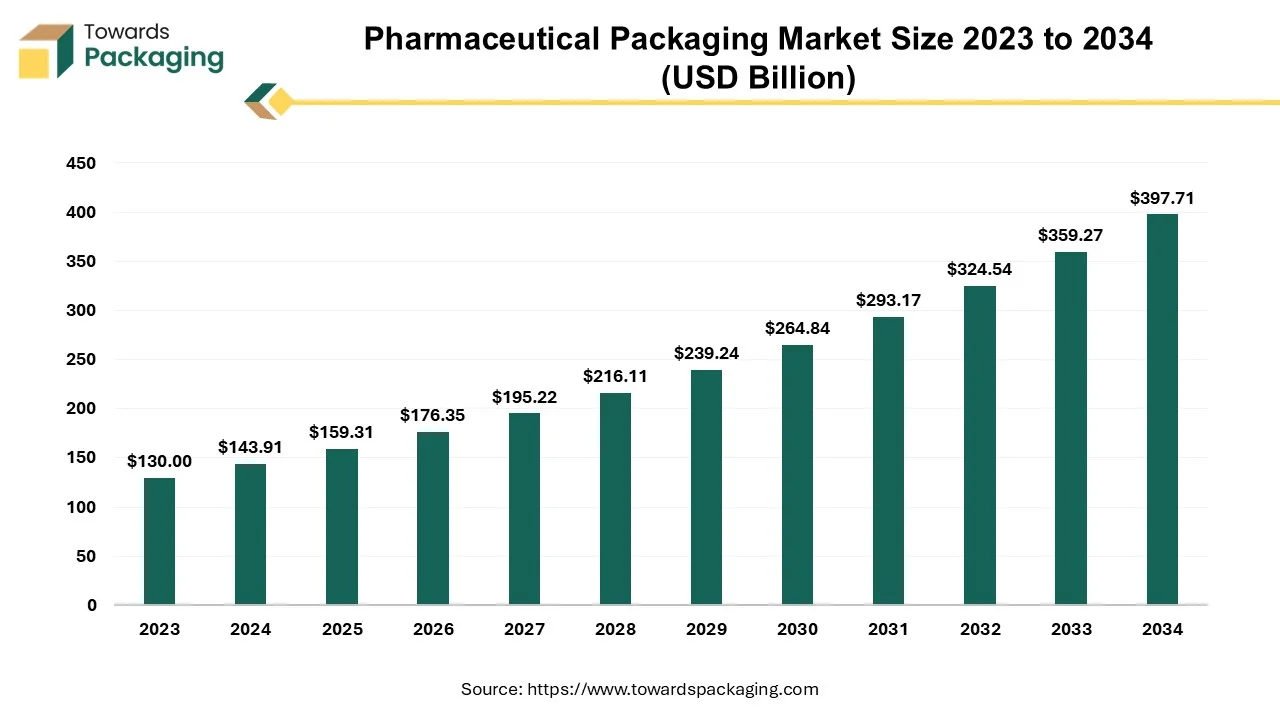

Future of Pharmaceutical Packaging Market

The global pharmaceutical packaging market is forecasted to expand from USD 159.31 billion in 2025 to USD 397.71 billion by 2034, growing at a CAGR of 10.7% from 2025 to 2034. The growth is mainly driven by the increasing need for safe and effective drug packaging due to rising demand for medicines worldwide. This is supported by advances in technology and stricter regulations ensuring product quality and patient safety.

A vital part of medicine delivery, pharmaceutical packaging guarantees the efficacy, safety, and integrity of pharmaceutical products for the course of their lifetime. Pharma packaging shields goods against deterioration, contamination, and other outside influences that could jeopardize patient safety and product quality by using specific materials and technology. Packaging acts as a protective barrier against temperature changes, moisture, light, and physical harm.

Future of Corrugated Packaging Market

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

Future of Corrugated Boxes Market

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

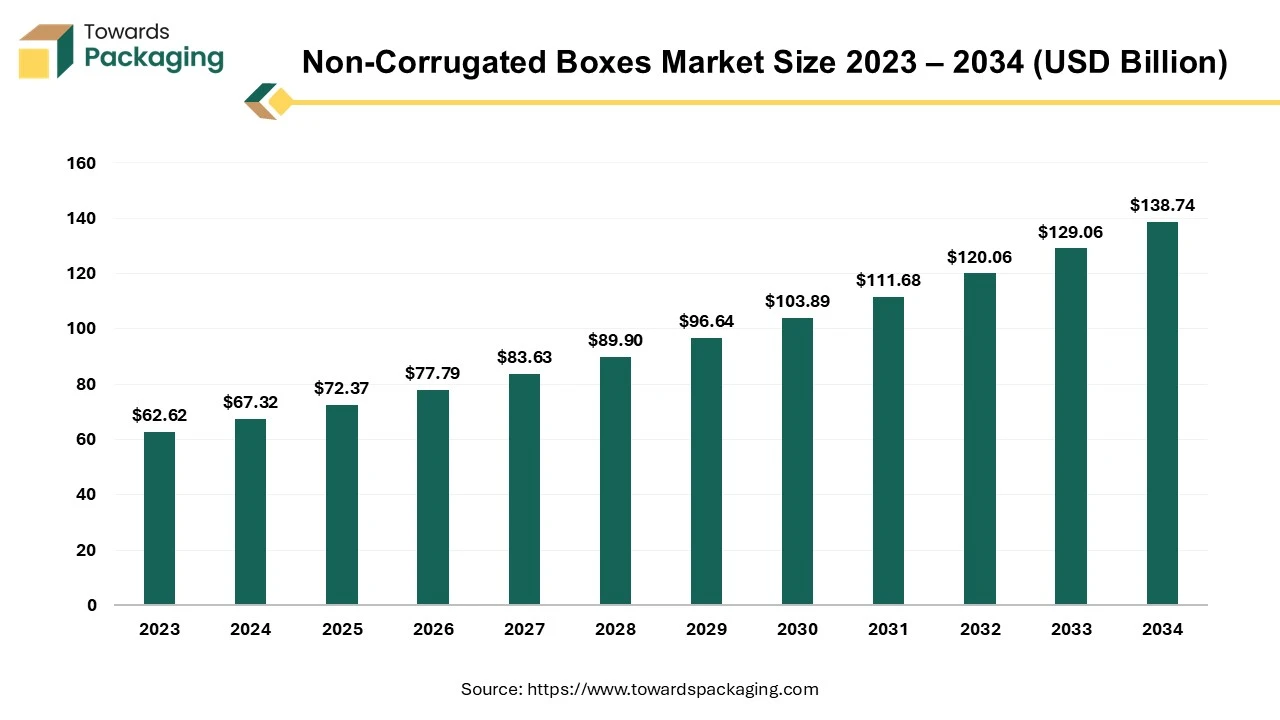

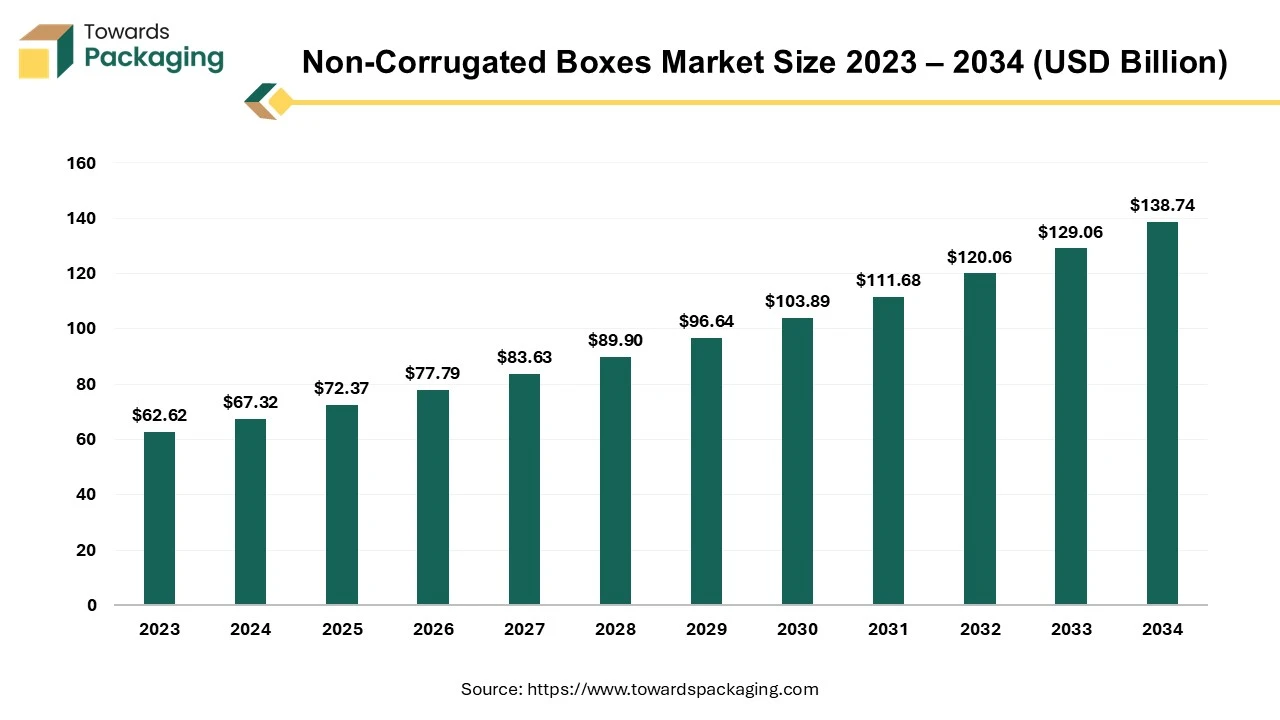

Future of Non-Corrugated Boxes Market

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

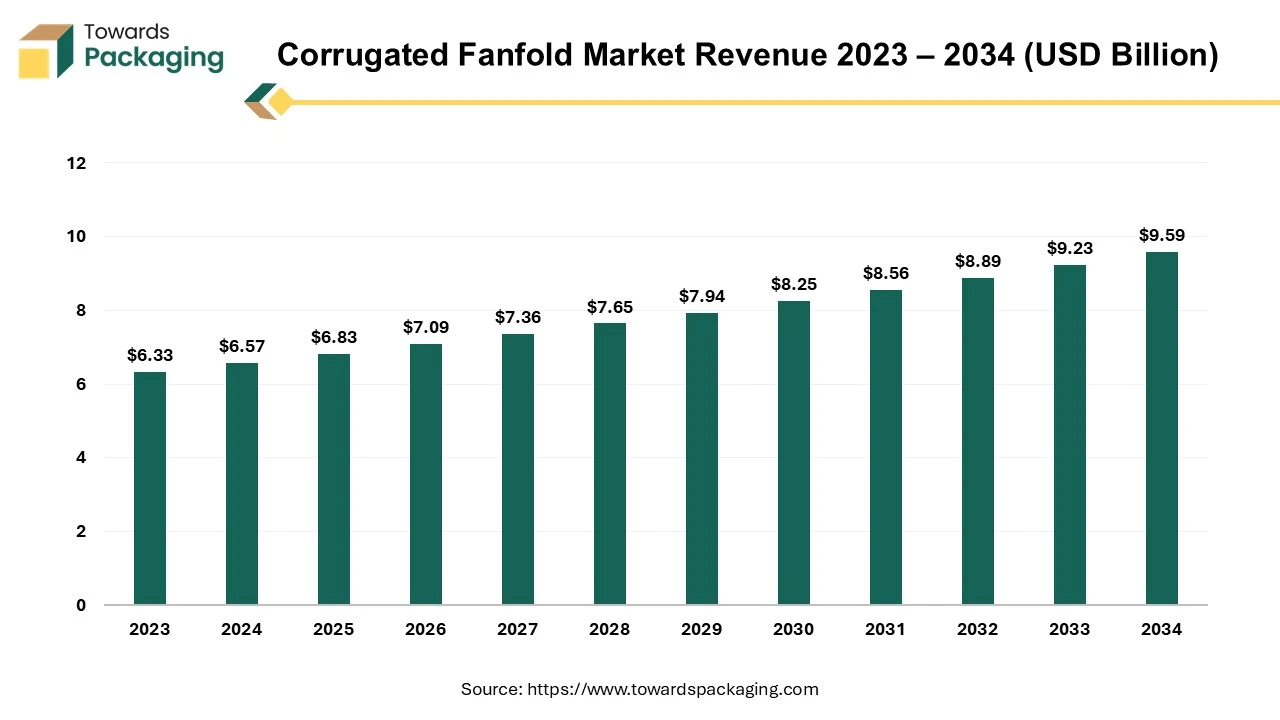

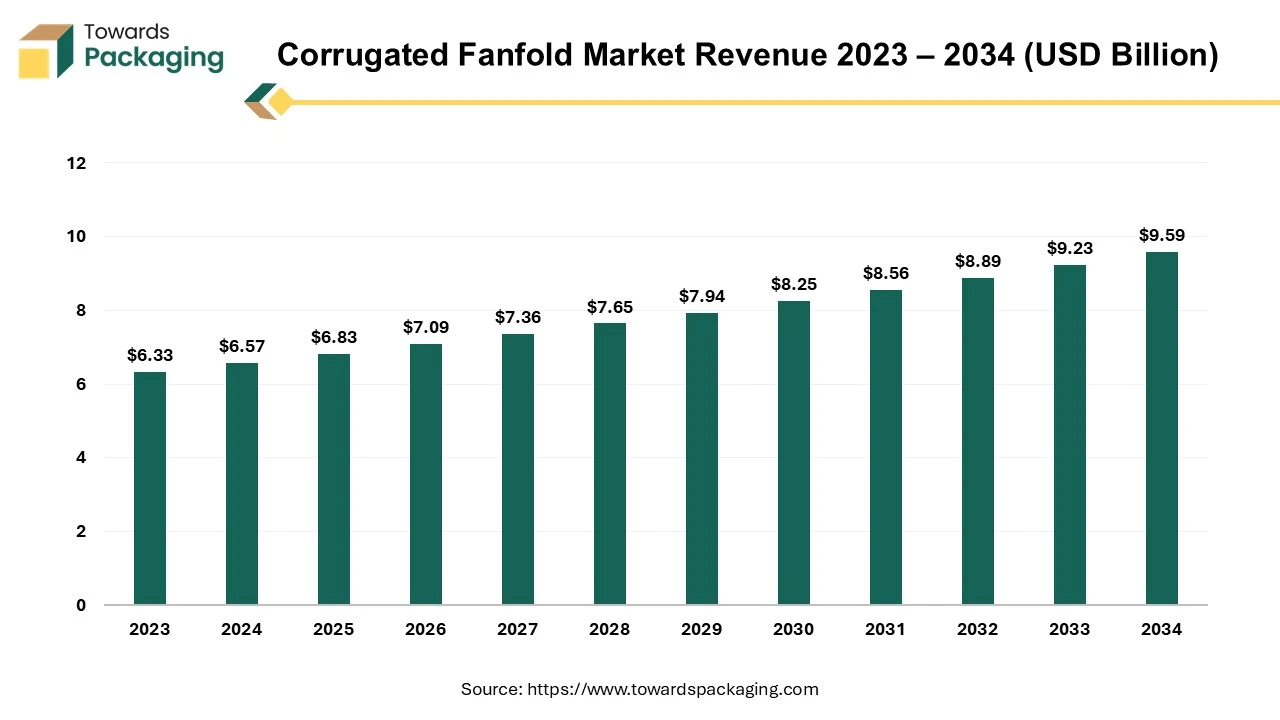

Future of Corrugated Fanfold Market

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

Top Companies in the Corrugated Packaging for Pharmaceutical Market

Latest Announcements by Industry Leaders

- In January 2025, Marlena Hardy, Innovation Product Manager, DS Smith: “TailorTemp® demonstrates just how versatile and reliable fibre-based material can be, not only to maintain temperatures in cold chain logistics, but also to deliver a recyclable outcome for customers seeking to meet sustainability targets. Design is everything, and our team is using specialist predictive modelling in the creation of solutions for our pharma customers that are fit for purpose and then validating them in the laboratory without delay”.

New Advancements in the Market

- In January 2025, DS Smith launches an innovative temperature-controlled packaging solution.

- In October 2024, Berry Global launched a range of clarified polypropylene (PP) bottles for healthcare applications, which offer sustainability and enhanced product protection compared to traditional coloured PET pill bottles.

Global Corrugated Packaging for Pharmaceutical Market

By Box Type

- Regular Slotted Container (RSC)

- Die-Cut/Folio Boxes

- Sleeve & Tray Configurations

- Printed Promotional/Instructional Packaging

By Wall Type

- Single-Wall Corrugated

- Double-Wall Corrugated

- Triple-Wall Corrugated

By Application

- Oral Solid Dosage (Tablets, Capsules)

- Injectables & Biologics

- Medical Devices & Diagnostics

- Over-the-Counter Healthcare Products

By Add-On Features

- Tamper-Evident Seals and Closures

- Moisture-Barrier or Coated Boards

- Printed Safety and Dosing Information

- Temperature-Control Liner Inserts

By Distribution Channel

- Direct to Pharmaceutical Manufacturers (OEM)

- Contract Packaging and CMOs

- Wholesale and Drug Distributors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa