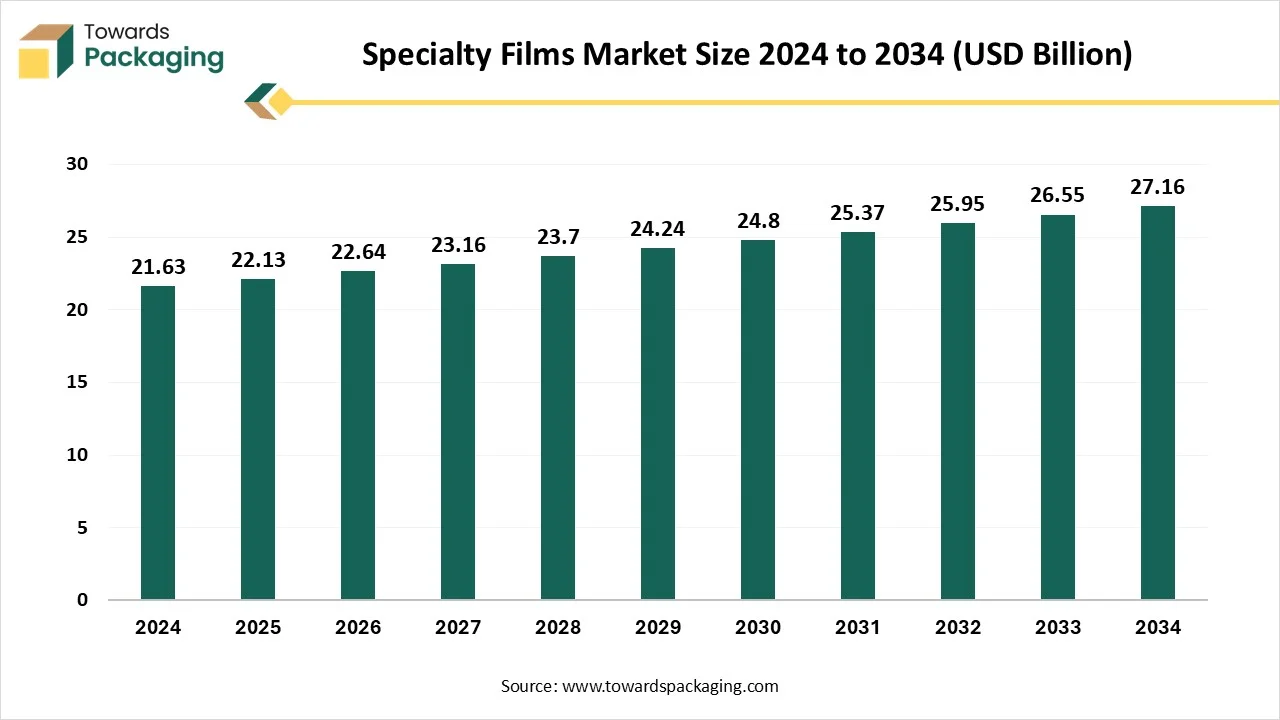

The specialty films market is forecasted to expand from USD 22.65 billion in 2026 to USD 27.87 billion by 2035, growing at a CAGR of 2.33% from 2026 to 2035. This report provides an in-depth analysis of market trends, segments, and applications across key regions including North America, Europe, Asia Pacific, Latin America, and MEA. Key segments analyzed include materials such as polyethylene (35%), PET (20%), polyamide (15%), polypropylene (10%), and others; product types like shrink film (40%) and stretch film (25%); and end-uses including food & beverages (35%), cosmetics (15%), pharmaceuticals (10%), and automotive parts (10%). Leading players such as 3M, Covestro AG, DuPont Teijin Films, Solvay S.A., and SABIC are profiled along with competitive analysis, trade flows, value chain insights, and supplier/manufacturer strategies.

Speciality packaging films refer to high-performance, engineered plastic films that are specifically designed to meet unique packaging requirements. These films offer special functional properties that go beyond conventional packaging, such as barrier protection, mechanical strength, thermal properties, optical properties, and chemical resistance.

High resistance to oxygen, moisture, light, or aroma to preserve product freshness and shelf life (e.g., in food or pharma). Toughness, puncture resistance, or flexibility for durability during handling and transport. Heat resistance or sealability for use in processes like heat sealing or microwave use. The specialty packaging films give clarity, gloss, or matte finishes for aesthetic appeal and visibility. The specialty packaging films are resistance to oils, acids, or solvents for industrial or chemical packaging.

| Metric | Details |

| Market Size in 2025 | USD 22.13 Billion |

| Projected Market Size in 2035 | USD 27.87 Billion |

| CAGR (2025 - 2035) | 2.33% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Product, By End Use and By Region |

| Top Key Players |

Environmental concerns and regulatory pressures are propelling the demand for biodegradable, compostable, and recyclable films. Innovations include bio-based polymers and materials designed to reduce plastic waste. For instance, the adoption of biodegradable films is gaining traction in response to stricter environmental regulations and consumer demand for sustainable packaging solutions.

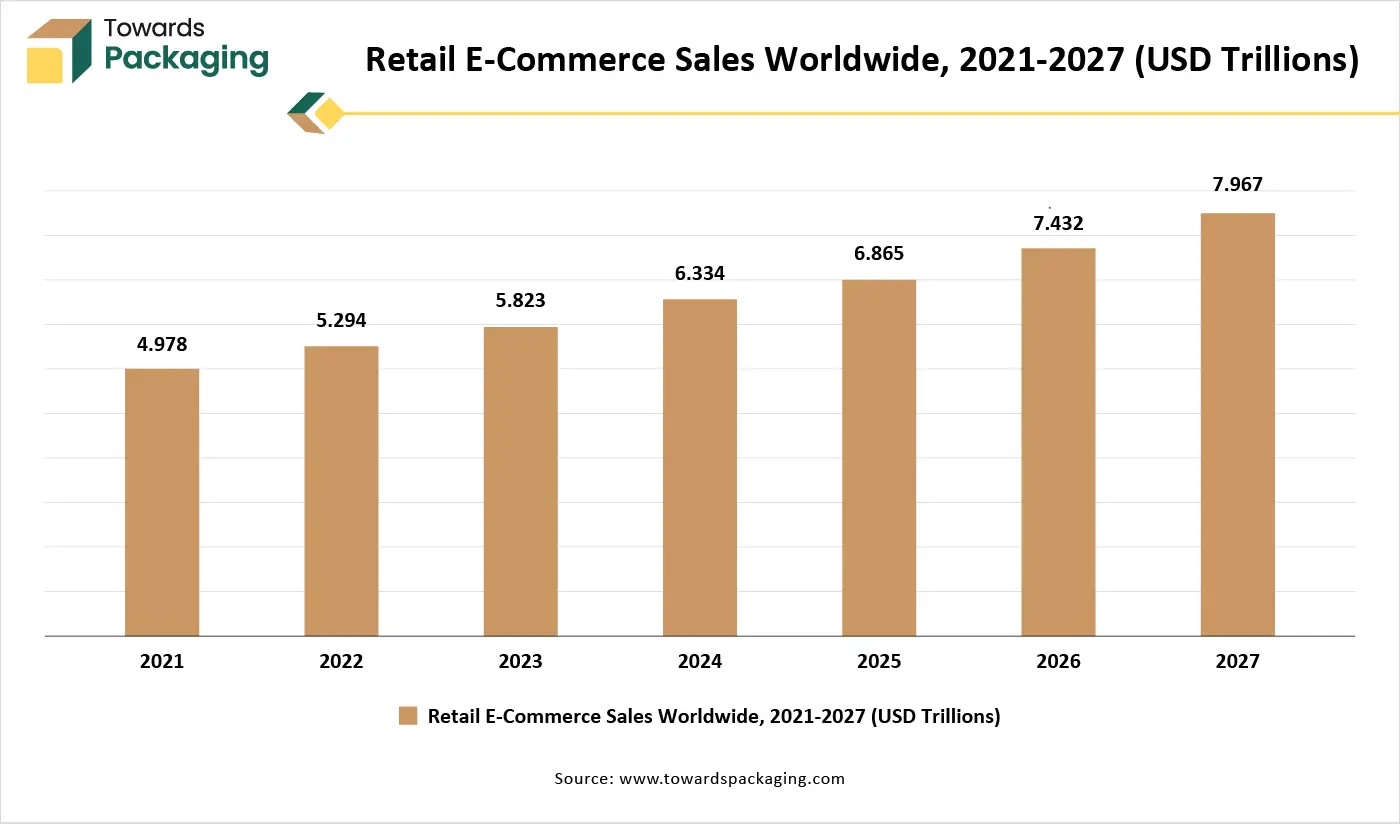

The surge in online shopping has increased the need for durable, lightweight, and protective packaging solutions. Specialty films, particularly BOPP (Biaxially Oriented Polypropylene), are favoured for their moisture resistance and ability to extend product shelf life, making them ideal for flexible packaging in the food and beverage sector.

Advancements in technology are leading to the development of smart packaging films that can monitor product freshness, authenticity, and supply chain information. These intelligent films incorporate features like QR codes and sensors, enhancing consumer engagement and product safety. For example, battery-free, stretchable smart packaging systems have been developed to monitor food freshness in real-time, extending shelf life and reducing waste.

There's a growing demand for specialty films with superior barrier properties to protect against moisture, oxygen, and contaminants. These films are crucial in the food and pharmaceutical industries to maintain product integrity and extend shelf life. High-performance barrier films are being developed to meet these stringent requirements.

Artificial intelligence and automation are revolutionizing the specialty films industry by optimizing manufacturing processes, enhancing quality control, and enabling the development of films with tailored properties. AI-driven analytics are being utilized to streamline production and innovate new film functionalities.

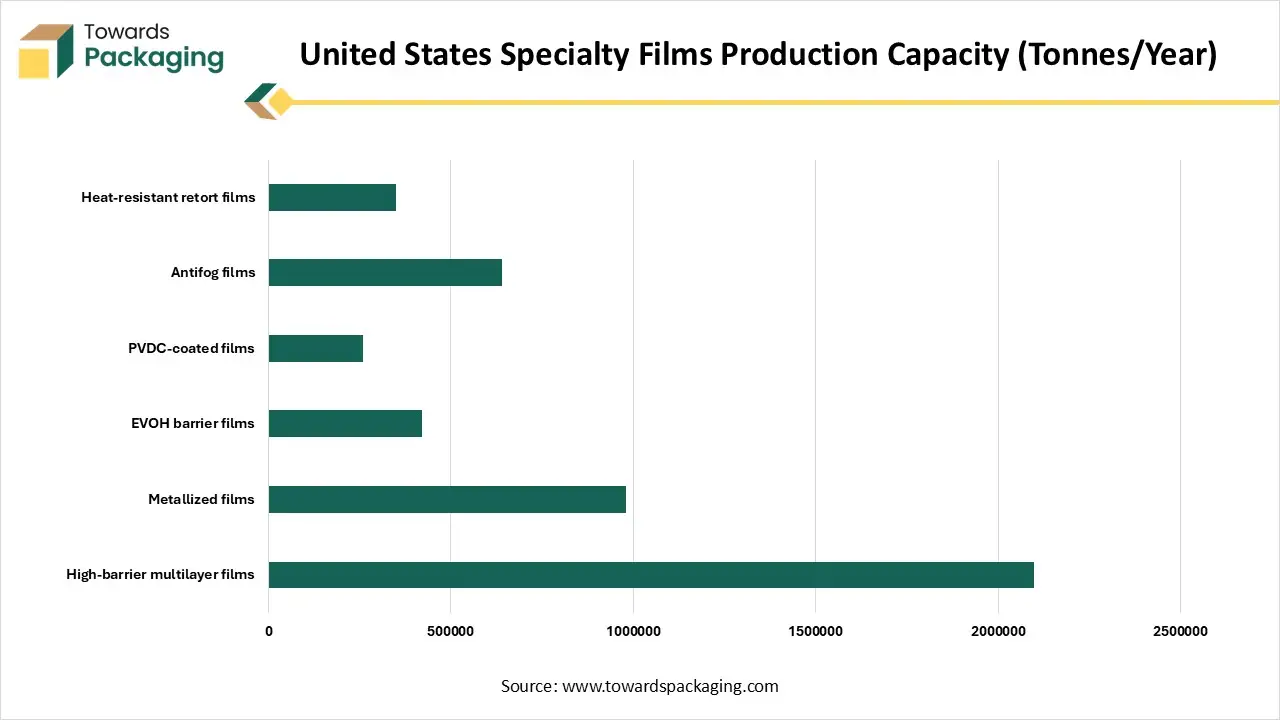

| Specialty Film Type | Capacity |

| High-barrier multilayer films | 2100000 |

| Metallized films | 980000 |

| EVOH barrier films | 420000 |

| PVDC-coated films | 260000 |

| Antifog films | 640000 |

| Heat-resistant retort films | 350000 |

AI algorithms can predict equipment failures before they occur, reducing downtime. Automated Defect Detection: Machine vision systems powered by AI can identify micro-defects (wrinkles, pinholes, color inconsistencies) during film production with high accuracy. AI models analyze parameters like temperature, film thickness, tension, and speed to adjust them in real time for better consistency and reduced waste.

AI can simulate how different polymers and additives will behave, helping design films with specific barrier, mechanical, or aesthetic properties. AI can quickly analyze large datasets of material combinations to identify optimal formulations for barrier films, bio-based polymers, or multilayer structures. AI can assess environmental impact during the R&D phase, allowing the development of more sustainable materials.

AI enables the development of packaging films with user- or product-specific functionalities. For brands using specialty films in food or cosmetics, AI can generate packaging designs or messages customized to demographics or consumer behaviour. AI can drive the integration of sensors, QR codes, or NFC chips that track temperature, humidity, and product freshness, which are embedded in specialty films. AI models can predict performance under various storage or transit conditions. AI can simulate how a packaging film resists moisture, oxygen, or UV over time, reducing the need for prolonged physical testing. AI helps predict the shelf life of perishable products based on film properties and storage conditions, aiding in film selection.

AI optimizes cutting and lamination to minimize scrap. AI tools evaluate film designs for ease of recycling or composting based on multilayer structures. AI manages sourcing and logistics to reduce the carbon footprint. Using NLP to analyze reviews and social media to guide design and sustainability features. AI integration helps in tracking innovations and patent filings to stay ahead of competitors.

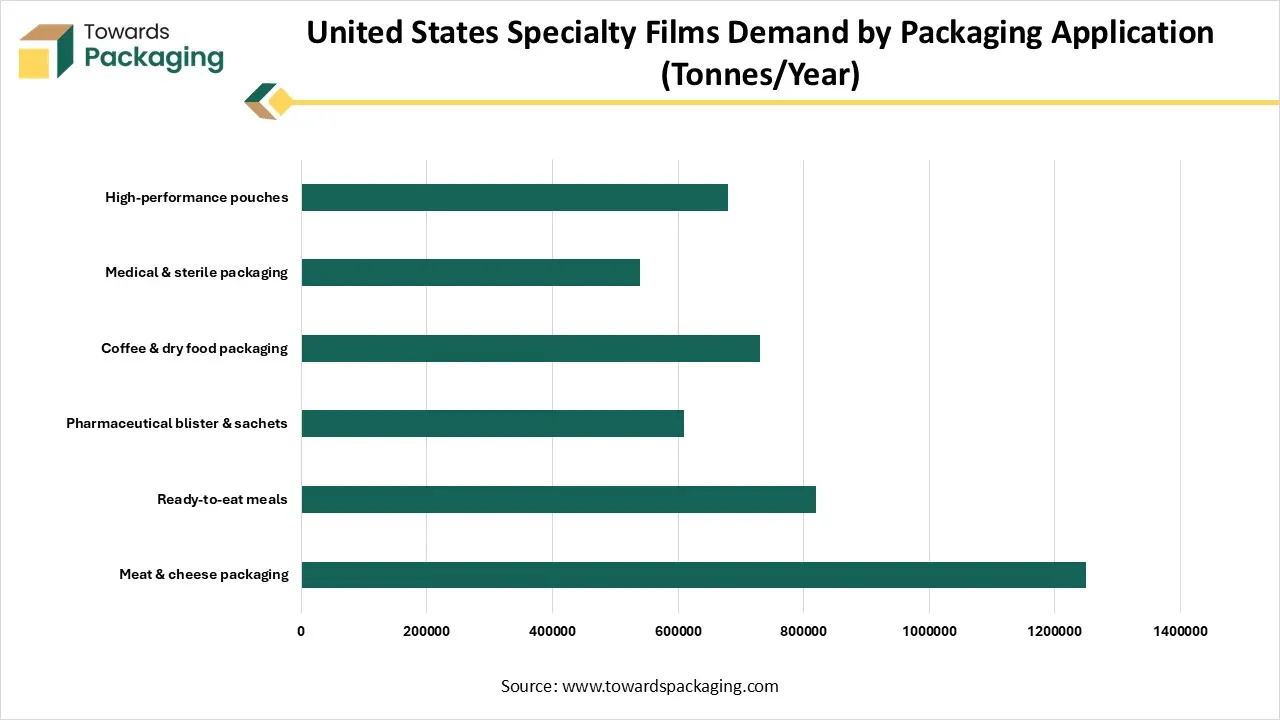

| Packaging Application | Demand |

| Meat & cheese packaging | 1250000 |

| Ready-to-eat meals | 820000 |

| Pharmaceutical blister & sachets | 610000 |

| Coffee & dry food packaging | 730000 |

| Medical & sterile packaging | 540000 |

| High-performance pouches | 680000 |

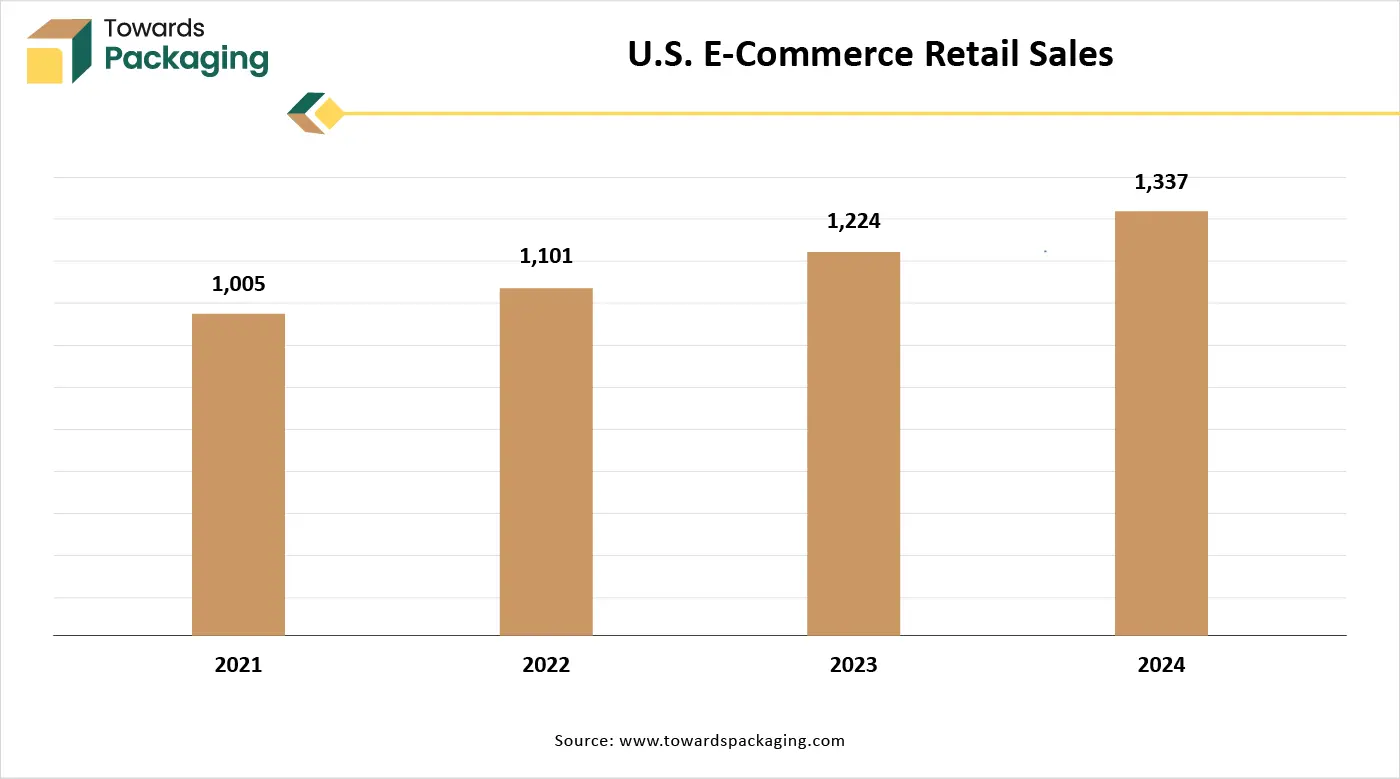

E-commerce and retail boom

Growth in online shopping requires durable and attractive packaging to ensure product protection during transit. Specialty films improve aesthetics and shelf appeal, crucial in competitive retail environments. E-commerce shipments require strong, durable, and flexible packaging films to withstand handling and logistics stress. Specialty films with barrier properties protect against moisture, oxygen, UV light, and contamination—critical for food, electronics, and personal care products shipped online. Online retailers seek to minimize shipping costs, driving demand for lightweight specialty films that reduce packaging weight without compromising strength.

Specialty films can also be engineered to be thinner yet stronger, leading to cost savings and sustainability benefits. E-commerce and retail players prioritize personalized packaging to enhance brand identity. Specialty films support high-quality printing and custom finishes, making them ideal for premium branding, especially in direct-to-consumer segments. Online grocery sales and fresh food delivery require high-barrier films to ensure freshness and extend shelf life. Specialty films with modified atmosphere capabilities are increasingly used in packaging for produce, meat, and dairy.

Complex Manufacturing Processes and Sustainability Concerns

Production of multi-layer, high-barrier films involves sophisticated technology and significant capital investment. Smaller players and emerging economies may struggle to adopt or afford such technology, restricting market penetration. Moreover, many specialty films are not easily recyclable and contribute to plastic waste, triggering regulatory restrictions. Single-use plastic bans and consumer demand for eco-friendly alternatives may shift demand away from conventional specialty films toward biodegradable or paper-based options.

Expansion in Pharmaceuticals and Healthcare

Specialty films with high barrier properties, chemical resistance, and tamper-proof features are critical for drug packaging. Growth in aging populations and chronic illness treatment boosts demand for medical-grade films (e.g., blister packs, transdermal patches). Supplying to pharmaceutical and nutraceutical companies can offer stable, high-margin opportunities.

Personalization and Premium Branding Trends

Brands are using specialty films for premium packaging designs that offer a tactile, visual, or functional upgrade. Custom films with matte/gloss finishes, holography, anti-counterfeiting features, or QR code integration are in demand. Supplying value-added films for luxury, health and wellness, and beauty brands can boost margins.

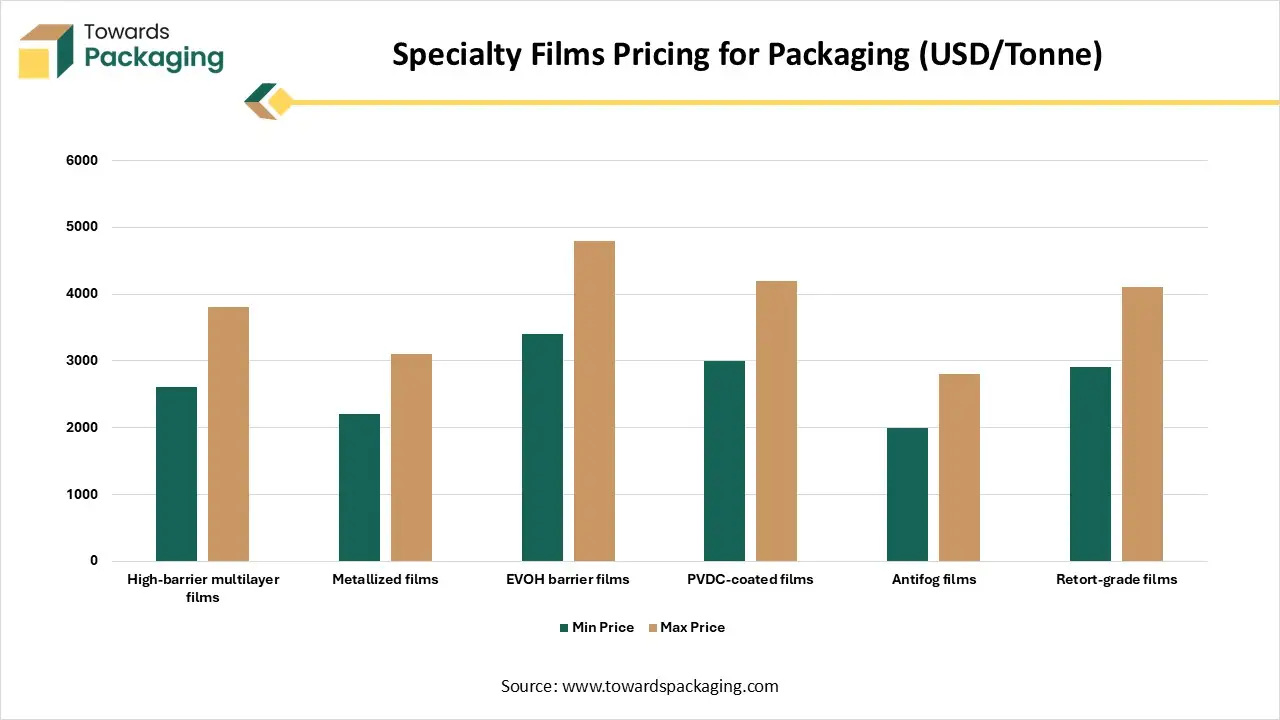

| Specialty Film Type | Min Price | Max Price |

| High-barrier multilayer films | 2600 | 3800 |

| Metallized films | 2200 | 3100 |

| EVOH barrier films | 3400 | 4800 |

| PVDC-coated films | 3000 | 4200 |

| Antifog films | 2000 | 2800 |

| Retort-grade films | 2900 | 4100 |

Polyethylene (PE) is relatively low-cost compared to other specialty polymers like PET, EVOH, or PVDC. This makes it highly attractive for mass-market and high-volume applications, especially in food, retail, and consumer goods sectors. Polyethylene (PE) is easy to extrude, laminate, and convert, making it highly compatible with standard and high-speed packaging machinery. It supports a range of manufacturing techniques: blown film, cast film, and extrusion coating. Polyethylene is one of the more recyclable plastics, especially in mono-material film structures. With growing focus on sustainable packaging, manufacturers favour PE for its ability to be part of closed-loop recycling systems.

Shrink films conform tightly around products when heat is applied, creating a snug and tamper-evident seal. This ensures product integrity and prevents movement during transport. Especially useful for bundling multipacks (e.g., water bottles, canned goods) or wrapping oddly shaped items. Shrink films are lighter and often cheaper than rigid packaging. Reduces packaging waste and shipping costs, especially for bulk or multipack applications.

Specialty films can block oxygen, moisture, UV light, and contaminants, which are the main causes of food spoilage. This extends shelf life and maintains the flavor, aroma, and texture of food and drinks. For instance, EVOH, PVDC, and metallized PET films are used for high-barrier needs like snacks, dairy, and ready meals. Specialty films help create and maintain a controlled internal atmosphere (e.g., low oxygen, high CO₂), crucial for perishable goods. Vacuum-sealed specialty films prevent bacterial growth and preserve freshness without additives. Specialty films can withstand freezing, refrigeration, pasteurization, or retort sterilization, making them suitable for a wide range of food products. Frozen foods, baby food pouches, and shelf-stable beverages all benefit from specialty packaging films.

Asia Pacific boasts growth in the pharmaceutical industry and high population density in the region. Countries like China, India, Indonesia, and Vietnam are experiencing rapid industrial growth with expansion fueled by demand for modern packaging solutions in sectors like food, pharmaceuticals, electronics, and cosmetics. On the other hand, countries like Japan and South Korea are also investing in circular economy solutions. Companies like Toray, Jindal Poly Films, Uflex, Cosmo Films, and Mitsubishi Chemical are based in or have significant operations in the region. These players continually invest in capacity expansion and technological innovation.

Asia Pacific is home to the world’s largest and fastest-growing middle-class population. With increased disposable incomes, there’s a surge in demand for premium, safe, and convenient packaged products, especially in food and personal care. Countries like South Korea, Japan, and China lead in consumer electronics production. Specialty films are crucial in protective and anti-static packaging for sensitive electronic components. Large populations in these countries drive massive consumption of packaged goods. This leads to high-volume demand for specialty films in flexible packaging formats like pouches and sachets. Rapid growth in processed and convenience food consumption necessitates advanced barrier films for shelf-life extension.

China Market Trends

China's specialty films market is driven by the expansion of e-commerce and smart logistics in the country. China has the largest e-commerce market in the world. Growth in online grocery and food delivery boosts the demand for durable, attractive, and protective films, especially for temperature-sensitive and perishable items. China is also a key player in global pharma manufacturing and exports. Stringent quality requirements for drug packaging encourage the use of sterile, high-barrier specialty films.

The rise in quick-service restaurants and e-commerce grocery platforms adds further momentum. China’s food industry is rapidly modernizing, with increased focus on shelf life, hygiene, and safety. Specialty films with high-barrier and antimicrobial properties are crucial for processed and ready-to-eat foods. Furthermore, driven by an aging population and increasing health awareness, China’s pharmaceutical industry is booming. Specialty films are critical for sterile, tamper-evident, and moisture-resistant packaging of drugs and medical devices. The Chinese government supports advanced manufacturing, local innovation, and sustainability. Initiatives to reduce plastic waste are driving the shift toward eco-friendly specialty films, such as biodegradable and recyclable materials.

China is a global hub for electronics and semiconductor production. Specialty films are essential for the safe packaging and transport of electronic components. Significant investments in polymer science, coating technologies, and nanomaterials are fueling innovation. Chinese companies are now offering high-performance multilayer films, smart films, and functional packaging materials. China benefits from efficient supply chains, low labor costs, and large-scale industrial parks. This allows for the mass production of specialty films at competitive prices, attracting both domestic and global clients. Major players like China Packaging Group, Zhejiang Great Southeast, and Hengli Petrochemical are scaling operations. Global giants are also investing in China through joint ventures and manufacturing facilities.

North America is one of the highest per capita packaging usage rates in the world, driven by consumer preference for premium, functional, and convenient packaging. Strong demand for personal care, household products, and health supplements supports niche film applications. Regulatory bodies like the EPA and state laws are pushing companies toward eco-friendly packaging. Strict regulations from the U.S. Food and Drug Administration, the U.S. Department of Agriculture (USDA), and Health Canada push companies to adopt high-grade materials and precise manufacturing standards.

There’s a strong industry movement toward recyclable, biodegradable, and compostable specialty films. North America is a leader in polymer science, nanotechnology, and multilayer extrusion. Active development of smart packaging and high-performance barrier films. Packaging firms collaborate with tech and material science companies to push the boundaries of functionality. Home to industry leaders like Berry Global, Sealed Air, Bemis Company, and Avery Dennison. These companies heavily invest in production capacity, sustainability R&D, and high-speed flexible packaging technologies.

U.S. Market Trends

The advanced manufacturing and research and development capabilities in the country drive the U.S. specialty films market. U.S. companies invest heavily in research and development (R&D), driving innovation in materials like barrier films, biodegradable films, and multilayer structures. Access to cutting-edge extrusion, co-extrusion, and coating technologies enables the production of high-performance specialty films. The U.S. has abundant petrochemical resources, particularly polyethylene and polypropylene, which are essential for film production. This ensures a consistent and cost-effective supply for film manufacturing. Well-developed logistics infrastructure and trade agreements allow the U.S. to export specialty films efficiently to other countries.

The U.S. has a massive packaged food industry that demands innovative, high-barrier, and shelf-stable packaging. These industries require high-performance films for medical packaging, which the U.S. produces at scale. Agencies like the U.S. FDA and EPA provide clear guidelines that encourage the development of safe and compliant specialty packaging materials. Regulatory frameworks help maintain quality and environmental standards, boosting global trust in U.S.-made films. Strong push for recyclable, biodegradable, and compostable films, driven by U.S. legislation and corporate sustainability goals, fuels innovation.

The EU Green Deal, Plastics Strategy, and Single-Use Plastics Directive are accelerating the shift toward sustainable packaging films. Europe is home to leaders like Amcor (HQ in Switzerland), Mondi, Huhtamaki, Constantia Flexibles, and Taghleef Industries. These companies are aggressively investing in sustainable product lines and recyclable film innovations. Europe is advancing in smart packaging with temperature indicators, anti-counterfeit features, and QR code-enabled traceability.

High regulatory pressure is pushing manufacturers to develop biodegradable, compostable, and recyclable specialty films. European consumers are among the most eco-conscious globally. Demand is rising for packaging that is minimal, recyclable, and made from renewable resources, driving the use of bio-based specialty films. The region leads in materials science and packaging innovation, particularly in multilayer films, nanotechnology, and co-extrusion techniques. Major research initiatives focus on sustainable materials, smart packaging, and biodegradable polymers.

Western Europe is a global hub for high-value pharmaceuticals and biologics. Specialty films are essential for sterile, moisture-resistant, and tamper-evident packaging, especially for injectables and temperature-sensitive drugs. EU grants and subsidies support green packaging initiatives and bio-economy innovation. Programs like Horizon Europe fund research on sustainable materials and packaging solutions. Specialty films with antimicrobial, oxygen scavenging, or UV-blocking properties are gaining ground.

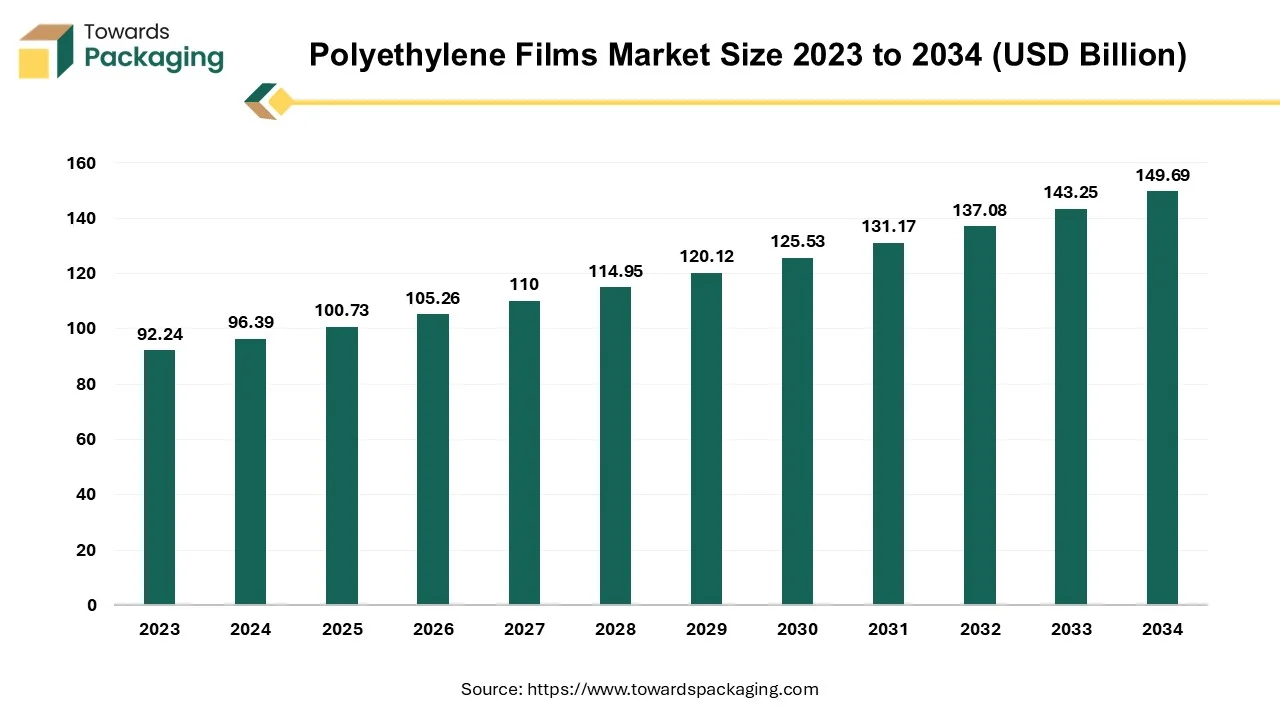

The polyethylene films market is expected to grow from USD 100.73 billion in 2025 to USD 149.69 billion by 2034, with a CAGR of 4.5% throughout the forecast period from 2025 to 2034.

The chemical ethylene, which is present in natural gas and petroleum, is the source of the polymer film that is called polyethylene (PE). considering its many uses, PE film is referred to by many different kinds of names, including plastic sheeting, polyethylene sheet, poly sheeting, and poly film. Despite over 100 million metric tonnes of PE resin generated annually, polyethylene has become the plastic material that is used the most globally. PE makes up nearly 34% of all polymer produced globally. The production of polyethylene is expected to be 22.67 million metric tonnes. An extensive selection of packaging materials, such as bags, wraps, pouches, and sacks, are able to be manufactured by moulding polyethylene films.

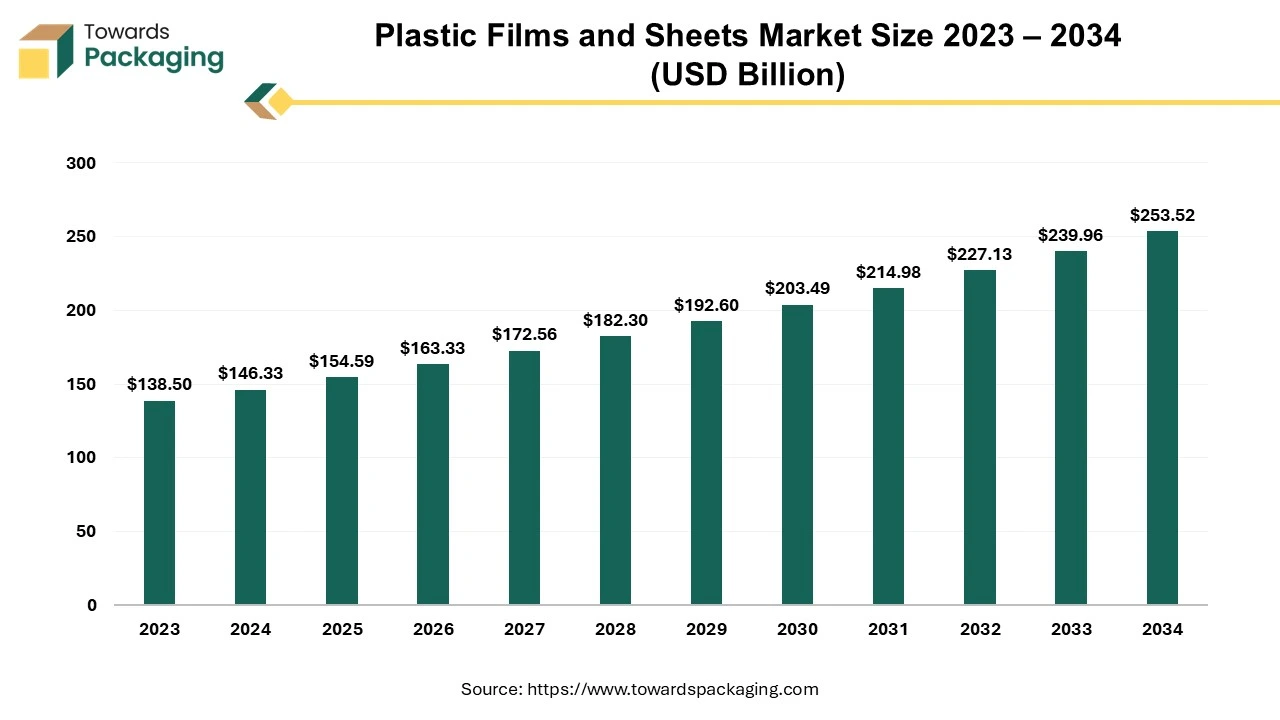

The plastic films and sheets market is expected to increase from USD 154.59 billion in 2025 to USD 253.52 billion by 2034, growing at a CAGR of 5.65% throughout the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing plastic films and sheets which is estimated to drive the global plastic films and sheets market over the forecast period.

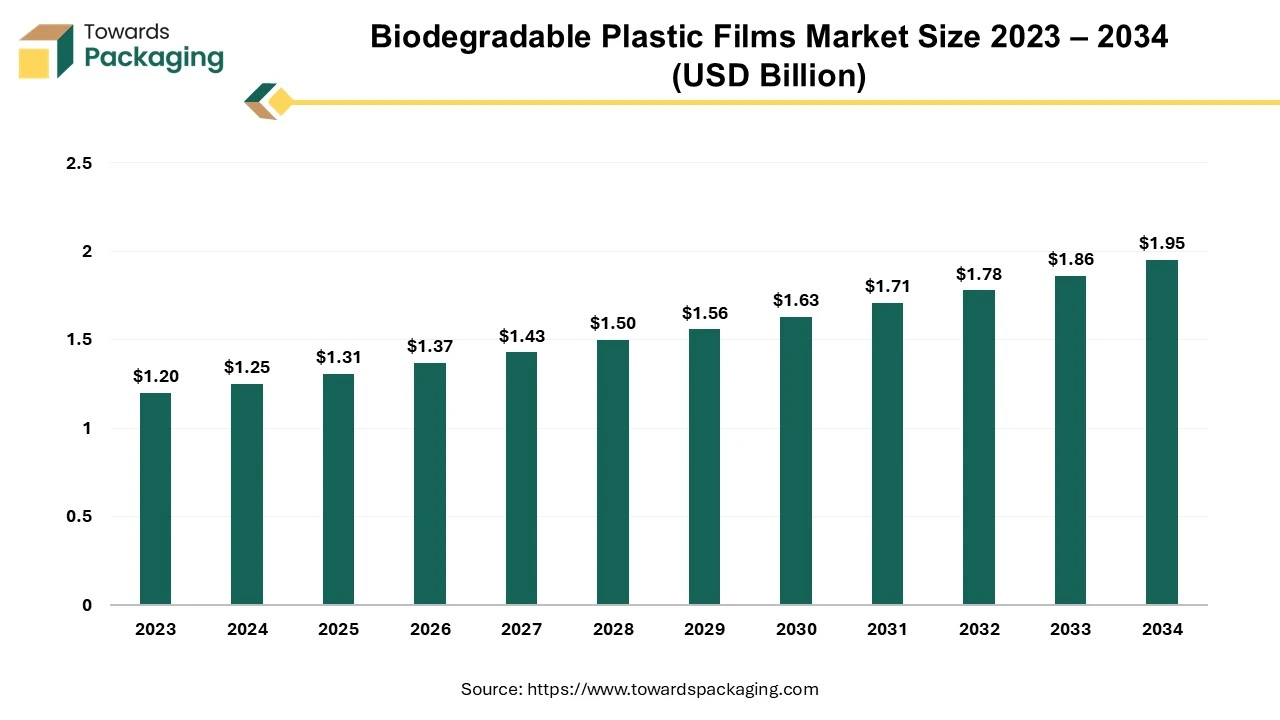

The biodegradable plastic films market is predicted to expand from USD 1.31 billion in 2025 to USD 1.95 billion by 2034, growing at a CAGR of 4.50% during the forecast period from 2025 to 2034. The biodegradable plastic films market continues to grow owing to the demand of harmless packaging materials, especially from the food and beverages sector. The end result of biodegradable films is less harmful to the environment than regular plastic bags.

The biodegradable plastic film market is growing rapidly as it offers the material that caters the demand that required products that cause less carbon emission. The materials used to make biodegradable films are plant-based, and the carbon footprint of the composting process is very low. Plastics are widely used in the production of packaging products due to their quality and ease of production. Biodegradable plastics use natural products; therefore, using bioplastics can reduce environmental damage by reducing petroleum use.

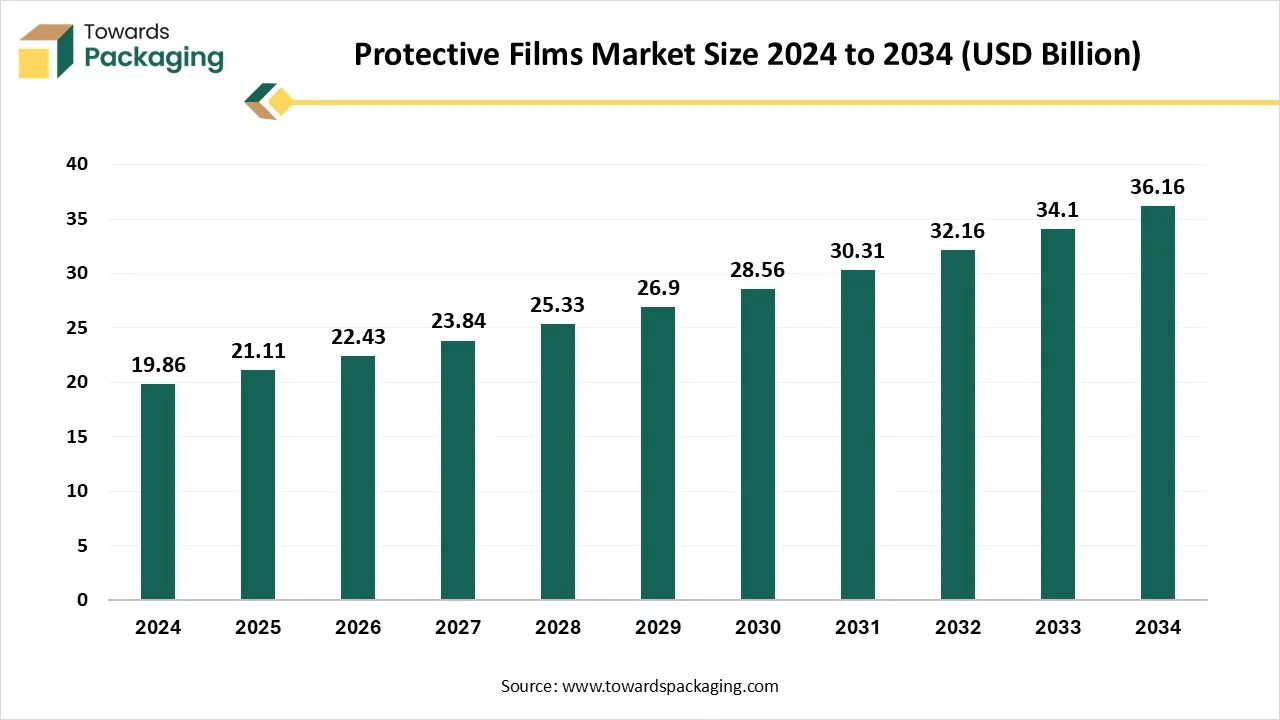

The protective films market is forecast to grow from USD 21.11 billion in 2025 to USD 36.16 billion by 2034, driven by a CAGR of 6.27% from 2025 to 2034. They are utilized in both exterior and interior automotive elements to prevent scratches, dust, and inventory at the time of transport and assembly. The growth in electric vehicle manufacturing further grows this demand due to high-level and sensitive componentry.

Protective films are important materials utilized across different industries to protect surfaces during storage, manufacturing, installation, and transportation. These films are crafted to prevent scratches, stains, and different kinds of damage, which ensures that products maintain their functional and aesthetic integrity. They are even known as surface protection film or temporary protective film, which is a thin layer of protective material applied to surfaces to protect them from different damage.

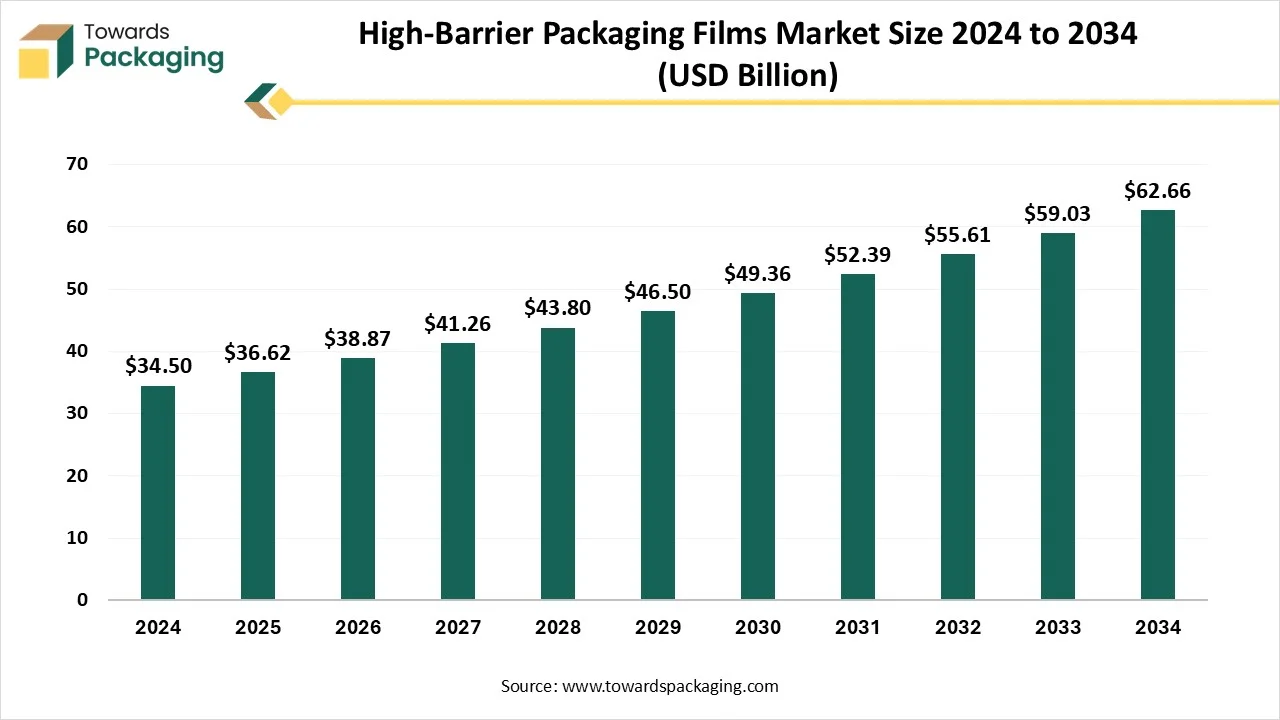

The high-barrier packaging films market is projected to reach USD 62.66 billion by 2034, expanding from USD 36.62 billion in 2025, at an annual growth rate of 6.15% during the forecast period from 2025 to 2034. The rising demand for enhanced protection of the perishable products from ecological adversities such as light, moisture, and oxygen has evolved the demand for market.

The high-barrier packaging films market refers to advanced multilayer films designed to provide superior protection against moisture, oxygen, light, and other external contaminants that can compromise product quality and shelf life. These films are widely used in food and beverages, pharmaceuticals, electronics, and industrial packaging, where product integrity and extended freshness are critical. Materials include plastic polymers, aluminum, and bio-based layers, often combined through co-extrusion, lamination, or metallization processes. Growth is driven by rising demand for packaged and convenience foods, stricter regulations on product safety, and consumer preference for longer shelf-life goods. Innovations such as recyclable high-barrier films, bio-based materials, and smart barrier technologies are reshaping the market, with Asia Pacific and North America emerging as key demand centers.

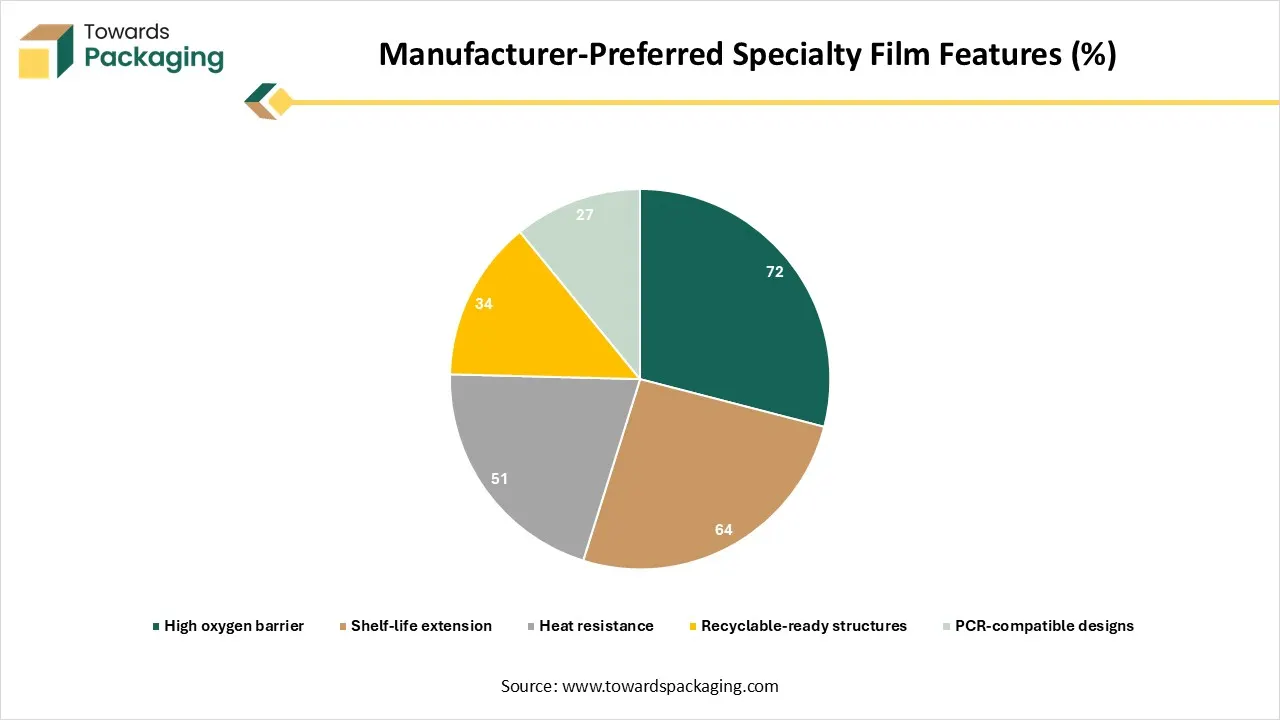

| Feature | Adoption |

| High oxygen barrier | 72 |

| Shelf-life extension | 64 |

| Heat resistance | 51 |

| Recyclable-ready structures | 34 |

| PCR-compatible designs | 27 |

By Material

By Product

By End Use

By Region

January 2026

January 2026

January 2026

January 2026