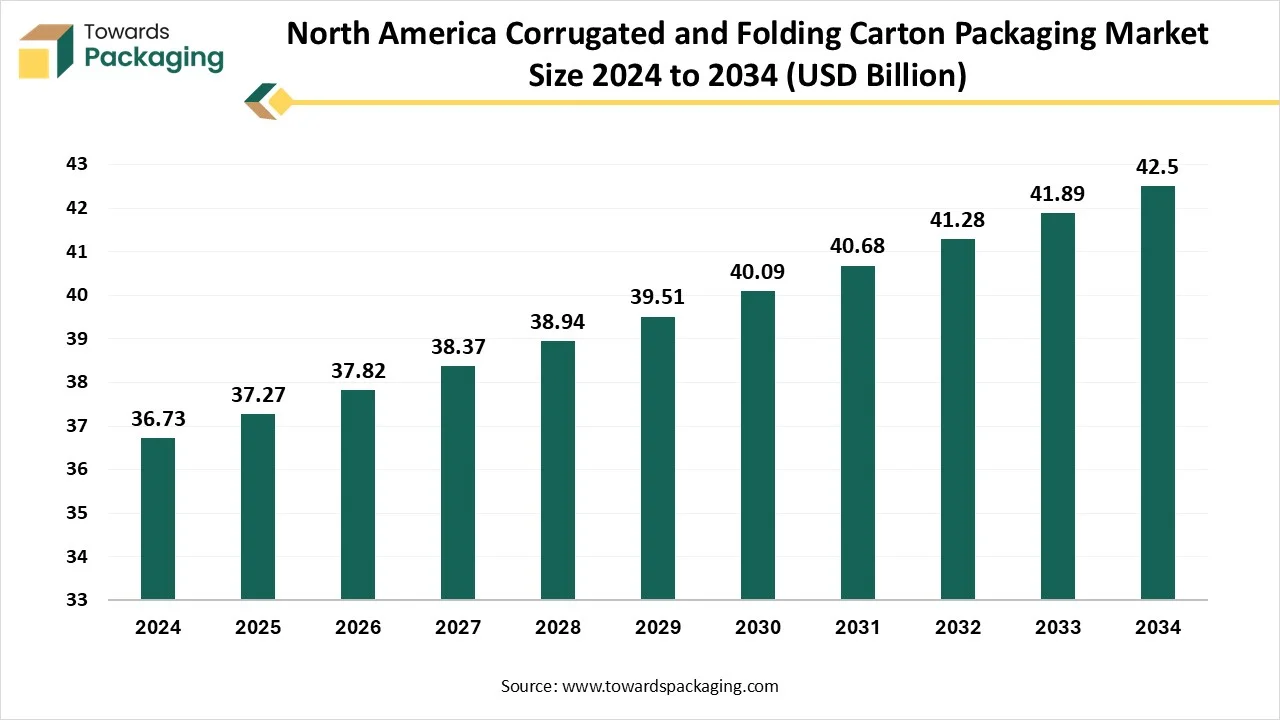

The north america corrugated and folding carton packaging market is forecasted to expand from USD 37.82 billion in 2026 to USD 43.13 billion by 2035, growing at a CAGR of 1.47% from 2026 to 2035. This report provides a detailed overview of market trends, segmentation by type and end-user industry, and regional insights across the U.S. and Canada. It also includes an in-depth analysis of top players such as International Paper Company, Packaging Corporation of America, WestRock Company, and Smurfit Kappa Group, covering their products, market capitalization, and strategic initiatives. The study further explores value chain dynamics, trade data, and the adoption of advanced technologies like AI, digital printing, and sustainable packaging solutions.

Corrugated and folding carton packaging are two widely used paper-based packaging types serving distinct purposes. Corrugated packaging is manufactured from corrugated fiberboard with three layers: an outer liner, an inner liner, and a fluted medium in between. It is strong, impact-resistant, and ideal for transporting heavy or fragile items in industries like e-commerce, logistics, and manufacturing. In contrast, folding carton packaging is crafted from paperboard that is printed, cut, and folded to form lightweight boxes used in retail packaging for products like food, cosmetics, and pharmaceuticals. Folding cartons offer high-quality printing surfaces for branding, but are not suited for heavy loads. While corrugated boxes focus on protection and durability, folding cartons prioritize visual appeal and convenience. Both types are recyclable and contribute to eco-friendly packaging solutions across different industries.

The North America corrugated and folding carton packaging market is driven by the advanced infrastructure supporting the packaging and robust end-use industry in the region. The North America region has a well-developed manufacturing and packaging ecosystem, with advanced machinery, digital printing, and automation widely adopted. This allows for efficient production, quick turnaround, and high-quality customized packaging. With highly organized warehousing, shipping, and last-mile delivery systems, the region supports large-scale production and distribution of corrugated packaging to meet the growing e-commerce and retail needs.

| Metric | Details |

| Market Size in 2025 | USD 37.27 Billion |

| Projected Market Size in 2035 | USD 43.13 Billion |

| CAGR (2026 - 2035) | 1.47% |

| Market Segmentation | By Type and By End-User Industry |

| Top Key Players | International Paper Company, Packaging Corporation of America, WestRock Company, Smurfit Kappa Group |

Recycling rates exceed 96%, with heavy investment in recycled fiber and lightweight board solutions (e.g., <26 lb MSF grades), aligned with circular economy goals. Folding cartons see a push toward eco-friendly, lightweight paperboard using technologies like Stora Enso’s FiberLight.

Automated fit-to-product and box-on-demand systems are rising to reduce over-packaging and optimize logistics. Fulfillment centers are adopting just-in-time production, minimizing storage costs while quickly fulfilling order-specific packages.

Corrugated packs integrate QR codes, RFID, NFC, and sensors for real-time traceability, tamper detection, and freshness monitoring. Food and pharma sectors are especially adopting smart packaging for safety and consumer engagement.

Digital print-on-demand allows vibrant, short-run graphics directly on corrugated surfaces no labels needed. Folding cartons benefit from high-resolution printing, vibrant designs, and security features, driving premium shelf visuals.

Facilities are investing in robotic packaging lines, IoT sensors, AI-driven production optimization, and reinforcement learning for robotic handling. ERP and production software (e.g., Amtech/Peak Rock/ Vista acquisition) are being adopted widely to manage complex supply chains.

Double- and triple-wall corrugated boxes are increasingly used for heavy, moisture-sensitive, or temperature-critical goods like food, medical, and industrial equipment. Barrier coatings (water, antimicrobial, biodegradable) enhance performance in the cold-chain and food packaging sectors.

AI integration is transforming the corrugated and folding carton packaging industry by enhancing efficiency, precision, and sustainability. In manufacturing, AI-powered systems optimize machine performance, predict maintenance needs, and reduce downtime through predictive analytics. In design, AI enables rapid prototyping of custom packaging by analyzing product dimensions, weight, and fragility, generating optimal packaging structures automatically. For folding cartons, AI improves print quality and alignment, ensuring consistent branding in high-speed production. AI also streamlines inventory and supply chain management, using real-time data to forecast demand, reduce waste, and avoid overproduction. In smart packaging, AI can integrate with sensors to monitor product conditions like temperature or tampering, especially useful in the food and pharma sectors. Ultimately, AI enhances automation, personalization, cost savings, and eco-efficiency, helping packaging manufacturers meet modern demands with agility and intelligence.

Growth in Retail Sales, Consumer Goods, and a Boom in Ecommerce

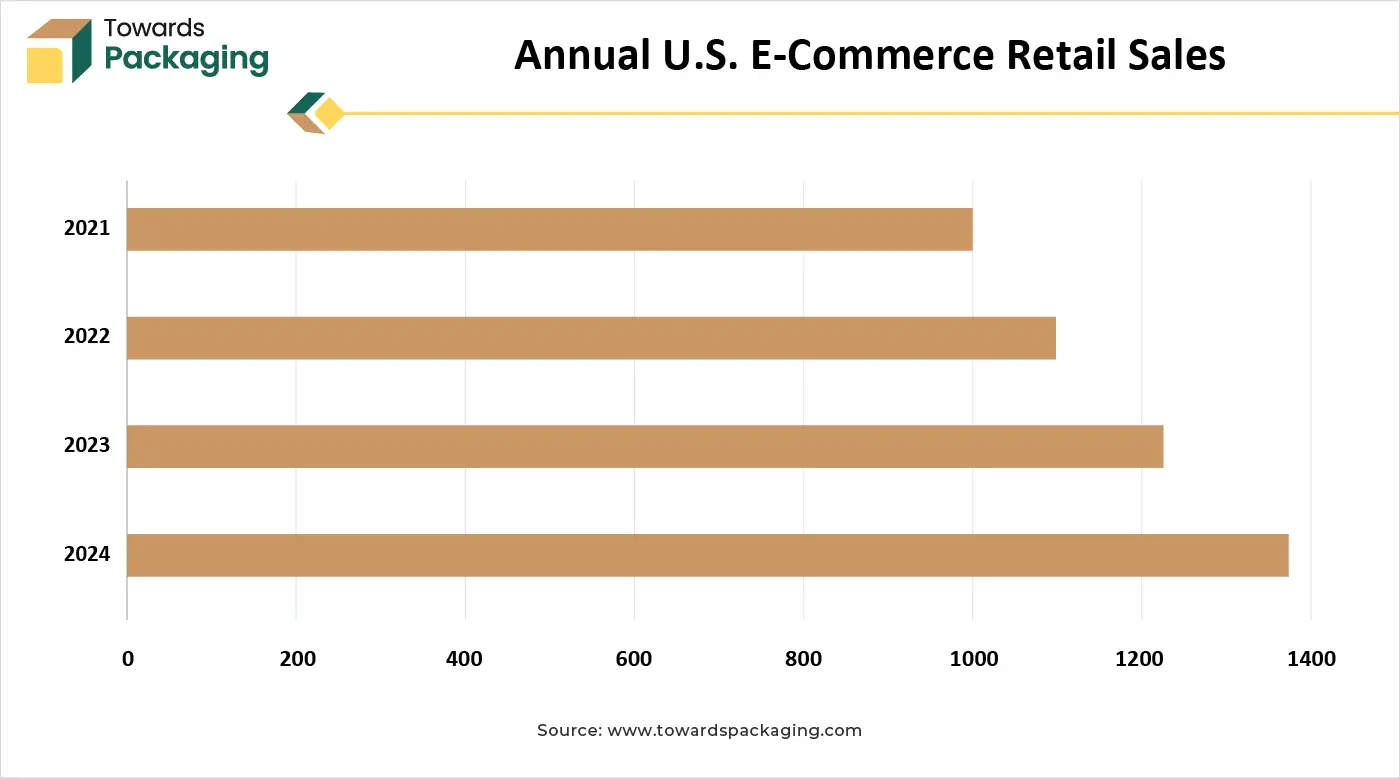

The rapid growth of e-commerce has significantly increased demand for corrugated boxes used in shipping and last-mile delivery. Consumers expect durable, protective packaging for online orders, driving demand for both custom and standard corrugated formats. Folding cartons are widely used for packaging in retail sectors such as food and beverages, cosmetics, pharmaceuticals, and electronics. Growing consumption of these products boosts the need for lightweight, printable, and visually appealing packaging.

According to the data published by the American E-Commerce Association (AEA), in the year 2024, retail e-commerce sales in the U.S. reached USD 1.34 trillion, a 9.24% year-over-year increase. In 2024, commerce accounted for 18.4% of total retail sales revenue, up 6.36% year over year. According to some estimates, between 2024 and 2029, U.S. e-commerce revenue will rise by 55.4% overall, or an average yearly rate of 11.1%. In December 2024, the monthly record for online purchases in the U.S. was 21.2% of retail sales dollars. Twenty percent of the global fashion e-commerce market is based in the U.S. In 2024, apparel e-commerce sales in the U.S. reached USD 145.2 billion, or 21.4% of all online sales.

Recycling Infrastructure Limitations and Competition from Alternative Materials

The key players operating in the market are facing restrictions due to competition from alternative materials and recycling infrastructure limitations. Corrugated and paperboard packaging is less durable in wet or humid environments, making it unsuitable for certain applications like frozen foods or outdoor transport unless coated, which adds cost and reduces recyclability. Rigid plastics, Corrugated and Folding Carton Packaging, and metal containers often offer better barrier properties, longer shelf life, and durability, especially for liquids, chemicals, or extended storage needs, posing strong competition.

With increasing demand for eco-friendly packaging, there is a major opportunity to develop 100% recyclable, compostable, and biodegradable cartons and corrugated solutions. Brands are seeking alternatives to plastic, boosting demand for sustainable fiber-based packaging.

As consumers prioritize convenience, health, and hygiene, demand for packaged foods, over-the-counter medications, and wellness products is rising. This drives the need for folding cartons that are lightweight, tamper-evident, and printable.

There is growing potential in smart packaging with embedded technologies like QR codes, sensors, and RFID, which improve tracking, enhance consumer interaction, and ensure product authenticity, especially in pharma and food.

The single wall segment accounted for the dominant revenue share of the corrugated and folding carton packaging market in 2024. Single-wall corrugated sheets consist of one fluted layer between two linerboards, offering a good balance of lightweight structure and adequate protection. This makes them ideal for packaging consumer goods that don’t require heavy-duty protection. They are cheaper to produce than double or triple-walled sheets. Their cost-efficiency makes them suitable for mass-market retail packaging, where affordability is important without compromising on basic protection.

Single-wall sheets are more flexible and easier to die-cut and fold, which is essential for folding carton designs. They also offer a smooth surface suitable for high-quality printing and branding. Folding cartons manufactured from single-wall corrugated sheets are commonly used for packaging electronics, cosmetics, apparel, and food items, where moderate cushioning is sufficient and heavyweight protection is unnecessary. Single-wall corrugated sheets are 100% recyclable and biodegradable, aligning with growing consumer and regulatory demands for sustainable packaging. Their thinner profile also means less material use and a lower carbon footprint during shipping.

The food segment dominates the market due to high demand for branding and customization capability. Corrugated packaging provides structural strength and cushioning, protecting food items from physical damage, moisture, and contamination during transit and storage. Folding cartons are ideal for lightweight, shelf-ready food products. Corrugated boxes are widely used for fresh produce, frozen meals, bakery items, and bulk groceries due to their ability to regulate airflow, absorb moisture, and withstand refrigeration and freezing conditions with coatings. Folding cartons offer excellent print surfaces for product branding, nutritional labeling, and marketing messages. This enhances shelf appeal and brand recognition, especially in competitive food categories.

The E-commerce segment is growing rapidly due to the explosion of online shopping and a focus on the unboxing experience. The surge in online retail and direct-to-consumer (D2C) brands has drastically increased the demand for corrugated and folding carton packaging, which is essential for shipping, product protection, and branding in e-commerce. Corrugated boxes provide durable, impact-resistant protection, making them ideal for shipping a wide range of items, from electronics and clothing to food and cosmetics. Their strength reduces product damage during delivery. E-commerce brands use custom-printed folding cartons and corrugated mailers to enhance the unboxing experience, reinforce brand identity, and create a memorable first impression for online customers. E-commerce packaging is increasingly incorporating QR codes, trackers, and smart labeling, especially in pharmaceuticals and luxury goods. Corrugated cartons easily support these technologies.

The U.S. corrugated and folding carton packaging market is growing due to its mature packaging industry, rapid e-commerce growth, and high consumer spending. Home to global retail and tech giants like Amazon, Walmart, Apple, and Target, the country sees massive demand for corrugated boxes for shipping and folding cartons for consumer goods. The booming food delivery, pharmaceutical, and cosmetics sectors also rely heavily on paper-based packaging. Additionally, strong sustainability initiatives, including bans on single-use plastics in several states, are driving demand for eco-friendly carton alternatives. The U.S. also benefits from widespread adoption of automation, digital printing, and AI technologies in packaging design and production, enhancing output quality and speed.

Canada plays a key role in the North America region’s leadership with its strict environmental regulations and increasing consumer preference for suitable packaging. Canadian brands and retailers are rapidly shifting from plastic to biodegradable and recyclable corrugated and carton options, especially in food and beverage packaging. The country’s growing agriculture, frozen food, and health product sectors drive high usage of corrugate packaging for both domestic use and exports. Canada’s well-developed infrastructure and government incentives for green technology adoption also support its strong position in the paper-based packaging segment.

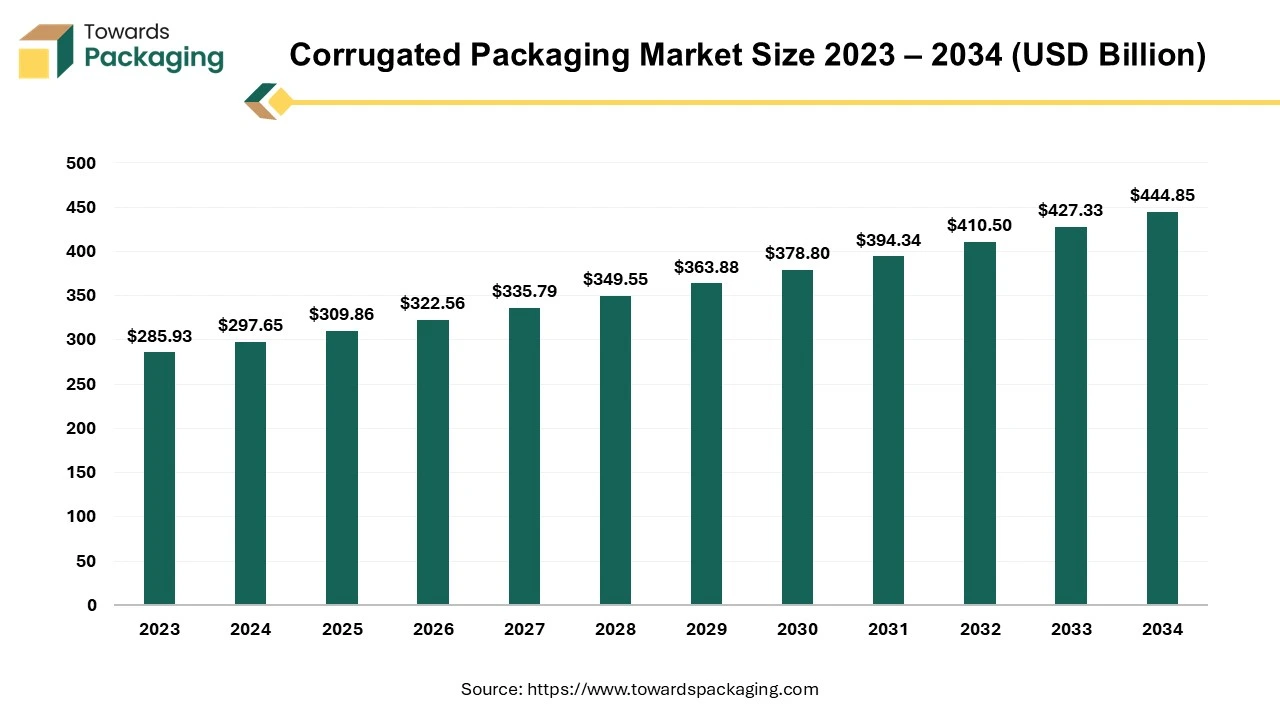

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

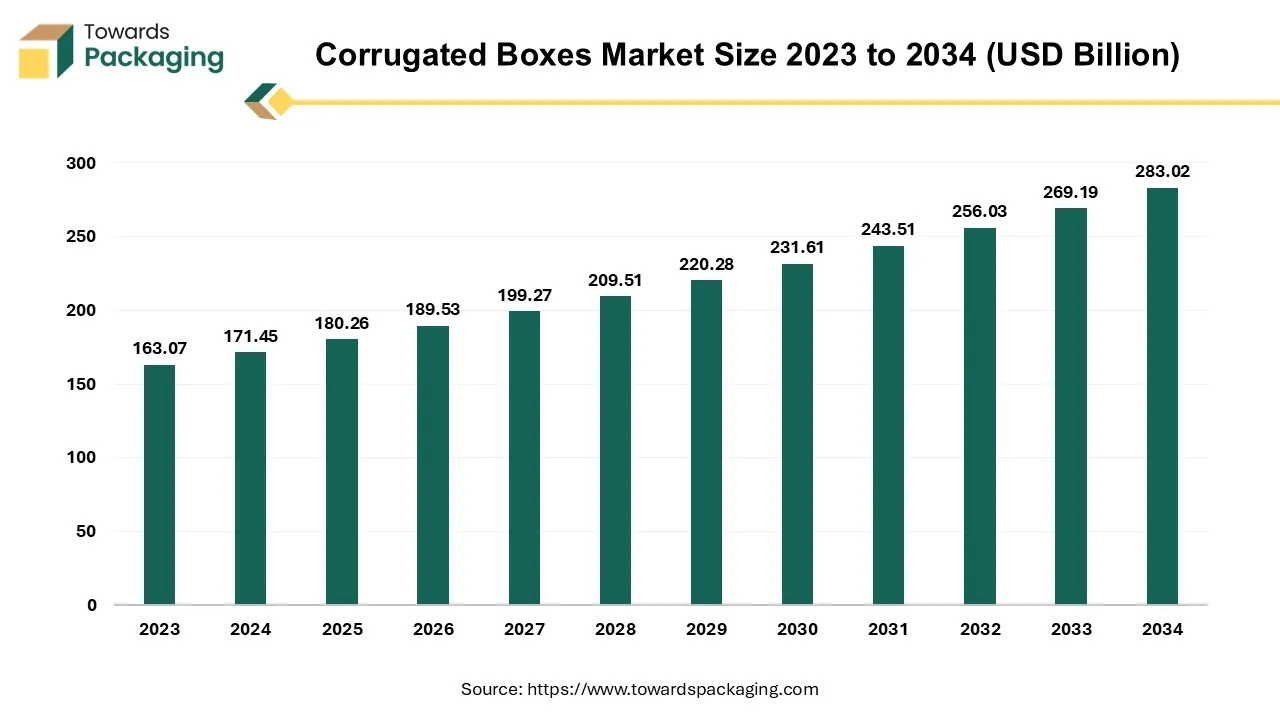

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

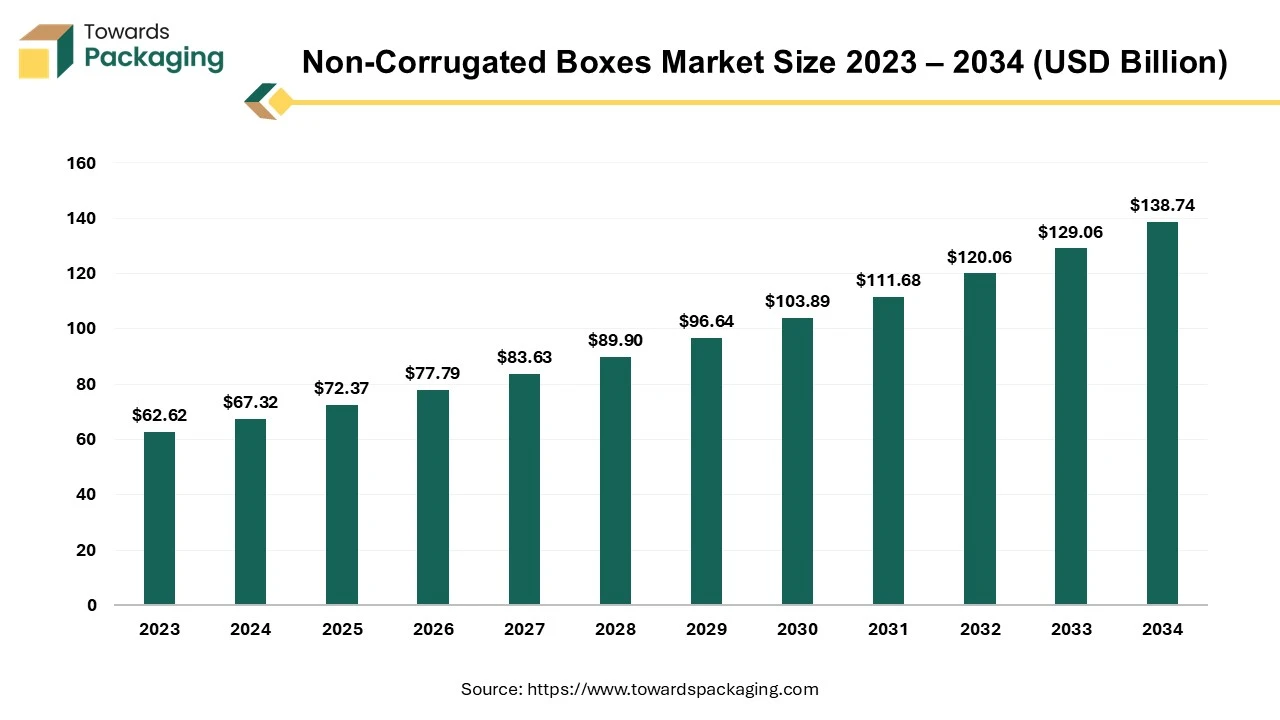

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

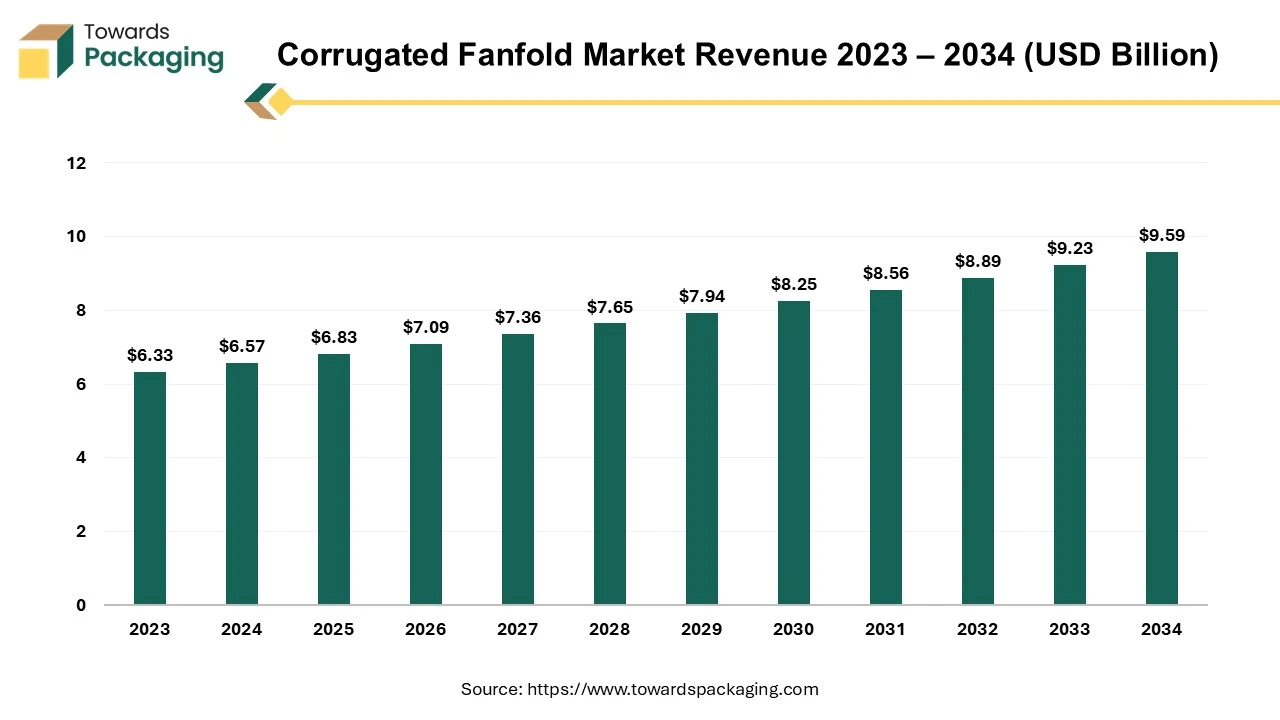

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

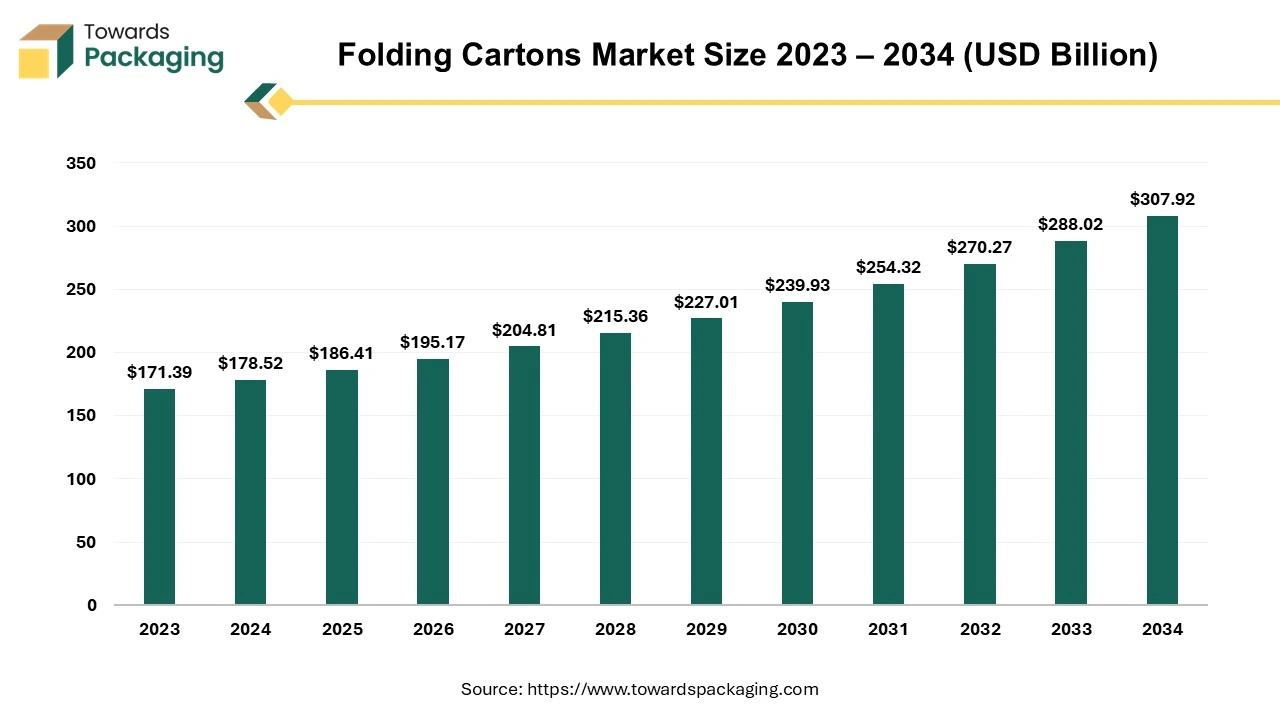

The global folding cartons market is estimated to reach USD 307.92 billion by 2034, up from USD 178.52 billion in 2024, at a compound annual growth rate (CAGR) of 5.46% from 2025 to 2034.

The folding cartons market is likely to register impressive growth during the projected forecast period. One of the most often used product packaging formats nowadays is the folding carton, which may be utilized for transporting almost anything. Products like electronics, food, and cosmetics are all packaged in folding cartons. Folding cartons are boxes or box sleeves developed with either single-ply paperboard or corrugated cardboard and are manufactured with the help of special machine in the required shape and size. Foldable cartons have many advantages as compared to the other methods of packaging. They can be customized to meet specific needs and are available in nearly any size and form imaginable. Additionally, they can be imprinted with unique images and writing and are available in a range of finishes. They are inexpensive to make as paperboard, a reasonably priced material, is used to make them. Also, folding cartons ship flat, this minimizes the cost of handling and shipping.

By Type

By End-User Industry

February 2026

February 2026

February 2026

February 2026