December 2025

The plastic jar packaging market is set to grow from USD 20.29 billion in 2026 to USD 30.03 billion by 2035, with an expected CAGR of 4.45% over the forecast period from 2026 to 2035. This market is growing due to increasing demand for convenient, durable, and lightweight packaging solutions across the food, cosmetics, and pharmaceutical industries. This market is dominating in the Asia Pacific region due to rising middle-class urbanization and demand for packaged foods and drinks.

The plastic jar packaging market is witnessing strong momentum, driven by an increase in demand for household goods, cosmetics, personal care, food and drinks, and medications. Plastic jars' lightweight, affordable, and long-lasting qualities make them a popular option for producers and consumers alike, and advancements in recyclable and biodegradable plastics are assisting the sector in meeting sustainability targets. Adoption is being further fueled by the rising popularity of retail-ready packaging and e-commerce, as plastic jars provide shelf appeal, ease of storage, and transportation. Nonetheless, shifting market strategies are being influenced by shifting raw material prices and mounting regulatory pressure on single-use plastics, which is driving participants toward eco-friendly materials and circular economy models. In general, the market is developing as a combination of affordability, sustainability, and usefulness, establishing plastic jar packaging as a robust and flexible sector of the worldwide packaging market.

The plastic jar packaging market is growing due to the rising demand for convenient, durable, and cost-effective packaging solutions across multiple industries, including food and beverages, cosmetics, personal care, and pharmaceuticals. Ready-to-eat and portable products are becoming increasingly popular with consumers, necessitating dependable packaging that preserves product quality and shelf life. Additionally, the demand for strong, lightweight, and impenetrable containers is being driven by the growth of e-commerce and contemporary retail channels. By satisfying consumer preferences and legal requirements for sustainable packaging design, material, and eco-friendly alternative innovations are further driving market expansion.

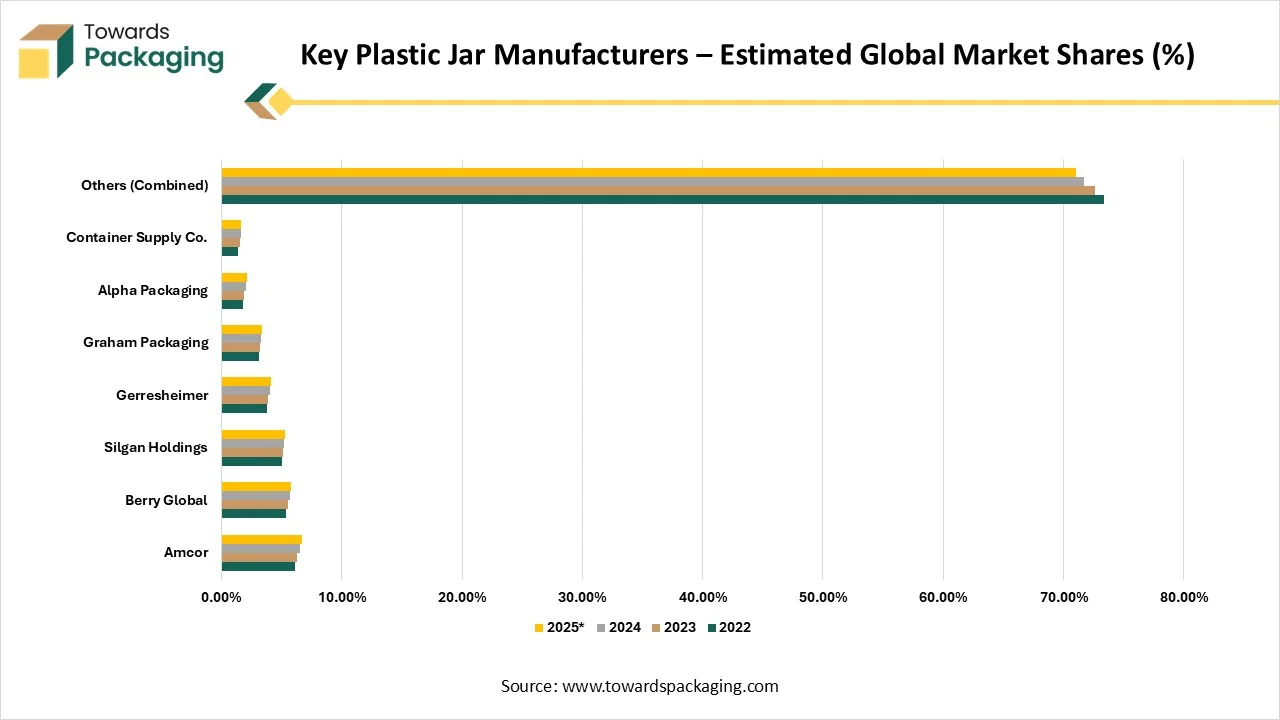

| Company | 2022 | 2023 | 2024 | 2025 |

| Amcor | 6.10% | 6.30% | 6.50% | 6.70% |

| Berry Global | 5.40% | 5.50% | 5.70% | 5.80% |

| Silgan Holdings | 5.00% | 5.10% | 5.20% | 5.30% |

| Gerresheimer | 3.80% | 3.90% | 4.00% | 4.10% |

| Graham Packaging | 3.10% | 3.20% | 3.30% | 3.40% |

| Alpha Packaging | 1.80% | 1.90% | 2.00% | 2.10% |

| Container Supply Co. | 1.40% | 1.50% | 1.60% | 1.60% |

| Others (Combined) | 73.40% | 72.60% | 71.70% | 71.00% |

Sustainability in the plastic jar packaging market is motivated by the shift to bio-based plastics, refillable formats, and recycled resins (rPET, rPP) to lessen environmental impact. Regulations about single-use plastics, recyclability, labeling food contact safety, and post-consumer recycled content requirements are becoming more stringent for manufacturers. To comply with FDA and international food safety regulations, brands are redesigning jars for mono-material structures, simpler sorting, and lower resin usage. Companies are also incorporating low-carbon manufacturing, solvent-free colorants, and closed-loop recycling partnerships in order to comply with ESG regulations and circular economy objectives. This change in regulations encourages the development of high-end, environmentally friendly plastic substitutes that preserve brand appeal.

There is a growing push toward minimalist packaging designs to reduce material consumption and waste. Companies are scaling up PCR content targets to address regional compliance requirements. Automated sorting and chemical recycling technologies are improving recovery rates and raw material quality. Brands are also exploring bio-composite resins to balance performance with environmental impact.

AI can improve the plastic jar packaging market by optimizing design, production, and distribution processes to enhance efficiency, quality, and sustainability. Generative AI and machine learning can produce jar designs that consumers prefer AI AI-driven material analysis guarantees longevity with little waste. Recalls are decreased by real-time quality control systems that identify production flaws and supply chain management driven by AI to predict demand and optimize inventory. AI also helps with sustainability initiatives by evaluating materials' life cycles to find recyclable and refillable solutions and using consumer data to enable customized packaging strategies. AI generally speeds up innovation, reduces expenses, and adapts packaging to changing environmental and consumer demands.

Rising Demand from the Food and Beverage industry

Plastic jars are widely used for packaging daily products, spreads, sauces, dry fruits, confections, and ready-to-eat meals because of their robust sealing capabilities and ease of use. People are gravitating toward packaged and portion-controlled food options due to busy lifestyles and growing urbanization. Furthermore, the trend toward single-serve and on-the-go formats is increasing demand for lightweight compact jars, which are ideal for contemporary convenience because this plastic jar packaging plays a crucial role in accommodating changing consumer dietary preferences.

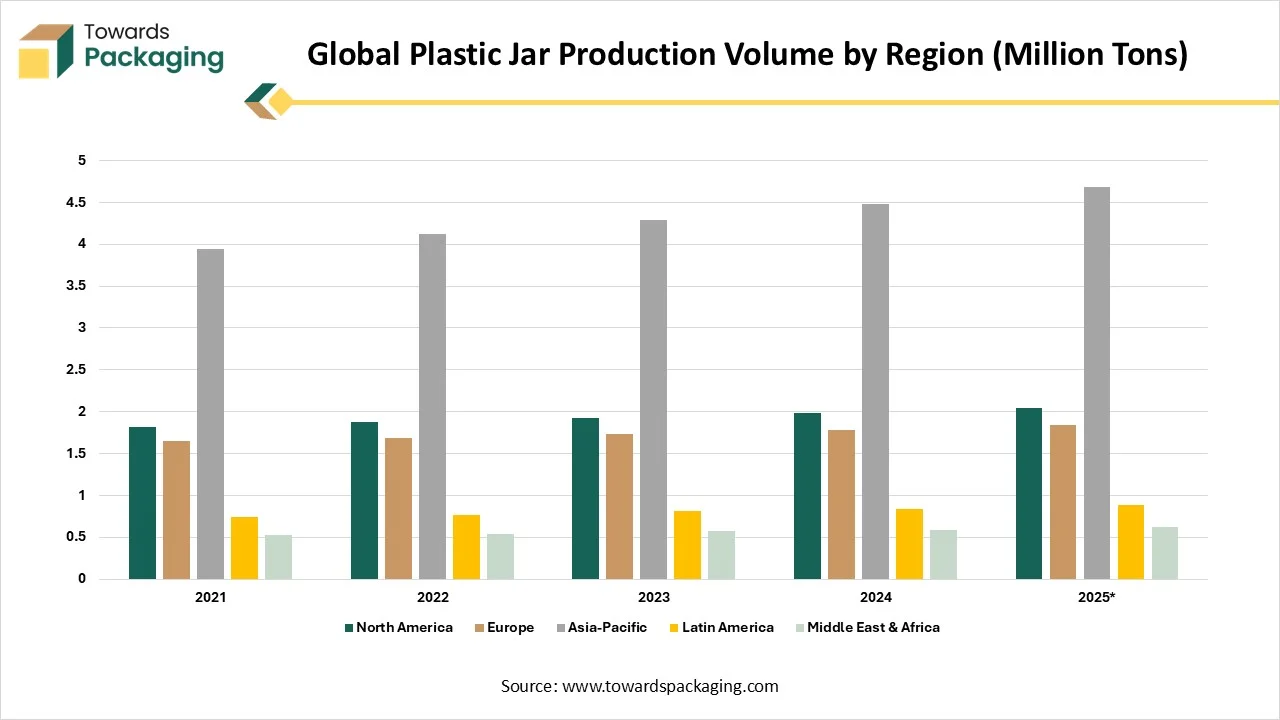

| Region | 2021 | 2022 | 2023 | 2024 | 2025 |

| North America | 1.82 | 1.87 | 1.92 | 1.98 | 2.04 |

| Europe | 1.65 | 1.69 | 1.73 | 1.78 | 1.84 |

| Asia-Pacific | 3.94 | 4.12 | 4.29 | 4.48 | 4.68 |

| Latin America | 0.74 | 0.77 | 0.81 | 0.84 | 0.88 |

| Middle East & Africa | 0.52 | 0.54 | 0.57 | 0.59 | 0.62 |

Due to the volatility of the oil market disruption in trade and geopolitical tensions, production costs are extremely sensitive to changes in the price of petroleum-based resin. Prices can rise by 15-20% in a matter of months due to abrupt increases in crude oil prices, which significantly affect manufacturers' profit margins. Due to their inability to negotiate contracts for bulk purchases, smaller businesses are especially at risk. In highly competitive consumer goods markets where margins are already narrow, these fluctuations not only complicate cost forecasting but also interfere with pricing strategies.

Markets like high-end cosmetics and fine dining frequently choose glass or metal because of their perceived sustainability and quality. These substitutes give off a more upscale, environmentally conscious vibe, which is in line with the growing demand from customers for sustainable goods. Concurrently, advancements in paper-based and biodegradable packaging are increasing the viability of non-plastic alternatives for widespread use. Plastic jars could lose ground to alternatives that are positioned as high-end and environmentally friendly, which would be a long-term competitive risk.

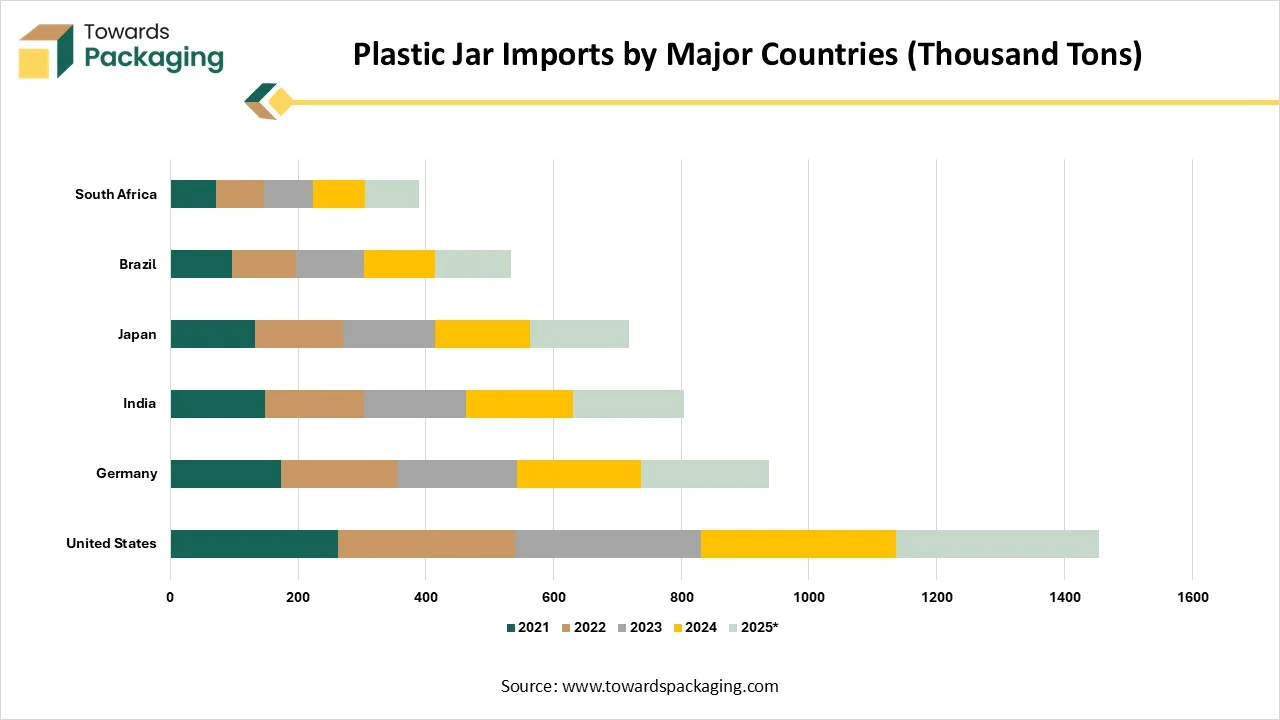

| Country | 2021 | 2022 | 2023 | 2024 | 2025 |

| United States | 262 | 278 | 291 | 305 | 318 |

| Germany | 174 | 181 | 188 | 194 | 201 |

| India | 148 | 155 | 160 | 167 | 175 |

| Japan | 132 | 138 | 144 | 149 | 155 |

| Brazil | 96 | 101 | 106 | 112 | 118 |

| South Africa | 71 | 75 | 78 | 81 | 85 |

For businesses that sell recyclable, compostable, or bio-based plastic jars, the drive toward a circular economy opens a world of opportunities. Sustainable packaging is becoming more popular, allowing brands to position their products as premium. Businesses investing in greener solutions are also receiving financial incentives from governments and non-governmental organizations, which makes it an appealing option. In the changing packaging market, this trend positions businesses that innovate in recycled PRT and biodegradable polymers as long-term winners.

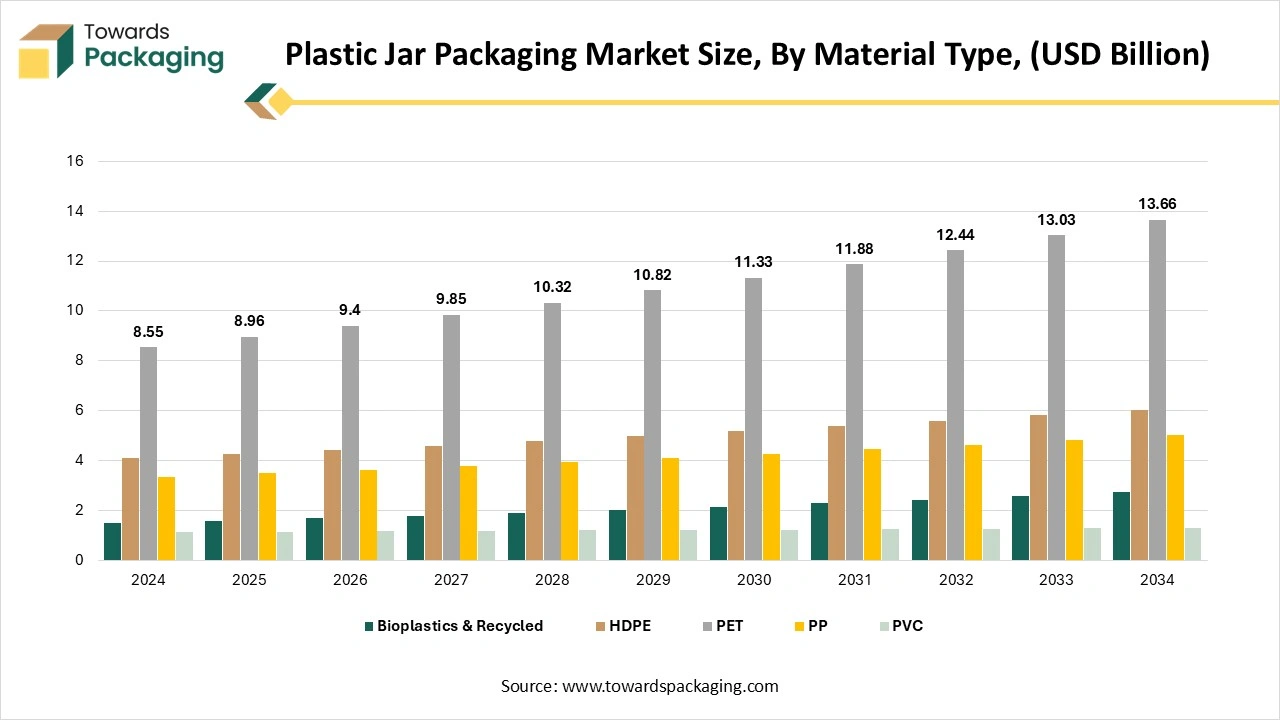

PET segment held the largest share of the market in 2024 because it is affordable, robust, and lightweight. For packaging food, drinks, cosmetics, and medications, its superior barrier qualities, high transparency, and recyclability make it the material of choice. PET jars are preferred by consumers due to their ease of use and longevity, and manufacturers appreciate their shaping and branding flexibility. PET is now the most popular material in the market for plastic jar packaging, thanks to these benefits.

Bioplastics & recycled plastics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This growth is driven by international regulatory requirements that promote eco-friendly packaging options, the growing emphasis on sustainability, and circular economy principles. Throughout the forecast period, the demand for this segment is anticipated to increase due to rising consumer awareness of the need to reduce plastic waste and the growing use of recycled packaging by food and FMCG companies.

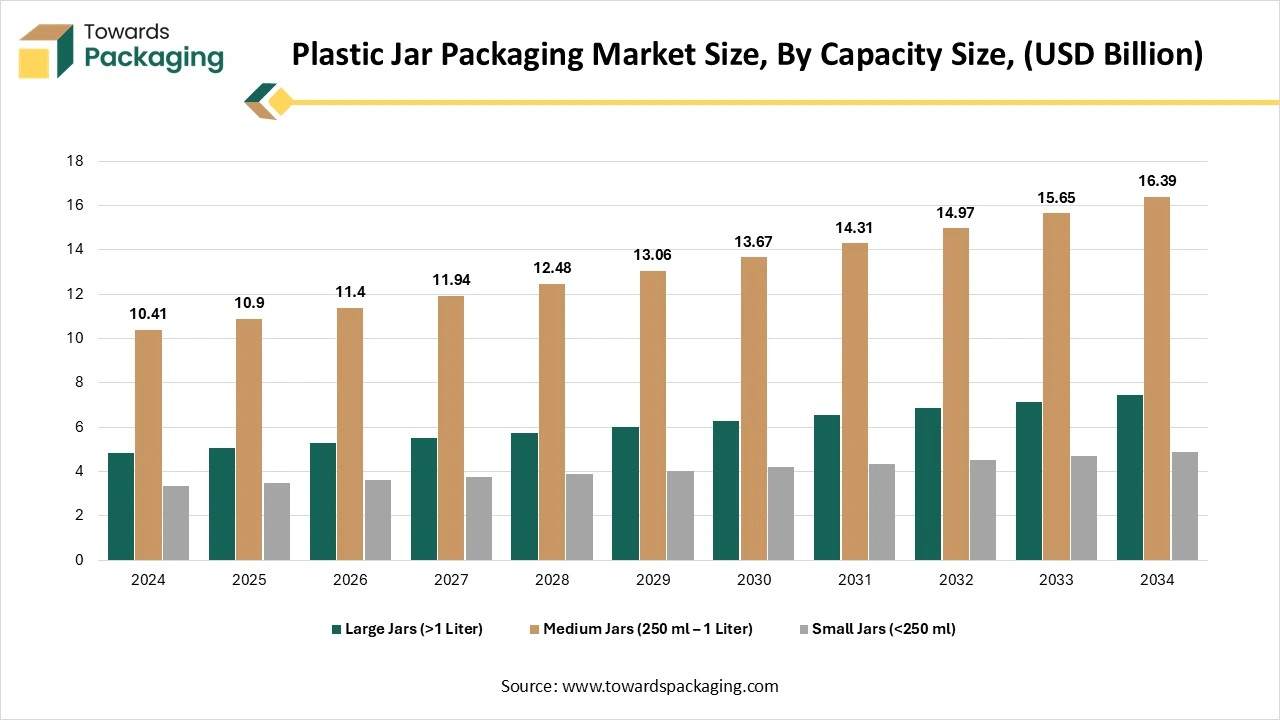

Medium jars (250 ml-1l) segment held the largest share of the market in 2024, because they provide the ideal ratio of storage space to portability. These jars are widely used in the packaging of food and drink items like sauces, spreads, and powders, as well as personal care items like creams and gels. They offer consumers convenience and manufacturers' efficiency. Their dominance has been solidified by their adaptability and appropriateness for both domestic and commercial applications.

Small jars (<250 ml, for nutraceuticals & cosmetics) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Smaller single-use travel-friendly packaging formats are becoming increasingly popular due to the increased demand for skincare, cosmetics, health supplements, and nutraceuticals. In the upcoming years, this market is expected to grow quickly due to rising consumer demand for premium and sample-sized packs, particularly through retail and e-commerce channels.

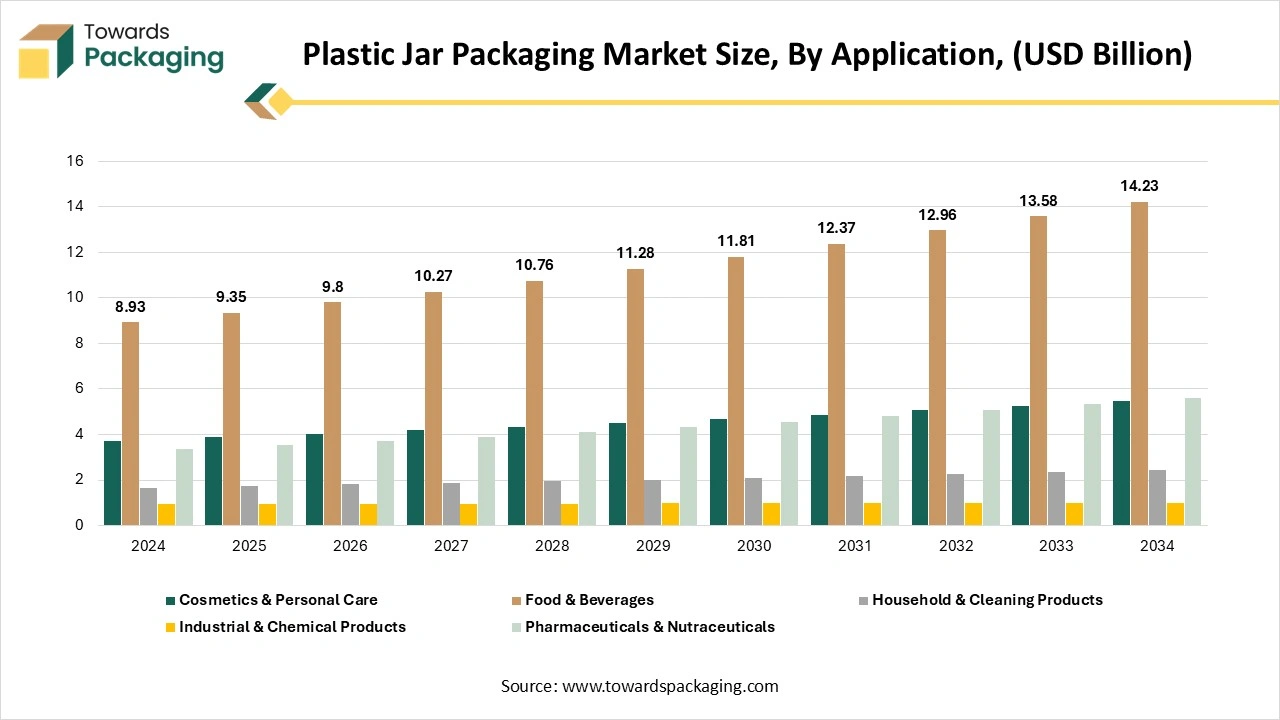

Food & beverages segment held the largest share of the market in 2024, motivated by the requirement for dependable, affordable, and lightweight packaging options. With their strong resistance to oxygen and moisture and long shelf-life, plastic jars are frequently used to package jams, sauces, pickled candies, instant mixes, and ready-to-eat foods. Their popularity in this market was further increased by their clarity and manageability.

Nutraceuticals & personal care segment is expected to grow at the fastest rate in the market during the forecast period, because of growing dietary supplement demand, growing health consciousness, and rising skincare and cosmetic product consumption. To meet this demand, plastic jars provide an appealing design, easy dispensing, portion control, and user convenience, which makes them a great option for producers aiming to reach upscale and specialized markets.

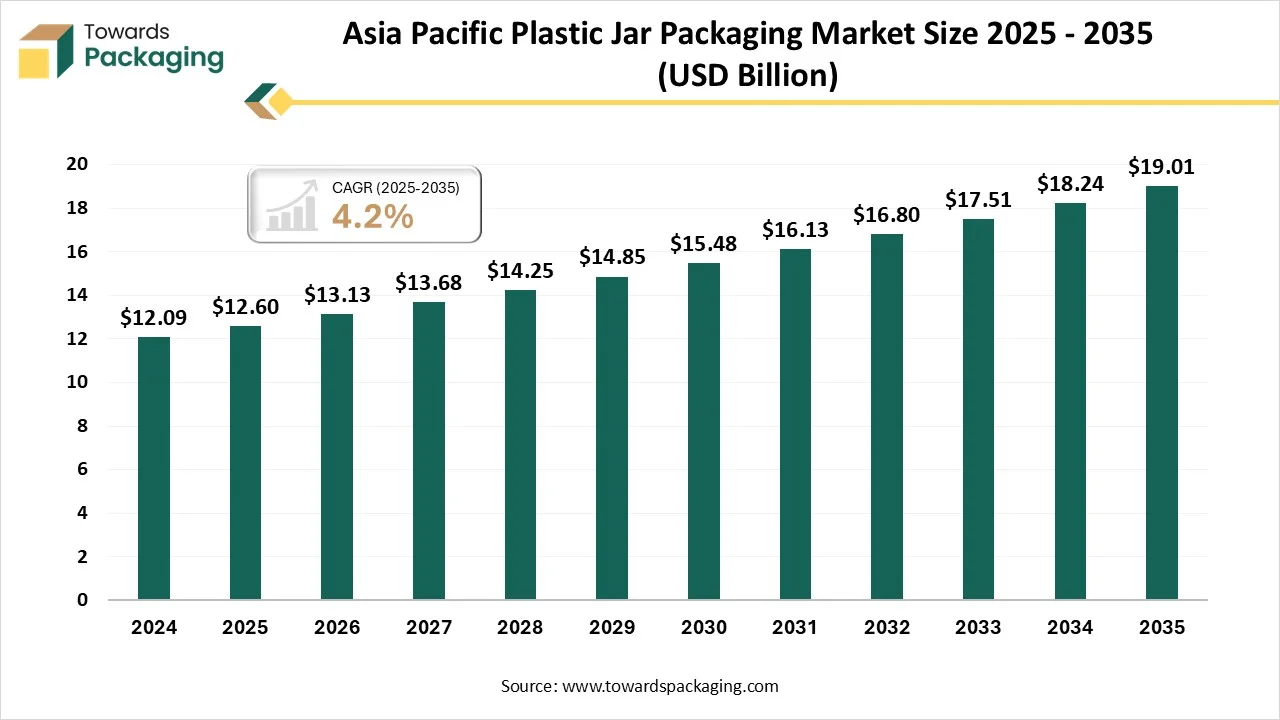

Asia Pacific led the plastic jar packaging market in 2024, encouraged by the growing middle-class urbanization and demand for packaged foods and drinks. The expansion of retail and e-commerce channels, coupled with higher disposable incomes, has further strengthened the region's leadership in the market.

The main trend in plastic jar packaging in India is a rigid urge for the durable, lightweight, and smooth containers linked with rising encouragement for compliance and sustainability with the government regulations and the plastic use. The growth of e-commerce is a main driver of the reliability of plastic jars. A developing middle class, bigger incomes, and rising urbanization are driving the urge for packaged user goods that include plastic jars.

The Indian government has revealed new regulations to craft the single-use plastics and include the Extended Producer Responsibility (EPR) rules for plastic packaging. These guidelines market the circular economy by pushing the usage of packaging that is recyclable, reusable, or compostable.

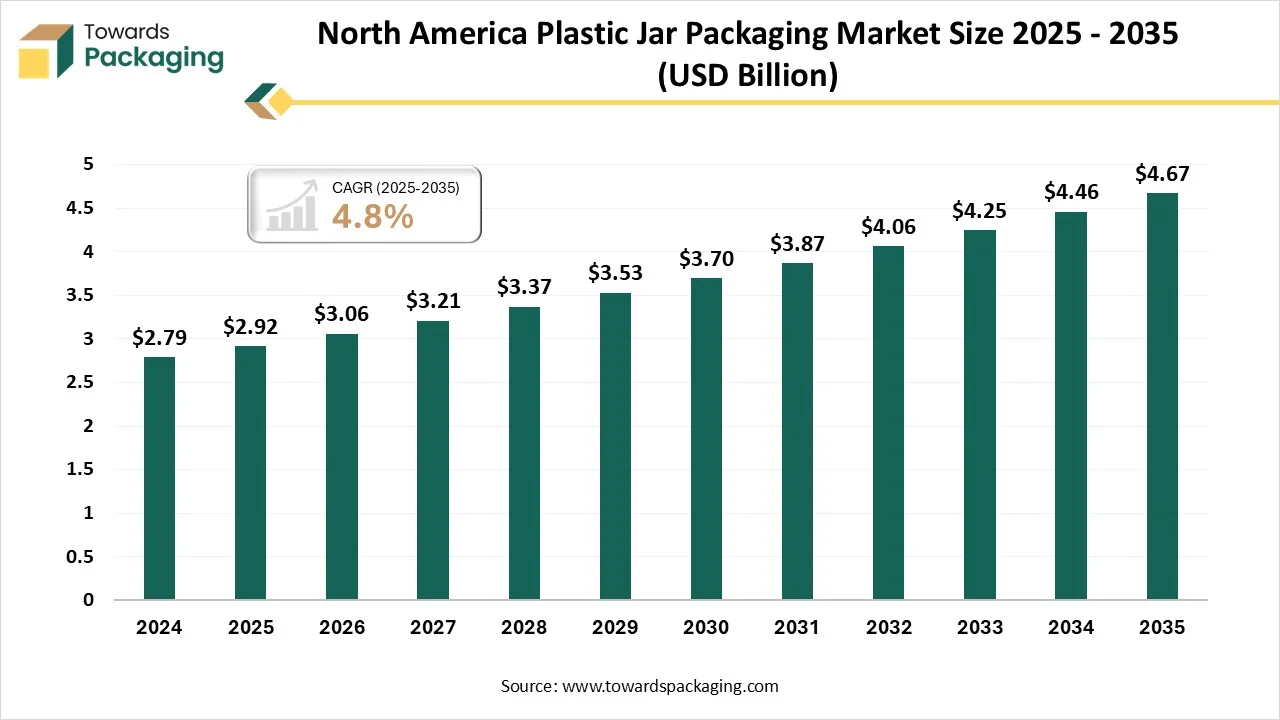

North America is expected to grow at the fastest pace during 2025 to 2034. The region’s growth is driven by stringent sustainability regulations, greater adoption of recycled and eco-friendly packaging materials, and rising demand for nutraceuticals and premium food packaging. Strong innovation capabilities among packaging companies will continue to accelerate market expansion.

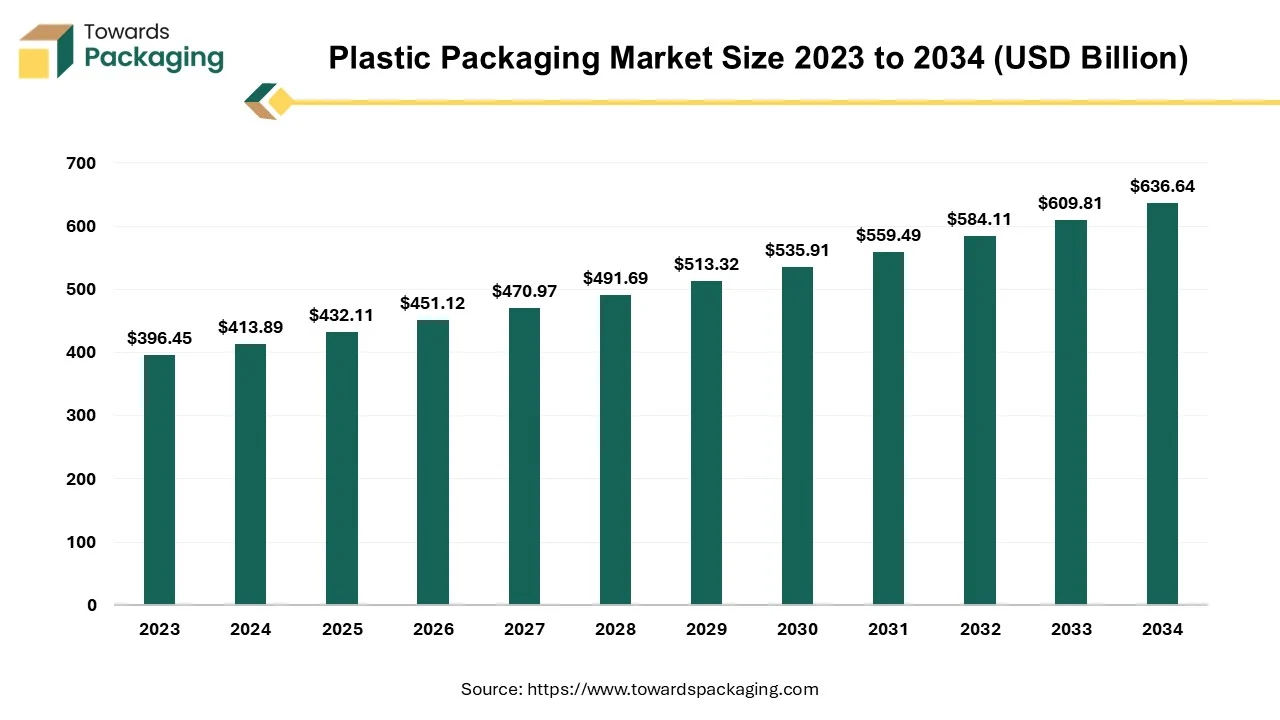

The plastic packaging market is projected to grow from USD 432.11 billion (2025) to USD 636.64 billion (2034) at 4.4% CAGR. Our report covers segment data (materials: PET leading in 2024; products: rigid leading; technologies: extrusion leading; applications: food & beverages leading), regional analysis across NA, EU, APAC, LA, MEA (with APAC dominating 2024 and North America set for strong growth), company profiles, competitive analysis, value chain mapping, trade statistics, and a manufacturers & suppliers database. We also quantify key adjacencies: Flexible Plastic Packaging (USD 205.76B 2025 to USD 319.20B 2034, 5.0% CAGR), Rigid Plastic Packaging (USD 351.69B 2025 to USD 614.65B 2034, 6.4% CAGR), Molded Plastic Packaging (USD 294.7B 2025 to USD 450.55B 2034, 4.83% CAGR), Pharmaceutical Plastic Packaging (USD 62.43B 2025 to USD 110.97B 2034, 6.6% CAGR), Single-Use Plastic Packaging (USD 4.85B 2025 to USD 8.13B 2034, 5.90% CAGR).

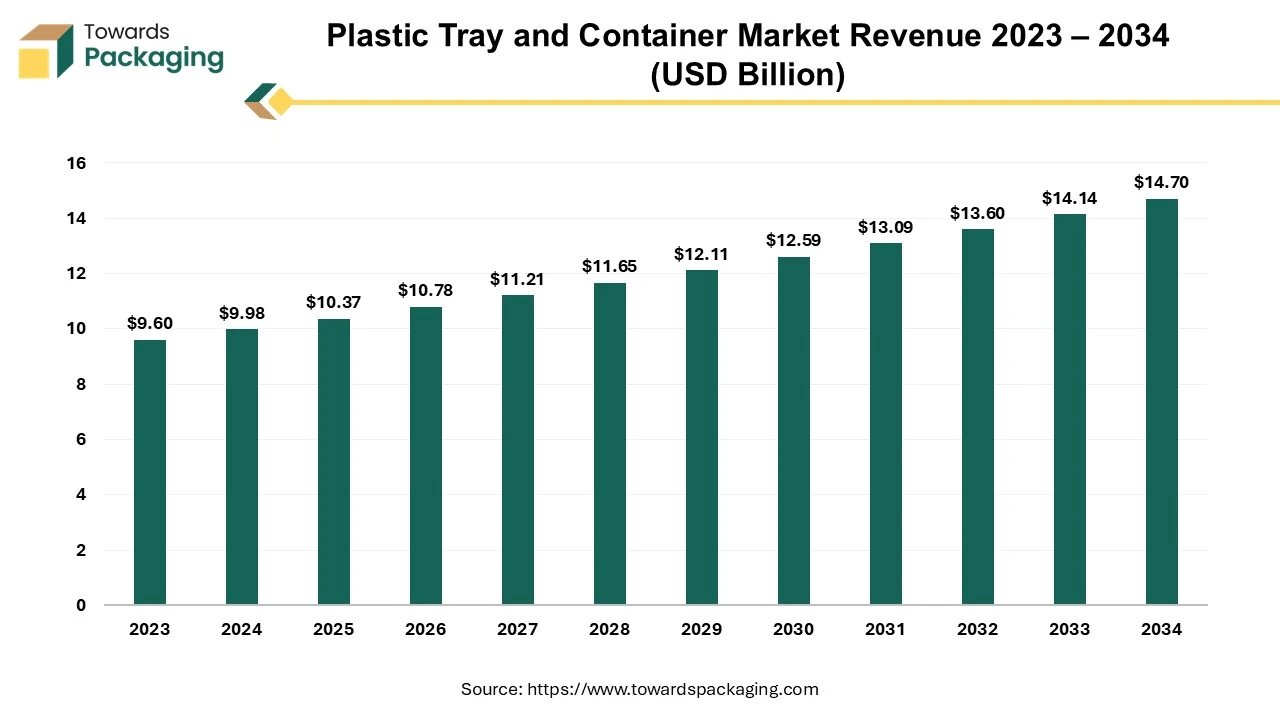

The plastic tray and container market is forecasted to expand from USD 10.37 billion in 2025 to USD 14.70 billion by 2034, growing at a CAGR of 3.95% from 2025 to 2034.

The market is proliferating due to the increasing business retail market of food& beverage, healthcare services, horticulture, e-commerce, personal care & cosmetics, hotels & cafes, catering, offices, bakeries, and many others which require plastic trays and containers for storage, packaging and delivery purposes. The growing trend of online ordering facilities is boosting the plastic tray and container market.

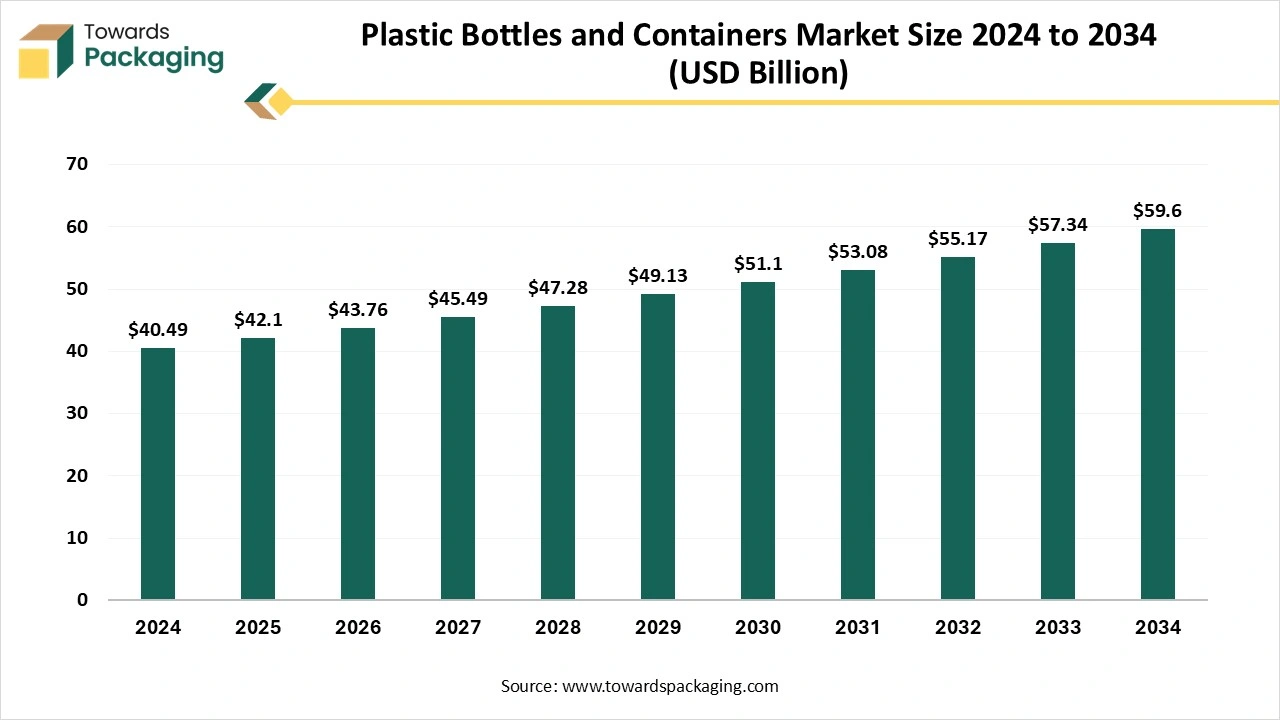

The plastic bottles and containers market is set to grow from USD 42.1 billion in 2025 to USD 59.6 billion by 2034, with an expected CAGR of 3.94% over the forecast period from 2025 to 2034.The growing demand for packaged food products has raised the demand for high-quality bottles and containers, which are lightweight and easy to store without leakage, increasing the demand for the plastic bottles and containers market. The growing concern for the usage of recyclable and bio-based packages has influenced the demand for plastic bottles and containers.

polyethylene (HDPE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS) are the main raw materials utilized in the plastic jar packaging industry. Recycled plastics are also being used more to cut expenses and achieve sustainability goals. The sourcing of raw materials is essential for guaranteeing longevity, clarity, and adherence to safety regulations for food.

Components in this market include preforms, closures, lids, and labels, which are essential for offering strength, transparency, and customizable designs. Advanced injection molding and blow molding techniques are widely used to create lightweight yet durable jars suitable for food, beverages, cosmetics, and pharmaceuticals.

Plastic jar packaging’s lightweight, shatter-resistance, and cost-effectiveness make it ideal for global trade and e-commerce distribution. Its protective qualities ensure product integrity during transportation and storage. Efficient distribution channels, including wholesale, retail, and online platforms, significantly drive the market’s growth.

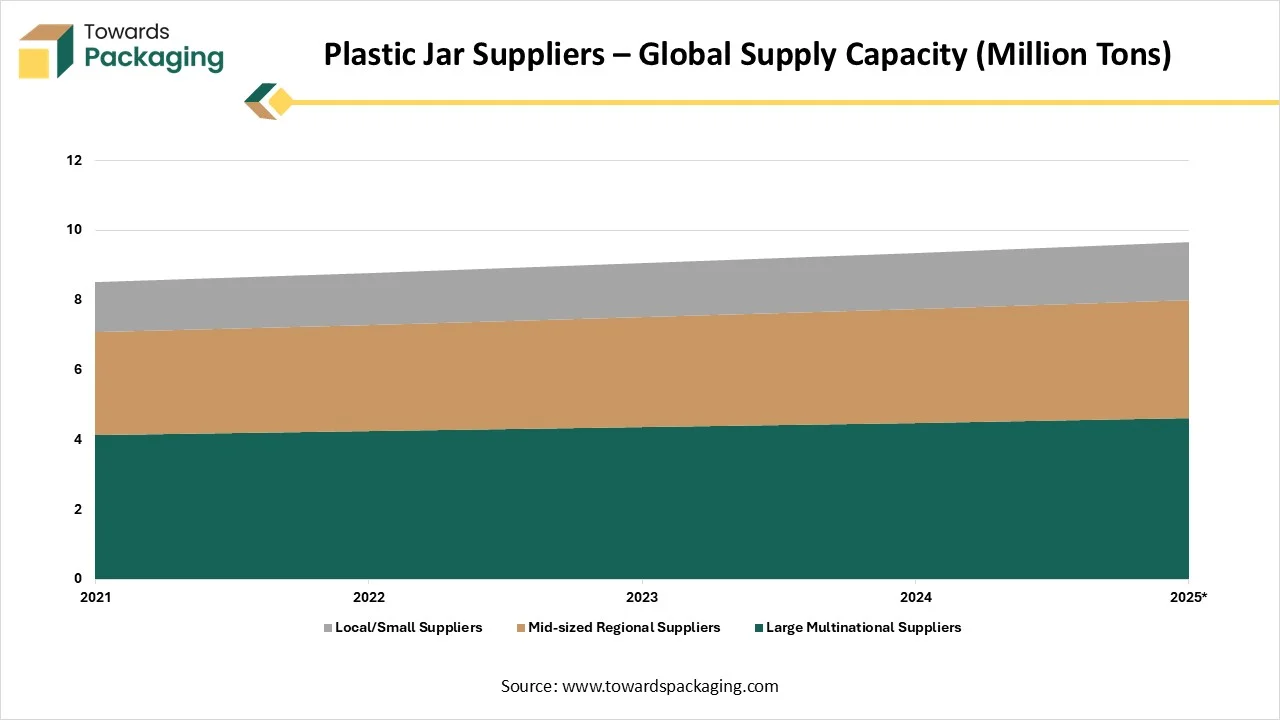

| Supplier Type | 2021 | 2022 | 2023 | 2024 | 2025* |

| Large Multinational Suppliers | 4.12 | `4.24 | 4.36 | 4.48 | 4.62 |

| Mid-sized Regional Suppliers | 2.96 | 3.05 | 3.15 | 3.26 | 3.38 |

| Local/Small Suppliers | 1.43 | 1.49 | 1.55 | 1.6 | 1.66 |

By Material Type

By Capacity / Size

By Application

By Region

December 2025

December 2025

December 2025

December 2025