Sustainable Flexible Packaging Market Size, Share and Trends, Import & Export Analysis

The sustainable flexible packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The growing consumer demand for sustainable flexible packaging, growing environmental awareness, increasing regulatory pressures, rising innovation in flexible packaging materials, increasing focus on achieving sustainability goals, and supportive government regulations promoting eco-friendly alternatives are expected to drive the growth of the global sustainable flexible packaging market over the forecast period. Plastic takes almost 1000 years to decompose, which spurs the demand for sustainable flexible packaging materials.

It plays a crucial role in significantly lowering carbon footprints, reducing waste, and plastic pollution across various industries such as food & beverages, pharmaceuticals, cosmetics & personal care, consumer goods, e-commerce, industrial packaging, agriculture & horticulture, and other (toys, electronics). Sustainability is the key focus and greatest option for lowering plastic waste. Several companies operating in the market are focused on adopting sustainable, flexible packaging materials to align with the principles of the circular economy. Additionally, the market is expanding rapidly in Europe, fuelled by rising focus on adopting sustainable flexible packaging, stringent government initiatives to lower greenhouse gas (GHG) emissions, and growing demand from multiple industries.

Key Takeaways

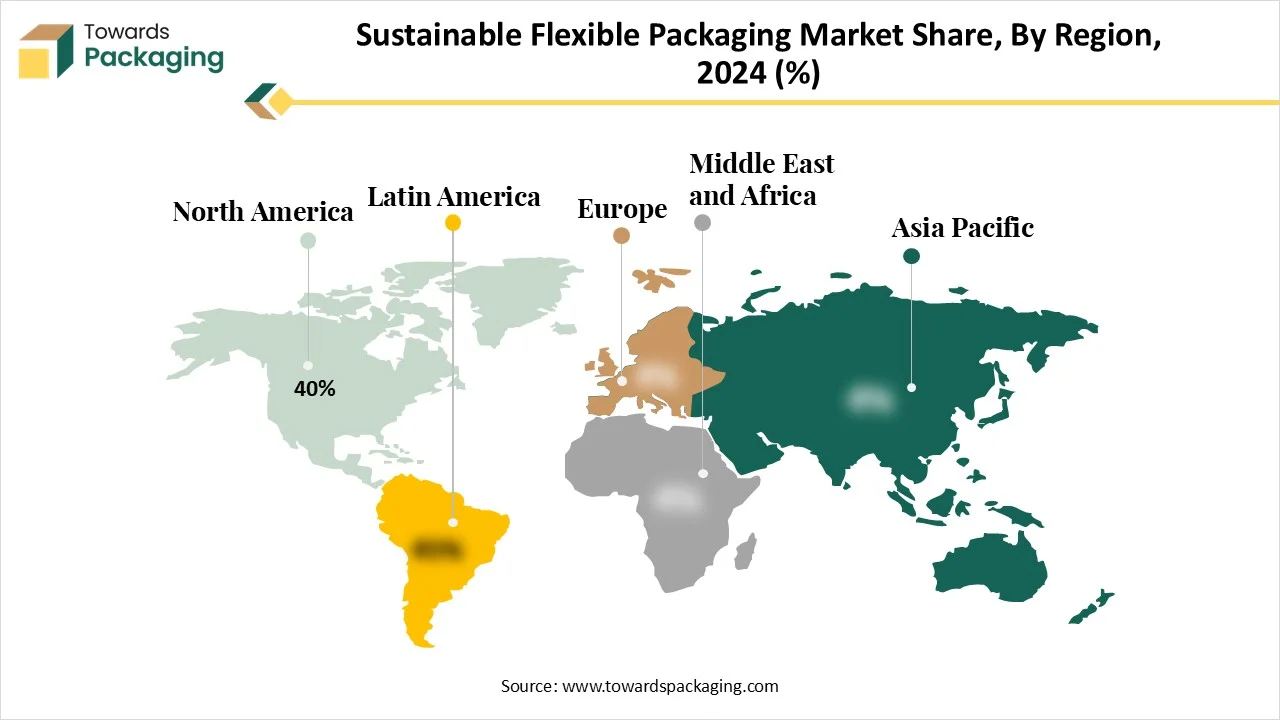

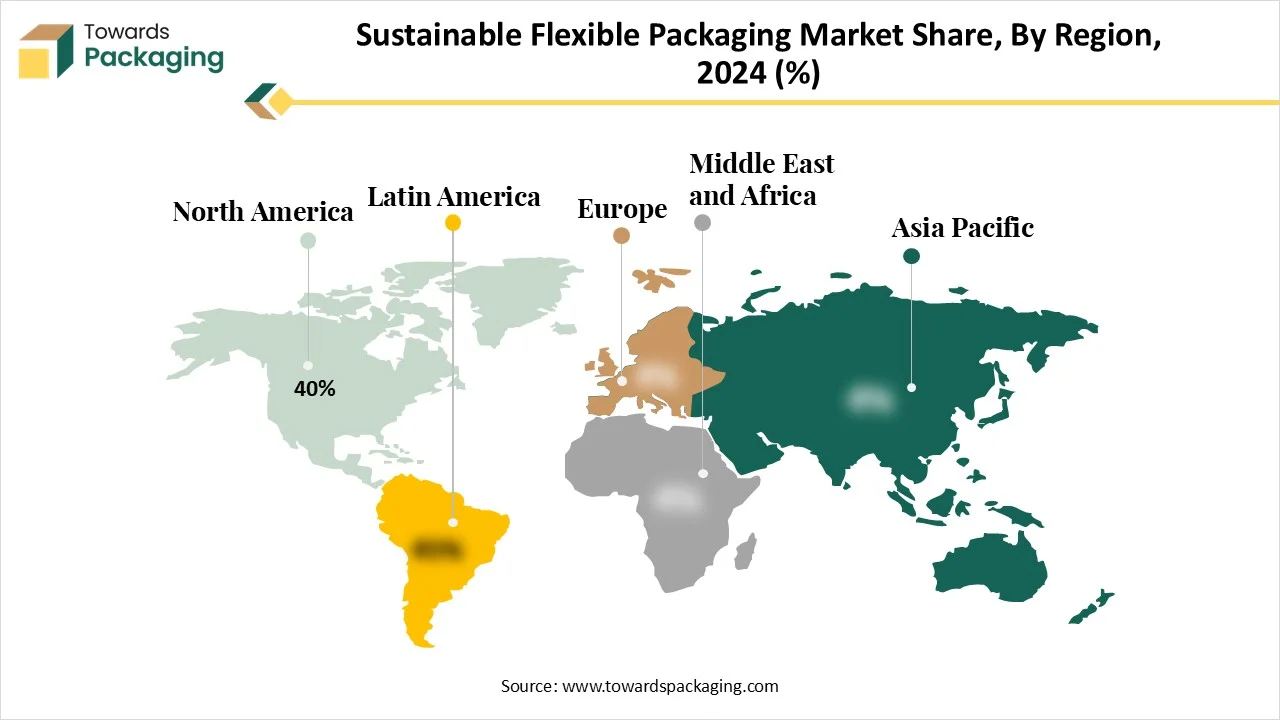

- North America dominated the sustainable flexible packaging market in 2024 with 40%.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By material type, the plastic films segment is expected to continue its dominance over the forecast period, with 40%.

- By material type, the paper-based packaging segment is expected to grow at the fastest CAGR during the forecast period.

- By product type, the pouches segment is expected to hold the dominating share of 30% in the market during the forecast period.

- By product type, the bags segment is expected to grow at a notable rate.

- By recyclability, the fully recyclable segment registered its dominance with 60% over the global sustainable flexible packaging market in 2024.

- By recyclability, the non-recyclable (but compostable) segment is expected to grow significantly during the forecast period.

- By end-use industry, the food & beverages segment contributed the biggest market share of 35% in 2024.

- By end-use industry, e-commerce is expanding at a significant CAGR during the forecast period.

Market Overview

The sustainable flexible packaging market refers to the sector dedicated to the development and use of eco-friendly packaging solutions that reduce environmental impact. These packaging solutions are made from materials that can be recycled, reused, or biodegraded, while still maintaining the required functionality, safety, and durability for packaging products. Sustainable flexible packaging includes innovations such as biodegradable films, recyclable laminates, and reduced plastic usage, helping to meet the growing demand for environmentally conscious packaging from industries like food & beverage, pharmaceuticals, consumer goods, and others.

The EU is effectively tackling the single-use plastic items most commonly found on Europe’s beaches and is promoting sustainable alternatives. 32 million tonnes of plastic waste per year in Europe. In 2023, the Commission adopted measures that restrict microplastics intentionally added to products under the EU chemical legislation REACH. It also proposed new rules to prevent plastic pellet losses in the environment. These actions will directly contribute to reaching the 30% reduction target for microplastic releases set out in the Zero Pollution Action Plan.

Future Demands

- Rapid growth because flexible packaging is lightweight, cost-saving, and uses less material.

- More brands will choose recyclable, compostable, and bio-based flexible formats to reduce their carbon footprint.

- High demand from the food, beverage, personal care, and e-commerce sectors.

- Companies will replace heavy packaging with thin films and pouches to meet sustainability and cost goals.

- Expansion of mono-layer flexible films that improve recyclability.

- Demand for renewable materials such as paper-based flexibles will increase.

- More products will shift to refillable pouches and flexible formats to reduce waste.

- Growth in digital printing will support short-run, customizable, flexible packaging for brands.

Emerging Technologies

- Compostable multi-layer films with high strength and printability for food packaging.

- Water-based barrier coatings are replacing traditional aluminum, PVDC, and solvent-based layers.

- Paper–flexible film hybrids balancing sustainability with barrier performance.

- Digital watermarking for recycling sorting to identify packaging composition automatically.

- High-strength PCR content films enabling food-grade recycled flexible packaging.

- Biodegradable inks and adhesives supporting low-toxicity, sustainable packaging systems

Factors of Sustainability and Compliance for Sustainable Flexible Packaging:

Growing regulations about compostability, recyclability, and the removal of dangerous chemicals are driving the development of sustainable flexible packaging, requiring manufacturers to completely rethink their materials. Regulations prohibiting PFAS-specific inks and hazardous additives are influencing formulation decisions and encouraging producers to switch to safer bio-based substitutes. Reducing packaging weight is another regulatory priority that promotes thinner structures and efficient use of resources without sacrificing functionality. To increase consumer awareness and waste sorting efficiency, many regions are also implementing mandatory recyclability labeling. Additionally, certification programs for compostable and bio-based materials bolster credibility. In general, eco-design principles and circular materials are becoming more prevalent in flexible packaging applications due to sustainability regulations.

Global Production Volumes in Sustainable Flexible Packaging (2025)

| Category |

Volume / Year |

| Sustainable PE/PP Films |

19.5 million tons |

| Paper-Based Flexible Packs |

11.2 million tons |

| Compostable Films |

3.4 million tons |

| Bio-based PLA/PHA Films |

2.1 million tons |

| Recycled Content Flexible Films |

6.8 million tons |

Government Initiatives for Sustainable Flexible Packaging Solutions:

European Union:

The EU 2024/2025 regulation under PPWR mandates reuse, refill, and minimal packaging practices. Packaging must be optimized to reduce material use, unnecessary packaging avoided, and reuse/refill options encouraged, especially for takeaway food, beverages, and retail packaging. Restrictions on certain single-use plastics, such as lightweight bags and disposable containers, push companies toward sustainable packaging formats, including reusable, refillable, compostable, or recyclable solutions. These combined regulatory pressures make sustainable packaging both a market requirement and a compliance mandate, accelerating the industry-wide shift toward circular-economy packaging practices and environmentally conscious materials.

How is Artificial Intelligence Integration Impacting the Growth of the Sustainable Flexible Packaging Market?

As technology continues to evolve, the integration of artificial intelligence holds significant potential to reshape the landscape of the sustainable flexible packaging market by improving manufacturing efficiency, optimizing material usage, promoting sustainability, and reducing wastage. Artificial intelligence (AI) in the sustainable flexible packaging market assists in creating more efficient, cost-effective, and eco-friendly packaging solutions. AI-driven solutions are widely adopted in waste management practices, including automated sorting for recycling and improving the quality and usability of recycled materials. AI can effectively select sustainable, flexible materials by effectively analysing environmental impact data, biodegradability, and recyclability options, promoting a shift towards sustainable alternatives. Several companies are leveraging AI to track packaging materials and waste material data to streamline compliance with environmental regulations.

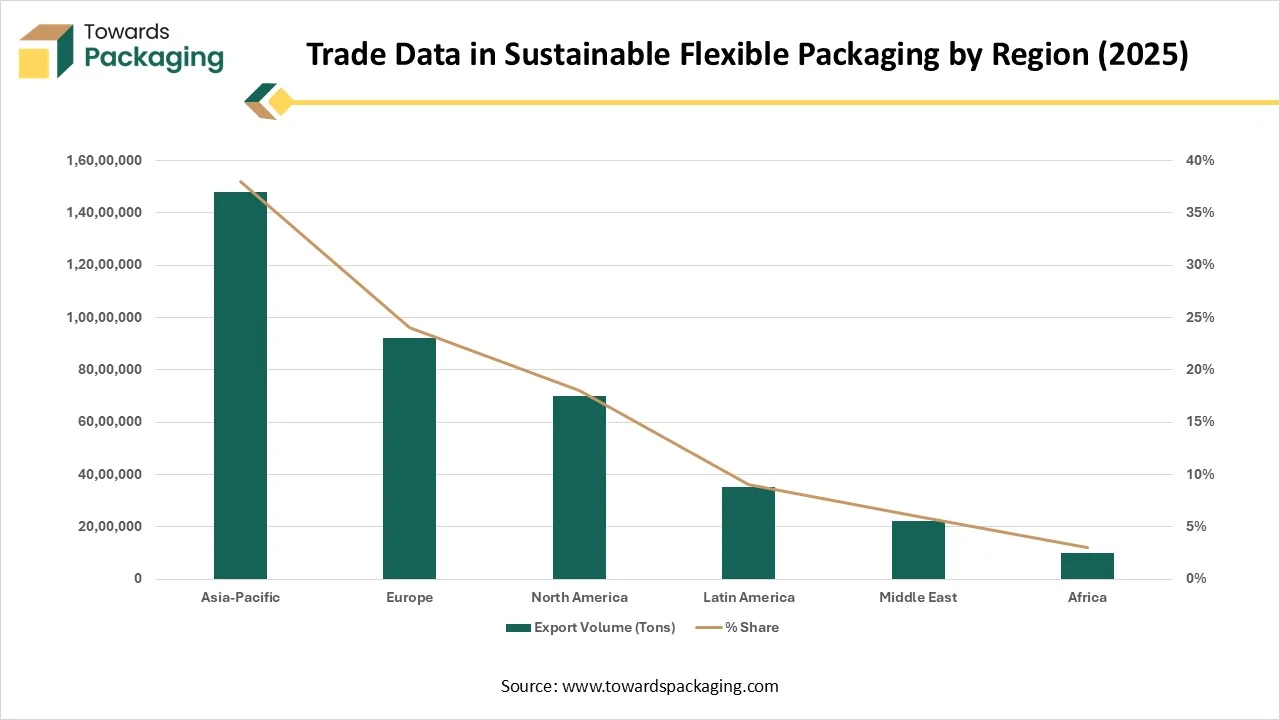

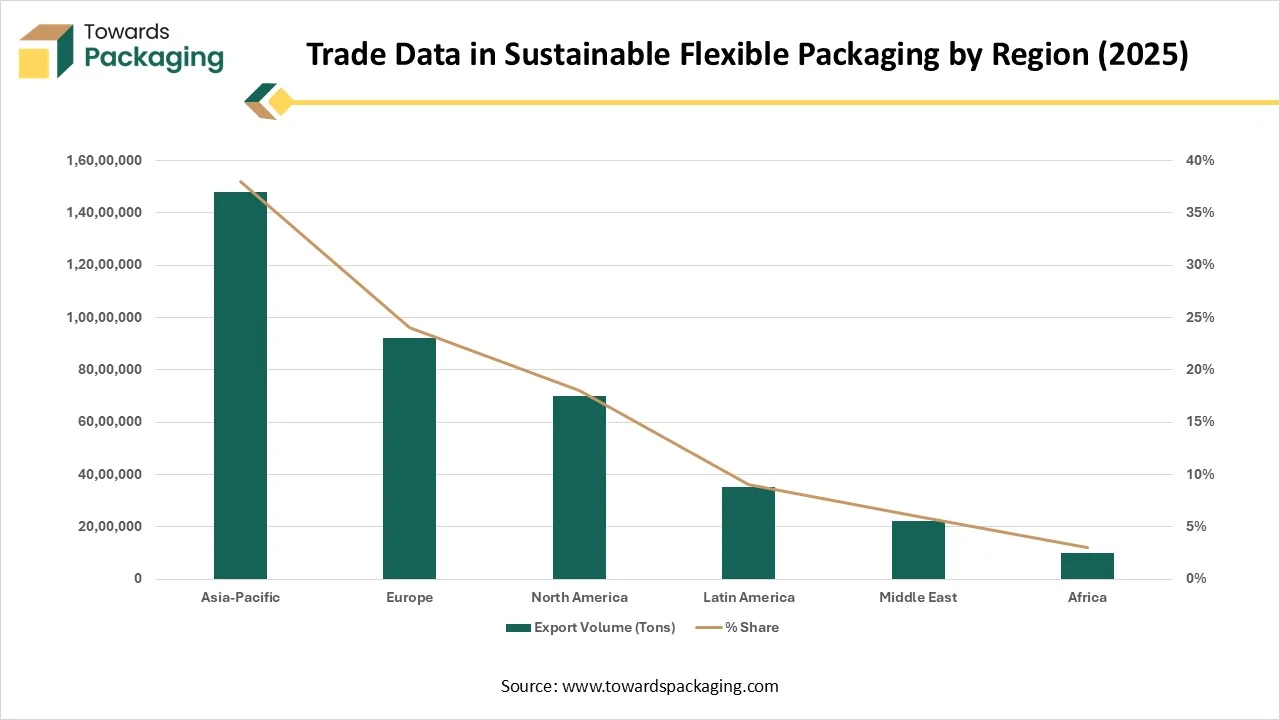

Trade Data in Sustainable Flexible Packaging by Region (2025)

| Region |

Export Volume (Tons) |

% Share |

| Asia-Pacific |

1,48,00,000 |

38% |

| Europe |

92,00,000 |

24% |

| North America |

70,00,000 |

18% |

| Latin America |

35,00,000 |

9% |

| Middle East |

22,00,000 |

6% |

| Africa |

9,80,000 |

3% |

What are the Key Trends Driving the Growth of the Sustainable Flexible Packaging Market?

- The rising demand for sustainable flexible packaging across various industries such as food & beverages, pharmaceuticals, cosmetics & personal care, consumer goods, e-commerce, industrial packaging, agriculture & horticulture, and others, is driving the growth of the market’s revenue during the forecast period.

- Their lightweight design of the sustainable flexible packaging results in consuming less fuel during production and transportation, which reduces the overall environmental footprint compared to other traditional plastic alternatives.

- The surge in online shopping is expected to boost the demand for sustainable flexible packaging that is lightweight, durable, and cost-effective for shipping and handling, significantly contributing to the overall growth of the sustainable flexible packaging market during the forecast period

- The restricted use of single-use plastics and a favourable government framework for using sustainable packaging materials are anticipated to accelerate the market’s growth of the market in the coming years.

- The changing lifestyles, along with the rapid urbanization, are expected to fuel the consumer demand for convenient and packaged foods, supporting the growth of the sustainable flexible packaging market during the forecast period.

- The rising consumer preferences for flexible packaging materials that are recyclable, reusable, and biodegradable are improving environmental sustainability while maintaining their functional requirement.

- The advancements in material science, along with the rising shift towards more circular economy models, are anticipated to fuel the expansion of the sustainable flexible packaging market during the forecast period.

PE Flexible Film Recycling - EU28+2 (2018)

| Category |

Value (Mt) |

% Share |

Notes |

| Total PE film streams sent for recycling |

2.8 |

100% |

Includes moisture, organics & contamination |

| Post-consumer films recycled in EU28+2 |

1.7 |

66% |

From collection & sorting systems |

| Production scrap sent to recyclers |

0.6 |

19% |

Re-processed industrial scrap |

| Total input to recyclers |

2.2-2.3 |

— |

Post-consumer + scrap |

| Share from Household film |

— |

14% |

Of total recycler input |

| Share from Commercial & Industrial film |

— |

43% |

Largest supply segment |

| Share from Agricultural waste film |

— |

17% |

High contamination levels |

| Share from Production scrap |

— |

26% |

Cleanest feedstock |

| Average yield of recyclate from post-consumer film |

— |

71% |

Final usable output |

| Total recyclate produced |

1.9 |

— |

Final recycled output |

| Recyclate from post-consumer films |

1.4 |

— |

Net after processing losses |

| Recyclate from production scrap |

0.4 |

— |

Near-100% clean material |

| Installed recycling capacity (Europe 2018) |

2.4 |

— |

Up from 1.5 Mt in 2014 |

| Recycling plant capacity utilization |

— |

91% |

Very high rate |

| Countries holding 80% of total capacity |

— |

— |

France, Germany, Italy, Netherlands, Poland, Spain |

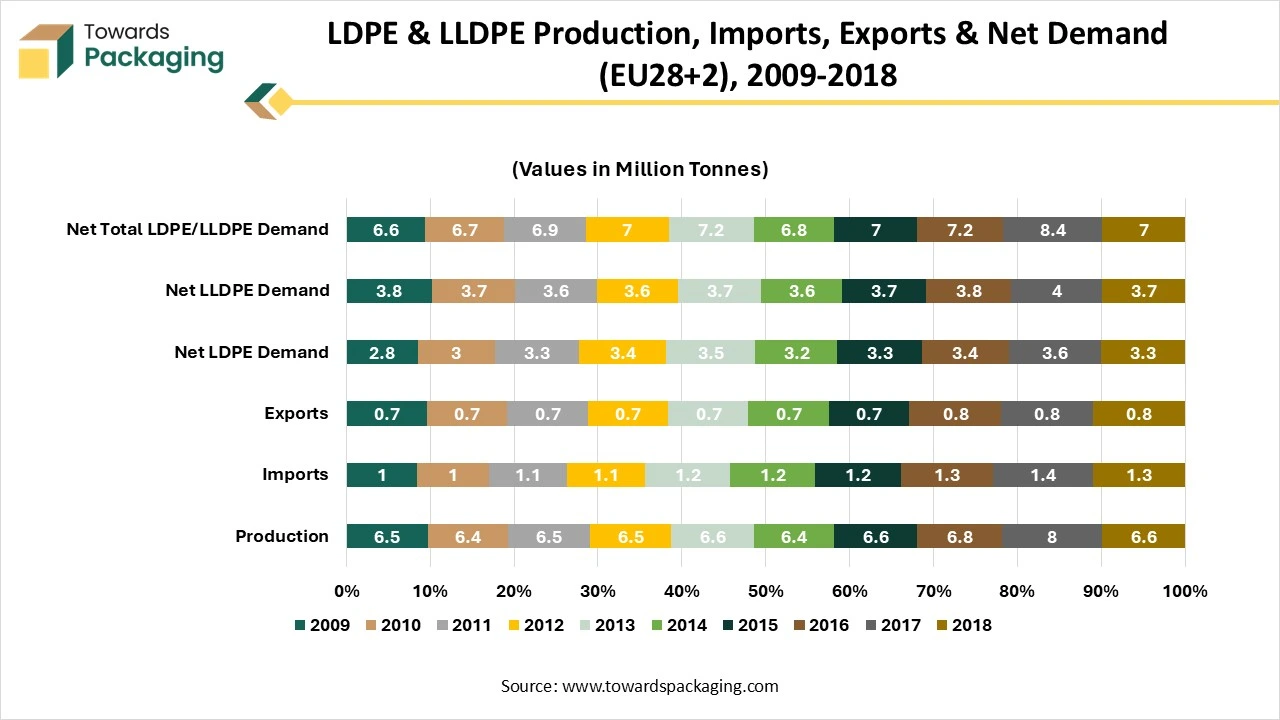

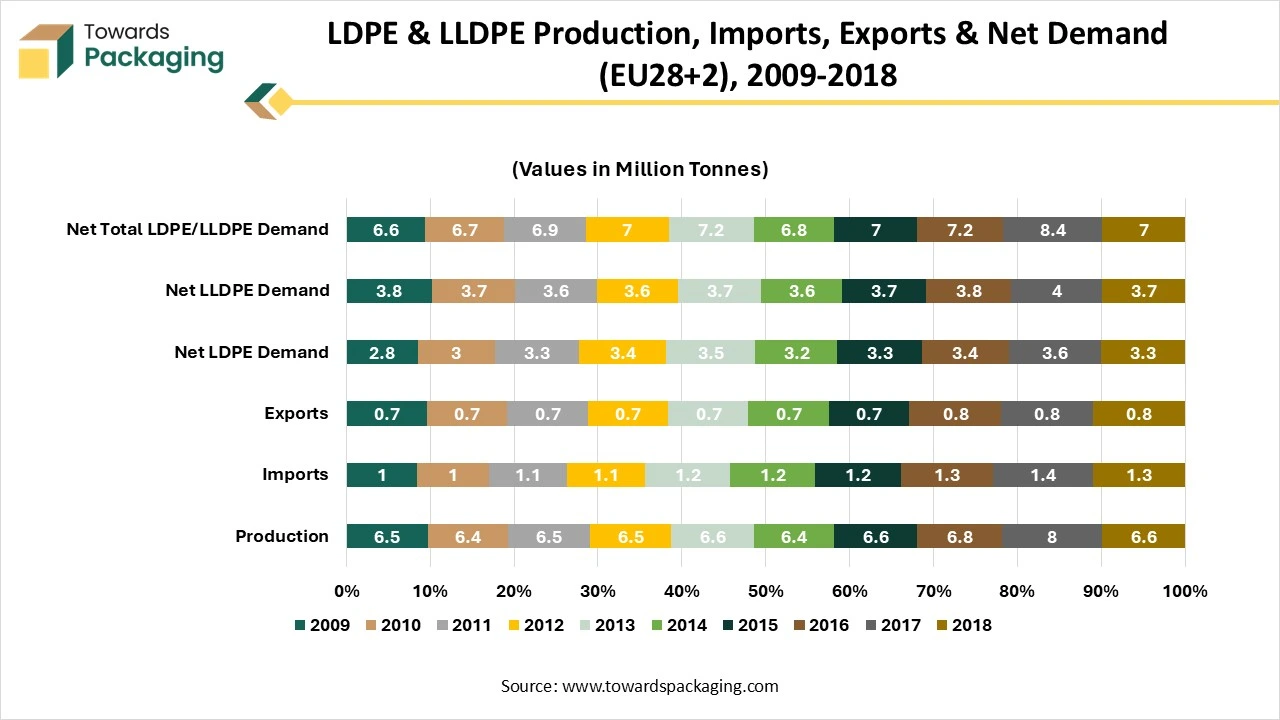

LDPE & LLDPE Production, Imports, Exports & Net Demand (EU28+2), 2009-2018

The data shows the trend in production and use of LDPE and LLDPE the main polymers used in flexible packaging films in the EU28+2 region over the past decade. Production levels remained relatively stable between 6.1 and 6.7 million tonnes, except for 2017, when production peaked at 8 million tonnes before returning to typical levels in 2018. Net demand for LDPE and LLDPE stayed steady between 6.5 and 7.1 million tonnes, exceeding production by about 0.5 million tonnes in 2018, which had to be covered through imports.

In 2018, the total demand for PE flexible films was estimated at 8.5-9 million tonnes, of which 1.2-1.3 million tonnes came from recycled material. When including other polymers such as PP, multilayer materials, PET, PVC and biodegradable plastics, the overall flexible film market reached 13-15 million tonnes. PP and multilayer films each accounted for 2-2.5 million tonnes.

Market Dynamics

Driver

Growing Consumer Demand for Sustainable, Flexible Packaging

The rising consumer demand for sustainable flexible packaging is expected to fuel the growth of the market during the forecast period. Consumers are increasingly aware of environmental issues like climate change, plastic pollution, and natural resource depletion, which has led them to actively seek out packaging products with sustainable packaging. Consumers are increasingly demanding eco-friendly alternatives like recyclable, compostable, and biodegradable packaging solutions to reduce the usage of traditional fossil fuel-based plastics.

Several studies have shown that consumers are even willing to pay more for sustainable packaging solutions. These flexible packaging materials are widely used across various industries, from food & beverages and pharmaceuticals to cosmetics & personal care and e-commerce, offering several environmental benefits. Moreover, the adoption of sustainable flexible packaging solutions by several businesses assists in substantially reducing their carbon footprint and becoming more environmentally conscious.

Restraint

Higher Costs of Sustainable Flexible Packaging Materials

The high cost of sustainable packaging materials is anticipated to hinder the market’s growth. Sustainable packaging materials such as recycled content, bioplastics, and paper-based alternatives are often more costly than virgin plastics. The high production costs can adversely impact the profitability of manufacturers. The limited availability of sustainable, flexible packaging materials often results in supply shortages and inconsistency in the supply chain. Such factors may restrict the expansion of the global sustainable flexible packaging market during the forecast period.

Opportunity

How are the Rising Circular Economy Initiatives Impacting the Expansion of the Market?

The rising circular economy initiatives are projected to offer lucrative growth opportunities to propel the growth of the sustainable flexible packaging market. Circular economy initiatives continue to inspire eco-friendly innovations that contribute to a more sustainable planet for future generations. As the global community increases its focus on sustainability, several industries are revolutionizing their packaging practices. Sustainable flexible packaging solutions reduce the environmental footprint without compromising functionality.

In recent years, sustainability has played a crucial role in developing sustainable flexible packaging materials, encouraging businesses to invest in eco-friendly materials such as recycled, reused, and biodegradable materials. Several governments around the world are responsibly addressing the ongoing environmental concerns about single-use packaging waste. Therefore, the increasing focus on aligning with the circular economy principle assists in reducing the carbon footprint in the ecosystem, as it relies heavily on fossil fuel-based plastic packaging.

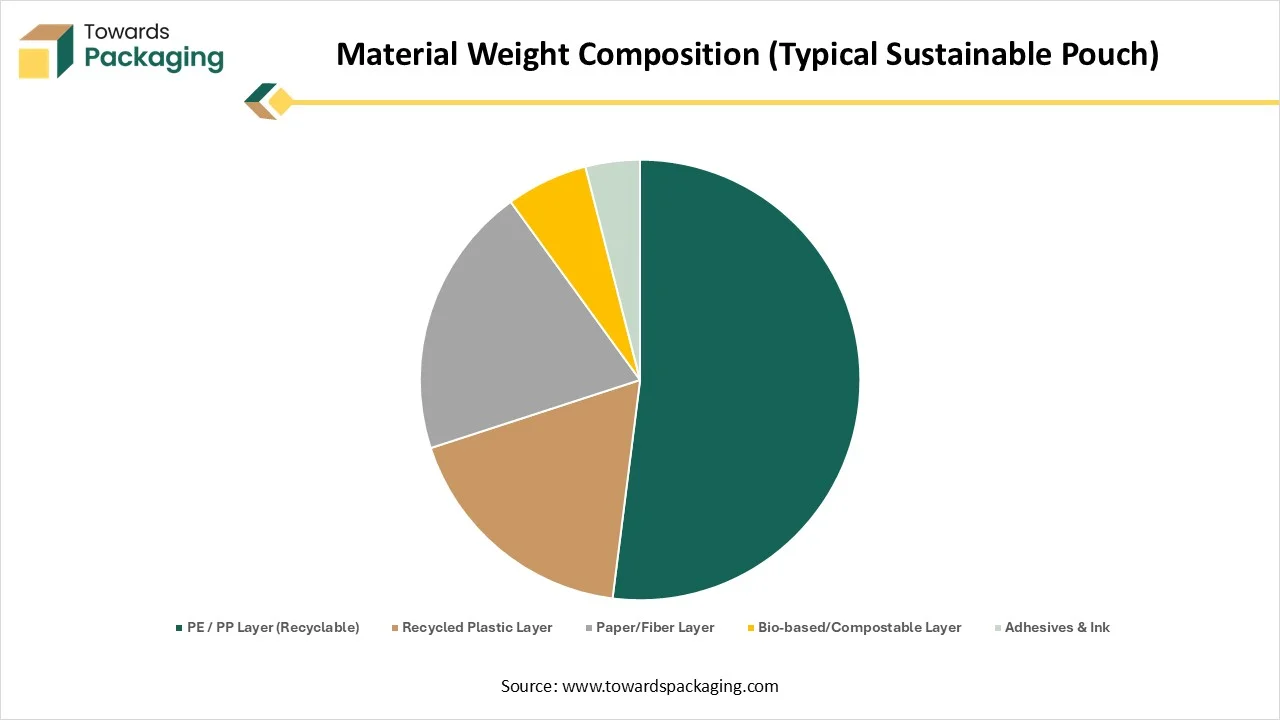

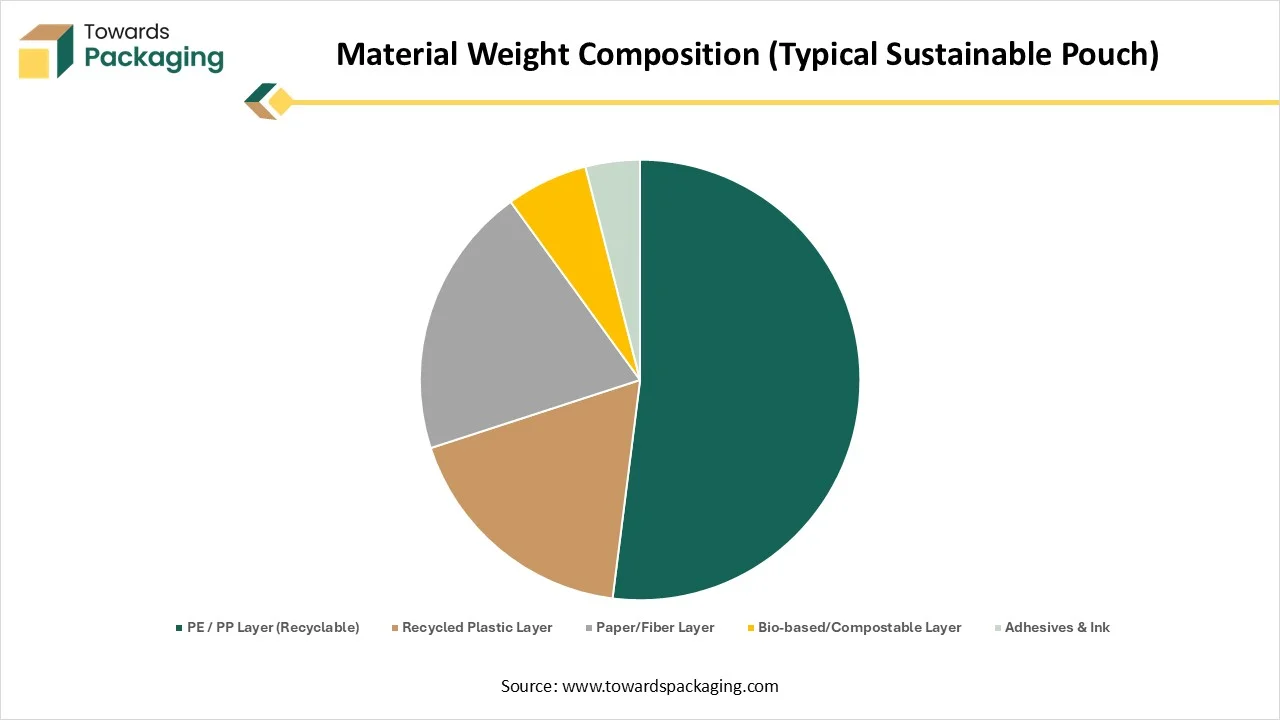

Material Weight Composition (Typical Sustainable Pouch)

| Component |

% Weight |

| PE / PP Layer (Recyclable) |

52% |

| Recycled Plastic Layer |

18% |

| Paper/Fiber Layer |

20% |

| Bio-based/Compostable Layer |

6% |

| Adhesives & Ink |

4% |

Segment Insights

How will Plastic Film Segments Dominate the Market in 2024?

The plastic film segments held a dominant presence in the sustainable flexible packaging market in 2024, owing to the growing consumer demand for eco-friendly packaging and rising awareness regarding the associated benefits of plastic film. Sustainable plastic films find application in food packaging, agriculture, consumer goods, healthcare, e-commerce, and other applications. Moreover, increasing focus on sustainability and stringent environmental concerns, such as bans on single-use plastics, are anticipated to bolster the segment’s growth during the forecast period.

On the other hand, the paper-based segment is expected to grow at a significant rate, owing to its efficient biodegradability and recyclability properties, which make it an attractive option for sustainable flexible packaging. Paper-based packaging offers a more sustainable alternative to conventional fossil fuel-based plastics and assists in reducing the carbon footprint. In addition, the increasing expansion of the e-commerce sector and increasing concern regarding the impact of packaging waste materials on the environment, which are not easily degradable in the water or soil, further boost the growth of the segment.

- In September 2024, Mespack and Mondi collaborated to develop cutting-edge paper-based packaging solutions that combine sustainability and performance. At Mespack’s Innovation Center (MIC), we have collaboratively developed high-quality paper pouches using Mondi’s re/cycle Functional Barrier Paper 95/5 and re/cycle HiProtex Paper range on Mespack’s advanced HR230 horizontal form-fill-seal (HFFS) machine.

Which Sub-segment Holds the Majority of the Share in the “By Product Type” Segment?

The pouches dominated the sustainable flexible packaging market in 2024, owing to the increasing consumer preference for sustainable pouches. These pouches offer several benefits, such as reduced material usage and lower shipping costs, which substantially contribute to their popularity. They are recyclable, reusable, and biodegradable, which aligns with sustainability goals. Flexible pouches are extensively adopted in the food and beverage sector, owing to their convenience and extending the shelf life of the product.

On the other hand, the bags segment is expected to grow at a notable rate during the forecast period. The shift towards eco-friendly flexible packaging solutions is encouraging businesses across various industries to invest in developing innovative and sustainable bag materials for circular packaging. The lightweight packaging design of bags significantly reduces the material use and maximizes recyclability. Moreover, a surge in e-commerce activities increases the need for protective and sustainable bags, highly preferred for their lightweight and space-saving attributes.

By Recyclability

The fully recyclable segment accounted for the dominating share in 2024. Fully recyclable packaging materials are specifically designed to be easily recycled and can be reprocessed into new products. It primarily focuses on utilizing materials that can be easily collected, processed, and reused in new packaging. Fully recyclable packaging aims to extend the life span of packaging materials and reduce the dependence on single-use packaging options. Additionally, the rising awareness of recyclable packaging and the increasing governments' focus on promoting circularity are expected to propel the segment’s growth.

On the other hand, the non-recyclable (but compostable) segment is expected to witness a significant share during the forecast period. Non-recyclable (but compostable) offers a viable alternative to conventional plastic packaging solutions, and these materials are often made from plant-based sources, which can be broken down into nutrient-rich soil through composting. Some of the common examples of non-recyclable (but compostable) include PLA (polylactic acid), cornstarch packaging, and other paper-based packaging materials.

Increasing Demand from the Food & Beverages Industry

The food & beverages segment accounted for a significant share of the sustainable flexible packaging market in 2024. The surge in the consumption of processed meats & sausages, bakery, dairy, fruits & vegetables, and others. In the food & beverages, sustainable flexible packaging includes recycled plastics, paper and cardboard, and bioplastics (PLA, PHA). Sustainable flexible packaging offers lightweight designs, reduces material usage, and provides protective packaging options. The rapid urbanization, along with the rising trend of grocery shopping in supermarkets, has significantly increased the demand for sustainable packaging films.

- Packing all food in Flexible Packaging, even with 0% recycling, would reduce the total carbon footprint for packaging by 40% in the EU (≈1% of all EU greenhouse emissions).s

On the other hand, the e-commerce segment is expected to grow at a notable rate during the projection period, owing to the rising need for lightweight, protective, and sustainable packaging solutions in the e-commerce sector. The growth of the segment is mainly driven by the rapid expansion of the e-commerce industry, particularly in developing and developed nations. The stringent environmental regulations are promoting the use of recycled, biodegradable, and compostable packaging materials to lower the dependence on traditional virgin plastics. Additionally, technological innovation, including new material formulations to enhance the strength and functionality of sustainable flexible packaging, has significantly increased its adoption in the e-commerce segment.

Regional Insights

North America is Supporting its Dominance with the Majority of the Market Share

North America held the dominant share of the sustainable flexible packaging market in 2024. The North America region has an established food & beverages, pharmaceuticals, cosmetics & personal care, consumer goods, e-commerce, industrial packaging, agriculture & horticulture, and other (toys, electronics) sectors that are the major users of sustainable flexible packaging solutions. The growth of the region is attributed to the government-led sustainable initiatives, increasing restrictions on single-use plastics, rising disposable income, increasing consumer preference for recyclable flexible material, rising environmental awareness, and surging investments in bioplastics and compostable films.

United States

The United States is one of the leading markets for sustainable flexible packaging, driven by strong regulatory support and growing consumer demand for eco-friendly solutions. Federal and state-level initiatives, such as extended producer responsibility (EPR) programs and packaging waste reduction laws, are pushing companies to adopt recyclable, compostable, and recycled-content materials. Many states also mandate reporting and accountability for packaging waste, incentivizing manufacturers to redesign flexible packaging to minimize environmental impact while meeting regulatory standards. These measures are accelerating innovation in sustainable materials and production processes across the U.S. flexible packaging sector.

The increasing R&D funding and partnerships or collaborations focused on low-carbon footprint solutions, coupled with strong sustainability policies of North American countries, are contributing to the regional market’s growth. Furthermore, the rapid expansion of the e-commerce industry and rising innovation in recycling technologies are expected to drive the growth of the sustainable flexible packaging market during the forecast period.

On the other hand, the Asia Pacific is expected to grow at the fastest CAGR. The growth of the region is driven by the increasing consumer awareness of its environmental benefits, rapid urbanization, surge in disposable income, growing demand for convenience foods, and growing demand from various end-user industries such as food & beverages, cosmetics & personal care, consumer goods, e-commerce, industrial packaging, agriculture & horticulture, and others. The surging investment of key players in the development of mono-material films and bioplastics, along with improved recycling technologies, is anticipated to fuel the adoption of sustainable flexible packaging solutions in various industries.

Japan

Japan’s sustainable flexible packaging market is propelled by comprehensive recycling laws and environmental initiatives targeting packaging waste reduction. The country enforces strict container and packaging recycling legislation that mandates the proper sorting, collection, and recycling of packaging materials. Additionally, manufacturers are incentivized to reduce packaging volume, use renewable or recycled materials, and develop innovative, eco-friendly flexible packaging solutions. Government support, coupled with high consumer demand for sustainable products, has fostered a robust market for environmentally responsible flexible packaging in Japan.

The rising concern about numerous environmental issues is shifting purchasing habits towards sustainable options. Government organizations are increasingly promoting the use of recyclable, compostable, and biodegradable packaging materials to reduce the carbon footprint of packaging waste and improve sustainability. Additionally, the expansion of the e-commerce sector and organized modern retail is expected to boost the market’s revenue in the region.

Trend of Sustainable Flexible Packaging Market in India:

Users are heavily concerned about the environmental effects of packaging. This trend is predicted to continue in the year 2025, with a rising urge for sustainable flexible packaging solutions, such as those created from biodegradable or recycled materials. The growth of e-commerce is making an urge for tailored and personalized packaging solutions. Users predict a positive and smooth online shopping experience, and packaging plays a crucial role in this by developing an unpredictable experience and showing individual choices. The flexible packaging serves many benefits over regular rigid packaging, which include improved shelf life, reduced material usage, and improved travelling efficiency.

Trend of Sustainable Flexible Packaging Market in Canada:

The trend towards sustainable flexible packaging in Canada is rapidly developing, which is being driven by the rigid government regulations, developing user demand, and technological growth. Canada has a varied and dynamic packaging industry. It counts different sectors such as food and beverage, cosmetics, healthcare, and e-commerce too. With a developing population and rising user spending, the urge for packaging solutions continues to develop. This has risen in packaging that serves both challenges and possibilities for organizations that operate in this sector.

Canadian companies are using sustainable flexible packaging alternatives at an unparalleled rate. From the biodegradable and compostable materials to reusable containers and fewer designs, a huge series of environmentally friendly options are gaining attention.

Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

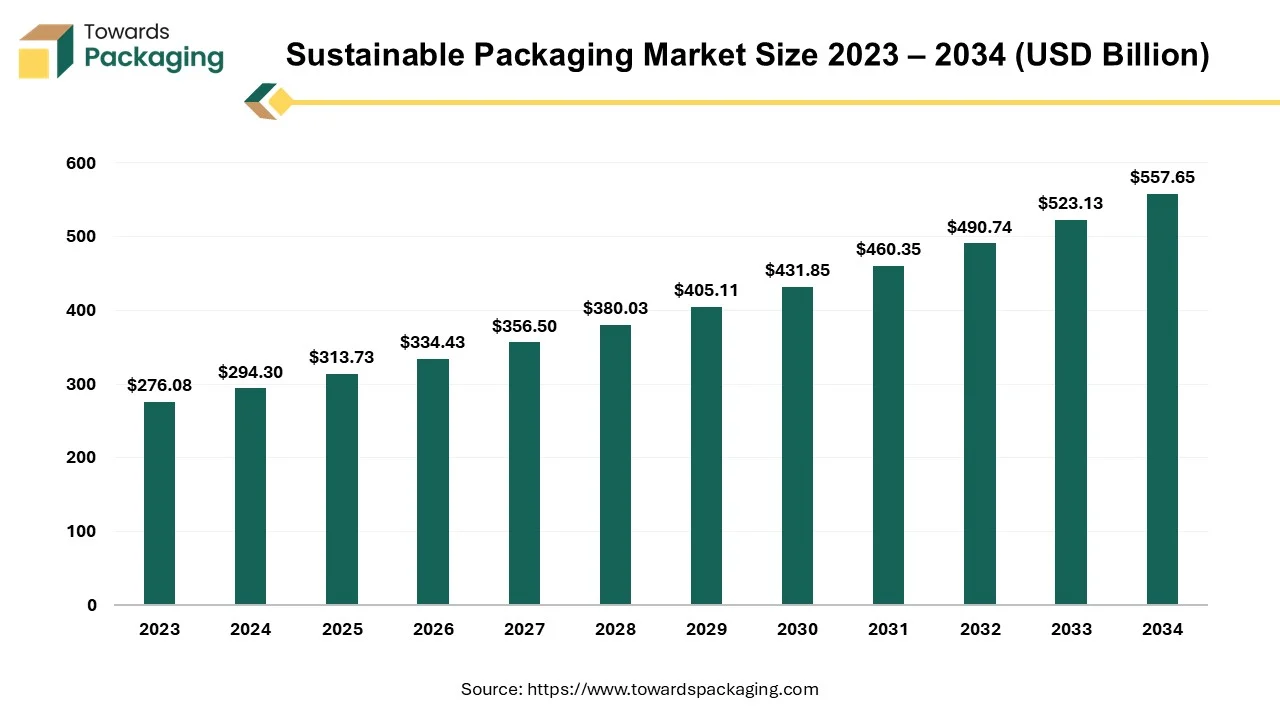

Sustainable Packaging Market Recycling Rates, New Product Development, Production and Consumption Data, Future Prospects and Innovations

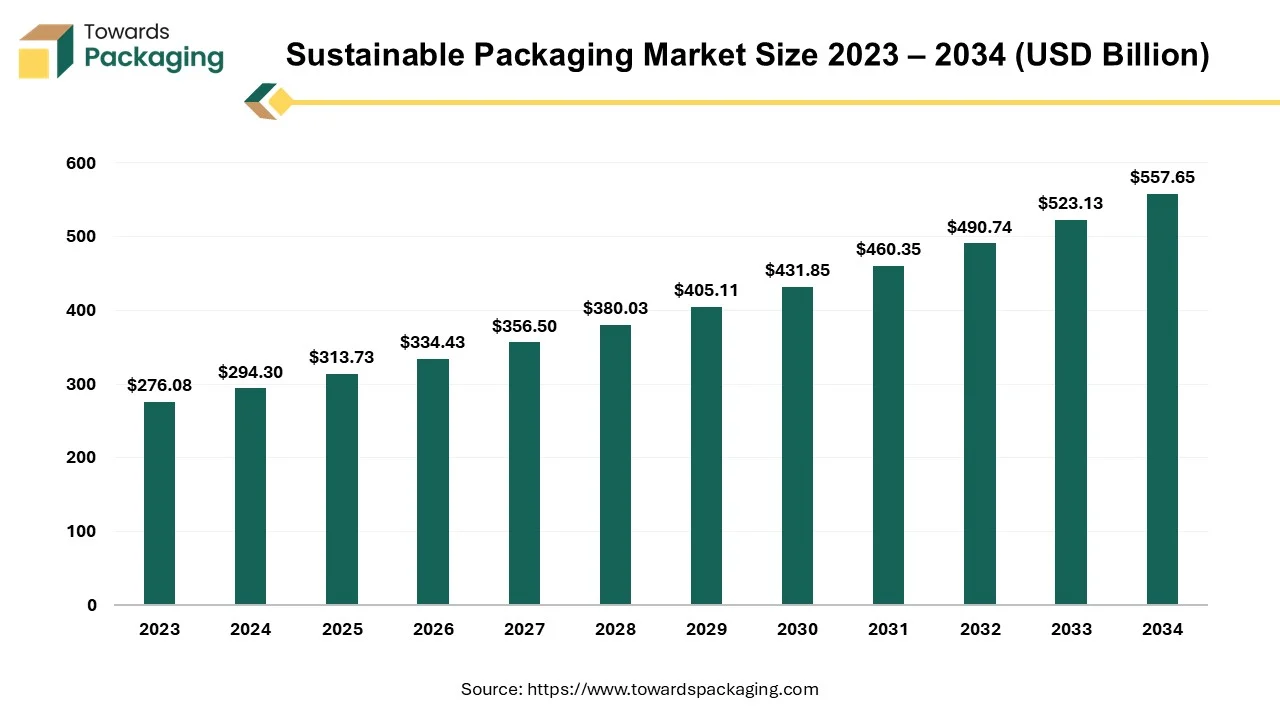

The sustainable packaging market is predicted to expand from USD 313.73 billion in 2025 to USD 557.65 billion by 2034, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

Report Highlights: Important Revelations

- This expansion is growing at a CAGR of 6.6% over the period from 2025 to 2034.

- Pioneering sustainable packaging development in the Asia Pacific region.

- Emergence of North America as a key player in sustainable packaging innovation.

- Paper holds dominance as the leading material in sustainable packaging.

- Evolution of sustainable packaging: bags leading the way.

- Growing importance of reusable packaging in today's sustainable packaging landscape.

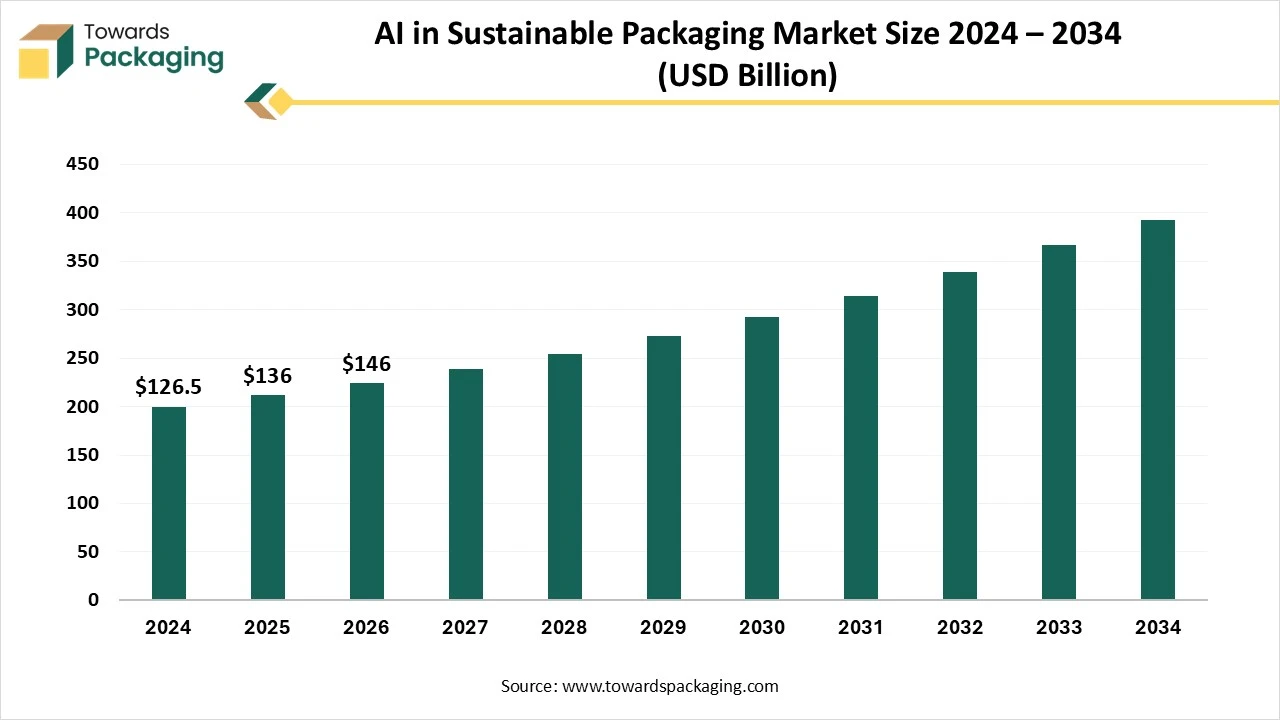

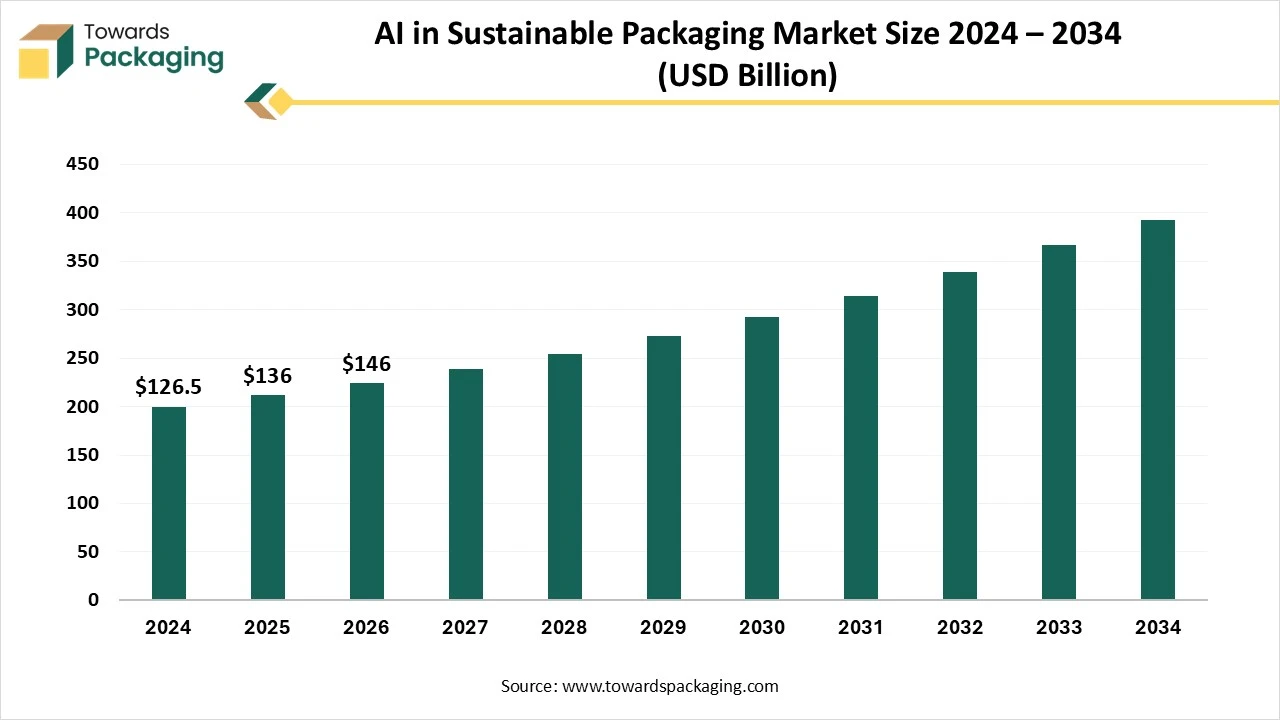

AI in Sustainable Packaging Market Size, Share, Trends and Forecast Analysis

The global AI in sustainable packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing sustainable packaging. The market is growing rapidly, driven by increasing demand for eco-friendly solutions and efficiency in production.

AI technologies optimize material usage, reduce waste, and enhance packaging design for recyclability. They also support smart supply chain management and predictive maintenance. Brands are adopting AI to meet sustainability goals and regulatory compliance. Integration of machine learning and computer vision further improves quality control and automation. This market is poised for strong growth across industries like food, beverages, cosmetics, and e-commerce.

Key Insights

- North America dominated the global AI in sustainable packaging market in 2024.

- Asia Pacific is expected to grow at a significant CAGR during the forecast period.

- The European market is expected to grow notably in the foreseeable future.

- By AI technology type, the machine learning algorithms segment dominated the market in 2024.

Top Sustainable Flexible Packaging Market Players

- Amcor Plc

- Berry Global, Inc.

- Sealed Air Corporation

- Mondi Group

- Huhtamaki Group

- Smurfit Kappa Group

- Sappi Ltd.

- Coveris

- Bemis Company, Inc. (now part of Amcor)

- Clondalkin Group

- Inteplast Group

- BASF SE

- ProAmpac

- Nordic Paper

- UPM-Kymmene Corporation

- LyondellBasell Industries

- Dow Inc.

- WestRock Company

- Lenzing AG

- Ahlstrom-Munksjö

Latest Announcement by Industry Leader

- In May 2025, Oroville Flexible Packaging, LLC, a pioneer in flexible plastics and packaging solutions for retail and foodservice customers, announced the launch of “Oroflex,” a sustainable flexible plastics, packaging, and recycling system. Oroflex is a flexible packaging system for retail and foodservice customers that features comprehensive, customized, domestic manufacturing and recycling services with transparent audit trails that support customers’ operational efficiency and sustainability goals.

Recent Developments

- Borealis has revealed the Bicycle M CWT120CL, a cutting-edge recycled linear low-density polyethylene (rLLDPE), which is crafted to develop sustainability in terms of flexible packaging. This latest grade includes the 85% post-consumer recyclate, which is being integrated with a 15% LLDPE booster, which makes it perfect for performance in high-end uses in which environmental responsibility is a priority.

- In September 2025, Tipa revealed that the compostable packaging, which is a supplier of compostable flexible packaging materials, has stretched its profile to include four new high-barrier films that cover the products.

- Mondi has collaborated with the main leader in sustainable packaging and paper, which has partnered with luxury in order to launch paper-based stand-up pouches for the dishwashing base in the locations of Portugal and Spain.

- Ahlstrom, which is a top leader in terms of fiber-based specialty materials, has revealed the LamiBak Fex, which is the newest addition to its LamiBak, a profile of the high-performance base papers. It is usually crafted for flexible packaging, Lamibak Flex, which is being constructed on the proven success of the original LamiBak.

- In May 2025, ProAmpac, a global leader in flexible packaging and material science, teamed up with ScottsMiracle-Gro to revolutionize the packaging used in the new O.M. Scott & Sons brand of natural grass seed, clover seed, and grass food products. The packaging features ProAmpac’s PRO-EVO Recyclable SOS Bags, which have helped the O.M. Scott & Sons brand transition to fiber-based solutions that are curbside recyclable and support top-tier product protection.

- In May 2025, Intec Bioplastics, Inc., announced the launch of its new sustainable packaging, EarthPlus Hercules Bioflex Stretch Wrap. The material can be used in pallet and food wrap applications. The bio-resin engineering company aims to help its customer achieve their sustainability goals. This could relate to achieving a Net Zero Carbon Footprint, Net Zero plastic, or minimising the amount of waste they send to landfills.

Sustainable Flexible Packaging Market Segmentations

By Material Type

- Plastic Films

- Bio-based Plastics (e.g., PLA, PHA)

- Recycled Plastics

- Conventional Plastics (with reduced environmental impact)

- Paper-Based Packaging

- Coated Paperboard

- Kraft Paper

- Aluminum Foil

- Biodegradable Materials

- Plant-Based Plastics

- Starch-Based Films

- Compostable Films

- Multi-Layer Films

By Product Type

- Pouches

- Stand-up Pouches

- Flat Pouches

- Spouted Pouches

- Bags

- Grocery Bags

- Reusable Bags

- Trash Bags

- Films

- Shrink Films

- Stretch Films

- Barrier Films

- Labels

- Paper-based Labels

- Plastic-based Labels

- Compostable Labels

- Laminates

- Mono-layer Laminates

- Multi-layer Laminates

By Recyclability

- Fully Recyclable

- Partially Recyclable

- Non-Recyclable (but Compostable)

By End-Use Industry

- Food & Beverages

- Fresh Produce

- Frozen Food

- Ready-to-eat Meals

- Snacks and Confectionery

- Pharmaceuticals

- Over-the-counter Drugs

- Medical Devices and Consumables

- Nutraceuticals

- Cosmetics & Personal Care

- Skin Care

- Hair Care

- Oral Care

- Consumer Goods

- Household Products

- Pet Care

- E-commerce

- Shipping Materials

- Protective Packaging

- Industrial Packaging

- Agriculture & Horticulture

- Other (Toys, Electronics)

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait