Flexible Green Packaging Market Size, Share, Trends and Growth Forecast

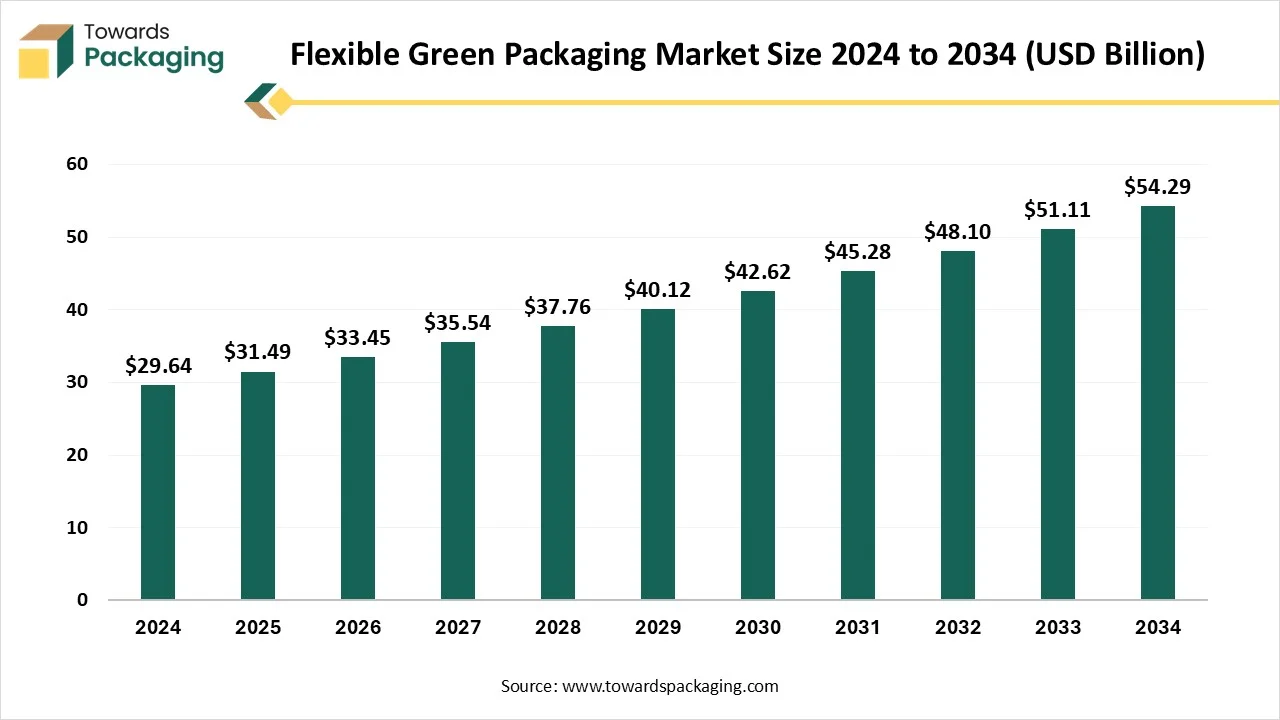

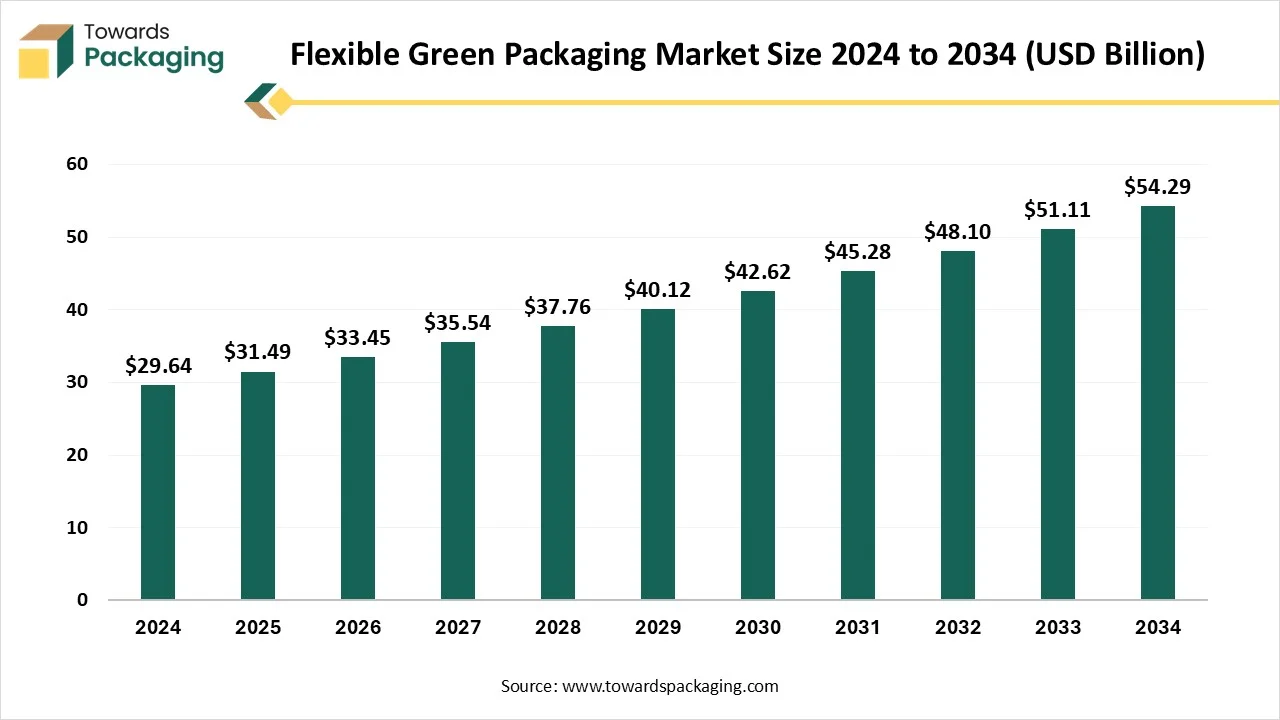

The global flexible green packaging market is expected to increase from USD 33.45 billion in 2026 to USD 57.68 billion by 2035, growing at a CAGR of 6.24% throughout the forecast period from 2026 to 2035. The Flexible Green Packaging Market is experiencing significant growth due to rising environmental awareness and increasing demand for sustainable packaging solutions across various industries. Factors such as strict government regulations on plastic use, a growing shift toward recyclable and biodegradable materials, and consumer preference for eco-friendly products are driving market expansion.

The food and beverage industry is a key contributor, as companies adopt green packaging to reduce their environmental footprint and appeal to environmentally conscious consumers. Innovations in material technology, such as compostable films and bio-based plastics, are further boosting market development, offering sustainable alternatives without compromising functionality or shelf life.

Key Insights

- In terms of revenue, the market is valued at USD 31.49 billion in 2025.

- The market is projected to reach USD 54.29 billion by 2034.

- Rapid growth at a CAGR of 6.24% will be observed in the period between 2025 and 2034.

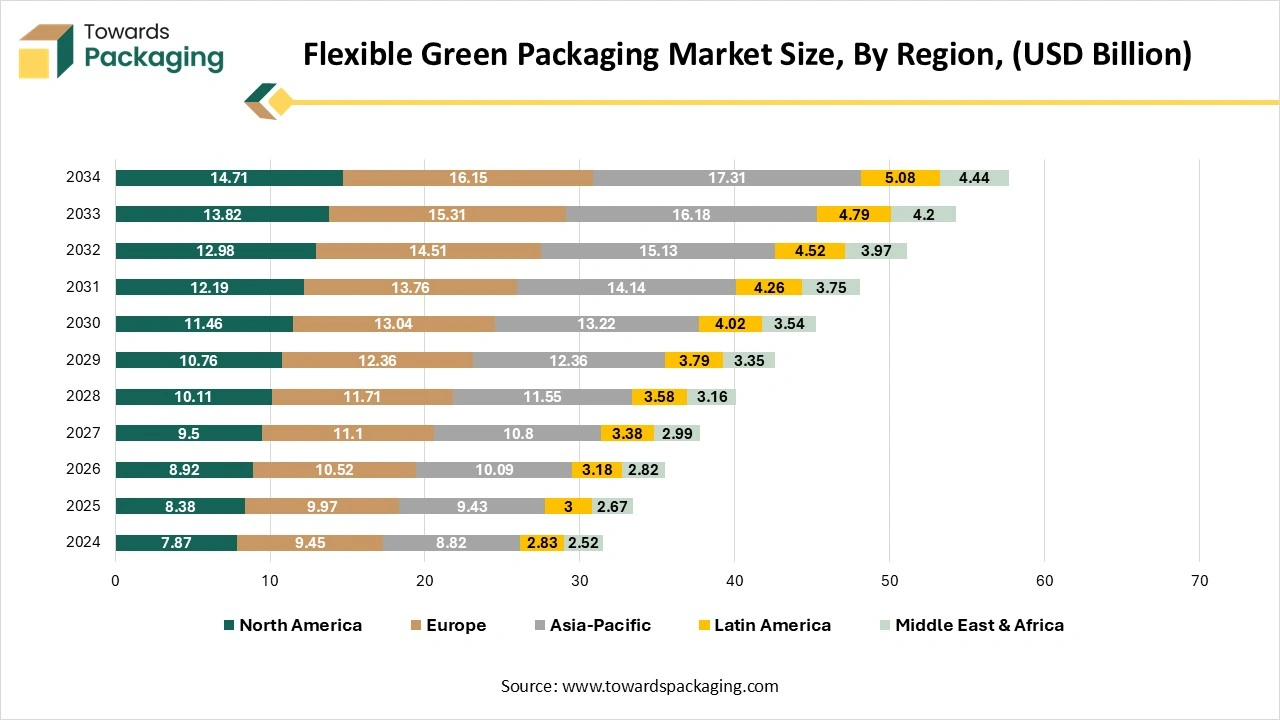

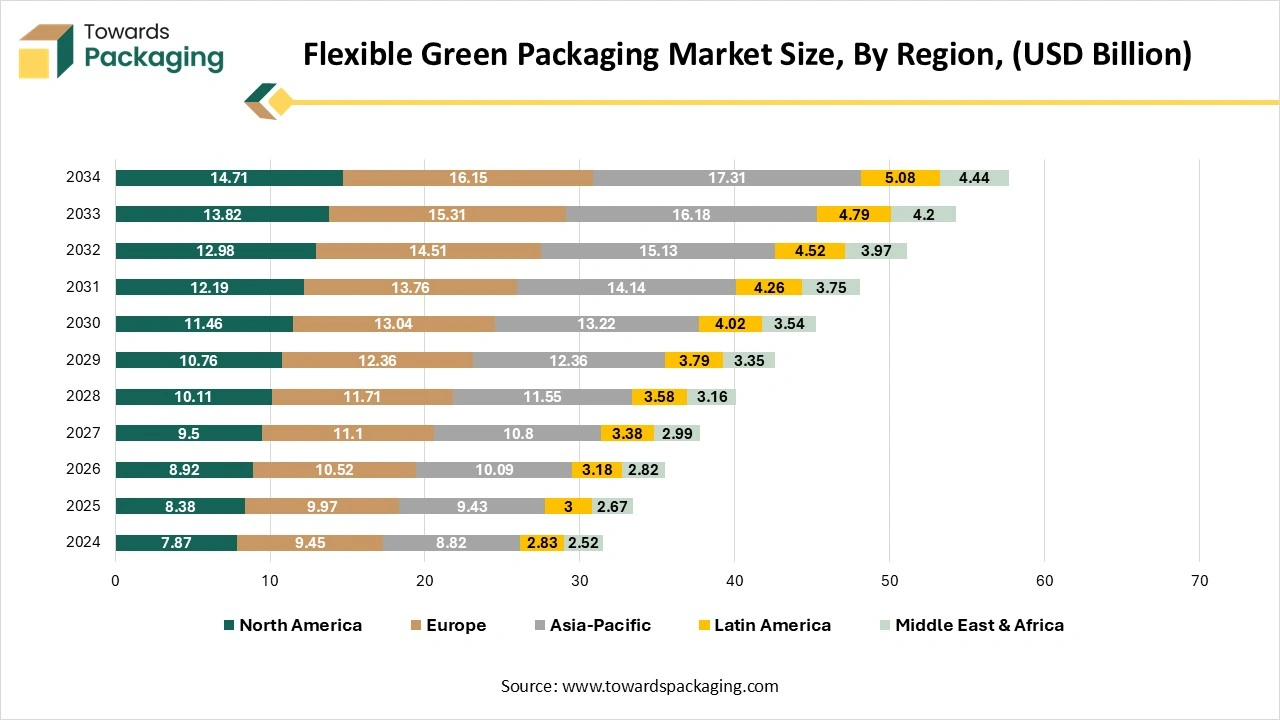

- Europe dominated the global flexible green packaging market in 2024.

- Asia Pacific is expected to grow at a significant CAGR in the market during the forecast period.

- The North American market is expected to grow at a notable CAGR in the foreseeable future.

- By material type, the recycled plastics segment dominated the market with the largest share in 2024.

- By material type, the bioplastics (especially PLA & PHA) segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By packaging type, the pouches segment dominated the market in 2024.

- By packaging type, the compostable films & wraps segment is expected to grow at the fastest CAGR in the forecast period.

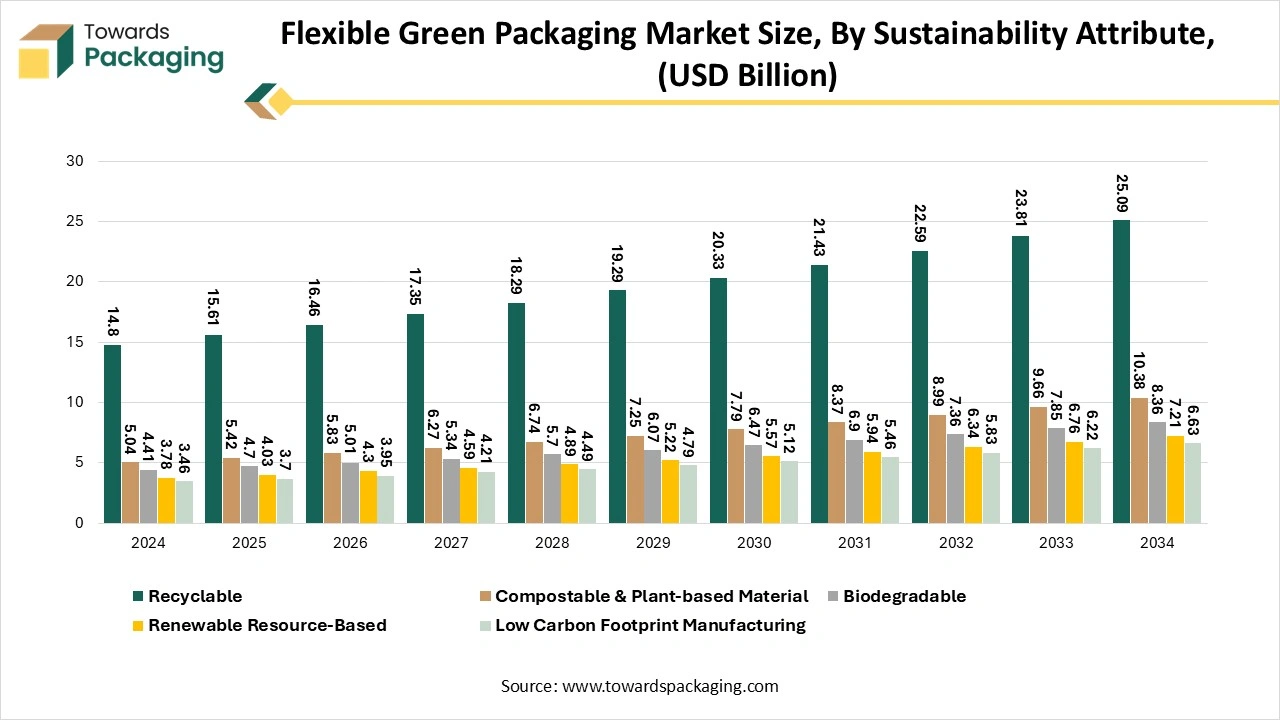

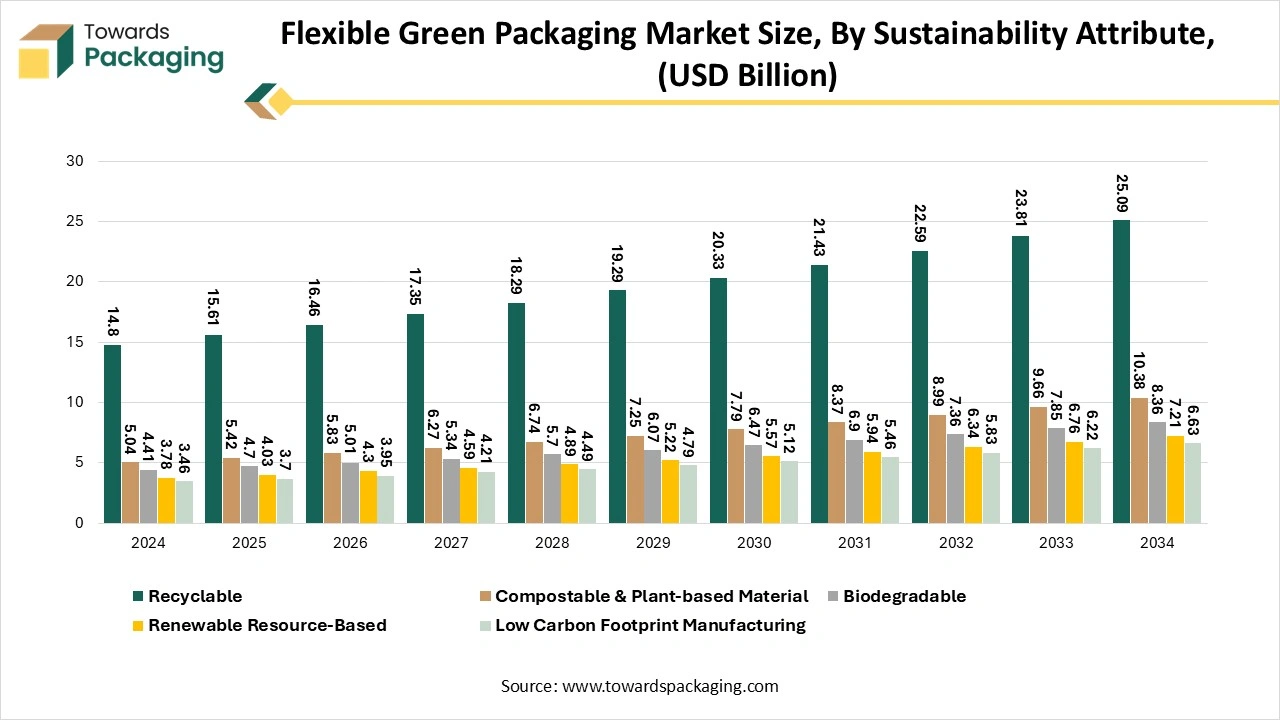

- By sustainability attribute, the recyclable segment dominated the market in 2024.

- By sustainability attribute, the compostable & plant-based materials segment is expected to grow at the fastest CAGR in the forecast period.

- By end-use industry, the food & beverage segment dominated the market with the largest share in 2024.

- By end-use industry, the retail & e-commerce packaging segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By distribution channel, the direct sales (B2B) segment dominated the market with the largest share in 2024.

- By distribution channel, the online platforms & digital B2B Marketplaces segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

Market Overview

The flexible green packaging market refers to the segment of the packaging industry focused on eco-friendly, lightweight, and resource-efficient packaging solutions that minimize environmental impact. This includes packaging made from biodegradable, compostable, recyclable, or renewable materials and produced using sustainable processes. Flexible green packaging is widely used across industries such as food & beverage, personal care, pharmaceuticals, and e-commerce, offering benefits like reduced material use, lower carbon footprint, extended shelf life, and improved product-to-package ratios. As sustainability regulations tighten and consumer awareness of environmental issues grows, this market is seeing rapid innovation and adoption globally.

Flexible green packaging refers to environmentally sustainable packaging solutions made from materials that are recyclable, biodegradable, or compostable, and designed to reduce environmental impact. Unlike traditional rigid packaging, flexible packaging uses less material and is lightweight, which lowers transportation costs and carbon emissions. Green packaging emphasizes the use of renewable resources, such as plant-based plastics, paper, and biodegradable films, instead of petroleum-based materials. It aims to minimize waste, conserve energy, and reduce pollution throughout the product lifecycle. This type of packaging is widely used in industries like food and beverage, personal care, and pharmaceuticals, offering both environmental and economic benefits. By combining sustainability with functionality, flexible green packaging supports the global move toward a circular economy.

What Are the Major Trends in the Flexible Green Packaging Market?

Shift Toward Biodegradable and Compostable Materials

- There is a growing preference for packaging made from natural, plant-based materials like cornstarch, PLA (polylactic acid), and cellulose. These materials decompose naturally without leaving toxic residues, reducing landfill burden and pollution. Brands are increasingly adopting such materials to align with sustainability goals and to comply with global regulations against plastic waste.

Increased Use of Recyclable Mono-Material Packaging

- Traditional flexible packaging often uses multi-layered materials that are hard to recycle. The trend now is toward using single-material (mono-material) films like PE (polyethylene) or PP (polypropylene) to make recycling more efficient. This helps improve recyclability, reduces contamination during the recycling process, and simplifies the waste management system.

Rising Adoption of Bio-Based Plastics

- Bio-based plastics, derived from renewable sources such as sugarcane or corn, are becoming more popular as alternatives to fossil-fuel-based plastics. These materials reduce the carbon footprint without compromising packaging strength. Companies are using bio-based packaging to appeal to eco-conscious consumers and reduce dependence on non-renewable resources.

Lightweight Packaging Innovations

- Flexible green packaging is becoming even lighter through innovations in design and materials, reducing the amount of raw material used. Lighter packaging lowers transportation costs, reduces energy consumption, and decreases greenhouse gas emissions.

Smart and Sustainable Packaging Integration

- Some green packaging now includes smart technologies like QR codes or indicators that track freshness, origin, or recycling instructions. This enhances consumer engagement, supports recycling efforts, and improves overall transparency in the supply chain.

Regulatory Push and Industry Standards

- Governments across the globe are implementing stricter environmental regulations, encouraging manufacturers to switch to sustainable packaging options. Compliance with these rules is pushing companies to innovate and invest in green packaging solutions to avoid penalties and maintain market reputation.

Brand Differentiation and Consumer Demand

- Eco-conscious consumers prefer brands that show a commitment to sustainability. Companies are using green packaging as a marketing tool to enhance brand value. Sustainable packaging is becoming a competitive advantage, influencing purchase decisions and fostering customer loyalty.

How Can AI Improve the Flexible Green Packaging Industry?

AI integration is transforming the flexible green packaging market by enhancing efficiency, sustainability, and innovation across the value chain. Through predictive analytics, AI helps manufacturers forecast demand accurately, minimizing material waste and overproduction. In design and development, AI-powered tools enable rapid prototyping of eco-friendly packaging structures that optimize material use while maintaining product protection. AI also improves quality control through real-time defect detection in production lines, ensuring consistent performance and reducing waste.

In supply chain management, AI algorithms optimize logistics by identifying the most efficient routes and reducing carbon emissions. Additionally, AI-driven consumer insights help brands tailor packaging solutions based on sustainability preferences, boosting customer satisfaction and brand loyalty. Machine learning models further support recycling processes by improving the sorting of packaging materials, thereby enhancing the circular economy. Overall, AI plays a critical role in making flexible green packaging smarter, more cost-effective, and aligned with environmental goals.

Market Dynamics

Driver

Increasing Environmental Awareness & Stringent Government Regulations

Consumers and businesses are becoming more conscious of environmental issues such as plastic pollution and climate change. This awareness is driving demand for sustainable packaging solutions that reduce environmental impact. Governments around the world are implementing bans, taxes, and guidelines on single-use plastics and non-recyclable materials. These regulatory pressures are encouraging companies to adopt eco-friendly, flexible packaging alternatives.

Restraint

Limited Recycling Infrastructure & Performance Limitations

The key players operating in the market are facing issues due to performance limitations and limited recycling infrastructure, which is estimated to restrict the growth of the flexible green packaging market. Many regions lack the infrastructure required to collect, sort, and process flexible green packaging effectively. This limits the circular use of materials and discourages businesses from adopting these solutions. Biodegradable, compostable, and bio-based materials often cost more than conventional plastics. This increases the overall production cost, making it challenging for small and medium enterprises (SMEs) to adopt green packaging solutions at scale. Some green packaging materials may not offer the same level of barrier protection, durability, or shelf life as traditional plastics, especially for moisture- or oxygen-sensitive products. This can limit their use in industries like food, pharmaceuticals, and chemicals.

What are the Opportunities for the Growth of the Flexible Green Packaging Market?

Innovation in Eco-Friendly Materials

Continuous research and development in bio-based, biodegradable, and compostable materials is opening doors for improved performance and cost-efficiency. Advanced materials like algae-based films, mushroom packaging, and nanotechnology-enabled compostable plastics offer new avenues for market expansion.

E-commerce and Direct-to-Consumer Brands

The global boom in e-commerce has increased the demand for flexible, protective, and sustainable packaging for shipping purposes. Companies that offer green, lightweight, and customizable packaging for e-commerce shipments can capitalize on this growing trend.

Growth in Health, Wellness, and Organic Product Markets

As consumers shift toward healthier lifestyles and organic products, there's a rising demand for packaging that aligns with the values of purity and environmental friendliness. Green packaging offers a perfect fit for organic food, natural personal care, and clean-label product segments.

Segmental Insights

Why does the Recycled Plastic Segment Dominate the Flexible Green Packaging Market?

The recycled plastic segment is the dominant segment in the flexible green packaging market due to its cost-effectiveness, wide availability, and compatibility with existing packaging technologies. Recycled plastics, such as rPET (recycled polyethylene terephthalate) and rPE (recycled polyethylene), offer a sustainable alternative to virgin plastics while maintaining the required durability, flexibility, and barrier properties for various applications. Increasing regulations promoting the use of post-consumer recycled content and growing consumer preference for eco-friendly packaging are further accelerating adoption. Additionally, advancements in recycling processes have improved the quality and consistency of recycled plastics, making them suitable for food, personal care, and industrial packaging.

Bioplastic Segment to Grow at Fastest Rate

The bioplastics segment is the fastest-growing segment in the flexible green packaging market due to increasing demand for renewable, biodegradable, and compostable materials. Made from natural sources like corn starch, sugarcane, and potato starch, bioplastics offer an eco-friendly alternative to conventional plastics without compromising functionality. Rising consumer awareness, strict government regulations on plastic use, and corporate sustainability initiatives are driving adoption across industries such as food and beverage, cosmetics, and healthcare. Technological advancements have also improved the performance and scalability of bioplastic films, making them more viable for commercial applications. Their reduced carbon footprint further enhances their appeal in a sustainability-focused market.

Why does the Pouches Segment Dominate the Flexible Green Packaging Market?

The pouches segment is the dominant packaging type in the flexible green packaging market due to its versatility, lightweight nature, and material efficiency. Pouches require less raw material compared to rigid packaging, reducing both production costs and environmental impact. Their space-saving design lowers transportation and storage costs, making them ideal for industries like food and beverage, personal care, and pharmaceuticals. Pouches can also be easily produced using recyclable, biodegradable, or compostable materials, aligning well with green packaging goals. Additionally, innovations in resealable closures, barrier properties, and printing technologies have further enhanced their functionality and appeal to both consumers and manufacturers.

Compostable Wraps & Films Segment to Grow at Fastest Rate

The wraps & films segment is the fastest-growing in the flexible green packaging market due to rising environmental concerns and increasing demand for sustainable food packaging solutions. These films and wraps are made from renewable resources such as corn starch, polylactic acid (PLA), or cellulose, and are designed to break down naturally in industrial or home composting environments. They offer essential packaging benefits like flexibility, barrier protection, and shelf-life extension while significantly reducing plastic pollution. Growing consumer preference for zero-waste and eco-friendly products, combined with government bans on conventional plastics, is accelerating adoption across food, retail, and personal care industries.

Which End-Use Industry Segment Dominated the Flexible Green Packaging Market in 2024?

The food and beverages segment is the dominant end-use industry in the flexible green packaging market due to the high volume of packaged goods and the growing demand for sustainable alternatives to conventional plastic packaging. This industry requires packaging that preserves freshness, extends shelf life, and offers convenience, all of which can be achieved using eco-friendly materials like biodegradable films, recyclable laminates, and compostable wraps. Rising consumer awareness of health, hygiene, and environmental impact is encouraging brands to adopt green packaging. Additionally, strict food safety and sustainability regulations are pushing manufacturers to switch to flexible, lightweight, and environmentally responsible packaging solutions, further driving this segment’s dominance.

Retail & E-Commerce Segment to Grow at Fastest Rate

The retail & e-commerce segment is the fastest-growing segment in the flexible green packaging market due to increasing consumer awareness about sustainability and a rapid shift toward online shopping. In the retail and e-commerce industry, brands are under pressure to reduce plastic waste and enhance their environmental image, leading to the adoption of biodegradable films, compostable sachets, and recyclable pouches. Simultaneously, the surge in e-commerce has fuelled demand for lightweight, durable, and sustainable packaging that protects products during transit while minimizing environmental impact. Consumers are now seeking eco-friendly packaging even in online purchases, pushing companies to offer green alternatives. Additionally, innovations such as reusable mailers, compostable shipping bags, and mono-material films are making sustainable packaging more accessible, scalable, and effective in these rapidly expanding sectors.

Which Sustainability Attribute Segment Dominated the Flexible Green Packaging Market in 2024?

The recyclable segment is the dominant sustainable type in the flexible green packaging market due to its wide acceptance, established infrastructure, and compatibility with existing packaging systems. Recyclable materials like polyethylene (PE) and polypropylene (PP) are cost-effective and maintain essential packaging properties such as durability, flexibility, and barrier protection. As governments worldwide introduce regulations promoting circular economy practices, businesses are increasingly opting for recyclable solutions to comply with environmental standards and reduce waste. Consumers also prefer packaging that is easy to recycle, reinforcing market demand. Moreover, innovations in mono-material films and improved recycling technologies have enhanced the efficiency and scalability of recyclable flexible packaging, securing its leading position.

Compostable & Plant-based Materials Segment to Grow at Fastest Rate

The compostable and plant-based material segment is the fastest-growing segment in the flexible green packaging market due to rising environmental concerns and the urgent need to reduce plastic pollution. Made from renewable resources such as cornstarch, sugarcane, and cellulose, these materials are biodegradable and break down naturally without harming the environment. Growing consumer preference for plastic-free, sustainable alternatives, especially in food, personal care, and organic product packaging, is accelerating demand. Government regulations banning single-use plastics and encouraging compostable materials are also driving adoption. Additionally, advancements in material science have improved the functionality and shelf life of compostable packaging, making it a viable alternative to conventional plastics in both industrial and consumer applications.

Which Distribution Channel Segment Dominated the Flexible Green Packaging Market in 2024?

The direct sales segment is the dominant distribution channel in the flexible green packaging market due to its ability to offer customized solutions, better pricing control, and stronger customer relationships. Manufacturers often prefer direct sales to communicate technical details, sustainability certifications, and product benefits more effectively to end-users. This channel enables packaging companies to cater specifically to the unique requirements of large industries such as food and beverage, personal care, and healthcare. It also allows for faster feedback, tailored packaging innovations, and better after-sales service. As demand for eco-friendly, customized packaging grows, direct sales offer a more efficient and responsive approach, reinforcing their dominance in the market.

Online Platforms / E-Marketplaces Segment to Grow at Fastest Rate

The online platforms and e-marketplaces segment is the fastest-growing in the flexible green packaging market due to the increasing digitalization of procurement processes and the growing preference for convenience and speed in sourcing sustainable packaging solutions. These platforms enable businesses to compare products, access a wider variety of eco-friendly packaging options, and place orders with minimal effort. Small and medium-sized enterprises (SMEs), in particular, benefit from the transparency, competitive pricing, and ease of access offered by digital channels. Additionally, the rise of e-commerce and digital marketing has made it easier for green packaging manufacturers to reach global buyers, accelerating growth in this segment.

Regional Insights

Which Region Dominated the Flexible Green Packaging Market in 2024?

Europe is the dominant region in the flexible green packaging market due to its strong environmental policies, advanced recycling infrastructure, and widespread consumer awareness regarding sustainability. The European Union has implemented stringent regulations like the Single-Use Plastics Directive and the Green Deal, which promote the reduction of plastic waste and encourage the use of recyclable and compostable materials.

European consumers are highly eco-conscious, driving demand for sustainable packaging solutions across sectors such as food and beverage, personal care, and pharmaceuticals. The region also benefits from strong governmental support and funding for research and innovation in bio-based and biodegradable packaging technologies. These factors, combined with a mature packaging industry and circular economy initiatives, position Europe as a leader in the global flexible green packaging market.

Germany Market Trends

Germany is a key leader in sustainable packaging due to its robust recycling infrastructure, strict environmental laws, and advanced packaging industry. The country’s strong focus on a circular economy and producer responsibility laws (such as VerpackG) encourages businesses to use eco-friendly materials. German consumers also prioritize sustainability, influencing market demand.

France Market Trends

France is making rapid progress in green packaging, driven by aggressive policies targeting plastic reduction and waste minimization. Laws banning single-use plastics and promoting compostable and bio-based materials have boosted the adoption of flexible green packaging, particularly in the food and retail sectors.

U.K. Market Trends

The U.K. has shown strong momentum post-Brexit, with independent sustainability regulations and public support for eco-conscious products. Government initiatives like the Plastic Packaging Tax and Extended Producer Responsibility (EPR) encourage businesses to switch to recyclable and biodegradable flexible packaging options.

Italy Market Trends

Italy is emerging as a prominent market due to its investments in bio-based packaging and strong agricultural exports requiring sustainable solutions. The country supports innovation in biodegradable films and compostable materials, supported by both public and private sector R&D initiatives.

Netherlands Market Trends

The Netherlands focuses on circular economy strategies and has high recycling rates. Dutch companies emphasize reusable and recyclable packaging, and there’s a strong push from both the government and NGOs to transition toward greener alternatives.

Spain Market Trends

Spain is actively transitioning toward sustainable packaging due to rising consumer demand and national policies aligning with EU green goals. Growth in sectors like food processing and retail is increasing the demand for lightweight, flexible, and eco-friendly packaging.

What Promotes the Growth of the Asia Pacific Flexible Green Packaging Market?

Asia Pacific is the fastest-growing market for flexible green packaging due to rapid industrialization, urbanization, and increasing environmental awareness across major economies such as China, India, Japan, and Southeast Asian countries. Rising disposable incomes and a growing middle-class population are driving demand for packaged goods, particularly in the food, beverage, and personal care sectors, creating strong incentives for sustainable packaging alternatives.

Governments in the region are implementing stricter regulations to curb plastic pollution and promote eco-friendly practices, such as bans on single-use plastics and incentives for biodegradable materials. Additionally, increased foreign investments and technological advancements are enabling local manufacturers to develop cost-effective, flexible green packaging solutions. The combination of policy support, market demand, and evolving consumer preferences positions Asia-Pacific as a high-potential, fast-expanding region in the global green packaging landscape.

India Market Trends

India is emerging as a significant player in the flexible green packaging market due to growing environmental awareness, a large consumer base, and supportive government policies. Initiatives like the ban on single-use plastics, Extended Producer Responsibility (EPR), and the Swachh Bharat (Clean India) mission are encouraging businesses to adopt recyclable and biodegradable packaging. India's booming food delivery, FMCG, and e-commerce sectors are fueling the need for sustainable packaging alternatives.

China Market Trends

As the largest packaging market in the region, China is seeing rapid adoption of green packaging due to environmental reforms and industrial modernization. The government’s aggressive targets for plastic reduction, combined with regulations like the “Green Packaging Standard,” are driving companies to use recyclable and compostable flexible packaging. Additionally, growing domestic consumption and export demand create strong momentum for sustainable innovations.

Japan Market Trends

Japan, known for its innovation and efficiency, is investing in recyclable, lightweight, and biodegradable packaging technologies as part of its circular economy strategies.

South Korea: The country’s strict waste management laws and tech-savvy packaging industry support the shift toward green packaging solutions.

Southeast Asia (e.g., Thailand, Indonesia, Vietnam): These nations are addressing marine pollution concerns and are increasingly adopting green packaging for food exports, tourism, and domestic consumption.

North America’s Growing Food & Beverage Company to Project Notable Growth

North America is witnessing notable growth in the flexible green packaging market due to strong consumer demand for sustainable products, supportive regulations, and rapid innovation in packaging technologies. Governments in the U.S. and Canada are implementing policies to reduce plastic waste, including bans on single-use plastics and the promotion of recyclable and compostable materials. Major industries such as food and beverage, healthcare, and personal care are increasingly adopting eco-friendly packaging to meet sustainability goals and appeal to environmentally conscious consumers. The region also benefits from a well-established recycling infrastructure and significant investment in R&D for bio-based materials and advanced flexible packaging solutions.

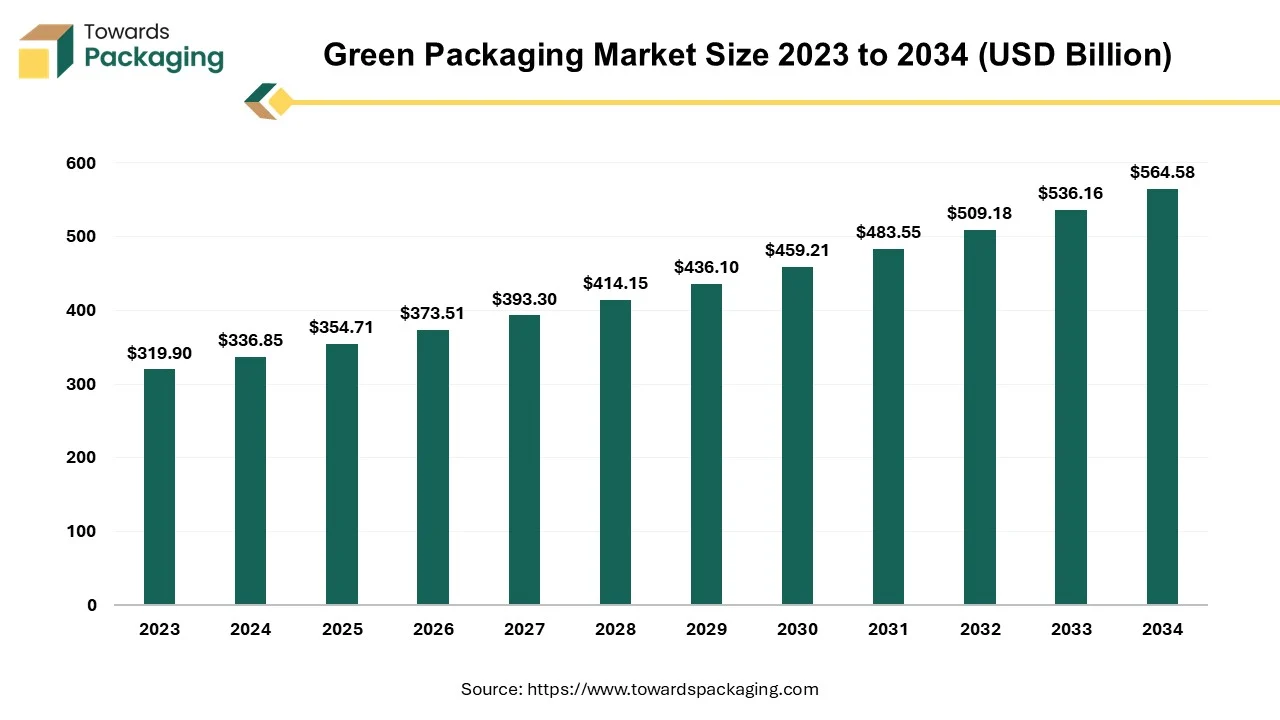

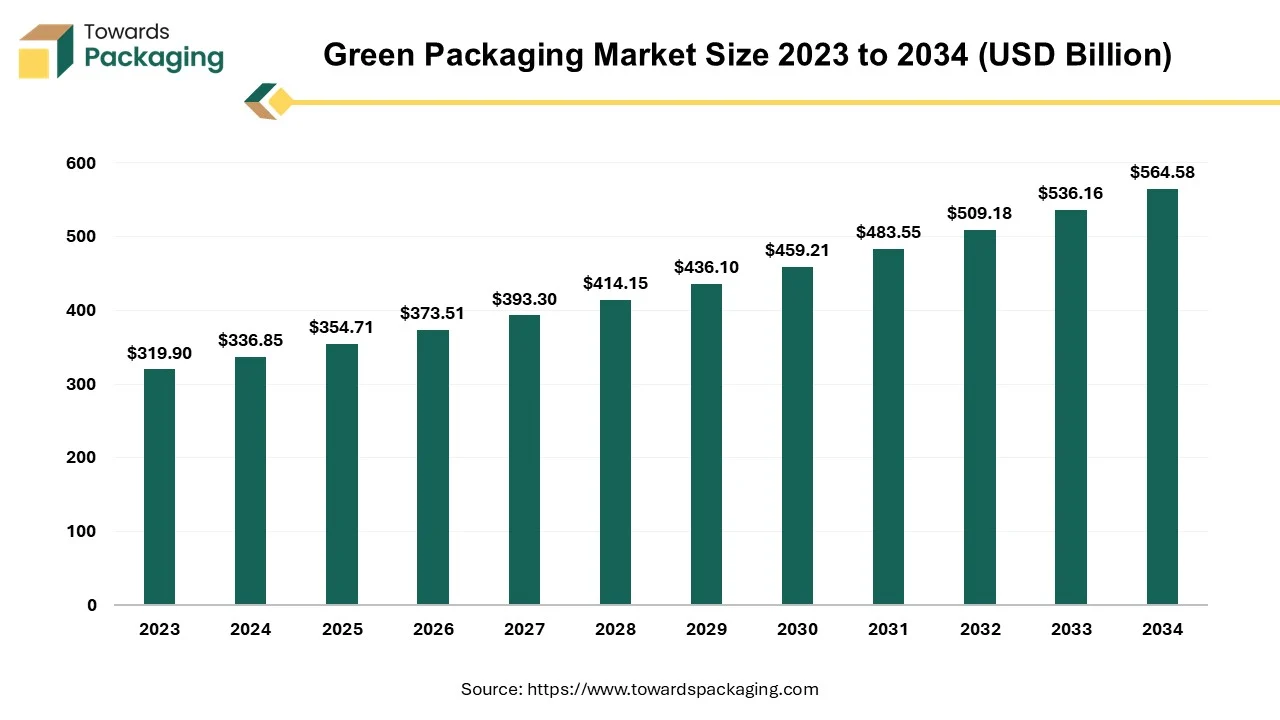

Future of Green Packaging Market

The green packaging market is expected to rise from USD 336.85 billion in 2024 to USD 564.58 billion by 2034, growing at a CAGR of 5.3%. Consumers are demanding more environmentally responsible products, pushing companies to change their packaging methods. Governments are enforcing stricter rules that require businesses to reduce waste and use sustainable materials.

Green packaging, also known as sustainable packaging or eco-friendly packaging, refers to packaging materials and practices that minimize environmental impact. The green packaging Reduces excess materials and using lightweight packaging to cut down on waste. Green packaging, also known as sustainable packaging or eco-friendly packaging, refers to the use of materials and production methods that have a minimal environmental impact. As concerns about pollution, climate change, and resource depletion grow, businesses and consumers are shifting toward packaging solutions that are sustainable, recyclable, and biodegradable. The green packaging is derived from renewable sources like cornstarch, sugarcane, or algae. Examples include PLA (polylactic acid) and PHA (polyhydroxyalkanoates).

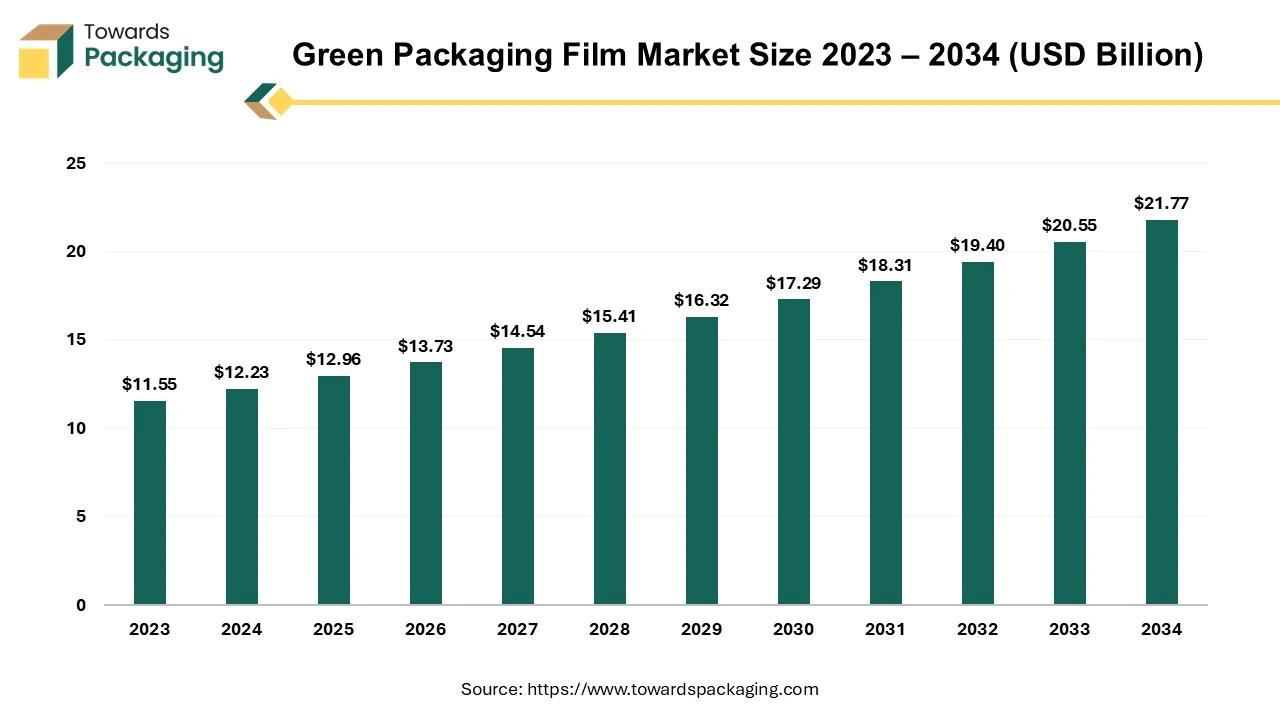

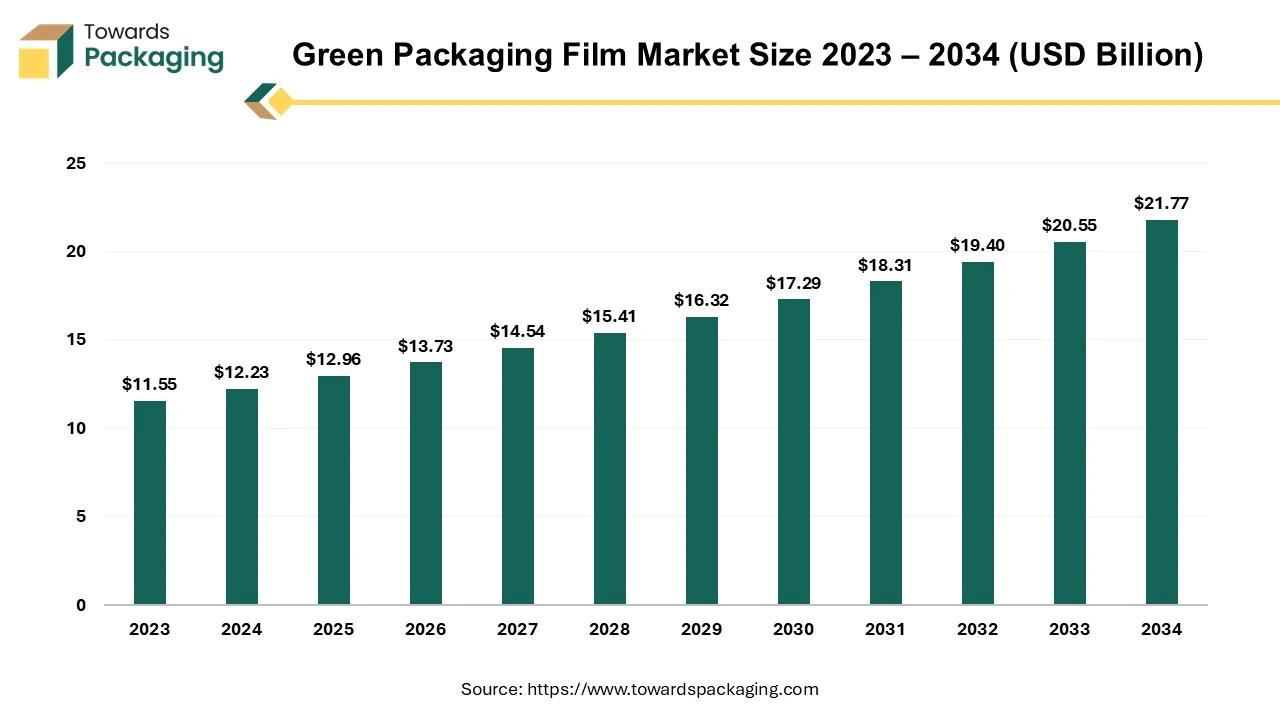

Future of Green Packaging Film Market

The green packaging film market is set to grow from USD 12.96 billion in 2025 to USD 21.77 billion by 2034, with an expected CAGR of 5.93% over the forecast period from 2025 to 2034.

The term "green packaging" describes the creation and application of sustainable and ecologically friendly packaging. Compostable, biodegradable, or recyclable materials are used in green packaging. This involves using materials that are easily repurposed or decomposable without leaving behind hazardous residues, as well as recycled content. Reduction The goal is to use less packaging material overall. This is creating packages that are more compact or effective in order to reduce waste and preserve resources. Rather than using petroleum-based plastics, green packaging frequently uses materials made from renewable resources, such as plant-based materials (like bamboo, hemp, or cornstarch). Reducing greenhouse gas emissions and energy consumption are the two main goals of the green packaging production process.

Future of Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

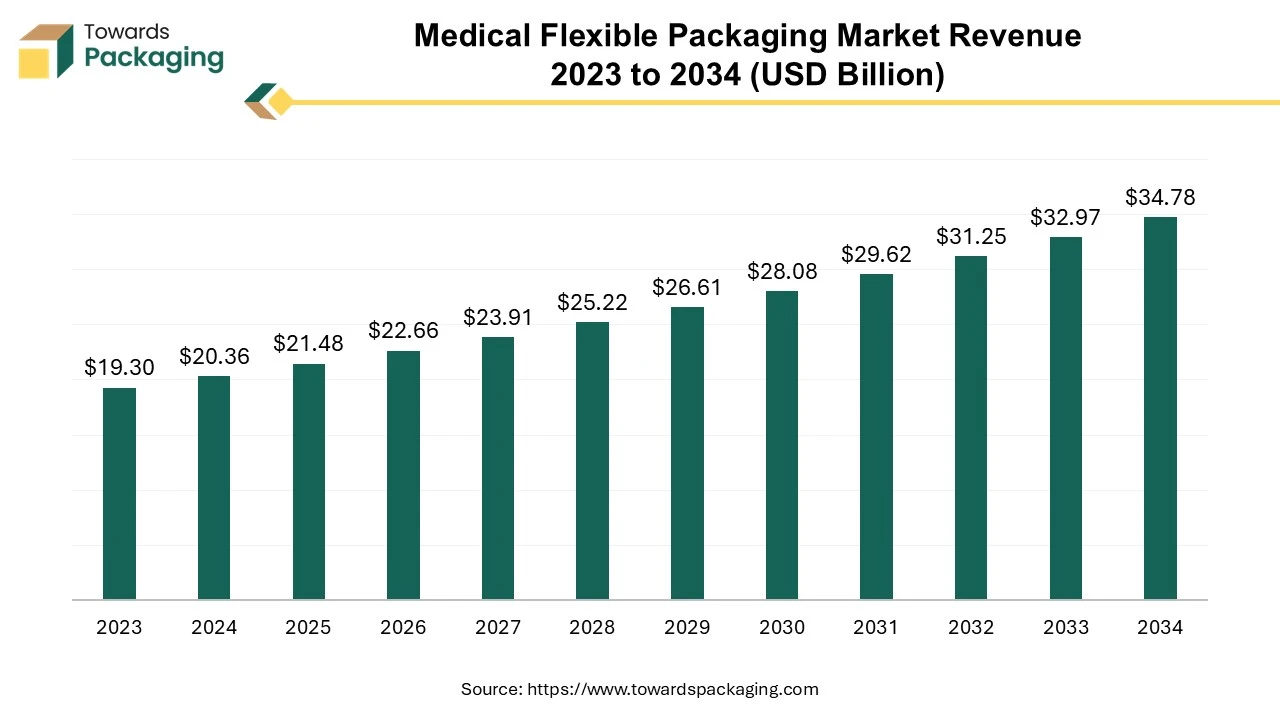

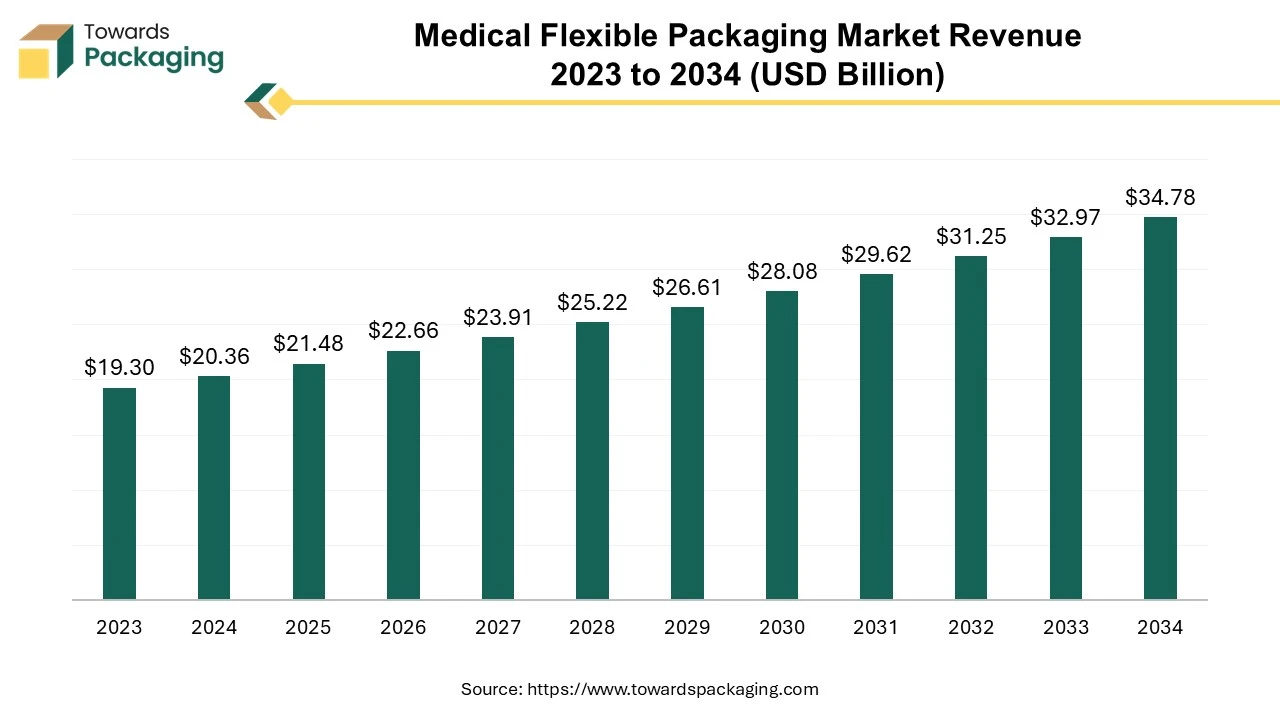

Future of Medical Flexible Packaging Market

The medical flexible packaging market is anticipated to grow from USD 21.48 billion in 2025 to USD 34.78 billion by 2034, with a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2025 to 2034.

The market is proliferating due to the increasing demand for pharmaceutical industry telemedicine, delivery of drugs, and packaging of various other things that require safe and flexible packaging. The growing trend of online ordering systems is boosting the medical flexible packaging market.

The healthcare sector is showing a major transition towards convenience and portable packaging due to the growing online facility in this sector. This flexible medical packaging provides lightweight, safe, leakage-proof, and compact rigid packaging for different products. Such packaging makes it easier to carry small products such as inhalers, injection needles, bandages, and many others. Due to this convenience in carrying such essential products the demand for medical flexible packaging market. Biotechnology and the pharmaceutical industry together contribute towards the growth of the medical flexible packaging market.

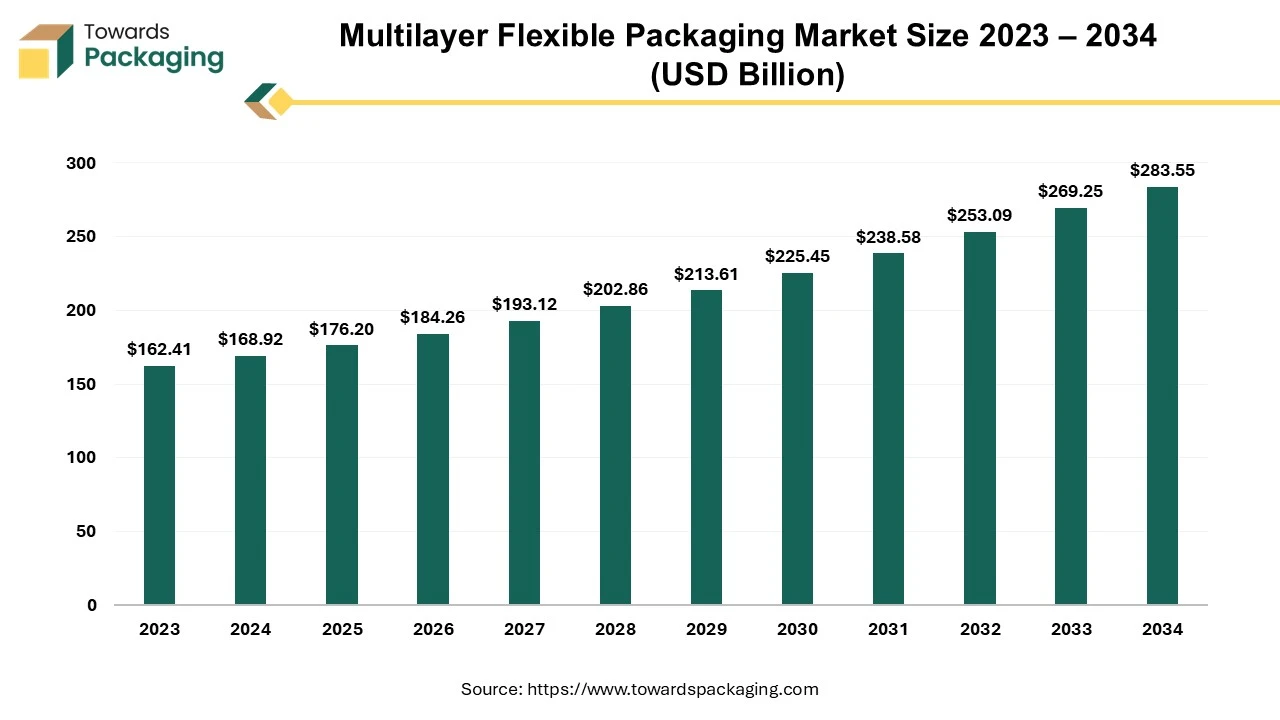

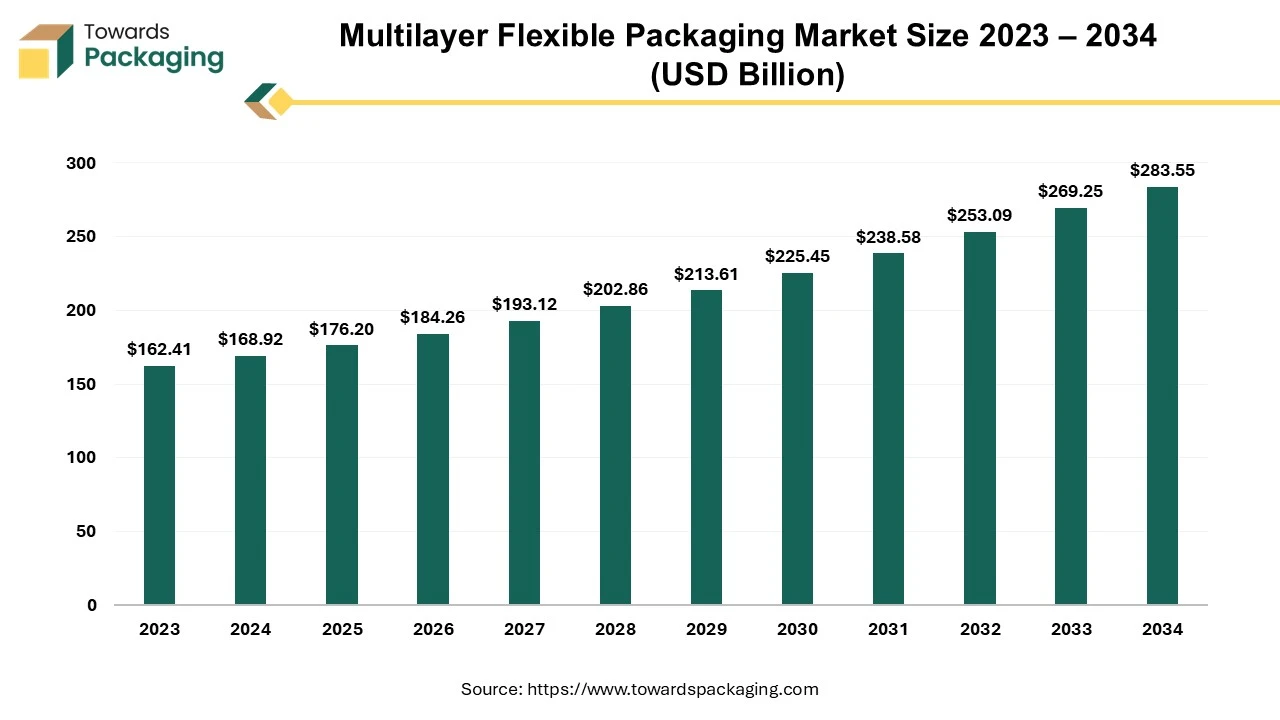

Future of Multilayer Flexible Packaging Market

The global multilayer flexible packaging market is estimated to reach USD 283.55 billion by 2034, up from USD 168.92 billion in 2024, at a compound annual growth rate (CAGR) of 5.32% from 2025 to 2034.

The multilayer flexible packaging market is anticipated to grow at a substantial rate during the forecast period. Multilayer flexible packaging is made by combining multiple layers of materials such as plastics, paper, aluminum or bio-based films, to create a single structure. These layers are supposed to utilize each material's specific features such as strength and barrier protection, creating a packaging that is lightweight, strong as well as highly functional.

Global Flexible Green Packaging Market Key Players

Latest Announcements by Industry Leaders

- In July 2025, Evonik Animal Nutrition, a company that produces amino acids, Dr. Dirk Hoehler head of head of the Essential Nutrition product line, makes the point that product packaging matters as a key component of the company's efforts to reduce CO2 emissions and achieve a resource-keeping the circular economy intact. Packaging must be used to protect products effectively, but it should be done in the most in the most sustainable way possible. Together, Mondi and Evonik will launch a pre-made, recyclable paper in April 2025 container for chemicals in powder form. Reports state that the packaging was designed to reduce the environmental impact of a wide range of consumer and commercial products that use shipping fumed silica.

New Advancements in the Market

- In March 2025, Green Lab, the top producer of eco-packaging in Southeast Asia, formally entered the American market. Green Lab, a division of Frasers & Neave Group, one of the biggest SGX-listed corporations in Southeast Asia, is currently delivering its environmentally friendly packaging options to North America. Several container shipments are currently on their way, and the business provides 100% recycled paper bags, FSC-certified, and environmentally friendly food packaging that is competitively priced and performs as well as conventional options.

- In March 2025, Ahlstrom, a world leader in fiber-based specialty materials, revealed the launch of the most recent addition to LamiBak's line of high-quality performance-based documents. Especially made for flexible packaging, building on the original LamiBak product's demonstrated success, the LamiBak Flex line. This introduction demonstrates Ahlstrom's dedication to offering cutting-edge solutions that meet the increasing demand for high-quality, sustainable, and safe materials for barrier packaging.

Global Flexible Green Packaging Market Segments

By Material Type

- Bioplastics

- PLA (Polylactic Acid)

- PHA (Polyhydroxyalkanoates)

- Starch-Based Plastics

- Recycled Materials

- Post-Consumer Recycled (PCR) Plastics

- Recycled Paper & Cardboard

- Paper & Cellulose-Based Films

- Compostable Films

- Aluminum Foils & Biodegradable Laminates

- Mushroom & Plant Fiber-Based Materials

By Packaging Type

- Pouches

- Stand-Up Pouches

- Flat Pouches

- Wraps & Films

- Shrink Wraps

- Stretch Films

- Bags & Sachets

- Reclosable Zip Bags

- Single-Serve Sachets

- Rollstock

- Liners & Wrappers

By End-Use Industry

- Food & Beverage

- Organic & Natural Foods

- Ready-to-Eat Meals

- Dairy, Meat & Produce

- Personal Care & Cosmetics

- Healthcare & Pharmaceuticals

- Home Care Products

- Retail & E-Commerce

- Industrial & Institutional

By Sustainability Attribute

- Recyclable

- Compostable & Plant-based Material

- Biodegradable

- Renewable Resource-Based

- Low Carbon Footprint Manufacturing

By Distribution Channel

- Direct Sales (B2B)

- Retail Packaging Suppliers

- Online Platforms / E-Marketplaces

- Distributors & Wholesalers

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait