Pharmaceutical Packaging Market Strategic Analysis & Growth Opportunities

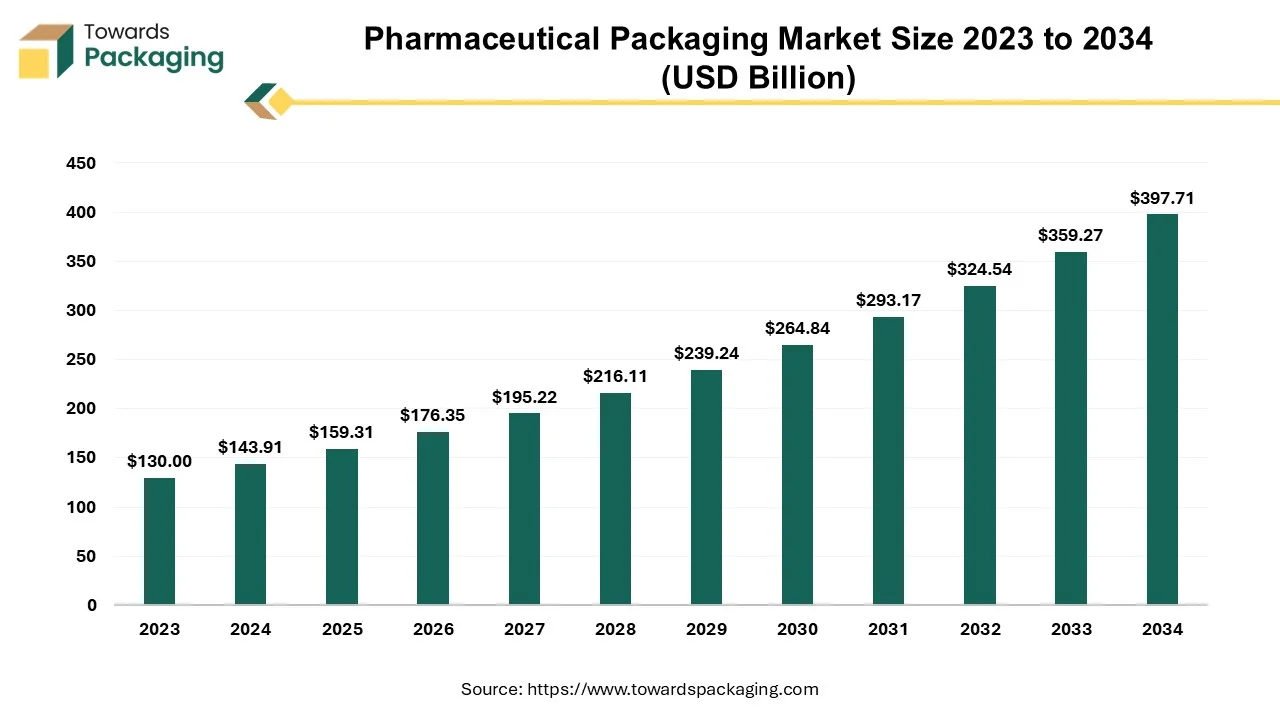

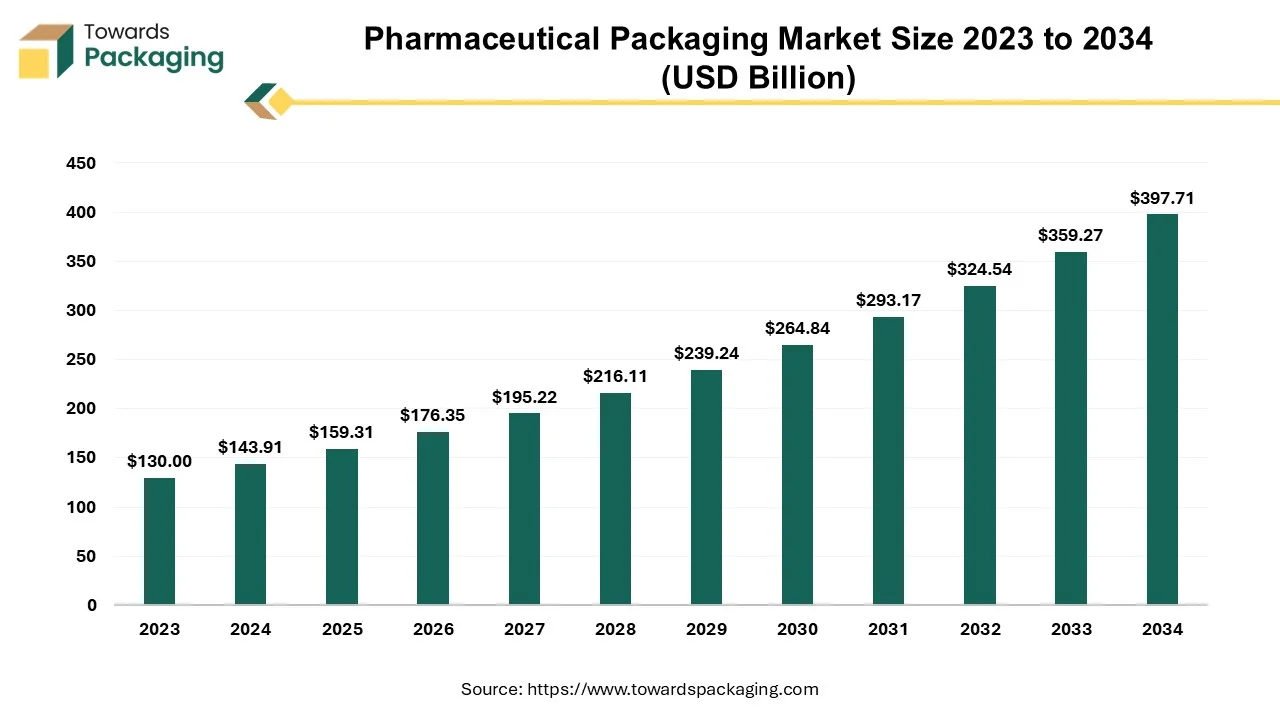

The pharmaceutical packaging market is forecast to grow from USD 176.35 billion in 2026 to USD 440.27 billion by 2035, driven by a CAGR of 10.7% from 2026 to 2035. with full segment statistics by material (plastics & polymers, glass, paperboard, foil), product (primary, secondary, tertiary), drug-delivery mode (oral, injectables, topical, ocular, nasal, pulmonary, etc.), and end-use (pharma manufacturing, CPOs, retail, institutional). It provides regional data for North America, Europe, Asia Pacific, Latin America, and MEA; company market shares (e.g., 2024 leader table) and supplier EBITDA margins; competitive benchmarking, pricing and regulatory dashboards; value-chain and cost breakdowns; and trade metrics (import/export volumes, unit values), plus manufacturer and supplier databases with site footprints and capacities.

Major Key Insights of the Pharmaceutical Packaging Market:

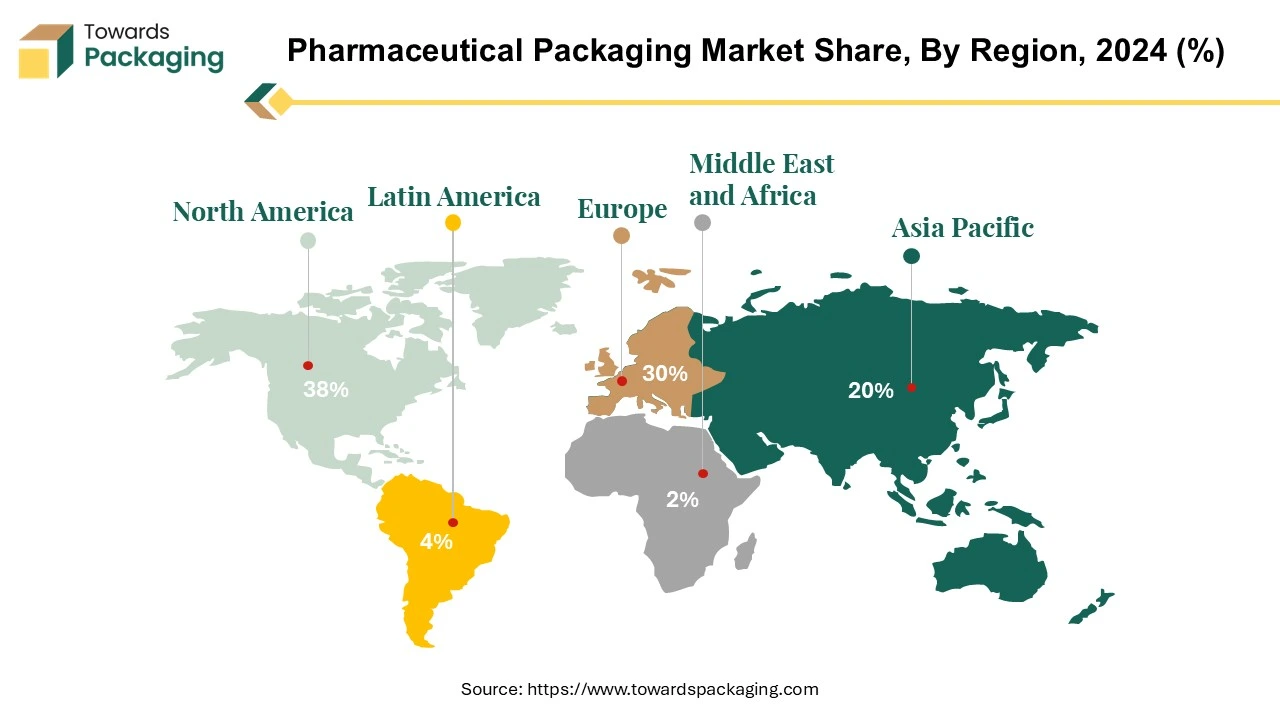

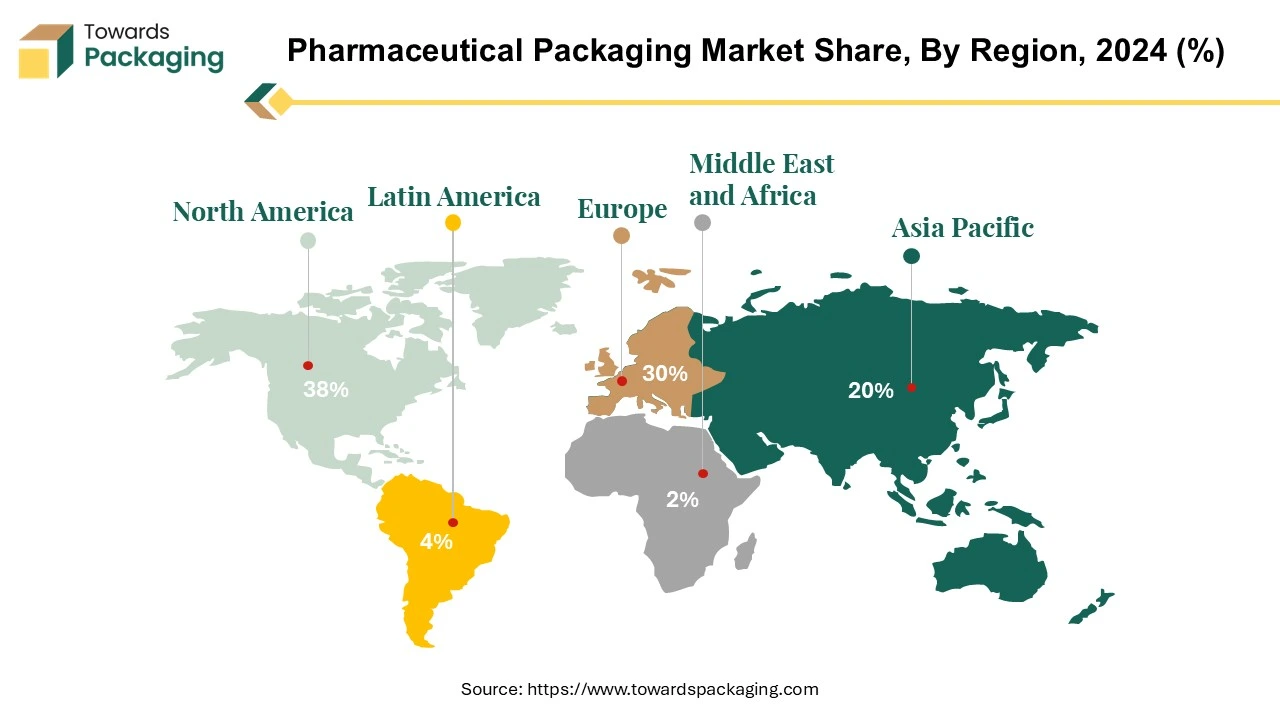

- North America dominated the pharmaceutical packaging market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By material, the plastics & polymers segment dominated the market with the largest share in 2024.

- By product, the primary segment registered its dominance over the global pharmaceutical packaging market in 2024.

- By drug delivery mode, oral drug delivery segment is expected to grow at significant rate during the forecast period.

- By end use, the pharma manufacturing segment dominated the pharmaceutical packaging market in 2024.

Pharmaceutical Packaging Market: Protective Packaging

A vital part of medicine delivery, pharmaceutical packaging guarantees the efficacy, safety, and integrity of pharmaceutical products for the course of their lifetime. Pharma packaging shields goods against deterioration, contamination, and other outside influences that could jeopardize patient safety and product quality by using specific materials and technology. Packaging acts as a protective barrier against temperature changes, moisture, light, and physical harm.

To guarantee that pharmaceuticals are safe and effective for general public consumption, pharmaceutical packaging adheres to strict requirements. Packaging is essential for informing patients and healthcare providers about compliance, appropriate usage guidelines, and pertinent product information. Pharmaceutical medicines may be transported, stored, and accessed with ease thanks to well-designed packaging.

Market Trends

Integration of Smart & Connected Packaging

Embedding electronics and connectivity into primary packs is revolutionizing adherence and patient engagement. Smart blisters and bottles with NFC or IoT-enabled sensors can remind patients to take doses, record real-time usage, relay adherence data back to healthcare providers improving outcomes and minimizing waste.

Eco-friendly & Sustainability Materials

Regulatory pressures and corporate ESG goals are driving adoption of biodegradable, recyclable, and bio-based polymers. Manufacturers are optimizing designs to minimize layers, utilizing recycled content, and even exploring paper-based alternatives for cartons and labels to cut plastic waste and CO2 footprints.

Track-and-Trace & Serialization

Global mandates (e.g., U.S. DSCSA, EU Falsified Medicines Directive) require unique, machine-readable IDs on every unit. Integrating 2D barcodes, RFID tags, and secure printing not only ensures compliance but also enables rapid recalls, combats counterfeiting, and offers end-to-end supply-chain visibility.

Improved Safety & Anti-Counterfeiting Features

Beyond child-resistant and tamper-evident closures, advanced security inks (holographic, color-shifting) and covert markers are becoming standard. These measures safeguard drug integrity, help verify authenticity at the point of dispense, and protect patients from falsified or diverted products.

Patient-Centric & Personalized Packaging

As precision medicine and specialty therapies grow, packaging is adapting with unit-of-use blister cards, 3D-printed dosage forms, custom labelling (e.g., larger fonts, color-coded regimens), improving usability for seniors, paediatrics, and complex regimens.

Automation of Pharmaceutical Packaging

Automated filling, sealing, labelling and cartooning lines powered by AI and machine-vision are boosting throughput, reducing human error, and ensuring real-time quality control. Fully integrated digital platforms tie production data back into ERP and MES systems for end-to-end traceability and predictive maintenance.

How Can AI Improve the Pharmaceutical Packaging Industry?

Pharmaceutical packaging production and management are optimized through the use of Al-based solutions. To assess the amount and kind of packaging needed, these systems examine demand projections, storage conditions, and previous data. Overproduction and waste are decreased as a result making it possible to produce packaging that better meets real demand.

Al is utilized not just for production but also for tracking and monitoring goods during the packaging process in order to spot any irregularities or flaws. Because, yes, just like all other commodities, packing is necessary! Furthermore, pharmaceutical packaging needs to adhere to strict safety and quality standards. For instance, a renowned irradiation center in Italy uses radiation to sterilize ophthalmic tubes.

The packaging industry is only one of several sectors that artificial intelligence is transforming. Rapid technology advancements have made it possible to use artificial intelligence to packaging, which presents new growth prospects in the industry by improving process efficiency, customization, and sustainability. This technology is transforming not just the creation and manufacturing of medications but also other facets of packaging, which is essential for the distribution, safety, and preservation of pharmaceutical products. This is particularly true in the pharmaceutical packaging industry.

Pharmaceutical security functions are served by Internet of Things (loT) and Al technologies, which measure medicine temperature sensitivity, detect tampering instances, and alert manufacturers and purchasers to dangerous situations. The intelligent monitoring system guarantees that medications reach their destination in the best possible condition and minimizes human error.

Driver

Rising Pharmaceutical Demand & Healthcare Spending

An aging global population and rising prevalence of chronic diseases (diabetes, cardiovascular disorders) are fuelling unprecedented growth in drug production and consumption. This is turn, directly expands packaging requirements across all dosage forms. Moreover, increasing launch of online platform for sales of pharmaceutical products has estimated drive the growth of the pharmaceutical packaging market over the forecast period.

- In 2023, the pharmaceutical industry submitted 12,425 patent applications via the Patent Cooperation Treaty administered by the World Intellectual Property Organization (WIPO). The average time from clinical trial start to patient enrolment close increased by 26% from 2019 to 2023, highlighting the growing complexity of pharmaceutical R&D.

- For instance, in January 2025, according to the data published by the International Pharmaceutical Federation (FIP), a number of pharmaceutical packaging businesses are expanding significantly at the moment. Global packaging giant Amcor, for instance, recorded US$ 14.5 billion in revenue in 2022. In a similar manner, AptarGroup, which is well-known for its drug delivery systems, made US$ 3.3 billion in sales in 2023. Additionally, due to the rising demand for medical supplies, West Pharmaceutical Services upped its 2024 annual profit prediction.

Moreover, the pharmaceutical sector files 12, 425 patent applications under the World Intellectual Property Organization’s (WIPO) Patent Co-operation Treaty in 2023. The increasing complexity of pharmaceutical R&D is demonstrated by the 26% rise in the average duration from the commencement of clinical trials to the conclusion of patient enrolment from 2019 to 2023.

Restraint

Stringent Regulatory Laws & Counterfeit and Product Integrity Concerns

The key players operating in the market are facing issue due to stringent regulatory laws and product integrity concerns which has estimated to restrict the growth of the pharmaceutical packaging market over the forecast period. Compliance with different international and national regulations (e.g., EMA, FDA) adds complexity and cost. Frequent updates and changes in packaging standards slow innovation and time-to-market. The rise in counterfeit drug pushes demand for anti-tampering and track-and-trace solutions, but implementation can be costly and technically challenging for smaller companies. Growing demand for eco-friendly packaging clashes with strict hygiene and barrier requirements in pharma packaging.

Market Opportunity

Connected and Smart Packaging

Growth in biologics, including vaccines and gene therapies, necessitates specialized packaging solutions to maintain product stability and efficacy. This trend is driving demand for advanced packaging materials and technologies, such as cold chain packaging and sophisticated vial and syringe designs. The integration of digital technologies into packaging such as RFID tags, QR codes, and sensors improves product safety and patient compliance. Smart packaging can provide real-time information on product usage and condition, improving patient engagement and adherence to medication regimens. Hence, automation in packaging and smart packaging has estimated create lucrative opportunity for the growth of the pharmaceutical packaging market over the forecast.

- For instance, in February 2025, Systech, a division of Markem-Imaje and Dover, has introduced UniSecure artAI, new authentication system driven by AI. The new system, which is entirely cloud-based SaaS, is intended to guarantee packaging quality, protect brands, and secure patients.

The system offers forensic investigation and real-time results by utilizing pre-existing packaging artwork and AI applications (such as machine vision and learning). Therefore, artAI seeks to assist users in overcoming obstacles encountered by businesses in the pharmaceutical and life science sectors.

Segmental Insights

Plastics & Polymers Led the Market in 2024

The plastics & polymers segment held a dominant presence in the pharmaceutical packaging market in 2024. Plastics like polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) provide effective barriers against moisture, oxygen, light, and contaminants. This helps maintain the stability and shelf life of pharmaceutical products. Plastics are lightweight, which reduces shipping costs and improves portability. They are also tough and impact-resistant, reducing the risk of breakage during transport or handling (compared to glass).

Plastic packaging is generally cheaper to produce at scale than alternatives like glass or metal. It supports mass production with high efficiency and low material waste. Many pharmaceutical plastics are chemically inert, meaning they won’t react with or leach into the drug product. Plastics allow for the incorporation of tamper-evident features, which is critical for patient safety and regulatory compliance.

Primary Segment Held Significant Share in 2024

The primary segment accounted for a significant share of the pharmaceutical packaging market in 2024. Primary packaging holds the actual pharmaceutical substance (e.g., tablets, syrups, injectables). It forms the first barrier against external influences like moisture, light, air, and contaminants. It ensures the chemical and physical stability of the drug throughout its shelf life. Every single dose or unit of a medication requires c blister packs for tablets, vials for injectables, bottles for syrups, etc.

Oral Drug Delivery Led Market in 2024

The oral drug delivery segment registered its dominance over the global pharmaceutical packaging market in 2024. Oral drugs (e.g., tablets, capsules, syrups) are easy to administer, no special training, tools, or professional supervision required. This leads to high patient acceptance and compliance, especially in outpatient and chronic care. A significant majority of medications are developed for oral administration due to: Simpler formulation processes, Cost-effective manufacturing, and Non-invasive nature. This drives large-scale demand for related packaging (blister packs, bottles, sachets). Oral dosage packaging is typically cheaper and faster to produce compared to injectables or inhalable.

This benefits both branded and generic drug manufacturers, making it widely adopted across global markets. The oral segment supports various packaging types: blister packs for solid doses, plastic and glass bottles for liquids, and stick packs, sachets, strip packs for powders or granules. Oral medications are the go-to for managing chronic conditions like diabetes, hypertension, mental health disorders, etc. Many oral drug formulations are more stable and require less complex packaging compared to biologics or injectables, making them more commercially viable.

Expanding Pharmaceutical Manufacturing Sector to Promote Dominance

The pharmaceutical manufacturing segment dominated the pharmaceutical packaging market globally. More drugs being produced means more units to be packaged—whether tablets, vials, syrups, or injectables. Every additional batch of drugs requires primary, secondary, and tertiary packaging, boosting market demand across all packaging segments. Pharmaceutical companies expanding into India, China, Southeast Asia, and Africa create new demand for cost-effective, regulation-compliant packaging. Local manufacturing hubs also drive regional packaging industry growth. CMOs and CDMOs (Contract Development and Manufacturing Organizations) often provide end-to-end solutions, including packaging. As pharma companies outsource production, CMOs ramp up packaging operations to support faster go-to-market strategies.

With expansion comes the need for quick scaling and fast packaging solutions. This drives demand for automation, smart packaging lines, and modular packaging designs that can handle a variety of drug forms. Expanding manufacturers must meet global packaging regulations (FDA, EMA, WHO). This necessitates the adoption of high-quality, standardized packaging materials and practices—driving demand for premium packaging solutions. As competition rises, manufacturers use packaging as a tool for branding, patient engagement, and market positioning especially in OTC and specialty drug markets.

Regional Insights

North America’s Advanced Infrastructure to Promote Dominance

North America held the largest share of the pharmaceutical packaging market in 2024, owing to advanced infrastructure facilities to manufacture pharmaceutical packaging. North America, especially the U.S. and Canada, has a large and growing elderly population. Regulations from bodies like Health Canada and FDA (U.S.) ensure high packaging standards for safety, traceability, and tamper evidence, which drives innovation and investment in advanced packaging technologies.

U.S. Pharmaceutical Packaging Industry Trends

U.S. pharmaceutical packaging market is driven due to expanding consumer base for pharmaceutical packaging. The U.S. Food and Drug Administration (FDA) enforces rigorous standards for pharmaceutical packaging to ensure drug safety and efficacy. Regulations such as the Drug Supply Chain Security Act mandate serialization and traceability, driving the demand for advanced packaging technologies that can comply with these requirements.

The global U.S. pharmaceutical packaging market is predicted to expand from USD 52.48 billion in 2025 to USD 99.44 billion by 2034, growing at a CAGR of 7.36% during the forecast period from 2025 to 2034. The rising drug production, growing demand for personalized medicine & biologics, increased regulatory scrutiny, and increasing popularity of sustainable, smart, and tamper-evident packaging are expected to drive the growth of the U.S. pharmaceutical packaging market over the forecast period.

Several key players operating in the market are increasingly focused on adopting inorganic growth strategies such as acquisition and collaboration to develop innovative and sustainable packaging for the U.S. pharmaceutical industry. Primary packaging continues to dominate the market. Primary packaging is considered the medication's immediate container, which is vital for maintaining its utmost safety and quality. Sustainability concern plays a crucial role, with manufacturers developing eco-friendly pharmaceutical packaging to meet environmental concerns.

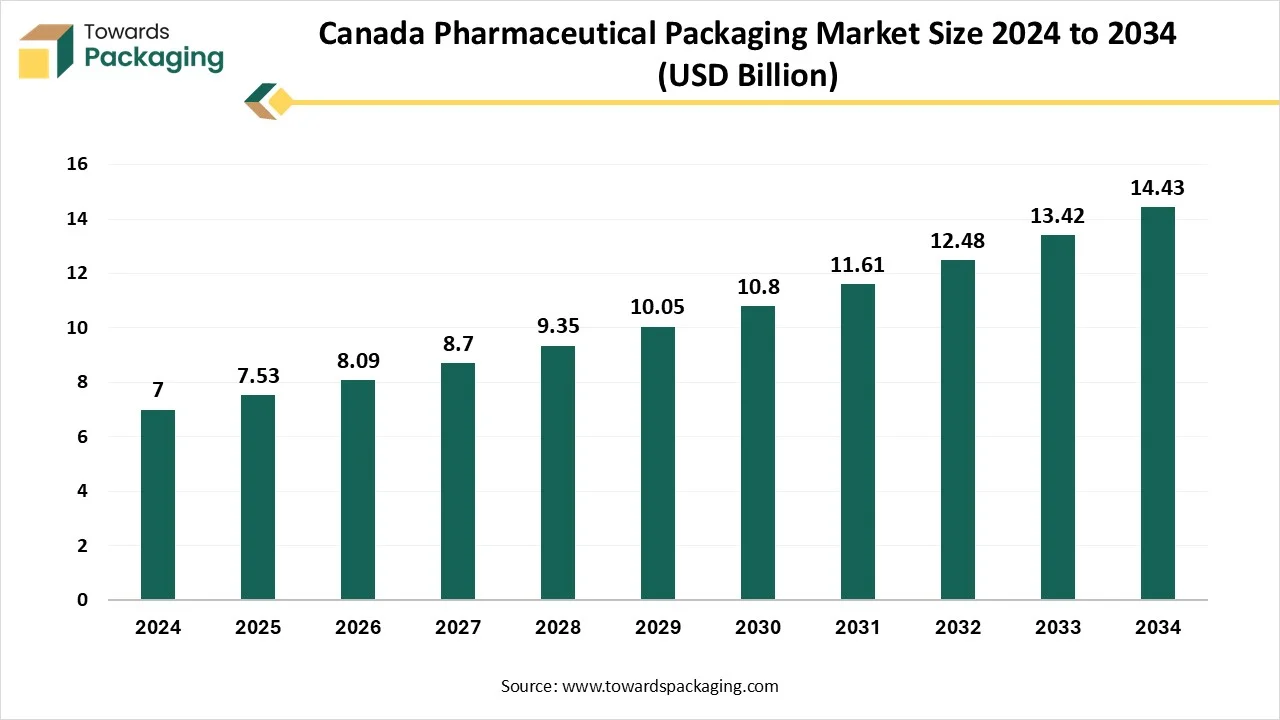

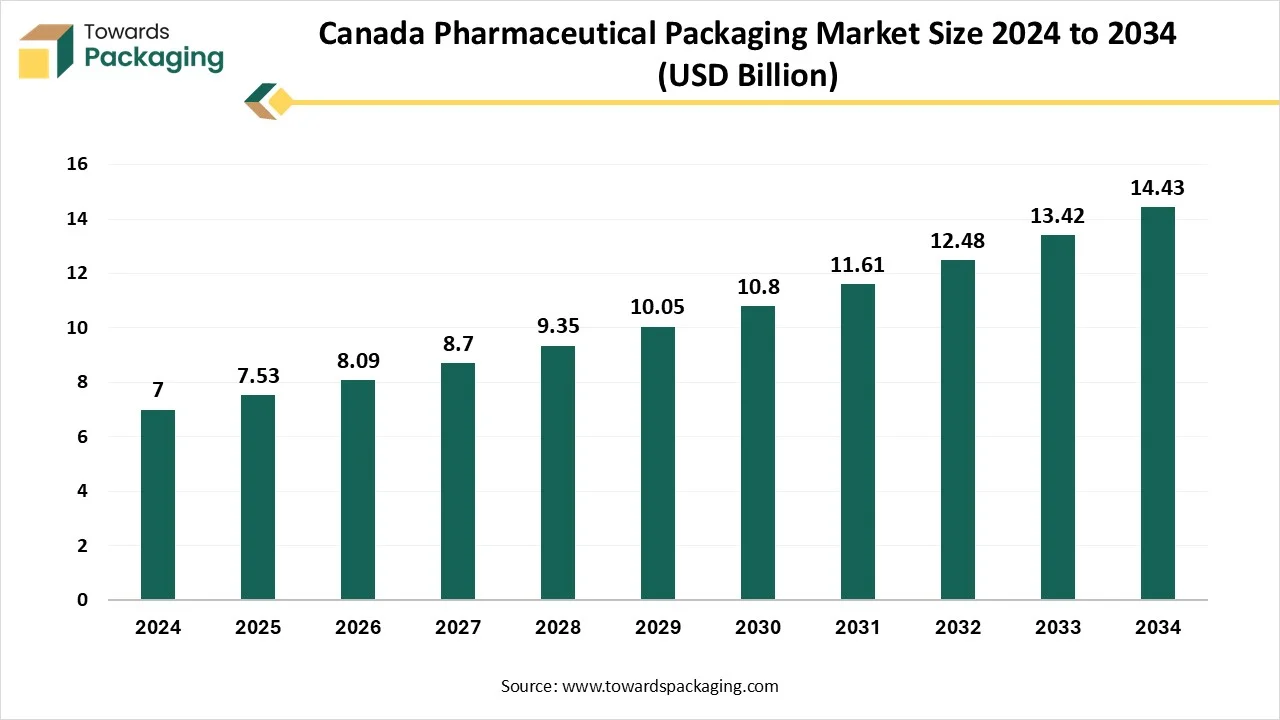

Canada Pharmaceutical Packaging Market Size, Share, Trends and Growth Forecast

The Canada pharmaceutical packaging market is expected to increase from USD 7.53 billion in 2025 to USD 14.43 billion by 2034, growing at a CAGR of 7% throughout the forecast period from 2025 to 2034. The growing pharmaceutical companies in this region and the increasing elderly population have influenced the demand for pharmaceutical products, which has raised the innovation in the Canada pharmaceutical packaging solutions market.

Ontario is dominating this market due to continuous innovation, sustainability initiatives, and growing customer demand. This market plays an important role in almost every customer and industrial segment, enabling the transportation, storage, safety, and marketing of goods.

The Canada pharmaceutical packaging market refers to the industry focused on materials and solutions used for safely enclosing pharmaceutical products during storage, distribution, and usage. Packaging types include blister packs, bottles, vials, ampoules, pouches, and pre-filled syringes, made from plastic, glass, paperboard, and aluminium. Emphasis is placed on tamper-evidence, child resistance, regulatory compliance, and cold-chain capabilities. Growth is driven by increasing drug exports, biologic drugs, an aging population, and rising generic drug penetration.

Asia’s Growing Pharmaceutical Industry to Support Growth

Asia Pacific region is anticipated to grow at the fastest rate in the pharmaceutical packaging market during the forecast period. Countries like China, India are major players in global pharmaceutical manufacturing India, for insurance, is the world’s largest provider of generic medicines, accounting for 20% of global supply by volume. This robust production base necessitates extensive packaging solutions to meet both domestic and international demands. Government across the Asia Pacific region are implementing policies to bolster the pharmaceutical sector.

- In India, the production linked incentive scheme encourages domestic manufacturing, indirectly boosting the packaging industry.

China has world’s largest population as well as huge pharmaceutical & Biopharmaceutical hub. China’s investments in healthcare infrastructure and modernization efforts are driving demand for advanced packaging solutions.

Europe’s Sustainability Initiatives to Project Steady Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The European Medicines Agency (EMA) enforces rigorous packaging regulations to ensure drug safety and combat counterfeit medicines. The Falsified Medicines Directive mandates features like tamper-evident seals and unique identifiers (e.g., 2D Data Matrix codes) on pharmaceutical packaging, enhancing traceability and patient safety. Europe’s commitment to environmental sustainability is reshaping the pharmaceutical packaging landscape.

Initiatives like the Europe’s Packaging and Packaging Waste Regulation aim for all pharmaceutical packaging to be 100% recyclable by 2035. Countries like Germany, France, and the UK possess well-established pharmaceutical manufacturing sectors with robust R&D capabilities. Germany, for instance, accounts for over 30% of Europe’s Pharmaceutical production, driving need for innovative packaging solutions.

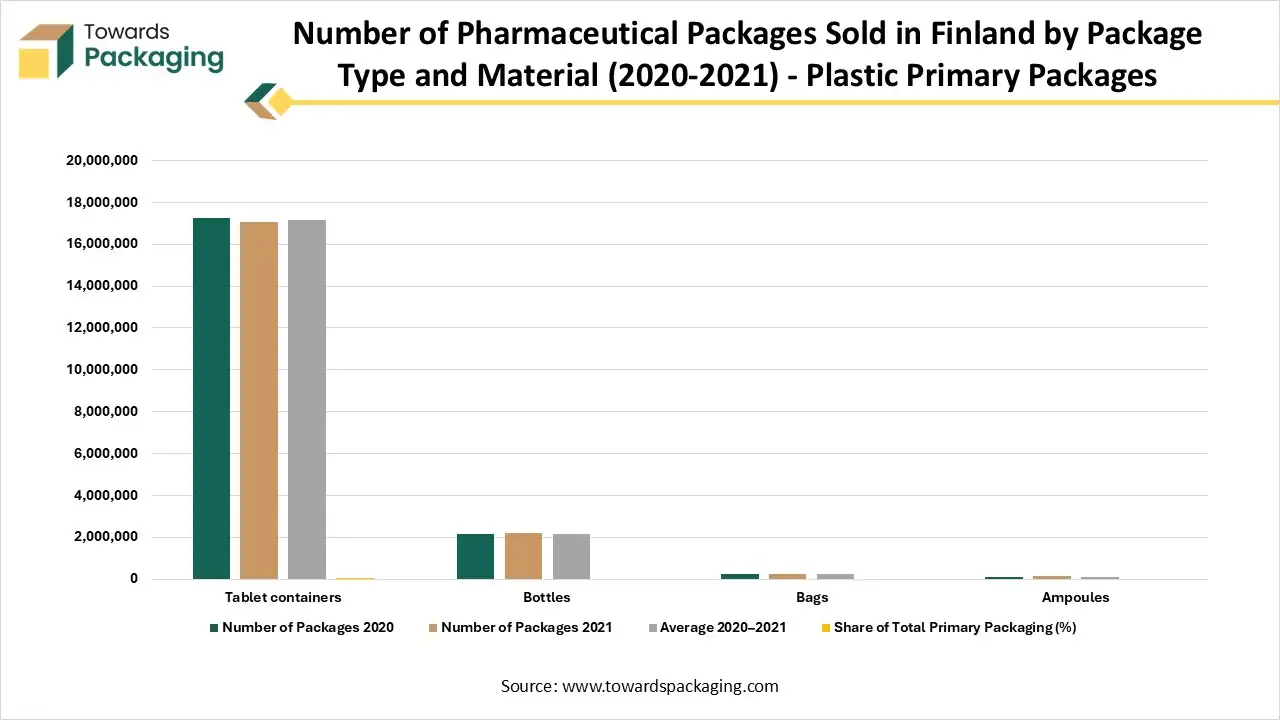

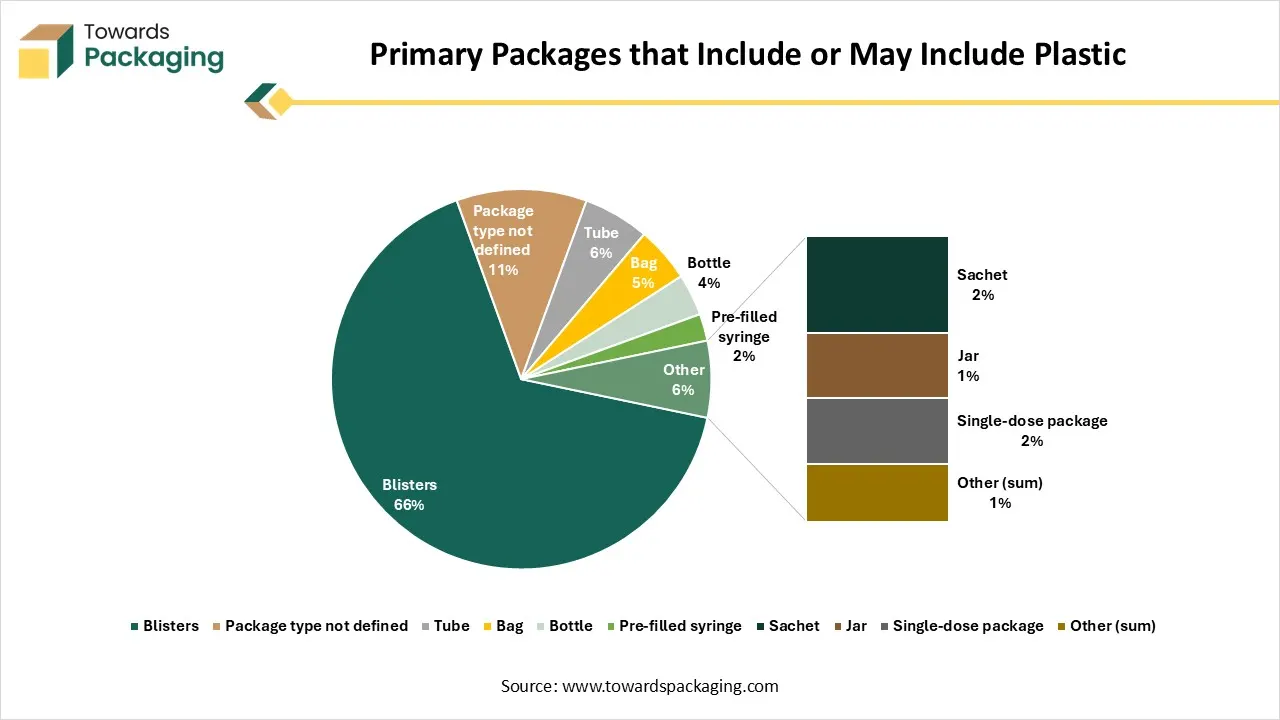

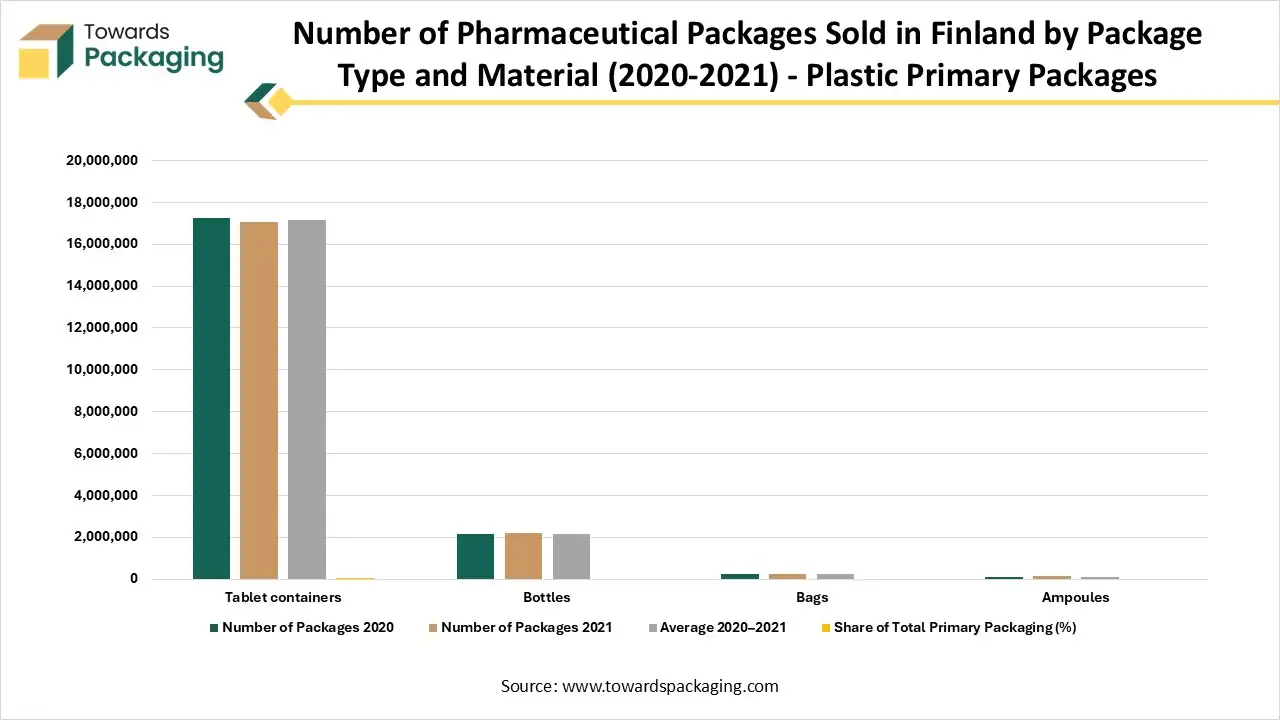

Number of Pharmaceutical Packages Sold in Finland by Package Type and Material (2020-2021)

Plastic primary packages

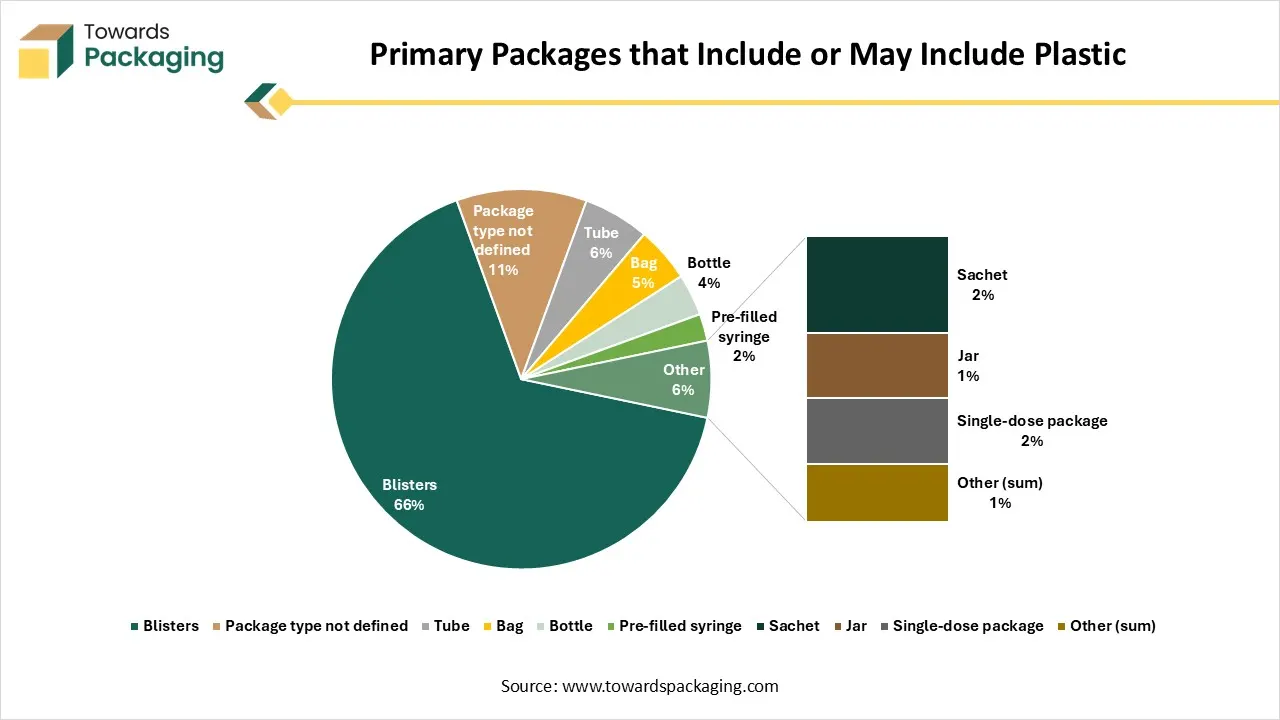

Primary packages that include or may include plastic

The table shows the number of pharmaceutical packages sold in Finland in 2020 and 2021, categorized by type and material. Plastic primary packages like tablet containers and bottles account for a modest share of total packaging, while blisters (which may include plastic) make up the largest portion. The numbers indicate overall stability in packaging use between 2020 and 2021, with minor fluctuations across package types.

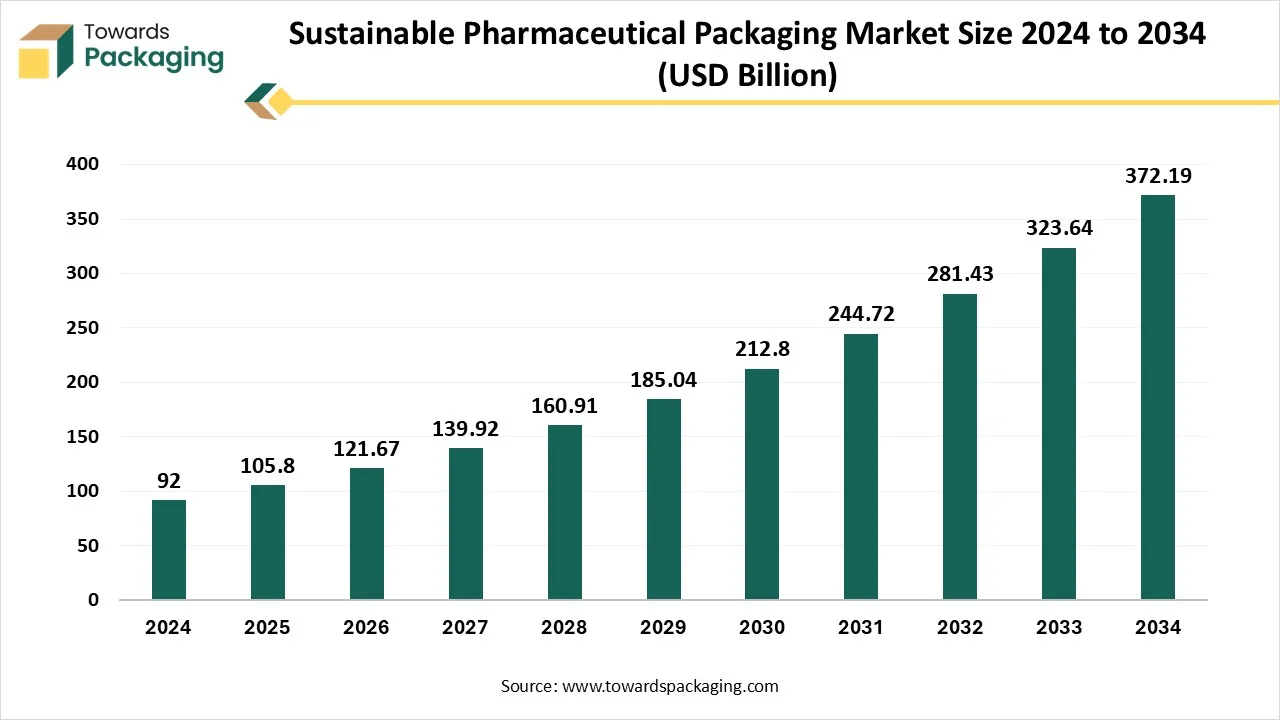

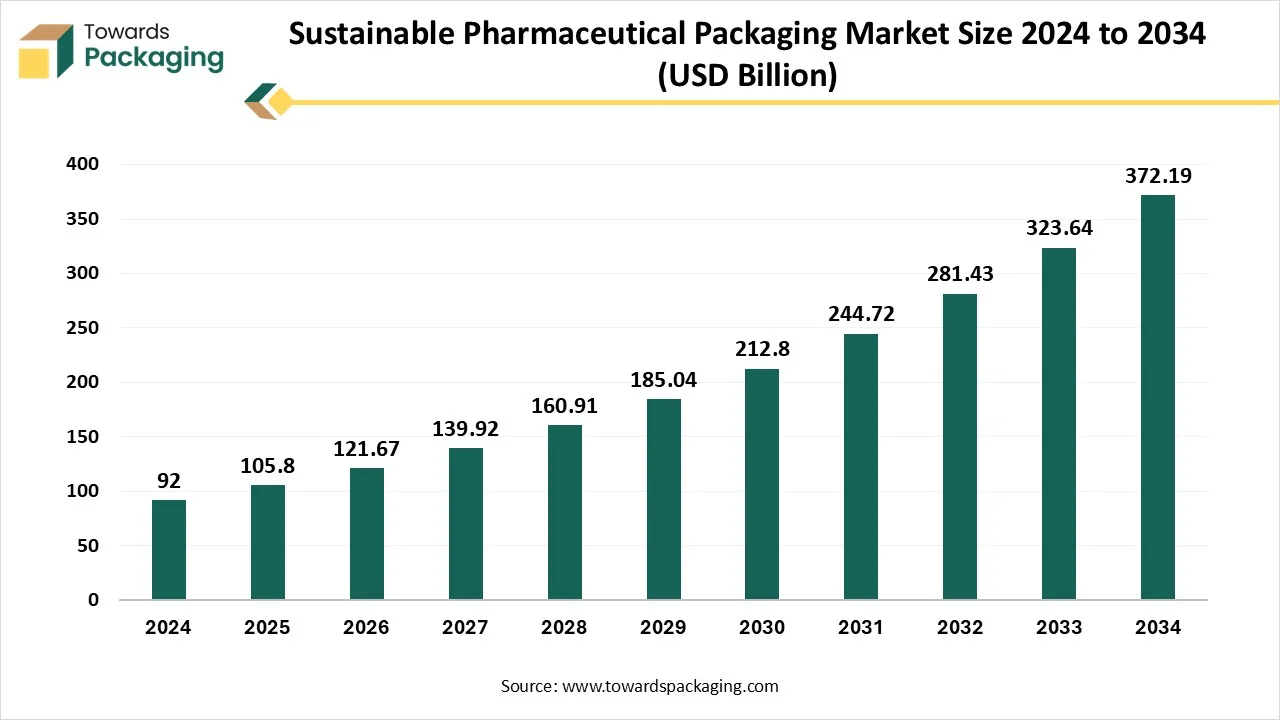

Growth of Sustainable Pharmaceutical Packaging Market

The sustainable pharmaceutical packaging market is expected to increase from USD 105.80 billion in 2025 to USD 372.19 billion by 2034, growing at a CAGR of 15% throughout the forecast period from 2025 to 2034. This market proliferates due to the growing necessity for sustainable packaging, as the demand for pharmaceutical products is increasing, and the massive use is creating waste management issues due to non-biodegradable packaging. All these factors are going to show huge growth in the upcoming times in the sustainable pharmaceutical packaging market.

Globally, many chronic diseases are prevalent, and the requirement for health care and pharmaceuticals is increasing rapidly. After COVID-19, thousands of tons of waste were produced. It is a challenging thing to do waste management if the materials are non-biodegradable. Such scenarios have created the necessity to shift to sustainable pharmaceutical packaging.

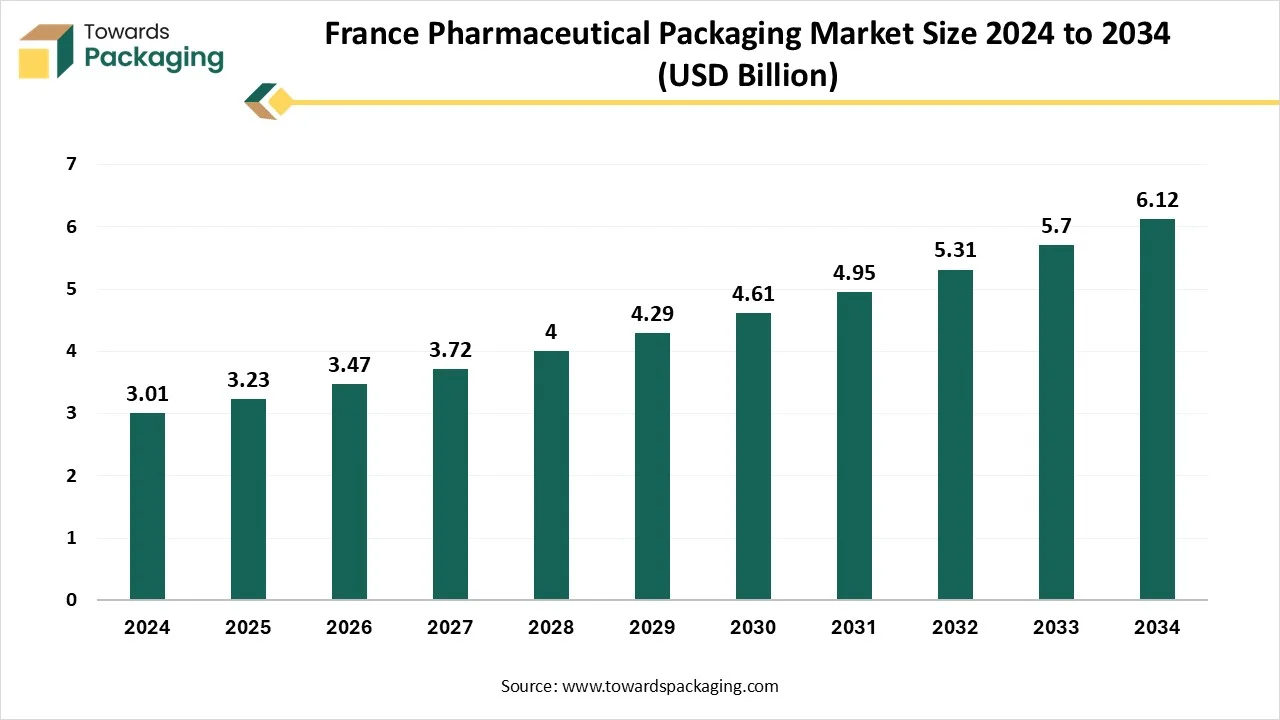

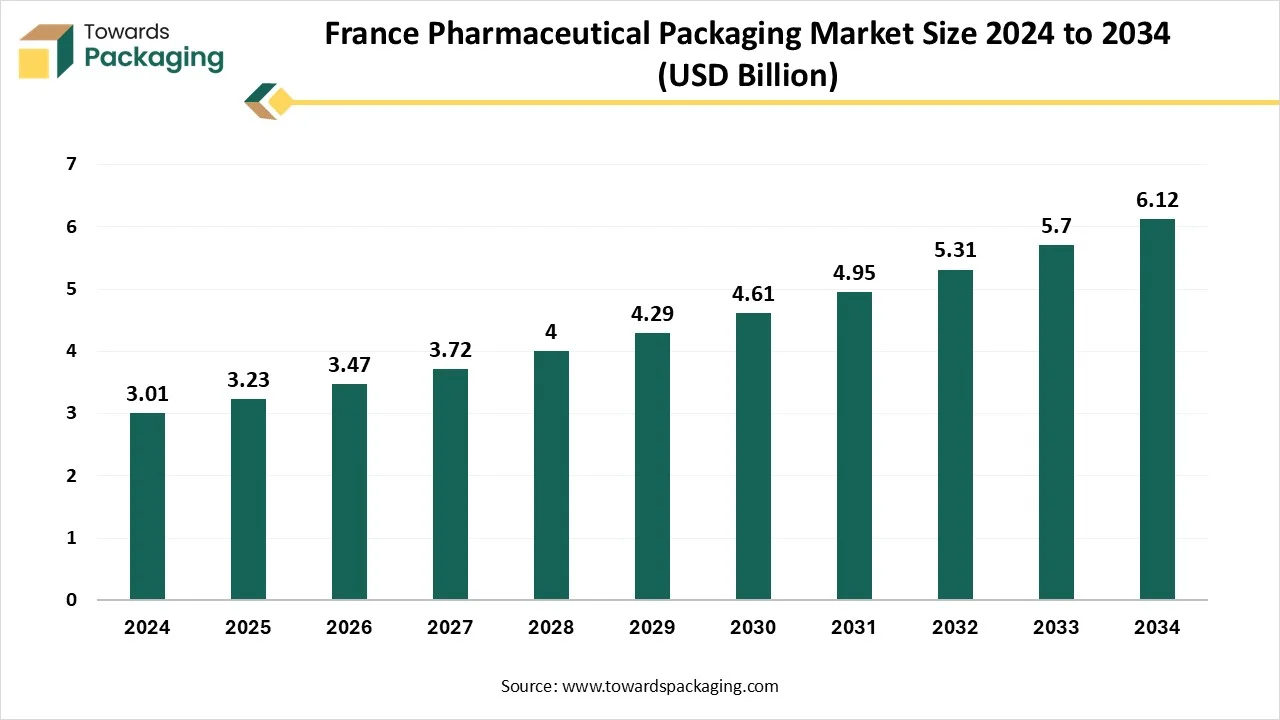

Growth of France Pharmaceutical Packaging Market

The France pharmaceutical packaging market is expected to increase from USD 3.23 billion in 2025 to USD 6.12 billion by 2034, growing at a CAGR of 7.35% throughout the forecast period from 2025 to 2034. The market is driven by rising drug consumption, aging populations, increased regulatory scrutiny, and growing demand for child-resistant, sustainable, and smart packaging formats.

Blister packs were the most popular packaging style in 2024, although prefilled syringes and cartridges are predicted to grow at the quickest rate. Glass will expand the most in the future, yet plastic materials predominate. By route of delivery, oral medications accounted for the biggest proportion, with injectables and inhalables rapidly gaining ground. The largest end users were pharmaceutical companies, while the fastest-growing end users will be contract packaging organizations (CPOs). By product type, generic medications were the most popular, but through 2034, biologics are expected to expand at the quickest rate.

Global Pharmaceutical Packaging Market Players

Latest Announcements by Pharmaceutical Packaging Industry Leaders:

- In February 2025, Sreedhar Patnala, General Manager at Systech, stated, that the company has revealed the introduction of artAI, a ground-breaking offering that highlights the company’s commitment to providing cutting-edge solutions to challenges ranging from counterfeiting and diversion to upholding the highest level of quality. Brands can implement packaging quality checks and counterfeit prevention at scale utilizing artAI’s rapid problem-solving capabilities. It offers instant value, is simple to use, doesn’t require packaging changes, and can be quickly deployed.

New Advancements in Pharmaceutical Packaging Industry

- In October 2024, Berry Global, pharmaceutical packaging company, revealed the introduction of the range of healthcare-use clarified polypropylene (PP) bottles that provide better product protection and sustainability than conventional colored PET pill bottles. A vast range of items, including a vitamin, nutraceuticals nutritional supplements, cosmetic supplements and over-the-counter medications, are preferred choice for ClariPPil bottes. According to Berry, the new bottle production technology reduces CO emissions by about 71% when compared to the conventional injection stretch blow mold process for PET bottles.

- In December 2024, At Pharmapack Europe 2025, which will be held in Paris, France on January 22–23, 2025, LOG Pharma Primary Packaging, a top worldwide supplier of cutting-edge packaging solutions for the pharmaceutical sector, will highlight its ground-breaking barrier eco line for innovative and generic drug companies. The new eco line packaging solution provides the best moisture and oxygen protection for medications while drastically lowering the cost of producing environmentally friendly barrier bottles. The barrier eco bottles expand LOG's line of superior barrier packaging solutions by utilizing its demonstrated proficiency in cutting-edge technology and novel pharma-grade polymers.

Global Pharmaceutical Packaging Market Segments

By Material

- Plastics & Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Glass

- Aluminium Foil

- Others

By Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

By Drug Delivery Mode

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

By End-use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait